XLV Quantitative Analysis Report (Based on Wyckoff Method)

Product Code: XLV

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, for the underlying asset XLV: Open price 154.00, Close price 155.40, 5-day moving average (MA_5D) 156.94, MA_10D 157.29, MA_20D 156.28, daily change -0.22%, weekly change -0.85%, monthly change +0.39%, quarterly change +0.39%, annual change +0.39%.

- • Moving Average Alignment and Price Action:

- • Long-term Trend Upward: Throughout the analysis period, the MA_60D (long-term trend line) steadily increased from 142.70 to 152.67, forming a clear bullish alignment foundation, confirming the integrity of the long-term uptrend.

- • Short-term Trend Divergence and Weakening: In late November 2025 (November 21-25), the price experienced a strong rally, breaking above all short-term moving averages (MA_5D, MA_10D, MA_20D, MA_30D), forming a short-term bullish alignment. However, starting November 26, the price entered a high-level consolidation and began a correction in December. Entering January 2026, although the price rallied again and made a new high (159.66 on Jan 7), it quickly retreated. By the end of the reporting period (Jan 20), the closing price of 155.40 had fallen below all short-term moving averages (MA_5D: 156.94, MA_10D: 157.29, MA_20D: 156.28), remaining only above the MA_60D. This indicates exhaustion of short-term upward momentum and a weakening market structure.

- • Moving Average Crossover Signals: In mid-January, the price correction caused the MA_5D to cross below the MA_10D, forming a bearish crossover, further confirming the deterioration of short-term momentum.

- • Inferred Market Phase:

- • Considering the price's rapid retreat after reaching a new all-time high (see historical ranking data), the behavior of volume at key levels (see Volume-Price Analysis below), and the loss of short-term moving average support, the current market is likely in the late stages of a "Distribution Phase" or the early stages of a "Deep Correction within an Uptrend". The failure to hold above the decade-high level indicates that supply (selling pressure) is beginning to overwhelm demand (buying) in the historical high region.

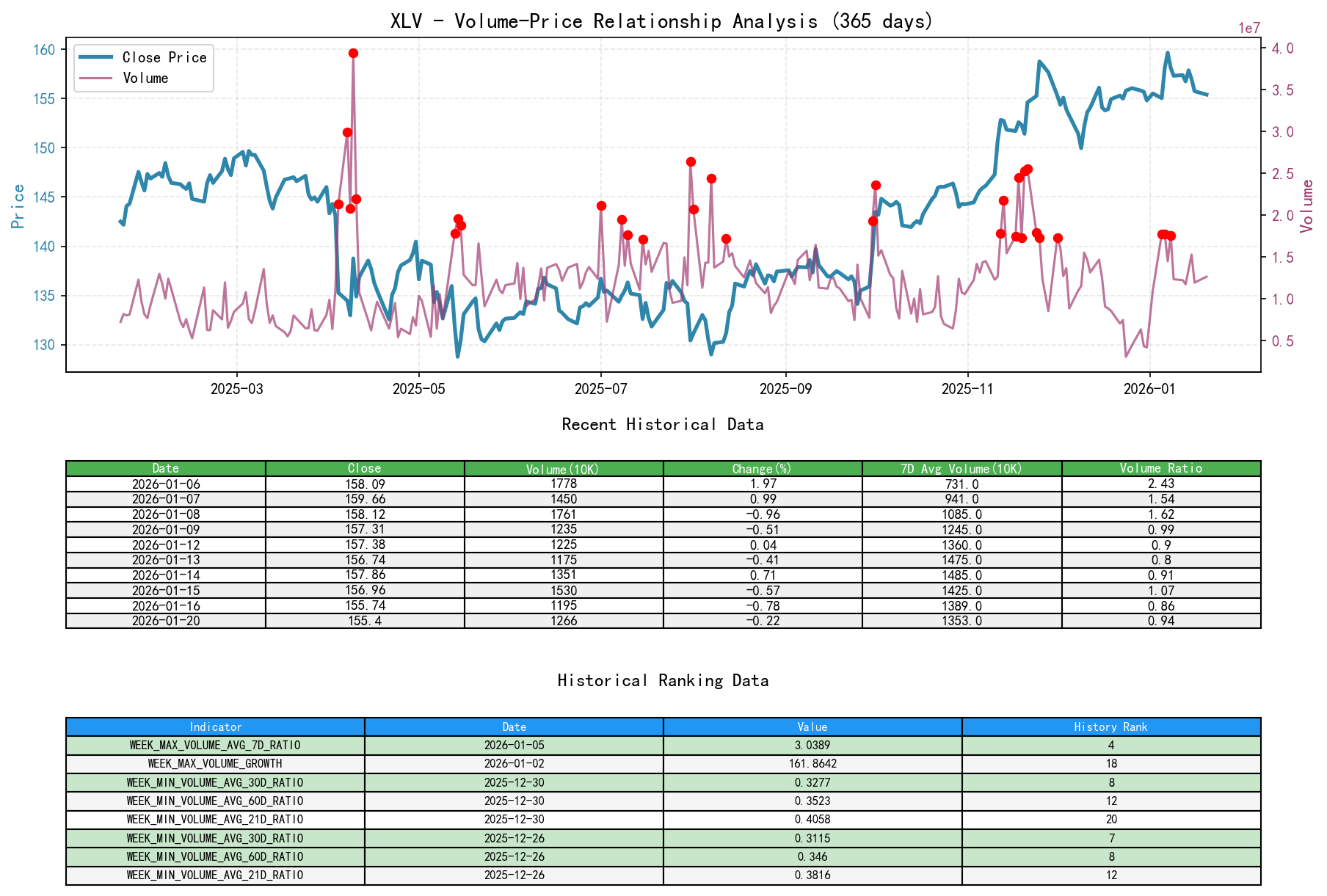

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, for the underlying asset XLV: Open price 154.00, Close price 155.40, Volume 12,660,185, daily change -0.22%, Volume 12,660,185, 7-day average volume 13,534,359.57, 7-day volume ratio 0.94.

- • Key Day Analysis (Based on Wyckoff Principles):

- 1. Demand-led Rally (2025-11-21 & 2025-11-25): Prices rose 2.11% and 2.26% on these two days, with volumes as high as 25.52 million and 17.30 million respectively. The

VOLUME_AVG_60D_RATIOwas 2.02 and 1.32, classifying them as "Rally on High Volume". This indicates strong, aggressive demand entry, characteristic of healthy advance. - 2. Warning Sign of Supply Emergence (2025-12-01): Price fell -1.50% on volume of 17.32 million (

VOLUME_AVG_7D_RATIO0.98), a relatively high-volume decline for the period. This marks the first significant "Supply Expansion Signal" after the rally, suggesting some capital began profit-taking at high levels. - 3. Top Signal of Exhausted Demand (2026-01-07): The price closed at a new all-time high of 159.66 (Historical Rank #1), but the daily volume was only 14.51 million, with a

VOLUME_AVG_60D_RATIOof merely 1.18. This is a classic Wyckoff top warning signal: "New High on Low Volume". It indicates weak demand follow-through, with the advance driven by inertia or minimal buying, lacking solid foundation. - 4. Supply Overwhelms Demand (2026-01-08): The day after making the new high, the price fell -0.96% on significantly increased volume of 17.61 million (

VOLUME_AVG_7D_RATIO1.62), forming "High Volume Decline after Stalled Advance". This is a classic signal of the Distribution Phase, showing that substantial supply (selling) flooded in at the historical high and quickly overwhelmed demand. - 5. Current State (2026-01-20): Price fell -0.22% on volume of 12.66 million, with volume ratios (

VOLUME_AVG_*D_RATIO) all near or slightly below 1. This suggests the supply during the decline is not extreme, likely representing natural profit-taking outflow rather than panic selling.

- 1. Demand-led Rally (2025-11-21 & 2025-11-25): Prices rose 2.11% and 2.26% on these two days, with volumes as high as 25.52 million and 17.30 million respectively. The

- • Volume Anomaly Quantification:

- • The

WEEK_MAX_VOLUME_AVG_7D_RATIOreached 3.04 on 2026-01-05, ranking as the 4th highest in the past decade, indicating market activity reached historically extreme levels on that day (and surrounding period). - • The

WEEK_MAX_VOLUME_GROWTHreached 161.86% on 2026-01-02, ranking 18th, showing massive capital movement on the first trading day of the new year.

- • The

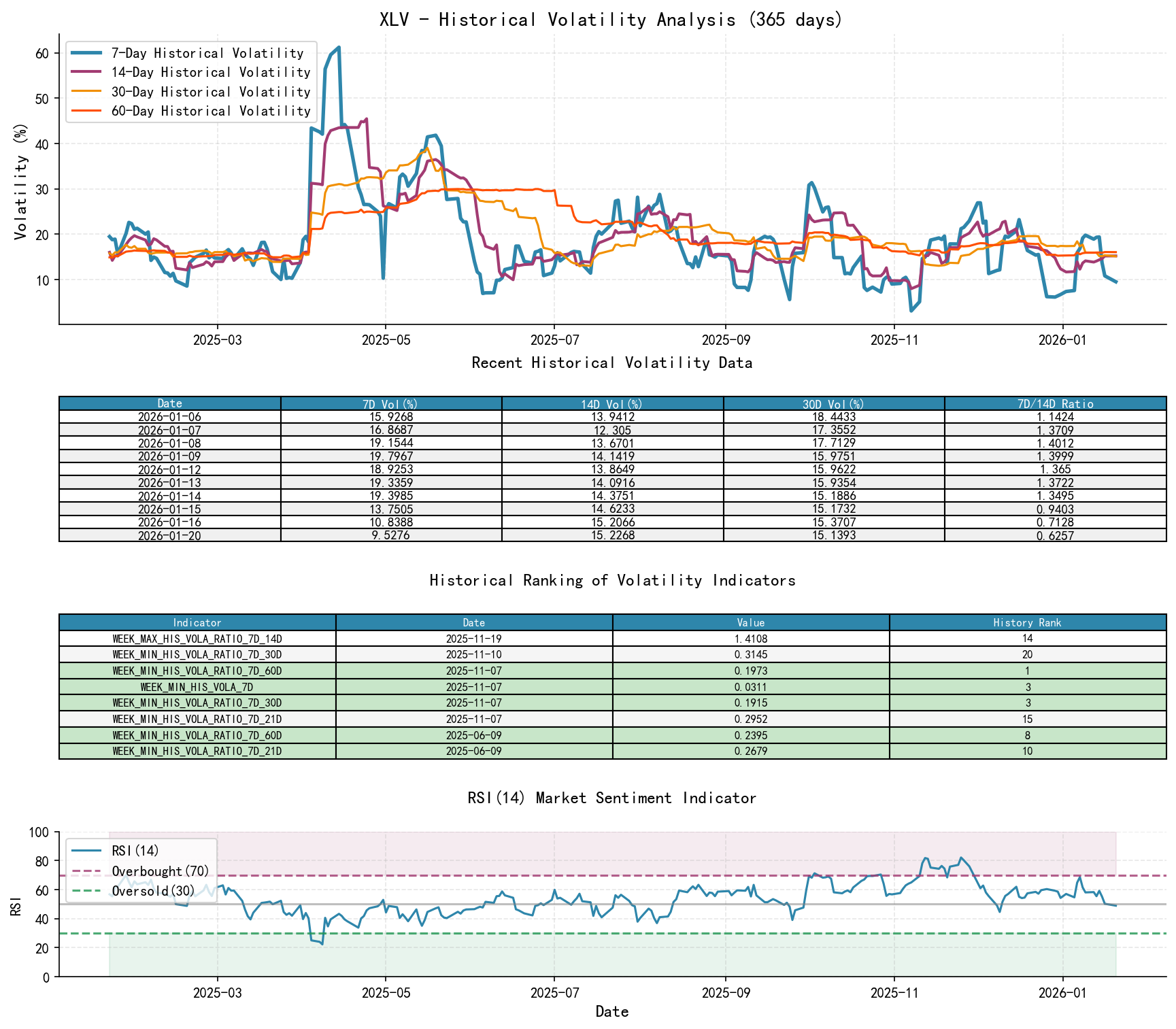

3. Volatility and Market Sentiment

As of January 20, 2026, for the underlying asset XLV: Open price 154.00, 7-day Intraday Volatility (Parkinson) 0.13, 7-day Intraday Volatility Ratio 0.93, 7-day Historical Volatility (HIS_VOLA) 0.10, 7-day Historical Volatility Ratio 0.63, RSI 48.97.

- • Volatility Analysis:

- • Short-term Volatility Rises Then Falls: During the early December price correction, both

HIS_VOLA_7DandPARKINSON_VOL_7Dreached local highs (e.g., HIS_VOLA_7D=0.269 on Dec 1), reflecting nervous market sentiment. Subsequently, volatility declined consistently. By January 20,HIS_VOLA_7Dhad dropped to 0.095 andPARKINSON_VOL_7Dto 0.132, indicating market sentiment had shifted from tension during the correction to relative calm. - • Volatility Ratio Convergence: The ratios of short-term to long-term volatility (e.g.,

HIS_VOLA_RATIO_7D_60D) all fell below 1.0 in mid-to-late January, indicating no panic or euphoria-driven abnormal volatility expansion. The current adjustment is more likely orderly.

- • Short-term Volatility Rises Then Falls: During the early December price correction, both

- • Market Sentiment (RSI):

- • When the price reached a phase high on November 25,

RSI_14hit 82.19, historically ranking as the 6th highest in the past decade, confirming the market was in an extreme overbought state. - • The RSI then declined rapidly during the price correction, reaching a low of 44.64 on December 9. By the end of the reporting period, the RSI was 48.97, in the neutral zone, indicating the overbought condition has been sufficiently corrected, and market sentiment is no longer a primary obstacle for a short-term rebound.

- • When the price reached a phase high on November 25,

4. Relative Strength and Momentum Performance

- • Momentum Trend:

- • Short-term Momentum Turns Negative: The

WTD_RETURN(weekly return) was -0.85% at the report's end, andMTD_RETURN(monthly return) was only +0.39%, significantly weaker than in November 2025 (when MTD_RETURN reached +10.07%). Short-term momentum has clearly decayed and weakened. - • Medium-to-Long-term Momentum Persists but Flattens: The

YTD(year-to-date) return is +0.39%, and theTTM_36(three-year rolling return) is +16.05%, showing that long-term upward momentum still exists. However, the recent flattening (YTD) indicates the long-term momentum engine is currently failing to provide new upward thrust. This momentum performance aligns with the judgment of a "correction or distribution within an uptrend."

- • Short-term Momentum Turns Negative: The

5. Smart Money Behavior Identification

- • Behavior Inference:

- 1. Accumulation and Markup (Late November 2025): The high-volume rally suggests smart money was actively building or increasing positions, pushing the price out of its consolidation range.

- 2. Testing and Distribution (December 2025 to Early January 2026): The price correction to the December 9 low (149.96), followed by a low-volume rebound, can be seen as a test of support. The subsequent high-volume rally in early January, especially the historically high volume ratio on January 5 (Rank #4), likely represents smart money conducting a final markup (UT - Upthrust) or secondary distribution, attracting late-coming buyers.

- 3. Clear Distribution Action (January 7-8, 2026): The "New High on Low Volume" on January 7 is a typical Upthrust (UT) or exhaustion of demand signal, where smart money stopped buying. The "High Volume Decline" on January 8 is a clear marker of a "Sign of Weakness (SOW)" or "Distribution Day," where smart money distributed shares to retail investors at high levels, capitalizing on market enthusiasm.

- 4. Current Intent: Recent price declines have occurred on moderate volume, with no signs of panic selling. This suggests the bulk of smart money distribution may have been completed around January 8. The current market is in a natural decline phase post-distribution. Smart money is likely observing, waiting for prices to decline to more attractive valuation zones (e.g., near the long-term MA_60D) before reassessing potential re-entry.

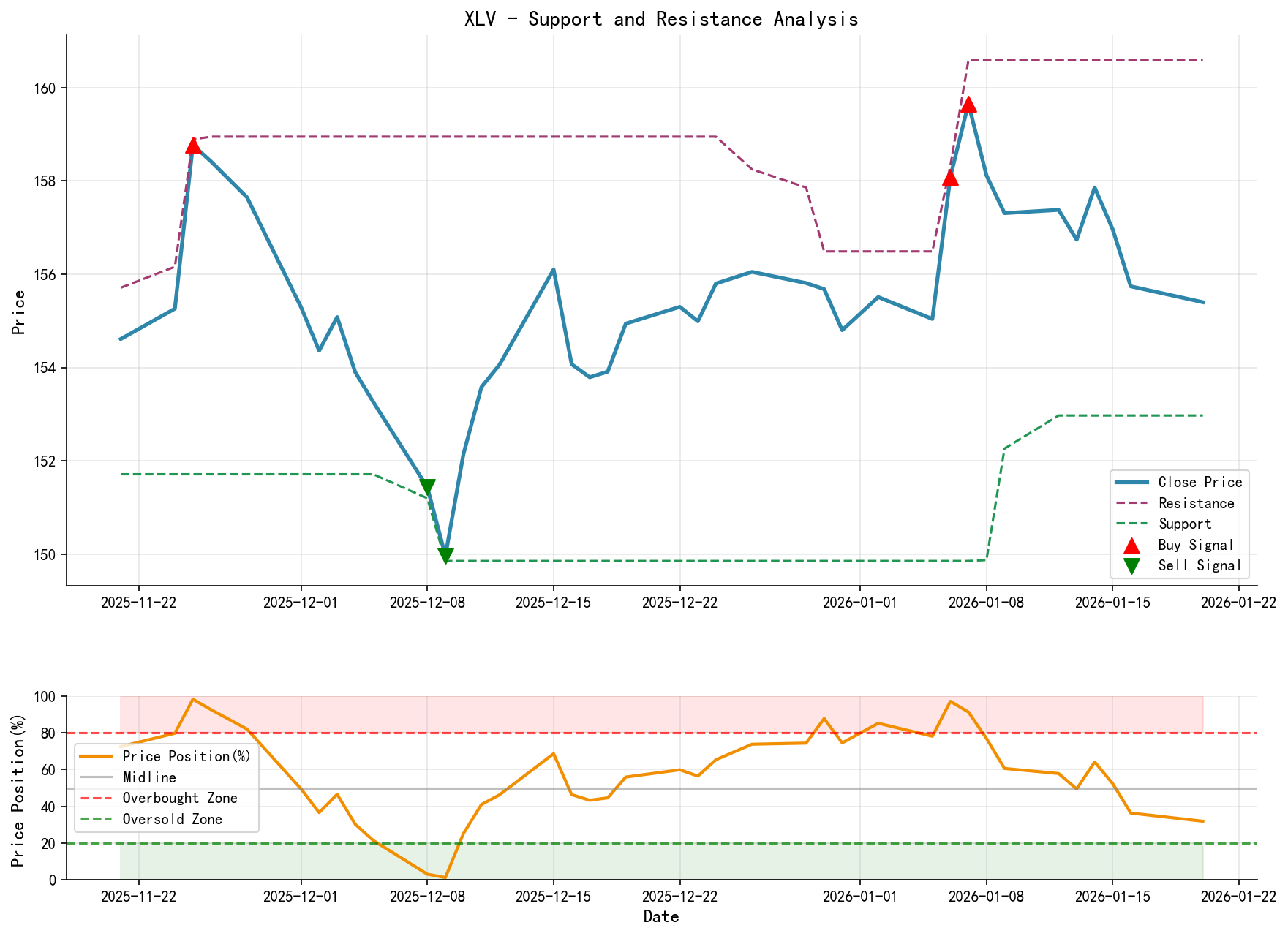

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Strong Resistance: 159.66 - 160.50 (Closing high on 2026-01-07 and intraday high on 2026-01-08, both historical rank top 2). This zone is a clear distribution area with substantial supply.

- • Secondary Resistance: 157.80 - 158.50 (Mid-January consolidation highs and previous high zone).

- • Near-term Support: 154.00 - 155.00 (Late-January consolidation lows and the Jan 20 closing level).

- • Strong Support: 149.96 (The low on 2025-12-09, the lowest point of this correction) and the MA_60D (approx. 152.70). This area represents the long-term trend line and the upper boundary of the previous accumulation zone, where significant demand is expected.

- • Comprehensive Trading Signal and Action Plan:

- • Wyckoff Event Assessment: The market has likely completed a typical structure of an "Upthrust (UT)" followed by a "Sign of Weakness (SOW)," suggesting the main distribution process may be finished.

- • Current Signal: Bearish/Wait-and-See. Price is below short-term moving averages and faces strong historical high resistance. The supply-demand structure has shifted to supply exceeding demand.

- • Action Plan:

- • Aggressive Strategy (Short): Consider establishing short positions if the price rebounds into the 156.5 - 157.5 secondary resistance zone. Initial stop-loss above 159.70 (above the recent high). First target at 152.5 (near MA_60D), second target at 150.0 (strong support zone).

- • Conservative Strategy (Wait-and-See): Given the long-term trend remains upward, it is advisable to wait on the sidelines. Await a decline to the 152.5 - 150.0 strong support zone. Observe for the emergence of Wyckoff bullish signals such as "Stopping Volume" or "Spring" / "Jump Across the Creek" patterns, before considering long entry.

- • Future Validation Points:

- 1. Bearish Confirmation: A price break below 153.20 (Jan 20 low) on high volume would confirm the continuation of the downtrend, targeting 149.96 next.

- 2. Bearish Invalidation: A price breakout and sustained move above 159.70 on high volume would indicate the distribution hypothesis is incorrect, and the market may be entering a new uptrend leg, requiring reassessment.

Executive Summary: Following its record high in nearly a decade, volume-price data for XLV shows signs of demand fatigue and the emergence of supply dominance. Combined with the historically extreme overbought RSI ranking and high volume ratio rankings, it is inferred that smart money has conducted distribution operations in the historical high region. The technical structure has weakened in the short term, with prices falling below short-term moving averages. A cautious or bearish strategy is recommended, focusing on whether prices can find effective support near the long-term moving average (MA_60D) and show new demand signals. Key validation points for future price action lie in how prices test the 159.70 resistance level and the 153.20/149.96 support levels.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantees regarding its accuracy or completeness. Markets carry risks; investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Interpretations are published daily at 8:00 AM before market open. Please feel free to leave comments and share; your recognition is paramount. Let's work together to see the market signals clearly.

Member discussion: