Understood. Following your instructions. As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive and in-depth quantitative analysis report based on the POOL (Pool Corporation) data you have provided.

POOL Wyckoff Volume-Price Analysis Report

Product Code: POOL

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset POOL has an opening price of 262.24, a closing price of 260.69, a 5-day moving average of 264.28, a 10-day moving average of 252.91, a 20-day moving average of 242.15, a daily change of -2.72%, a weekly change of -0.49%, a monthly change of +13.96%, a quarterly change of +13.96%, and a year-to-date change of +13.96%.

Based on moving average and price action analysis, POOL has undergone a complete transition over the past approximately two months, from "Panic Selling" to "Accumulation", and finally entering a phase of "Strong Markup / Possible Initial Distribution".

- • Bullish/Bearish Alignment:

- • Initial State (2025-11-21):

Price(239.98) < MA_5D(236.90) < MA_10D(243.61) < MA_20D(257.85) < MA_30D(269.99) < MA_60D(292.32). All moving averages are in a bearish alignment with a steep downtrend, confirming the market was in a strong downtrend. - • Evolution: The price repeatedly tested lows in the 230-233 USD range during December 2025, accompanied by significantly increased volume (e.g., 1.1 million shares on Dec-19). Subsequently, the price bottomed on January 2, 2026 (229.71) and rebounded, successively breaking through the moving averages.

- • Current State (2026-01-20):

Price(260.69) > MA_20D(242.15) ≈ MA_30D(240.90) > MA_10D(252.91) > MA_5D(264.28) < Price. Key Signal: MA_20D has crossed above MA_30D to form a golden cross, and the price is firmly above MA_20D and MA_30D. MA_5D and MA_10D maintain a bullish alignment, but the price has retreated below MA_5D. This indicates that the long-term bearish alignment has been broken, and the market has entered a pullback phase following the uptrend. MA_60D (248.74) is still above the current price but has been broken and is now acting as support.

- • Initial State (2025-11-21):

- • Market Phase Inference (Wyckoff Framework):

- 1. Panic Selling and Automatic Rally (Late Nov to Early Dec 2025): The price fell continuously from its highs, with YTD returns reaching a low of -32.91% (2025-12-31), accompanied by several instances of high-volume declines (e.g., Nov-24, volume of 3.86 million shares, ranking 4th highest single-day volume in nearly a decade), consistent with panic selling characteristics. This was followed by a technical rebound, but the initial rally lacked volume (e.g., Dec-26).

- 2. Secondary Test and Accumulation (Mid to Late Dec 2025): The price formed a narrow consolidation range between 230-233, with concentrated high volume (multiple

AVERAGE_VOLUME_21/30Dindicators ranked within the top 20 over nearly a decade), yet the price refused to decline further. This suggests strong demand (buying) absorbed the panic selling at the lows, aligning with institutional accumulation behavior. TheRSI_14rebounded after touching the oversold zone of 32-34 in late December, validating the sentiment low. - 3. Strong Markup (Early to Mid Jan 2026): The price broke out of the consolidation range and all short-to-medium-term moving averages on increased volume, showing the ideal pattern of rising price with rising volume. Particularly on January 12, the volume surged to 1.5 million shares (ranking 12th highest single-day in nearly a decade) with a strong price advance, indicating complete dominance by demand.

- 4. Initial Distribution Signal or Natural Pullback (2026-01-20): After reaching a recent high of 267.99, the price exhibited a "high-volume decline" on Jan-20 (volume 995k vs. 30-day average of 727k, ratio 1.37; PCT_CHANGE -2.72%). This is the first clear sign of expanded supply following the uptrend, warranting caution for a potential transition to a distribution phase or a natural correction within the uptrend.

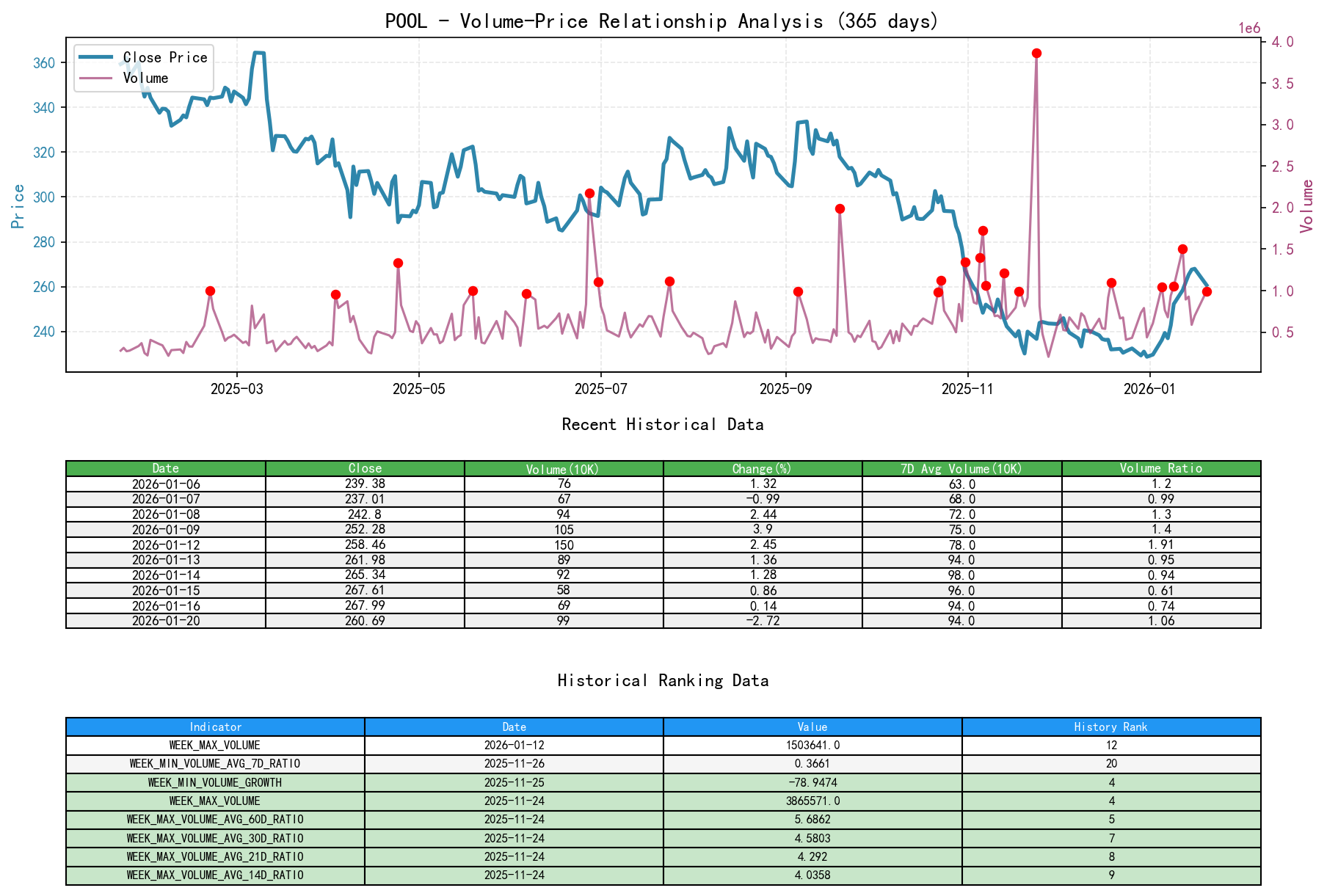

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset POOL has an opening price of 262.24, a closing price of 260.69, volume of 994,587, a daily change of -2.72%, volume of 994,587, a 7-day average volume of 942,596.14, and a 7-day volume ratio of 1.06.

The volume-price relationship clearly reveals a dramatic shift in supply and demand forces:

- • Supply-Dominated Period (Nov-Dec 2025):

- • 2025-11-24: Volume exploded by 322.79% (

VOLUME_GROWTH), with a single-day volume of 3.86 million shares (WEEK_MAX_VOLUMEranking 4th), yet the price fell 1.36%. This is a classic high-volume decline, indicating exceptionally strong and panicked supply (selling pressure). - • 2025-12-19: Volume was 1.1 million shares (

VOLUME_AVG_30D_RATIO1.31), the price fell 1.84% and closed near the day's low, characteristic of a Selling Climax near the end of the decline.

- • 2025-11-24: Volume exploded by 322.79% (

- • Demand Emergence and Dominance (Late Dec 2025 to Mid Jan 2026):

- • 2026-01-02: The price rose 0.42%, but the volume (606k) was only on par with the 7-day average (

VOLUME_AVG_7D_RATIO1.02), indicating a low-volume rally and insufficient initial demand. - • Key Turning Point 2026-01-05: The price surged 2.85% on volume of 1.045 million shares, 1.79 times the 7-day average. This is a Sign of Strength (high-volume advance), confirming that demand began entering the market in large scale.

- • Demand Acceleration 2026-01-09 & 01-12: Consecutive high-volume advances (

VOLUME_AVG_30D_RATIO1.62 and 2.29 respectively), with strong price breakouts. Notably on 01-12, the volume ratio to the 14-day average was as high as 2.04, a signal of extremely strong demand.

- • 2026-01-02: The price rose 0.42%, but the volume (606k) was only on par with the 7-day average (

- • Supply Re-emergence (2026-01-20):

- • Current Key Day: The price fell 2.72% on volume of 995k shares, 1.37 times the 30-day average (

VOLUME_AVG_30D_RATIO). This high-volume decline indicates that at relatively higher levels, supply has re-emerged and suppressed the price. This could be the first sign of distribution after the rally or a natural pullback due to profit-taking, requiring further observation.

- • Current Key Day: The price fell 2.72% on volume of 995k shares, 1.37 times the 30-day average (

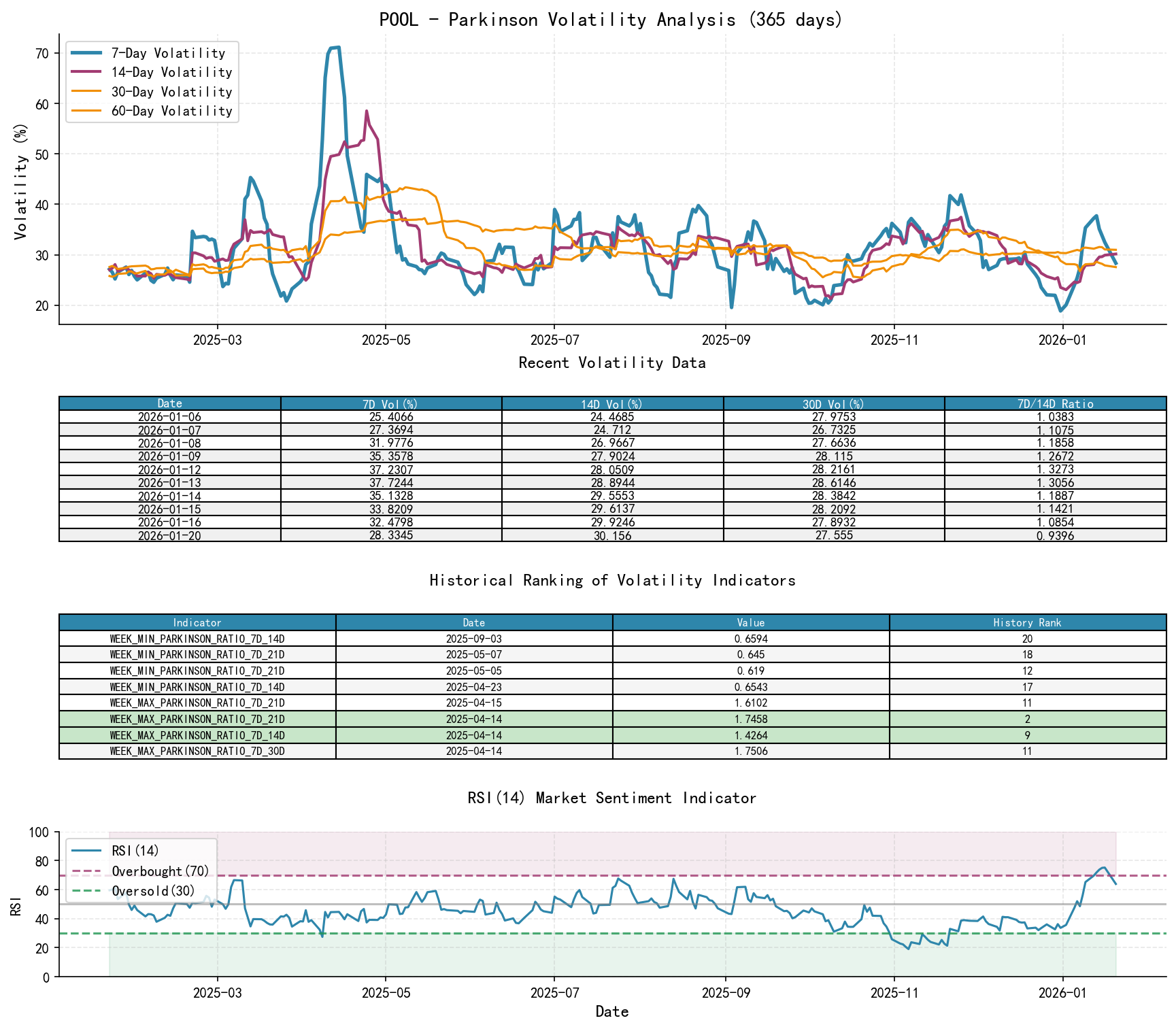

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset POOL has an opening price of 262.24, a 7-day Parkinson volatility of 0.28, a 7-day Parkinson volatility ratio of 0.94, a 7-day historical volatility of 0.39, a 7-day historical volatility ratio of 1.18, and an RSI of 63.95.

Volatility data precisely captures the process of market sentiment shifting from a trough, warming up, boiling, to developing doubts:

- • Sentiment Trough and Compression (Late Dec 2025):

HIS_VOLA_7DandPARKINSON_VOL_7Ddropped to lows (0.13-0.16) in late December, whilePARKINSON_RATIO_7D_60Dfell below 0.8, indicating short-term volatility was significantly lower than long-term levels. This shows extremely depressed market sentiment and a state of volatility compression at the end of a trend. - • Sentiment Warming and Trend Initiation (Early Jan 2026): As the price rose, short-term volatility rapidly expanded.

HIS_VOLA_RATIO_7D_30Dsurged from 0.58 on Jan 2 to 1.34 on Jan 9, indicating short-term volatility far exceeded the medium-term average, signaling a shift in sentiment from depression to excitement and trend acceleration. - • Sentiment Euphoria (Mid Jan 2026): The

RSI_14reached the overbought zone of 75.25 on Jan 15, confirming short-term market sentiment was overheated. - • Sentiment Showing Signs of Panic (2026-01-20): On the day of the price pullback,

HIS_VOLA_7D(0.39) jumped aboveHIS_VOLA_14D(0.33), with a ratio of 1.18. Meanwhile, the ratio ofPARKINSON_VOL_7D(0.28) to long-term volatility remained relatively healthy. This indicates abnormal expansion in short-term historical volatility due to the decline, suggesting the emergence of doubt or panic in the market, but the actual intraday price fluctuations did not show a corresponding abnormal expansion.

4. Relative Strength and Momentum Performance

Momentum indicators perfectly corroborate the trend and phase transition:

- • Long-Term Weakness: By the end of the analysis period,

TTM_36,TTM_24, andTTM_12returns were significantly negative (-25% to -26%), indicating POOL has been in a long-term weak position over the past 1-3 years. - • Short-Term Momentum Reversal: The key change occurred in January 2026. The

YTDreturn reversed sharply from -32.91% on December 31 to +13.96% on January 20. TheMTD(Month-to-Date) return for January is as high as +13.96%. TheWTD(Week-to-Date) return reached 9.83%-11.95% during the period of Jan 12-16 but turned to -0.49% by the week of Jan 20. Conclusion: Short-term momentum has been extremely strong, but signals of momentum deceleration have appeared in the most recent week, echoing the high-volume price pullback.

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff events and volume-price analysis, the operational path of large investors is clearly discernible:

- 1. Accumulation (Accumulation): In December 2025, when the price oscillated in the 230-233 zone, significant volume accumulation occurred (multiple

AVERAGE_VOLUMEindicators ranked high historically). Smart money utilized market panic to quietly absorb retail selling pressure in this zone, manifesting as "high-volume price stabilization." The high-volume panic bar on December 19 was likely the Terminal Shakeout of the accumulation phase. - 2. Aggressive Position Building and Markup (Markup): The consecutive high-volume bullish candles on January 5, 9, and 12, 2026, are signs of smart money openly and forcefully driving the price higher after completing accumulation. The huge volume of 1.5 million shares on Jan 12 (12th highest in nearly a decade) is a typical signal of large capital entry, aimed at attracting trend followers.

- 3. Initial Distribution or Profit Taking (Initial Distribution/Profit Taking): The high-volume bearish candle on Jan 20 is the first clear warning signal since the rally began. Smart money may be engaging in the following at this level:

- • Partial Profit-Taking: Realizing profits on low-cost positions at higher levels.

- • Testing Market Reaction: Observing the strength of market demand (whether follow-up buying is sufficient) during the pullback.

- • If distribution is beginning, subsequent price action should show "low-volume rallies and high-volume declines."

Core Inference: Smart money successfully completed accumulation in the 230-233 zone and initiated a strong markup rally in January. The current price level (~260) is a zone where they may begin initial distribution or profit management.

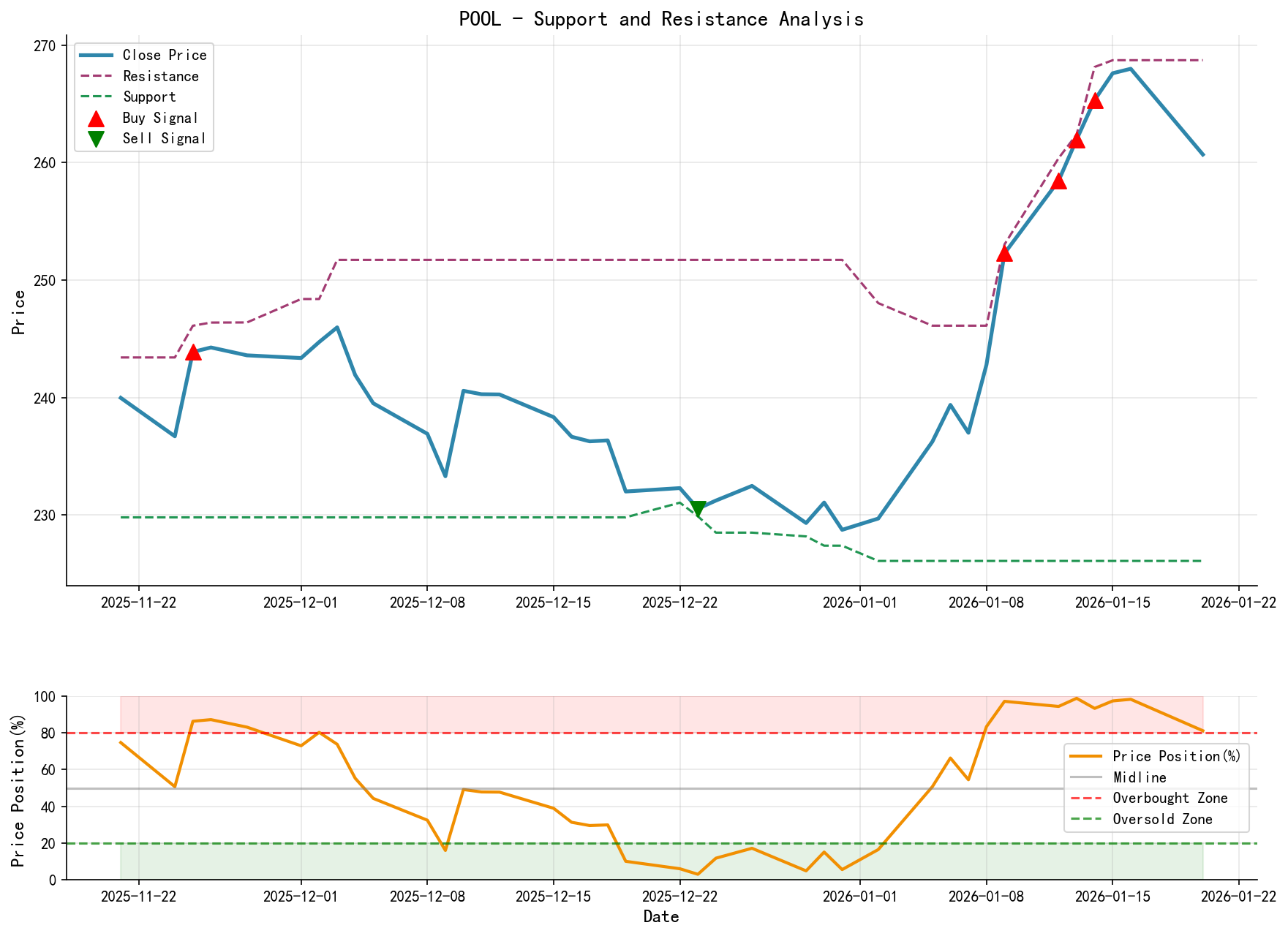

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- 1. Primary Support: 255-260 Zone. This is the convergence area of the recently broken MA_20D/MA_30D moving averages and the lower boundary of the Jan 16-20 consolidation range. If the pullback reaches this zone and shows low-volume stabilization (demand recovery), it would be a healthy correction.

- 2. Ultimate Support: 230-233 Zone. The upper boundary of the previous accumulation range and a price congestion zone. A breakdown below this zone would invalidate the entire accumulation-markup logic.

- • Key Resistance Levels:

- 1. Near-Term Resistance: 268-270 Zone. The recent highs established on Jan 15-16. Breaking through this zone requires renewed high-volume confirmation.

- 2. Psychological Resistance: 280-285 Zone. Corresponds to a previous platform consolidation area during the decline in November 2025.

- • Comprehensive Wyckoff Trading Signals:

- • Medium to Long-Term Signal: Bullish. Because a complete accumulation structure and demand-dominated markup have been observed.

- • Short-Term Signal: Cautious/Waiting for Demand Recovery Signal. Because the first sign of expanded supply through a high-volume pullback has appeared, suggesting a potential short-term transition to distribution or correction.

- • Specific Action Recommendations and Validation Points:

- • For Observers / Those Waiting to Enter: It is advisable to wait for a price pullback to the 255-260 support zone and observe for the following demand recovery signals:

- •

- 1. Significantly diminished volume (e.g.,

VOLUME_AVG_7D_RATIO< 0.8), indicating selling exhaustion.

- 1. Significantly diminished volume (e.g.,

- •

- 2. A "Spring" or "Test": Price dips slightly below support and quickly recovers on low volume.

- •

- 3. A subsequent high-volume bullish candle confirming demand's return.

- • Ideal Entry Point: Around 260, upon observing the aforementioned low-volume stabilization signals.

- • Initial Stop-Loss: Set below the lower boundary of the 230-233 accumulation zone (e.g., 228).

- •

- • For Existing Holders: The 255-260 zone can serve as a reference for partial profit-taking or moving stop-losses. If the price breaks below this zone on high volume, consider significantly reducing the position to protect profits.

- • Future Validation Points:

- • Bullish Validation: After stabilizing on low volume at the support level, the price breaks above the 268-270 high on renewed high volume.

- • Bearish Validation: On a rebound to the 268-270 zone, signs of high-volume price stagnation or long upper shadows (re-emerging supply) appear, or the price directly breaks below the 255-260 support zone on high volume. This would confirm that a distribution phase may have begun.

- • For Observers / Those Waiting to Enter: It is advisable to wait for a price pullback to the 255-260 support zone and observe for the following demand recovery signals:

Disclaimer: The content of this report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. Markets involve risks, and investments require caution. Any investment actions based on this report are undertaken at one's own risk.

Thank you for your attention! Daily Wyckoff Volume-Price Market Analysis is published punctually at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let us work together to see the market signals clearly.

Member discussion: