Okay. As a quantitative trading researcher proficient in the Wyckoff Method, I will write a comprehensive and in-depth quantitative analysis report based on the XLK data and historical ranking metrics you provided. The report will strictly adhere to the six required dimensions. All conclusions are derived from data and conform to Wyckoff's volume-price principles, eliminating subjective speculation.

XLK Quantitative Analysis Report (Based on the Wyckoff Method)

Product Code: XLK

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset XLK opened at 143.09, closed at 141.84, with moving averages: 5-day MA at 145.81, 10-day MA at 145.72, 20-day MA at 145.34. Performance metrics: Daily change: -2.60%, Weekly change: -3.17%, Monthly change: -1.48%, Quarterly change: -1.48%, Year-to-date change: -1.48%.

Data Derivation and Principle Application:

- • MA Alignment and Trend Direction: At the beginning of the analysis period (November 21), the moving averages showed a standard bearish alignment: MA_5D (280.79) < MA_10D (286.12) < MA_20D (292.05) < MA_30D (289.70) < MA_60D (282.52), with the price (136.6) far below all MAs, confirming the market was in a strong long-term downtrend. Subsequently, all MAs continued to decline rapidly, indicating strong downward momentum. By the end of the analysis period (January 20), the short-term MA (MA_5D 145.81) was still far below the long-term MA (MA_60D 198.49), but the gap had narrowed significantly compared to the beginning, suggesting a slowdown in the decline rate in January. However, the bearish alignment pattern remained unchanged.

- • MA Crossover Signals: Throughout the analysis period, short-term MAs consistently remained below long-term MAs, with no golden crosses signaling a trend reversal. A key bearish signal emerged on January 20, when MA_5D (145.81) crossed below MA_20D (145.34), forming a short-term death cross, indicating a potential reacceleration of downward momentum.

- • Price Action and Market Phase: After experiencing an extreme crash (-49.81%) on November 21, the price staged a weak rally from early to mid-December (peaking at 148.73). However, this rally failed to effectively break above prior significant highs (e.g., the December high). Subsequently, the price fell again with increased volume on January 20, approaching the previous low (139.39 on December 17). According to Wyckoff theory, this aligns with the classic characteristics of a "Weak Rally within a Downtrend (Automatic Rally)" followed by a "Secondary Test". The entire analysis cycle may be situated within a larger "Distribution" or "Markdown" phase.

Conclusion: XLK was in a clear medium-to-long-term downtrend throughout the analysis period. The December rally lacked strength and was a technical rebound. The market showed signs of re-entering the primary decline wave in late January.

2. Volume-Price Relationship and Supply-Demand Dynamics

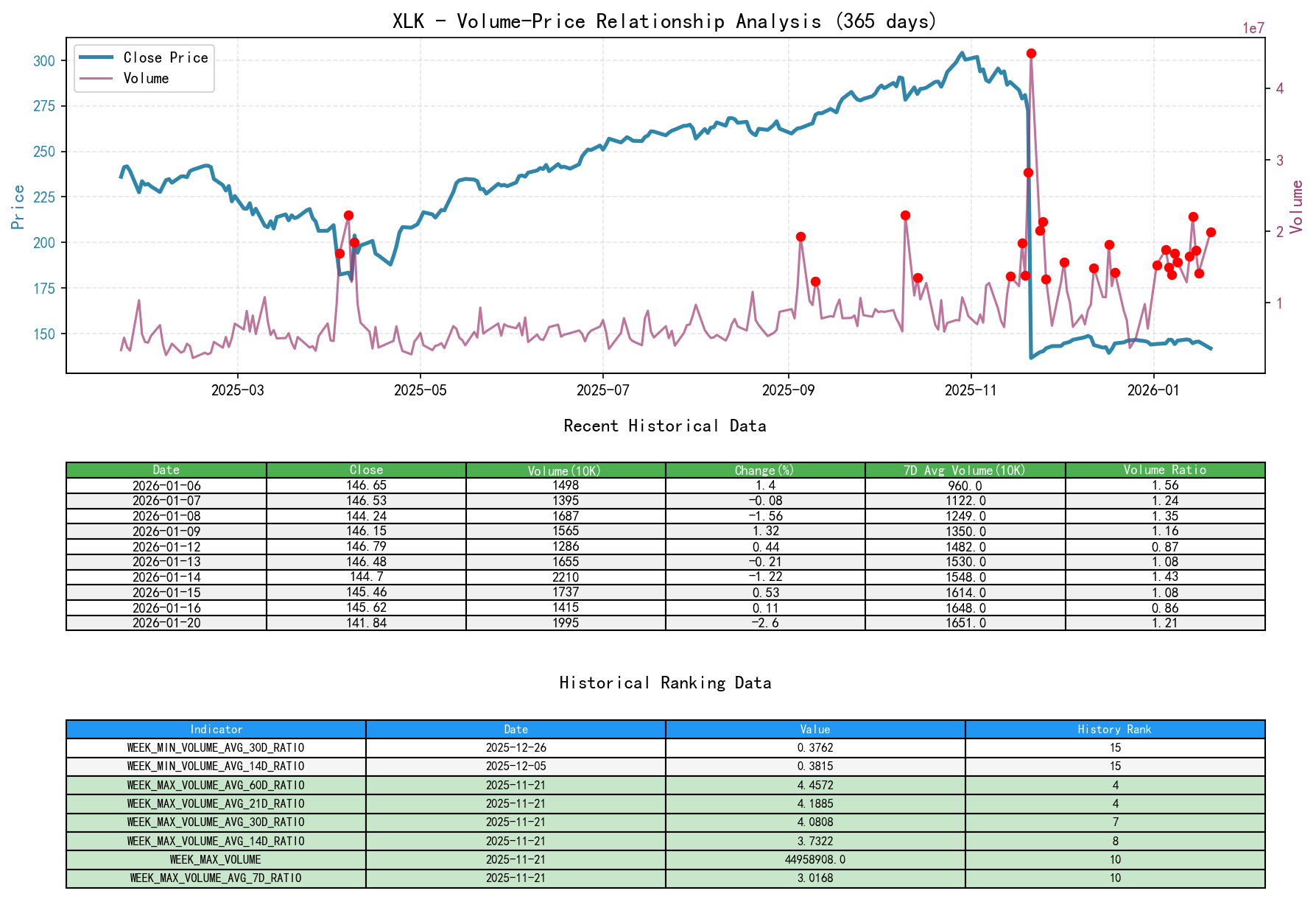

As of January 20, 2026, the underlying asset XLK opened at 143.09, closed at 141.84, with volume 19955110. Performance metrics: Daily change: -2.60%, Volume: 19955110, 7-day average volume: 16510611.00, 7-day Volume Ratio: 1.21.

Data Derivation and Principle Application:

- • Key Day Analysis - Panic Selling: On November 21, volume surged to 44.95 million (

VOLUME_AVG_14D_RATIOas high as 3.73, ranking 8th highest in nearly a decade) while the price plummeted -49.81%. This is a typical "Panic Selling" day, representing an extreme release of supply, potentially setting the stage for a subsequent halt in the decline (HISTORY_RANK:MIN_PCT_CHANGErank 1,MIN_RSI_14rank 1). - • Key Day Analysis - Weak Rally: From December 1 to December 11, the price recovered slowly, but volume contracted significantly. For example, on December 4 and 5, prices rose but

VOLUME_AVG_30D_RATIOwas only 0.78 and 0.52 respectively, indicating weak demand. The rally was driven by short covering, not new buying interest. - • Key Day Analysis - Supply Reappearing:

- • December 12: Price fell -2.89% with amplified volume to 14.87 million (

VOLUME_AVG_7D_RATIOat 1.67). This is a clear signal that supply overwhelmed demand again after the rally ended. - • January 14 & January 20: Prices fell -1.22% and -2.60% respectively, both accompanied by abnormally high volume (22.10 million,

VOLUME_AVG_14D_RATIOat 1.87; 19.95 million,VOLUME_AVG_14D_RATIOat 1.38), indicating persistent and strong selling pressure at key price levels, confirming the decline with volume.

- • December 12: Price fell -2.89% with amplified volume to 14.87 million (

- • Supply-Demand Shift Signals: The extreme volume on November 21 is a potential sign of a selling climax. The subsequent low-volume rally (early December) indicated temporary exhaustion of supply, but demand did not follow. The "high-volume decline" pattern since mid-January (price rises on low volume, falls on high volume) is a typical supply-demand characteristic in a downtrend—supply consistently dominates the market.

Conclusion: The market experienced a complete Wyckoff cycle: Panic Selling (Selling Climax) -> Automatic Rally (Insufficient Demand) -> Secondary Test/New Decline (Supply Reappearance). The current market state (as of January 20) is dominated by the supply side (sellers), with weak demand.

3. Volatility and Market Sentiment

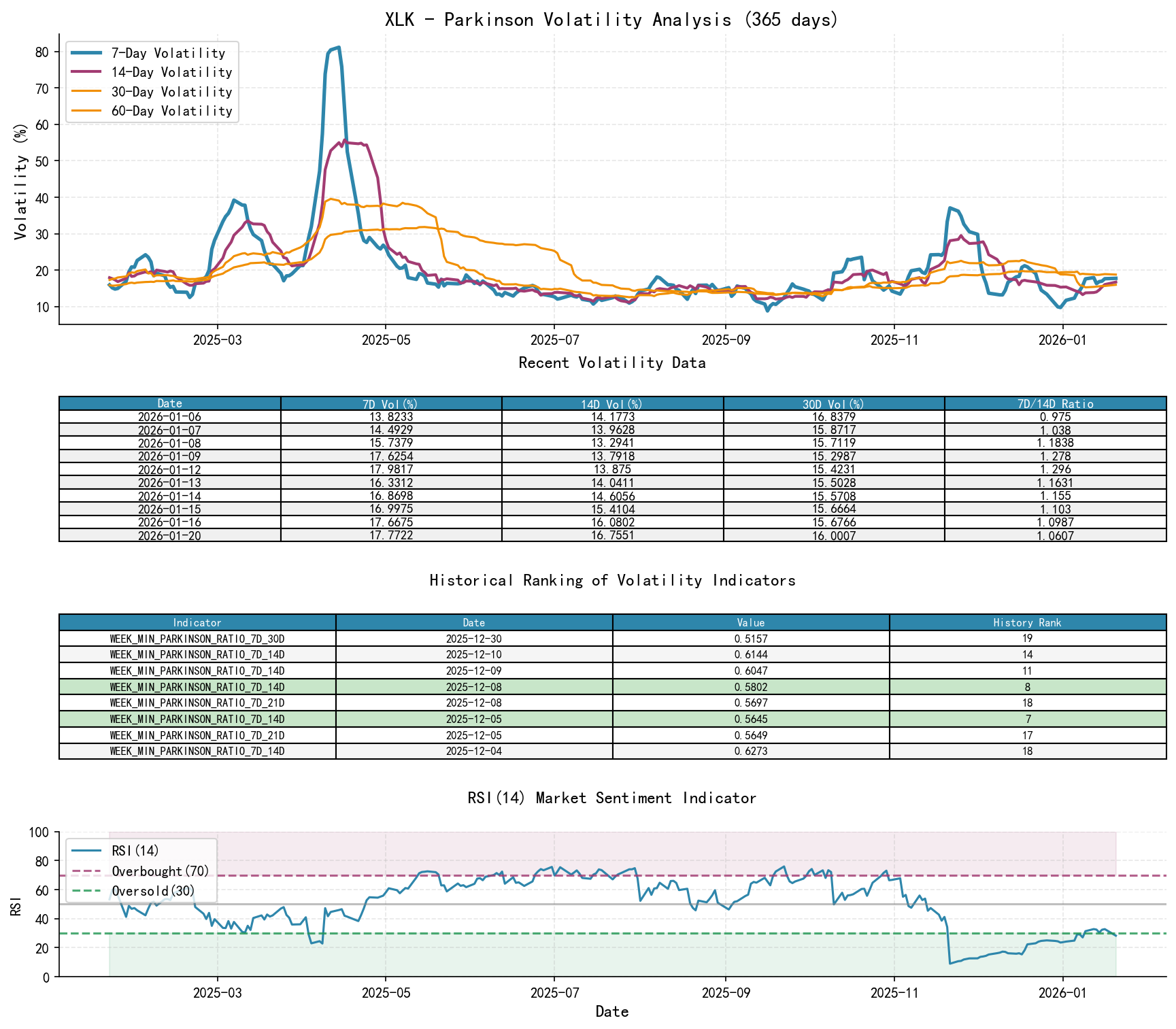

As of January 20, 2026, the underlying asset XLK opened at 143.09, with metrics: 7-day intraday volatility 0.18, 7-day intraday volatility ratio 1.06, 7-day historical volatility 0.25, 7-day historical volatility ratio 1.19, RSI 28.28.

Data Derivation and Principle Application:

- • Volatility Levels and Sentiment Extremes: From late November to early December, historical volatility (

HIS_VOLA) across periods reached decade-long peaks (e.g.,HIS_VOLA_7Dreached 5.048 on Dec 2, rank 1;HIS_VOLA_14Dreached 3.553 on Dec 11, rank 1). Simultaneously, Parkinson volatility (PARKINSON_VOL) also spiked, indicating intense intraday price swings and market sentiment in a state of panic and high instability. - • Volatility Structure Changes: During the panic period, short-term volatility far exceeded long-term volatility. For instance, on December 2,

HIS_VOLA_RATIO_7D_60Dwas as high as 2.93 (rank 1 in nearly a decade), showing an extremely steep volatility curve, quantifying trend acceleration and sentiment extremes. Entering mid-to-late December, this ratio rapidly declined, even hitting an extremely low value of 0.0319 on December 10 (rank 1 in nearly a decade), indicating rapid volatility convergence and a market shift from panic to a disorderly or consolidating state. However, on January 20, this ratio rebounded to 0.145, with short-term volatility amplifying relative to long-term again, resonating with the new wave of decline. - • Overbought/Oversold Validation: RSI_14 hit an extreme oversold low of 8.97 on November 21 (rank 1 in nearly a decade), consistent with the price-volume behavior of panic selling. RSI subsequently rebounded but peaked only at 29.22 on January 6, never entering the overbought zone (>70), and failing to break above the 40 midline. This validates the weak nature of the rebound from a momentum perspective. RSI fell back to 28.28 on January 20, approaching oversold but not extreme, suggesting there is still room for downward momentum to be released.

Conclusion: Market sentiment evolved from extreme panic (late November) to brief calm (mid-December) and then to renewed concern (late January). The current volatility structure and RSI position do not support the formation of a reliable market bottom; downward momentum persists.

4. Relative Strength and Momentum Performance

Data Derivation and Principle Application:

- • Periodic Return Analysis: Returns across all periods are deeply negative, confirming an absolute weak pattern.

- • Short-term Momentum (WTD/MTD): Weekly (WTD) and Monthly (MTD) returns fluctuated sharply, occasionally turning briefly positive (e.g., WTD +0.63% on Dec 19) but unable to sustain, ultimately returning to negative values (MTD -1.48% on Jan 20). This shows short-term rebounds are fragile and cannot form sustained upward momentum.

- • Medium-to-Long-term Momentum (QTD/YTD/TTM): Quarterly (QTD), Year-to-date (YTD), and Trailing 12-month (TTM_12) returns range from -38% to -50%, showing deep and persistent negative momentum. The Trailing 3-year (TTM_36) return is barely positive (4.54% - 17.60%), but the Trailing 2-year (TTM_24) is -20% to -30%, indicating a clear and highly destructive medium-to-long-term downtrend.

Conclusion: XLK exhibits significantly negative relative strength across all timeframes, lacking sustainable upward momentum at any level. Short-term technical rebounds do not alter its medium-to-long-term weak pattern.

5. Large Investor (Smart Money) Behavior Identification

Data Derivation and Principle Application:

Based on the above volume-price, trend, and volatility analysis, large investor behavior can be inferred:

- 1. November 21 Panic Day: The huge volume (nearly decade-high ranking) accompanied by a price crash indicates a large amount of stock was sold regardless of cost. Concurrently, there must have been counterparties buying. Smart Money may have conducted preliminary, probing Accumulation at this moment, but more likely it was passive trading resulting from the market crash.

- 2. December Weak Rally Period (Dec 1-11): Prices rose but volume continuously contracted, especially on December 4-5 where volume was far below average. This indicates Smart Money did not engage in active buying or accumulation within this price range. They may have been observing or considered the current price insufficiently attractive for large-scale entry. The rally was primarily driven by short covering and retail buying.

- 3. January High-Volume Decline Period (Jan 14, 20): High-volume declines occurred as prices approached or broke below previous support areas. Two possibilities exist:

- • Smart Money Selling (Distribution/Stop-loss): They sold holdings acquired near the December rally peak or at lower levels.

- • Smart Money Creating Panic (Shakeout): At the potential end of an accumulation zone, using high-volume declines to shake out weak long positions.

- • Combined with trend and momentum analysis, the first scenario is more likely currently. As the overall market is in a downtrend with weak rebounds, Smart Money behavior is more likely utilizing rallies to reduce positions (distribution) or directly shorting, rather than counter-trend accumulation. The high-volume decline on January 20 is a clear signal that supply-side forces (potentially including institutional selling) have regained absolute dominance.

Conclusion: Smart Money may have made probing purchases during the initial panic but remained restrained during the subsequent weak rally. In the current phase, their behavior leans more towards continuing distribution or applying selling pressure after the rally faltered, rather than actively positioning for a long.

6. Support/Resistance Level Analysis and Trading Signals

Key Price Level Identification:

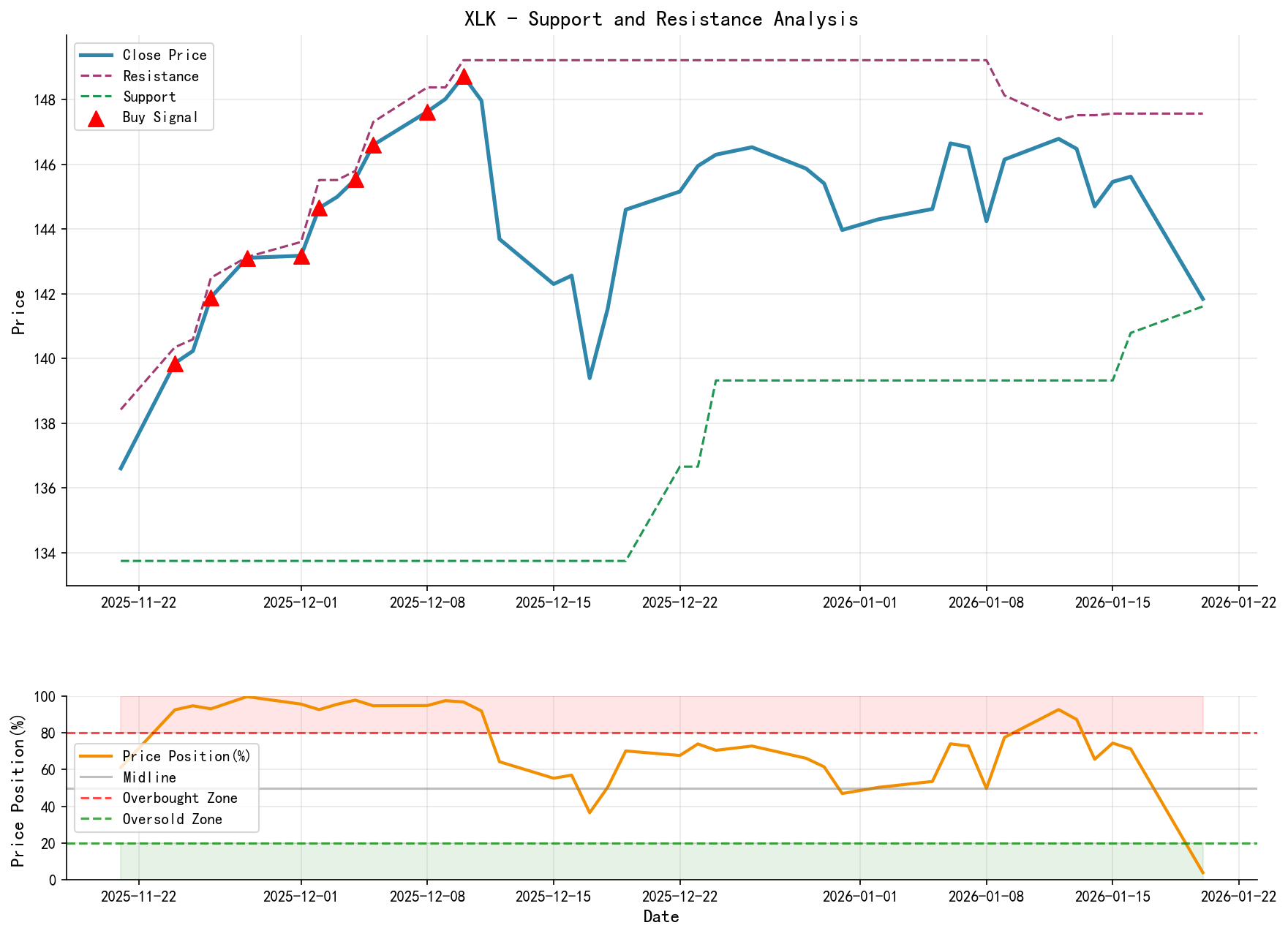

- • Recent Resistance Levels:

- • Primary Resistance: 148.73 (December 10 high, also the rally peak).

- • Secondary Resistance: 146.50-147.50 zone (range formed by January 6 and 12 highs).

- • Recent Support Levels:

- • Primary Support: 141.61 (January 20 low).

- • Key Support: 139.39 (December 17 low). A break below this would open up further downside.

- • Long-term Support: Requires reference to longer-term charts, but in the current downtrend, prior lows serve only as psychological references.

Comprehensive Trading Signals and Operational Suggestions:

- 1. Comprehensive Judgment: Based on the combination of Wyckoff events (Panic Selling -> Weak Automatic Rally -> High-Volume Failed Secondary Test), combined with the bearish MA alignment, weak momentum, and Smart Money distribution behavior, a bearish view on XLK is maintained. The market is currently in a "Upthrust after Distribution" or "Continuation" phase within the downtrend.

- 2. Operational Suggestions:

- • Long Investors: Should exercise extreme caution. Any rally towards resistance (146.50-147.50) accompanied by signals of stalling and low volume presents an opportunity to reduce or exit positions. No new long positions should be considered until the price clearly breaks and holds above 148.73 with volume, and MAs show reversal signals.

- • Short Investors/Hedgers: The current price (~141.84) is near short-term support, making it unsuitable for chasing the short. Wait for a price rebound towards the 146-147 resistance zone. If price rises on low volume, stalls, or forms bearish candlestick patterns with high volume again, consider it a timing opportunity for shorting or increasing short hedges.

- • Observers: Continued observation is recommended. The market has not presented reliable bottom reversal signals.

- 3. Key Validation Points (Future Observation):

- • Bearish Validation: A high-volume break below 139.39 (prior low) would confirm continuation of the downtrend, requiring recalculation of the next target based on patterns.

- • Bullish Reversal Signals (Require multiple concurrent occurrences):

(1) Price shows clear signs of low-volume stabilization in the 139-141 zone (consecutive small candles, extremely low volume).

(2) Subsequently, a "Spring" or "Accumulation Test" pattern appears—price momentarily breaks below that support and quickly recovers, accompanied by expanding volume.

(3) Price breaks above the recent downtrend line (connecting Dec 10 high with Jan 12/20 highs) with volume and successfully retests it.

(4) Short-term MAs (e.g., MA_5D & MA_20D) form a golden cross. Only when multiple signals from the above occur consecutively can the possibility of a trend reversal be considered.

Report Summary: XLK exhibited textbook downtrend characteristics during the analysis period. Despite potential halting signals from extreme selling in late November, subsequent demand was severely insufficient, leading to a weak rally. In January, supply pressure returned, Smart Money behavior leaned towards distribution, and market structure deteriorated again. Quantitative signals unanimously point towards the continuation of the downtrend. Investors should adopt defensive strategies. Any counter-trend operations require waiting for multiple, strong bottom confirmation signals.

Disclaimer: The content of this report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding its accuracy or completeness. The market carries risks; investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Interpretation is released daily at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's see the market signals together.

Member discussion: