As a quantitative trading researcher proficient in the Wyckoff Method, I have conducted a comprehensive and in-depth analysis of the VCR data you provided. This report strictly adheres to six dimensions, with all conclusions derived from data and consistent with Wyckoff's principles of volume and price.

Quantitative Analysis Report: VCR

Product Code: VCR

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of 2026-01-20, the underlying asset VCR had an opening price of 399.26, a closing price of 395.47, a 5-day moving average of 408.69, a 10-day moving average of 406.60, a 20-day moving average of 403.18, a daily change of -2.63%, a weekly change of -3.87%, a monthly change of 0.39%, a quarterly change of 0.39%, and an annual change of 0.39%.

Current Price vs. Moving Average Relationship: As of 2026-01-20, the closing price of 395.47 has fallen below the 5-day (408.69), 10-day (406.60), 20-day (403.18), and 30-day (400.89) moving averages, remaining only above the 60-day moving average (394.20). Short-term moving averages (5-day, 10-day) have turned downwards and are beginning to cross below the medium-term moving average (20-day), exhibiting the initial characteristics of a typical bearish alignment.

Moving Average Crossover Signals: The MA_5D continued to decline from 409.998 on January 16 to 408.692 on January 20 and, towards the end of the data period, crossed below the MA_20D (Jan 16: 5-day line 409.998 < 20-day line 402.714), forming a clear "death cross" signal, confirming a shift from an uptrend to a downtrend in the short-term trend.

Inferred Market Phase (Based on Wyckoff Theory):

- • November to December 2025: The price oscillated upward from 371.3 to the 390+ zone, accompanied by intermittent volume-backed rallies (e.g., Nov-24, Dec-10). This can be considered an Accumulation/Uptrend phase.

- • Early January 2026 (Jan-08 to Jan-09): The price accelerated to a new all-time high of 412.7. Notably, the volume on Jan-09 (45,716) at the new high was lower compared to the massive volume the previous day (65,086), showing a preliminary sign of "Price making a new high with diverging volume."

- • Mid-January 2026 to present (Jan-12 to Jan-20): The price retreated from the high and experienced high-volume declines (e.g., Jan-14, Jan-20). Combined with the volume-price divergence at the new high and the subsequent high-volume decline, this aligns with the characteristics of a "Distribution" phase in Wyckoff theory. The current market is transitioning from "Distribution" to a "Markdown" phase.

2. Volume-Price Relationship and Supply-Demand Dynamics

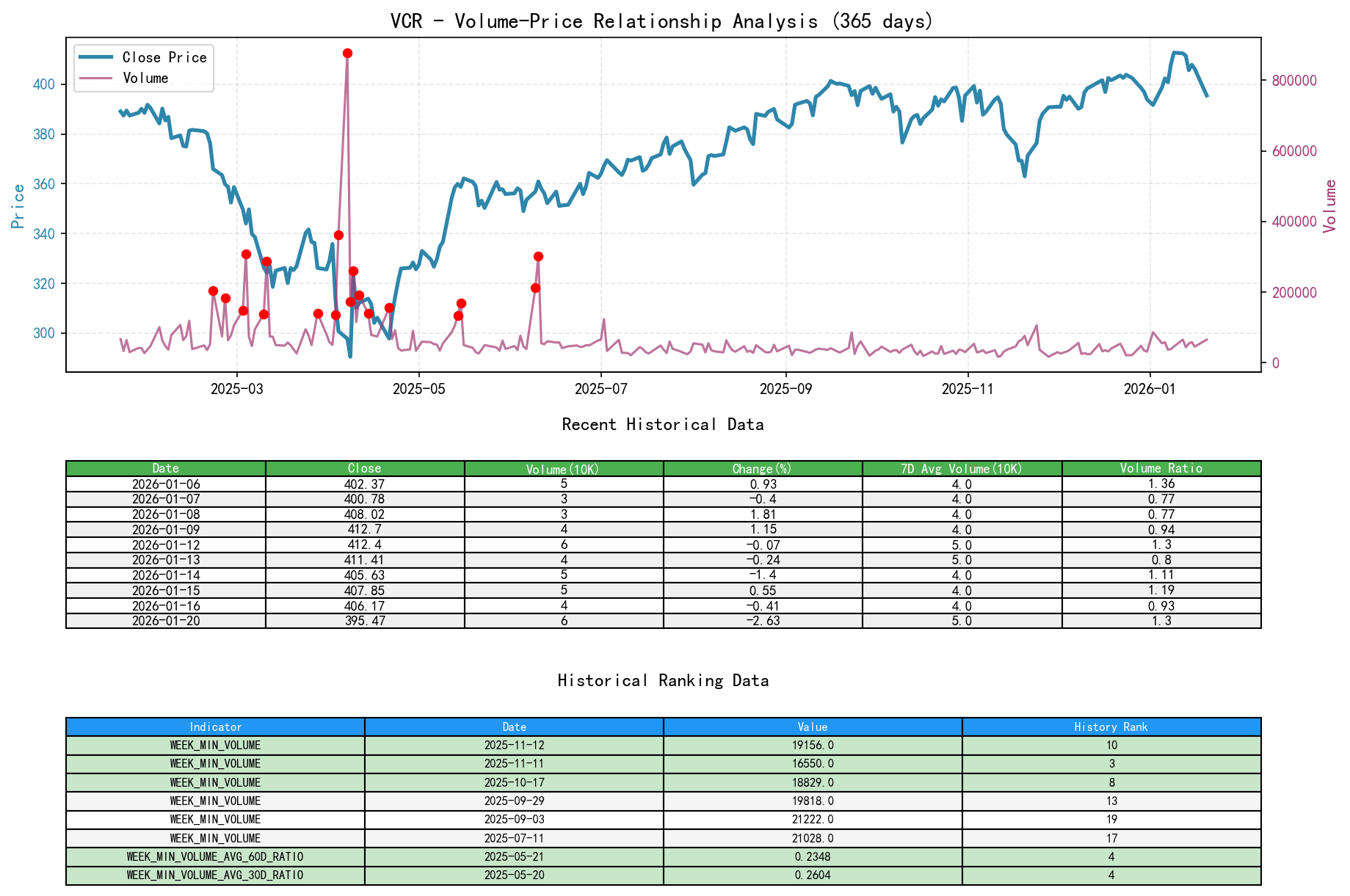

As of 2026-01-20, the underlying asset VCR had an opening price of 399.26, a closing price of 395.47, volume of 65058, a daily change of -2.63%, volume of 65058, a 7-day average volume of 50027.14, and a 7-day volume ratio of 1.30.

- • Demand-Dominant Phases:

- • 2025-11-24: Price increased by 1.36%, with volume (105,645) surging 114%, reaching 2.03 times the 7-day average (

VOLUME_AVG_7D_RATIO). This was a clear rally on high volume, indicating strong demand. - • 2026-01-08: Price rose by 1.81%, with volume (38,175) at 0.98 times the 30-day average. Although volume was not significantly high, the strong price breakout showed demand was in control.

- • 2025-11-24: Price increased by 1.36%, with volume (105,645) surging 114%, reaching 2.03 times the 7-day average (

- • Supply-Dominant/Demand Exhaustion Phases:

- • 2026-01-12 to 01-14: These three days constituted a critical turning point. On Jan-12, price fell slightly by -0.07%, but volume (65,086) surged to 1.76 times the 30-day average, showing high-volume stagnation. Subsequently, on Jan-13, a minor decline, followed by a sharp drop of -1.40% on Jan-14, with volume (53,985) remaining high at 1.38 times the 30-day average. This is a clear signal of substantial supply entering the market, unmet by demand.

- • 2026-01-20: Price plummeted -2.63%, with volume (65,058) soaring to 1.63 times the 60-day average (

VOLUME_AVG_60D_RATIO), indicating a panic-driven, high-volume decline with supply completely dominating the market.

- • Demand Deficiency Phase:

- • 2025-12-24/26: Around Christmas, prices moved within a narrow range, and volume shrank to 0.53-0.55 times the 30-day average, indicating low-volume consolidation with low market participation.

3. Volatility and Market Sentiment

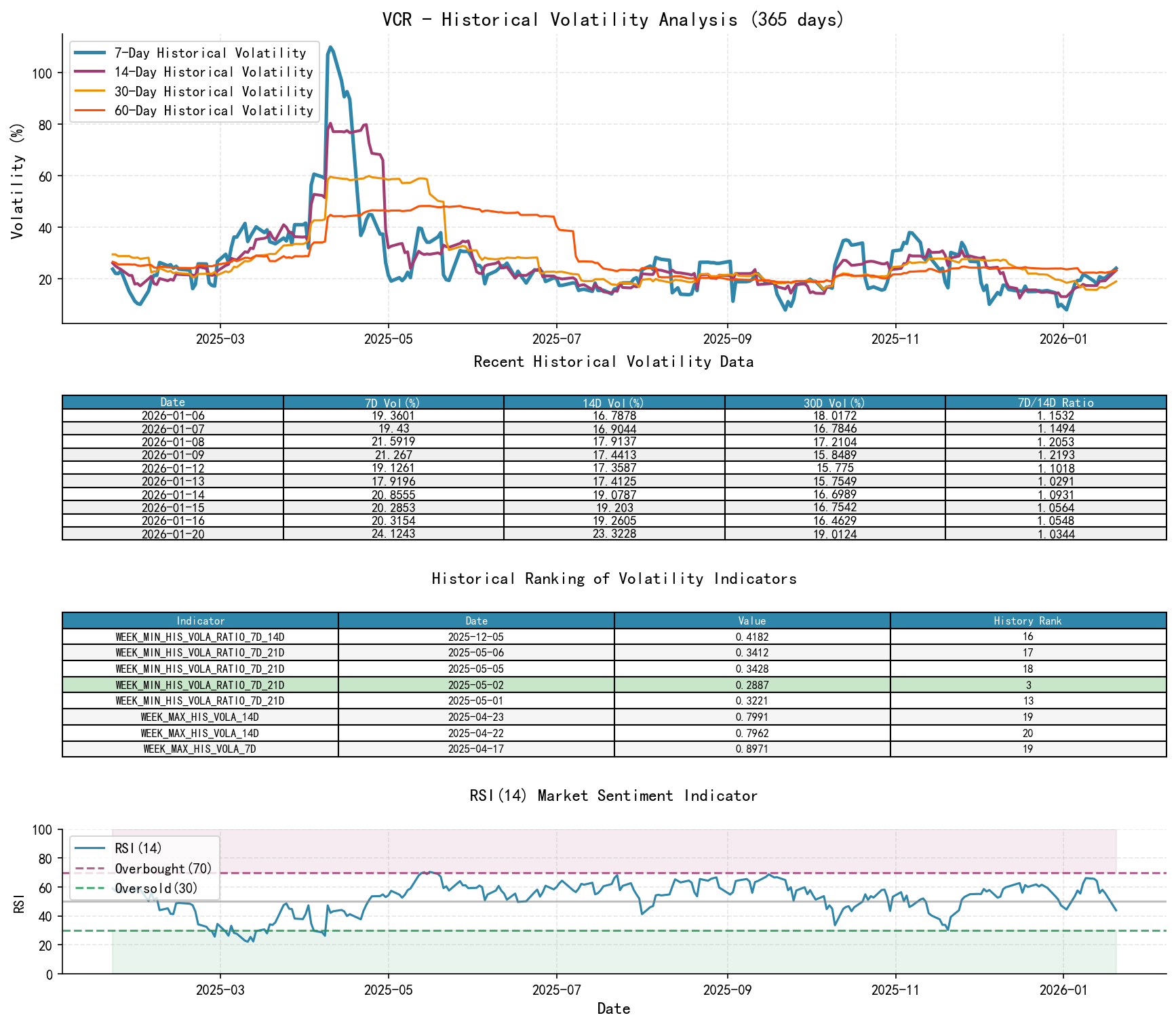

As of 2026-01-20, the underlying asset VCR had an opening price of 399.26, a 7-day intraday volatility of 0.14, a 7-day intraday volatility ratio of 0.91, a 7-day historical volatility of 0.24, a 7-day historical volatility ratio of 1.03, and an RSI of 43.91.

- • Volatility Levels: Short-term volatility peaked in January. The Parkinson volatility (

PARKINSON_VOL_7D) reached 0.188 on January 9, the highest recent level. Historical volatility (HIS_VOLA_7D) reached a high of 0.241 on January 20. - • Volatility Structure Anomaly: Short-term volatility expanded sharply relative to long-term volatility. The

PARKINSON_RATIO_7D_14Dreached 1.515 on January 9, ranking 7th in nearly 10 years of history, indicating abnormal intraday price swings. TheHIS_VOLA_RATIO_7D_60Dwas also greater than 1 on January 20, showing short-term uncertainty far exceeding the long-term average. This structure typically appears at trend endings or reversal points, currently corresponding to the onset of the decline, consistent with panic sentiment characteristics. - • Market Sentiment Indicators: The RSI_14 entered the overbought zone (66.21) on January 9 and then fell rapidly, dropping to a neutral-to-weak zone of 43.91 by January 20. The rapid decline in RSI confirms the exhaustion of upward momentum and the strengthening of bearish forces.

4. Relative Strength and Momentum Performance

- • Momentum Fully Weakening: Returns across all periods have turned negative or significantly narrowed.

- •

WTD_RETURN(Weekly Return) deteriorated sharply from +5.37% on January 9 to -3.87% on January 20, indicating a complete weakening of short-term momentum. - •

MTD_RETURN(Monthly Return) shrank substantially from +4.77% on January 9 to +0.39% on January 20, showing that January's gains were almost entirely erased. - •

YTD(Year-to-Date Return) was only +0.39%, indicating that the strong uptrend at the beginning of the year has ended.

- •

- • Conclusion: VCR's short-term and medium-term momentum has undergone a fundamental reversal, shifting from strong upward momentum to weak downward momentum.

5. Identifying Large Investor (Smart Money) Behavior

Based on the above volume-price and volatility analysis, the operational intent of large investors can be clearly inferred:

- 1. Distribution: When the price reached its highest closing price in nearly a decade and an all-time high (based on HISTORY_RANK data) in early January 2026, high-volume stagnation (Jan-12) and rallies on low volume (Jan-09) occurred. This strongly suggests large capital was conducting distribution operations at historical highs, transferring holdings to retail investors chasing the rally.

- 2. Withdrawal of Support and Initiating Shorts: During the high-volume decline from Jan-12 to 14, large investors not only failed to provide support but likely joined the selling or utilized derivatives to short, accelerating the price decline.

- 3. Inducing Panic (Shakeout): The high-volume plunge on January 20, with volume hitting a recent high. This could be large capital actively suppressing the price after distribution was complete, inducing market panic to flush out remaining long positions, creating conditions for subsequent potential operations (continued decline or low-level accumulation).

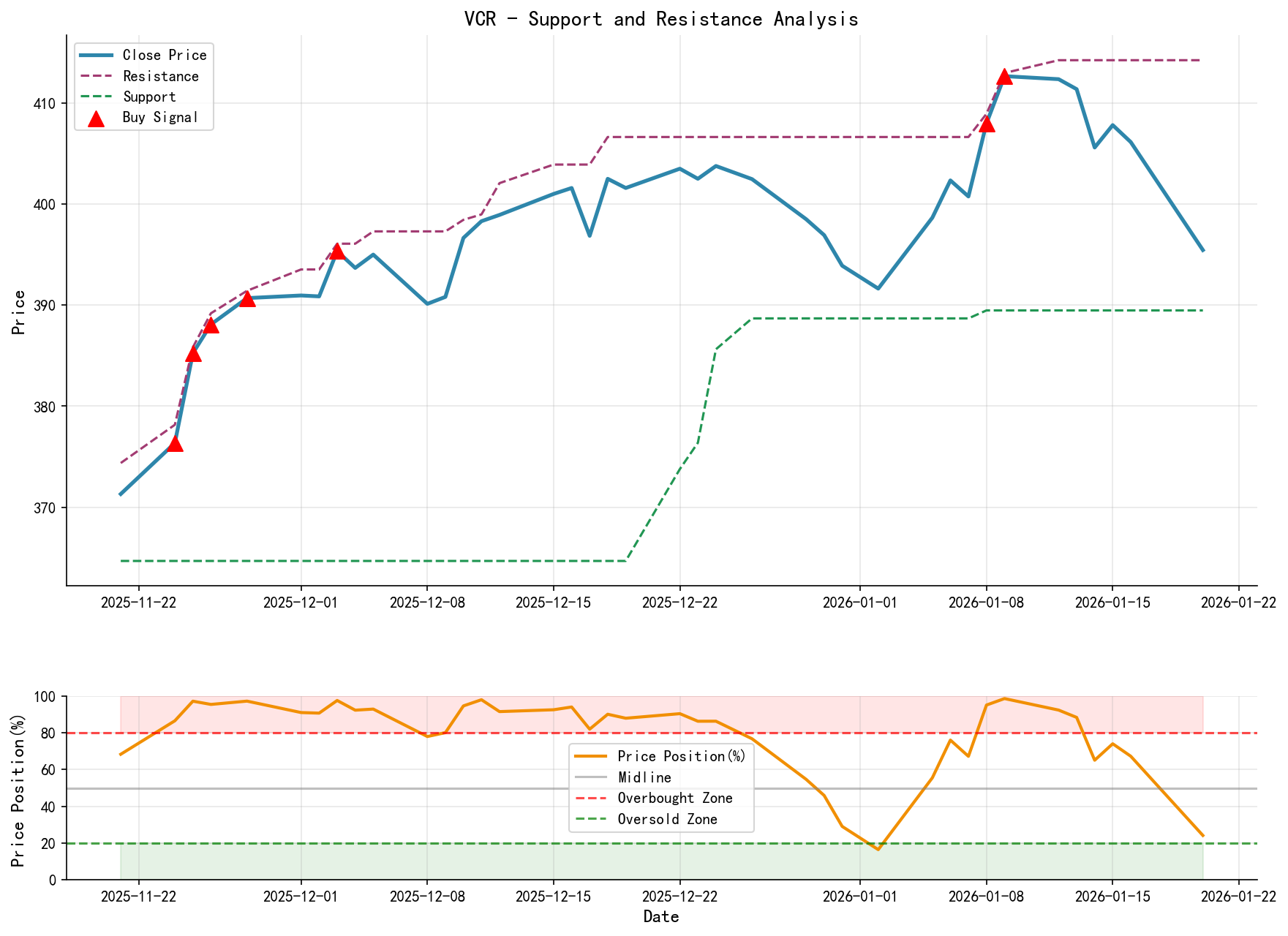

6. Support/Resistance Level Analysis and Trading Signals

- • Key Resistance Levels:

- • R1: The 400.00 psychological level and the previous consolidation platform. Already breached, now a strong resistance.

- • R2: The 405.60 - 407.85 zone. The rebound highs during the mid-January decline, a secondary resistance.

- • R3: 412.70 (Distribution zone high). The ultimate strong resistance, also the highest price zone in nearly a decade.

- • Key Support Levels:

- • S1: 390.71 (Low on 2026-01-02). The first support level to be tested recently.

- • S2: The 387.50 - 385.26 zone (Late November 2025 uptrend initiation platform).

- • S3: The 376.35 - 371.30 zone (Upper boundary of the November 2025 accumulation zone).

- • S4: 364.67 (Data starting low, ultimate support).

Composite Wyckoff Events and Trading Signals:

- • Current Phase: Post-Distribution Markdown phase.

- • Core Signal: Bearish. The market has provided strong signals of "Supply Dominance" (high-volume decline) and "Failed Breakout" (immediate reversal after making new highs).

- • Operational Recommendations:

- • Long Positions: Should exit and observe. Any rebound towards the 400 area, if accompanied by low volume or weak rally strength, presents an opportunity to reduce or exit positions.

- • Short Positions/Defense: Consider establishing short positions if the price rebounds to the 405-408 resistance zone and shows signs of rally exhaustion. Alternatively, follow the trend if the price breaks below the 390 support level on high volume.

- • Stop-Loss Reference: For short strategies, an initial stop-loss can be placed above recent rebound highs (e.g., 408.5).

- • Future Validation Points:

- • Confirmation of Bearish View: Price consistently trades below 400, and rebounds fail to reclaim this level effectively; or a high-volume break below the 390 support.

- • Invalidation of Bearish View: Price shows significant low-volume stabilization near 390 or the S2/S3 support zones, followed by the emergence of Wyckoff bullish structures like a "Spring" or "Jump Across the Creek," accompanied by high-volume rallies reclaiming the 400 level. No such signals are currently present in the data.

End of Report

Disclaimer: The content of this report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantees regarding its accuracy or completeness. The market carries risks, and investment requires caution. Any investment actions taken based on this report are at your own risk.

Thank you for your attention! Daily Wyckoff volume-price market analysis will be released promptly by 8:00 AM before the market opens. Please feel free to leave comments and share. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: