Understood, I have received your instructions. As a quantitative trading researcher proficient in the Wyckoff Method, I will compile a comprehensive and in-depth quantitative analysis report based on the SOLUSDT data you provided.

SOLUSDT Wyckoff Quantitative Analysis Report

Product Code: SOLUSDT

Analysis Date Range: 2025-12-17 to 2026-02-15

Report Generation Date: 2026-02-16

1. Trend Analysis and Market Phase Identification

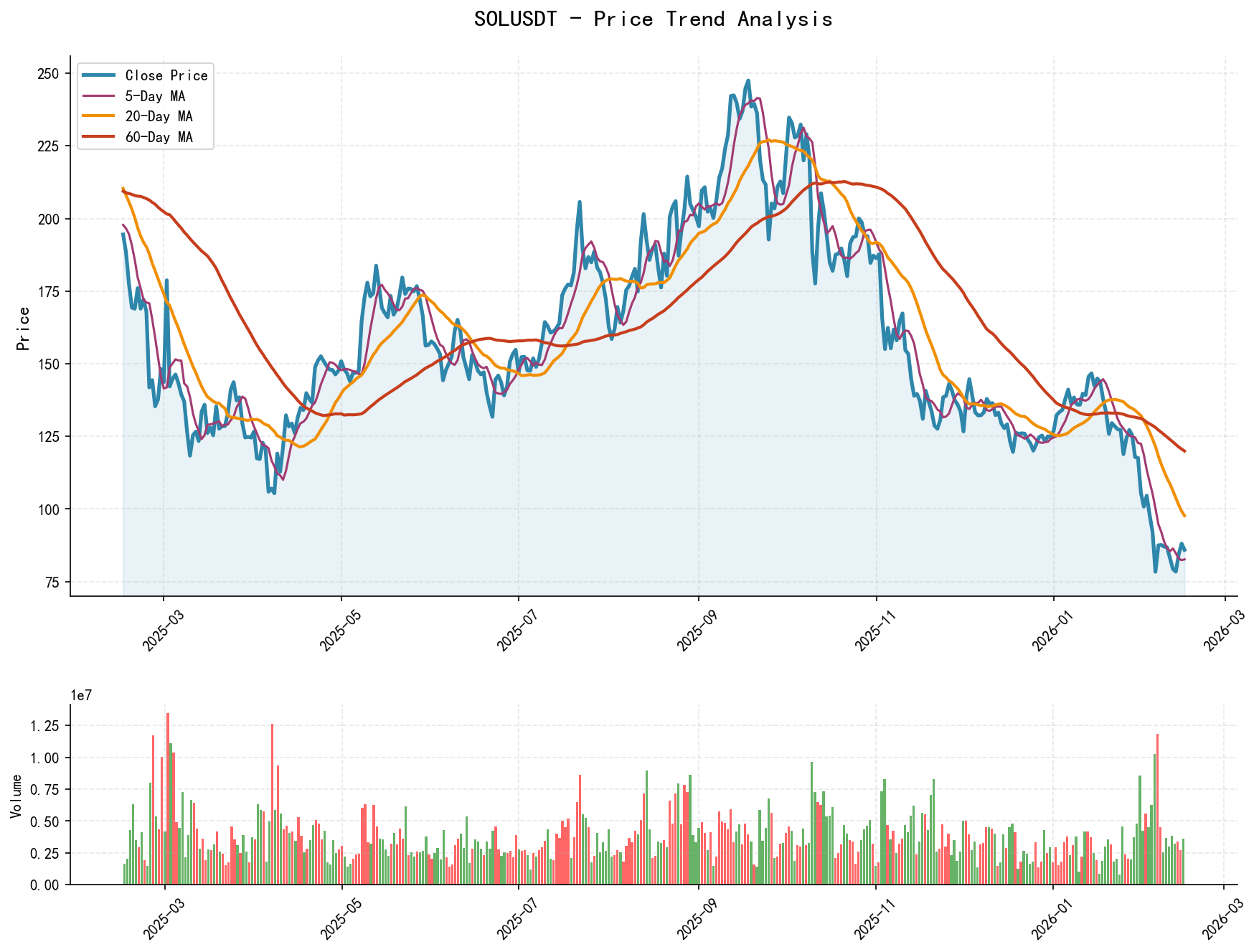

As of February 15, 2026, for the underlying asset SOLUSDT: Open 88.06, Close 85.90, 5-day Moving Average 82.62, 10-day Moving Average 84.02, 20-day Moving Average 97.67, Daily Change -2.45%, Weekly Change -1.25%, Monthly Change -18.64%, Quarterly Change -31.09%, Year-to-Date Change -31.09%.

- 1. Trend Determination:

- • Long-term Trend (Bearish): The price has consistently remained below all key moving averages (MA_60D > MA_30D > MA_20D > MA_10D > MA_5D > Price) throughout the analysis period, forming a standard bearish alignment. The MA_60D declined continuously from 154.01 to 119.92, confirming the long-term downtrend.

- • Mid-term Structure (Bear Market Rally and Breakdown): The market experienced a significant bear market rally in early January 2026 (January 1 to January 15), with the price rebounding from 124.65 to 145.51 (+16.73%), briefly breaking above the MA_5D and MA_10D. However, this rally encountered strong resistance near the MA_20D (a high-open, low-close bearish candle on January 15), and subsequently reversed downward, forming a clear "Lower High" structure.

- • Recent Phase (Panic Selling): Since January 25, the price broke below all moving average support with consecutive large bearish candles and accelerated its plunge in early February (February 1 to 5), dropping from 100.79 to 78.35, a decline of 22.3%. Combined with the volume-price and volatility analysis below, the current market can be clearly determined to be in the concluding phase or initial stabilization period of the "Panic Selling" stage.

- 2. Moving Average Crossover Signals:

- • Throughout the analysis period, only a brief bullish crossover (MA_5D crossing above MA_10D) was observed in early January, which was quickly replaced by death crosses (MA_5D crossing below MA_10D, MA_20D, etc.) beginning on January 25. Currently, the short-term moving average group (MA_5D, MA_10D) is steeply downward sloping, forming overhead resistance above the price.

- 3. Wyckoff Market Phase Inference:

Integrating price action and volume-price relationships, the evolution of the market phase during the analysis period is: Distribution (early to mid-January 2026) → Markdown (late January) → Panic (early February).- • Distribution Phase: The rally in early January was accompanied by relatively active but not persistently increasing volume (

VOLUME_AVG_7D_RATIOfluctuated around 1.3). The rally high on January 13 (148.74) failed to surpass the previous high from December 17 (133.99), exhibiting a "Lower High" characteristic. The high-volume stagnation and decline on January 15, 18, and 19 are typical distribution signals. - • Panic Phase: From February 1 to 5, the price broke downward with extreme volume (e.g.,

VOLUME_AVG_7D_RATIOreached 1.91 on February 5, and historical ranking data shows February 5's volume growth ranking was high) and extreme price decline (a single-day drop of -14.95% on February 5, the largest in the analysis period), clear signs of panic selling. The massive volume in this phase typically represents panic selling by the public being absorbed by large investors.

- • Distribution Phase: The rally in early January was accompanied by relatively active but not persistently increasing volume (

2. Volume-Price Relationship and Supply-Demand Dynamics

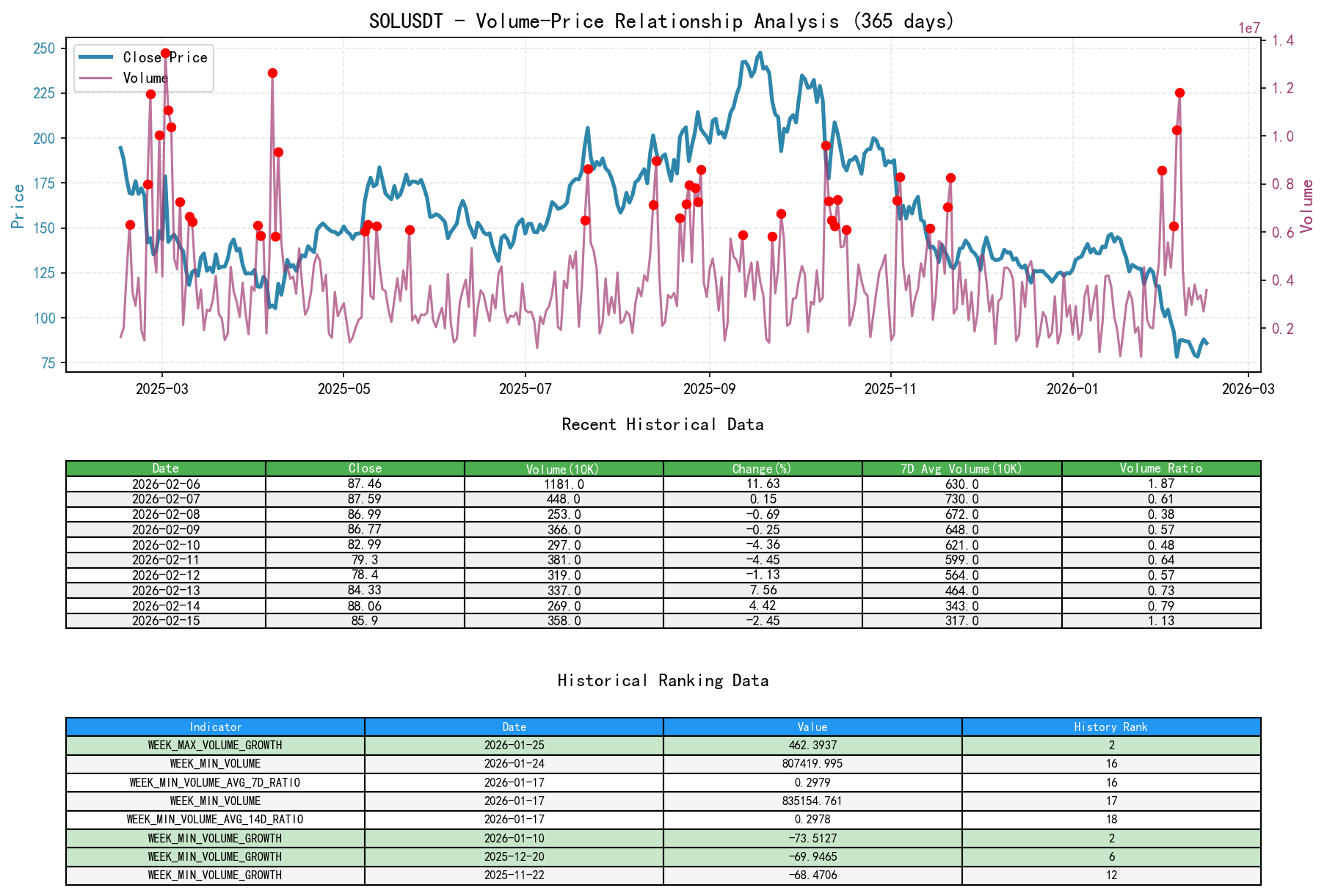

As of February 15, 2026, for the underlying asset SOLUSDT: Open 88.06, Close 85.90, Volume 3585630.47, Daily Change -2.45%, Volume 3585630.47, 7-day Average Volume 3179714.88, 7-day Volume Ratio 1.13.

- 1. Key Demand Days:

- • 2025-12-19: Following a large decline the previous day, the price closed up 5.58% with volume above the 7-day and 14-day averages (

VOLUME_AVG_7D_RATIO=1.23, VOLUME_AVG_14D_RATIO=1.20), constituting a "rising price with high volume," indicating short-term demand entry. - • 2026-01-06: The price continued its rise (+2.31%) with significantly higher-than-average volume (

VOLUME_AVG_7D_RATIO=1.58), a signal of sustained demand during the upward wave. - • 2026-02-06: This is the most analytically valuable demand day. Following a 14.95% plunge to a new low the previous day, the price gapped down significantly but ultimately closed up 11.63%, forming a long bullish candle with massive volume (

VOLUME_AVG_7D_RATIO=1.87). This aligns with the Wyckoff concept of a "strong rebound following panic selling" (Spring or Shakeout), suggesting powerful demand (smart money) entering at extreme lows to absorb panic selling.

- • 2025-12-19: Following a large decline the previous day, the price closed up 5.58% with volume above the 7-day and 14-day averages (

- 2. Key Supply Days and Distribution Signals:

- • 2026-01-25: The price plummeted -6.57% with a surge in volume (

VOLUME_AVG_7D_RATIO=1.96,VOLUME_GROWTH=+462.39%). Historical ranking data shows this day's volume growth reached the second highest in nearly a decade. This "high-volume plunge" broke the previous consolidation range, a sign that supply had completely overwhelmed demand, marking the end of the distribution phase and the beginning of the markdown phase. - • 2026-01-15, 18, 19: The price consecutively closed lower in the high-price region (142-138), with volume remaining at relatively high levels (

VOLUME_AVG_7D_RATIObetween 0.78-1.09). This is "high-volume stagnation/decline," typical supply manifestation during distribution. - • 2026-02-05: The price plunged -14.95% with volume reaching a recent peak (

VOLUME_AVG_7D_RATIO=1.91), representing the peak of panic selling where supply was released in an extreme form.

- • 2026-01-25: The price plummeted -6.57% with a surge in volume (

- 3. Supply-Demand Inflection Point:

- • Panic Low (2026-02-06): As mentioned, this day exhibited the classic demand absorption pattern of "high-volume cessation of decline with a strong rally." In the subsequent trading days (February 7-15), the price fluctuated widely within the 78-89 range. Volume retreated from extreme highs but remained above pre-plunge levels, indicating that supply (panic selling) was heavily digested in a short period, and a new period of balance testing between bulls and bears has begun.

3. Volatility and Market Sentiment

As of February 15, 2026, for the underlying asset SOLUSDT: Open 88.06, 7-day Parkinson Volatility 0.83, 7-day Parkinson Volatility Volume Ratio 0.74, 7-day Historical Volatility 0.85, 7-day Historical Volatility Volume Ratio 0.67, RSI 36.02.

- 1. Volatility Levels and Structure:

- • Extreme Panic Signal: During the early February plunge, short-term volatility spiked sharply. The 7-day Parkinson Volatility reached 1.74 on February 6, and the 7-day Historical Volatility reached 1.73 on the same day. More importantly, the ratio of short-term to long-term volatility reached extreme levels:

PARKINSON_RATIO_7D_60Dwas 2.51 on February 6, andHIS_VOLA_RATIO_7D_60Dwas 2.22. Historical ranking data shows these two ratios ranked 10th and 16th respectively over the past decade, indicating the volatility structure has reached a historically extreme state, typically corresponding to the peak of emotional panic. - • Volatility Convergence: Since the panic low on February 6, various short-term volatility metrics (

PARKINSON_VOL_7D,HIS_VOLA_7D) have begun to decline rapidly, while long-term volatility remains elevated. By February 15,PARKINSON_RATIO_7D_60Dhad fallen back to 1.20, andHIS_VOLA_RATIO_7D_60Dto 1.06. This indicates that market panic sentiment is receding quickly, and volatility is normalizing.

- • Extreme Panic Signal: During the early February plunge, short-term volatility spiked sharply. The 7-day Parkinson Volatility reached 1.74 on February 6, and the 7-day Historical Volatility reached 1.73 on the same day. More importantly, the ratio of short-term to long-term volatility reached extreme levels:

- 2. Market Sentiment (RSI):

- • Extreme Oversold Confirmation: RSI_14 dropped to 19.69 on February 5, the lowest value in the analysis period. Historical ranking data shows this is the lowest value in nearly a decade, strictly confirming from a data perspective that market sentiment had fallen into an extremely oversold and panicked state.

- • Sentiment Recovery: RSI rebounded strongly to 29.67 on February 6 and subsequently oscillated around the 30-37 range from February 13-15, moving out of the extreme oversold zone but not yet entering neutral territory (50). This indicates market sentiment remains fragile, in a preliminary recovery stage from panic.

4. Relative Strength and Momentum Performance

- • Momentum Weakened Across All Timeframes: Returns for all periods are negative, with recent deterioration being severe.

MTD_RETURNis -18.64%,QTD_RETURNis -31.09%,YTDis -31.09%. This indicates SOLUSDT has been a weak asset in the short, medium, and long term. - • Momentum Validates Trend and Sentiment: The negative momentum aligns with the bearish moving average alignment and extremely oversold RSI, together painting a complete picture of a bear market. However, the single-day strong positive return on February 6 (+11.63%) is the first potential signal that downward momentum may be exhausting.

5. Large Investor (Smart Money) Behavior Identification

Based on the volume-price, volatility, and sentiment analysis above, we can infer the behavioral path of large investors:

- 1. Distribution (Early to Mid-January 2026): During the January rally, large investors capitalized on the market's rebound sentiment to distribute holdings in the 142-148 range. The high-volume bearish candles on January 15, 18, 19, and the high-volume breakdown candle on January 25 are classic signs of institutional capital transferring holdings to the public chasing the rally.

- 2. Inducing Panic and Accumulation (Early February 2026): After the price broke below key support, the market entered the panic phase. The epic high-volume plunge on February 5 (-14.95%) was likely large investors using market panic, potentially through algorithmic trading or concentrated selling, to trigger stop-losses and panic selling, thus testing the market's final supply. The very next day, February 6, massive absorption and a strong rebound occurred at a lower price (78.35), which most likely represents large-scale proactive buying (Accumulation) by the same cohort of large investors at lower levels. Historically extreme volatility ratios and RSI provided them with the perfect "extreme sentiment" entry backdrop.

- 3. Current Behavior (Testing and Secondary Accumulation): The price has been fluctuating between 78-89 since February 7, with volume retreating from peak levels but remaining above normal. Large investors are likely observing the market's natural rebound strength post-panic and may conduct secondary tests (Test) and further accumulation near the lower bound of the range (around 80).

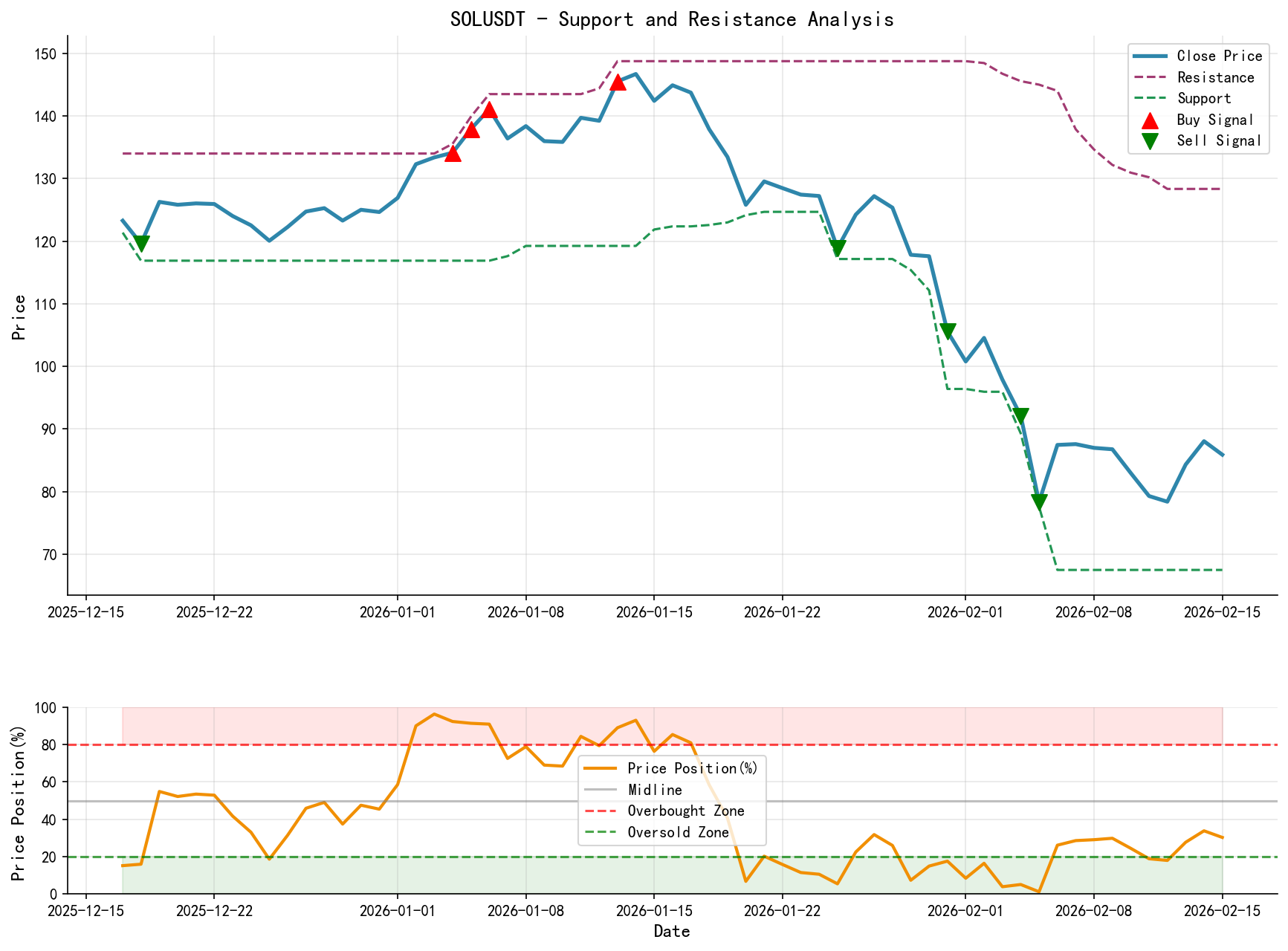

6. Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Levels:

- • Strong Resistance: 89.00 - 91.00 (The rebound high area from February 7-9, also the first supply appearance zone post-panic plunge); 100.00 (Psychological level and pre-breakdown platform from February 1).

- • Core Trading Range: 85.00 - 89.00 (Current price oscillation area).

- • Key Support: 78.00 - 80.00 (Panic low from February 6 and subsequent tested lows, the first major smart money intervention area); below this level, support becomes sparse.

- • Ultimate Support: 67.50 (Absolute low from February 6, low probability of being broken in the short term; a break would likely trigger a new wave of panic).

- 2. Wyckoff Integrated Trading Signals:

- • Primary Trend Signal: Bearish (Bearish alignment, moving average resistance).

- • Phase Signal: The market is transitioning from the Panic Phase to a preliminary Automatic Rally or Secondary Test Phase.

- • Operational Recommendation: Primarily look to sell on rallies, cautiously trade bounces.

- • Aggressive Short Strategy: Consider initiating short positions when the price rallies to the 89.00-91.00 resistance zone and shows signs of supply (e.g., stagnation with small candles, declining volume). Initial stop-loss can be placed above 92.00 (break above the recent range high).

- • Long Counter-Trend Strategy (High Risk): Suitable only for investors with high-risk tolerance. Wait for the price to retest the 78.00 - 80.00 support zone again and show clear demand absorption signals (e.g., long lower wick, high-volume cessation of decline). A light long position can be attempted with a strict stop-loss set below 77.00 (break below the panic low).

- • Wait-and-See Signal: When the price moves directionlessly within the 85-89 range, it is advisable to remain on the sidelines and wait for a directional breakout from the range.

- 3. Future Validation Points:

- • Bearish Validation: The price fails to effectively break above the 89.00-91.00 resistance zone and exhibits another high-volume decline below this area, confirming that supply still dominates and the downtrend will continue.

- • Bullish Validation (Preliminary Trend Reversal Signal): The price can break above and sustain above the 91.00 resistance level with high volume, subsequently retest this level without breaking down, and further challenge the 100.00 integer level. Simultaneously, the MA_5D should begin to flatten and turn upward.

- • Current Core Observation: Monitor the price action during tests of the 78.00-80.00 support zone. If the price can stabilize here with persistently shrinking volume, it will strengthen the validity of the "panic bottom," creating conditions for a larger-scale rebound later.

Conclusion Reiterated: Following the distribution in January and the panic plunge in early February, SOLUSDT is currently in a phase of oversold rebound and consolidation within a bearish structure. Data clearly indicates that large investors conducted their first major accumulation in the 78-80 region amidst historically extreme volatility and sentiment indicators. However, the overall bearish trend remains unchanged. It is recommended that traders adopt "selling at key resistance levels during rallies" as the primary strategy. Any long attempts should be considered counter-trend bets and require strict adherence to stop-loss discipline. The market's next directional move will depend on the price's test results for the two key areas: 78.00 support and 89.00-91.00 resistance.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. Markets involve risks; investment requires caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Wyckoff volume-price market analysis will be released daily at 8:00 before market open. Your comments and shares are highly valued. Together, let's see the market signals clearly.

Member discussion: