Okay, as per your instructions. As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive, in-depth quantitative analysis report based on the provided TONUSDT data (2025-11-21 to 2026-01-20) and historical ranking indicators.

TONUSDT Quantitative Analysis Report

Product Code: TONUSDT

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

Methodology: Wyckoff Volume-Price Principles, Data-Driven Analysis

I. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying TONUSDT had an opening price of 1.59, a closing price of 1.54, a 5-day moving average of 1.68, a 10-day moving average of 1.72, a 20-day moving average of 1.77, a daily change of -3.02%, a weekly change of -14.50%, a monthly change of -7.23%, a quarterly change of -7.23%, and a yearly change of -7.23%.

- • Moving Average Alignment Analysis:

- • Throughout the observation period, the price (

CLOSE) consistently remained below all moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), forming a classic bearish alignment pattern. - • Moving averages across periods (especially MA_30D, MA_60D) exhibited a clear downward trend, confirming the existence of a long-term downtrend.

- • Throughout the observation period, the price (

- • Moving Average Crossover Signals:

- • Early Phase (Late Nov to Mid-Dec): Short-term MAs (e.g., MA_5D) persistently stayed below longer-term MAs (e.g., MA_20D) and repeatedly suppressed price rebounds, constituting clear bearish signals.

- • Recent Change (Late Dec to Mid-Jan): Starting from December 27, 2025, MA_5D began crossing above MA_20D and maintained its position above it, forming a "Golden Cross." Concurrently, the price repeatedly moved above MA_5D and MA_10D in early January, indicating short-term selling pressure is exhausting, and the market is entering a phase of oversold rebound or a consolidation/bottoming stage.

- • Market Phase Identification (Based on Wyckoff Cycle):

- • Phase 1 (Late Nov to Late Dec): Accelerated Decline and Panic Selling (Panic/PSY). Prices continued to decline sharply (e.g., Nov 23: -4.17%), with volume significantly amplified on down days (

VOLUME_AVG_14D_RATIOfrequently >1.5). Combined with historical rankings, the lowest prices (e.g., 1.42, ranked #2 lowest) and closing prices (1.437, ranked #1 lowest) during this phase reached extreme values over the past decade, confirming market panic. - • Phase 2 (Early Jan): Technical Rebound and Automatic Rally (AR). After touching the historical low zone, prices showed significant rebounds on dates like December 27 and January 2 (+4.64%, +6.38% respectively), accompanied by a sharp spike in volume (Jan 2

VOLUME_GROWTHreached 220.43%, historical rank #11). This aligns with the "Automatic Rally after Panic Selling" feature in Wyckoff theory, representing a correction of excessive decline. - • Phase 3 (Mid-Jan to Present): Secondary Test and Potential Accumulation (ST/Creek). After the rebound was rejected near 1.93, the price retraced and began to consolidate. A key observation is that volume expanded again during recent declines (e.g., Jan 19: -4.74%) (

VOLUME_GROWTH+183.21%, historical rank #16), but the closing price did not set a new low, potentially forming a "Higher Low" (HL). Combined with the short-term MA golden cross, the market may be transitioning from a downtrend (Markdown) towards an Accumulation range, though this is not yet definitively confirmed.

- • Phase 1 (Late Nov to Late Dec): Accelerated Decline and Panic Selling (Panic/PSY). Prices continued to decline sharply (e.g., Nov 23: -4.17%), with volume significantly amplified on down days (

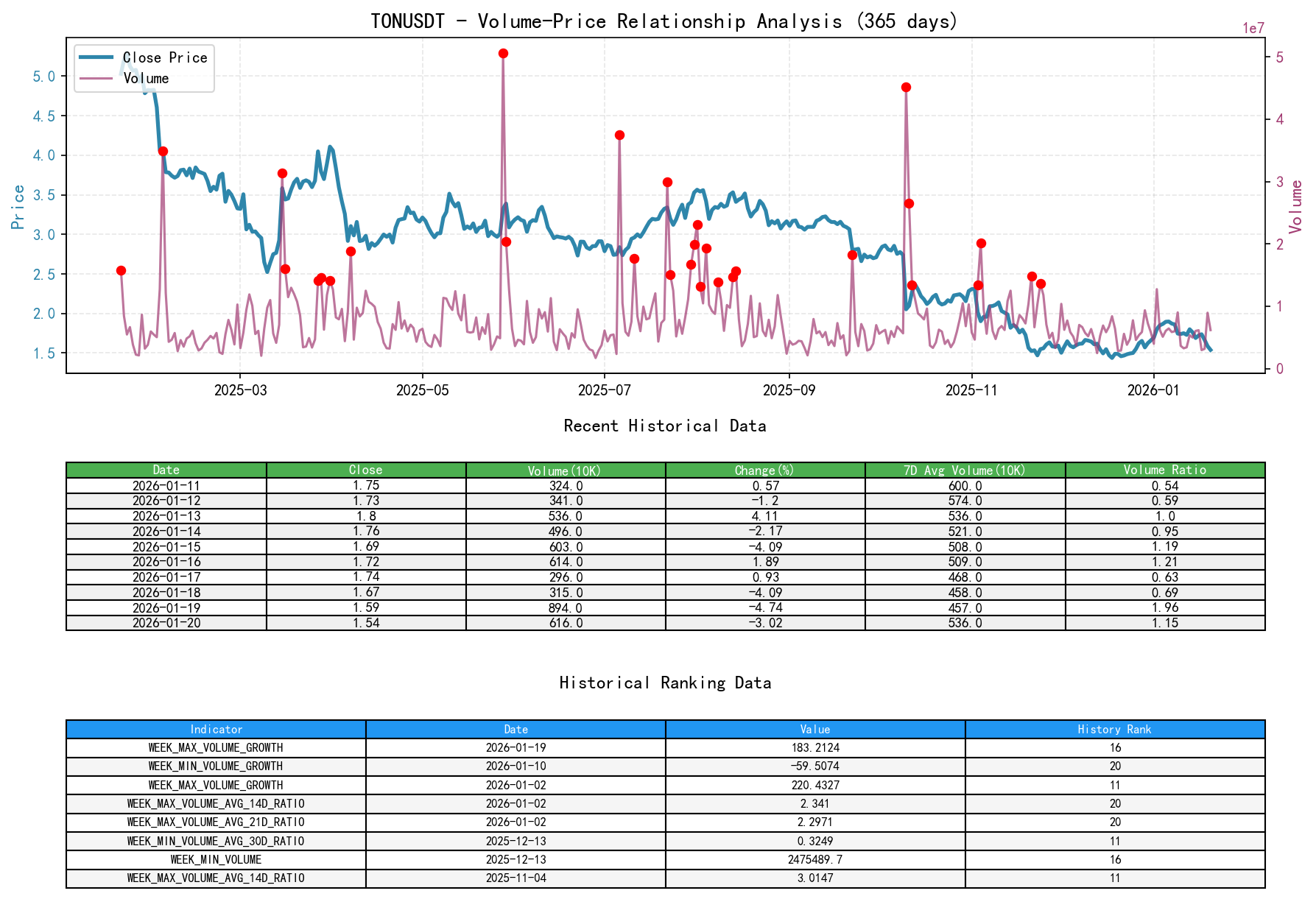

II. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying TONUSDT had an opening price of 1.59, a closing price of 1.54, a volume of 6166029.00, a daily change of -3.02%, a volume of 6166029.00, a 7-day average volume of 5368273.27, and a 7-day volume ratio of 1.15.

- • Key Session Analysis:

- • High-Volume Decline (Supply Dominated): On 2025-11-23, price change -4.17%,

VOLUME_AVG_14D_RATIOreached 1.24; on 2026-01-19, price change -4.74%, volume was 73% above its 14-day average. Both are signs of overwhelming supply dominance. - • High-Volume Rise (Demand Test): On 2026-01-02, price change +6.38%,

VOLUME_AVG_14D_RATIOwas as high as 2.34 (historical rank #20), indicating strong demand entry. However, the subsequent rise failed to sustain (UT/Upthrust), suggesting persistent overhead supply. - • Low-Volume Rebound (Insufficient Demand): During recent (mid-Jan) rebounds, e.g., Jan 13 (+4.11%) and Jan 16 (+1.89%), their

VOLUME_AVG_14D_RATIOwere 0.89 and 1.02 respectively, indicating volume failed to expand significantly, pointing to lackluster follow-through buying and questioning the quality of the rebound. - • High-Volume Stagnation/High-Level Consolidation: From Jan 3 to Jan 6, prices consolidated at high levels (1.85-1.90) with sustained high volume but unable to achieve a decisive breakout, exhibiting volume-price characteristics of Distribution.

- • High-Volume Decline (Supply Dominated): On 2025-11-23, price change -4.17%,

- • Supply-Demand Strength Transition:

- • The

VOLUME_AVG_*D_RATIOindicators show that market activity peaked around Jan 2 and has gradually declined since. Recently (Jan 20), the ratio hovers around 1.15, indicating cooling trading heat and the market entering a wait-and-see period of buyer-seller contest. - • The simultaneous attenuation of both price momentum (from large bearish candles to smaller ones or dojis) and volume momentum (from huge volume to average volume) is a signal that the downtrend may be nearing its end.

- • The

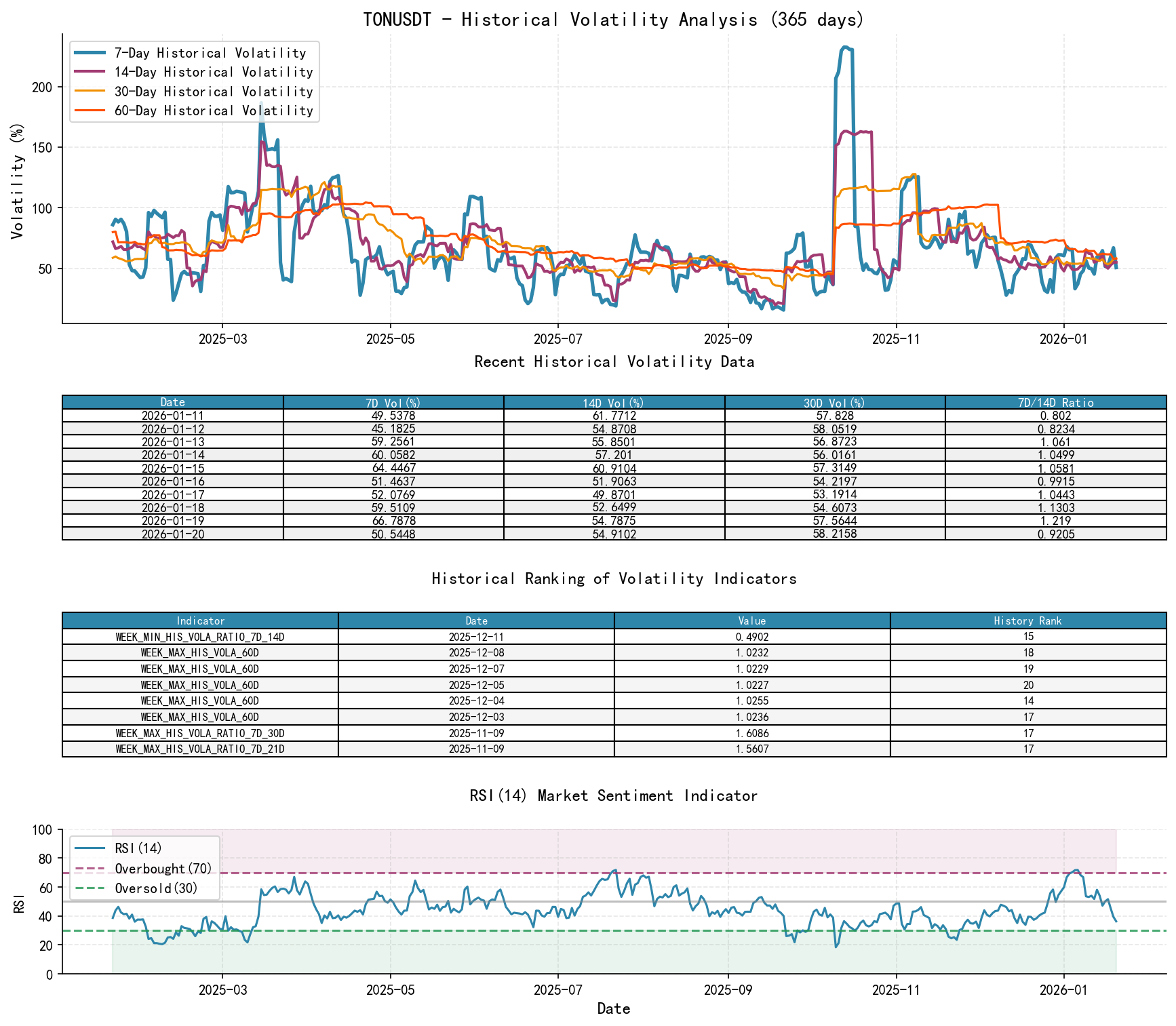

III. Volatility and Market Sentiment

As of January 20, 2026, the underlying TONUSDT had an opening price of 1.59, a 7-day intraday volatility of 0.63, a 7-day intraday volatility volume ratio of 1.09, a 7-day historical volatility of 0.51, a 7-day historical volatility volume ratio of 0.92, and an RSI of 36.29.

- • Volatility Levels and Changes:

- • In early December, long-term volatility peaked. Historical ranking data shows

PARKINSON_VOL_60Dreached 1.0389 on Dec 7/8 (ranking #1 over the past decade), andHIS_VOLA_60Dwas also at historically high levels (1.0255, rank #14). This confirms the market was in a high-volatility panic state at that time. - • Subsequently, volatility indicators declined systematically. By Jan 20,

PARKINSON_VOL_60Dhas retreated to 0.6119, andHIS_VOLA_60Ddropped to 0.5781, indicating a significant alleviation of market panic and a return to normalized volatility.

- • In early December, long-term volatility peaked. Historical ranking data shows

- • Volatility Structure and Sentiment:

- • The ratio of short-term volatility (7D) to long-term volatility (60D) (

HIS_VOLA_RATIO_7D_60D,PARKINSON_RATIO_7D_60D) has been below 1 for most of January, especially the historical volatility ratio often below 0.9. This indicates short-term volatility has significantly fallen below its long-term average, suggesting market sentiment has shifted from panic to apathy and hesitation.

- • The ratio of short-term volatility (7D) to long-term volatility (60D) (

- • Overbought/Oversold Status (RSI):

- • RSI_14 touched a low of 23.51 in late November (ranked #10 lowest over the past decade), confirming extreme oversold conditions.

- • During the early January rebound, RSI climbed to a high of 71.85 (Jan 6, ranked #4 highest over the past decade), nearing overbought territory.

- • The current RSI_14 is 36.29, returning to a neutral-to-weak zone, leaving room for the next directional move. Sentiment has calmed down after rebounding from extreme pessimism.

IV. Relative Strength and Momentum Performance

- • Periodic Return Analysis:

- • Short-term (WTD): Performance is unstable, alternating between strong rebounds (e.g., week of Jan 2: +16.18%) and rapid declines (e.g., week of Jan 20: -14.50%), showing high volatility and trendless characteristics.

- • Mid-term (MTD/QTD): The return since the beginning of January is -7.23%, and the quarterly return is -7.23%, indicating the mid-term downtrend remains unbroken.

- • Long-term (YTD/TTM_12): Year-to-date return is -7.23%, and the trailing 12-month return is -69.40%, indicating an extremely strong long-term downtrend; the asset is in a deep bear market.

- • Conclusion: The market exhibits a pattern of short-term momentum reversals (consolidation), weak mid-term momentum (decline), and extremely weak long-term momentum (bear market). The strong rebound in early January can be viewed as a significant correction within the long-term downtrend.

V. Smart Money Behavior Identification

Based on the above volume-price, volatility, and phase analysis:

- 1. Absorption During Panic Selling (Mid-to-Late Dec): When prices hit multi-year lows (1.42-1.45 zone) accompanied by huge volume declines (e.g., Dec 18, Jan 19), according to Wyckoff principles, this could be Panic Selling (PSY). Smart Money might have been conducting Preliminary Support accumulation, taking advantage of public panic. Historically extreme low prices and surging volume are the data manifestations of this behavior.

- 2. Distribution at Rebound Highs (Early Jan): After the price rebounded to the 1.88-1.93 zone, it showed signs of stagnation and high-volume consolidation. Given the preceding steep decline, this is more likely a technical rebound. Smart Money may have used this rebound to Distribute low-cost positions to retail traders chasing the rally, evidenced by "high-volume stagnation."

- 3. Inferred Current Behavior (Mid-Jan to Present): The price has retraced from the rebound high but shows some resilience in the 1.50-1.55 zone (no new low formed). If a low-volume retest of the previous low area (e.g., near 1.50) without breaking it occurs subsequently, accompanied by shrinking volume again, it could signal Smart Money conducting a Secondary Test (ST) and re-accumulation. The high-volume decline on Jan 19 without breaking the prior low warrants caution - it could be an Ultimate Shakeout (Spring) or merely a pause in the decline.

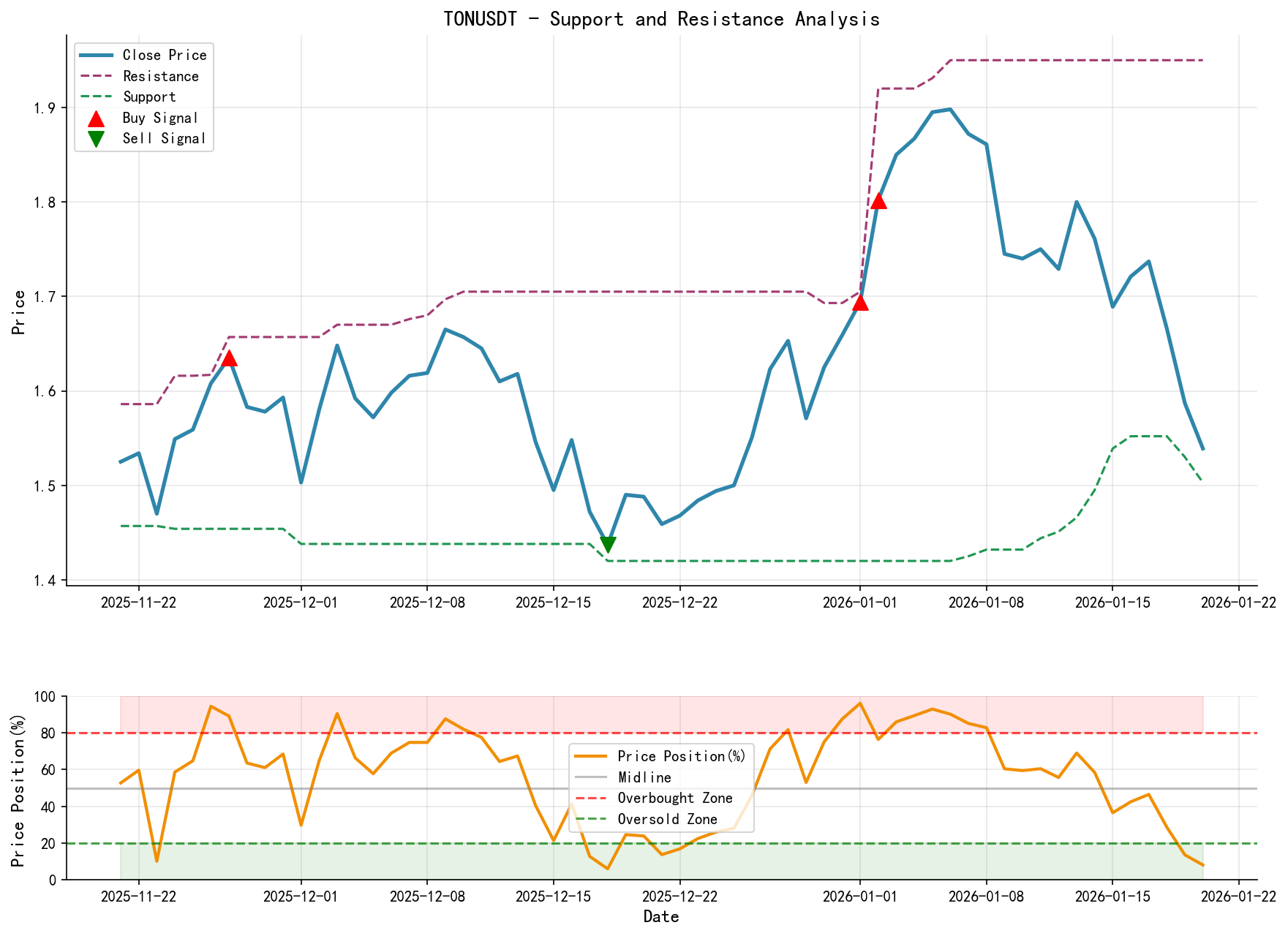

VI. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • Primary Support (S1): 1.50 - 1.55 Zone. This is the low zone tested multiple times recently (Jan 19, 20) and the first consolidation platform after the rebound from the December panic low (1.42). A breakdown below this zone opens the door to further downside.

- • Strong Support (S2): 1.42 - 1.45 Zone. The absolute low zone over the past decade (the top 3 historically ranked low prices are here), serving as the long-term bull-bear demarcation line.

- • Key Resistance Levels:

- • Near-term Resistance (R1): 1.66 - 1.67 Zone. The mid-Jan rebound high, also near the current MA_20D level.

- • Strong Resistance (R2): 1.85 - 1.93 Zone. The high-volume consolidation area and peak formed during the early January rebound, representing a clear supply zone.

- • Comprehensive Trading Signals and Action Plan:

- • Current Market State: Potential bottom-building phase within a long-term bear market. The market has moved away from panic into a balanced, testing, and consolidating stage. Trend traders should remain cautious, while swing traders can focus on range-bound opportunities.

- • Bullish Signals & Conditions (All required):

- 1. Price Action: Price breaks above and holds above the R1 (1.67) resistance with significant volume (

VOLUME_AVG_14D_RATIO> 1.5). - 2. Volume-Price Confirmation: The breakout is accompanied by significant price advance on increasing volume, with pullbacks occurring on low volume.

- 3. Confirmation Point: After the breakout, price retraces without breaking below 1.60, forming a higher low.

- 1. Price Action: Price breaks above and holds above the R1 (1.67) resistance with significant volume (

- • Action Plan (Aggressive): Initiate a small long position upon a confirmed breakout of R1, with a stop-loss set below 1.60. Target the R2 zone.

- • Bearish Signals & Conditions (Any one suffices):

- 1. Price Action: Price exhibits high-volume stagnation or long upper shadows again near R1 (1.67) or R2 (1.85).

- 2. Support Failure: Price breaks below the S1 (1.50) key support zone with expanding volume.

- • Action Plan: If Signal 1 appears, consider selling short near the resistance zone with a stop-loss above the resistance. If Signal 2 appears, follow the bearish trend with a target towards S2.

- • Observation/Waiting Signals:

- • When price moves erratically within the range between S1 (1.50) and R1 (1.67), it is advisable to remain on the sidelines.

- • Wait for the appearance of the above-mentioned key confirmation points, allowing the market itself to reveal the next direction.

Conclusion Restatement: TONUSDT is currently in a critical contesting stage at the tail end of a long-term downtrend. Smart Money is likely exchanging positions utilizing the wide swings. Traders should abandon predictions of a unilateral trend and instead focus on Wyckoff events (e.g., Spring, UT, ST) occurring near critical price levels along with their volume-price confirmation, and formulate high-probability strategies accordingly. The primary task at present is to observe price action around the 1.50-1.55 support zone.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risk; investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff volume-price market analysis is published daily at 8:00 before market open. Your comments and shares are sincerely appreciated and crucial. Let us work together to identify market signals.

Member discussion: