As an expert quantitative trading researcher proficient in the Wyckoff Method, I will draft a comprehensive, in-depth quantitative analysis report for you based on the provided XLY data table and historical ranking data.

Quantitative Analysis Report: XLY (Consumer Discretionary Select Sector SPDR Fund)

Product Code: XLY

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Time: Based on data as of 2026-01-21

I. Trend Analysis and Market Phase Identification

As of January 20, 2026, the target XLY had an opening price of 120.28, a closing price of 119.12, a 5-day moving average (MA) of 123.20, a 10-day MA of 122.56, a 20-day MA of 121.89, a daily change of -2.60%, a weekly change of -4.10%, a monthly change of -0.24%, a quarterly change of -0.24%, and an annual change of -0.24%.

1. Moving Average Alignment and Trend Structure:

- • Data Observation: At the end of the analysis period (2026-01-20), the closing price of 119.12 has clearly broken below all key moving averages (MA_5D: 123.20, MA_10D: 122.56, MA_20D: 121.89, MA_30D: 121.25, MA_60D: 119.38), presenting a bearish alignment pattern.

- • Evolution Process: Between January 2 and January 9, 2026, the price rallied strongly from 118.35 to 124.41, during which the moving average system briefly formed a bullish alignment. However, after peaking at 124.52 on January 12, the price began to decline, successively breaking below the 5-day, 10-day, 20-day, and 30-day MAs, and finally piercing the long-term 60-day MA on January 20. This is a classic signal of a failed uptrend transitioning into a downtrend.

- • Wyckoff Phase Inference: Combined with price action, the rally in early January created a new high (historical ranking data confirms the January 9 closing price of 124.41 as the second-highest weekly close), but subsequently failed to continue. This can be preliminarily judged as a potential Distribution area. The current price falling below all MAs and continuing downward indicates the market has entered the Markdown Phase.

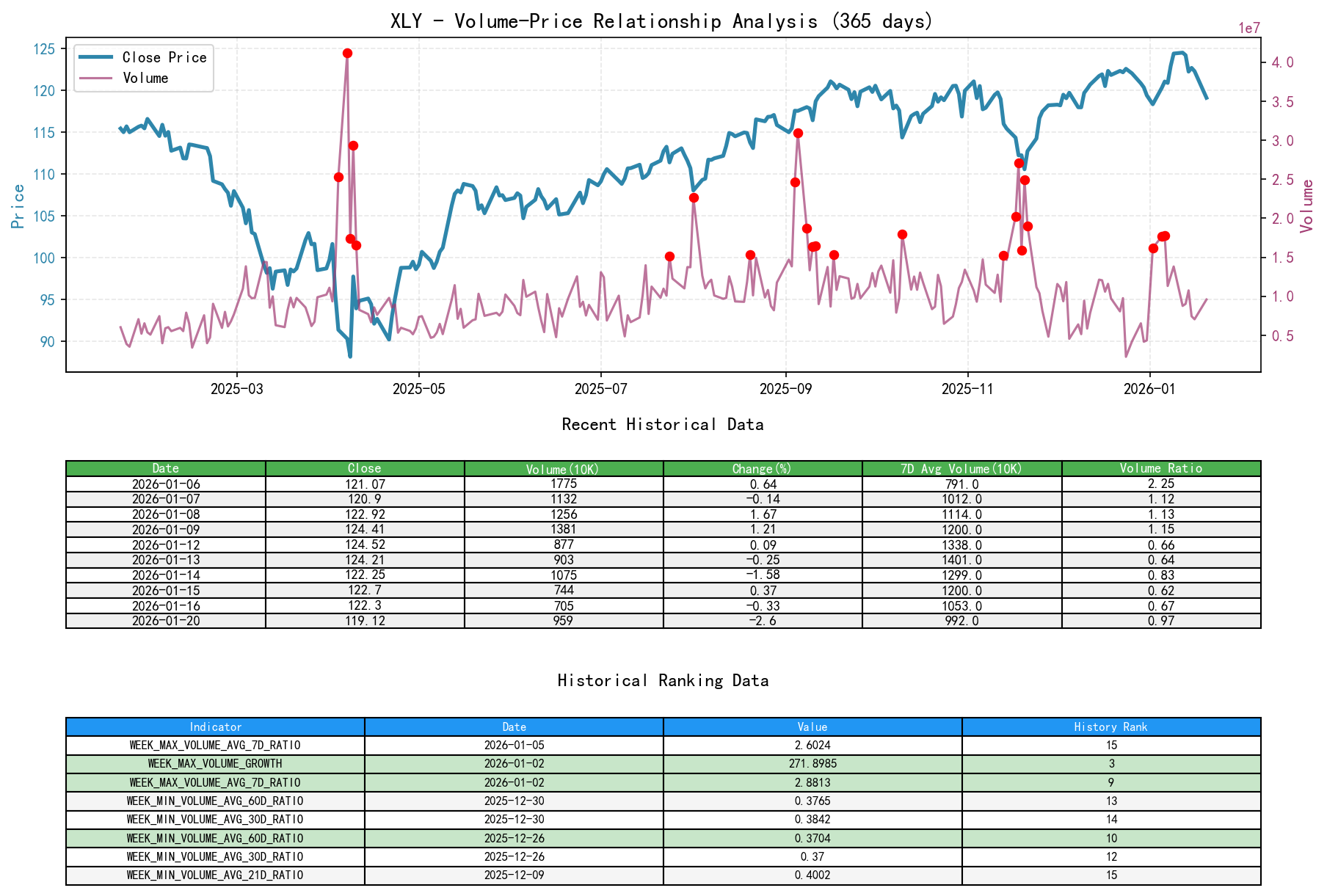

II. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the target XLY had an opening price of 120.28, a closing price of 119.12, a volume of 9,591,658, a daily change of -2.60%, a volume of 9,591,658, a 7-day average volume of 9,922,090.14, and a 7-day volume ratio of 0.97.

1. Key Day Analysis (Based on Wyckoff Principles):

- • Panic Selling (Preliminary Supply & Selling Climax):

2026-01-02is a key signal day. The price fell 0.89%, but volume surged by 271.90%, with the volume growth magnitude ranking 3rd in the past decade (HISTORY_RANK: 3). This is a classic characteristic of panic selling, indicating a massive influx of supply into the market. Although the closing price (118.35) that day became the starting point for the subsequent rebound, the high-volume decline established a significant supply zone overhead. - • Distribution Volume (Sign of Weakness & Upthrust): On

2026-01-09, the price rose 1.21% to a phase high of 124.41, with volume (13.81 million) significantly higher than the average of the preceding days (VOLUME_AVG_7D_RATIO: 1.15). Combined with the subsequent price reversal, this aligns with "rising to new highs accompanied by increased volume," a possible sign of distribution activity. The price stagnation and retreat at high levels on2026-01-12and2026-01-13further confirm supply dominance at elevated prices. - • Exhaustion of Demand and Persistent Supply (Test & Lack of Demand): On

2026-01-20(latest data), the price fell sharply by 2.60% to 119.12. Volume (9.59 million) increased by 35.89% compared to the previous day, but theVOLUME_AVG_7D_RATIOwas 0.97, not showing extreme volume similar to January 2nd. This indicates that supply continues to dominate during the decline, but panic selling may have temporarily subsided. The market is entering an Orderly Decline, with demand completely absent.

2. Quantitative Analysis of Volume Anomalies:

- • Historical ranking data shows that the

VOLUME_AVG_7D_RATIOfor2026-01-02(2.88) and for2026-01-05(2.60) rank as the 9th and 15th highest in the past decade, respectively. This confirms that the volume anomaly in early January is significant at a historical level, providing clear evidence of large-scale fund activity (whether distribution or accumulation). - • Recent

VOLUME_GROWTHindicators have retreated from extreme positive values, indicating that the volume-driven event has temporarily concluded, and the market has returned to normal trading dynamics.

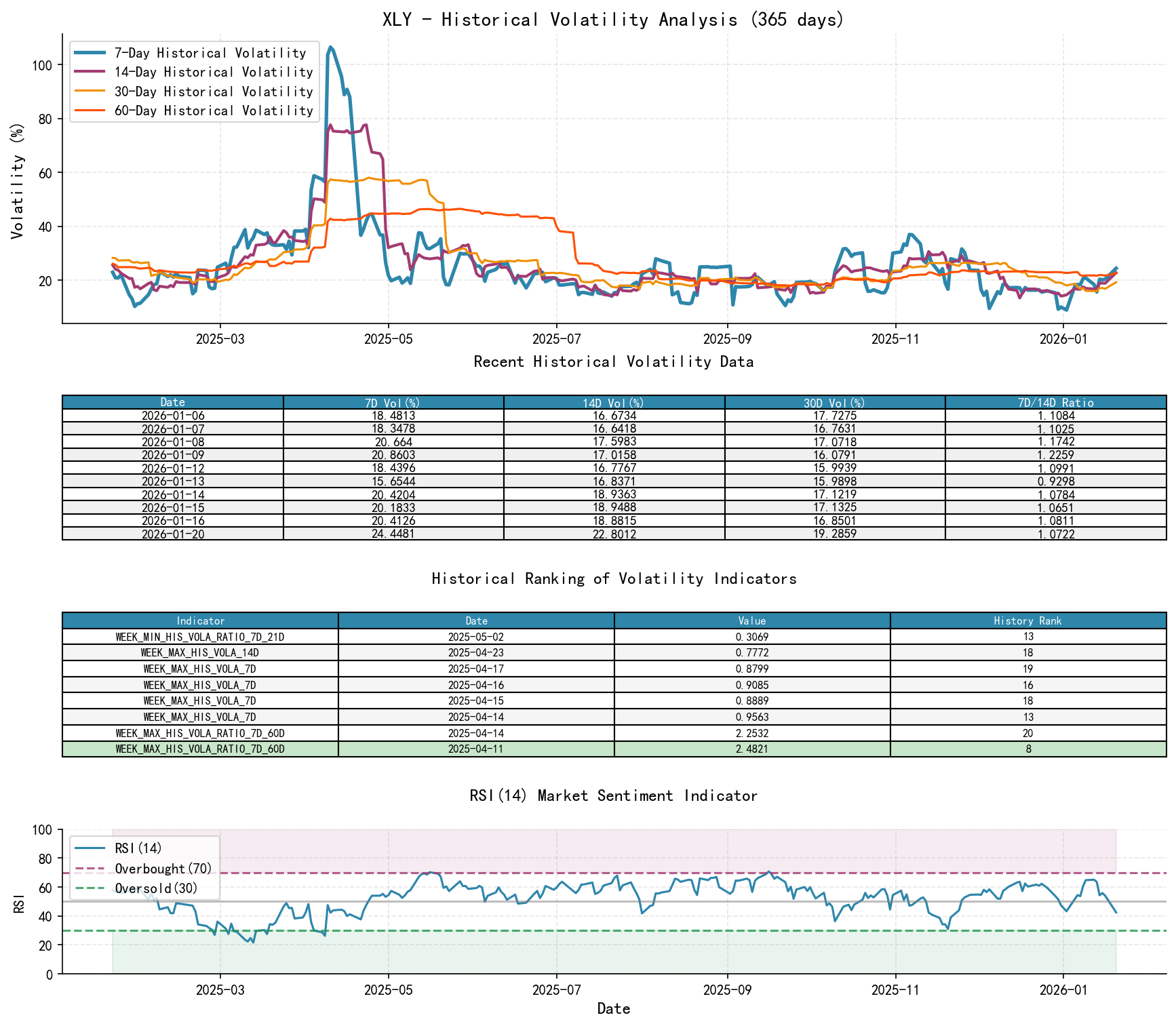

III. Volatility and Market Sentiment

As of January 20, 2026, the target XLY had an opening price of 120.28, a 7-day intraday volatility of 0.14, a 7-day intraday volatility ratio of 0.92, a 7-day historical volatility of 0.24, a 7-day historical volatility ratio of 1.07, and an RSI of 42.49.

1. Volatility Analysis:

- • Volatility Amplification: The

PARKINSON_RATIO_7D_14D(short-term/mid-term intraday volatility ratio) peaked at 1.474 on2026-01-09, ranking 10th highest in the past decade. TheHIS_VOLA_RATIO_7D_30Dreached 1.268 on2026-01-20. These two indicators together show that short-term volatility has significantly surpassed mid-term volatility recently, a typical feature of trend acceleration or heightened market nervousness, consistent with the price action of topping and then declining. - • Sentiment Indicators: The

RSI_14fell rapidly from a high of 64.81 in the overbought zone on January 9 to 42.49 on January 20, approaching the neutral-to-weak range. The rapid decline in RSI confirms the exhaustion of upward momentum and the strengthening of bearish forces. It has not yet entered the oversold zone (<30), suggesting there may still be room for further decline.

IV. Relative Strength and Momentum Performance

1. Momentum Cycle Analysis:

- • Short-term Momentum Weakening:

WTD_RETURN(weekly return) andMTD_RETURN(monthly return) were both negative at the end of the reporting period (-4.10% and -0.24%), clearly indicating that short-term and medium-term momentum have turned from positive to negative. - • Medium-to-Long-term Structure Still Intact:

YTD(year-to-date) and longer-termTTM_36(three-year) returns remain positive, indicating that the longer-term uptrend structure has not yet been completely broken. The current decline can be viewed as a significant correction within a long-term bull market.

V. Large Investor ("Smart Money") Behavior Identification

Based on the above analysis of volume-price relationships, volatility, and trends, we can infer the behavioral path of large investors:

- 1. Distribution Occurred at Early January Highs: The price reached the second-highest weekly closing price in nearly a decade (124.41) on January 9, accompanied by high volume and volatility. "Smart money" likely conducted large-scale distribution in this area, transferring holdings to buyers chasing the high. The subsequent decline and breakdown of the moving average system confirm the completion of distribution.

- 2. Accumulation Test During Panic Selling: The historically significant high-volume decline on January 2 (volume growth ranking 3rd) could have been a Secondary Test or selective accumulation by smart money capitalizing on market panic. Despite the price drop, the massive volume indicates substantial turnover around that level (~118.35), potentially forming a preliminary support zone.

- 3. Current Phase: After the price broke below all moving averages, the market entered a downtrend. Smart money is likely currently in a wait-and-see mode, waiting for the price to decline to more favorable value areas (such as near the previous panic selling zone or long-term trend support) before considering re-entry. The decline on January 20 was not accompanied by extreme volume, suggesting major selling pressure has temporarily eased, and the market is now driven by smaller-scale selling and a lack of buying interest.

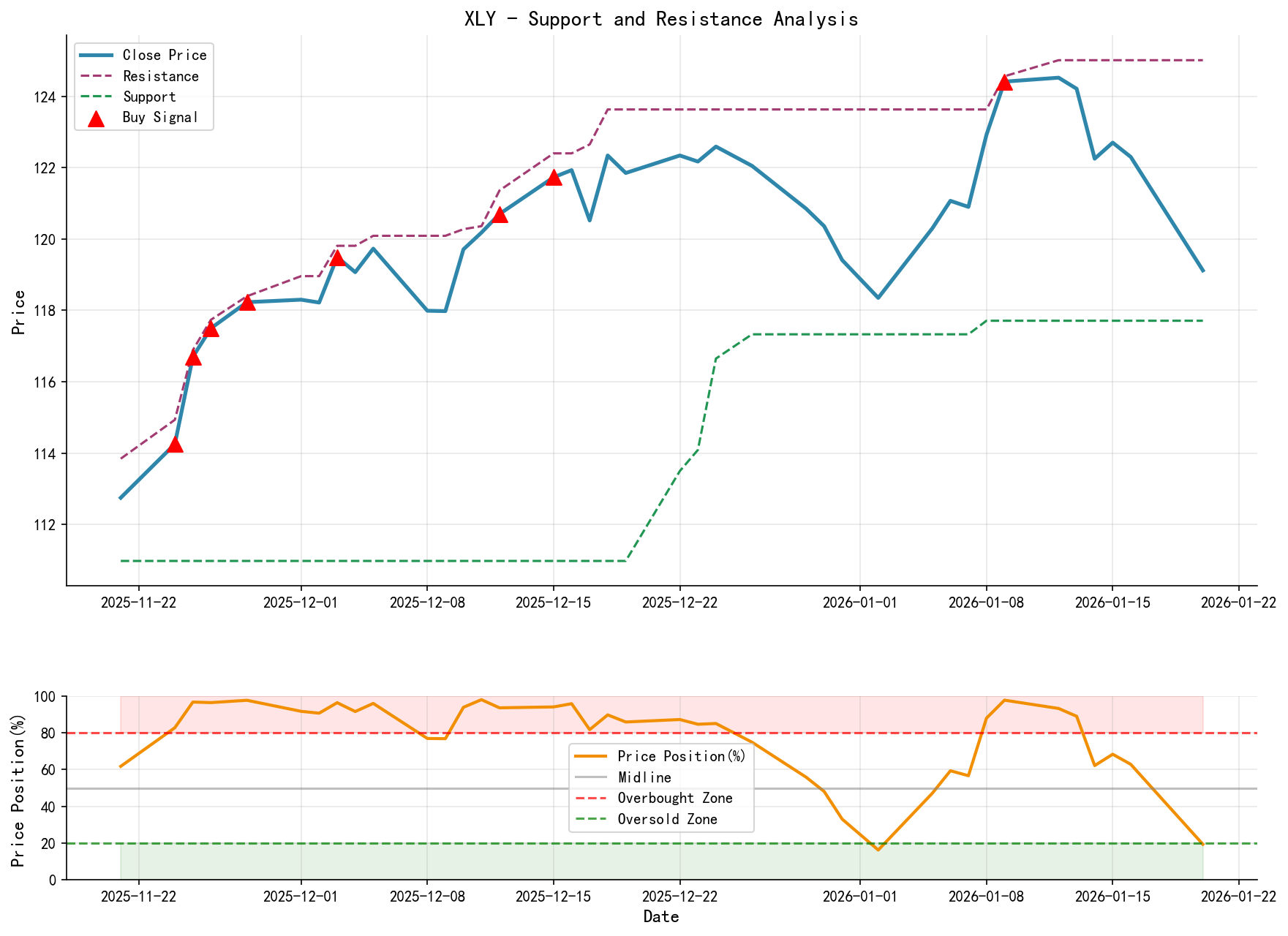

VI. Support/Resistance Level Analysis and Trading Signals

1. Key Price Level Identification:

- • Strong Resistance Zone: 122.92 - 124.41. This is the upper boundary of the distribution zone formed on January 8-9 and a recent high point for multiple rebounds. Any rally encountering resistance in this zone would be a strong bearish signal.

- • Initial Support/Resistance Conversion Zone: 120.85 - 121.85. This is the consolidation area from late December to early January and the first area of dense trading above the 60-day MA (119.38), now acting as resistance.

- • Critical Support Zone: 118.35 - 119.41. This is the low point area of the panic selling on January 2 and the level currently being tested. This zone is the critical line for determining whether the market can halt its decline. A high-volume break below this zone would open up further downside potential.

- • Long-term Trend Support: Need to observe the previous low area from November 2025 (110.98-112.75).

2. Integrated Wyckoff Events and Trading Signals:

- • Market Phase: Markdown Phase following completed distribution.

- • Core Contradiction: The conflict between an intact long-term trend and a clearly bearish short-term trend.

- • Comprehensive Signal: Bearish. Trend, momentum, and volume-price relationships all point to bearish dominance.

3. Operational Recommendations:

- • Aggressive Strategy (Trend Following): The current price (~119.12) has broken below key moving averages, which can be considered confirmation of weakness. Consider seeking shorting opportunities when prices rebound near the 120.85-121.85 resistance zone. Initial stop-loss can be set above the upper boundary of the strong resistance zone at 124.50. Downside targets are toward the lower boundary of the critical support zone at 118.35, with further targets at 115.00 if broken.

- • Conservative Strategy (Wait-and-See / Await Reversal Signals): Stay on the sidelines, avoiding blind bargain-hunting in a downtrend. Patiently wait for clear Wyckoff reversal signals to appear in the critical support zone (118.35-119.41), such as: Stopping Action (with shrinking volume) -> Successful Test -> Sign of Strength (with increasing volume). Only when such signals emerge, accompanied by the price reclaiming key moving averages (e.g., 20-day or 60-day), should one consider a potential trend reversal and formulate a long plan.

4. Future Validation Points:

- • Confirming Bearish View: Price rallies fail to break above 121.85 and continue falling with volume below 118.35.

- • Invalidating Bearish View / Potential Reversal Signals: Price finds sustained support in the 118.35-119.41 zone with significantly shrinking volume (indicating exhaustion of supply), followed by a strong, high-volume bullish candlestick that closes above 121.85. This should be accompanied by RSI forming a bullish divergence and short-term volatility declining from elevated levels.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantees regarding its accuracy or completeness. The market involves risks, and investing requires caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is released daily before the market opens at 8:00 AM. Your feedback and shares are highly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: