Understood. As a quantitative trading researcher proficient in the Wyckoff Method, I will produce an in-depth quantitative analysis report on ETHUSDT based on the data you provided.

ETHUSDT Wyckoff Volume-Price Deep Dive Analysis Report

Product Code: ETHUSDT

Analysis Date Range: 2025-12-17 to 2026-02-15

Report Generation Date: 2026-02-16

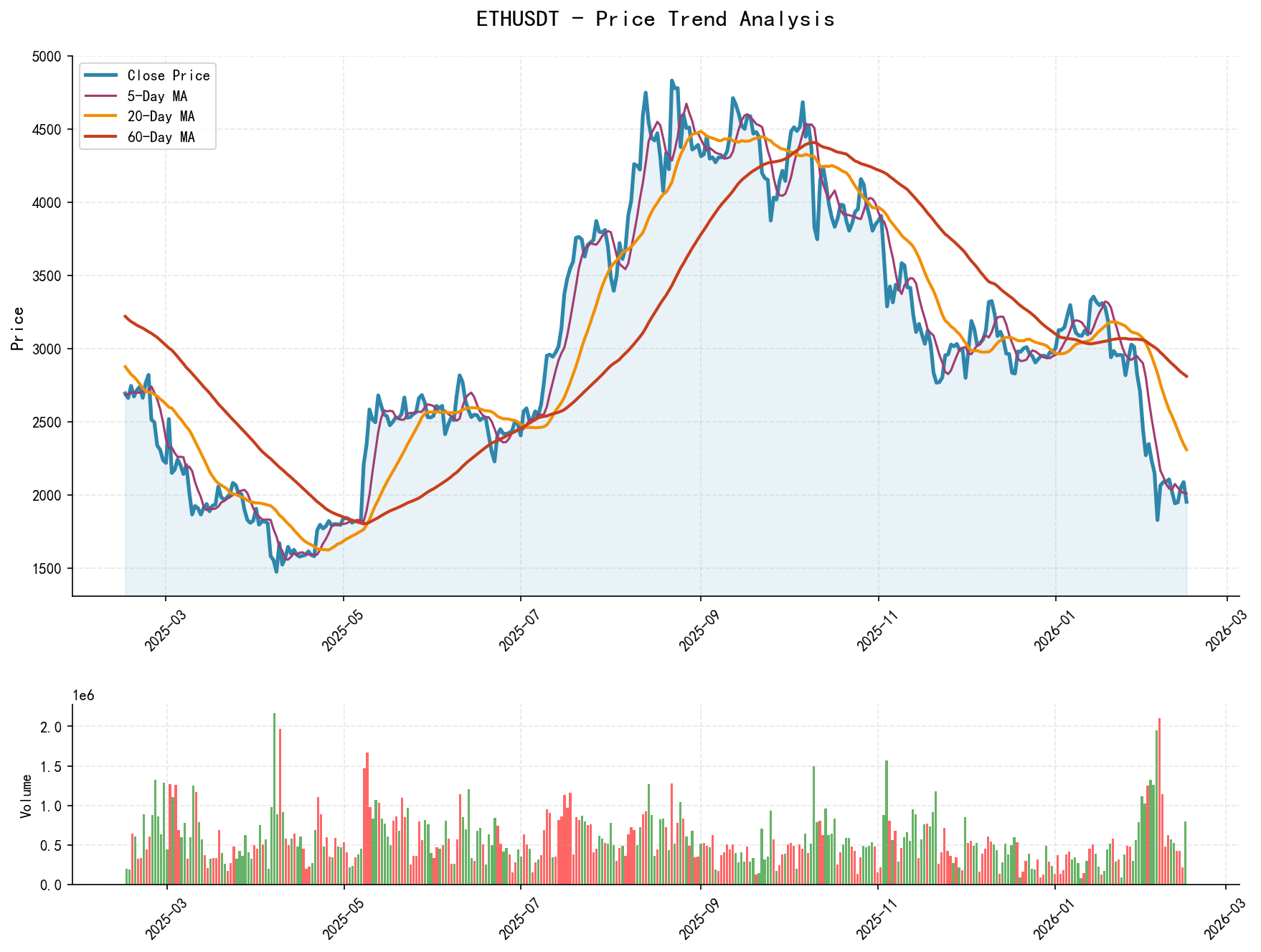

1. Trend Analysis and Market Phase Identification

As of February 15, 2026, ETHUSDT opened at 2086.59, closed at 1951.52. The 5-day moving average (MA) is 2009.40, the 10-day MA is 2021.91, the 20-day MA is 2308.40. The daily change is -6.47%, weekly change is -6.61%, monthly change is -20.41%, quarterly change is -34.33%, yearly-to-date change is -34.33%.

Data Interpretation:

- • MA Alignment: Throughout the analysis period, the price (CLOSE) has predominantly traded below all moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), displaying a clear and widening bearish alignment. As of 2026-02-15, the MA_5D (2009.40) is significantly below the MA_60D (2810.01), indicating strong and accelerating downward momentum.

- • MA Crossovers and Price Action: The price experienced a brief rally from late December 2025 to mid-January 2026 (low ~2900 to high ~3367), during which the MA_5D briefly crossed above the MA_20D. However, this rally failed to reverse the downtrend of the longer-term MAs (MA_30D/MA_60D). After the rally ended, the price initiated a major downward wave around January 20th. The moving averages once again formed a downward divergent bearish alignment, confirming the resumption and acceleration of the downtrend.

- • Price Behavior: The price fell consistently from the peak of 3325.82 on 2026-01-13 to the low of 1951.52 on 2026-02-15, with a maximum drawdown exceeding 41%. The overall pattern exhibits characteristics of "weak rally -> accelerated decline -> panic crash".

Wyckoff Phase Inference:

Based on the above, the market has clearly entered the final stage of the Markdown trend – the Panic Selling phase. The evidence lies in the consecutive, steep declines in early February, accompanied by extreme volume expansion (see volume-price analysis below), which is a hallmark of market sentiment breakdown and panic selling by retail investors.

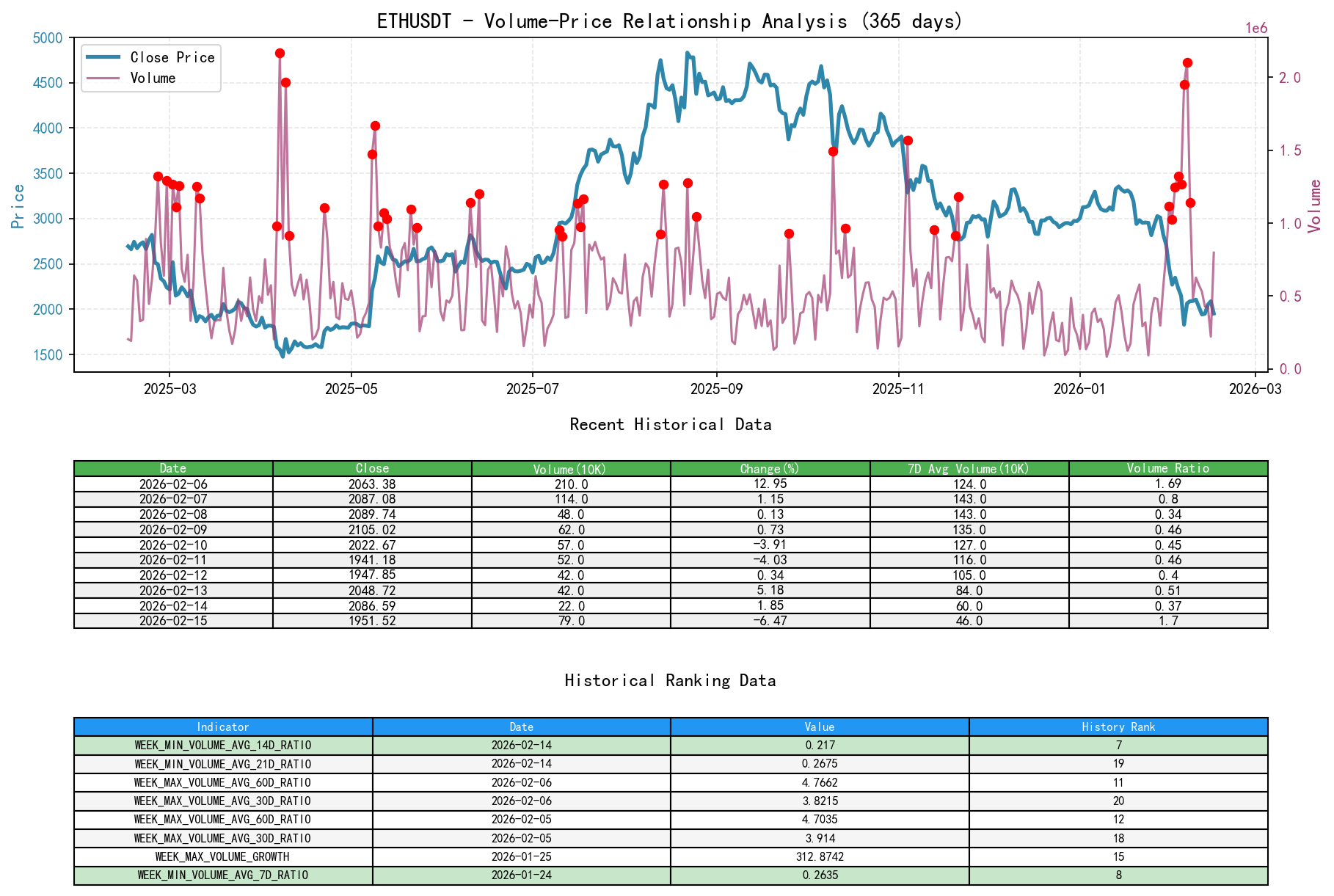

2. Volume-Price Relationship and Supply-Demand Dynamics

As of February 15, 2026, ETHUSDT opened at 2086.59, closed at 1951.52, volume was 796562.55, daily change was -6.47%. The 7-day average volume is 469441.07, resulting in a 7-day volume ratio of 1.70.

Data Interpretation and Key Day Identification:

- 1. Distribution and Trend Reversal (2026-01-13 to 2026-01-20):

- • 01-13: Price surged 7.43% to 3325.82, with volume significantly expanding (VOLUME_AVG_30D_RATIO=1.57). This could represent a "last buying climax" at the end of the rally, where supply began to emerge.

- • 01-20: Price plunged -7.83%, with the volume ratio (VOLUME_AVG_30D_RATIO=1.90) reaching one of the cycle's highs. This plunge on high volume confirmed that supply had completely taken control of the market, ending the rally trend.

- 2. Panic Selling and High-Volume Transfer (2026-01-31 to 2026-02-06):

- • Extreme Volume Surge: Trading volume spiked dramatically during this period. For example: The VOLUME_AVG_60D_RATIO reached 2.83 on 02-01 (ranking 20th in the past 10 years), 4.70 on 02-05 (ranking 12th), and 4.77 on 02-06 (ranking 11th). This represents exceptionally high-volume trading rarely seen in the past decade.

- • Price Down, Volume Up: The price plummeted from 2451.95 to 1826.83 during this period, a 25.5% drop, perfectly aligning with the volume-price characteristics of panic selling. According to Wyckoff principles, such "high-volume crashes" are often accompanied by passive absorption or active accumulation by large investors.

- 3. Initial Stabilization and Demand Testing (2026-02-06 to 2026-02-15):

- • 02-06: Price rebounded 12.95% after the crash, with volume (VOLUME_AVG_60D_RATIO=4.77) remaining at extreme levels. This formed the outline of Preliminary Support or a potential Selling Climax, indicating buying interest (demand) at extreme lows.

- • 02-07 to 02-15: Price oscillated within the 1800-2100 range. Volume retreated from extreme highs but remained significantly above the December average. On 02-15, the price fell -6.47%, but volume (VOLUME_AVG_7D_RATIO=1.70) expanded again, suggesting renewed supply and a Test of the support strength in the previous low area.

Supply-Demand Conclusion:

Supply completely dominated the market in late January, triggering panic. The massive, high-volume crash in early February marked the climax of panic selling, simultaneously revealing substantial absorbing power (demand). The market is currently in a Secondary Test or consolidation/bottoming phase post-panic, where supply and demand are fiercely contesting within the new lower price range.

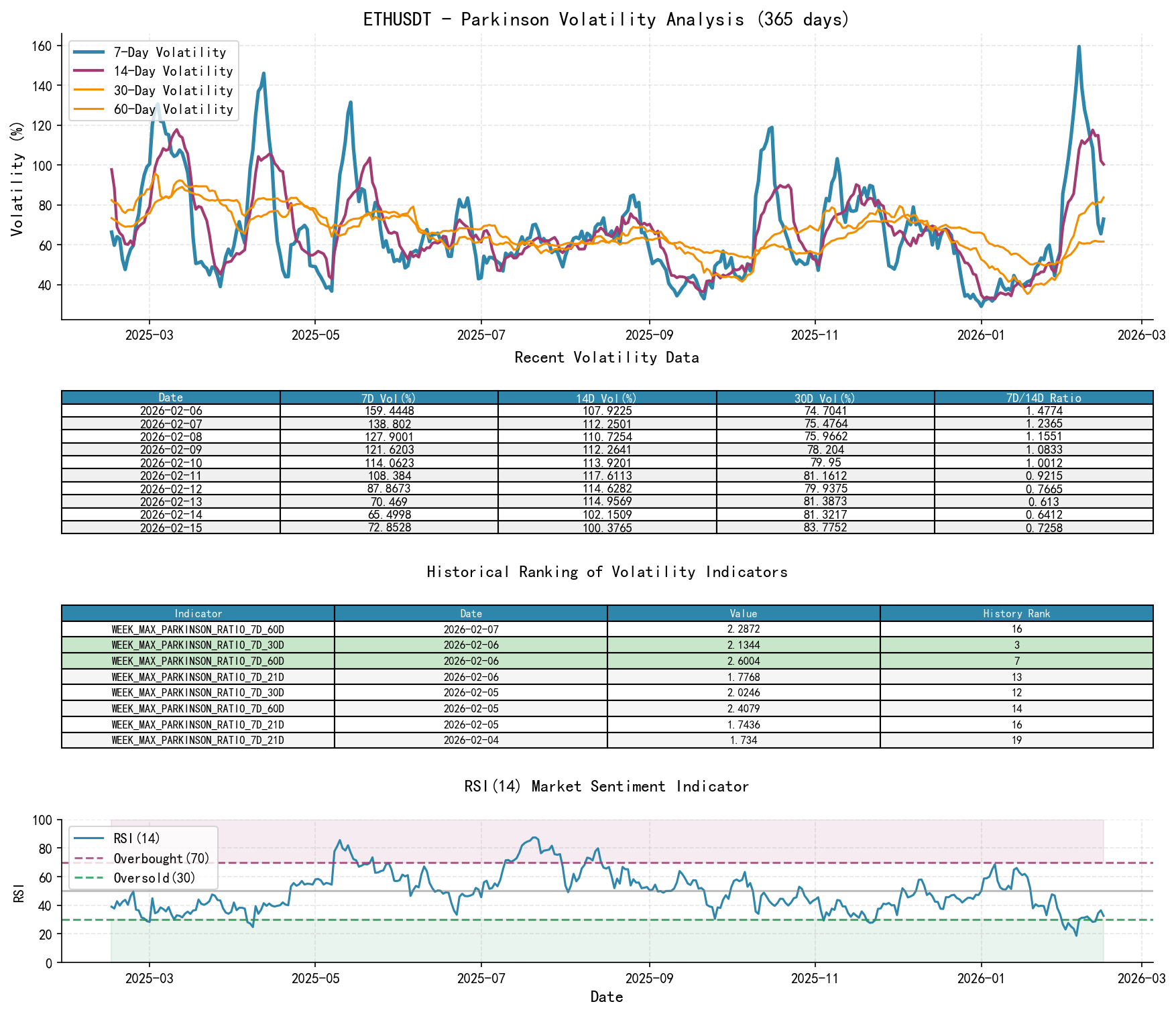

3. Volatility and Market Sentiment

As of February 15, 2026, ETHUSDT opened at 2086.59. The 7-day intraday volatility is 0.73, its 7D/60D ratio is 0.73. The 7-day historical volatility is 0.78, its 7D/60D ratio is 0.63. The RSI is 32.58.

Data Interpretation:

- 1. Extreme Volatility:

- • Short-term volatility spiked sharply during the early February crash. For instance, on 02-06,

HIS_VOLA_RATIO_7D_60Dreached 2.23 (ranking 16th in the past 10 years), andPARKINSON_RATIO_7D_60Dreached 2.60 (ranking 7th). This indicates the 7-day volatility was over twice the 60-day volatility, representing a historical-level volatility expansion event, serving as quantitative evidence of market panic and trend acceleration. - • Recently (02-13 to 02-15), short-term volatility ratios (e.g.,

HIS_VOLA_RATIO_7D_60D) have retreated from the peak of 2.23 to 0.98, showing that market panic is easing from extreme levels.

- • Short-term volatility spiked sharply during the early February crash. For instance, on 02-06,

- 2. Oversold Condition:

- • RSI_14 dropped to 18.68 on 02-05 (ranking 8th lowest in the past 10 years), entering a severely oversold zone. This resonated with the price crash and high volume, confirming an emotional breakdown point.

- • As of 02-15, RSI_14 is at 32.58. While it has moved out of the extreme oversold zone, it remains in a weak area, indicating fragile market sentiment and lackluster rebounds.

Sentiment Conclusion:

Market sentiment underwent a qualitative shift from "concern" to "extreme panic" in early February, precisely captured by volatility indicators and historical ranking data. Current sentiment is recovering from the panic peak but remains pessimistic and hesitant, with no clear reversal signal to optimism yet.

4. Relative Strength and Momentum Performance

Data Interpretation:

- • Momentum indicators across all timeframes are deeply negative, confirming the market is in a strong downtrend. As of 2026-02-15:

WTD_RETURN(-6.61%),MTD_RETURN(-20.41%),QTD_RETURN(-34.33%),YTD(-34.33%). - • Momentum aligns with price and volume conclusions: Short-term momentum (WTD), while still negative, has improved compared to the extreme negative values in early February (e.g., -35.28% on 02-05). This coincides with price oscillation in the 1800-2100 range and receding volatility, indicating downward momentum is decaying, but has not yet turned positive.

5. Large Investor ("Smart Money") Behavior Identification

Inferred Operational Intent Based on Wyckoff Events:

- 1. Distribution (Early to Mid-January): Large investors distributed holdings at the rally highs of 3300-3400, manifested as "high-volume stagnation" and "high-volume decline" from January 13-20, successfully transferring holdings to buyers chasing the rally.

- 2. Inducing Panic and Accumulation (Late January to Early February): Within the downtrend, large capital may have sold or allowed the decline to induce panic (Creek), triggering panic selling by retail investors (Panic). The historic high-volume crash from February 1st to 6th is a classic "Selling Climax" scenario. Wyckoff theory posits that such massive volume must include active buying (accumulation) by large investors who absorbed the panic-driven selling at these levels.

- 3. Testing and Shaking Out (February 7th to Present): Post-panic, the price rebounded near 2100 before declining again (02-10, 02-15). This could be smart money testing for remaining supply and gauging retail investor conviction. The decline on 02-15 on increased volume without breaking the previous low can be viewed as a Test of support. If subsequent tests occur at "lower prices with lower volume," it would further prove supply exhaustion.

Core Answer: During the massive early February crash, panicked retail and small investors were selling, while large investors with a long-term perspective (smart money) were absorbing in tranches. In the current phase, large capital is likely using oscillation and testing to shake out weak holders and solidify the bottom structure.

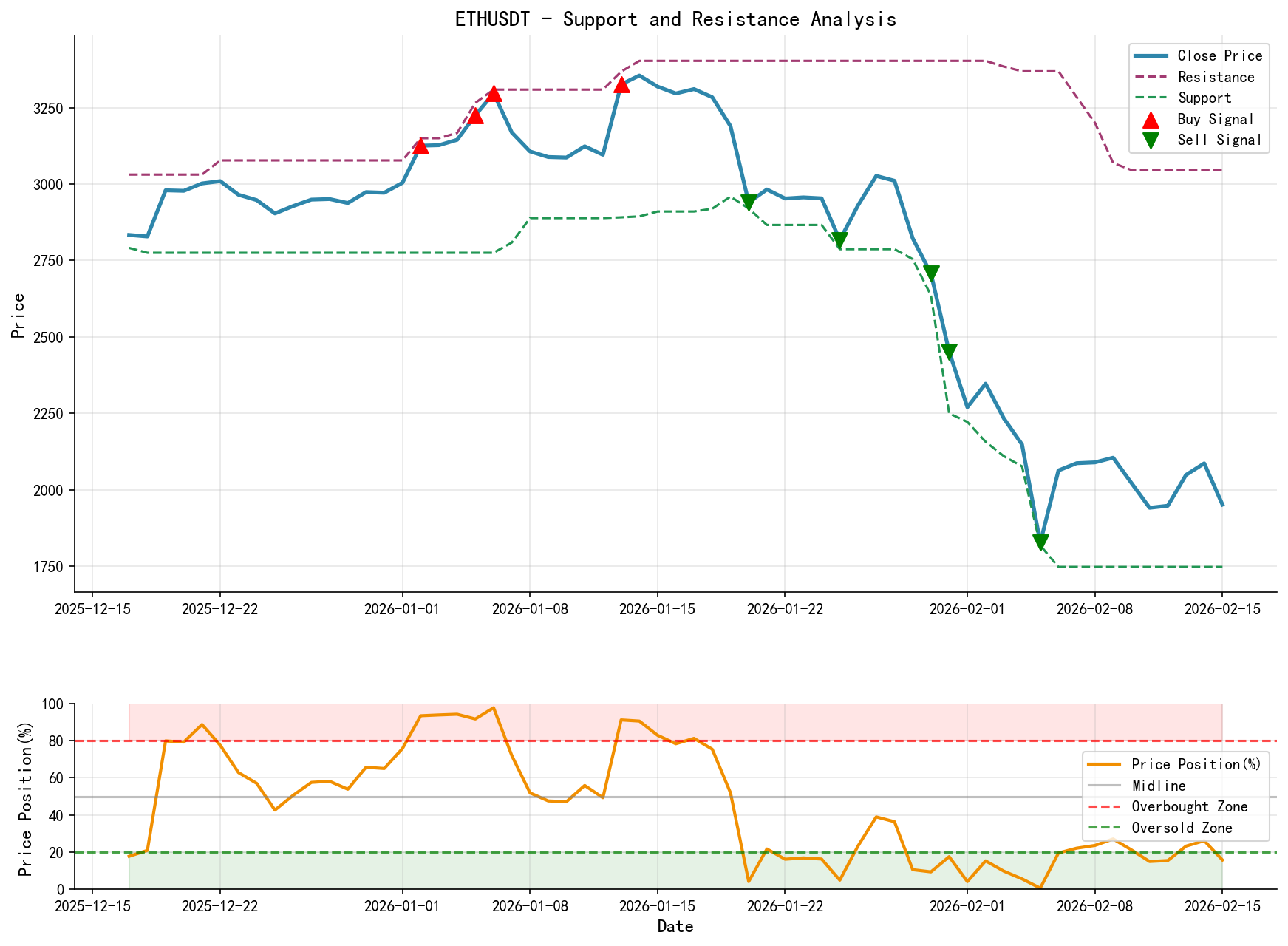

6. Support/Resistance Level Analysis and Trading Signals

Key Levels:

- • Strong Support Zone:1900. This is the low area from the panic selling (lows on 02-05, 02-06, 02-11), tested multiple times, representing the first major emergence of demand.

- • Near-term Resistance Zone:2100. This is the post-panic rally high (highs on 02-07, 02-09, 02-14) and the upper bound of the current consolidation range, where supply is evident.

- • Major Resistance Zone:2350. The platform low before the late-January crash, constituting a strong future resistance for any rebound.

Integrated Wyckoff Trading Signals and Operational Recommendations:

- • Current Market State: Transitioning from "Panic Selling" towards "Automatic Rally/Secondary Test". The bottoming process is not yet confirmed.

- • Operational Recommendation: Adopt a wait-and-see approach. Aggressive traders may consider lightly positioning for a rebound but must enforce strict risk management.

- • Bullish / Entry Signals (all required):

- 1. Price Action: Price finds support again above the 1800-1900 support zone, accompanied by contracting volume (successful supply test).

- 2. Volume-Price Confirmation: A bullish candle with expanding volume (volume higher than previous day) breaks above the $2100 resistance and closes above it.

- 3. Structure Confirmation: Formation of a "Higher Low (HL)" and "Higher High (HH)" structure.

- • Bearish / Stop-Loss Signals:

- 1. Price breaks below the $1800 support zone on high volume, signaling failed accumulation and a resumption of the downtrend.

- 2. A rally near $2100 is met again with high-volume stagnation or long upper shadows, signaling an opportunity to sell/short.

- • Bullish / Entry Signals (all required):

- • Specific Operations (Example):

- • Aggressive (Left Side): In the 1850-1900 area, if a bullish candlestick pattern indicating exhaustion of selling appears on 1-hour or 4-hour charts (e.g., hammer, bullish engulfing) accompanied by low volume, consider a light long position (e.g., 1-2% of capital), with a stop-loss placed below 1800.

- • Conservative (Right Side): Wait for price to break and close above2050, with a stop-loss placed below 2020.

- • Future Validation Points:

- 1. Confirming Bullish Hypothesis: Requires observing that volume during a test of the 1800-1900 support is significantly lower than the panic volume of early February (VOLUME_AVG_30D_RATIO < 1.0).

- 2. Invalidating Bullish Hypothesis: If price fails to break above 2100 on a rebound and falls with expanding volume (VOLUME_AVG_7D_RATIO > 1.5), the bottom formation may have failed, requiring a reassessment of downside risk.

Conclusion Reiteration: ETHUSDT has undergone a panic selling event of rare intensity in the past decade, generating historical-level volume-price and volatility signals. Smart money has shown willingness to absorb at extreme lows, and the market has entered a complex bottoming phase. Traders should not blindly chase the short side but patiently await the risk-controlled, supply-demand shift confirmation signals provided by the aforementioned Wyckoff events. The current critical tasks are confirming the validity of the 1800-1900 support zone and observing whether demand can effectively break through the 2100 supply zone.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risks; invest cautiously. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is published daily before the 8:00 AM market open. Please feel free to leave comments and share; your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: