As an expert quantitative trading researcher proficient in the Wyckoff Method, I will draft a comprehensive and in-depth quantitative analysis report based on the VAW data you provided. All conclusions are strictly derived from the data and adhere to Wyckoff's principles of volume and price analysis.

VAW Quantitative Analysis Report

Product Code: VAW

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Time: 2026-01-21

Analyst Role: Wyckoff Method Quantitative Researcher

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the target VAW had an opening price of 223.92, a closing price of 223.28, a 5-day moving average of 224.87, a 10-day moving average of 221.21, a 20-day moving average of 215.30, a daily change of -0.73%, a weekly change of -0.59%, a monthly change of 7.58%, a quarterly change of 7.58%, and an annual change of 7.58%.

- • Price Relationship with Moving Averages:

- • Initial Period (2025-11-21): The closing price (194.54) was below all period moving averages (MA_5D to MA_60D), showing a typical bearish alignment.

- • Final Period (2026-01-20): The closing price (223.28) was above all short-term to medium-term moving averages (MA_5D, MA_10D, MA_20D, MA_30D), only slightly below MA_60D (204.51). MA_5D, MA_10D, and MA_20D were aligned in an upward sequence, presenting a strong bullish alignment.

- • Moving Average Crossovers and Evolution: During the analysis period, the price successfully transitioned from a bearish to a bullish alignment. The key turning point was in mid-December 2025, when the price (around 206-207 range) stabilized above MA_20D (~200), followed by MA_5D crossing above MA_20D, confirming the uptrend. By January 2026, short-term moving averages accelerated upward, leading the price to new highs.

- • Market Phase Inference (Based on Wyckoff Theory):

- • Accumulation Phase: From late November to early December 2025, after a previous decline, the price consolidated and formed a base within the 190-203 range. On November 24th, a massive rebound on high volume occurred (volume 161,533, far exceeding the average), followed by contracting volume and a slight price increase, consistent with demand taking dominance after a "shakeout."

- • Markup Phase: Starting from December 10, 2025, the price climbed steadily in a pattern of "advance - low-volume pullback - advance again." Particularly in early January 2026, the price experienced consecutive advances on expanding volume (e.g., Jan 2nd, 6th, 9th), propelling the market into the main upward wave.

- • Initial Distribution Phase Signals: On January 15, 2026, when the price reached a new all-time high (226.41), an extreme volume expansion occurred with minimal price gain (PCT_CHANGE only 0.47%). This "effort without result" candlestick pattern is a classic warning signal for distribution. The price pullback on January 20th suggests the market may have entered a re-accumulation or initial distribution phase in the late stage of the markup.

- • Historical Ranking Data Validation:

- • As of the end of the analysis period, price metrics such as the high price (226.41), closing price (225.76), and opening price (224.86) all reached near-decade historical highs (HISTORY_RANK of 1 or 2), clearly confirming the current position within a historically strong uptrend.

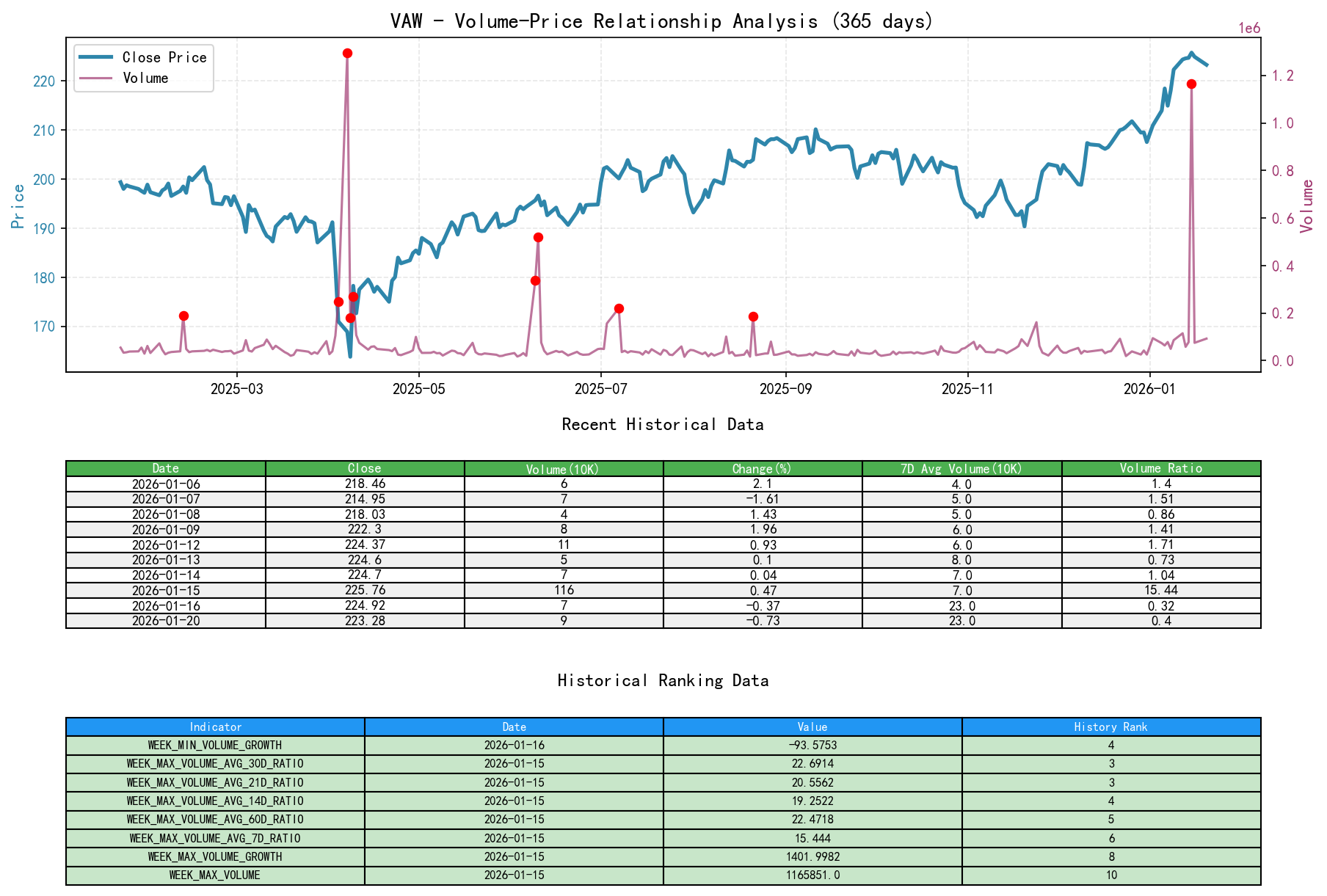

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the target VAW had an opening price of 223.92, a closing price of 223.28, a volume of 92,594, a daily change of -0.73%, a volume of 92,594, a 7-day average volume of 232,461.86, and a 7-day volume ratio of 0.40.

- • Demand-Dominated Days (Advance on Expanding Volume):

- • 2025-11-24: Volume (161,533) increased by 161% day-over-day, price closed up 0.67%, establishing a stage bottom, indicating strong demand entry.

- • 2025-12-10: Volume (41,040) expanded after consecutive contractions, price surged 1.84%, breaking out of the consolidation range, demand regained control.

- • 2026-01-02 & 01-06: Volume (94,399 & 63,658) significantly higher than recent averages, price advanced 1.63% and 2.10% respectively, representing the initial demand push for the New Year's main upward wave.

- • Supply-Dominated Days / Danger Signals (High Volume Stagnation or Decline):

- • 2026-01-15 (Core Danger Signal): Volume (1,165,851) ranked 10th highest in the past decade. Its ratio relative to various period average volumes (

VOLUME_AVG_*D_RATIO) all ranked in the historical top 6 (highest at 3rd). However, the price only gained a mere 0.47%. This is an extremely classic "climax volume with minimal price advance," indicating massive supply (selling pressure) emerging at this historical high, despite equally strong demand (buying pressure), it could no longer easily push prices higher. - • 2025-12-08: Advance on volume (53,275) followed by a 1.20% decline, a supply pressure test during the uptrend.

- • 2026-01-15 (Core Danger Signal): Volume (1,165,851) ranked 10th highest in the past decade. Its ratio relative to various period average volumes (

- • Insufficient Demand Days (Advance on Low Volume):

- • 2025-11-28 & 12-01: Price advanced but volume (21,423 & 63,127) was relatively low, showing weakened upward momentum and temporary demand hesitation.

- • Panic / Stopping Decline Days (High Volume Plunge or Low Volume Stopping Decline):

- • 2025-12-31: Price declined 0.94%, but volume (25,453) hit a recent low (

VOLUME_GROWTH-40%), indicating exhaustion of selling pressure, a positive stopping decline signal. - • 2026-01-16: Price corrected -0.37%, volume (74,903) plummeted 93.58% compared to the previous day's extreme climax volume (this decline magnitude ranks 4th historically), also showing that supply did not expand during the pullback.

- • 2025-12-31: Price declined 0.94%, but volume (25,453) hit a recent low (

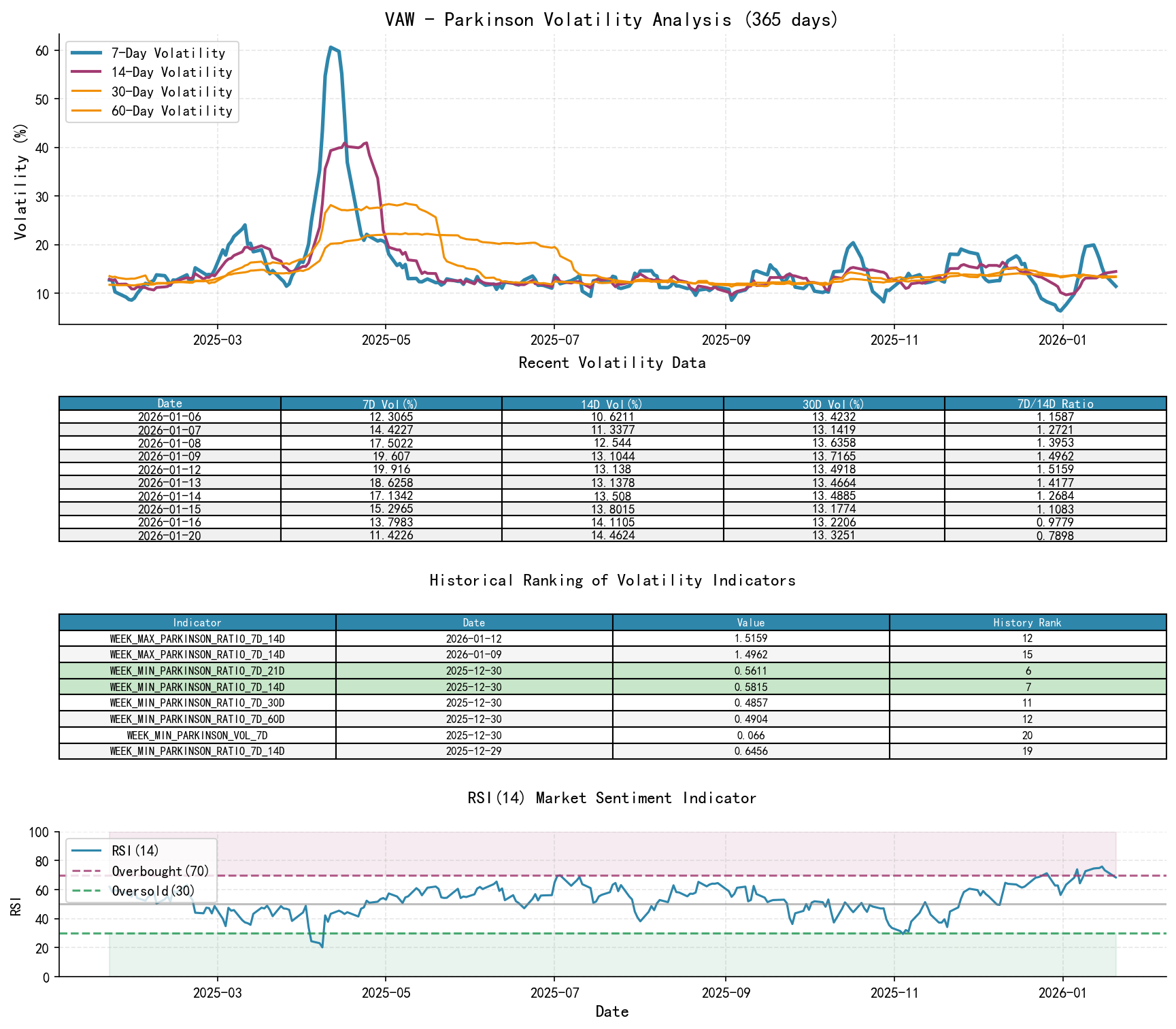

3. Volatility and Market Sentiment

As of January 20, 2026, the target VAW had an opening price of 223.92, a 7-day intraday Parkinson Volatility of 0.11, a 7-day Parkinson Volatility Volume Ratio of 0.79, a 7-day Historical Volatility of 0.17, a 7-day Historical Volatility Volume Ratio of 0.77, and an RSI of 68.45.

- • Volatility Levels and Changes:

- • Short-Term Volatility Spike: During the fastest price advance phase (Jan 6th - Jan 12th), both

PARKINSON_VOL_7DandHIS_VOLA_7Dreached stage peaks (>0.19 and >0.28).PARKINSON_RATIO_7D_14Dreached 1.516 on Jan 12th, ranking 12th highest in the past decade, indicating excited short-term sentiment and abnormally amplified volatility, consistent with characteristics of an accelerating trend phase. - • Volatility Contraction: During the sideways consolidation in late December 2025,

PARKINSON_VOL_7Ddropped to extremely low levels of 0.06-0.07 (0.066 on Dec 30th ranked 20th lowest in the past decade),PARKINSON_RATIO_7D_14Dalso fell to 0.58 (7th lowest in the past decade), showing market sentiment was extremely calm, a precursor to a trend change, followed by the breakout in early January. - • Current State: As of Jan 20th, short-term volatility (

HIS_VOLA_7D=0.169,PARKINSON_VOL_7D=0.114) has retreated from the highs, and volatility ratios have returned to normal ranges, indicating market sentiment has cooled somewhat from extreme excitement.

- • Short-Term Volatility Spike: During the fastest price advance phase (Jan 6th - Jan 12th), both

- • RSI Overbought/Oversold:

- • RSI_14 mostly remained within the strong range of 50-75 throughout the uptrend. When the price made a new high on Jan 15th, RSI reached 75.95 (historical rank 19th), entering overbought territory but not at extreme levels. On Jan 20th, RSI retraced to 68.45, still within strong territory. Subsequent observation is needed for RSI's high-level flattening or divergence.

4. Relative Strength and Momentum Performance

- • Return Analysis:

- • Extremely Strong Short-Term Momentum:

WTD_RETURNandMTD_RETURNwere mostly positive for most of January, especially reaching 5.39% for the week of Jan 9th. - • Strong Mid-Term Trend Reversal:

QTD_RETURNreversed from -5.04% on 2025-11-21 to +7.58% on 2026-01-20,YTD(8.37%) also performed well, confirming strong mid-term upward momentum. - • Recent Momentum Slowdown: The weekly return (

WTD_RETURN) turned negative at -0.59% for the week of Jan 20th, indicating short-term momentum may be fading.

- • Extremely Strong Short-Term Momentum:

5. Large Investor (Smart Money) Behavior Identification

- • Distribution Behavior: The "climax volume with minimal price advance" on January 15, 2026, is the clearest evidence of smart money distribution to date. The historical trading value (4th highest in the past decade) and volume ratios indicate this was institution-level large-scale turnover. Sellers (supply) successfully transferred a large number of shares to chasing buyers (demand) at high levels. This is a classic Wyckoff distribution model of "smart money exiting, public taking over."

- • Accumulation Behavior: The high-volume bullish candlestick on November 24, 2025, and the volume-backed breakout on December 10th can be viewed as active accumulation behavior by smart money at relatively low levels. The low-volatility consolidation in late December and the low-volume stopping decline on December 31st also align with the "test" and "shakeout" characteristics of the late accumulation phase.

- • Current Intent Inference: Based on the January 15th signal, it is reasonable to infer that large investors initiated profit-taking and distribution operations at record highs. The low-volume pullbacks on January 16th and 20th indicate they are not panicking but are releasing supply in a measured, tentative manner, observing the market's absorption capacity.

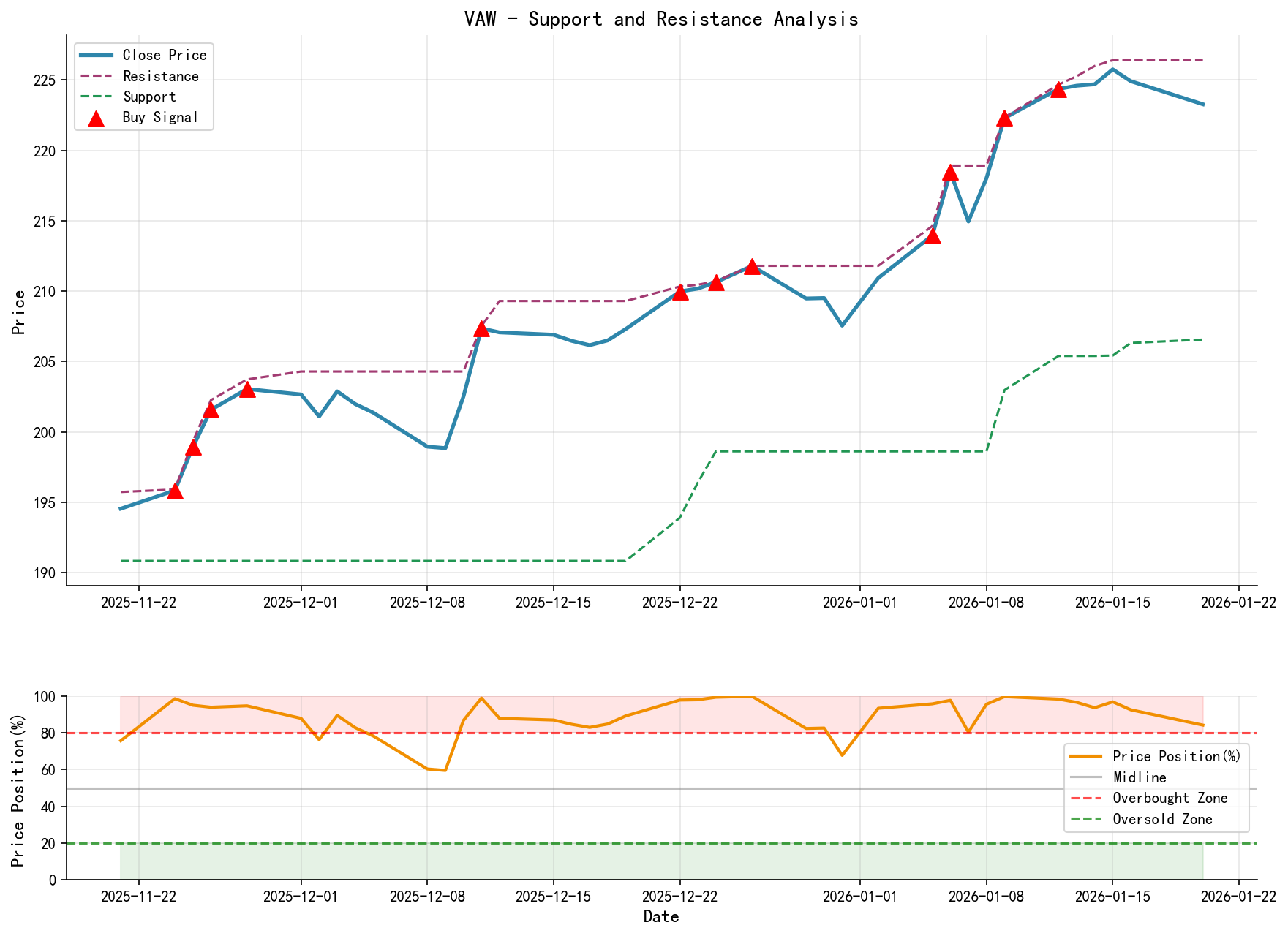

6. Support/Resistance Level Analysis and Trading Signals

- • Key Resistance Levels (Resistance):

- • R1: 226.41 - The highest price within the analysis period (also historically), a core psychological and price resistance level.

- • R2: 225.76 / 224.92 - Secondary resistance zone formed by recent highs.

- • Key Support Levels (Support):

- • S1: 221.37 - Recent low (Jan 20th), also the first pullback support level after breaking the previous high (~219). A breakdown below this level on expanding volume would strengthen evidence for distribution.

- • S2: 214.45 - The January 7th pullback low, coinciding with the MA_20D (currently ~215), an important mid-term trend support level.

- • S3: 207.07 - The high of the mid-December consolidation platform, now a strong support level.

- • Integrated Trading Signals and Operational Recommendations:

- • Overall Assessment: The market is in the late stage of a strong uptrend, with initial distribution warning signals appearing. Trend inertia persists, but risks have increased significantly. Shift to a cautiously bearish or neutral stance, rather than aggressively chasing longs.

- • Bearish / Reduce Position Signals:

- 1. Scenario A (Active Defense): Price rebounds near R1 (226.41) or R2 (225.76/224.92), again showing low-volume stagnation or high-volume stagnation/decline, is a clear signal to reduce positions or test short.

- 2. Scenario B (Trend Break Confirmation): Price breaks below S1 (221.37) on expanding volume would confirm the January 15th climax as distribution behavior, signaling a high risk of the uptrend ending. This is a strong exit or go-short signal.

- • Bullish Signals (Require Caution): If price can stabilize near S1 (221.37) or S2 (214.45) on low volume, accompanied by renewed demand entry on expanding volume (e.g., single-day gain >1.5% and volume ratio >1.5), it would suggest distribution failed or it's merely a continuation pattern, allowing consideration for small position re-entry. This signal has lower reliability in the current environment.

- • Operational Recommendations:

- • Long Position Holders: It is recommended to reduce positions by at least 50% or more when price rebounds to resistance zones (R1, R2) or falls below S1, to lock in profits.

- • Short Position Holders or Observers: Consider waiting for a confirmation after a breakdown below S1 (weak, low-volume bounce failure) as a safer right-side short entry point. Initial stop-loss can be set above the recent high (224.92).

- • Future Verification Points:

- 1. Distribution Confirmation: Whether subsequent price action shows a weak rebound after a "test" or "UT or Spring" and eventually forms a lower low downtrend structure.

- 2. Uptrend Continuation Confirmation: Whether price can effectively break and stabilize above R1 (226.41) without extreme volume, allowing RSI to form a new upward wave rather than a top divergence.

- 3. Volume is the Key Verification Indicator: Any downward breakdown must be accompanied by expanding volume (supply expanding). Any upward rebound lacking volume support (insufficient demand) is a sign of weakness.

Disclaimer: This report is based on quantitative analysis of historical data and Wyckoff principles. All conclusions are model-based inferences and do not constitute any investment advice. Financial markets involve risks; invest with caution.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is released daily at 8:00 AM before the market opens. Please feel free to leave comments and share. Your recognition is highly valued. Let's work together to see the market signals clearly.

Member discussion: