Excellent. As a quantitative trading researcher proficient in the Wyckoff Method, I will compile a comprehensive quantitative analysis report based on the PEPEUSDT data you provided (analysis period: December 17, 2025, to February 15, 2026) and the historical ranking indicators from the past 10 years. All conclusions will be strictly derived from the data and adhere to the principles of Wyckoff price-volume analysis.

PEPEUSDT Wyckoff Price-Volume Analysis Report (December 17, 2025, to February 15, 2026)

Core Summary:

Based on nearly two months of price-volume data analysis, PEPEUSDT rapidly entered a distribution and decline cycle following a "flash bull" driven by extreme sentiment in early January 2026. The current price structure (as of February 15, 2026) shows a bearish alignment, positioned above a key support zone. The market exhibits initial signs of stabilization after the panic selling on February 5, but the overall supply-demand dynamic remains weak, with large investors potentially in a phase of tentative accumulation or observation. A comprehensive assessment suggests the market is in the late-stage re-accumulation phase of a downtrend or the extended decline phase following distribution, awaiting stronger demand signals to confirm a trend reversal.

1. Trend Analysis & Market Phase Identification

As of February 15, 2026, for the target PEPEUSDT: Open Price 0.00, Close Price 0.00, 5-Day Moving Average 0.00, 10-Day Moving Average 0.00, 20-Day Moving Average 0.00, Daily Change -8.90%, Weekly Change 16.40%, Monthly Change 6.02%, Quarterly Change 9.18%, Yearly Change 9.18%

- • Moving Average Alignment & Trend:

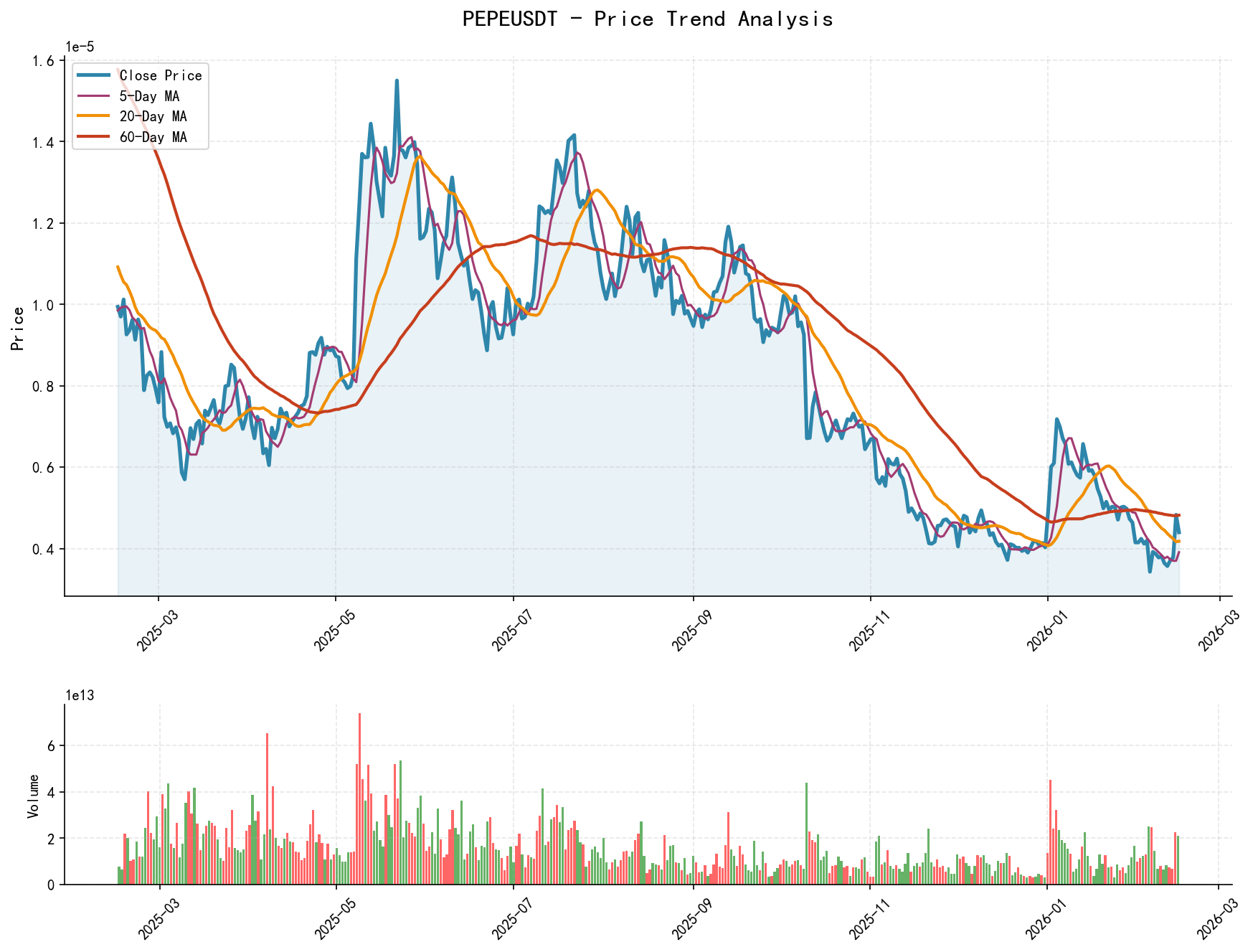

- • Current State: As of February 15, 2026, the closing price (0.00000440) is below all key moving averages (MA_5D: 0.00000391, MA_20D: 0.00000418, MA_60D: 0.00000482), presenting a standard bearish alignment (MA_60D > MA_30D > MA_20D > MA_10D > MA_5D). This indicates a clear medium- to long-term downtrend.

- • Dynamic Evolution:

- 1. Accumulation/Bottoming (Late December 2025): The price consolidated in a narrow range at low levels (0.00000384 - 0.00000440) with shrinking volume (e.g., December 24 VOLUME_AVG_7D_RATIO: 0.45). The moving averages were bearishly aligned but with gentle slopes, aligning with the initial characteristics of a Wyckoff "accumulation range."

- 2. Demand Surge & Uptrend (January 1 to 4, 2026): The price violently broke through all moving averages accompanied by massive volume (see below). Short-term moving averages quickly crossed above long-term ones, forming a brief bullish alignment.

- 3. Distribution & Trend Reversal (From January 5, 2026): After reaching a high (0.00000726), the price failed to sustain and began a volatile decline. Short-term moving averages (MA_5D, MA_10D) successively turned down and crossed below medium-term ones (e.g., MA_20D), signaling the end of the uptrend and the start of a downtrend.

- 4. Decline & Panic (January 31 to February 6, 2026): The price accelerated its decline, with bearishly aligned moving averages diverging, entering a phase of panic selling.

- • Inferred Market Phase:

Combining price action with Wyckoff theory, the market has completed the following cycle: Preliminary Accumulation (December 2025) -> Demand-driven rapid markup (Early January 2026) -> Distribution at highs (Early to mid-January) -> Supply-driven decline (Late January to early February) -> Panic Selling (February 5). The current phase (February 15) is initial stabilization or an attempt to form a base after panic selling, but clear signals of "completion of accumulation" have not yet appeared.

2. Price-Volume Relationship & Supply-Demand Dynamics

As of February 15, 2026, for the target PEPEUSDT: Open Price 0.00, Close Price 0.00, Volume 21170944916400.00, Daily Change -8.90%, Volume 21170944916400.00, 7-Day Average Volume 9462460976784.29, 7-Day Volume Ratio 2.24

- • Key Day Analysis (Wyckoff Events):

- 1. Demand-driven Rally (Climax & Upthrust):

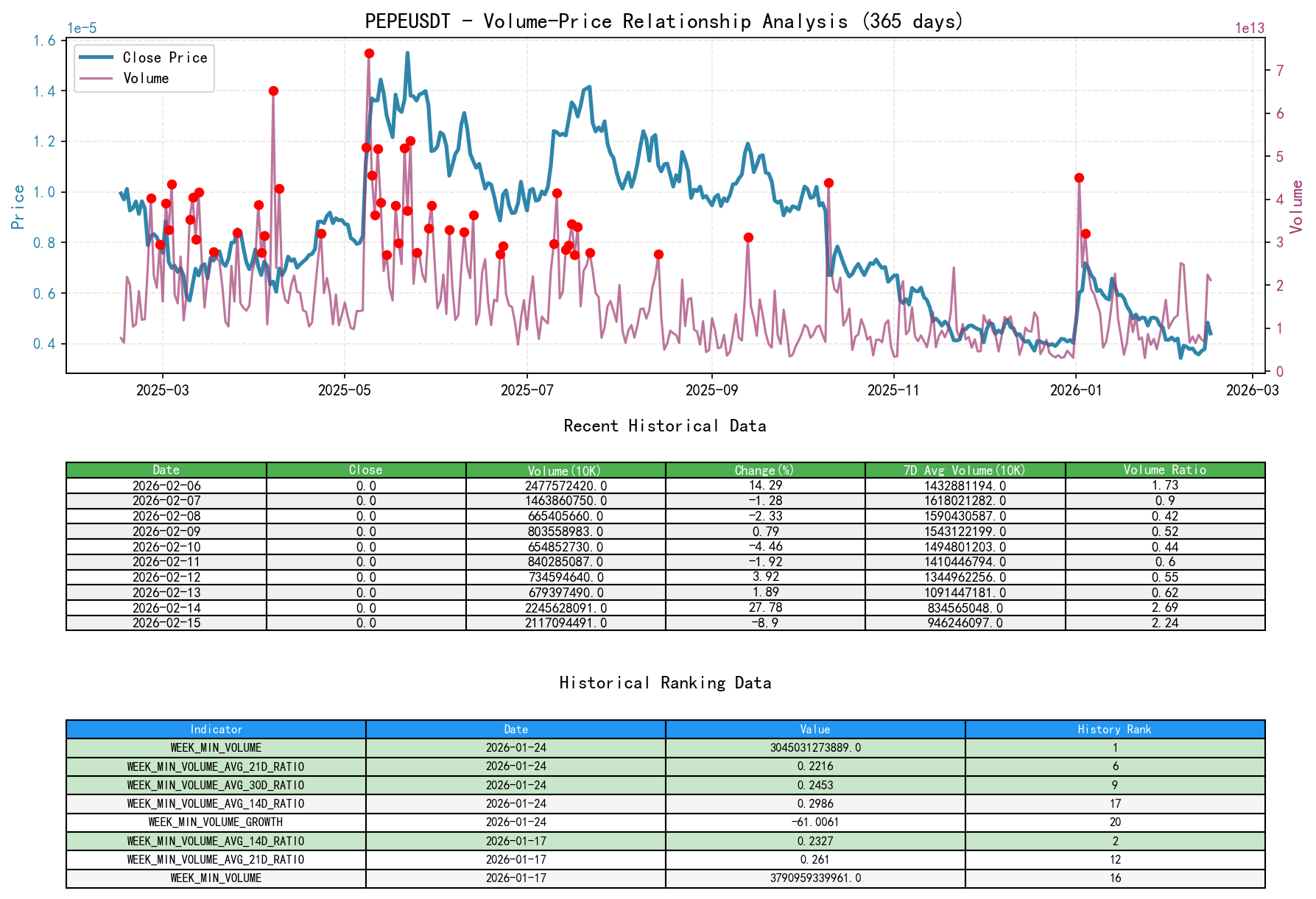

- • January 1-2, 2026: Prices surged 22.08% and 22.15% respectively, with volume skyrocketing 342.81% and 230.15%. The

VOLUME_AVG_7D_RATIOreached 3.83 and 8.91 respectively (Historical Rank: 15th and 1st). This is a typical "buying climax," indicating concentrated large buying. However, such extreme volume is often unsustainable, hinting at potential subsequent distribution.

- • January 1-2, 2026: Prices surged 22.08% and 22.15% respectively, with volume skyrocketing 342.81% and 230.15%. The

- 2. Supply Emergence & Distribution (Sign of Weakness & Distribution):

- • January 4, 2026: Price rose another 17.70%, but the volume increase (32.58%) was far lower than the previous two days, and

VOLUME_AVG_7D_RATIOdropped to 2.29. This shows signs of increased volume with limited price progress (churning), suggesting supply was appearing. - • January 8 & 10, 2026: Prices fell (-7.32%, -2.94%) on volume that, while high in absolute terms, was lower than previous days—this was falling on increased volume, confirming supply dominance.

- • January 4, 2026: Price rose another 17.70%, but the volume increase (32.58%) was far lower than the previous two days, and

- 3. Panic Selling (Selling Climax):

- • February 5, 2026: Price plummeted -18.33% (Historical Rank: 6th largest single-day drop), with volume surging 93.21%. The

VOLUME_AVG_14D_RATIOwas as high as 2.72. This is a classic panic selling (SC) event, where a large number of retail investors capitulated in fear. This is the first key signal for a potential trend reversal.

- • February 5, 2026: Price plummeted -18.33% (Historical Rank: 6th largest single-day drop), with volume surging 93.21%. The

- 4. Automatic Rally & Secondary Test:

- • February 6-14, 2026: Following the panic low (0.00000310), an "Automatic Rally" (AR) occurred. February 14 saw a strong rally of 27.78% on increased volume (

VOLUME_AVG_7D_RATIO: 2.69). Subsequently, on February 15, the price corrected -8.90% on shrinking volume (VOLUME_GROWTH: -5.72%), which can be viewed as a "Secondary Test" (ST) of the panic low area. The lower volume on the test day indicates reduced selling pressure compared to the panic day.

- • February 6-14, 2026: Following the panic low (0.00000310), an "Automatic Rally" (AR) occurred. February 14 saw a strong rally of 27.78% on increased volume (

- 1. Demand-driven Rally (Climax & Upthrust):

- • Supply-Demand Conclusion:

The market shifted from extreme demand dominance in early January to supply dominance. The panic selling on February 5 cleared out a significant amount of weak positions. The subsequent rally and low-volume test indicate temporary supply exhaustion, but demand has not yet demonstrated sustained, strong buying power (as evidenced by the correction on February 15). Overall, the market is in the early stage of transitioning from supply exceeding demand towards a rebalancing of supply and demand.

3. Volatility & Market Sentiment

As of February 15, 2026, for the target PEPEUSDT: Open Price 0.00, 7-Day Intraday Volatility 1.26, 7-Day Intraday Volatility Ratio 0.94, 7-Day Historical Volatility 2.06, 7-Day Historical Volatility Ratio 1.06, RSI 50.66

- • Volatility Analysis:

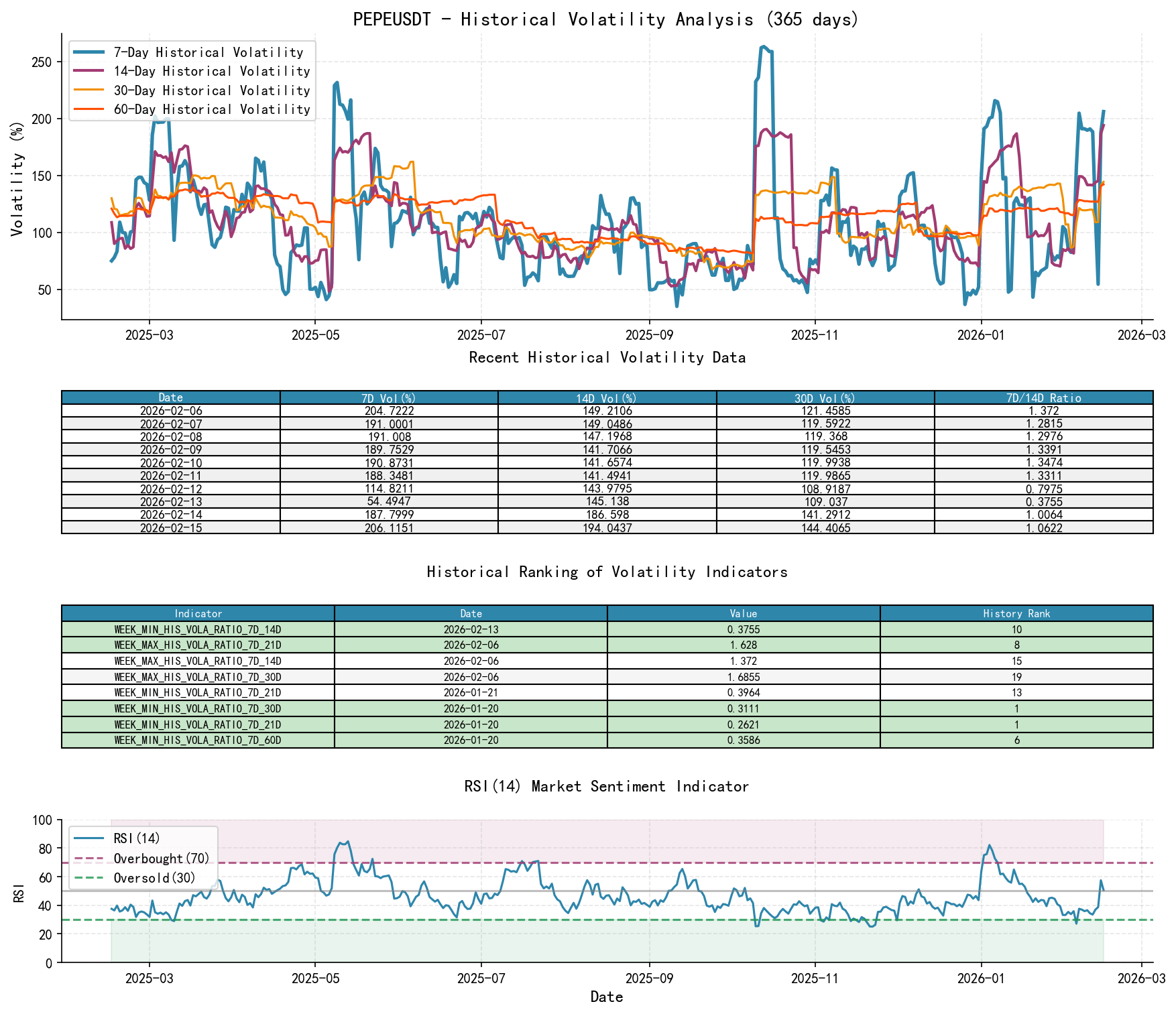

- • Characteristics of Panic Period: During the panic decline on February 5-6, short-term volatility spiked sharply.

HIS_VOLA_7Dreached 2.0472 on February 6, 1.372 times theHIS_VOLA_14D(Historical Rank 15th).PARKINSON_VOL_7Dalso reached 1.6388. This phenomenon, where short-term volatility far exceeds its long-term average, is typical of extreme market panic and trend acceleration. - • Sentiment Shift: Volatility has since moderated but remains elevated overall (

HIS_VOLA_7Dis 2.06 on February 15), indicating that market sentiment has not fully settled, and the divergence between bulls and bears remains significant.

- • Characteristics of Panic Period: During the panic decline on February 5-6, short-term volatility spiked sharply.

- • RSI & Overbought/Oversold Conditions:

- • Extreme Point Confirmation: The RSI_14 reached 82.15 (Historical Rank 16th highest) at the rally climax on January 4, confirming overbought conditions. It dropped to 27.14 during the panic selling on February 5, entering the oversold zone. Currently (February 15), the RSI is 50.66, in a neutral-to-weak zone, indicating neither overbought pressure nor strong oversold rebound momentum.

4. Relative Strength & Momentum Performance

- • Return Analysis:

- • Short-term (WTD): The weekly return as of February 15 is +16.40%, primarily driven by the violent rebound on February 14. However, intra-week volatility was high, indicating unstable momentum.

- • Medium-term (MTD/QTD): The monthly (February) return is +6.02%, and the quarterly-to-date return is +9.18%. However, measuring from the January high reveals a massive drawdown (over 50%). This indicates that medium-term momentum has turned from positive to negative, with the market in a weak rebound following a decline.

- • Conclusion: The asset exhibits typical "high volatility, weak trend" momentum characteristics. The short-term rebound has failed to reverse the medium-term weakness, and momentum strength is insufficient.

5. Large Investor ("Smart Money") Behavior Identification

- • Key Behavior Inferences:

- 1. Distribution at Highs: The massive volume rally in early January, combined with the subsequent rapid decline, aligns with the smart money behavior pattern of "pump and dump." The historically highest volume ratios suggest they completed significant position changes in this area.

- 2. Absorption During Panic: The historically significant volume decline on February 5 requires an equivalent level of buying to absorb such massive selling pressure. This is likely smart money absorbing supply passively or actively during the panic. Although the price continued to make new lows, the huge volume is a signal of "potential accumulation."

- 3. Restraint & Testing During the Rebound: Following the strong rebound on February 14, a correction occurred the next day with shrinking volume. Smart money may be testing overhead supply and the strength of follow-up buying, not rushing to initiate consecutive rallies, suggesting their accumulation process may not be complete or they are still observing.

- • Smart Money Intent Summary:

Large investors have likely completed the transition from "distribution" to "preliminary accumulation during panic." Currently, they may be consolidating the bottom area through volatility and testing, observing market sentiment and the response of follow-up buying. Their behavior has shifted from "active selling" to "tentative buying/observation."

6. Support/Resistance Level Analysis & Trading Signals

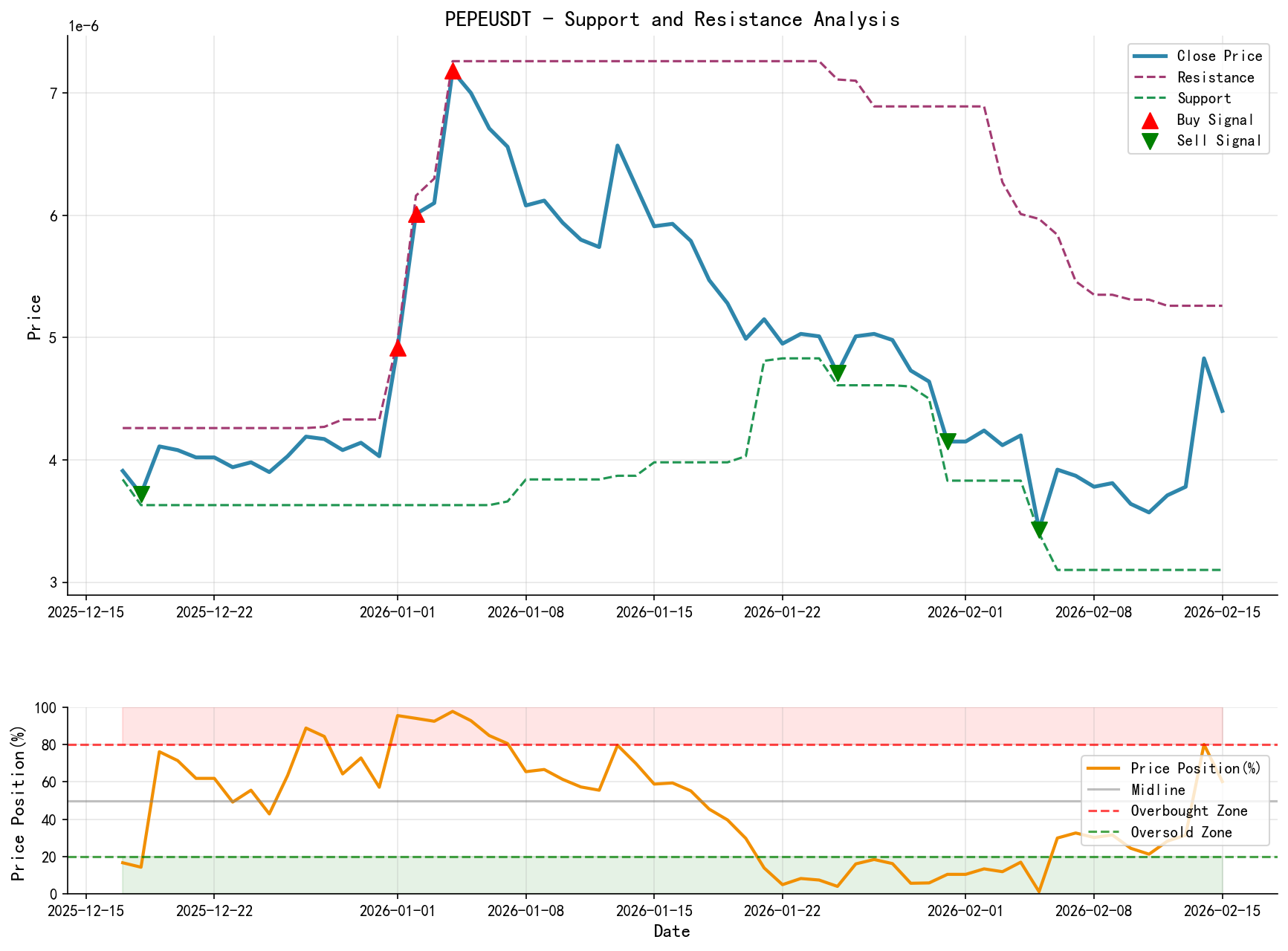

- • Key Price Levels:

- • Strong Resistance Zone: 0.00000600 - 0.00000650. This is the dense trading range from late January to early February and the level where the prior decline broke down, now converted into strong resistance.

- • Secondary Resistance/Supply Zone: 0.00000500 - 0.00000550. The area of recent rebound highs (February 14) and the consolidation platform from early February.

- • Key Support Zone: 0.00000340 - 0.00000360. The low area formed during the panic selling on February 5-6, representing the last line of defense. A break below this zone would open up new downside space.

- • Immediate Support: 0.00000415 - 0.00000440. The recent consolidation lows, also near the February 15 close, serving as immediate support.

- • Comprehensive Wyckoff Trading Signals:

- • Primary Signal: Observe/Cautiously Bullish on Rebound. The market has exhibited panic selling (SC), an automatic rally (AR), and a preliminary secondary test (ST), forming the rudiments of a Wyckoff bottom structure (Spring or Terminal Shakeout). However, confirmation signals like the "Last Point of Supply (LPSY)" or "Sign of Strength (SOS)" have not yet appeared.

- • Bullish Scenario & Trigger Conditions:

- 1. Entry Signal: Price breaks above and holds the 0.00000500 resistance level on increased volume (

VOLUME_AVG_7D_RATIO > 1.5), with RSI recovering above 55. This would be an initial signal of demand returning and a potential new uptrend initiation. - 2. Add-to-Position/Confirmation Signal: Price further conquers the 0.00000600 strong resistance zone on increased volume.

- 3. Stop-loss Level: Set below the key support zone, e.g., 0.00000330. If the price falls below this level, the bottom formation fails, necessitating a shift to a bearish stance.

- 1. Entry Signal: Price breaks above and holds the 0.00000500 resistance level on increased volume (

- • Bearish Scenario & Trigger Conditions:

- 1. Entry Signal: Price shows clear signs of distribution (e.g., increased volume with limited progress, weak bounce on low volume, candlestick patterns like long upper shadows, bearish engulfing) near the 0.00000500 or 0.00000600 resistance levels, followed by a break below recent support at 0.00000415.

- 2. Target Level: Downside target to the key support zone 0.00000340, with a break below opening further downside.

- 3. Stop-loss Level: Set above the resistance levels, e.g., 0.00000550 or 0.00000660.

- • Future Validation Points:

- 1. Demand Validation: Can the price consistently find support and show decreasing volume during pullbacks to the 0.00000400-0.00000420 area? Can rallies be accompanied by sustained, moderate volume increases?

- 2. Supply Exhaustion Validation: If the price tests the 0.00000340-0.00000360 area again, is the volume significantly lower than the panic volume of February 5? (Successful low-volume test).

- 3. Breakout Validation: For any upward challenge to 0.00000500 or 0.00000600, how well does the volume match the price gain? Does a "gap-up breakout on high volume" strong signal appear?

Conclusion Restated: PEPEUSDT is at a critical potential trend transition point. Based on Wyckoff events (panic selling, secondary test), the downtrend is in its final stages, but a new uptrend has not yet been established. Traders are advised to maintain a high degree of caution, waiting for clear signals of supply-demand shift confirmed by price-volume action near key levels before taking action. The most prudent strategy at present is observation, or positioning with very small size for long trades above key support zones while strictly adhering to stop-losses.

Disclaimer: This report/interpretation is for market analysis and research based on publicly available information only and does not constitute any investment advice or operational guidance. While the author strives for objectivity and impartiality, no guarantee is made regarding its accuracy or completeness. Markets involve risk, and investments require caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Wyckoff price-volume market analysis is released promptly before the market opens at 8:00 AM daily. Your feedback and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: