Wyckoff Quantitative Analysis Report: TRUMPUSDT

Product Code: TRUMPUSDT

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Time: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, for the subject TRUMPUSDT: Open price 5.01, Close price 4.86, 5-day moving average (MA) 5.23, 10-day MA 5.36, 20-day MA 5.31, daily change -3.09%, weekly change -14.26%, monthly change +1.19%, quarterly change +1.19%, annual change +1.19%.

Based on the arrangement of moving averages (MA) and price action, the market experienced a complete "decline - bottoming - rally - rejection" cycle during the analysis period and is currently in the early stages of a potential Distribution phase.

- 1. Trend and Arrangement:

- • Dominant Decline (2025-11-21 to 2025-12-31): Price declined unilaterally from4.801, a cumulative drop of 23.5%. During this period, MA_5D, MA_10D, MA_20D, MA_30D, MA_60D formed a perfect bearish arrangement (Price < MA5 < MA10 < MA20...), confirming a strong downtrend.

- • Trend Reversal and Rally (2026-01-01 to 2026-01-13): Price initiated a strong rally from the absolute low of5.666 (+18.0%). A key signal emerged on 2026-01-05, when MA_5D (5.084) crossed above MA_20D (5.026), forming a "Golden Cross," marking a shift from a short-term downtrend to an uptrend. During the rally, MA_5D and MA_10D successively crossed above MA_20D, constructing a short-term bullish arrangement (Price > MA5 > MA10 > MA20).

- • Rally Rejection and Trend Entanglement (2026-01-14 to Present): After hitting the high of $5.666, the price failed to continue rising, instead correcting and oscillating around MA_5D and MA_10D. By the end of the analysis period (2026-01-20), the price (4.858) had fallen below all short-term MAs (MA_5D: 5.234, MA_10D: 5.360), breaking the short-term bullish arrangement structure, indicating exhaustion of the rally momentum.

- 2. Market Phase Inference:

- • Decline and Panic Selling: The decline in December, especially on December 1st (volume growth +326.87%, historical rank #8) and the high-volume sharp drop on December 18-19, aligns with the "Panic Selling" characteristics in Wyckoff theory, typically marking the last concentrated release of downward momentum.

- • Automatic Rally and Secondary Test: The early January rally was the "Automatic Rally" following panic. The subsequent price correction on January 18-20, accompanied by significantly increased volume (VOLUME_AVG_7D_RATIO > 1.26), can be viewed as a "Secondary Test" of the previous low support area. The high-volume nature of the decline during this test suggests supply still exists in this zone.

- • Potential Distribution: The current price oscillates in the mid-range ($5.2-5.4) between the previous rally high (4.8). Recent signs include high-volume stagnation (failure to follow through after the high-volume rise on January 13th) and high-volume decline (January 18-20). Combined with the loss of support from short-term moving averages, the market may be transitioning from the rally phase to the early stages of Distribution by large investors.

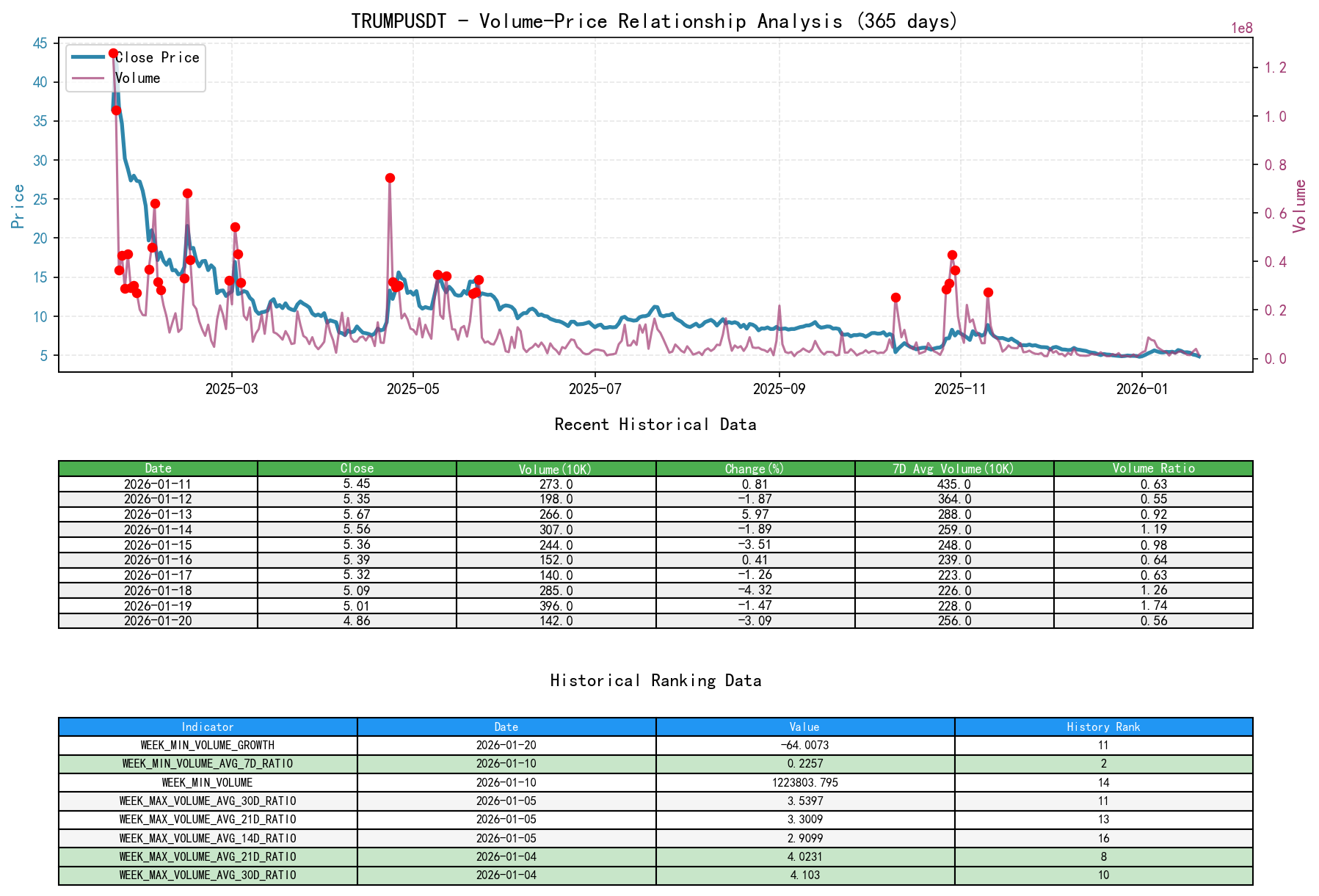

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, for the subject TRUMPUSDT: Open price 5.01, Close price 4.86, Volume 1425692.03, daily change -3.09%, Volume 1425692.03, 7-day average volume 2562791.38, 7-day volume ratio 0.56.

Volume-price analysis reveals intense battles between supply and demand forces at key levels, forming the core basis for judging market phases.

- 1. Supply-Driven Decline (2025-11 to December):

- • High-Volume Decline (Supply Overwhelms Demand): December 1st (PCT_CHANGE: -4.63%, VOLUME_GROWTH: +326.87%) and December 18th (PCT_CHANGE: -4.32%, VOLUME_GROWTH: +102.68%) are classic panic selling days. Huge volume with long bearish candles indicates complete supply dominance.

- • Low-Volume Decline (Supply Dwindles): Bearish candles in mid-to-late December generally had volumes below their respective period averages (VOLUME_AVG_*D_RATIO mostly < 0.5), especially on December 29-30, where multiple volume indicators hit historically low rankings (e.g., AVERAGE_VOLUME_7D rank #1 and #3 low). This aligns with the Wyckoff volume-price characteristic of "end of decline, selling climax (supply exhaustion)."

- 2. Demand-Driven Rally (Early January 2026):

- • High-Volume Rise (Demand Enters): January 3rd (PCT_CHANGE: +4.18%, VOLUME_GROWTH: +176.49%) was the rally initiation signal. That day, the ratios of volume relative to 7-day/14-day/21-day/30-day averages (VOLUME_AVG_RATIO) all reached historically high rankings (#5, 4, 3, 5), indicating aggressive new demand entry.

- • Accumulation Behavior Confirmed: The consecutive high-volume rises from January 1st to January 5th, with volume ratios relative to 14-day and 21-day averages (WEEK_MAX indicator) ranking in the historical top 20, confirmed concentrated accumulation behavior by large buyers in the panic low area.

- 3. Supply-Demand Stalemate and Supply Re-emergence (Mid-to-Late January 2026):

- • High-Volume Stagnation at Highs: On January 13th, price rose 5.97% but failed to follow through the next day. January 14th closed down, with both days maintaining high volume (VOLUME_AVG_7D_RATIO > 0.92). This is an initial sign of "effort without result" - demand's effort to push prices higher encountered strong supply.

- • Supply Overwhelms Demand Again: The high-volume declines on January 18th (-4.32%) and January 20th (-3.09%) clearly show that in the $5.4-5.6 price zone, supply has regained dominance. Demand cannot sustain price rises, while sell-offs are heavy during price declines - a typical volume-price structure for the distribution phase.

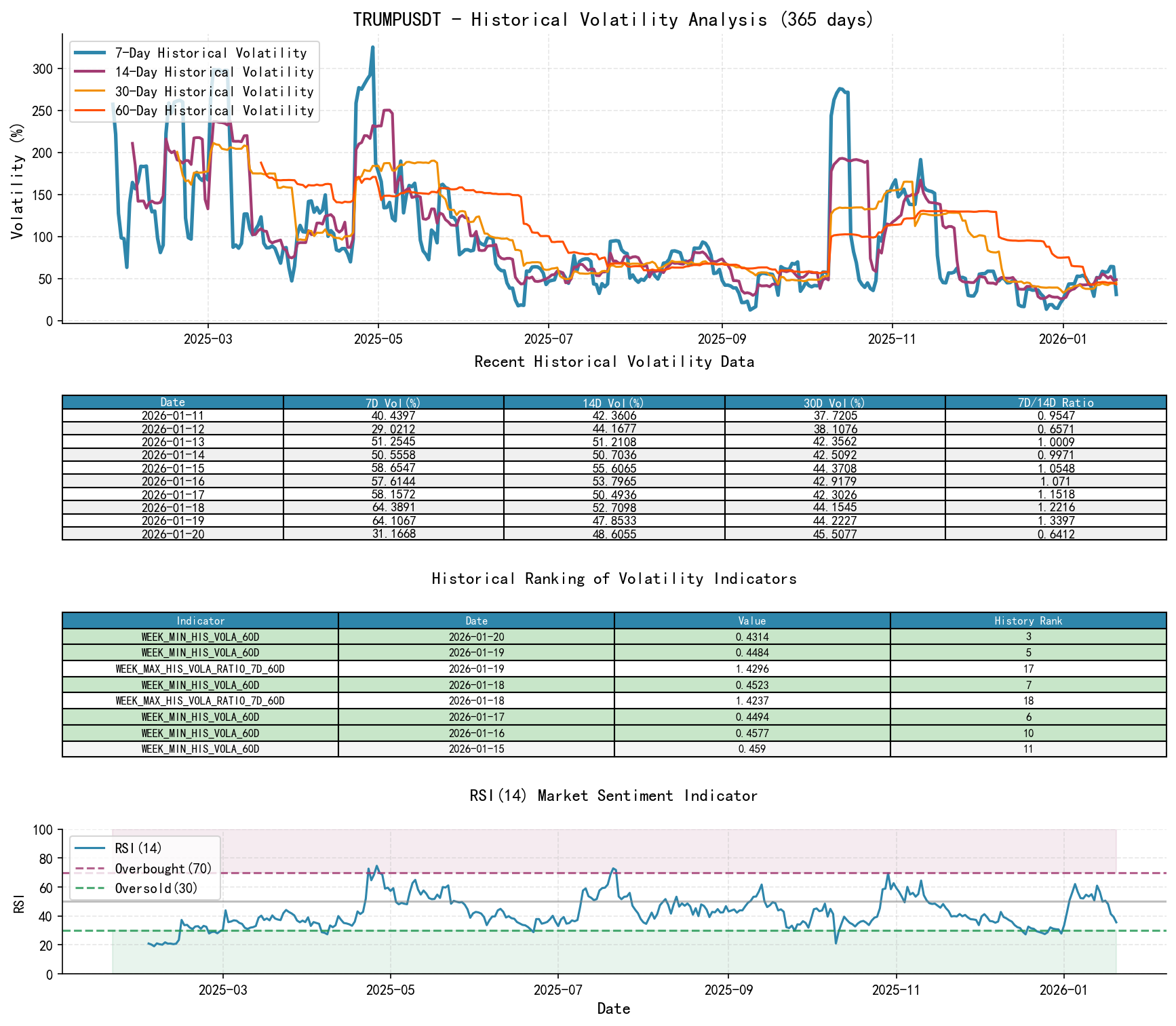

3. Volatility and Market Sentiment

As of January 20, 2026, for the subject TRUMPUSDT: Open price 5.01, 7-day intraday volatility 0.56, 7-day intraday volatility ratio 1.06, 7-day historical volatility 0.31, 7-day historical volatility ratio 0.64, RSI 35.63.

Volatility data precisely maps the market's emotional cycle from "panic - depression - excitement - normalization."

- 1. Extreme Low Volatility (Market Sentiment Freeze): In late December 2025, historical volatility (HIS_VOLA) and Parkinson intraday volatility across various periods touched or approached historical lowest levels (e.g., WEEK_MIN rankings for HIS_VOLA_14D, HIS_VOLA_21D, PARKINSON_VOL_14D were mostly #1). This marks extremely depressed market sentiment and stagnant trading activity, an important precursor to potential reversal.

- 2. Sharp Volatility Expansion (Sentiment Activation and Trend Acceleration): The early January 2026 rally quickly activated market volatility. The ratio of short-term to long-term volatility surged sharply. For example, the WEEK_MAX ranking for PARKINSON_RATIO_7D_30D on January 6-8 reached a high of #14-16, indicating the intensity of short-term volatility far exceeded the average of the past month, accompanying the price rise - a signal of trend acceleration and a shift toward optimism.

- 3. Volatility Structure Change (Sentiment Divergence): By mid-to-late January, although absolute volatility levels receded somewhat, structural divergence appeared. On January 18-19, the WEEK_MAX ranking for HIS_VOLA_RATIO_7D_60D was #17-18, indicating short-term volatility relative to long-term (60-day) remained at a relatively high percentile; the market had not completely calmed down, and speculative sentiment persisted.

- 4. RSI Confirms Oversold and Rally: RSI_14 touched lows of 27.29, 27.51, and 27.88 on December 18th, 25th, and 31st, respectively (historical lowest rankings #14, 16, 17), confirming a severely oversold condition, providing a technical basis for the rally. At the rally peak, RSI_14 rose to 62.10 (January 5th, historical rank #15), approaching overbought territory, limiting further upside.

4. Relative Strength and Momentum Performance

Momentum indicators highly align with the price trend, confirming the strength and limitations of the rally.

- 1. Extremely Weak Long-Term Momentum: As of the period end, QTD_RETURN (this quarter, essentially since Q4 2025) was -33.41%, and TTM_12 (trailing 12 months) return was -86.69%, revealing the subject has been in a strong long-term downtrend.

- 2. Strong but Weakening Short-Term Momentum: MTD_RETURN (month-to-date) peaked at +17.04% on January 5th, showing extremely strong monthly rebound momentum. However, WTD_RETURN (week-to-date) turned negative after January 13th, declining to -14.26% by period end, indicating short-term upward momentum has been completely exhausted and reversed. This rapid decay of short-term momentum corroborates the price stagnation behavior at resistance.

5. Smart Money (Large Investors) Behavior Identification

Integrating volume-price, trend, and volatility, the operational path of large participants can be inferred:

- 1. Accumulation During Panic: During late December to early January, the market experienced extremely low-volume declines (supply exhaustion) and high-volume plunges (panic selling). Smart money likely conducted covert or active accumulation in the $4.8-5.0 range during this stage, exploiting market panic. The extremely low volatility and volume rankings provided cover.

- 2. Markup and Testing: The consecutive high-volume rises from January 3rd to 13th represent smart money marking up prices away from their cost base, aiming to attract market followers and test supply pressure above. RSI entering high levels and soaring volatility ratios are typical characteristics of the markup phase.

- 3. Distribution at Highs: Current evidence strongly suggests distribution is occurring. In the $5.4-5.6 range, price repeatedly showed high volume but failed to make new highs (January 14-15), or declined directly on high volume (January 18-20). Who is buying on high volume? At rebound highs, facing clear stagnation and selling pressure, the buyers are likely latecomers (retail) or trend followers. Who is selling? It is the smart money that accumulated at lows and earlier trapped holders. Who is waiting on low volume? The current price correction without massive volume suggests smart money distribution may not be completed all at once; the market is falling back into a wait-and-see mode.

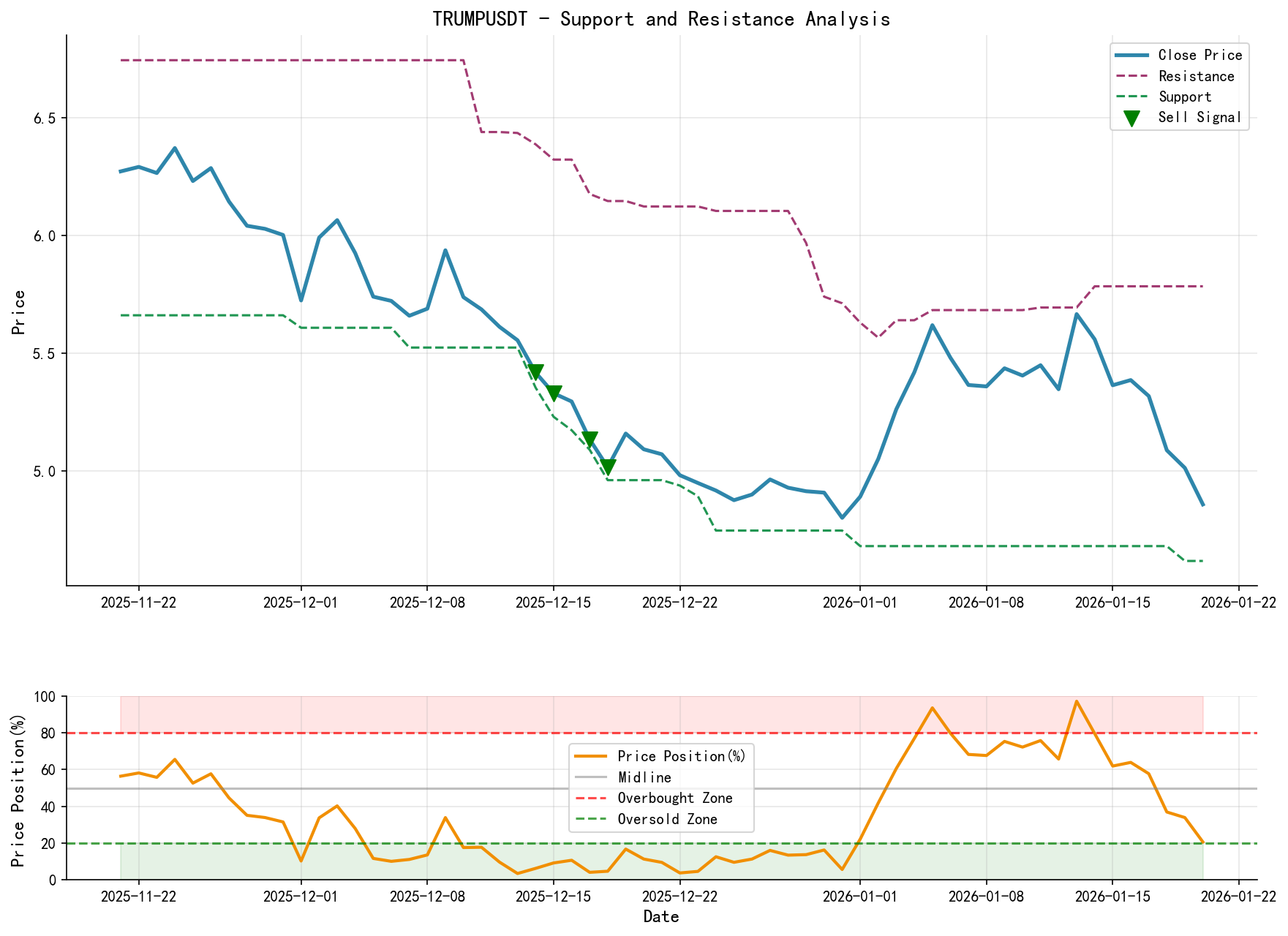

6. Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Levels:

- • Strong Support Zone (Demand Zone):5.00. Formed by the lows of 2025-12-31 and 2026-01-20, this is the area of panic selling and secondary testing. A decisive break below this zone would open new downside.

- • Core Resistance Zone (Supply Zone):5.60. The upper boundary of the current distribution range and also the peak area of the January rally. Any upward rebound to this zone will face strong selling pressure.

- • Upper Strong Resistance:6.00. Corresponds to the consolidation platform from late November to early December (prior support turned resistance).

- 2. Integrated Wyckoff Events and Trading Signals:

- • Current Primary Event: Distribution is underway. Signals include: broken uptrend structure (price below short-term MA cluster), high-volume stagnation/decline at highs, negative short-term momentum.

- • Trading View: Short-term bearish, mid-term awaiting new accumulation signals. After completing an effective rally, the market faces overhead supply and profit-taking.

- • Operational Suggestions:

- • Aggressive Short Sellers: May consider light test shorts if price rebounds to the $5.30-5.45 resistance zone (near MA_10D) and shows signs of exhaustion on 15-minute or hourly charts (e.g., long upper wicks, small real-body candles). Initial stop-loss above $5.65 (above recent rally high). Target $5.00 support, with extension to $4.80 upon break.

- • Conservative Investors/Observers: Should remain on the sidelines. The current zone (~4.80-5.00** strong support zone, such as "low-volume decline" or "high-volume bullish reversal candle," indicating supply exhaustion and renewed demand entry.

- • Future Validation Points:

- • Bearish View Confirmation: Price breaks below $4.95-5.00 (secondary test low) on high volume and fails to reclaim it on a rebound.

- • Bearish View Invalidation: Price breaks above the $5.60-5.65 resistance zone on high volume with strong momentum (especially with a full-bodied bullish candle), leading to a renewed Golden Cross of MA_5D/MA_10D. This would indicate distribution failure and potential continuation of the rally, necessitating reassessment.

Executive Summary: Following a robust technical rally triggered by panic selling bottoming and smart money accumulation, TRUMPUSDT now exhibits clear distribution characteristics at the rally highs (4.80-$5.60. Investors should wait for price to retreat to key support zones and show new demand evidence, or for a strong breakout above current resistance, before seeking high-conviction trading opportunities.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. Markets involve risk; investment requires caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Wyckoff Volume-Price Market Insights are published daily at 8:00 AM before the market opens. Your comments and shares are highly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: