PPH Quantitative Analysis Report (Based on the Wyckoff Method)

Product Code: PPH

Analysis Date Range: November 21, 2025 - January 20, 2026

Report Generation Date: January 21, 2026

I. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset PPH had an opening price of 104.16, a closing price of 104.54, a 5-day moving average of 105.63, a 10-day moving average of 105.30, a 20-day moving average of 104.33, a daily change of -0.74%, a weekly change of -0.87%, a monthly change of 1.33%, a quarterly change of 1.33%, and a yearly change of 1.33%.

1. Moving Average Alignment and Trend Status:

- • Current Status (As of 2026-01-20): Exhibits a clear bearish alignment. The closing price

104.54is below all major moving averages (MA_5D:105.63,MA_10D:105.30,MA_20D:104.33,MA_30D:102.92,MA_60D:99.85). The price has broken below all short-term support levels. - • Recent Evolution: In early January 2026, the price successfully pulled the short-term moving averages (5-day, 10-day) above the medium- and long-term moving averages (20-day, 30-day, 60-day), forming a short-term bullish alignment and reaching a new high. However, since the high of

107.28on January 7th, the price has undergone consecutive pullbacks, causing the short-term moving averages to turn downward and successively form death crosses with the medium- and long-term moving averages, marking the end of the uptrend and the initiation of a downtrend.

2. Market Phase Inference (Based on Wyckoff Principles):

- • Late November to Early December 2025: The price rapidly corrected from a high of

103.21to a low of97.57(December 9th). Volume significantly expanded during the initial decline (December 1st,VOLUME_AVG_60D_RATIO: 1.71), followed by high-volume consolidation at the low (December 4th, 10th). This aligns with the characteristics of transitioning from a Distribution phase into a Markdown phase. - • Mid-December 2025 to Early January 2026: The price initiated a strong rebound from the

97.57low, successfully broke the previous high, and created a new high of107.28. This process was accompanied by a moderate expansion in volume (January 6th) and a repair of the moving average system. This constitutes a complete Secondary Test and Markup phase. - • Current (Mid to Late January 2026): The price has retreated from the new high, broken below key short-term moving averages, and shows weak rebound momentum. Combined with the volume-price analysis below, the current market is transitioning from the Markup phase to either a new Distribution phase or a test phase within the uptrend. However, the price's failure to quickly recover above the moving averages and the signs of expanding supply increase the likelihood of forming a Distribution Range.

II. Volume-Price Relationship and Supply-Demand Dynamics

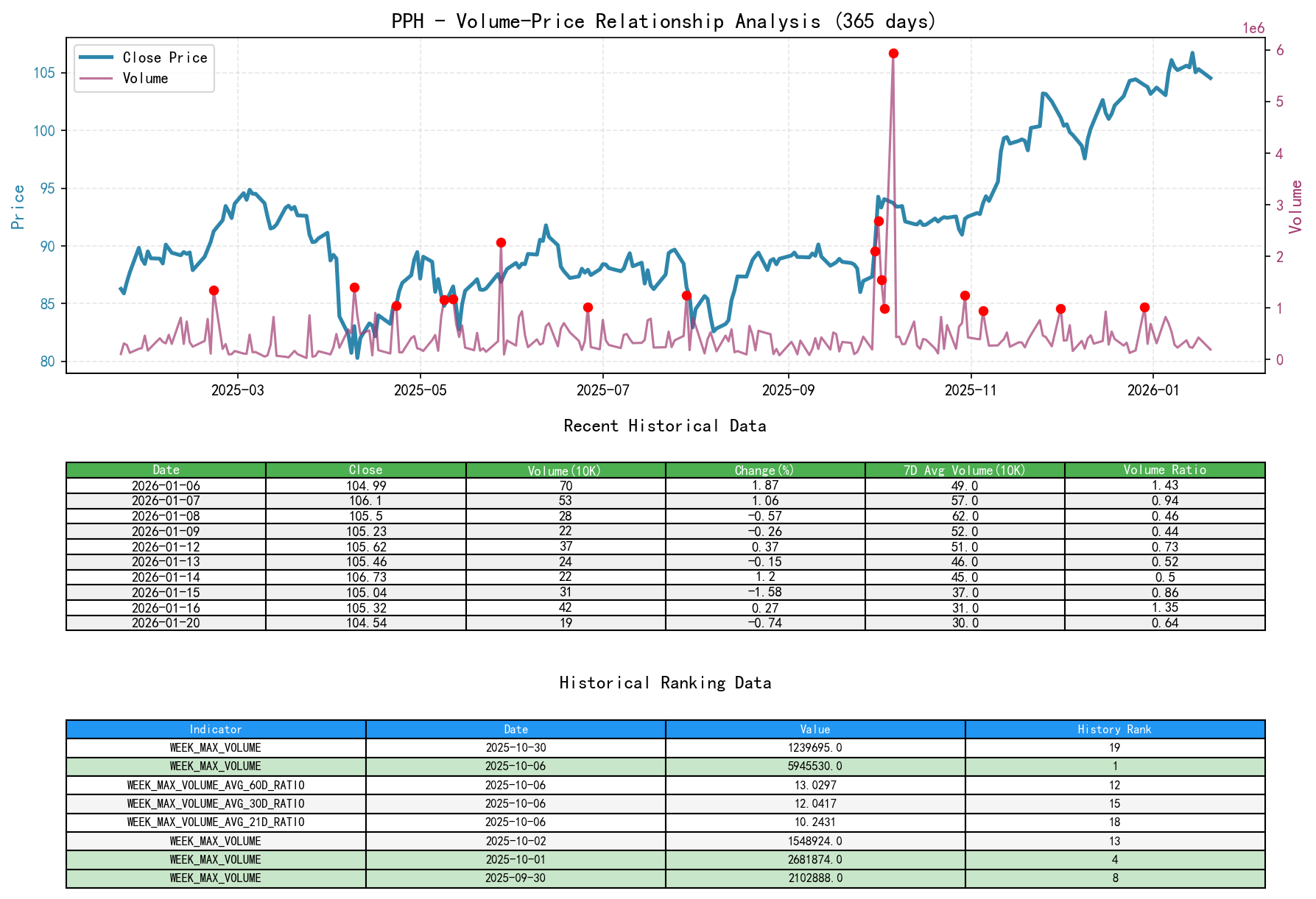

As of January 20, 2026, the underlying asset PPH had an opening price of 104.16, a closing price of 104.54, a volume of 191935, a daily change of -0.74%, a volume of 191935, a 7-day average volume of 300075.14, and a 7-day volume ratio of 0.64.

1. Key Volume-Price Event Analysis:

- • 2025-12-01 (High-Volume Decline): Price declined

-1.38%with a volume of993,863lots, which is1.71times the 60-day average. This is a typical high-volume decline at a high price level, indicating a massive emergence of supply (selling pressure) and an inability of demand (buying interest) to absorb it, serving as a strong warning signal for a trend reversal. - • 2026-01-07 (New High on Low Volume): The price reached a new cycle high of

107.28, closing at106.10, but the daily volume was only537,304lots, merely0.94times the 7-day average. This is a significant divergence indicating price rising with weakening demand (exhaustion of demand). According to Wyckoff theory, this is a sign that large investors may be ceasing purchases or even beginning distribution in the top area. - • 2026-01-15 (Breakdown on Volume): Price declined

-1.58%with a volume of318,086lots (VOLUME_AVG_7D_RATIO: 0.86). While not extremely high, its occurrence as the price fell from the high and broke below short-term support confirmed the persistence of supply. - • 2026-01-20 (Low-Volume Drift Lower): Price declined

-0.74%with volume sharply contracting to191,935lots, only0.42times the 60-day average. This significant contraction in volume during a decline indicates: ① Panic selling has temporarily subsided; ② However, active buying demand is also extremely scarce, and the market has entered a wait-and-see mode. This is a signal of "consolidation" or "no-demand decline" within the trend development.

2. Supply-Demand Power Transition Summary:

- • At the end of the recent uptrend (

97.57->107.28), demand clearly exhausted (January 7th new high on low volume). - • The market turning point was dominated by expanding supply (high-volume decline days in early January).

- • The current market is in a phase controlled by supply but with temporarily easing selling pressure; demand has not yet shown signs of organized re-entry.

III. Volatility and Market Sentiment

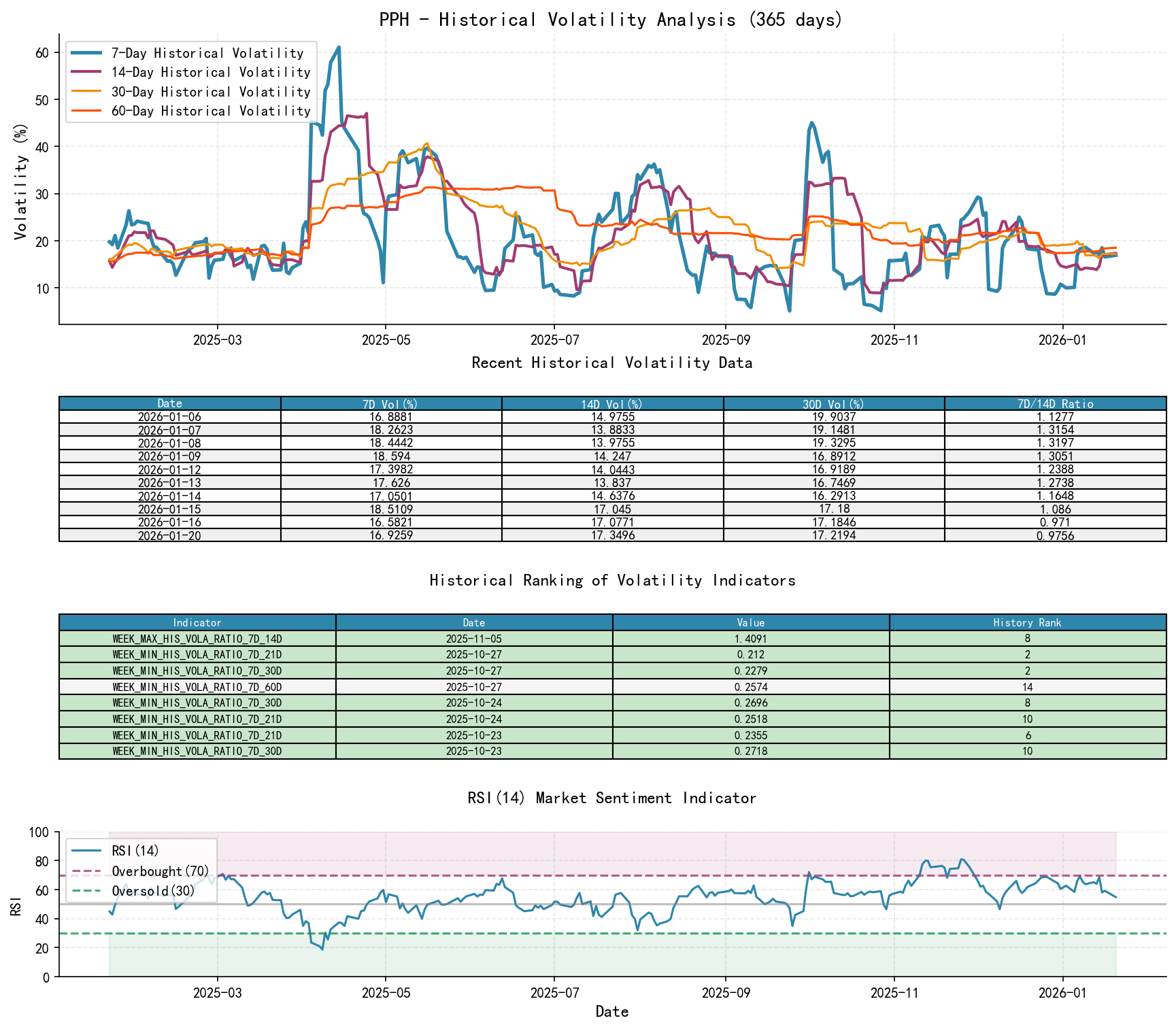

As of January 20, 2026, the underlying asset PPH had an opening price of 104.16, a 7-day intraday volatility of 0.15, a 7-day intraday volatility ratio of 0.97, a 7-day historical volatility of 0.17, a 7-day historical volatility ratio of 0.98, and an RSI of 54.87.

1. Volatility Analysis:

- • Absolute Level: The recent Parkinson intraday volatility (

PARKINSON_VOL_7D: 0.152) and historical volatility (HIS_VOLA_7D: 0.169) are at a medium level within the analysis period but are higher than the 60-day long-term volatility benchmarks (PARKINSON_VOL_60D: 0.150,HIS_VOLA_60D: 0.185), indicating a slight short-term increase in volatility. - • Relative Change: A key signal appeared on 2026-01-12, with

PARKINSON_RATIO_7D_14Dreaching1.423. Historical ranking data shows this value ranks 16th over the past 10 years, which is significantly high. This means that in early January, short-term volatility was abnormally higher than medium-term volatility, typically corresponding to panic/excitement at trend acceleration or major turning points, which highly coincides with the timing of the price peak. - • Current Status: As of January 20th, the short-term volatility ratio (

PARKINSON_RATIO_7D_14D: 0.968) has retreated to around 1, indicating that market sentiment has cooled from extremes and volatility has converged.

2. Overbought/Oversold Status:

- • RSI_14 reached

80.92on the price peak day (2025-11-25,103.21), ranking as the 2nd highest over the past 10 years, confirming that the market was severely overbought at that time, laying the groundwork for the subsequent correction. - • The current RSI is

54.87, having retreated from the overbought zone to a neutral area, indicating that the previous extreme optimism has been released. The RSI has not entered the oversold zone (<30), suggesting that the downward momentum may not be fully exhausted.

IV. Relative Strength and Momentum Performance

- • Short-Term Momentum (WTD): The weekly return as of January 20th is

-0.87%, momentum has turned negative, confirming the short-term correction pattern. - • Medium-Term Momentum (MTD/QTD/YTD): The monthly, quarterly, and year-to-date returns are all positive (

1.33%,1.33%,1.33%), but the main gains were concentrated in the rapid rise in early January. The recent correction has eroded most of the monthly gains. - • Momentum Conclusion: Short-term momentum has significantly weakened and turned negative. While medium-term momentum remains, its structure has been compromised. Momentum analysis is consistent with the conclusions from trend and volume-price analysis: the short-term uptrend has ended, and the market has entered a correction.

V. Identification of Large Investor ("Smart Money") Behavior

Based on a synthesis of the above dimensions, the intent of large investors is inferred as follows:

- 1. Significant Distribution Behavior:

- • Location: Occurred as the price reached near-decade highs (multiple indicators such as highest price and closing price entered the top 20 historical rankings) and the RSI reached an extreme overbought area ranking 2nd highest over the past decade.

- • Methodology: Initially manifested as exhaustion-of-demand rallies (January 7th, new high on low volume), a typical signal that smart money has stopped chasing highs or even begun operating in reverse. This was followed by expanding-supply declines (high-volume bearish candles in early January), indicating distribution behavior shifting from covert to overt.

- • Data Corroboration: Historical rankings show that in mid-to-late December 2025,

AVERAGE_VOLUME_60Drepeatedly hit near-decade record highs (occupying many spots in the top 20 rankings). This indicates that the most active trading in nearly a decade occurred during the high-price, wide-range consolidation. Combined with the price's failure to sustain the rise, this strongly aligns with the Wyckoff "Distribution Range" characteristic—large investors distributing holdings to retail participants amid active trading.

- 2. Current Behavior: Observation and Testing

- • The recent extreme contraction in volume (January 20th) indicates that large investors are neither engaged in large-scale selling (no panic) nor active buying (no demand). They are likely observing the market's reaction at key support levels or waiting for more favorable price levels for their next move (which could be further distribution or beginning new accumulation after a deeper correction).

VI. Support/Resistance Level Analysis and Trading Signals

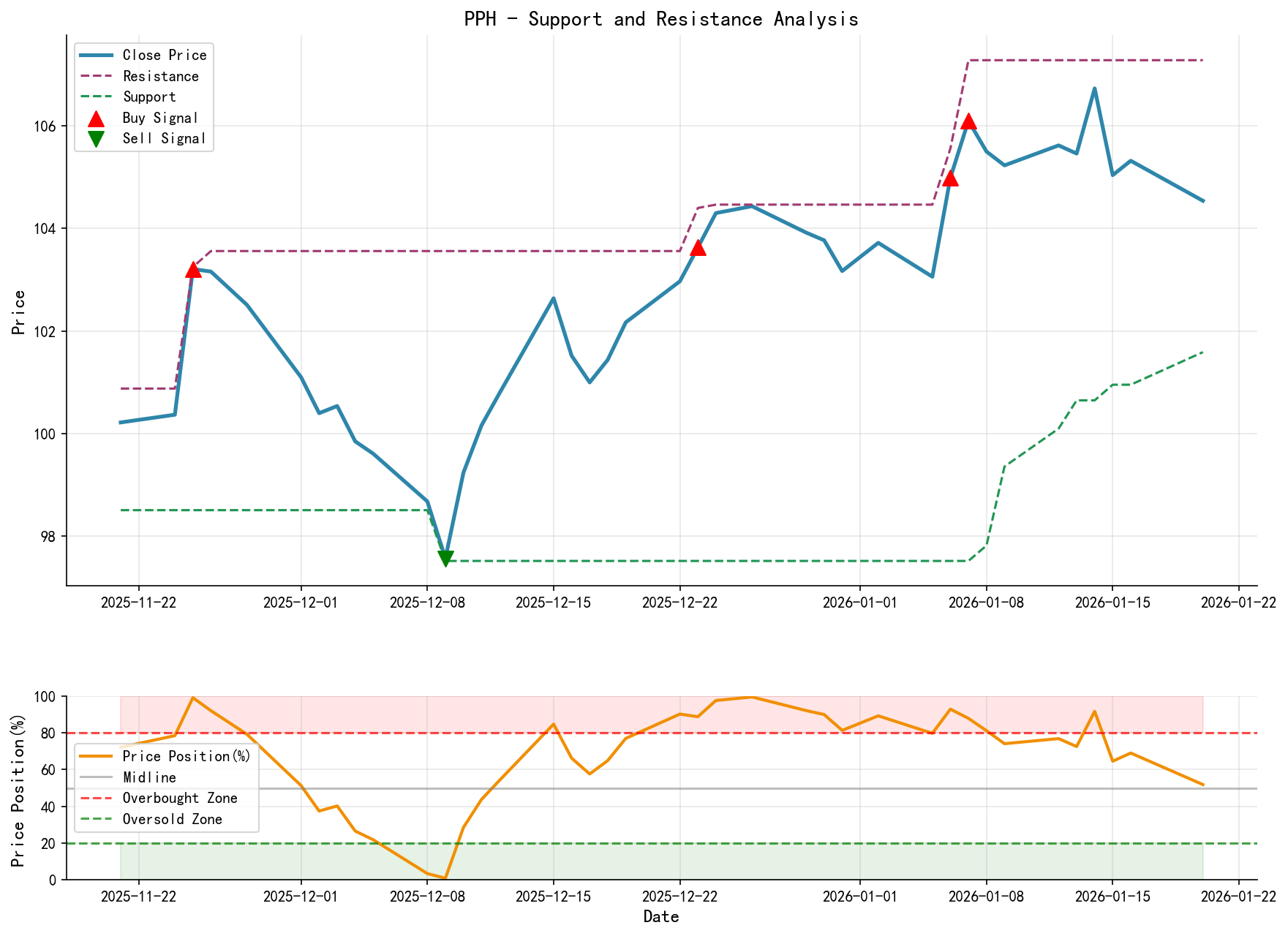

1. Key Price Levels:

- • Immediate Resistance:

106.74(January 14th high),107.28(January 7th high / ultimate resistance of this rally). - • Immediate Support:

103.48(January 20th low),102.44(January 5th low). - • Medium-Term Strong Support: The

97.50area (the December 2025 low area, also where the rising 60-day moving average is approaching).

2. Comprehensive Trading Signals and Operational Recommendations:

Current Primary Signal: Bearish/Wait-and-See (Biased towards shorting on rebounds).

- • Market Positioning: The market has completed a full cycle of markup-distribution and is currently in the initial markdown phase or test phase following distribution. The main contradiction is supply control and lack of demand.

- • Operational Recommendations:

- 1. Aggressive Strategy (Shorting Highs): If the price experiences a low-volume rebound approaching the

105.50area (near the previous minor consolidation level and the descending 5/10-day MAs) or the106.00area, and again shows signs of weak upward momentum and contracting volume, it could be viewed as a secondary distribution opportunity, considering a light short position. Set a stop-loss above107.30. - 2. Cautious Strategy (Wait-and-See): It is recommended to maintain a core position of cash. The current low-volume drift lower is not a safe timing for long positions. Wait for one of the following two signals:

- • Supply Exhaustion Signal: Price declines to the strong support zone (e.g.,

97.50-100.00) and exhibits high-volume stabilization after panic selling (Spring) or a subsequent test (UT/ST) following extreme volume contraction, at which point long opportunities can be evaluated. - • Strong Demand Re-entry Signal: Price recaptures

105.50and even106.74with significantly expanded volume, leading short-term moving averages to form golden crosses again. This would potentially negate the distribution hypothesis, requiring a reassessment of the trend.

- • Supply Exhaustion Signal: Price declines to the strong support zone (e.g.,

- 1. Aggressive Strategy (Shorting Highs): If the price experiences a low-volume rebound approaching the

3. Future Validation Points:

- Confirming the Bearish View: Price rebounds weakly and breaks below the 103.48 and 102.44 support levels on volume, moving towards the next targets of the 100.00 psychological level and the 97.50 area.

- Invalidating the Bearish View: Price stabilizes in the 103.00-104.00 area and shows consecutive days of rising prices on expanding volume, quickly recovering 105.50, forming a Wyckoff "accumulation at a support level after decline" structure. This would suggest the market may shift to high-level consolidation rather than direct decline.

Disclaimer: All conclusions in this report are derived from quantitative analysis of the provided historical data and Wyckoff principle deduction and do not constitute any investment advice. Markets involve risks; invest with caution. Users of this report should make independent judgments and are responsible for their own investment decisions.

Thank you for your attention! Wyckoff Volume-Price market interpretation is released daily before market open at 8:00 AM. Your comments and shares are sincerely appreciated. Let's work together to see the market signals clearly.

Member discussion: