Very well. As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive and in-depth quantitative analysis report based on the XRPUSDT data and historical ranking metrics you provided.

Wyckoff Quantitative Analysis Report - XRPUSDT

Product Code: XRPUSDT

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

Core Objective: Analyze supply and demand dynamics based on Wyckoff volume-price principles, identify the operational intentions of large investors, and provide quantifiable trading signals.

1. Trend Analysis & Market Phase Identification

As of January 20, 2026, the underlying asset XRPUSDT had an opening price of 1.99, a closing price of 1.90, a 5-day moving average of 2.04, a 10-day moving average of 2.07, a 20-day moving average of 2.08, with a daily change of -4.21%, weekly change of -12.15%, monthly change of 3.26%, quarterly change of 3.26%, and annual change of 3.26%.

- • Moving Average Alignment Analysis: Throughout the analysis period, the price experienced a process from a complete bearish alignment to a weak rebound, and then a return to a bearish alignment. On the start date (November 21st), the price closed below all moving averages (MA_5D=2.14, MA_20D=2.29, MA_60D=2.54), establishing a downtrend. The rebound from late December to early January briefly lifted the short-term moving average (MA_5D) above the long-term moving averages (MA_20D/30D), forming a local bullish alignment, but failed to hold effectively. By the period's end date (January 20th), the price (1.9024) had once again fallen below all short-term moving averages (MA_5D=2.037, MA_10D=2.071) and was under the suppression of the medium-term (MA_30D=2.01) and long-term (MA_60D=2.03) moving averages, indicating that the bearish trend has been re-established.

- • Moving Average Crossover Signals:

- • Death Cross (Bearish): On January 16th, MA_5D (2.102) crossed below MA_20D (2.047) from above, providing a clear signal of short-term trend weakness. Following this signal, the price accelerated its decline, validating its effectiveness.

- • Crossover Direction: All key moving averages (MA_5D, MA_10D, MA_20D, MA_30D) are either pointing downwards or flattening. The downward slope of MA_60D is moderating, but the direction remains unchanged. This indicates waning medium-term trend momentum and the continuation of the bearish structure.

- • Market Phase Inference (Wyckoff Framework):

- • Phase A - Distribution: In late November 2025, the price began declining from highs above $2.0, with exceptionally high volume in the initial stage (e.g., November 21st, VOLUME_AVG_7D_RATIO=1.79). This is a classic Distribution characteristic, where "smart money" transfers holdings to the public chasing the rally at elevated prices.

- • Phase B - Markdown (Panic Selling): From late November through December, the price experienced a waterfall decline, reaching a low of 1.8076 (December 18th). This period was accompanied by multiple high-volume plunges (e.g., December 1st, VOLUME_AVG_7D_RATIO=1.51), indicating the market entered a panic phase.

- • Phase C - Automatic Rally & Secondary Test: After bottoming in late December, a sharp rebound to 2.3478 (January 5th) occurred in early January, representing the "Automatic Rally". Subsequently, the price retraced and is undergoing a Secondary Test of the previous low area (1.89-1.99). Currently (January 20th), the price is conducting a secondary test of the key support zone around 1.80-1.85. The market is in the Secondary Test phase of a downtrend, the outcome of which is crucial in determining whether it will transition into Accumulation or continue declining.

2. Volume-Price Relationship & Supply-Demand Dynamics

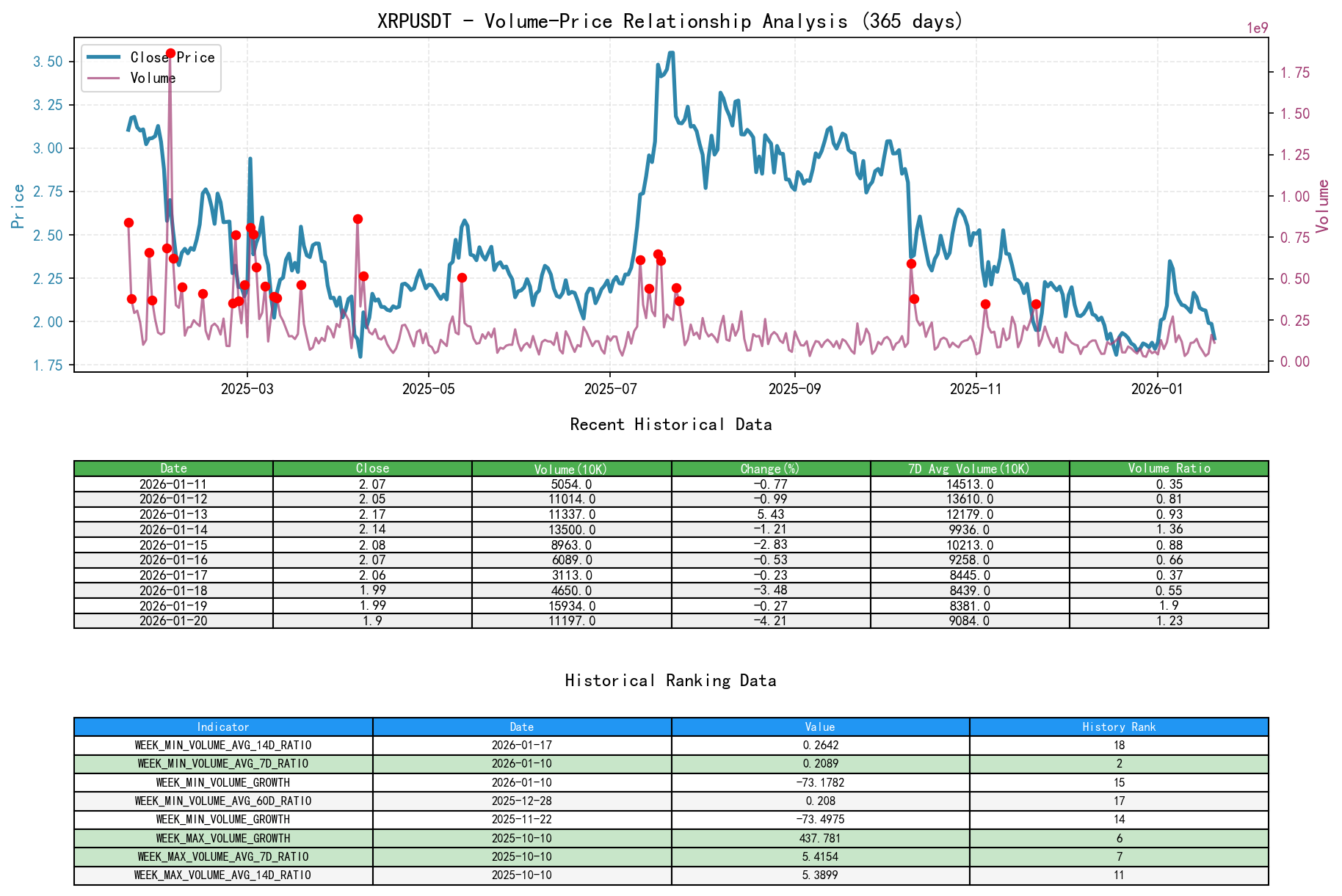

As of January 20, 2026, the underlying asset XRPUSDT had an opening price of 1.99, a closing price of 1.90, volume of 111971788.10, a daily change of -4.21%, volume of 111971788.10, a 7-day average volume of 90843566.61, and a 7-day volume ratio of 1.23.

- • Key Demand Day Identification (Potentially Bullish):

- • 2025-11-24: Price surged 8.71% (closing at 2.2276), volume spiked by 54% (VOLUME_GROWTH), and relative to the 7-day average volume (VOLUME_AVG_7D_RATIO=0.97), it was not significantly elevated. This indicates high-quality buying, with orderly buy-side entry, suggesting demand briefly took the lead.

- • 2026-01-02: Price surged 6.76%, and volume (VOLUME_AVG_7D_RATIO=2.53) reached a new high for the phase. This volume level ranked 2nd historically in the past 10 years on a weekly basis (see HISTORY_RANK: WEEK_MIN_VOLUME_AVG_7D_RATIO), indicating demand drove the breakout with overwhelming force, forming the starting point of the early January rebound.

- • 2026-01-05: Price soared 12.29% (closing at 2.3478), and volume (VOLUME_AVG_14D_RATIO=3.13) once again expanded significantly, showing robust demand even at the rebound peak.

- • Key Supply Day Identification (Potentially Bearish):

- • 2025-12-01: Price plummeted 5.81%, and volume (VOLUME_AVG_7D_RATIO=1.51) expanded more than 2.3 times, while the price made a new low (1.9835). This is a typical characteristic of a Selling Climax, where supply is concentratedly released amid fear, but it also creates space for subsequent rebounds.

- • 2026-01-07: Price plunged 6.01% near the rebound high, with volume (VOLUME_AVG_14D_RATIO=1.29) remaining elevated. This is high-volume decline, indicating that at the rebound high, supply quickly overwhelmed demand, and distribution behavior occurred.

- • 2026-01-20 (Latest Data): Price declined 4.21%, and volume (VOLUME_AVG_7D_RATIO=1.23) was significantly higher than the recent average. This represents expanding supply during the decline, suggesting bearish forces are still strengthening.

- • Low-Volume Rebound (Insufficient Demand):

- • 2026-01-10: Price declined slightly by 0.24%, but volume (VOLUME_AVG_7D_RATIO=0.21) contracted to an extreme historical low. Its weekly volume/7-day average volume ratio hit the 2nd lowest level in nearly 10 years (see HISTORY_RANK). This indicates extremely scarce demand during price consolidation, with the market entering a wait-and-see mode. Subsequently, the price broke down and fell.

- • Supply-Demand Transition Conclusion: The market experienced a strong demand-led rebound in early January, but encountered supply pressure on January 5th-7th, ending the rebound. Since then, supply has consistently dominated, while demand has been weak (marked by the extreme low volume on January 10th), leading the price back into a downtrend.

3. Volatility & Market Sentiment

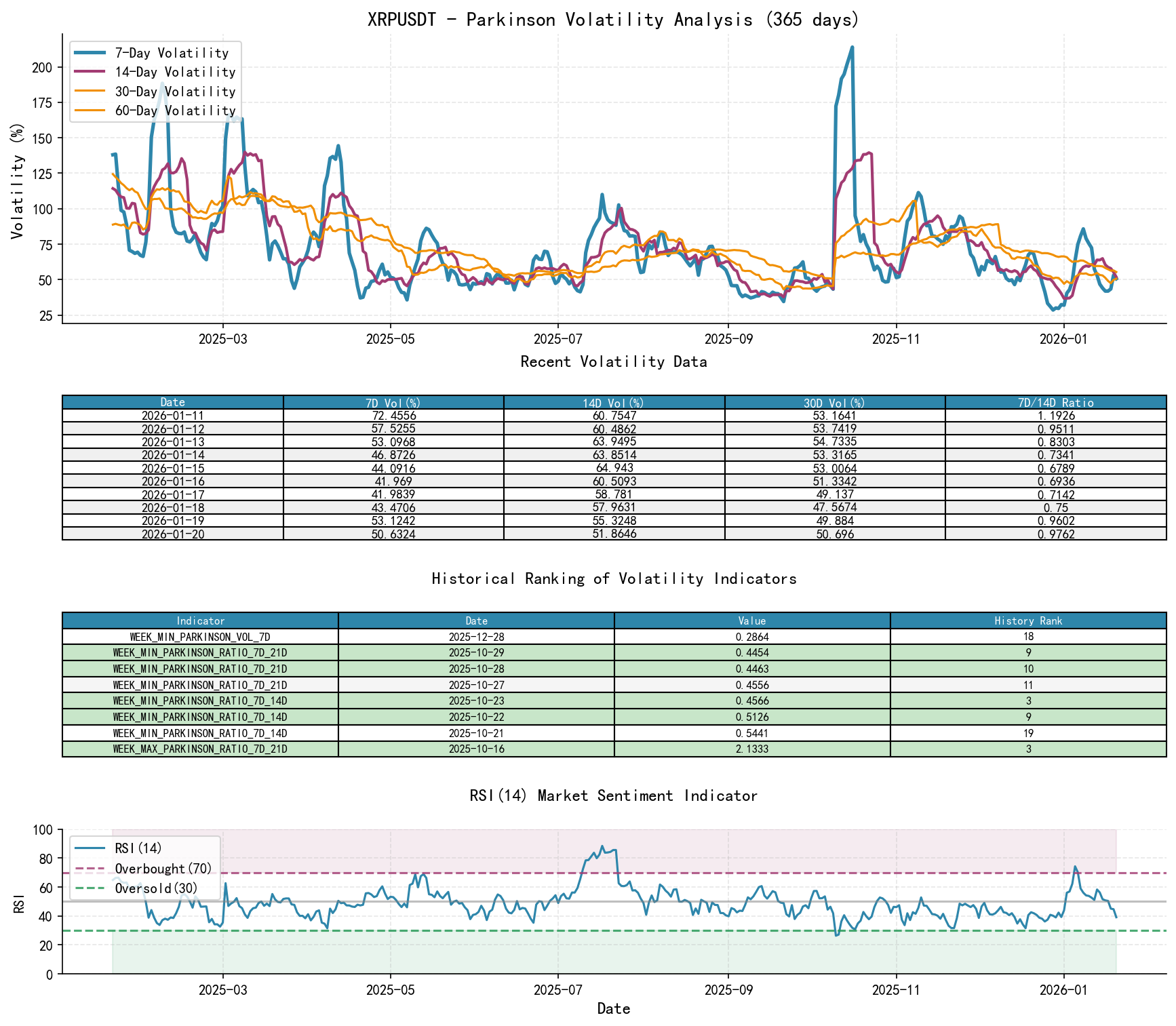

As of January 20, 2026, the underlying asset XRPUSDT had an opening price of 1.99, a 7-day intraday Parkinson volatility of 0.51, a 7-day Parkinson volatility ratio of 0.98, a 7-day historical volatility of 0.32, a 7-day historical volatility ratio of 0.65, and an RSI of 39.14.

- • Volatility Level & Changes: The Parkinson intraday volatility (PARKINSON_VOL_7D) remained at relatively low levels (0.3-0.5) from late December to early January, indicating market volatility convergence. From January 5th to 7th, short-term volatility (HIS_VOLA_7D=0.98, 1.10) surged sharply, far exceeding the 14-day and 30-day volatility averages (HIS_VOLA_RATIO_7D_14D > 1.3), indicating rapid market sentiment ignition and extreme shifts between panic and greed. By January 20th, short-term volatility (HIS_VOLA_7D=0.32) had significantly retraced and fallen below the long-term average. Market sentiment has stabilized, but the trend remains downward.

- • Sentiment Extreme Point Verification:

- • Oversold: RSI_14 touched or fell below 35 multiple times in mid-to-late December (e.g., 31.56 on December 18th), confirming an oversold market condition, aligning with the phase of panic-driven price decline.

- • Overbought: At the early January rebound peak, RSI_14 reached 74.35 (January 5th), entering the overbought zone, after which the price topped and reversed.

- • Current Sentiment: As of January 20th, RSI_14 is 39.14. It has rebounded from the oversold zone but has not entered strong territory. Market sentiment is weak but not extremely pessimistic, positioned for a technical correction within the downtrend.

4. Relative Strength & Momentum Performance

- • Return Analysis:

- • Short-term Momentum (WTD/MTD): As of January 20th, both the week-to-date return (WTD_RETURN=-12.15%) and month-to-date return (MTD_RETURN=3.26%) are negative, with a significant weekly decline, indicating extremely weak short-term momentum.

- • Medium-term Momentum (QTD/YTD): The quarter-to-date (QTD_RETURN=3.26%) and year-to-date (YTD=3.26%) returns are slightly positive, entirely contributed by the violent rebound in early January. Excluding this rebound, the medium-term momentum structure remains weak. The longer-term TTM_12 (-38.74%) is deeply negative, confirming a long-term weak pattern.

- • Momentum Composite Judgment: The market lacks sustained, healthy upward momentum. The impulse-style rebound in early January failed to alter the medium-term downtrend momentum structure. The current market is in a weak pattern characterized by collapsed short-term momentum and weak medium-term momentum.

5. Large Investor (Smart Money) Behavior Identification

Based on volume-price principles and extreme data, the following large capital behaviors are inferred:

- 1. Distribution: In late November to early December, during the initial decline phase, high-volume stalling/declining near highs (e.g., November 27th-28th) aligns with the behavior of large investors distributing holdings to the market at elevated prices.

- 2. Accumulation Test: The multiple occurrences of high-volume decline but closing near or above previous lows or with long lower shadows within the 1.80-1.90 range in mid-to-late December (e.g., December 18th, January 19th) suggest funds are testing and absorbing selling pressure at lower levels. The late-session recovery after a high-volume drop on January 19th is a clear support-testing behavior.

- 3. Utilizing Shakeouts: The high-volume breakdowns of key levels on January 7th and January 20th exhibit characteristics of "shakeouts," intended to flush out weak long positions. Combined with the subsequent price action (not immediately recovering), this behavior is more likely serving the continuation of the bearish trend.

- 4. Watching & Exiting: The record of the 2nd lowest volume ratio in nearly 10 years on January 10th (WEEK_MIN_VOLUME_AVG_7D_RATIO) is an extremely important signal. It indicates that near a critical technical level, large investors opted for extreme caution or exit, without active participation. This itself is a bearish signal – smart money is unwilling to establish long positions at this level.

- 5. Behavior Summary: Large investors conducted a brief, high-intensity demand injection (rally) during the early January rebound, followed by rapid distribution near the highs (~2.35). As the price retraced to the key support zone, there were sporadic absorption tests, but overall, no strong, sustained accumulation intent was demonstrated (evidenced by the extreme low volume on January 10th). The current behavior pattern leans more towards completing distribution during the rebound and then allowing or pushing the market towards a secondary test of the lows.

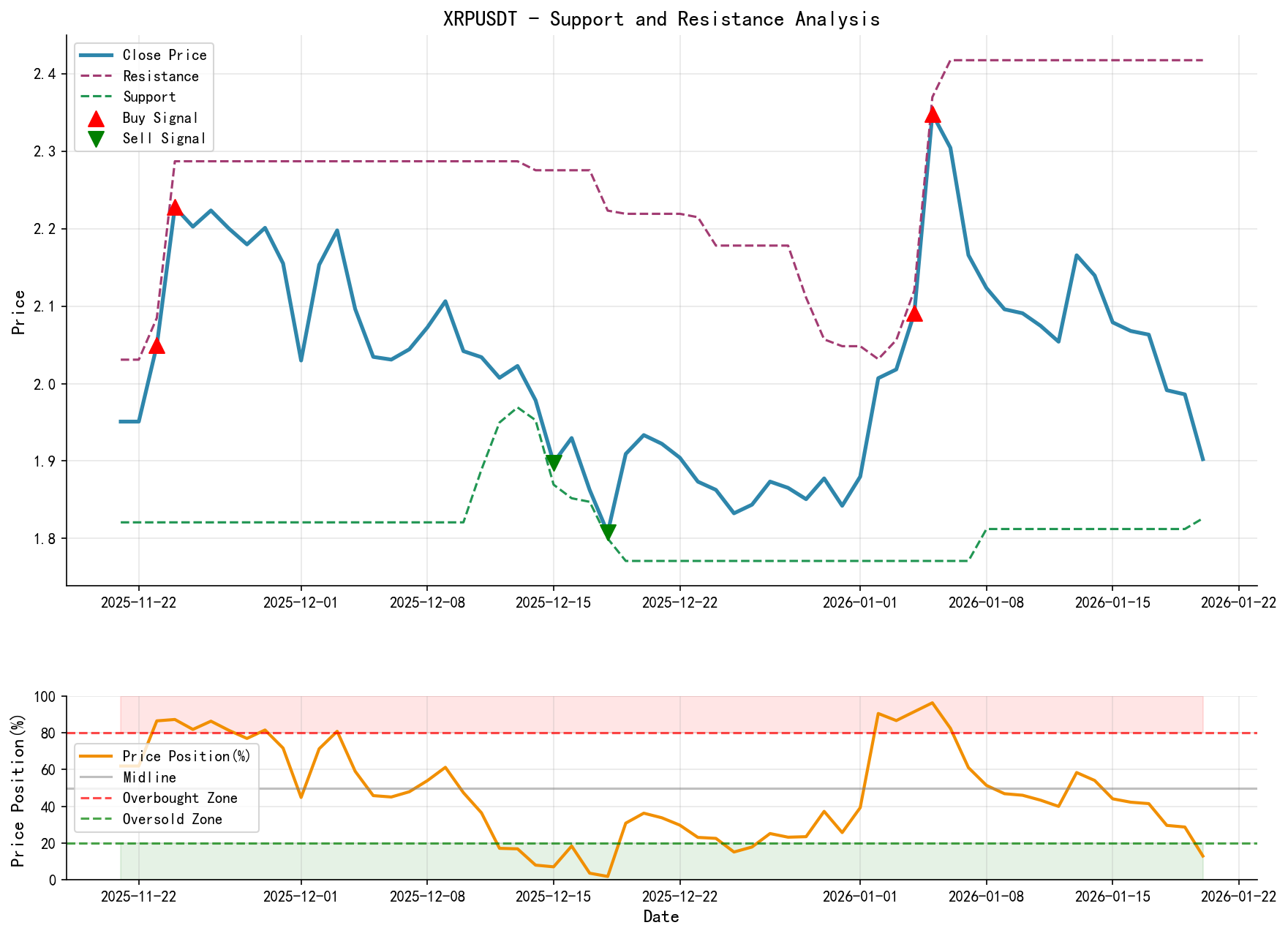

6. Support/Resistance Level Analysis & Trading Signals

- • Key Support Levels (Support):

- • Primary Support:1.85. This is a dense transaction zone formed by the December 18th panic low (1.8076) and recent multiple tests (January 19th low 1.847). This is the critical line determining whether the market enters deeper decline.

- • Secondary Support:2.02. The launch platform for the late December to early January rebound and the area near the 30-day MA, which has now transformed into recent resistance.

- • Key Resistance Levels (Resistance):

- • Strong Resistance:2.42. The early January rebound high and distribution zone, where significant trapped positions are concentrated.

- • Dynamic Resistance:2.10. Minor consolidation platforms during the recent decline, and the area where MA_5D and MA_10D are located.

- • Comprehensive Wyckoff Trading Signals:

- • Market Phase: In the Secondary Test phase of the downtrend, currently testing the key 1.80-1.85 support.

- • Signal Strength: Bearish. However, note that the price is nearing key support, and the RSI is in a neutral-to-weak zone, making chasing shorts here unattractive from a risk-reward perspective.

- • Operational Recommendations:

- 1. Aggressive Short Strategy: If the price rallies to the 2.05-2.10 resistance zone and shows signs of stalling or short-term bearish divergence, consider a light short position with a stop-loss above 2.15, targeting 1.85.

- 2. Breakout Follow Strategy: If the price breaks below the 1.80 support decisively on high volume (e.g., closing below 1.80 without a significant bounce the next day), the decline may extend further. Follow with a short position, targeting 1.70 and below.

- 3. Observation / Waiting for Reversal Signals: Strongly recommend observing. A more prudent strategy is to wait for a clear Wyckoff reversal signal in the 1.80-1.85 support zone (e.g., Spring: breaking below support and quickly reclaiming it on high volume) before considering long positions. Currently, no such signal is present.

- • Future Validation Points:

- • Bearish Validation: The price fails to rally and sustain above 2.05-2.10, and ultimately breaks below 1.80 on high volume.

- • Bullish Reversal Signal: The price finds footing in the 1.80-1.85 zone, and exhibits "high-volume advance against an oversold backdrop" (strong demand returning), and can close consecutively above 2.05. This would potentially break the downtrend, transitioning the market into an Accumulation phase.

Disclaimer: All conclusions in this report are derived from the provided historical data through the application of Wyckoff volume-price analysis principles and do not constitute any investment advice. Financial markets carry significant risks; please make decisions with caution. The "historical ranking" data cited in the report is used to provide context and does not guarantee future performance.

Thank you for your attention! Daily Wyckoff volume-price market analysis will be published promptly before the 8:00 AM market open. Please feel free to leave comments and share. Your recognition is crucial. Let's work together to see the market signals.

Member discussion: