As a quantitative trading researcher proficient in the Wyckoff Method, I will author a comprehensive quantitative analysis report based on the provided POLUSDT data and historical ranking indicators. All conclusions will be strictly derived from the data and adhere to the principles of Wyckoff Volume-Price analysis.

POLUSDT Quantitative Analysis Report

Product Code: POLUSDT

Analysis Date Range: 2025-12-17 to 2026-02-15

Report Generation Date: 2026-02-16

Core Methodology: Wyckoff Volume-Price Analysis, Market Structure Analysis, Extreme Value Statistics

1. Trend Analysis and Market Phase Identification

As of February 15, 2026, the underlying asset POLUSDT had an open price of 0.11, a close price of 0.11, with moving averages at 0.10 (5-day), 0.10 (10-day), 0.10 (20-day). The daily change was -1.37%, weekly change +13.10%, monthly change +3.95%, quarterly change +7.36%, and annual change +7.36%.

- • Moving Average Arrangement and Price Relationship:

- • During the entire analysis period, POLUSDT underwent a complete cycle of "Bearish Alignment -> Rally Test -> Resumption of Downtrend." As of 2026-02-15, moving averages of various periods exhibited a complete bearish alignment (MA_5D(0.0972) < MA_10D(0.0962) < MA_20D(0.1041) < MA_30D(0.1139) < MA_60D(0.1181)), with the price (0.1079) below all moving averages, indicating the long-term downtrend remains unchanged.

- • Key turning points: On January 9-10, 2026, the price staged a strong rally, briefly piercing above all short-term moving averages (MA_5D, MA_10D), forming the beginnings of a "Golden Cross." However, the rally failed to effectively break through MA_60D (around 0.126 at the time) and subsequently closed lower with high volume on January 11, confirming the rally's failure. The moving average system quickly re-formed a bearish divergence thereafter, marking the end of the rally trend.

- • Inferred Market Phase:

- • Phase 1 (2025-12-17 to 2026-01-01): Primary Decline Segment and Panic Selling. The price fell from 0.1072 to 0.1005, with multiple instances of high-volume declines (e.g., +68.54% VOLUME_GROWTH on Dec-18). The volume ratio indicator remained consistently above 1, and the RSI dropped to a low of 26.19 (historically ranked 7th lowest), aligning with the characteristics of "Panic Selling" in Wyckoff theory.

- • Phase 2 (2026-01-01 to 01-10): Automatic Rally and Secondary Test. Starting January 1, the price rallied with high volume, accompanied by a sharp increase in volume and volatility. This can be seen as an "Automatic Rally" following panic selling. On January 10, the RSI reached a historical extreme value of 84.80 (ranked #1), indicating market sentiment had entered an extremely overbought zone.

- • Phase 3 (2026-01-11 to 02-15): Distribution Completion and Downtrend Resumption. After reaching a high of 0.1866, the price retreated on January 11 with a -7.49% decline and massive volume nearing 2.5 billion. This marked the beginning of "Distribution" behavior. Subsequently, the price declined in a choppy manner with diminishing volume, showing weak rallies (e.g., a mere +0.42% rally on Jan-27 with relatively low volume). It ultimately experienced another high-volume plunge (VOLUME_GROWTH +153.73%, historically ranked 19th highest) from February 5th to 6th, confirming entry into a new declining phase. The current market is in a downtrend resumption period.

2. Volume-Price Relationship and Supply-Demand Dynamics

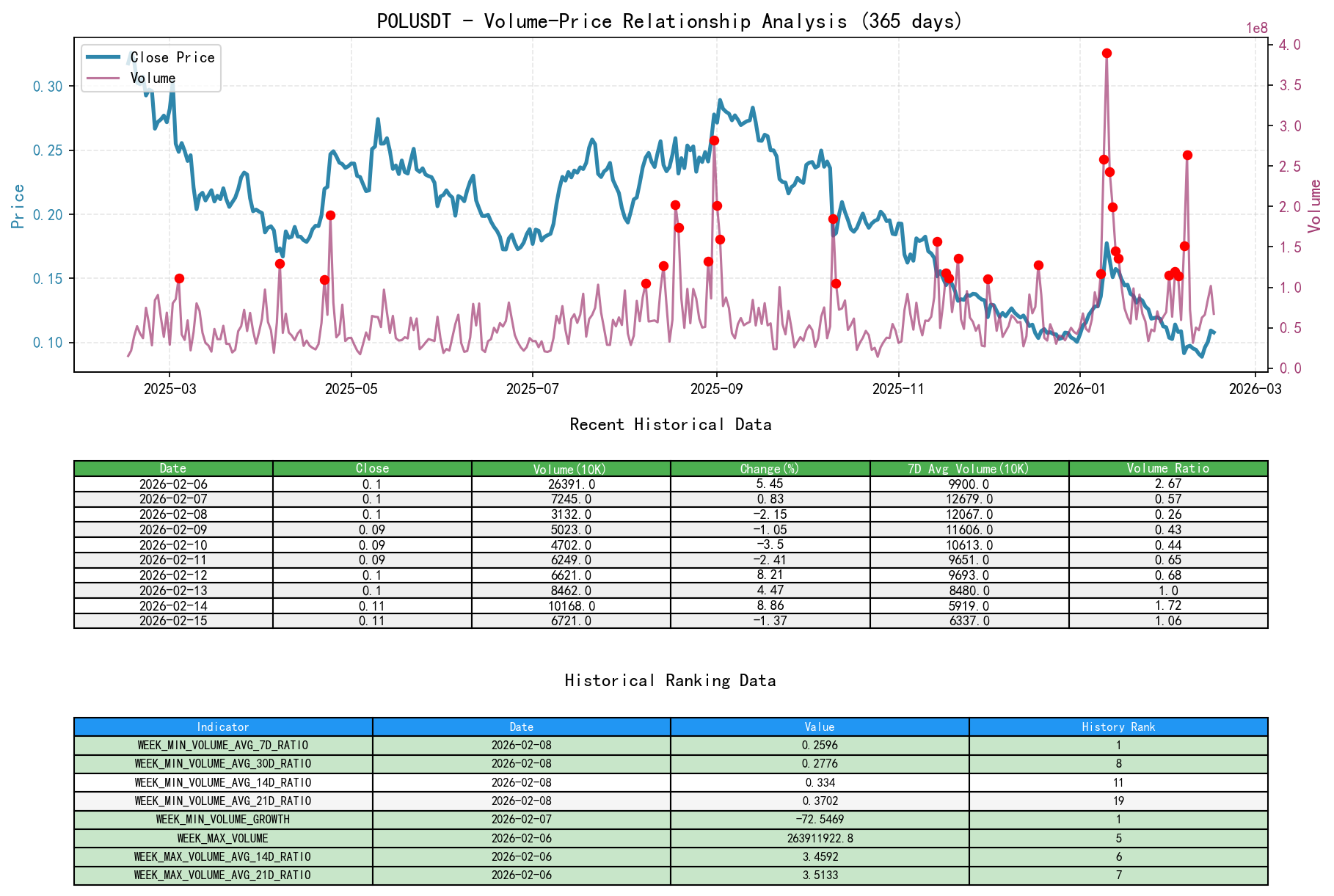

As of February 15, 2026, the underlying asset POLUSDT had an open price of 0.11, close price of 0.11, volume of 67215481.20, daily change of -1.37%, volume of 67215481.20, 7-day average volume of 63371935.30, and 7-day volume ratio of 1.06.

- • Core Alpha Signal Extraction:

- • Supply-Dominated Signals:

- 1. 2025-12-18: Price declined -3.45% with volume growth of +68.54%. The

VOLUME_AVG_7D_RATIOreached 2.16, indicating significantly expanding supply (selling pressure) during the decline. - 2. 2026-01-11: Price plummeted -7.49% from a historical high. Although volume decreased sequentially, the

VOLUME_AVG_14D_RATIOremained high at 2.45 (historically ranked 18th), andVOLUME_AVG_21D_RATIOwas 3.07 (historically ranked 12th). This is a textbook supply signal of high-volume decline at a top, indicating substantial selling pressure entering the market. - 3. 2026-02-05: Price plunged -15.72% with a massive sequential volume surge of +153.73%. The

VOLUME_AVG_7D_RATIOwas 1.75, typical of panic selling where supply completely overwhelms demand.

- 1. 2025-12-18: Price declined -3.45% with volume growth of +68.54%. The

- • Demand-Dominated Signals:

- 1. 2026-01-09/10: Prices rose 14.64% and 13.93% respectively, with volumes reaching 258 million and 390 million (historically ranked 6th and 1st). The

VOLUME_AVG_14D_RATIOvalues were exceptionally high at 4.46 and 5.30 (historically ranked 3rd and 1st). This represents a strong demand-dominated advance, with smart money aggressively buying in the bottoming area.

- 1. 2026-01-09/10: Prices rose 14.64% and 13.93% respectively, with volumes reaching 258 million and 390 million (historically ranked 6th and 1st). The

- • Demand Exhaustion Signals:

- 1. 2026-01-13 to 01-15: After consolidating at high levels, the price began to decline with significantly shrinking volume. The

VOLUME_AVG_7D_RATIOdropped from 1.12 to 0.47. This shows waning upward momentum and lack of follow-through demand. - 2. 2026-02-08 to 02-11: The price consolidated at low levels with extremely thin volume. The

VOLUME_AVG_7D_RATIOdropped to as low as 0.26 (historically ranked 1st lowest), andVOLUME_AVG_14D_RATIOalso reached 0.26 (historically ranked 1st lowest). This is typical of thin trading and cautious demand, with the market awaiting a new directional catalyst.

- 1. 2026-01-13 to 01-15: After consolidating at high levels, the price began to decline with significantly shrinking volume. The

- • Supply-Dominated Signals:

- • Supply-Demand Conclusion:

The market experienced extreme "demand explosion" in early January followed by a "supply counterattack." Currently, supply has regained absolute dominance following the plunge in early February. Demand has not shown any organized, forceful counterattack post-plunge (evidenced by low-volume, weak rallies). The current supply-demand dynamic is bearish.

3. Volatility and Market Sentiment

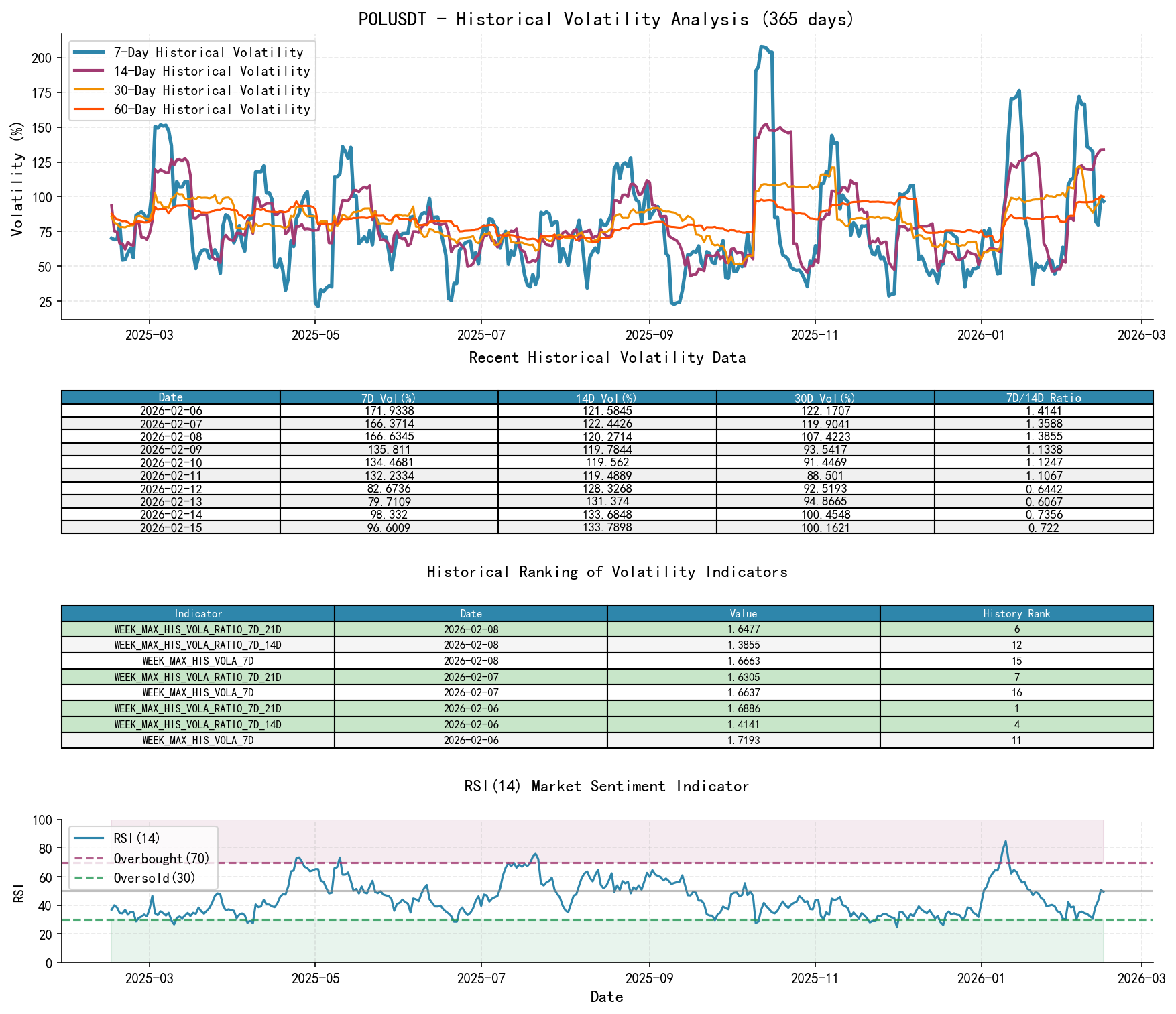

As of February 15, 2026, the underlying asset POLUSDT had an open price of 0.11, a 7-day intraday volatility of 0.97, a 7-day intraday volatility ratio of 0.79, a 7-day historical volatility of 0.97, a 7-day historical volatility ratio of 0.72, and an RSI of 49.45.

- • Volatility Level and Structure:

- • Extreme Volatility Period: Concentrated from January 9 to February 6, 2026. During this time,

HIS_VOLA_7Dpeaked at 1.7619 (Jan-15, historically ranked 8th), andPARKINSON_VOL_7Dpeaked at 1.7359 (Feb-06, historically ranked 8th), both reaching historical extremes. - • Volatility Structure Deterioration:

HIS_VOLA_RATIO_7D_14Dreached 1.42/1.41 on Jan-14/15 (historically ranked 3rd/6th), andHIS_VOLA_RATIO_7D_21Dreached 1.6886 on Feb-06 (historically ranked 1st). This indicates short-term volatility far exceeding medium-to-long-term volatility, signifying a highly unstable and panicked market state. - • Current State: As of Feb-15,

HIS_VOLA_7D(0.9660) andPARKINSON_VOL_7D(0.9715) remain elevated but have retreated significantly from their peaks. Volatility ratios have also reverted near normal ranges (e.g.,HIS_VOLA_RATIO_7D_14D= 0.72). The market has transitioned from "panic" to "hesitation."

- • Extreme Volatility Period: Concentrated from January 9 to February 6, 2026. During this time,

- • Sentiment Indicator (RSI):

- • Sentiment Extremes: The RSI reached 84.80 (historically ranked 1st) on Jan-10, marking extreme optimism and overbought conditions. Conversely, it dropped to 26.19 (historically ranked 7th) on Dec-18, marking extreme pessimism and oversold conditions.

- • Current Sentiment: The RSI_14 is 49.45, situated in a neutral-to-weak zone. It shows neither the urgency for an oversold bounce nor momentum for continued selling. Market sentiment is in a state of观望 and weak equilibrium.

4. Relative Strength and Momentum Performance

- • Return Analysis:

- • Short-Term Momentum:

WTD_RETURNis +13.10% (small-cycle bounce from Feb-12 to Feb-15), andMTD_RETURNis +3.95%. This indicates a technical bounce following an oversold condition. - • Medium-to-Long-Term Momentum:

QTD_RETURN(since the beginning of 2026) is +7.36%, andYTDis +7.36%. However, theTTM_12return is -66.04%. This shows that despite a strong rally at the beginning of the year, the asset remains in a deep long-term downtrend, with an overall weak momentum structure. The rally failed to reverse the long-term downtrend.

- • Short-Term Momentum:

- • Momentum and Trend Validation:

The contrast between short-term positive returns (WTD, MTD) and long-term negative returns (TTM_12) validates that the market is in a secondary corrective rally within a long-term downtrend. The current rally's strength (as measured by volume) is significantly weaker than in early January, casting doubt on its sustainability.

5. Large Investor (Smart Money) Behavior Identification

- • Accumulation and Distribution in Early January:

- 1. Bottom Accumulation: Around the panic lows near 0.10 in late December to early January, smart money drove a violent price rally through massive buying (record-breaking volume and turnover on Jan-09/10), completing the first phase of bottom accumulation.

- 2. Top Distribution: When prices rapidly surged to the 0.16-0.18 zone amid extreme market euphoria (RSI historically #1), smart money conducted distribution via massive selling (volume historically ranked 8th and 16th on Jan-11/12), successfully transferring holdings to retail investors chasing the highs.

- 3. Behavior Confirmation: Post-distribution, prices failed to make new highs, and every subsequent rally occurred on low volume, indicating no new large-scale smart money entry for absorption. The renewed plunge on Feb-05/06 can be seen as a natural slide after distribution completion, losing major support, possibly including some delayed institutional stop-loss selling.

- • Current Intent Inference:

Following the early February plunge, volume quickly shriveled to extremely low levels (multiple volume ratios hit their lowest historical rankings on Feb-08). This suggests that smart money is currently in a观望 state, neither buying heavily at the bottom (lack of demand) nor selling aggressively further (supply paused temporarily). They are likely waiting for better price levels or clearer fundamental signals. The market is in a "leaderless" phase dominated by散户博弈.

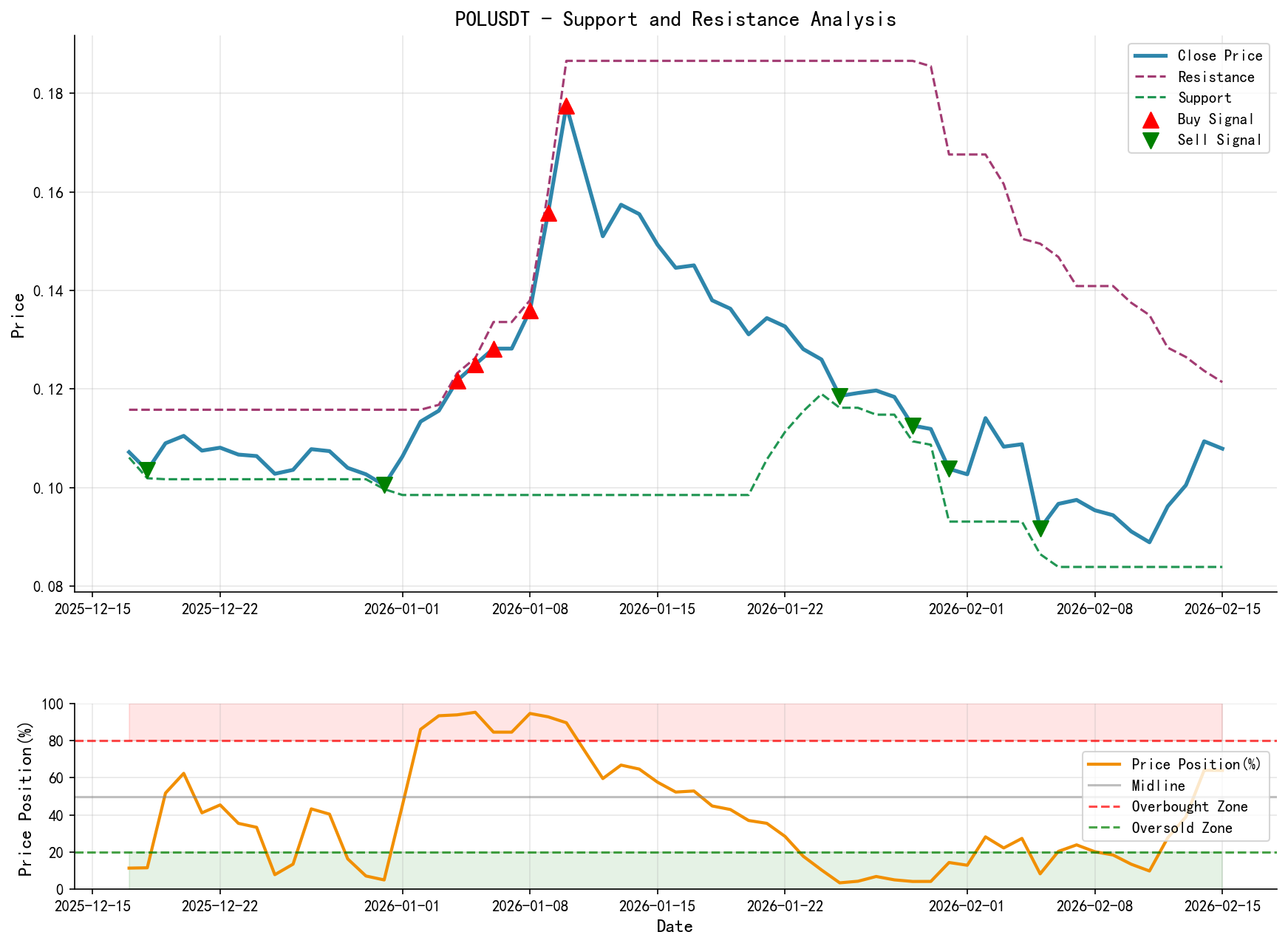

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Resistance Levels (Resistance):

- 1. R1: 0.1380 - 0.1400: Recent rally high (Feb-14) and the lower boundary of the mid-January consolidation platform.

- 2. R2: 0.1600 - 0.1620: Mid-axis of the January distribution range and a significant psychological level.

- 3. R3: 0.1866: Absolute historical high, strong resistance.

- • Support Levels (Support):

- 1. S1: 0.0889 - 0.0911: Preliminary support band formed by recent lows (Feb-10/11).

- 2. S2: 0.0839: The cycle low established on 2026-02-06, the absolute critical support. A break below this level would open new downside space.

- 3. S3: 0.0780 (Psychological Level): If S2 fails, there is no clear technical support below.

- • Resistance Levels (Resistance):

- • Wyckoff Events and Comprehensive Trading Signals:

- • Market Phase Determination: Currently in a long-term downtrend, specifically in the downtrend resumption period following the completion of the distribution phase. The rebound following the latest panic selling (Feb-05/06) is weak, typical of a bear market rally.

- • Trading Signal: Bearish/观望.

- • Core Logic: Primary trend is down, supply-demand dynamics are bearish, smart money is观望, and rallies lack volume.

- • Wyckoff Event: The current situation resembles a "No Demand Rally" following a "Secondary Test" or "Downtrend Resumption," presenting a potential shorting opportunity.

- • Operational Recommendations:

- 1. Aggressive Short Strategy: Wait for price to反弹 to the R1 (0.1380-0.1400) resistance zone. If signs of rally exhaustion with shrinking volume appear, consider establishing a short position. Initial stop-loss should be placed above R2 (0.1620). Target levels are S1 (0.0900) and S2 (0.0840).

- 2. Conservative 观望 / Breakdown Short Strategy: If price directly breaks below the key support S2 (0.0840) with volume, consider it a signal for downtrend resumption and pursue shorting, with a stop-loss set a reasonable distance above S2.

- 3. Long Risk: Any long positioning at this stage should be considered counter-trend抢反弹 and requires strict position sizing and stop-loss management. Consider taking a light long position only if a clear Wyckoff bullish structure like "Sign of Strength" or "Spring" appears near S2 (0.0840), with a stop-loss placed below the low.

- • Future Validation Points (Require Close Monitoring):

- 1. Demand Validation: Do prices exhibit signs of significant volume expansion coupled with price rejection of lower levels (long lower wicks or strong bullish candles) when approaching S1 or S2? This is key to determining if smart money is re-entering for accumulation.

- 2. Supply Validation: Do prices show signs of high-volume stagnation or long bearish candles upon反弹 to R1 or R2? This would confirm that overhead supply remains heavy and the downtrend persists.

- 3. Volatility Validation: If volatility (especially short-term volatility) experiences another extreme spike similar to mid-January, it often heralds the start of a new trending move. Directional判断 should be made in conjunction with this signal.

Report Summary: Over the past two months, POLUSDT has completed a full cycle from "Panic Selling" to "Automatic Rally," then to "Distribution at Highs," and finally "Downtrend Resumption." Despite the recent short-term oversold bounce, the long-term downtrend, weak supply-demand structure, and the观望 attitude of smart money all point towards a bearish market bias. It is recommended that investors adopt strategies such as selling into rallies or shorting upon breakdown of key support levels, with strict stop-losses in place. Blindly attempting to buy the bottom is not advisable before clear, "demand-dominated" reversal signals emerge.

Disclaimer: The contents of this report/analysis are solely for market analysis and research based on publicly available information and do not constitute any investment advice or operational guidance. While the author strives for objectivity and impartiality, no guarantees are made regarding accuracy or completeness. Markets involve risks, and investment requires caution. Any investment actions taken based on this report are undertaken at one's own risk.

Thank you for your attention! Daily Wyckoff Volume-Price market解读 are released promptly before the 8:00 AM market open. Your comments and shares are greatly appreciated. Your recognition is paramount. Let's work together to共同看见市场信号.

Member discussion: