Quantitative Analysis Report: XBI (SPDR S&P Biotech ETF)

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of 2026-01-20, the underlying asset XBI had an opening price of 122.42, a closing price of 125.29, a 5-day moving average of 124.63, a 10-day moving average of 124.00, a 20-day moving average of 123.70, a daily gain of 0.89%, a weekly gain of 1.16%, a monthly gain of 2.76%, a quarterly gain of 2.76%, and a yearly gain of 2.76%.

- 1. Trend Structure: Throughout the analysis period, XBI exhibited a typical "advance-pullback-re-advance" structure. The price rose from125.29 at the end, representing an overall increase of 7.4%.

- 2. Moving Average System Analysis:

- • Established Bullish Alignment: The MA_60D (long-term trend) showed a consistent unilateral ascent from 103.72 to 118.56, establishing the foundation for the primary uptrend.

- • Strengthening Intermediate Trend: From early December onward, MA_20D, MA_30D, and MA_60D formed a stable bullish alignment with an upward slope. During the adjustment in mid-to-late December, the price consistently remained above the MA_60D and found support near the MA_20D (Dec 17-19, Dec 29-30), aligning with the characteristics of a healthy uptrend pullback.

- • Critical Breakout Signal: On 2026-01-07, the price broke above all short and intermediate-term moving averages (MA_5D, MA_10D, MA_20D, MA_30D) with a high-volume, long bullish candle (+3.55%), recovering all previous losses and confirming the resumption of the primary uptrend.

- 3. Market Phase Inference (Wyckoff Framework):

- • Early Phase (2025-11-21 to 2025-11-28): Uptrend (Markup). The price rose consecutively on moderately increasing volume, with the RSI entering the overbought zone (76.98), indicating aggressive demand.

- • Mid-Phase (2025-12-01 to 2025-12-31): Distribution & Shakeout. The market entered a correction after reaching a new high (126.43).

- • Dec 1-2: High-volume decline (VOLUME_AVG_7D_RATIO of 1.11 and 2.20, respectively), showing the first large-scale appearance of supply (Sign of Weakness).

- • Dec 3-19: Price oscillated in the $120-124 range, with intermittent spikes in volume, failing to decisively break the previous high. The high-volume rebound on Dec 19 (VOLUME_GROWTH +83.7%) can be viewed as a rebound following a Secondary Test.

- • Dec 22-24: After rebounding near the previous high, volume contracted significantly (VOLUME_AVG_7D_RATIO dropped to 0.38-0.70), indicating insufficient demand and unsustainable advance.

- • Dec 29-30: Shakeout. The price broke below the lower boundary of the consolidation range ($121.67) on high volume, testing MA_60D support. The RSI entered the oversold zone (51.57), flushing out weak long positions.

- • Recent Phase (2026-01-02 to 2026-01-20): Accumulation & New Uptrend (Markup).

- • Jan 2-6: The price stabilized near the previous shakeout low on moderate volume, showing low-volume stabilization at the support level.

- • Jan 7: Sign of Strength. A massive long bullish candle (19.35M, VOLUME_AVG_7D_RATIO=2.37) broke above all short and intermediate-term moving averages, confirming aggressive accumulation by large investors following the pullback.

- • Jan 8-20: Following the breakout, the price consolidated at higher levels. Volume remained active, with lows gradually rising (124.18 -> 124.35 -> 125.29), indicating effective absorption of supply and dominant demand.

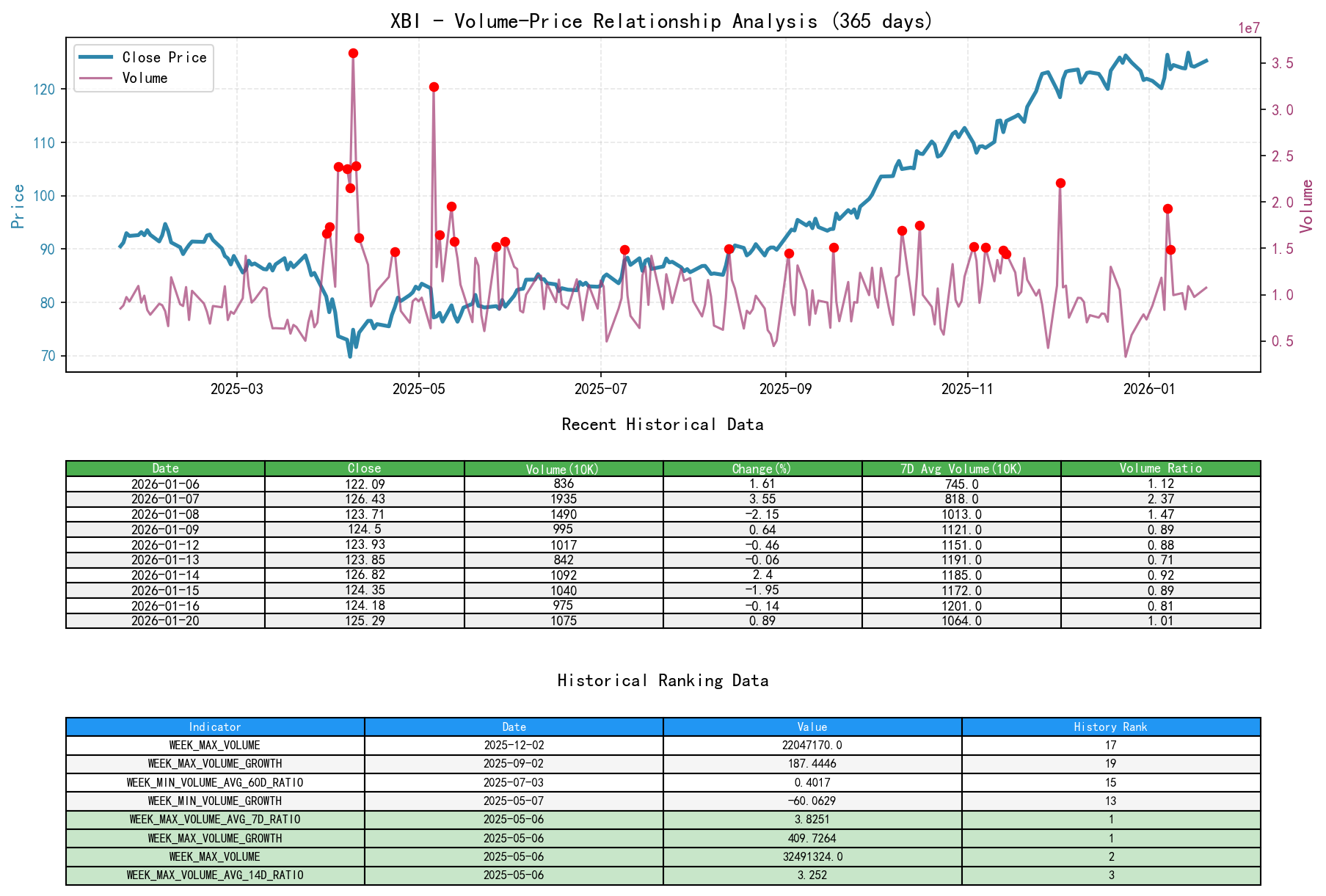

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-20, the underlying asset XBI had an opening price of 122.42, a closing price of 125.29, volume of 10755628, a daily gain of 0.89%, volume of 10755628, a 7-day average volume of 10649673.57, and a 7-day volume ratio of 1.01.

- 1. Demand-Dominated Phase (Powerful Advance):

- • 2025-11-24/25: Price rose by 2.51% and 1.50%, with volumes reaching 9.91M and 10.53M respectively, exceeding the 7-day average (VOLUME_AVG_7D_RATIO: 0.79, 0.89). Rising price with rising volume indicates healthy demand.

- • 2026-01-07: Core demand signal day. Price surged 3.55% with volume exploding to 19.35M, the highest single-day volume within the analysis period, far exceeding the average (VOLUME_AVG_7D_RATIO: 2.37). This is a textbook case of "high-volume breakout", demonstrating demand entering with overwhelming dominance.

- 2. Supply-Dominated Phase (Selling Pressure Emerges):

- • 2025-12-01/02: Price declined 2.69% and 1.16%, respectively, with volume surging (10.99M, 22.05M). Falling price with rising volume, especially on Dec 2 where volume was 2.20 times the 7-day average, clearly indicates a large influx of supply.

- • 2026-01-08: Following the massive advance the previous day, the price fell 2.15% the next day, while volume remained high at 14.91M (VOLUME_AVG_7D_RATIO: 1.47). This represents natural supply release after an advance but did not break below the key breakout level and was subsequently absorbed.

- 3. Supply Absorption Phase (Consolidation and Base Formation):

- • 2025-12-19: Price rose 2.85% after the pullback, with volume expanding to 13.02M (VOLUME_AVG_7D_RATIO: 1.67). A high-volume reversal rally appearing near the end of a downtrend signals potential demand beginning to absorb supply.

- • 2025-12-22 to 2026-01-06: Multiple instances occurred where the price declined but volume contracted significantly (e.g., 12-24, 12-26, 01-02), indicating waning downward momentum and reduced willingness to sell.

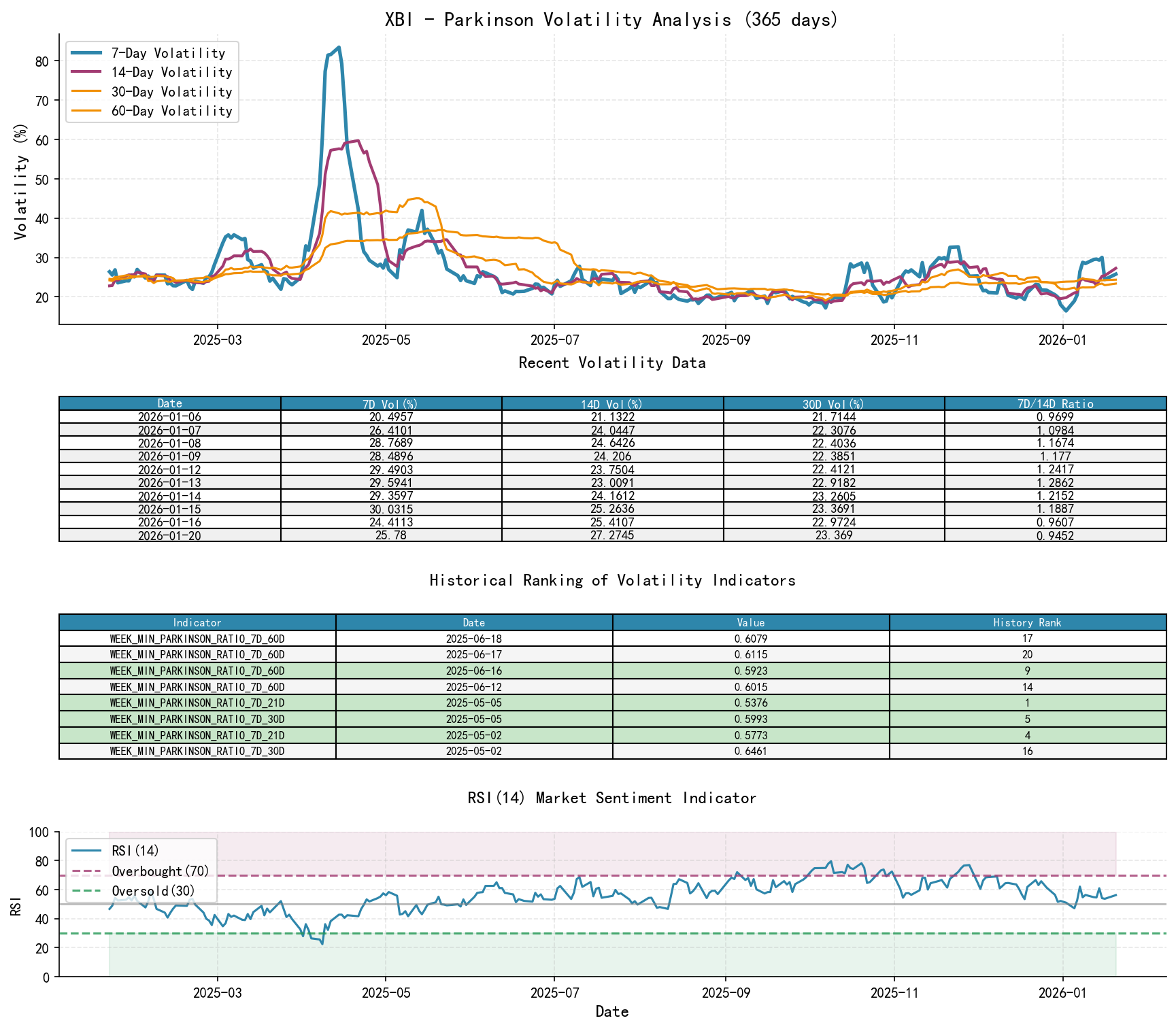

3. Volatility and Market Sentiment

As of 2026-01-20, the underlying asset XBI had an opening price of 122.42, a 7-day intraday Parkinson volatility of 0.26, a 7-day Parkinson volatility ratio of 0.95, a 7-day historical volatility of 0.25, a 7-day historical volatility ratio of 0.83, and an RSI of 56.25.

- 1. Volatility Level:

- • The historical volatility (HIS_VOLA_60D) fluctuated narrowly within the 0.27-0.29 range, indicating a stable long-term volatility environment.

- • Parkinson intraday volatility spiked significantly on key days: Dec 2 (HIS_VOLA_7D: 0.37) and Jan 7 (PARKINSON_VOL_7D: 0.26), corresponding to concentrated releases of supply and demand.

- 2. Volatility Structure:

- • During panic/turning points, short-term volatility rapidly exceeded long-term volatility. For example, on Dec 2, HIS_VOLA_RATIO_7D_60D jumped to 1.29; on Jan 7, this ratio rose to 1.21. Anomalous expansion in short-term volatility signals extreme market sentiment and potential turning points.

- 3. Sentiment Indicator (RSI):

- • The RSI reached overbought levels (76.98) in late November, warning of a pullback risk.

- • From late December to early January, the RSI retreated into the oversold region (47.16-52.24), forming an incipient bullish divergence with the price shakeout lows, laying the groundwork for the subsequent rebound.

- • After the massive advance on Jan 7, the RSI returned to the strong zone (62.14) without entering extreme overbought territory, indicating healthy upward momentum.

4. Relative Strength and Momentum Performance

- 1. Momentum Trends:

- • Strong Medium to Long-Term Momentum: Despite the pullback, the QTD_RETURN (2.76%), YTD (2.76%), and TTM_36 (44.03%) as of the period-end remained strongly positive, indicating significant relative strength over longer timeframes.

- • Short-Term Momentum Shifted from Weak to Strong: WTD_RETURN was negative in early January but turned positive to +1.16% by Jan 20; MTD_RETURN rebounded strongly from -1.46% on Jan 5 to +2.76%, confirming the reversal of the short-term downtrend and the formation of new upward momentum.

- 2. Conclusion: Following a healthy intermediate-term adjustment, XBI's short and medium-term momentum have both turned positive again, resonating with price breakouts and improved volume-price dynamics, indicating that its upward momentum is strengthening.

5. Large Investor (Smart Money) Behavior Identification

- 1. Accumulation Behavior: The massive long bullish candle on 2026-01-07 is a clear marker of large investor activity. After nearly a month of adjustment and shakeout, smart money entered the market with overwhelming buying power, achieving the highest recent volume. This is not retail behavior but organized capital inflow.

- 2. Shakeout and Test: The low-volume decline and high-volume stabilization during 2025-12-29 to 2026-01-05 align with the Wyckoff theory's pattern of "testing" support effectiveness after a "shakeout." Smart money used the decline to test the exhaustion of floating supply, preparing for the subsequent advance.

- 3. Distribution and Re-accumulation: The overall high-level consolidation in December 2025 can be viewed as a "distribution" process. However, the price did not collapse but formed a new trading range at a higher level (relative to early November). The subsequent decline (shakeout) and the Jan 7 breakout indicate that smart money completed a new round of "accumulation" at a higher price, providing a foundation for the next wave of advance.

- 4. Historical Ranking Corroboration: The provided HISTORY_RANK data shows that

WEEK_MAX_AMOUNTrecorded the 2nd and 5th highest weekly trading volume records in the past decade on 2025-12-02 and 2026-01-07, respectively. This strongly confirms the occurrence of extreme and rare institutional-level capital activity during the analysis period, significantly enhancing the reliability of the judgment regarding large-scale operations by large investors at key levels (support and breakout points).

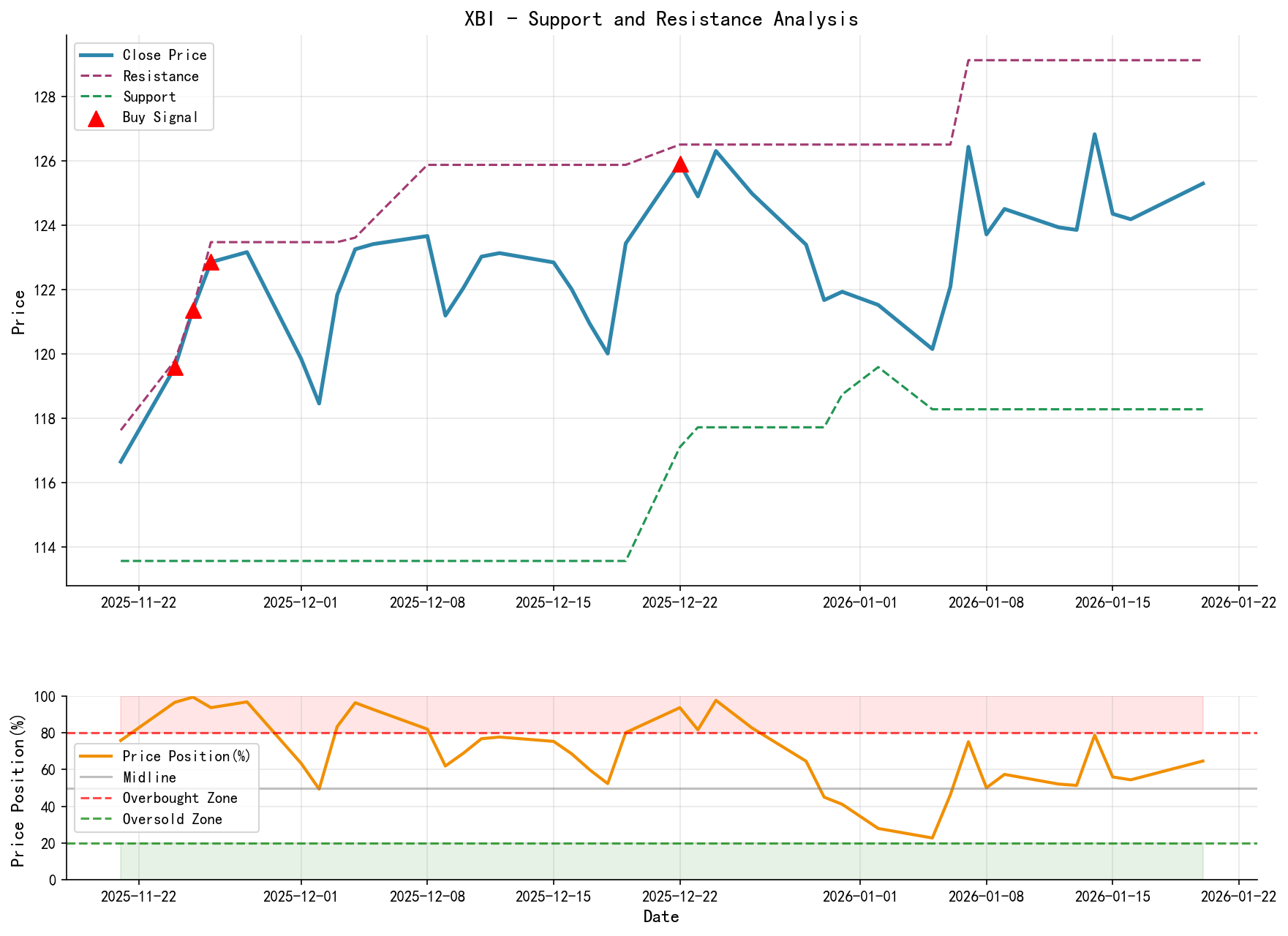

6. Support/Resistance Level Analysis and Trading Signals

- 1. Key Support Levels:

- • Primary Support (Demand Zone):120.00. This area encompasses the December pullback low, the January shakeout low, and the MA_20D/MA_30D confluence zone, representing strong demand. Any low-volume pullback to this zone presents a potential accumulation opportunity.

- • Secondary Support (Breakout Level):124.00. The midpoint of the massive bullish candle on Jan 7 and the subsequent consolidation platform, having transitioned from resistance to support.

- 2. Key Resistance Levels:

- • Near-term Resistance: $127.22 (2026-01-15 high). A break above this level would open the path toward the $130.00 psychological barrier.

- • Intermediate Target: Above $130.00. Based on the current volume-price structure and momentum, this is the next technical target area after a break above $127.22.

- 3. Integrated Wyckoff Events and Trading Signals:

- • Current Signal: Bullish. The market has completed the Wyckoff event sequence of "Shakeout" and "Sign of Strength" and is in the early stages of a new uptrend (Markup).

- • Operational Recommendations:

- • Existing Long Position Holders: Continue holding. Consider moving the stop-loss level up to $123.50 (lower boundary of the breakout platform).

- • Seeking Entry: Consider establishing long positions in tranches when the price pulls back to the124.50 support area with contracting volume.

- • Aggressive Investors: If the price breaks above $127.22 with significant volume (VOLUME_AVG_7D_RATIO > 1.2), it can be considered a trend acceleration signal for potential adding.

- • Stop-Loss Reference: The ultimate stop-loss for all long positions should be set below $119.00. A failure of this support would imply the breakdown of the current bullish thesis.

- • Future Validation Points:

- 1. Bullish Validation: The price holds the127.22 resistance with expanding volume.

- 2. Bearish Warning: The price fails to break123.50** would necessitate re-evaluating trend strength, potentially indicating a failed breakout and a return to consolidation.

Disclaimer: This report is generated based on the provided historical data and analytical methods. All conclusions are derived from data analysis and are for reference only. Financial markets involve risks, and past performance is not indicative of future results. Investors should make independent decisions based on their own circumstances.

Thank you for your attention! Wyckoff Volume-Price market analysis is published daily at 8:00 AM before market open.

Member discussion: