Certainly, please find the in-depth analysis report on XLF below, which is based on the data you provided and combines the Wyckoff Method with quantitative indicators.

XLF Quantitative Analysis Report

Product Code: XLF

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of 2026-01-20, the underlying asset XLF has an opening price of 53.61, a closing price of 53.20, a 5-day moving average of 54.50, a 10-day moving average of 55.23, a 20-day moving average of 55.20, a daily change of -2.28%, a weekly change of -1.90%, a monthly change of -2.87%, a quarterly change of -2.87%, and a yearly change of -2.87%.

- • Trend Structure: As of the last day of the analysis period (2026-01-20), the price (53.20) has significantly fallen below all short-term, medium-term, and long-term moving averages (MA_5D: 54.496, MA_10D: 55.225, MA_20D: 55.197, MA_30D: 54.867, MA_60D: 53.698). The moving average system exhibits a bearish alignment, i.e., MA_5D < MA_10D < MA_20D < MA_30D < MA_60D, and all are positioned above the price, indicating a clear downtrend structure.

- • Trend Evolution: After reaching a recent high of 56.40 on 2026-01-06, the price entered a sustained downward channel. The MA_5D crossed below both the MA_20D and MA_30D in mid-January, forming a "death cross," further confirming the end of the short-term uptrend and the acceleration of the downtrend.

- • Market Phase Inference:

- • Accumulation/Distribution Determination: From mid-to-late December 2025 to early January 2026, XLF traded within a range of approximately 53.30 to 56.40, with relatively active volume during this period (volume exceeded 45 million shares on multiple days). Combined with the subsequent decline, this phase aligns more closely with the characteristics of the Wyckoff Distribution Phase. Historical ranking data shows that the highest closing price during this period (56.40, 2026-01-06) set a record high for the past decade, providing favorable conditions for large investors to distribute holdings at elevated levels.

- • Current Phase: Starting from 2026-01-13, the price broke below the key 54.00 level with a high-volume long bearish candlestick, marking the end of the distribution phase and the official entry into the Markdown Phase. The recent sustained high-volume decline (January 13-20), accompanied by rising volatility and the RSI entering oversold territory, suggests the market may be experiencing panic selling.

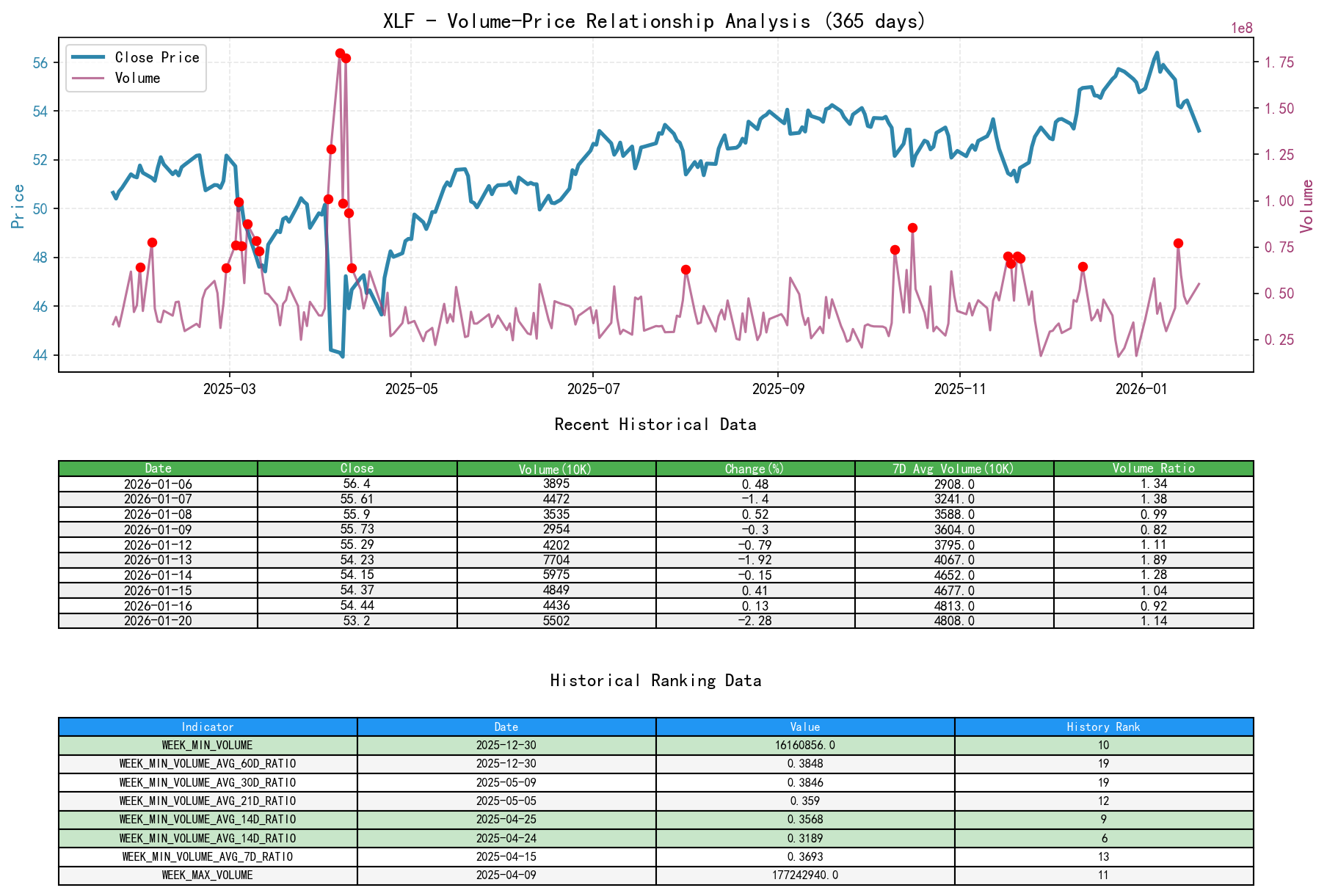

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-20, the underlying asset XLF has an opening price of 53.61, a closing price of 53.20, volume of 55025264, a daily change of -2.28%, volume of 55025264, a 7-day average volume of 48082635.57, and a 7-day volume ratio of 1.14.

- • Key Session Analysis:

- • High-Volume Advance (Demand Emergence): Sessions on 2025-11-25 (+1.25%, volume above 14-day MA), 2025-12-03 (+1.34%, volume above 21/30/60-day MAs), and 2026-01-05 (+2.18%, VOLUME_AVG_60D_RATIO reached 1.393) show demand-led advances.

- • High-Volume Stagnation/Decline (Supply Emergence):

- 1. Distribution Signal: On 2025-12-12 (+0.15%), volume (64.42 million) reached a near two-month high at the time (VOLUME_AVG_60D_RATIO: 1.565), yet the price gain was minimal, showing high-volume price stagnation, indicating supply beginning to overwhelm demand.

- 2. Decline Confirmation: On 2026-01-13 (-1.92%, volume 77.04 million, VOLUME_AVG_60D_RATIO: 1.870), a high-volume plunge confirmed that supply completely dominated the market, with panic sentiment spreading.

- 3. Persistent Supply: On 2026-01-20 (-2.28%, volume 55.02 million, VOLUME_AVG_60D_RATIO: 1.324), the decline was accompanied by above-average volume, indicating ongoing supply pressure.

- • Low-Volume Rebound (Weak Demand): Sessions on 2025-12-26 (-0.20%, volume only 20.41 million, VOLUME_AVG_60D_RATIO: 0.484) and 2025-12-30 (-0.25%, volume only 16.16 million) saw rebounding volume contract to recent and historical lows (Historical Ranking: the week's volume was the 10th lowest in the past decade), indicating extremely low market participation and a fragile rebound.

- • Supply-Demand Transition Summary: The market reached a demand peak (historical high) in early January, then rapidly transitioned to supply dominance. The volume-price sequence of high-volume stagnation → high-volume plunge → high-volume decline clearly outlines the transition path from distribution to panic selling. The recent decline has been consistently accompanied by above-average volume, suggesting supply is not yet exhausted.

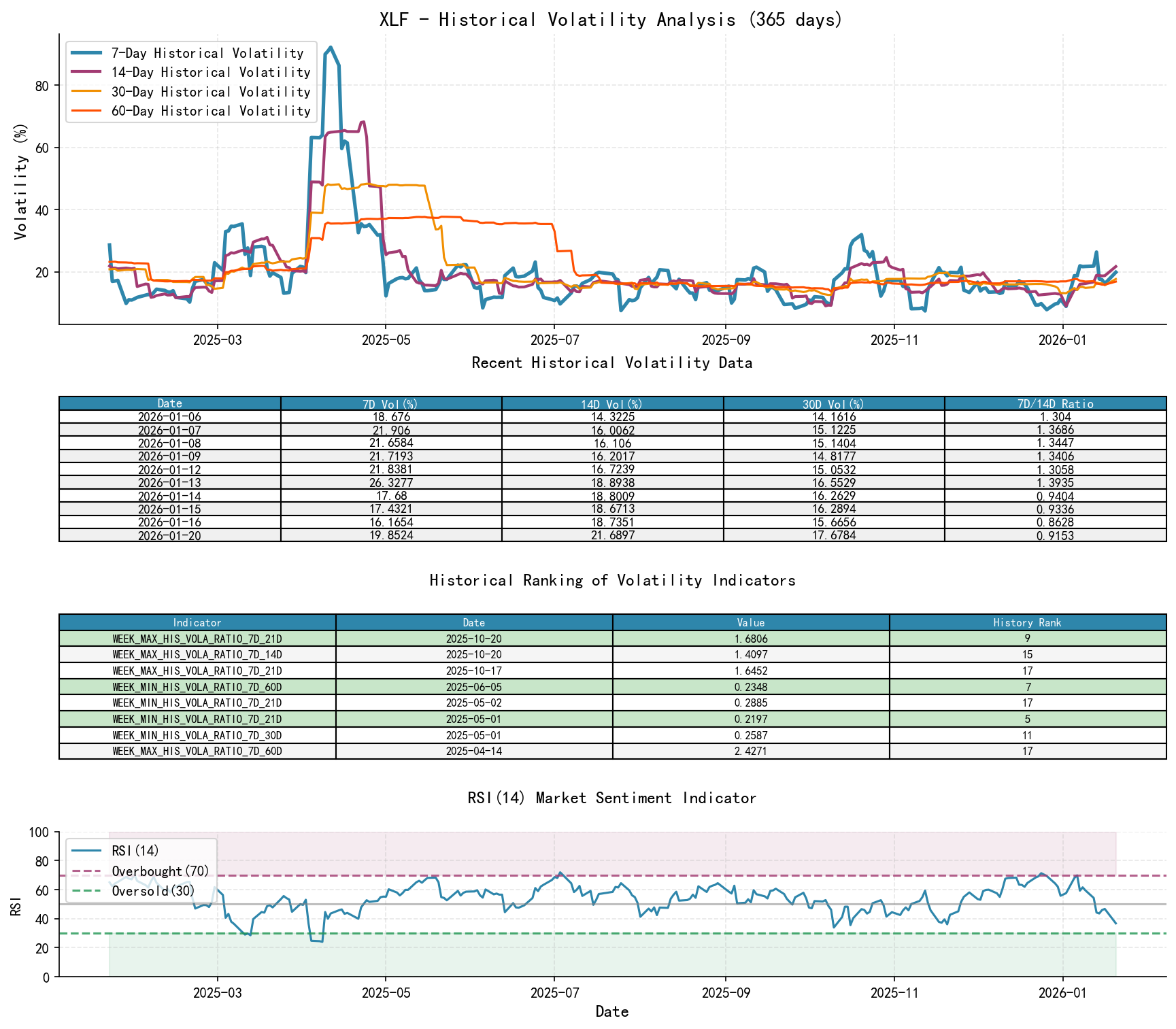

3. Volatility and Market Sentiment

As of 2026-01-20, the underlying asset XLF has an opening price of 53.61, a 7-day intraday volatility of 0.14, a 7-day volatility volume ratio of 0.93, a 7-day historical volatility of 0.20, a 7-day historical volatility volume ratio of 0.92, and an RSI of 36.78.

- • Volatility Level: As of 2026-01-20, short-term volatility has risen significantly. The 7-day historical volatility (HIS_VOLA_7D: 0.199) has approached and exceeded the 14-day and 21-day volatility levels (HIS_VOLA_RATIO_7D_14D: 0.915). Although the ratio is less than 1, the absolute level has more than doubled from the low point in late December (~0.09). The 7-day Parkinson volatility (PARKINSON_VOL_7D: 0.136) is also above its 14-day and 21-day averages, indicating an expansion in intraday price swings.

- • Volatility Structure: Throughout the decline, the absolute values of volatility ratios (HIS_VOLA_RATIO and PARKINSON_RATIO) were generally greater than 1 (especially during the plunge on January 13th), showing that short-term volatility consistently exceeded long-term volatility, a typical feature of an accelerating downtrend and heightened tension.

- • Sentiment Indicator (RSI): The RSI_14 plummeted rapidly from near overbought territory (69.89) on 2026-01-06 to 36.78 by 2026-01-20, entering oversold territory. Combined with high-volume decline, this reflects a swift shift in market sentiment from greed to fear. However, within a strong downtrend, oversold RSI conditions can persist or become muted.

4. Relative Strength and Momentum Performance

- • Momentum Turned Negative Across All Horizons: Returns for all periods are negative. Recent momentum has deteriorated sharply:

- • WTD_RETURN: -1.90% (Weekly turned negative)

- • MTD_RETURN: -2.87% (Monthly turned negative)

- • YTD: -2.87% (Year-to-date turned negative from positive)

- • Momentum Analysis: The reversal from strongly positive momentum on 2026-01-05 (YTD: +2.48%) to deeply negative values within just two weeks confirms a sharp exhaustion and reversal of market momentum. The momentum indicators are highly consistent with the conclusions from the price break below moving averages and the supply-dominant volume-price relationship.

5. Large Investor (Smart Money) Behavior Identification

- • Distribution Behavior: From December 2025 to early January 2026, multiple instances of high-volume price stagnation (e.g., December 12th) and low-volume rebounds (December 26th, 30th) occurred near the historical high-price zone (around the decade-high closing price). This is a classic characteristic of smart money distribution: utilizing market optimism and high liquidity to systematically distribute holdings at elevated levels, supported by retail buying.

- • Behavior During the Decline: During the Markdown Phase in mid-to-late January, sustained high volume indicates heavy selling pressure. This could be:

- 1. Large sell orders in the final stages of distribution (continued distribution).

- 2. Panicked selling by retail and leveraged funds (smart money is not rushing to buy).

- 3. Lack of demand absorption: A key signal is the absence of clear, substantial "high-volume stopping of decline" or "massive absorption after panic selling" candlesticks, despite the price decline and oversold RSI. This suggests smart money may not yet consider the current price level as its target accumulation zone or is waiting for supply to be fully exhausted.

- • Inferred Current Intent: Smart money has likely completed most of its high-level distribution earlier and is now observing and waiting, leveraging market panic. They have not yet intervened on a large scale to buy, indicating they believe the downtrend may not be over or are waiting for clearer signs of a bottom.

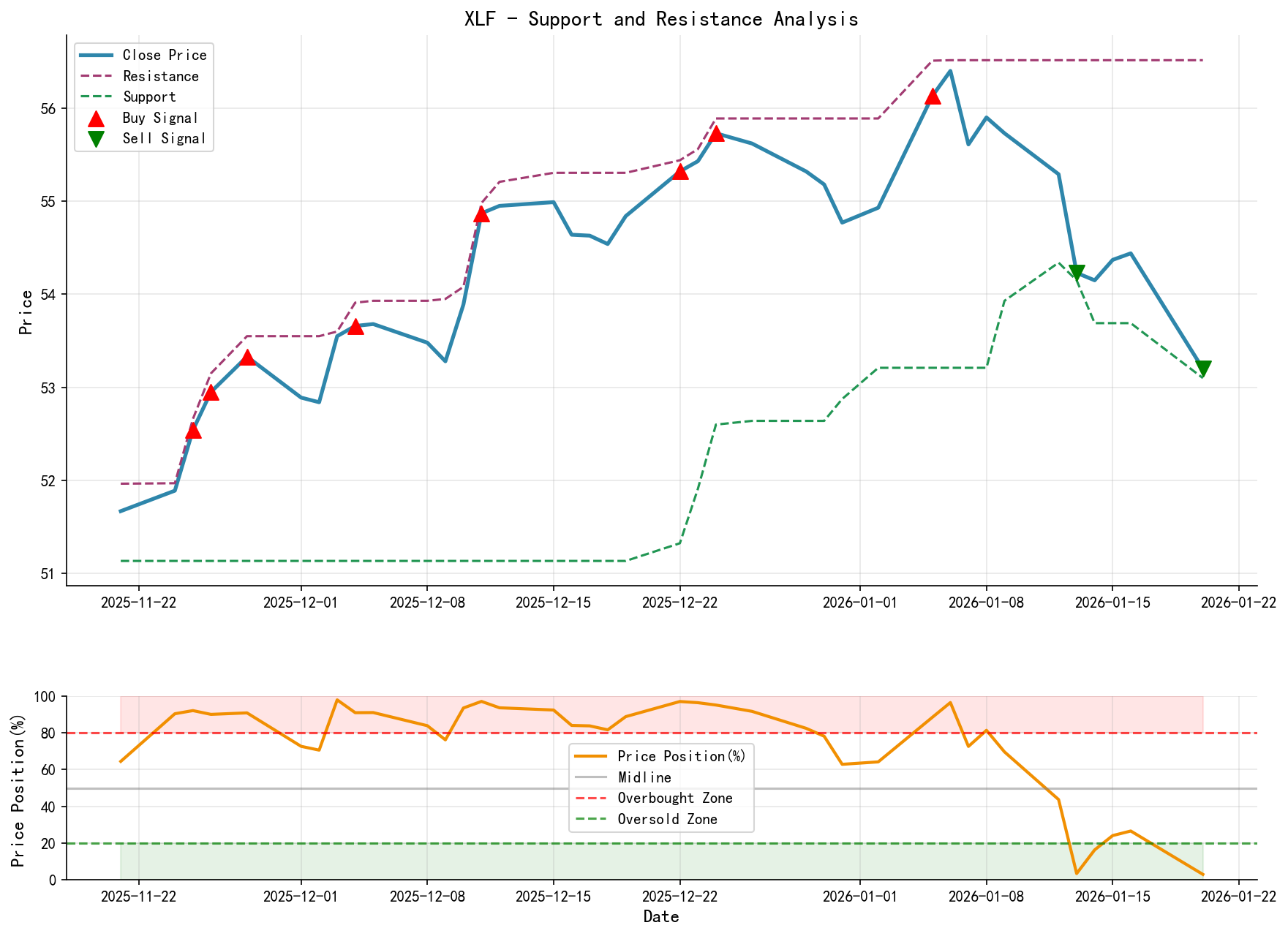

6. Support/Resistance Level Analysis and Trading Signals

- • Key Resistance Levels:

- 1. 56.40-56.50 Zone: The recent high, also the area of the decade-high closing price, constitutes strong resistance.

- 2. 55.00-55.50 Zone: The lower boundary of the mid-January consolidation platform and the confluence area of multiple moving averages (MA_20/30/60), constituting secondary resistance.

- • Key Support Levels:

- 1. 53.00-53.20 Zone: Near the current price, a minor recent consolidation platform that has now been broken, offering weak support.

- 2. 51.10-51.50 Zone: The dense price low area from November 2025, constituting the next important support zone.

- 3. Psychological Level 50.00: A significant integer psychological level.

- • Integrated Wyckoff Trading Signals:

- • Primary Signal: Bearish. Trend, volume-price, momentum, and smart money behavior all point downward.

- • Operational Recommendations:

- 1. Hold Shorts / Stand Aside: Existing short positions can be held. It is not recommended for unpositioned traders to initiate new shorts at this level, as the oversold RSI may trigger a technical rebound.

- 2. Potential Shorting Opportunity on Rebound: If the price experiences a low-volume rebound towards the 55.00-55.50 resistance zone and shows stagnation signals (e.g., long upper wicks, intraday volume-price divergence), this could be viewed as a high-probability secondary shorting opportunity.

- 3. Short Position Stop-Loss Reference: A decisive break and close above 56.00 (indicating the downtrend may be invalidated).

- • Future Verification Points and Watchlist:

- 1. Signs of a Bottom: Near the 51.10-51.50 support zone, watch for candlestick patterns such as "low-volume decline (supply exhaustion)" or "high-volume long lower wick (strong demand intervention after panic selling)". These are key signals for judging a potential end to the Markdown Phase and the beginning of smart money accumulation.

- 2. Rebound Quality Verification: Observe the volume accompanying any rebound. A low-volume rebound is a bull trap and will lead to further decline; only sustained high-volume advance can alter the current supply-dominant structure.

- 3. Volatility Contraction: Monitor whether the Parkinson and Historical Volatility ratios consistently fall back below 1 while their absolute levels decline. This usually indicates a calming of panic and the market potentially entering a new balance or accumulation phase.

Disclaimer: This report is derived from historical data and quantitative model analysis and is for reference only. Financial markets involve risks, and past performance does not guarantee future results. Investors should make independent judgments based on their own circumstances and bear corresponding risks.

Thank you for your attention! Daily Wyckoff volume-price market interpretations are released at 8:00 AM sharp before the market opens. We kindly request your comments and shares; your recognition is paramount. Let's work together to see the market signals clearly.

Member discussion: