Okay, adhering to your instructions. Here is the comprehensive quantitative analysis report for SOLUSDT based on the Wyckoff Method.

SOLUSDT Wyckoff Quantitative Analysis Report

Product Code: SOLUSDT

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset SOLUSDT had an opening price of 133.44, a closing price of 127.72, a 5-day moving average of 140.46, a 10-day moving average of 140.93, a 20-day moving average of 137.52, a daily change of -4.29%, a weekly change of -12.23%, a monthly change of 2.46%, a quarterly change of 2.46%, and a yearly change of 2.46%.

- • Moving Average Alignment and Trend Direction: As of 2026-01-20, all moving averages (MA_5D: 140.46, MA_10D: 140.93, MA_20D: 137.52, MA_30D: 132.98, MA_60D: 133.03) are positioned above the current closing price (127.72), forming a standard bearish alignment. The price has consistently traded below all key moving averages during the analysis period, indicating the market is in a clear intermediate-term downtrend.

- • Moving Average Crossover Signals: Throughout the analysis period, no bullish crossover signal, such as MA_5D crossing above MA_20D (Golden Cross), has occurred. The direction of MA crossovers has remained downward, confirming the persistence of bearish momentum. The significant gap between short-term MAs (MA_5D/10D) and long-term MAs (MA_30D/60D) also reflects the steepness of the recent decline.

- • Inferred Market Phase (Wyckoff Perspective): Analysis of price action from late November 2025 to mid-January 2026:

- • Initial Support/Distribution (November-December 2025): Price declined from the ~145 level in late November to ~120 by late December. Although there were rebounds during this period (e.g., December 2nd, 9th), subsequent highs were lower (e.g., Dec 3rd high of 146.08 > Dec 13th high of 148.74), and rallies near highs were accompanied by high-volume stagnation, characteristic of Distribution or a continuation pattern within a downtrend.

- • Re-accumulation or Bear Market Rally (Early January 2026): Entering January, the price staged a rally from around 123.28, peaking at 148.74 on January 14th. However, the key point is that this rally occurred alongside volatility and volume dropping to historical extremes (see below) and failed to decisively break above the December highs.

- • Downtrend Resumption (Mid-to-Late January 2026): The price retreated from its January 14th high and, on January 20th, made a new low (126.30) with a "high-volume long black candle", formally signaling the end of the rally and the market's entry into a new decline phase, potentially the early stage of a "Panic Selling" phase within the downtrend.

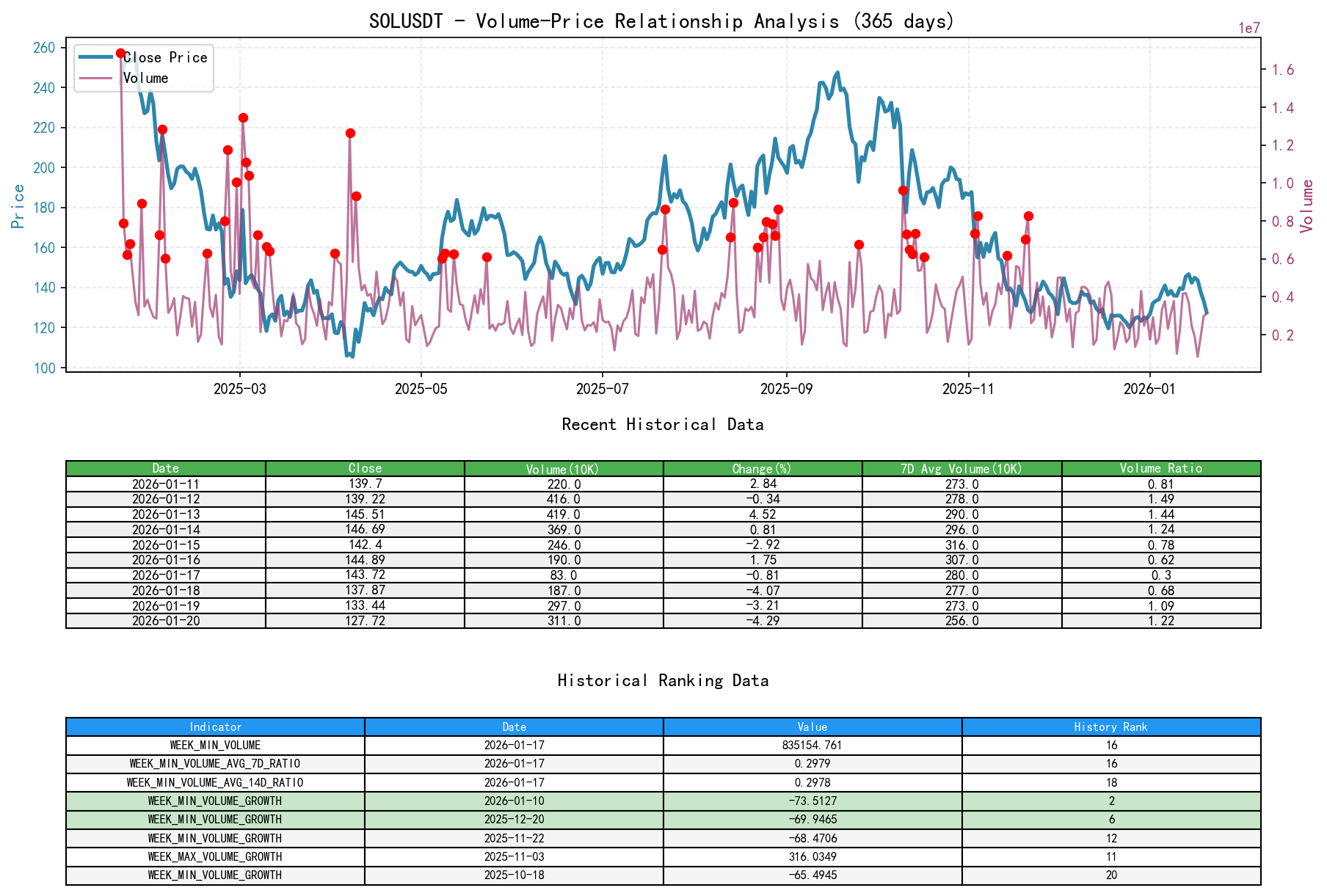

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset SOLUSDT had an opening price of 133.44, a closing price of 127.72, volume of 3114332.88, a daily change of -4.29%, volume of 3114332.88, a 7-day average volume of 2562614.32, and a 7-day volume ratio of 1.22.

- • Key Volume-Price Day Analysis:

- • High-Volume Advance (Demand Participation): 2025-11-24 (+6.02%, VOLUME_AVG_30D_RATIO=1.11), 2026-01-13 (+4.52%, VOLUME_AVG_30D_RATIO=1.55). These days showed attempts by demand to push prices higher.

- • High-Volume Stagnation/Decline (Supply Dominance): 2026-01-20 (-4.29%, VOLUME_AVG_30D_RATIO=1.23) is a decisive signal. The price making a new low accompanied by significantly higher volume clearly indicates that supply (selling pressure) overwhelmingly overpowered demand at the current level, a classic sign of panic selling.

- • Low-Volume Rally (Insufficient Demand): During the initial stages of the January 2026 rally (e.g., Jan 3rd, 4th), the gains were decent but volume was noticeably lower compared to prior averages (VOLUME_AVG_30D_RATIO < 0.8), suggesting the rally lacked broad buying support and was primarily driven by technical rebounds or short covering.

- • Supply-Demand Power Shift: Volume growth (VOLUME_GROWTH) data shows that during periods of market calm or minor rebounds (e.g., early January), volume shrank to extreme lows (Jan 10th, 17th). Historical ranking data confirms that the volume on January 17th (835,154) was the 16th lowest in nearly ten years, and the volume ratios to the 7-day and 14-day averages were also at historically extreme lows (ranks 16 and 18). This indicates that during the consolidation phase within the downtrend, trading activity was extremely thin, with both bulls and bears adopting a wait-and-see approach. The high-volume plunge on January 20th marked the sudden and forceful entry of supply into the market, breaking this fragile balance.

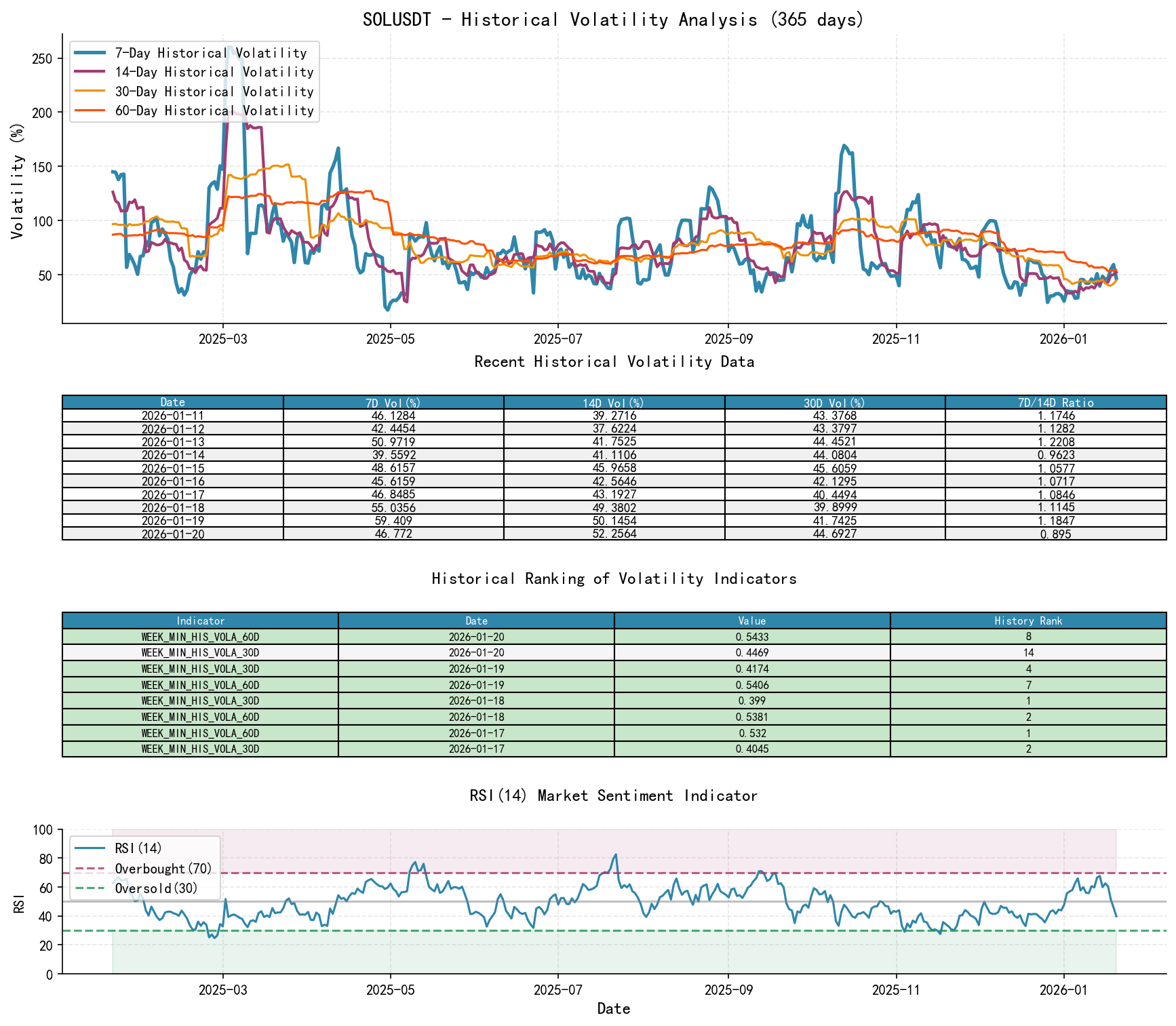

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset SOLUSDT had an opening price of 133.44, a 7-day intraday volatility of 0.48, a 7-day intraday volatility volume ratio of 0.95, a 7-day historical volatility of 0.47, a 7-day historical volatility volume ratio of 0.90, and an RSI of 39.83.

- • Volatility Levels and Historical Extremes: Volatility data reveals a critically important market state. In early January 2026, both the Parkinson intraday volatility and historical volatility, across their 14-day, 21-day, 30-day, and 60-day moving averages, fell to historically extreme lows for the past decade (multiple rankings in the top 20, some in the top 3). For example, the 14-day volatility ranks on January 2nd and 4th were the 3rd and 4th lowest. This indicates the market was in a state of extreme compression and highly convergent sentiment during the rally period, accumulating energy for a potential volatility expansion (i.e., a large price move).

- • Change in Volatility Structure: As of January 20th, the ratio of short-term volatility (7-day) to medium/long-term volatility (14-day, 21-day) (HIS_VOLA_RATIO_7D_14D=0.895, PARKINSON_RATIO_7D_14D=0.947) has begun to rise but has not yet formed the "short-term >> long-term" structure typical of a panic-driven spike. This suggests the market has just begun to awaken from its "extreme calm," with selling pressure spreading but not yet reaching the extreme level of emotional capitulation.

- • Overbought/Oversold Status: The RSI_14 closed at 39.83 on January 20th, in the weak zone but not yet in extreme oversold territory (<30). Combined with the high-volume breakdown, this suggests there may still be room for further decline. Market sentiment is shifting from观望 (observation) to pessimistic but has not yet reached the "capitulation" panic extreme.

4. Relative Strength and Momentum Performance

- • Momentum Cycle Analysis: Current momentum performance is extremely weak.

- • Short-term Momentum (WTD): -12.23%, the worst weekly performance recently, indicating extremely strong short-term selling momentum.

- • Medium-term Momentum (MTD): +2.46%, still positive, primarily due to the early-January rally. However, the recent week's sharp decline has nearly wiped out all monthly gains, and the momentum structure is already damaged.

- • Medium-to-Long-term Momentum (QTD, YTD): Both are +2.46%, showing that from a quarterly and annual perspective, the market turned positive only to be hit hard immediately, indicating a very fragile bullish foundation.

- • Conclusion: Momentum across all timeframes points to absolute dominance by the bears. The brief rally failed to reverse the long-term downtrend, and the current downward momentum is accelerating.

5. Large Investor ("Smart Money") Behavior Identification

- • Behavior Inference:

- 1. Low-Volatility Accumulation Attempt / High-Volatility Distribution in Early January? The extremely low volatility and volume in early January, combined with a mild price rebound, may reflect controlled, quiet accumulation by large investors at lower levels, attempting to test and establish initial positions. Alternatively, this could be a Bear Market Rally within a downtrend, where smart money used the liquidity vacuum to push prices higher in preparation for subsequent distribution.

- 2. High-Volume Selling on January 20th: Following the failed test of previous highs, the high-volume plunge clearly points to active selling by large suppliers. This could be: a) Stop-losses being triggered on positions (whether long or short covering) established during the earlier rally; b) Active shorting or distribution by bearish large institutions; c) Programmatic selling and leveraged liquidations triggered by the breach of key support levels.

- 3. Comprehensive Assessment: Based on the classic Wyckoff volume-price divergence of "low-volume rally, high-volume breakdown," coupled with volatility expansion from historical lows, the more likely scenario is: Smart money engaged in a failed re-accumulation or bounce operation during the market calm in the first half of January. Upon encountering strong resistance (the prior distribution zone), they quickly abandoned the effort and reversed to sell (or allow prices to fall), thereby triggering the panic selling (or a "shaking-out" to test lower-level demand) seen on January 20th. At the current stage, the supply side (bears/distributors) is in complete control.

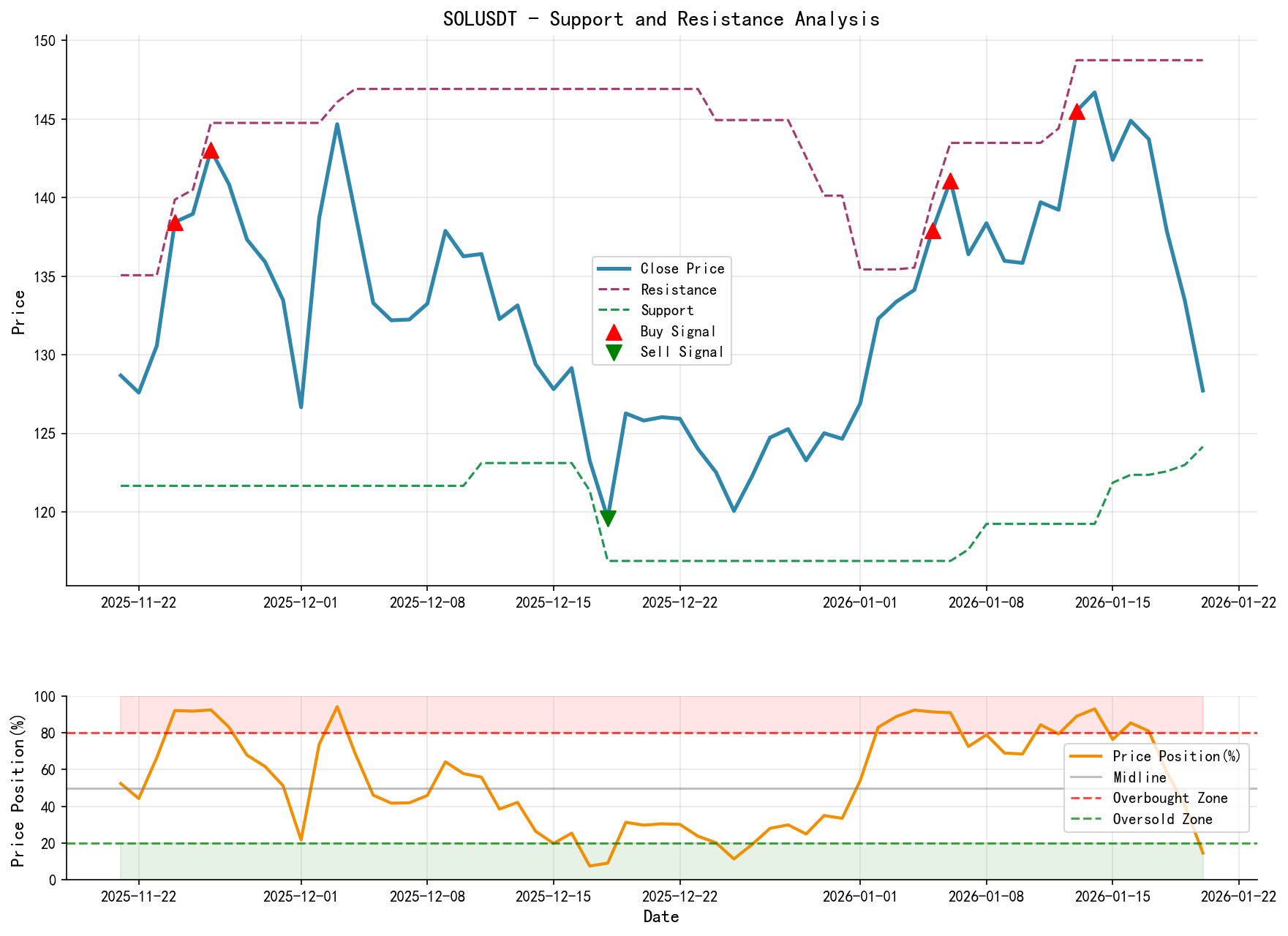

6. Support/Resistance Level Analysis and Trading Signals

- • Key Levels:

- • Nearest Support: 126.30 (intraday low on 2026-01-20). A break below this level opens the path towards 120.00 (the dense trading zone and low from late December 2025).

- • Major Resistance: The established resistance band is very clear.

- 1. 134.00 - 140.00: This area converges with multiple moving averages (MA_5D, MA_10D, MA_20D), forming a strong near-term resistance zone.

- 2. 146.73 - 148.74: The peak area of the mid-January rally, constituting the core resistance band. Any rally that fails to break above this area with significant volume should be considered a selling opportunity.

- • Wyckoff Composite Trading Signal:

- • Dominant Signal: Bearish. The market is in a downtrend and has just shown a high-volume breakdown signal indicating "supply overpowering demand."

- • Market Phase: Currently in the "Panic Selling" or "Continued Decline" phase of a downtrend.

- • Operational Suggestions:

- • Bearish Strategy (Primary): Wait for a price反弹 (rebound) towards the 134-140 resistance zone. If signs of stagnation appear (e.g., small-bodied candles, long upper shadows) without a significant increase in volume, it could be considered a shorting opportunity. An initial stop-loss can be placed above 148.75. Targets are 126.30, and upon breaking below that, 120.00.

- • Bullish Strategy (Counter-trend, High Risk): Bottom-fishing is not advisable at present. If the price falls to the 120.00 vicinity and shows signs of a "Spring Test" (a slight recovery after panic selling) or a "Secondary Test" with significantly reduced volume, aggressive traders may consider a light long position with a strict stop-loss below the new low.

- • Future Validation Points:

- 1. Bearish Validation: Price反弹 (rebound) fails to decisively突破 (break through) the 134-140 zone and experiences another high-volume decline below that area.

- 2. Bearish Invalidation/Trend Reversal Warning: Price breaks decisively above and holds above 148.75 with significant volume, accompanied by healthy volatility expansion and a修复 (repair) of the moving average system.

- 3. Bottom Formation Warning: Price exhibits a multi-stage testing structure of "high-volume止跌 (stop falling)-low-volume反弹 (rebound)" multiple times in the 120-126 region. Volume should be extremely high on down days (panic) and moderately higher on up days (demand absorption), while volatility recedes from high levels.

Summary: SOLUSDT is currently in a clear bearish trend. The rally in early January 2026 proved to be a demand-deficient "dead cat bounce." The market触顶 (reached a peak) at strong resistance and declared the resumption of the downtrend with a high-volume long black candle breakdown. Historical rankings indicate that the previously extremely low volatility and volume accumulated energy for this decline. The behavior pattern of large investors rapidly shifted from tentative accumulation/观望 (observation) to active selling or allowing prices to fall. The trading strategy should focus primarily on following the trend and shorting, with the key resistance zone being the ideal area for observation and entry. The market needs to show clear, multi-stage signs of a supply-demand structure转换 (shift) at lower levels (e.g., ~120) before any discussion of trend reversal can be considered.

Disclaimer: The content of this report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantees regarding its accuracy or completeness. The market carries risks, and investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff volume-price market interpretations are released promptly at 8:00 AM daily before the market open. Please feel free to leave comments and share; your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: