Understood. As a quantitative trading researcher proficient in the Wyckoff Method, I will draft a comprehensive, in-depth quantitative analysis report based on the XLE data and historical rankings you have provided.

Quantitative Analysis Report on XLE (Based on the Wyckoff Method)

Product Code: XLE

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: Inferred as 2026-01-21 based on data generation time

1. Trend Analysis and Market Phase Identification

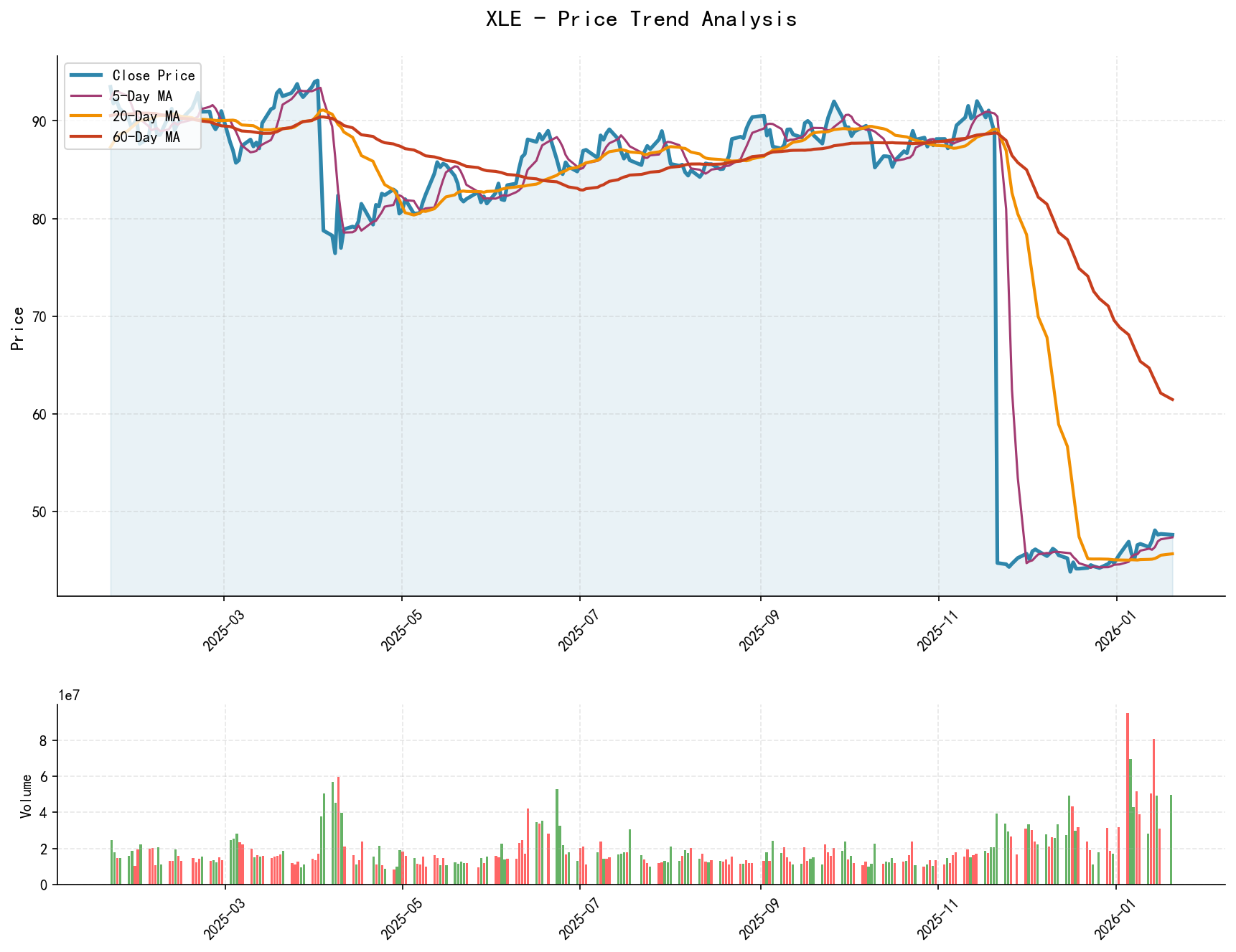

As of 2026-01-20, the underlying asset XLE has an opening price of 48.09, a closing price of 47.60, a 5-day moving average (MA) of 47.34, a 10-day MA of 46.76, a 20-day MA of 45.65, with a daily change of -0.19%, a weekly change of +1.28%, a monthly change of +6.46%, a quarterly change of +6.46%, and an annual change of +6.46%.

Relationship Between Price and Moving Averages:

- • Initial State (2025-11-21): The price (closing price 44.71) was significantly below all moving averages (MA_5D 90.43, MA_60D 88.74), showing a deeply oversold bearish alignment, indicating extreme market weakness.

- • Development Process: The price consolidated to form a bottom within the range of 43.81-46.18 (2025-11-21 to 2025-12-19). During this period, short-term moving averages (MA_5D, MA_10D) declined rapidly and converged towards the price. A strong rebound commenced from early January 2026.

- • Current State (2026-01-20): The price (47.60) has successfully broken above all short-term moving averages, positioned above both MA_5D (47.34) and MA_10D (46.76), but remains below MA_20D (45.65) and longer-term moving averages. MA_5D has already turned upwards and is about to form a golden cross with MA_10D and MA_20D. The market is transitioning from a bearish to a bullish alignment, with the short-term trend having clearly strengthened.

Moving Average Cross Signals and Significance:

- • The moving average system underwent a process from extreme dispersion to rapid convergence. MA_5D plummeted from a level far above 90 to intersect with the price (around 2025-12-26), completing the correction for the extreme decline.

- • Currently, the price is leading the short-term moving averages upwards, forming the initial blueprint of a positive feedback loop: "price rise -> short-term MA rise -> attracts more buying." This is a potential initial signal for a bottom reversal.

Inferred Market Phase (Based on Wyckoff Theory):

- • 2025-11-21 to 2025-12-16: Exhibits characteristics of "Panic Selling" and "Automatic Rally." Significant volume-driven plunges occurred on Nov 21 and Dec 16, followed by technical rebounds.

- • 2025-12-17 to 2025-12-31: The market entered the "Secondary Test" and "Accumulation" phase. The price oscillated repeatedly within the 44-46 range. Volume receded from abnormal highs but remained above earlier averages, and volatility declined from historical highs, indicating effective absorption of selling pressure and potential accumulation by large investors near the range bottom.

- • 2026-01-02 to Present: The price broke above the upper boundary of the consolidation range (46.00) on significant volume, entering the initial stage of the "Markup" phase. The high-volume, long bullish candles on Jan 5 and 14 are key markers. However, the decline on Jan 20 at a relatively high level accompanied by increased volume warrants caution—it could represent "Distribution" behavior or a "Shakeout" within the uptrend.

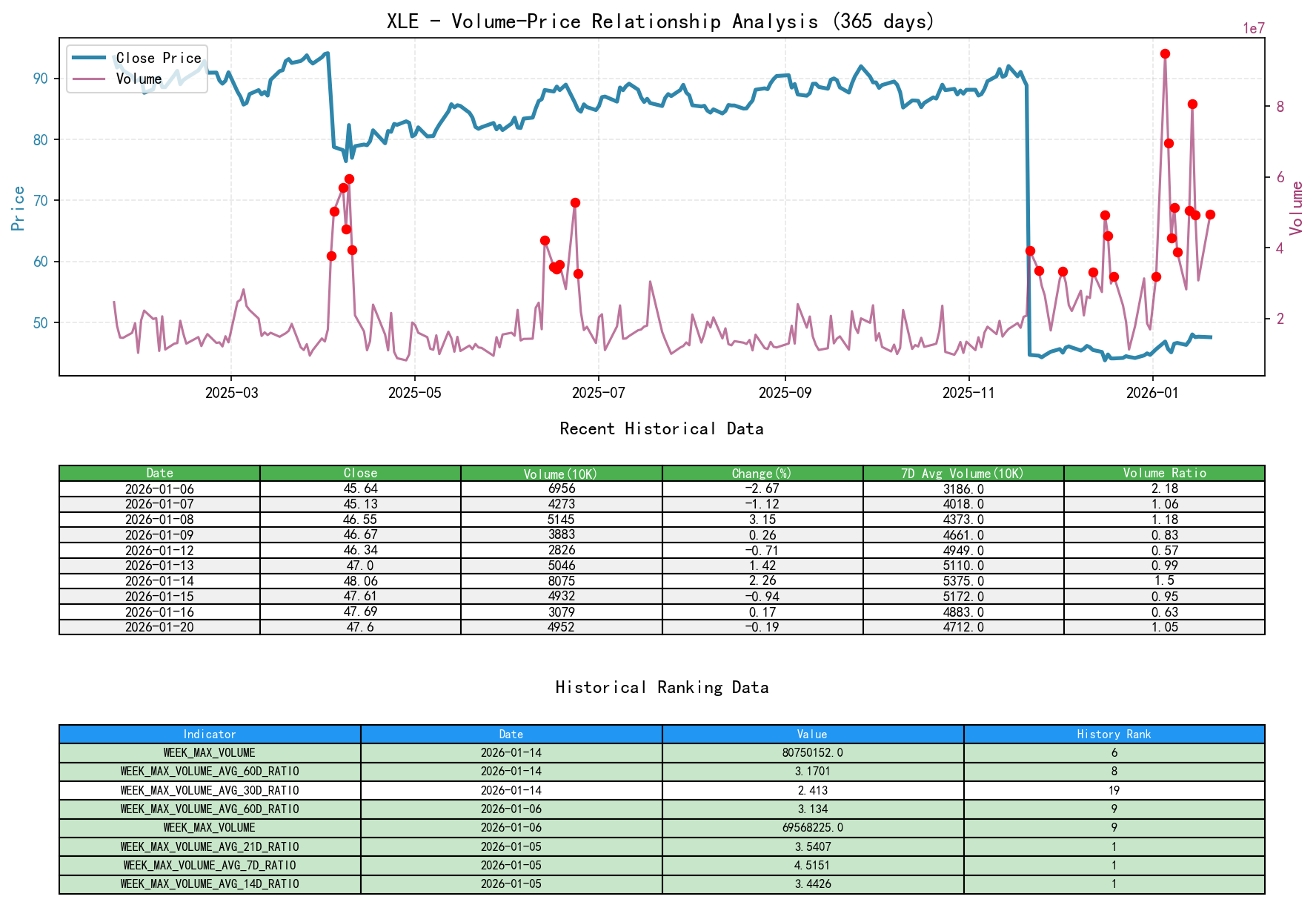

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-20, the underlying asset XLE has an opening price of 48.09, a closing price of 47.60, volume of 49,524,251, daily change of -0.19%, volume of 49,524,251, 7-day average volume of 47,128,552.43, and 7-day volume ratio of 1.05.

Key Day Analysis:

- • 2025-11-21: High-volume decline (volume 39.31 million, VOLUME_AVG_7D_RATIO=2.19) with a slight price decrease. This was the first instance post-panic selling of massive volume with a narrowing price decline, hinting at capital absorption at low levels and significant supply being absorbed.

- • 2025-12-16: A classic Panic Selling day. Price plummeted -3.05%, volume surged to 49.31 million (VOLUME_AVG_60D_RATIO=2.65). Historical rankings show that day's volume growth rate was 79.18%, ranking near the top. This represents an extreme manifestation of concentrated supply release.

- • 2025-12-17: Demand-led rebound. Price surged 2.21%, recovering most of the previous day's loss, with volume remaining high (43.37 million). This is a clear signal of smart money entering after the panic, confirming the validity of support at the previous day's low.

- • 2026-01-05: High-volume advance with an upper shadow. Volume reached a new high within the range at 94.96 million (ranking #3 historically over ten years), price rose 2.72% but failed to close at the high. This indicates strong demand but also suggests supply emerged near the 48.00 area. VOLUME_AVG_60D_RATIO=4.57, achieving the highest historical rank in nearly ten years (#1), indicating exceptionally abnormal trading activity that day.

- • 2026-01-14: High-volume breakout. Price surged 2.26%, breaking through prior highs, with volume at 80.75 million (historical rank #6). The healthy volume-price confirmation shows demand fully controlled the market.

- • 2026-01-20 (Latest Trading Day): High-volume stagnation. Price slightly declined -0.19%, but volume expanded to 49.52 million (VOLUME_AVG_60D_RATIO=1.80). High-volume non-advance after a continuous rally is a warning sign of emerging supply, requiring verification in subsequent trading days.

Supply-Demand Dynamics Summary:

- • Supply Exhaustion: The panic selling in mid-December 2025 was the climax of supply.

- • Demand Entry: From late December 2025 to early January 2026, price increases were accompanied by moderate or sustained high volume levels (VOLUME_AVG_*_RATIO > 1), indicating continuous demand.

- • Supply-Demand Inflection Point: The high-volume stagnation on 2026-01-20 is a potential Wyckoff event of "effort versus result," suggesting supply is starting to offset demand at the current level. Observation is needed to see if price declines follow for confirmation.

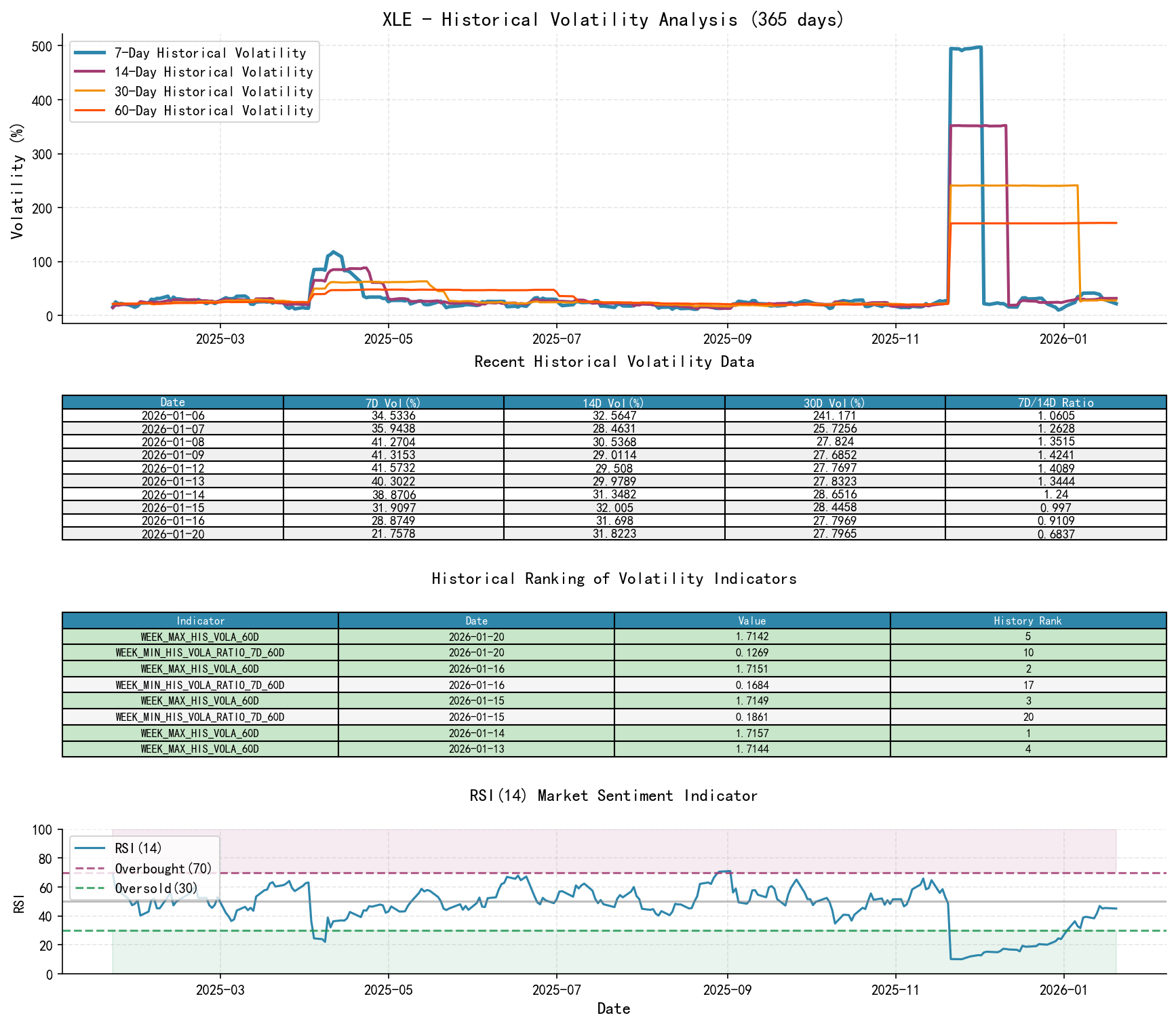

3. Volatility and Market Sentiment

As of 2026-01-20, the underlying asset XLE has an opening price of 48.09, a 7-day intraday Parkinson volatility of 0.18, a 7-day Parkinson volatility ratio of 0.80, a 7-day historical volatility of 0.22, a 7-day historical volatility ratio of 0.68, and an RSI of 45.14.

Volatility Levels and Changes:

- • Historical Volatility (HIS_VOLA): At the beginning of the analysis period (late November 2025), volatility across all periods was at extreme historical levels over nearly ten years. For example, HIS_VOLA_14D ranged between 3.51-3.52, consistently ranking within the top 12 historically. This confirms the market was in a state of high panic and disorder at that time.

- • Volatility Convergence: Starting from late December 2025, short-term volatility (7D, 14D) declined rapidly. By 2026-01-20, HIS_VOLA_7D had dropped to 0.22, with HIS_VOLA_RATIO_7D_60D=0.127, positioning it in the lowest historical range (historical rank #10). This indicates market sentiment has shifted from extreme panic to relative stability, and a trending market is developing.

Parkinson Intraday Volatility:

- • Following a similar trajectory to historical volatility, it peaked during the December panic period (PARKINSON_VOL_7D highest at 0.27 on Jan 8), then fluctuated downward. Currently (Jan 20), PARKINSON_VOL_7D is 0.18, having significantly retreated from the peak, with PARKINSON_RATIO_7D_14D=0.80, showing intraday volatility is contracting.

RSI Overbought/Oversold Status:

- • Extreme Oversold: In late November 2025, RSI_14 touched a low of 10.13 (rank #1 over nearly ten years), confirming极度悲观 market sentiment and serving as a crucial sentiment indicator for the bottoming area.

- • Sentiment Recovery: RSI subsequently oscillated higher, entering the neutral-to-strong zone of 40-50 during the January rally. The current RSI_14 is 45.14, having moved out of the oversold zone but not yet into overbought territory (>70), leaving room for further price appreciation. Sentiment has completed its repair from panic to neutrality.

4. Relative Strength and Momentum Performance

Periodic Return Analysis:

- • Strong Short-Term Momentum: WTD_RETURN (week-to-date) is +1.28%, MTD_RETURN (month-to-date) is +6.46%, QTD/YTD returns are also positive (+6.46%). All short-term and mid-term momentum indicators have turned positive and are strengthening.

- • Momentum Reversal: The key turning point occurred in January 2026. Prior to this, all period returns were deeply negative (e.g., YTD was -47.8% on 2025-12-31). The January rally successfully reversed the short-term, mid-term, and even long-term downward momentum.

- • Momentum and Volume-Price Confirmation: Strong positive returns, combined with expanding volume and rising prices, form a cohesive force, validating the effectiveness and strength of the current uptrend.

5. Large Investor ("Smart Money") Behavior Identification

Based on the above volume-price, volatility, and trend analysis, the operational intent of large investors can be inferred as follows:

- 1. Accumulation During Panic (Nov-Dec 2025): During periods of price collapse, volatility hitting historical highs, and extreme RSI oversold conditions, huge volume transactions occurred (e.g., Nov 21, Dec 16-17). Smart money capitalized on public panic sentiment, conducting large-scale accumulation at low levels. Who was absorbing the massive selling volume? The answer: Large investors.

- 2. Testing and Shakeouts During Accumulation (Dec 2025): Within the 43.8-46.1 consolidation range, there were multiple instances of low-volume declines (e.g., Dec 24, 26) testing support, and occasional high-volume declines (e.g., Dec 18). This likely represents smart money testing the solidity of lower support and shaking out weak holders through shakeouts.

- 3. Markup and Distribution Probing (Jan 2026): The consecutive high-volume, long bullish candles in early January are typical behavior of smart money driving the price higher (Markup). However, the high-volume long upper shadow on Jan 5 and the high-volume stagnation on Jan 20 show initial signs of Distribution. Smart money may be exploiting market euphoria to partially take profits or test selling pressure at relatively high levels. The answer to "Who was selling on Jan 20?" is: some profit-taking smart money and retail investors fearful of heights.

- 4. Current Intent: The market has moved out of the bottom accumulation zone. Smart money is currently in a phase of holding for further gains while simultaneously conducting tentative distribution. They need to observe market reactions at key resistance levels (e.g., 48.30-48.65) to decide the next step: either continue marking up or intensify distribution efforts.

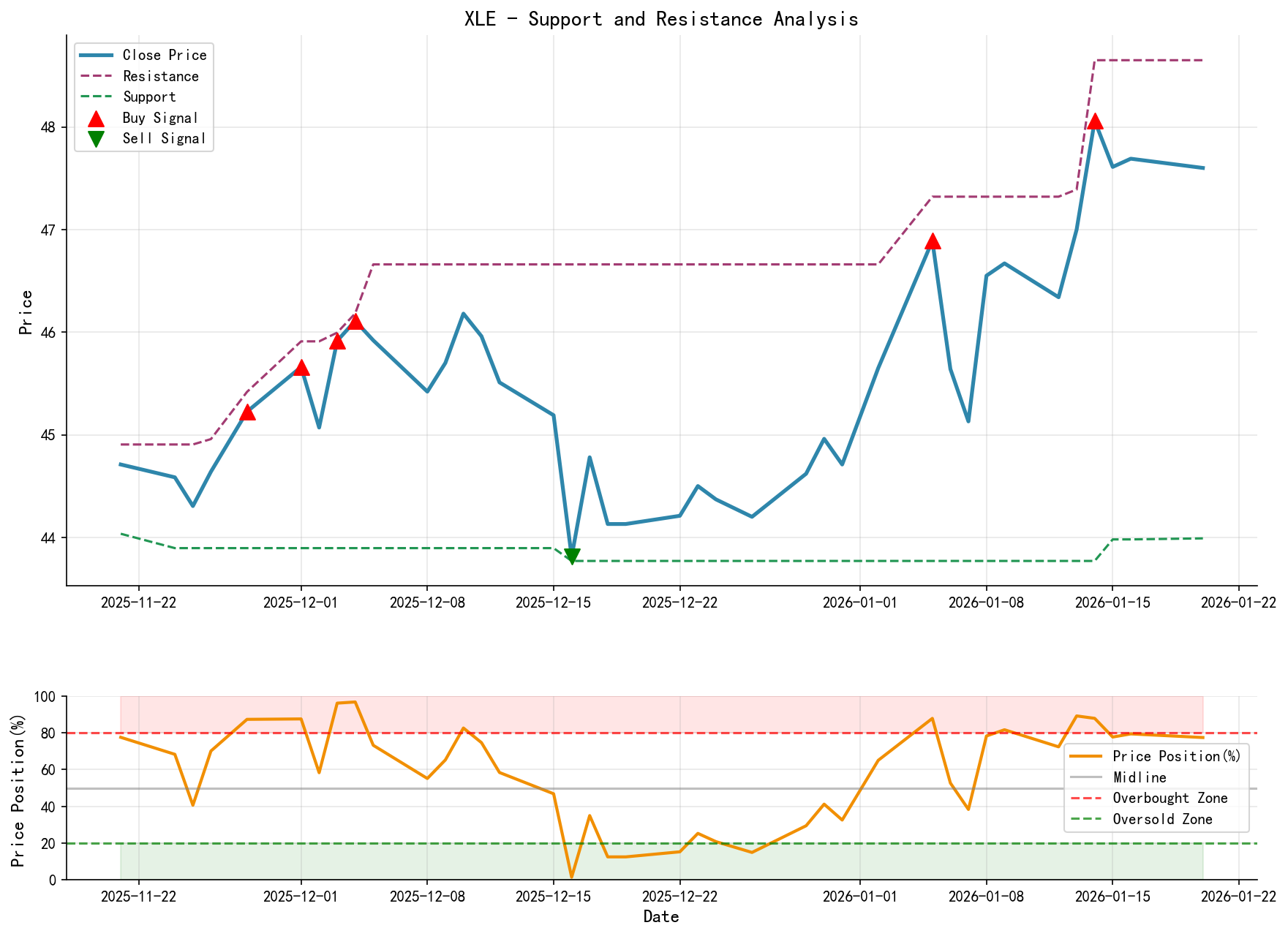

6. Support/Resistance Level Analysis and Trading Signals

Key Price Levels:

- • Strong Support: 44.00 (lower boundary of the Dec 2025 consolidation range and multiple test lows), 43.80 (panic low on 2025-12-16).

- • Weak Support/Trend Change Level: 46.90 (upper edge of the recent breakout gap and low from Jan 12). A break below this would damage the short-term uptrend structure.

- • Strong Resistance: 48.30 - 48.65 (upper shadow area of the Jan 14 long bullish candle and recent high zone). Historical ranking data indicates exceptionally high volume on Jan 14, signifying substantial supply exists here.

Integrated Wyckoff Events and Trading Signals:

- • Primary Assessment: The market has completed the transition from "Accumulation" to "Markup" but is currently facing its first strong resistance zone and showing initial signs of supply entry (high-volume stagnation on Jan 20).

- • Trading Signal: Short-term bullish, but approaching strong resistance; high vigilance required. Advised to shift to a wait-and-see or cautiously held stance, avoiding chasing highs.

- • Operational Suggestions:

- • Bullish Strategy (For holders): Raise the stop-loss level to just below 46.90. Consider partial profit-taking within the resistance zone of 48.30-48.65.

- • Bearish Strategy/For Observers: Await the market's reaction to the resistance zone. If a high-volume break below 46.90 occurs, it would signal a potential failure of the uptrend, allowing consideration of a light short position with a target of 44.00.

- • Add/Entry Signal: If the price can break above and sustain above 48.65 with strong volume (above the 7-day average) in the future, it may indicate the opening of further upside, serving as a new entry point.

- • Future Validation Points:

- 1. Confirmation of Bullishness: Price experiences a low-volume pullback to the 46.90-47.60 area, finds support, and then rallies again on high volume.

- 2. Confirmation of Bearishness/Distribution Start: Price shows high-volume stagnation or decline again near 48.30, followed by a break below the 46.90 support.

- 3. Confirmation of Shakeout: Price suddenly breaks below 46.90 on low or slightly increased volume but manages to recover quickly within 1-3 trading days. This would represent a final buying opportunity.

Conclusion Restated: After experiencing a historically significant panic decline, XLE has undergone bottom accumulation led by large investors and entered a technical bull market in January 2026. However, the initial advance has encountered a robust historical resistance zone and shows signs of fatigue. It is recommended that investors maintain caution amidst optimism, making decisions strictly based on the aforementioned key price levels and validation points, avoiding blind optimism near resistance.

Disclaimer: The content of this report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. While the author strives for objectivity and impartiality, no guarantees are made regarding its accuracy or completeness. Markets involve risks; investment requires caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis will be released daily at 8:00 AM before market open. We kindly ask for your comments and shares; your recognition is crucial. Let's work together to perceive market signals.

Member discussion: