Alright, adhering to your instructions. Below is the in-depth quantitative analysis report for .SPX, based on the Wyckoff principles of price-volume action and combined with historical ranking data.

Quantitative Analysis Report for SPX (.SPX)

Analysis Period: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

Analyst Role: Wyckoff Quantitative Trading Researcher

1. Trend Analysis & Market Phase Identification

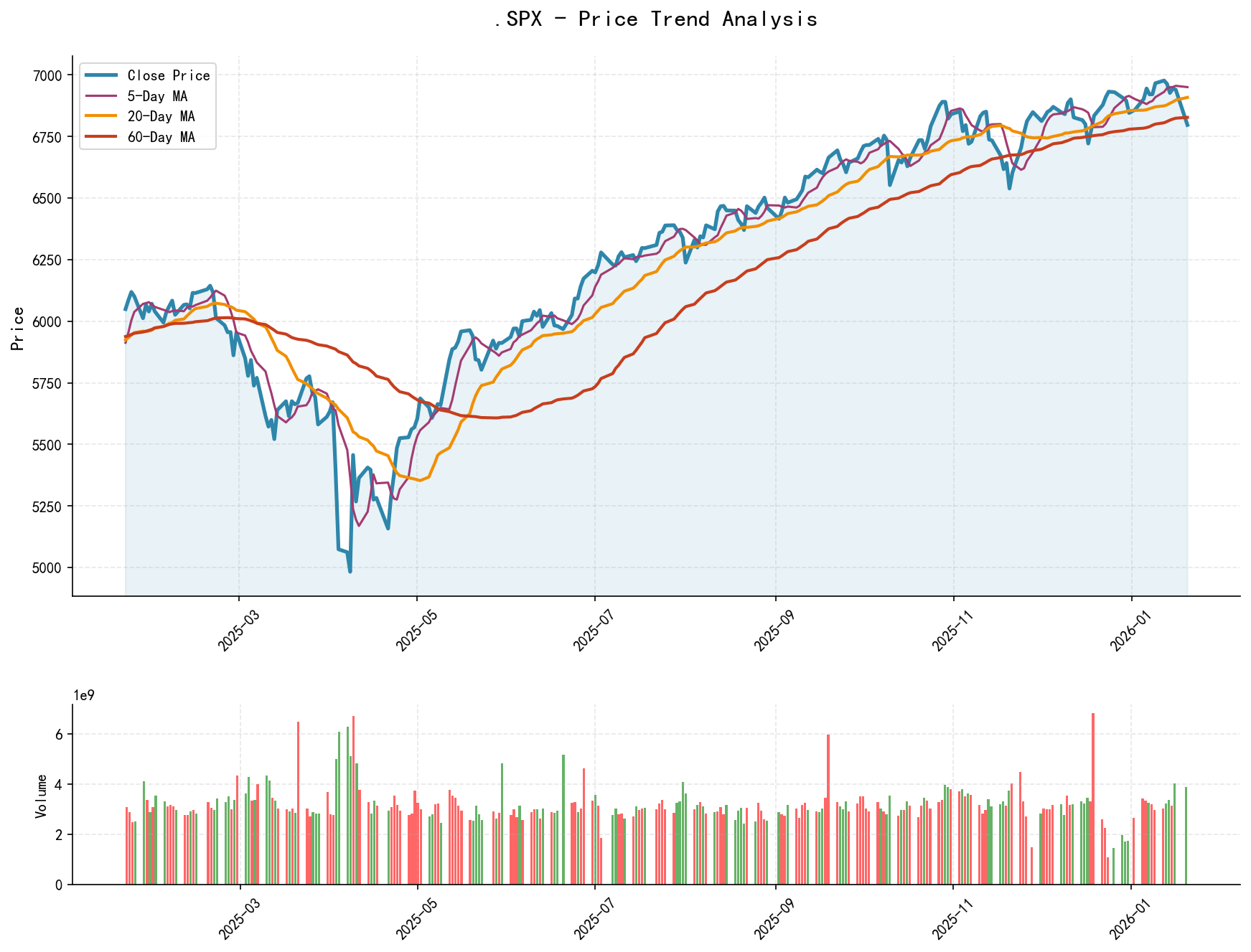

As of January 20, 2026, the underlying .SPX had an opening price of 6865.24, a closing price of 6796.86. Key moving averages: 5-day MA 6950.42, 10-day MA 6940.76, 20-day MA 6908.66. Daily change: -2.06%. Weekly change: -2.40%. Monthly change: -0.71%. Quarterly change: -0.71%. Yearly change: -0.71%.

Based on the dynamic relationship between price and moving averages, the market experienced a complete process of advance and reversal during the analysis period:

- • Establishment of Bullish Alignment (Late November - Early January): Following the low on November 21 (6521.92), the price initiated an advance. By mid-January, the price consistently traded above all key moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), forming a standard bullish alignment pattern. Short-term MAs like MA_5D and MA_20D provided dynamic support.

- • Trend Break and Bearish Signal (January 20): After reaching a new all-time high of 6986.33 on January 12, the market entered a high-level consolidation. The large bearish candlestick on January 20 (-2.06%) decisively broke below the MA_5D (6950.42), MA_10D (6940.76), MA_20D (6908.66), and MA_30D (6884.70), remaining only marginally above the MA_60D (6827.64). The closing price (6796.86) was significantly below multiple MAs, technically indicating a valid breakdown of the nearly two-month uptrend and a shift in market structure from strong to weak.

Market Phase Inference (Based on Wyckoff Theory):

- • Markup Phase (Upthrust): From late November to January 12, the price continuously made new highs, aligning with the characteristics of the "Markup" phase in Wyckoff theory.

- • Potential Start of Distribution Phase: After reaching the all-time high on January 12, the price failed to continue its strong advance, instead showing stagnation and volatility at high levels (6950-6980 zone). Combined with the high-volume breakdown long black candlestick on January 20, this aligns with the typical late-stage "Distribution" characteristic known as a "Sign of Weakness (SOW)" or "Break of Ice," where large-scale selling pressure begins to overwhelm buying, leading to a trend reversal.

2. Price-Volume Relationship & Supply-Demand Dynamics

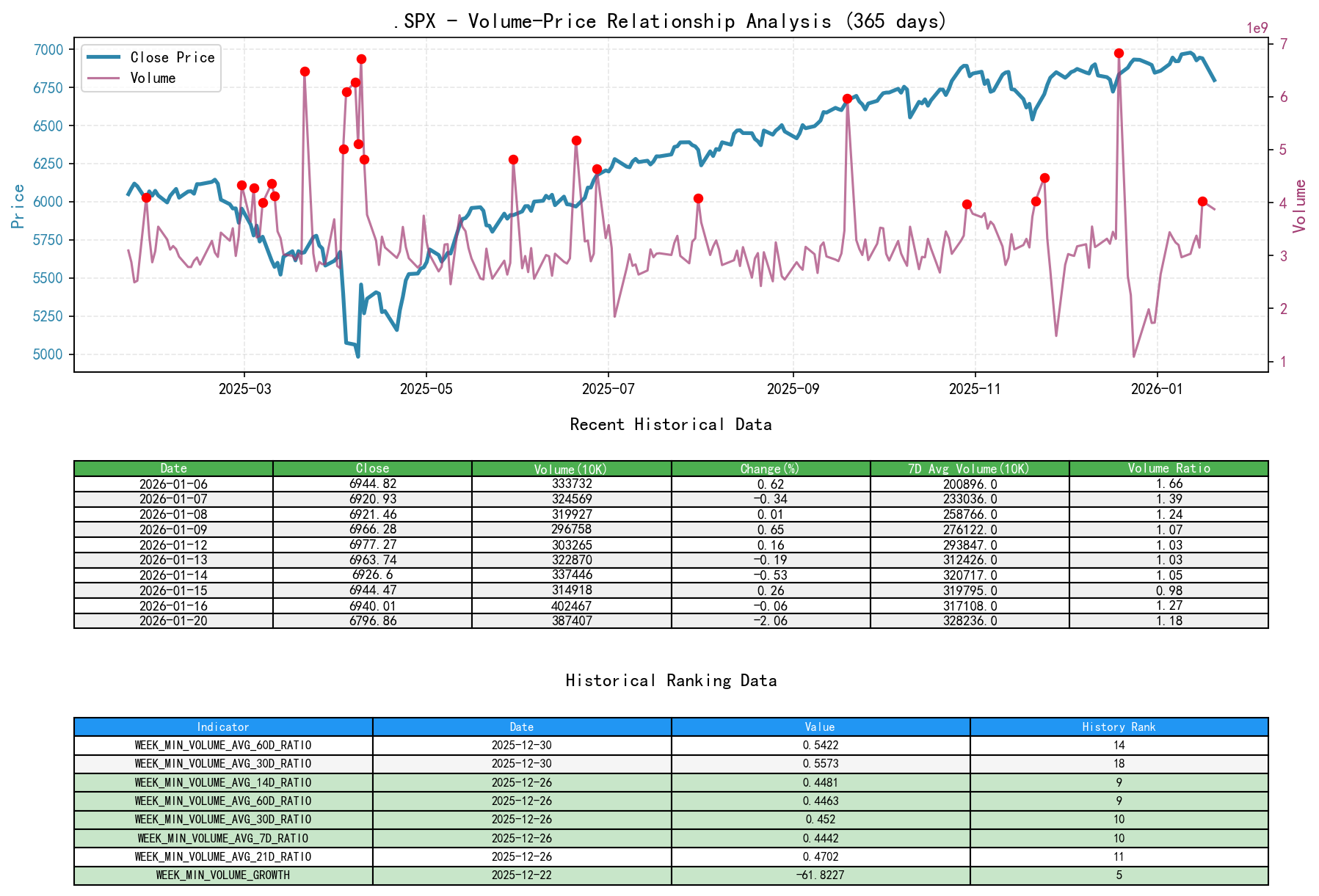

As of January 20, 2026, the underlying .SPX had an opening price of 6865.24, a closing price of 6796.86, volume of 3874073807, daily change of -2.06%, volume of 3874073807, 7-day average volume of 3282364866.71, and 7-day volume ratio of 1.18.

Volume data reveals a dramatic shift in supply-demand forces at key turning points:

- • Demand-Driven Advance (November 24 - Early December): During the initial advance (e.g., November 24), the price closed up 1.55% accompanied by a surge in volume (VOLUME_GROWTH +11.32%, VOLUME_AVG_7D_RATIO 1.31), representing healthy "price advance on increasing volume," indicating active demand entering the market.

- • High-Volume Stagnation at Highs - Distribution Warning (December 19): This was an extremely critical signal day. The price closed up 0.88%, but the volume surged to 6.83 billion, ranking as the #1 weekly volume high in nearly 10 years (HISTORY_RANK: 1). Its volume ratio relative to the 7, 14, and 21-day averages (RATIO > 2.0) all ranked within the top 20 historically for the past decade. This "high-volume advance" at relatively high levels, combined with the subsequent failure of prices to sustain strong breakthroughs, is more likely interpreted as large-scale organized selling (supply) being absorbed by temporarily strong retail buying (demand) - a classic distribution behavior. Historical ranking data confirms the extremity of this volume anomaly.

- • Supply Takes Full Control - Panic Selling (January 20): The price plummeted -2.06% on expanded volume of 3.87 billion (VOLUME_AVG_60D_RATIO 1.22). This is a typical "price decline on increasing volume," indicating that supply (selling) not only emerged but triggered some panic selling. Occurring after the breakdown from all-time highs, this marks a phase where supply has completely overwhelmed demand, and the market has entered a supply-dominated decline.

3. Volatility & Market Sentiment

As of January 20, 2026, the underlying .SPX had an opening price of 6865.24, 7-day intraday volatility 0.09, 7-day intraday volatility ratio 1.12, 7-day historical volatility 0.17, 7-day historical volatility ratio 1.25, and RSI 40.47.

Volatility and sentiment indicators collectively suggest the market is transitioning from calm to panic:

- • Volatility Expansion from Extreme Compression:

- • During the late stages of the advance from December to early January, short-term volatility (HIS_VOLA_7D, PARKINSON_VOL_7D) was compressed to extremely low levels (e.g., on December 5, PARKINSON_RATIO_7D_14D was only 0.50, ranking as the #1 lowest in nearly a decade), reflecting optimistic and complacent market sentiment.

- • On January 20, volatility expanded sharply. HIS_VOLA_7D jumped to 0.169, with its ratio to the 60-day volatility (HIS_VOLA_RATIO_7D_60D) reaching 1.18; PARKINSON_RATIO_7D_14D rose to 1.12. This indicates short-term volatility has significantly exceeded the long-term volatility average, and market sentiment is shifting from calm to tension or even panic, often accompanying trend acceleration or reversal.

- • RSI Reveals Rapid Shift from Overbought to Oversold: The RSI_14 was in a relatively strong zone at 62.71 when it made the phase high on January 12. By January 20, it had rapidly dropped to 40.47, entering the weak zone and approaching the oversold line (30). This rapid decline confirms a fundamental reversal in market momentum in the short term, with selling power increasing sharply.

4. Relative Strength & Momentum Performance

Momentum indicators across timeframes confirm the collapse of short-term momentum:

- • Sharp Downturn in Short-Term Momentum: As of January 20, the weekly return (WTD_RETURN) was -2.40%, and the month-to-date return (MTD_RETURN) turned negative at -0.71%. This indicates that short-term upward momentum has completely vanished and turned negative.

- • Mid-to-Long Term Momentum Remains but is Eroding: Although the year-to-date (YTD) and trailing twelve-month (TTM_12) returns remain positive (13.34%), the sharp decline on January 20 has begun to erode these medium-term gains. The momentum performance corroborates the conclusions of price breakdown and high-volume decline, indicating strong short-term downward momentum that may threaten the medium-term trend.

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff principles and the above price-volume analysis, the operational intent of large investors can be inferred as follows:

- 1. Systematic Distribution at Highs: The "historically significant high volume" on December 19 is the core evidence. With prices in an absolute high zone for nearly a decade (historical ranking data shows multiple OHLC metrics for that week and subsequent weeks ranked among historical highs), such massive volume is unlikely from retail activity. This strongly suggests large investors were conducting organized, planned distribution at highs, transferring holdings to the public by leveraging market optimism and strong demand.

- 2. Cessation of Support and Potential Shorting: After completing the primary distribution, large investors likely removed buying support at key support levels (e.g., short-term MAs). During the high-volume breakdown below multiple MAs on January 20, there was no significant buying support; instead, panic selling ensued. This may indicate some "smart money" has shifted to the sell side or at least ceased providing liquidity support.

- 3. Current Phase Judgment: The market has likely transitioned from the "Distribution" phase into the initial stage of the "Markdown" phase within the Wyckoff cycle. The intent of large investors has shifted from "selling into strength" to "observing or shorting with the trend," awaiting a price decline to the next valuable "Accumulation" zone.

6. Support/Resistance Analysis & Trading Signals

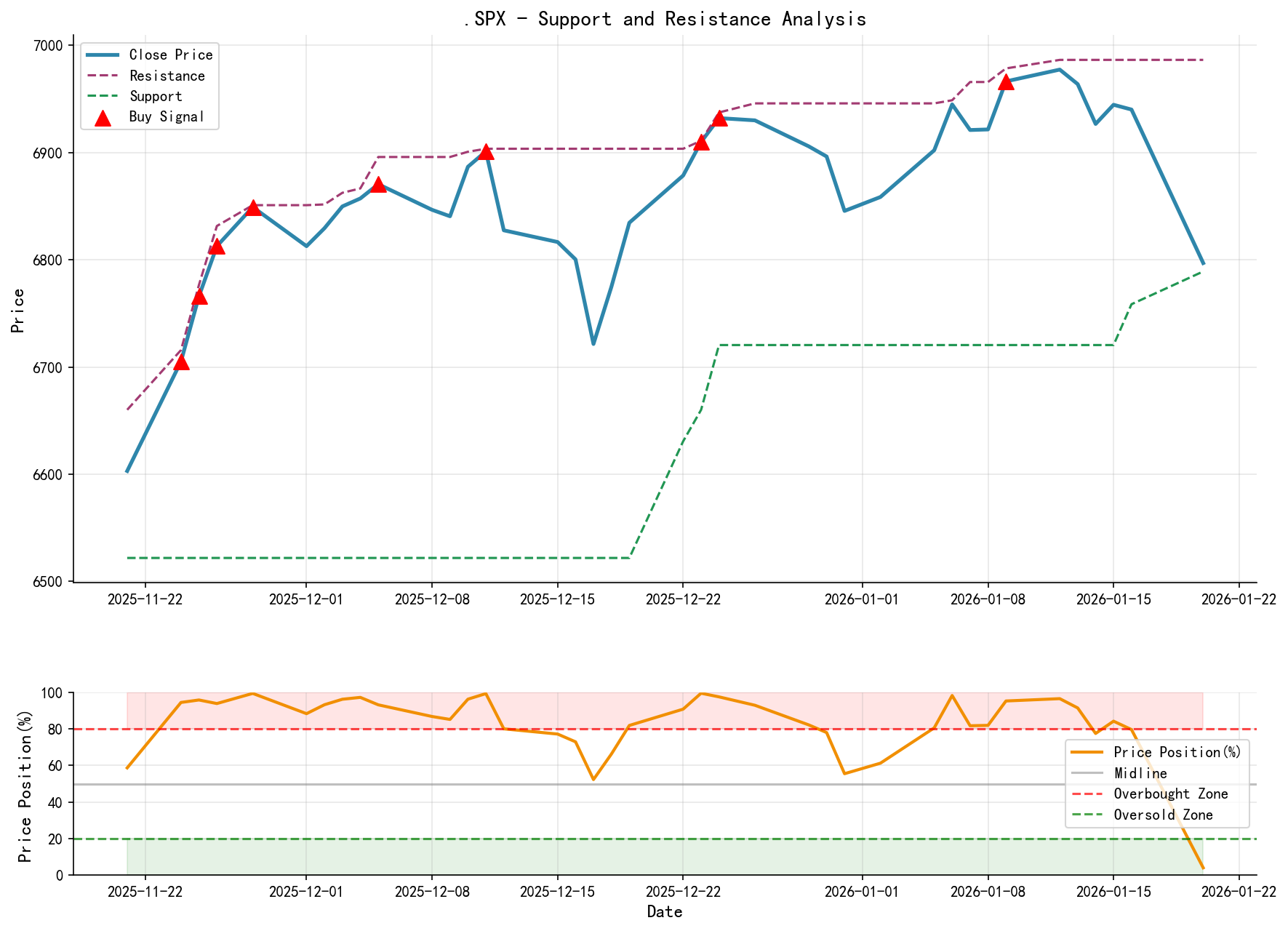

- • Key Resistance Levels:

- • R1: 6980-7000 Zone. This is the area of the recent all-time high and the primary distribution zone, which will serve as strong future resistance.

- • R2: 6880-6900 Zone. This corresponds to the lower boundary of the previous consolidation platform and the vicinity of the recently broken MA_30D, now acting as the first resistance level.

- • Key Support Levels:

- • S1: 6750 Zone. This corresponds to the low area of the mid-December pullback and is near the current MA_60D (6827), making it the primary support level to be tested.

- • S2: 6600 Zone. The high of the platform before the November rally began, serving as important medium-term support.

- • S3: 6520 Zone. The initial low of the recent advance, representing strong long-term support.

Integrated Wyckoff Events & Trading Signals:

- 1. Overall Judgment: Bearish. The market has exhibited the classic Wyckoff bearish combination of "breakdown after distribution": high-volume stagnation at highs + high-volume break below key support (MA cluster) + panic-driven volatility expansion.

- 2. Operational Recommendations:

- • Primary Strategy: Wait for weak rallies to establish short positions. Any rally towards the 6880-6900 resistance zone, if accompanied by diminished volume, presents a favorable risk-reward opportunity for shorting.

- • Entry Reference: When the price rallies near 6880 and shows signs of weakness (e.g., upper shadows, intraday price-volume divergence).

- • Stop-Loss Placement: Above 6950 (surpassing the high of the January 20 bearish candlestick's body).

- • Target Zones: First target 6750, second target 6600.

- 3. Future Validation Points:

- • Signals to Invalidate the Bearish View: Price needs to rebound swiftly and strongly, reclaiming and holding above 6900 on significant volume, indicating the January 20 decline was merely a "Shakeout." Current data does not support this hypothesis.

- • Signals to Confirm the Bearish View: Price rallies weakly to the 6880 area, fails, and then breaks below the 6750 support on increased volume, confirming the continuation of the downtrend towards the 6600 target. Also, monitor for the appearance of "Climax" selling during the decline, which would be an early signal that the markdown phase might be nearing its end.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. Markets involve risks; investing requires caution. Any investment actions taken based on this report are at your own risk.

Thank you for your attention! Daily Wyckoff price-volume market analysis is released promptly at 8:00 AM before the market opens. Please feel free to leave comments and share; your recognition is invaluable. Let's navigate the markets together by seeing its signals.

Member discussion: