XLB Quantitative Analysis Report (Based on the Wyckoff Method)

Product Code: XLB

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

I. Trend Analysis and Market Phase Identification

As of January 20, 2026, for the underlying asset XLB: Opening Price 48.35, Closing Price 48.19, 5-Day Moving Average 48.73, 10-Day Moving Average 48.02, 20-Day Moving Average 46.85, Daily Change -1.01%, Weekly Change -1.11%, Monthly Change +6.26%, Quarterly Change +6.26%, Year-to-Date Change +6.26%.

1. Price and Moving Average Relationship:

- • Current Alignment: As of 2026-01-20, the closing price of48.728, MA_10D:46.851, MA_30D:60.704). Since early December 2025, the price has successfully broken through and consistently traded above the major moving averages, presenting a standard bullish alignment pattern.

- • Moving Average Crossover Signals:

- • Medium-Term Signal: The MA_5D crossed above the MA_20D on December 10, 2025, forming a "golden cross," signaling a strengthening of short-term momentum and prompting the MA_10D to also cross above the MA_20D. This series of crossovers was confirmed and maintained from mid to late December, forming the technical foundation for this uptrend.

- • Short-Term Signal: Recently (2026-01-16 to 01-20), the MA_5D has shown signs of flattening and slightly turning downward (decreasing from48.728), but the price continues to trade closely to the MA_5D. This indicates a weakening of short-term upward momentum, entering a phase of high-level consolidation or pullback.

2. Market Phase Identification (Based on Wyckoff Price-Volume Principles):

- • Accumulation Phase Confirmation: The initial period of data (2025-11-21 to 11-28) exhibits typical "stabilization after a decline" characteristics. Following a significant price drop (PCT_CHANGE as low as -48.88%), a high-volume long lower shadow candle appeared on November 21 (volume 20.99 million, RSI_14=6.53 hitting a near-decade low), forming a Selling Climax. In subsequent days, the price rebounded but with stepwise declining volume (VOLUME decreasing from 12.46 million to 4.79 million), testing support near the previous low, constituting a "Secondary Test." This aligns with the initial characteristics of the Wyckoff accumulation model.

- • Markup Phase: From December 10, 2025, to January 15, 2026, the price advanced in an orderly fashion with intermittent volume surges (e.g., Dec 10, Jan 2, Jan 5). Each pullback was shallow with declining volume (e.g., Dec 15, Dec 22), indicating stable control by demand (buyers) and lack of supply (sellers). This is a standard "Markup" phase.

- • Current Phase Assessment (Potential Early Distribution): After reaching a recent high of $49.14, the price experienced high-volume declines on January 16 and 20, 2026 (volumes of 107 million and 174 million, PCT_CHANGE of -0.57% and -1.01% respectively). Notably, on January 20, the price broke below the prior day's low, closed below the MA_5D, and volume expanded significantly (VOLUME_AVG_7D_RATIO=1.28). This preliminarily satisfies the "Sign of Weakness (SOW)" condition in the Wyckoff distribution model. The market may be transitioning from the "Markup" to the "Distribution" phase.

II. Price-Volume Relationship and Supply-Demand Dynamics

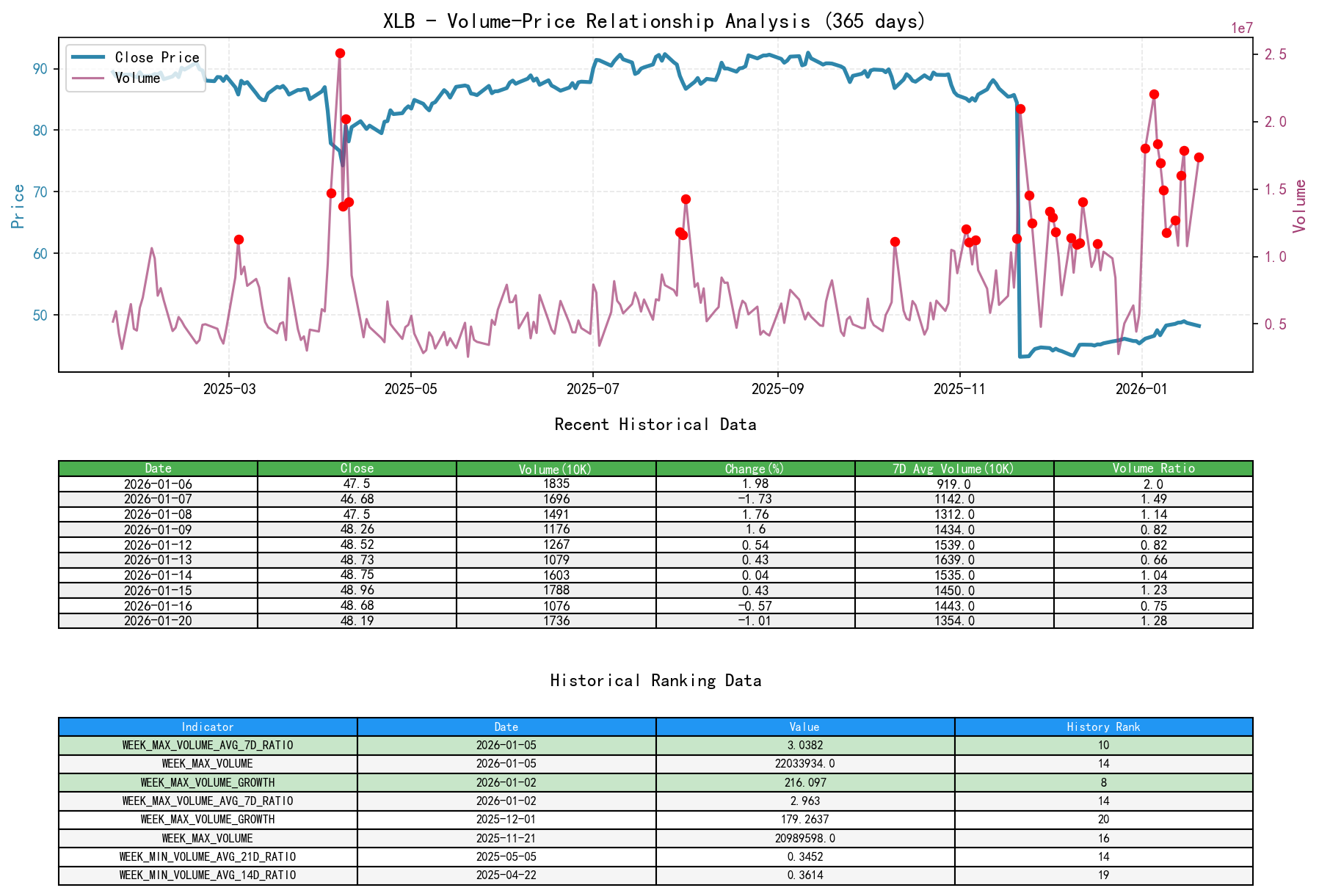

As of January 20, 2026, for the underlying asset XLB: Opening Price 48.35, Closing Price 48.19, Volume 17,369,739, Daily Change -1.01%, Volume 17,369,739, 7-Day Average Volume 13,548,947.29, 7-Day Volume Ratio 1.28.

1. Key Day Analysis:

- • Panic Selling and Demand Intervention (2025-11-21): A massive down day (volume 20.99 million, VOLUME_AVG_60D_RATIO as high as 3.11) but the close was far from the low (long lower shadow). Combined with its historical ranking (RSI_14 was the near-decade low that day), this is a classic panic selling day, with the huge volume hinting at large-scale buying (smart money) absorbing at low levels.

- • Demand-Driven Advance (2026-01-02 & 2026-01-05): Prices rose by 1.70% and 1.00% respectively, accompanied by unusually high volume (VOLUME_AVG_7D_RATIO of 2.96 and 3.04, ranking in the historical top 15). This is high-volume advance following a breakout of key resistance, showing strong demand entering the market.

- • Sign of Supply (2026-01-16 & 2026-01-20): Price declines accompanied by increased volume. January 20 is particularly typical: a decline of -1.01% with volume of 174 million (VOLUME_AVG_7D_RATIO=1.28, VOLUME_GROWTH as high as 61.29%). This is high-volume decline, indicating that at relatively high levels, supply (selling pressure) is beginning to overwhelm demand.

2. Quantitative Analysis of Volume Anomalies:

- • Demand Cycle: From late December 2025 to early January 2026, VOLUME_AVG_7D_RATIO exceeded 1.5 multiple times, indicating sustained active demand.

- • Supply Signal: On January 20, 2026, volume surged by 61.29% in a single day. This growth rate ranks high within the analysis period and occurred during a price decline, constituting a clear short-term signal of strengthening supply.

III. Volatility and Market Sentiment

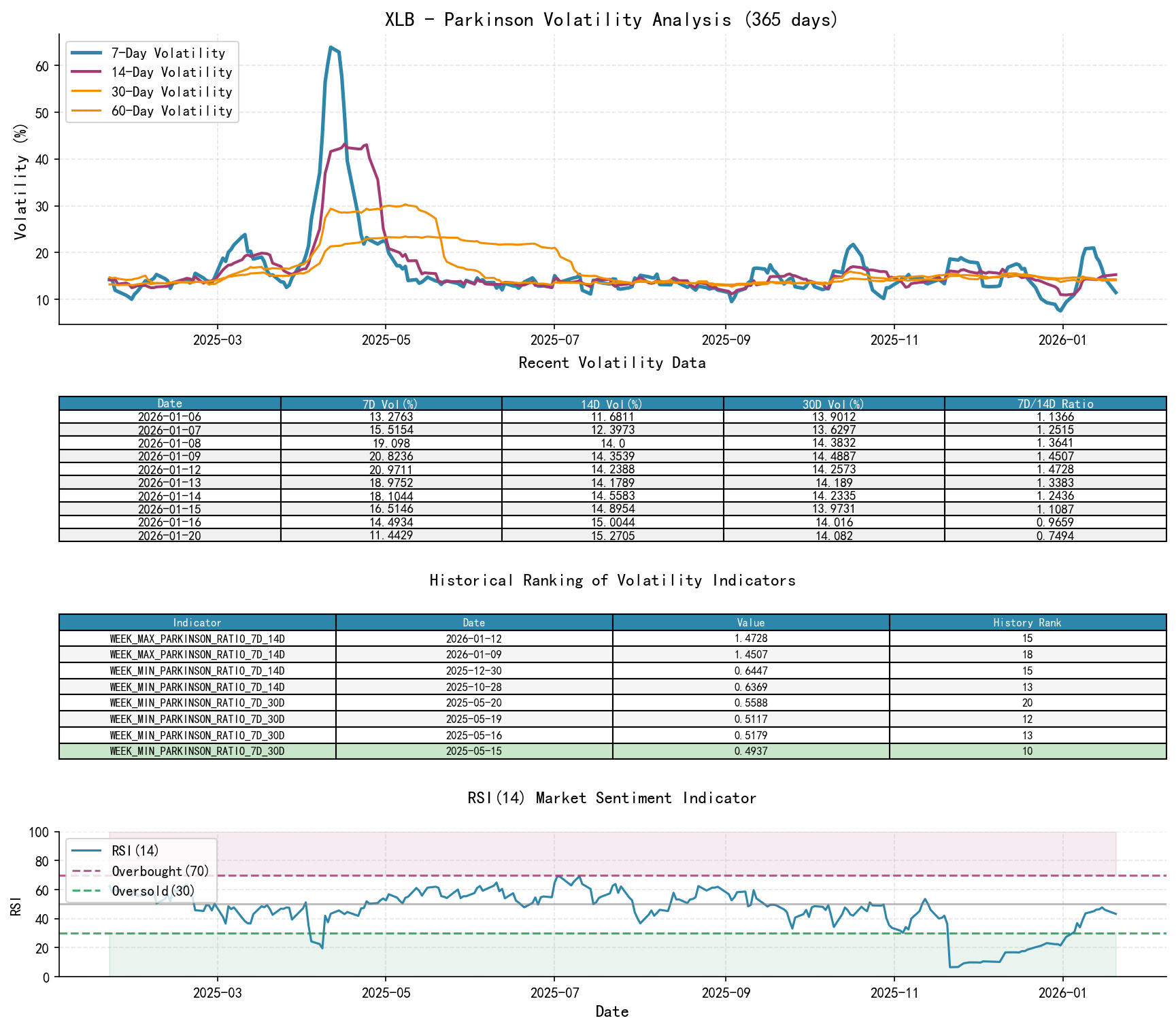

As of January 20, 2026, for the underlying asset XLB: Opening Price 48.35, 7-Day Intraday Volatility 0.11, 7-Day Intraday Volatility Volume Ratio 0.75, 7-Day Historical Volatility 0.16, 7-Day Historical Volatility Volume Ratio 0.73, RSI 43.30.

1. Volatility Levels and Changes:

- • Historically High Levels: At the beginning of the analysis period (late November to early December 2025), historical volatility (HIS_VOLA) across periods was at near-decade extremes (historical ranking TOP 20), e.g., WEEK_MAX_HIS_VOLA_7D (4.88, rank 1), WEEK_MAX_HIS_VOLA_14D (3.45, rank 1). This confirms the market was in a state of extreme panic and high volatility at that time.

- • Volatility Contraction and Re-expansion: Entering mid to late December, short-term volatility (HIS_VOLA_7D) rapidly contracted to very low levels (e.g., 0.048 on Dec 26, ranking historically low), indicating calming sentiment and smooth trend progression. Recently (January 2026), volatility has increased again. HIS_VOLA_7D rose from 0.116 on Dec 30 to 0.161 on Jan 20, suggesting renewed market tension.

2. Volatility Structure Anomalies:

- • Panic Period Characteristics: In late November 2025, short-term volatility was significantly higher than long-term (HIS_VOLA_RATIO_7D_60D as high as 2.93, a near-decade high), a classic volatility signature of panic selling.

- • Current Sentiment: As of Jan 20, while short-term volatility has risen, its ratio to long-term volatility (HIS_VOLA_RATIO_7D_60D=0.096) is at a historically normal to low level. This indicates no systemic panic in the market yet; the current volatility expansion is more likely due to short-term profit-taking or distribution activity.

3. RSI Overbought/Oversold Validation:

- • RSI_14 bottomed at 6.53 on Nov 21 (near-decade low), confirming extreme pessimism and an accumulation zone. It then fluctuated higher, reaching a high of 43.64 on Jan 9 before retreating, currently at 43.30. Throughout the entire advance, RSI_14 never entered overbought territory (>70), indicating a relatively healthy advance without overheated sentiment. The current pullback falls within the scope of a healthy correction.

IV. Relative Strength and Momentum Performance

- • Momentum Trend: Short-term (WTD_RETURN: -1.11%), medium-term (MTD_RETURN: +6.26%), and long-term (YTD: +6.26%) returns show clear medium-term upward momentum, but weakening short-term momentum. This aligns with the conclusions of high-volume decline at highs and the flattening MA_5D.

- • Momentum Inflection Point: The strong advance in the first half of January 2026 (Jan 2 to Jan 15) was the primary source of medium-term momentum. The pullback after Jan 16 constitutes the first significant attenuation of short-term momentum.

V. Large Investor (Smart Money) Behavior Identification

Based on the above price-volume, volatility, and momentum analysis, large investor behavior is inferred as follows:

- 1. Accumulation (Late November 2025): During extreme panic (historically low RSI, high volatility) and on the massive down day, smart money conducted large-scale absorption. Subsequent low-volume tests verified exhausted supply, completing the bottom formation.

- 2. Shakeout and Following Demand (December 2025 to Early January 2026): Breakouts at key levels (e.g.,46.00) in early December and early January were accompanied by significant volume expansion. This involved elements of shaking out weak holders (shakeout) as well as indications of smart money adding to positions or new money following the established trend.

- 3. Early Distribution Behavior (Current, Mid-Late January 2026): After the price reached the $49.14 high, high-volume stalling (Jan 15) and high-volume declines (Jan 16, 20) appeared. This fits the characteristics of "Stopping Action" and "Sign of Weakness" in the Wyckoff distribution model. Large investors may be utilizing market optimism and good liquidity to take profits at high levels. The 174 million volume on Jan 20 warrants caution as it could indicate institutional distribution.

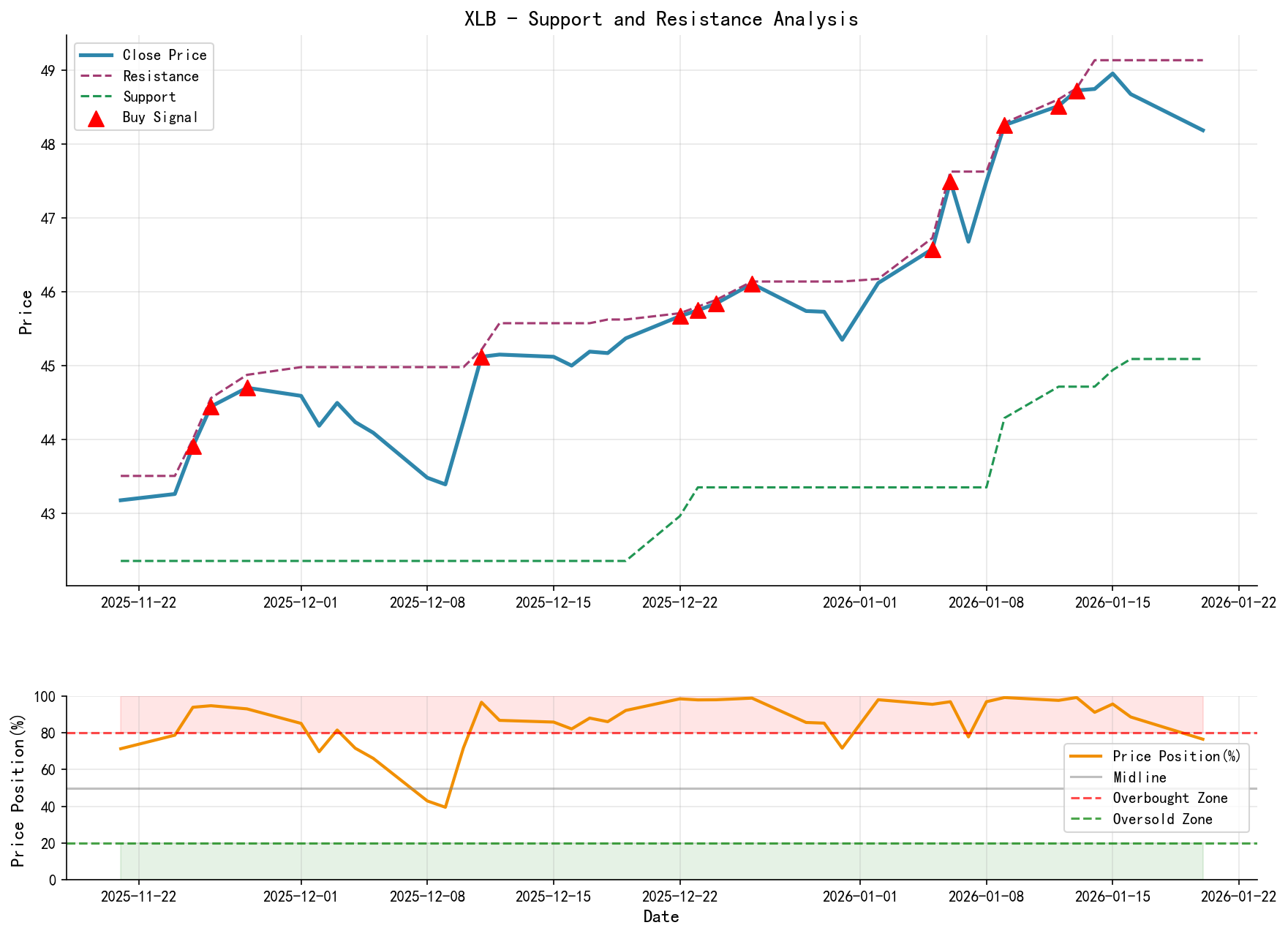

VI. Support/Resistance Level Analysis and Trading Signals

1. Key Price Levels:

- • Immediate Resistance: $49.14 (recent high, also a psychological level).

- • Secondary Resistance: $48.73 (Jan 20 high / near MA_5D).

- • Key Support: $45.35 (Dec 29 low, also a prior breakout level and near MA_20D).

- • Strong Support: $43.48 (Dec 8 panic low, upper bound of accumulation range).

2. Composite Trading Signals and Operational Suggestions:

- • Composite Assessment: The market has moved away from a smooth markup phase, entering a potential early distribution phase. The short-term technical structure has weakened, showing clear signals of increasing supply. Based on Wyckoff principles, caution is warranted for long positions, and opportunities for shorting or reducing exposure should be sought.

- • Operational Suggestions:

- • Existing Strategy (Long): It is suggested to reduce exposure or set tight stop-losses (e.g., below48.50-45.35.

- • Potential Strategy (Short): Bearish Signal. Aggressive traders may consider establishing light short positions on price rebounds to the49.00 area, with an initial stop-loss set above47.00 (Jan 7 pullback low) followed by a weak rally for entry.

- • Observation Strategy: If the price can stabilize above the46.00 support zone and again exhibit a demand-dominated pattern of low-volume pullback and high-volume advance, the uptrend may resume, requiring reassessment. Otherwise, the market may test lower supports.

3. Future Validation Points:

- • Confirmation of Bearish View: Price fails to reclaim47.00 with high or expanding volume, confirming ongoing distribution and the start of a downtrend.

- • Invalidation of Bearish View: Price consolidates narrowly above the46.00 support zone with significantly diminished volume (exhaustion of supply), followed by another bullish candle with a gain exceeding 1.5% and expanding volume (return of demand). This would indicate the current pullback is merely a healthy correction within the uptrend, and the trend will resume.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risks; investments require caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Wyckoff Price-Volume Market Interpretations are published daily at 8:00 AM before market open. Please feel free to leave comments and share. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: