Very well, in accordance with your instructions. As a quantitative trading researcher specializing in the Wyckoff Method, I will, based on the SOXX data and historical ranking indicators you provided, compile the following in-depth quantitative analysis report.

Product Code: SOXX

Analysis Date Range: 2025-11-21 to 2026-01-20

SOXX Quantitative Analysis Report (Based on the Wyckoff Method)

This report aims to decode the supply and demand dynamics and smart money intent within the analysis period for SOXX (iShares Semiconductor ETF) through price-volume analysis, volatility assessment, and historical percentile comparisons. All conclusions are strictly derived from the provided data.

1. Trend Analysis & Market Phase Identification

As of 2026-01-20, for the underlying asset SOXX: Open: 336.20, Close: 337.35, MA_5D: 335.05, MA_10D: 329.49, MA_20D: 316.64, Daily Change: -1.50%, Weekly Change: +1.22%, Monthly Change: +12.02%, Quarterly Change: +12.02%, Yearly Change: +12.02%

- • Bull/Bear Alignment: As of the latest trading day (2026-01-20), the closing price (337.35) is above all key moving averages (MA_5D to MA_60D). Moreover, the short-term moving average (MA_5D: 335.05) is above the long-term moving average (MA_60D: 303.43), indicating a clear bullish alignment.

- • Trend Evolution:

- • Late November (Base Formation): After hitting a low of 260.44 on November 21st, the price rebounded consecutively on the back of significantly increased volume (volume growth of 14.6%), breaking through multiple moving averages.

- • December Consolidation and Testing: After rallying in early December, there were two instances of "high-volume sharp declines" on December 12th and 17th (volumes of 13.81M and 10.42M shares, respectively). The price retested previous support levels, but the bullish moving average structure remained intact.

- • January New High Phase: Entering January, the price initiated a new round of uptrend confirmed by increased volume (volume of 8.49M shares on Jan 2nd), continuously reaching new highs and peaking at a closing price of 342.47 on January 16th.

- • Wyckoff Phase Inference: Combining price-volume action, the market exhibited characteristics of a selling climax (price bottoming, massive volume) on November 21st, followed by demand-driven rallies on high volume. This can be interpreted as the conclusion of the "Accumulation" phase and the beginning of the "Markup" phase. The two high-volume pullbacks in December can be seen as "Shakeouts" during the markup, designed to flush out weak hands. The price is currently in the markup phase and may be entering a high-level consolidation; vigilance is required to assess a potential transition to a "Distribution" phase.

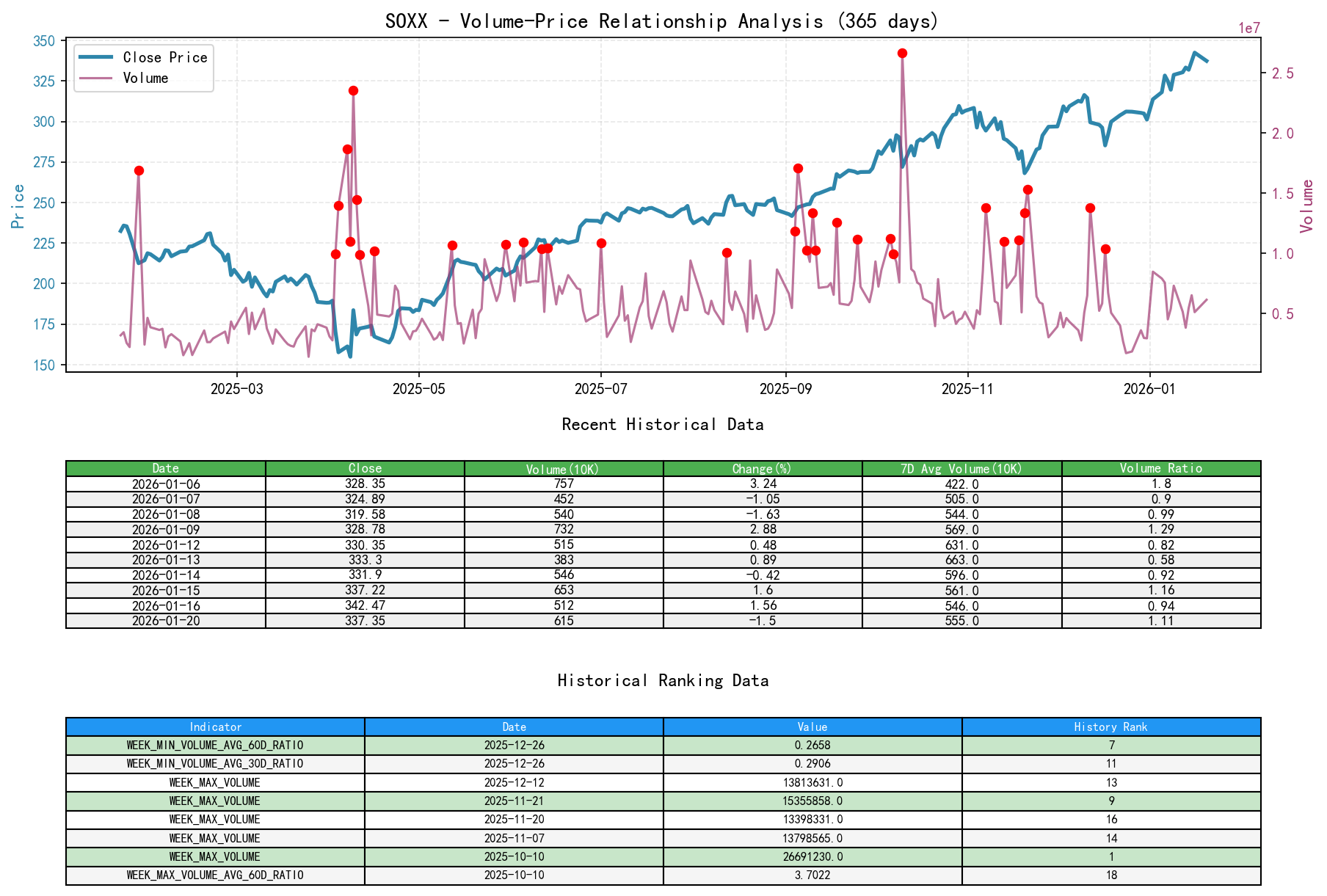

2. Price-Volume Relationship & Supply-Demand Dynamics

As of 2026-01-20, for the underlying asset SOXX: Open: 336.20, Close: 337.35, Volume: 6158012, Daily Change: -1.50%, Volume: 6158012, 7-day Avg Volume: 5550645.43, 7-day Volume Ratio: 1.11

- • Key Day Analysis (Wyckoff Events):

- 1. Selling Climax Day (2025-11-21):

- • Price: Recovered strongly after a steep decline (PCT_CHANGE: +1.02%), with a long real body indicating strong demand resistance against the selloff.

- • Volume: 15.36M (10-year historical rank: #9), value traded 4.12B (historical rank: #4). Characteristic of panic selling. According to Wyckoff principles, this type of "high-volume panic" often marks a Selling Climax, signaling smart money beginning to accumulate.

- 2. Demand-Driven Rally Day (2025-12-03):

- • Price: Strong advance (+2.15%), closing near the day's high.

- • Volume: 3.87M,

VOLUME_AVG_7D_RATIO: 0.59, indicating below-average volume. This suggests the rally faced negligible supply, and demand easily pushed the price higher—a sign of healthy advance.

- 3. Secondary Test & Shakeout Days (2025-12-12 & 2025-12-17):

- • Price: Sharp decline of -4.78% on Dec 12th, followed by -3.70% on Dec 17th. However, both closing prices were significantly higher than the intraday lows (Dec 12th: low 297.96, close 299.48).

- • Volume: 13.81M (historical rank: #13) and 10.42M, respectively. High-volume decline with closing price well off the low indicates concentrated supply was met with robust demand support at lower levels. This behavior can be classified as a "Shakeout" during markup, flushing out floating supply.

- 1. Selling Climax Day (2025-11-21):

- • Recent Supply-Demand Strength: In January, as prices made new highs, volume (5.0M-7.6M) was higher than the December average but did not surpass the massive levels seen during the November/December climax/shakeout days. Combined with the

VOLUME_AVG_7D_RATIOhovering around 1.0, it indicates stable but not exuberant demand during the price advance, suggesting increased supply pressure at current levels.

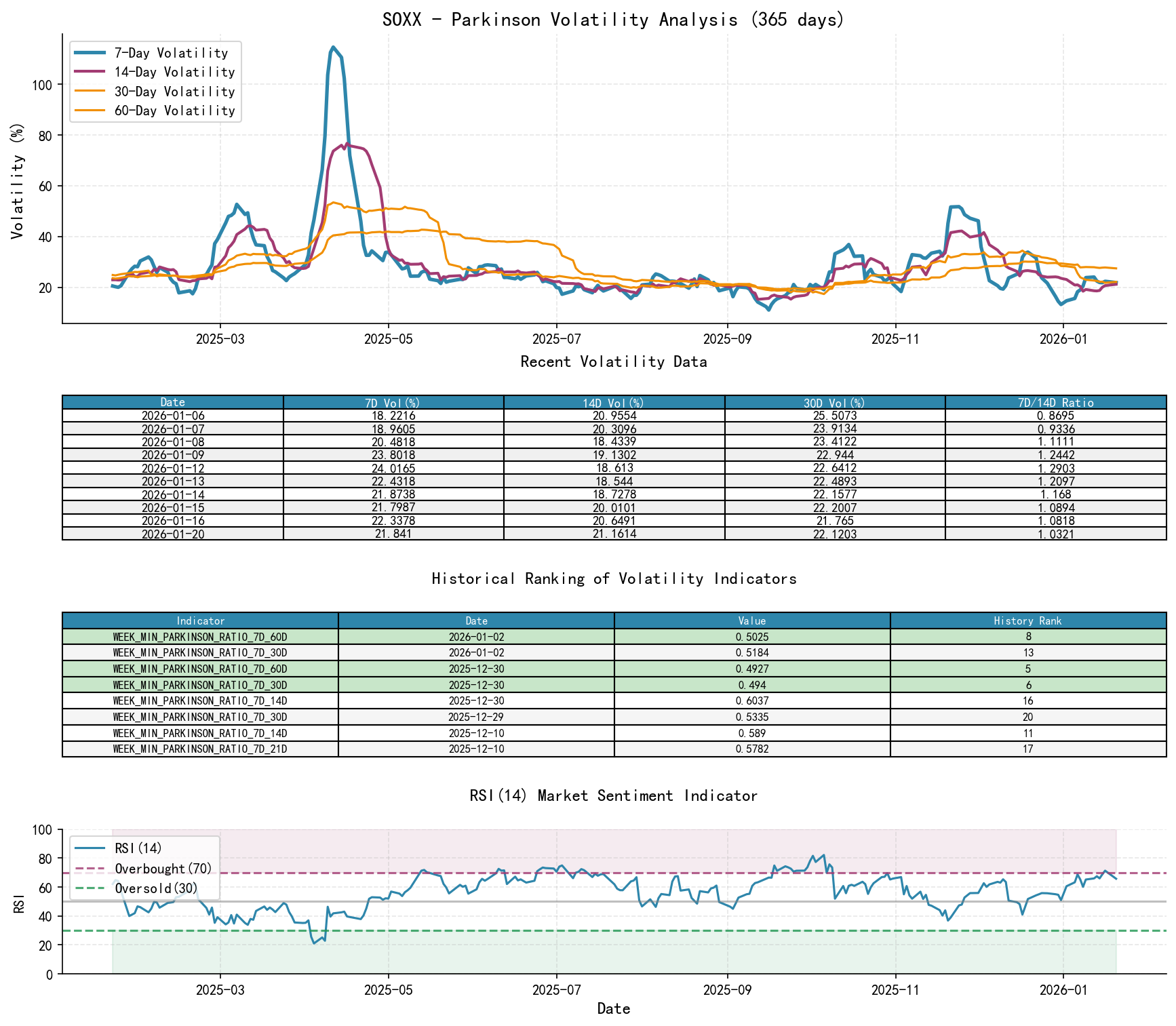

3. Volatility & Market Sentiment

As of 2026-01-20, for the underlying asset SOXX: Open: 336.20, 7-day Intraday Parkinson Volatility: 0.22, 7-day Parkinson Volatility Ratio: 1.03, 7-day Historical Volatility: 0.27, 7-day Historical Volatility Ratio: 0.78, RSI: 65.77

- • Volatility Levels & Changes:

- • Panic Period (Late November):

PARKINSON_VOL_7Dspiked to 0.516, with its ratio to the 60-day volatility (PARKINSON_RATIO_7D_60D) reaching 1.93 (historically extreme high), clearly marking the peak of market panic. - • Volatility Contraction (December-January): Subsequently, volatility declined steadily. By the end of December, short-term volatility was significantly below long-term levels (e.g.,

PARKINSON_RATIO_7D_60Ddropped to 0.49 on Dec 30th), indicating a return to calm market sentiment. - • Current Status (Jan 20th):

PARKINSON_RATIO_7D_60Dis 0.80, andHIS_VOLA_RATIO_7D_60Dis 0.68, indicating short-term volatility has modestly increased again but remains below its long-term average. Market sentiment is stable with a bullish bias.

- • Panic Period (Late November):

- • Overbought/Oversold Status:

RSI_14dropped to 39.0 (mildly oversold) on the panic day of Nov 21st, then rose to a recent high of 71.3 on Jan 16th during the rally. The current RSI of 65.8 is out of overbought territory but remains in a strong zone, consistent with the uptrend.

4. Relative Strength & Momentum Performance

- • Momentum Trend: Returns across all timeframes show strong momentum.

- •

YTD(2026): +12.02% (extremely strong year-to-date performance) - •

MTD_RETURN: +12.02% (significant gains for January alone) - •

WTD_RETURN: +1.22% (slower gains this week, suggesting potential short-term consolidation)

- •

- • Historical Strength Evidence: Historical ranking data shows that multiple price indicators (e.g.,

WEEK_MAX_CLOSE,WEEK_MAX_HIGH) in January 2026 have reached all-time highs (ranking #1-#5), confirming the current price's absolute strength and market leadership position.

5. Large Investor (Smart Money) Behavior Identification

- • Accumulation Behavior (Late November): During the record panic selling on Nov 21st, smart money acted as the "Final Demand", absorbing the panic selling in massive volume, completing the initial accumulation.

- • Markup & Shakeout Behavior (December): During the early December price advance, volume was moderate, suggesting smart money may not have aggressively added positions but rather held existing positions. The two mid-December "shakeouts" were likely used by smart money to flush out weak-handed longs utilizing market panic, reducing future selling pressure while potentially conducting secondary accumulation at lower levels.

- • Distribution Signs Assessment (January to Present): During the ascent to new all-time highs, volume has not expanded proportionally (

VOLUME_AVG_60D_RATIOremains stable around 1.0). This implies smart money has not engaged in large-scale selling (distribution) during the new high creation, nor have they committed significant new capital to chase the highs aggressively. They are likely in a "Hold and Observe" stance or possibly engaging in mild, orderly distribution at elevated levels. There are currently no clear distribution signals such as high-volume stalling or high-volume sharp declines.

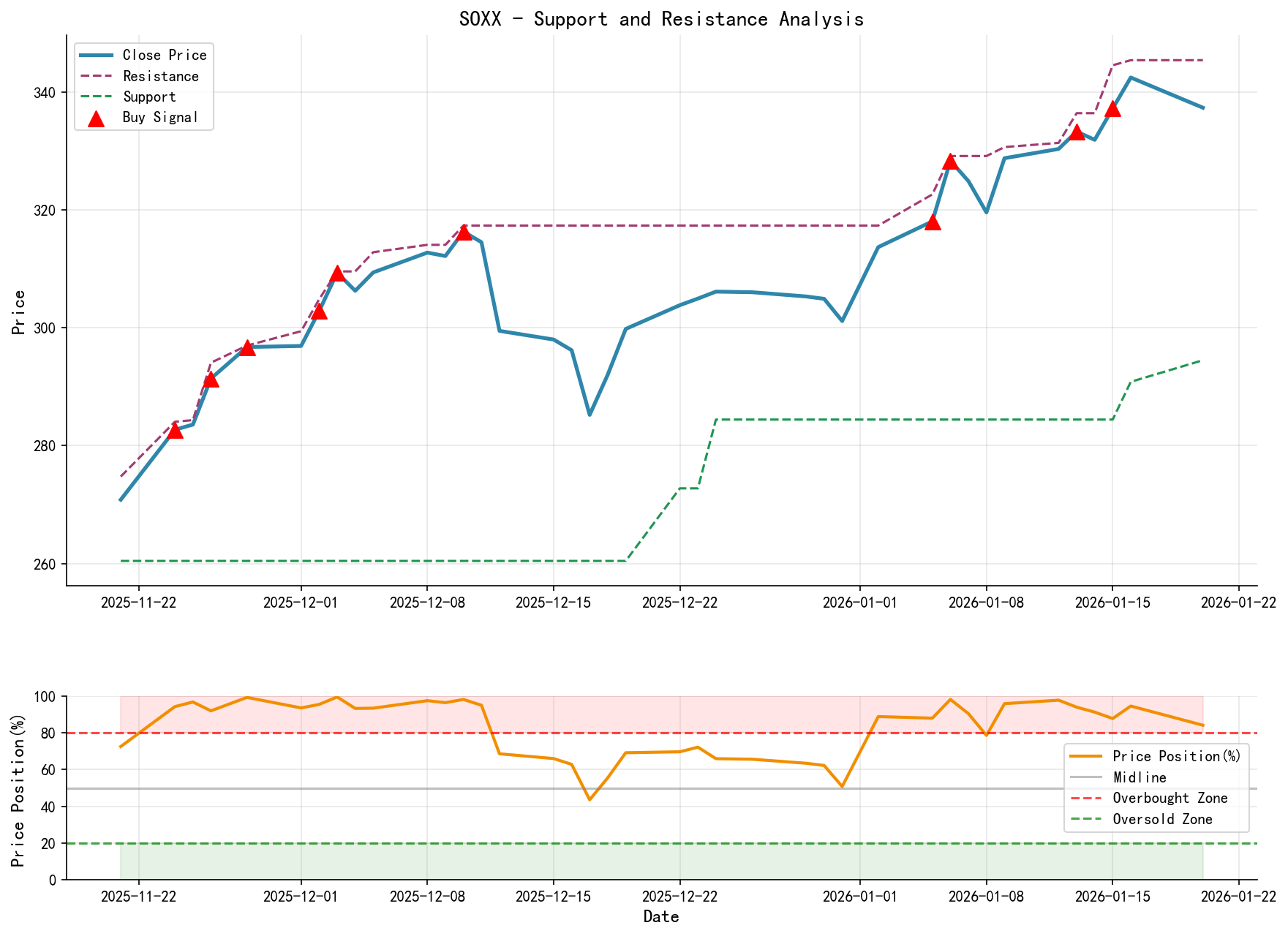

6. Support/Resistance Level Analysis & Trading Signals

- • Key Support Levels:

- • Primary Support: 300 - 310 zone. This is the dense low area from the two December "shakeout" pullbacks, also near the current MA_30D (312.77) and MA_20D (316.64). It represents a zone where demand was previously strong.

- • Secondary Support: 315 - 320 zone. The lower boundary of the recent high-level consolidation range and near the MA_10D (329.49).

- • Key Resistance Levels:

- • Immediate Resistance: 342 - 345 zone. The range formed by the January 16th high (345.41) and the January 20th high (343.19).

- • Breakout Target: If a breakout above 345.41 is achieved with significant volume (requiring volume notably higher than the 7-day average, e.g.,

VOLUME_AVG_7D_RATIO > 1.5), there is no significant technical resistance above, potentially opening new upside space.

- • Comprehensive Trading Signals & Actionable Suggestions:

- • Overall Assessment: Bullish trend, but approaching short-term resistance with slightly slowing momentum. The market is in the late stage of the Wyckoff "Markup" phase, potentially building a high-level platform.

- • Actionable Suggestions:

- 1. Existing Long Positions: Can be held, but consider raising the stop-loss to below the 300 psychological level (e.g., 298.00) to protect most profits. If price exhibits high-volume stalling in the 342-345 resistance zone (e.g., daily gain <0.5% with volume >1.5x the 7-day average), consider partial profit-taking.

- 2. Potential Buyers: Not advisable to chase the high at current levels (~337). Await one of two opportunities:

- • a) Pullback Entry: Wait for a low-volume pullback to the 315-320 support zone, accompanied by signs of demand resurgence (e.g., long lower wick, bullish engulfing pattern) before entering. Set stop-loss below 310.

- • b) Breakout Entry: Wait for price to break out decisively and sustain above 345.41 on high volume (

VOLUME > 6.5M) before entering. Set stop-loss below 340.

- • Future Validation Points:

- • Bullish Validation: Price finds support in the 315-320 zone and rebounds on increased volume, OR breaks above 345 on very high volume (setting a recent record).

- • Bearish Warning: Price breaks below 300 on high volume, OR shows consecutive (two or more) days of "high-volume stalling/declining" at elevated levels (>340) (high volume accompanied by minimal gains or losses). This would be a potential signal for the beginning of "Distribution" and warrants high alert.

Report Conclusion: SOXX has successfully undergone a classic Wyckoff cycle transition over the past two months—from the panic selling (Accumulation) in November to the current strong markup. Smart money completed the major accumulation during the panic and consolidated the uptrend foundation through shakeouts. The market is currently in a bullish trend. However, the failure of volume to expand significantly during the recent new highs suggests the short-term upward momentum may face a test. Trading should primarily follow the trend, but avoid blind chasing near resistance levels. Patience is required to wait for more ideal entry points or trend confirmation signals. All judgments are based on current data and require re-evaluation as market dynamics evolve.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantees regarding its accuracy or completeness. Markets involve risk, and investment requires caution. Any investment actions taken based on this report are at your own risk.

Thank you for your attention! Daily Wyckoff Price-Volume Market Analysis released promptly at 8:00 AM before market open. Your comments and shares are greatly appreciated. Your recognition is paramount. Let us see the market signals together.

Member discussion: