Understood. As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive and in-depth quantitative analysis report based on the provided POLUSDT data and its historical rankings.

Quantitative Analysis Report on POLUSDT (Wyckoff Method)

Product Code: POLUSDT

Analysis Period: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, for the underlying asset POLUSDT: Opening Price 0.14, Closing Price 0.13, 5-Day Moving Average 0.14, 10-Day Moving Average 0.15, 20-Day Moving Average 0.14, Daily Change -3.89%, Weekly Change -16.77%, Monthly Change +30.35%, Quarterly Change +30.35%, Year-to-Date Change +30.35%.

- • Trend Status and Moving Average Alignment:

- • Long-term Trend (MA_60D, MA_30D): Throughout the analysis period, the price (CLOSE) has consistently remained below all major moving averages (MA_5D to MA_60D), presenting a clear and robust bearish alignment. The MA_60D declined steadily from 0.19591 to 0.12556, confirming the long-term downtrend.

- • Medium-term Trend (MA_20D, MA_10D): Despite a strong price rebound in early January 2026, the rebound high (0.1775) was effectively suppressed by the MA_20D and MA_30D. As of January 20, the price (0.1310) has fallen below all moving averages again, indicating the medium-term bearish structure remains intact.

- • Short-term Signal (MA_5D): During the rebound in early January 2026, a brief Golden Cross occurred (MA_5D crossing above MA_20D). However, the price failed to sustain its strength post-cross. The MA_5D quickly reversed downward and fell to 0.14266 by January 20, confirming the exhaustion of rebound momentum and a return to short-term weakness.

- • Market Phase Inference (Based on Wyckoff Theory):

- 1. Panic Selling and Preliminary Accumulation (Late November - December 2025): The price experienced a sharp, high-volume decline on December 1st (-9.86%, VOLUME_AVG_7D_RATIO=2.10), reaching a new phase low (0.1198). Subsequently, on December 18th, another high-volume panic sell-off (VOLUME_AVG_30D_RATIO=1.97) drove the price to its lowest point of 0.1035. According to Wyckoff theory, such a "Selling Climax" (SC) accompanied by massive volume often signals large investors accumulating positions.

- 2. Natural Rally and Secondary Test (Early January 2026): Starting from the low of 0.1005 (December 31st), the price launched a rapid, high-volume "Jump across the Creek" (JAC) style rally on January 9-10 (daily gains of 14.64% and 13.93%). The trading volume during this phase reached historical peaks ranking 1st (January 10) and 5th (January 9) in the past 10 years (WEEK_MAX_VOLUME), indicating extremely strong demand. Subsequently, the price failed to continue rising on January 11-12 and experienced high-volume declines. This can be viewed as a "Secondary Test" (ST) of the prior rally, testing whether supply has been exhausted.

- 3. Distribution and Resumption of Downtrend (Mid-January 2026 to Present): Following the secondary test, subsequent price highs were lower (0.1775 -> 0.1642 -> 0.1574 -> 0.1555), accompanied by significantly diminished volume (VOLUME_AVG_14D_RATIO=0.37 on January 20). This "lower highs with diminishing volume" divergence aligns with the characteristics of the Wyckoff "Distribution" phase, suggesting waning demand, renewed supply dominance, and a resumption of the original downtrend.

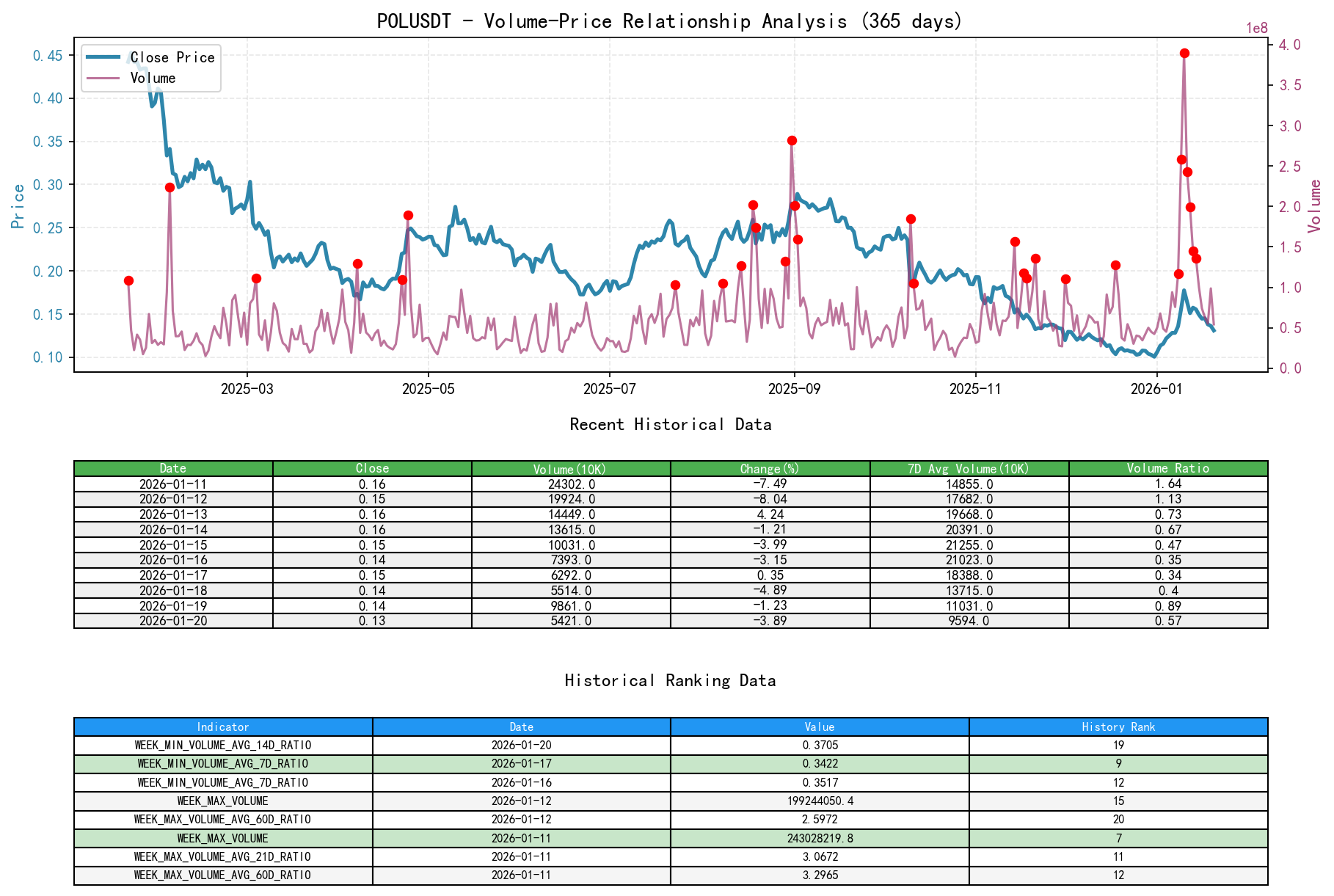

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, for the underlying asset POLUSDT: Opening Price 0.14, Closing Price 0.13, Volume 54210692.60, Daily Change -3.89%, Volume 54210692.60, 7-Day Average Volume 95941788.61, 7-Day Volume Ratio 0.57.

- • Key Supply-Demand Transition Points:

- 1. Supply Dominance (Panic Selling): 2025-12-01: The price plunged -9.86%, with volume surging to 2.10 times its 7-day average. The single-day volume growth (VOLUME_GROWTH) reached 310.24%, ranking as the 2nd highest in the past 10 years. This is a classic supply-dominated event, yet extreme volume also hints at potential selling exhaustion.

- 2. Demand Dominance (Strong Rally): 2026-01-09/10: Prices rose 14.64% and 13.93% respectively, with volume setting consecutive historical records. The ratios of volume to its 14, 21, 30, and 60-day averages (VOLUME_AVG_*D_RATIO) all ranked within the top 3 historically, indicating overwhelming demand entering the market.

- 3. Supply Re-emergence (Distribution Signal): 2026-01-11: Price advance stalled (closing down only -7.49% but with a large intraday range), while volume remained high at 2.45 times its 14-day average. This is a typical "high-volume stagnation" or "high-volume decline," indicating significant supply (selling pressure) emerged at high price levels that demand could not absorb.

- 4. Demand Contraction (Trend Confirmation): 2026-01-13 to 01-20: The price drifted lower beneath the rally highs on diminishing volume, quickly falling well below its moving averages across periods (e.g., VOLUME_AVG_14D_RATIO=0.37 on Jan 20, ranking as the 19th lowest historically). This "low-volume decline" suggests extremely weak demand and a lack of buying support.

- • Quantitative Conclusion on Supply-Demand Strength:

The data shows that POLUSDT experienced a historically rare, extreme demand-driven rebound in early January 2026 (volume metrics hit record levels). However, the volume-price structure deteriorated rapidly post-rally, indicating demand was exhausted in the short term, while supply (selling pressure) regained dominance. The current market is in a state of supply exceeding demand.

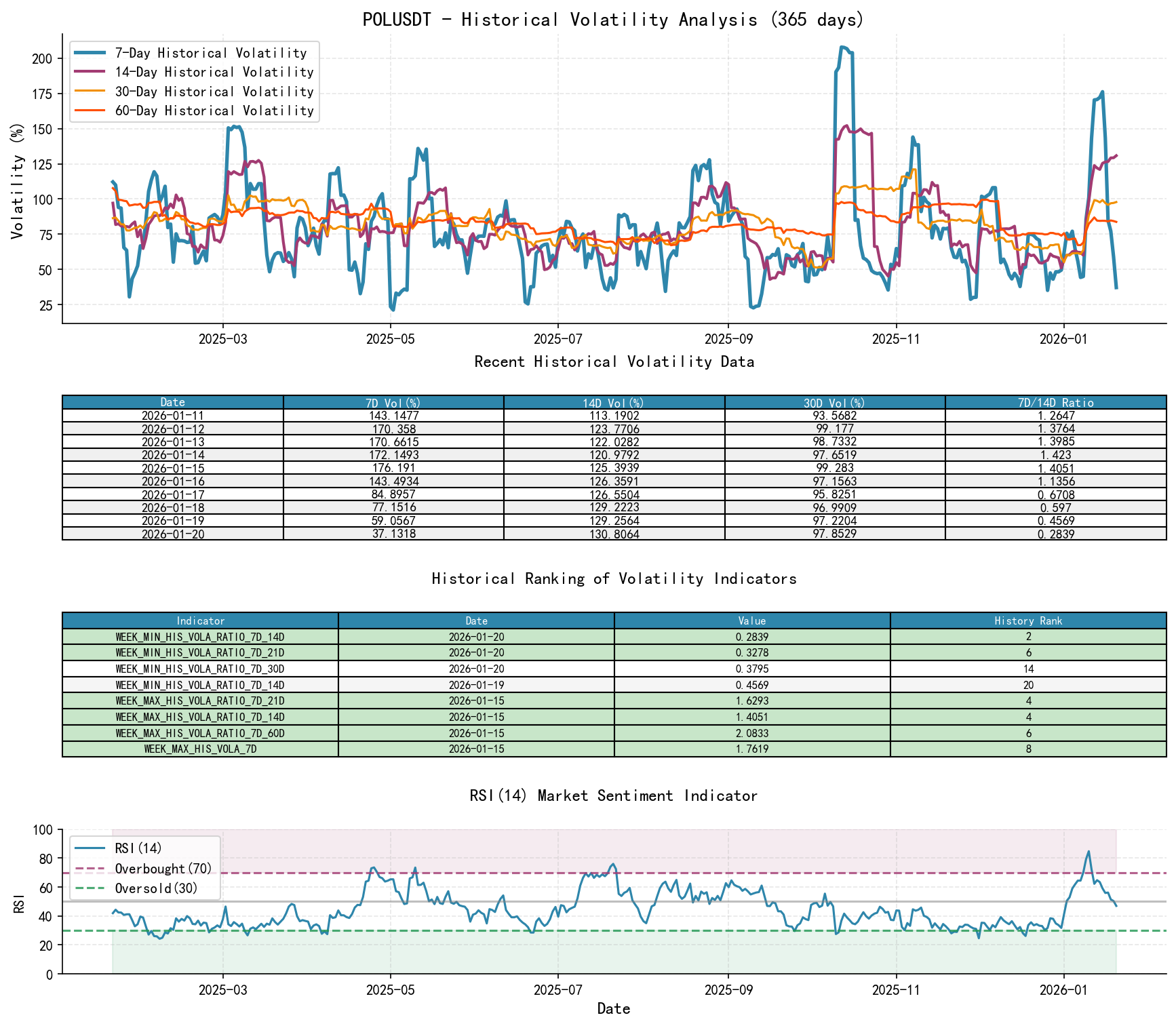

3. Volatility and Market Sentiment

As of January 20, 2026, for the underlying asset POLUSDT: Opening Price 0.14, 7-Day Intraday Volatility 0.86, 7-Day Intraday Volatility Volume Ratio 0.77, 7-Day Historical Volatility 0.37, 7-Day Historical Volatility Volume Ratio 0.28, RSI 47.00.

- • Volatility Analysis:

- • Volatility Surge: During the January rebound and subsequent pullback, short-term volatility (HIS_VOLA_7D) spiked sharply, peaking on January 14-15 (1.72-1.76), ranking at the 8th to 13th highest levels in the past 10 years. Concurrently, the ratio of short-term to medium-term volatility (HIS_VOLA_RATIO_7D_14D) reached 1.423 on January 14, the 3rd highest in the past 10 years. This indicates market sentiment experienced extreme short-term turbulence.

- • Volatility Contraction: By January 20, the 7-day historical volatility (HIS_VOLA_7D) had rapidly retreated to 0.371, and its ratio to the 14-day volatility (0.284) reached the 2nd lowest level in the past 10 years. This suggests short-term market volatility is cooling at an exceptionally fast pace, transitioning from a state of extreme panic/excitement back to calm, often preceding a new directional move.

- • Market Sentiment (RSI):

- • Extreme Overbought: At the rebound peak on January 10, the RSI_14 reached 84.80, setting a new record high for the past 10 years. This is a clear signal of market sentiment entering an extremely optimistic and overbought zone.

- • Return to Neutral-Weak: By January 20, the RSI_14 had retraced to 46.99, moving out of the overbought zone but remaining below the 50 midline, indicating a shift from euphoria to neutral-weak sentiment.

- • Integrated Sentiment and Volatility Conclusion:

The market experienced an extreme state of "high volatility, high sentiment" in early January, a characteristic often seen at the end of a trending move. The current rapid volatility contraction and receding sentiment indicators align with a market correction and consolidation phase following the conclusion of a short-term trend (rebound), building energy for the next trend.

4. Relative Strength and Momentum Performance

- • Momentum Cycle Analysis:

- • Long-term Momentum (YTD/TTM_12): Despite the strong January rebound with a YTD return of +30.35%, the TTM_12 (Trailing Twelve Months) return remains -70.37%, indicating the momentum of the long-term downtrend is still potent.

- • Short-term Momentum (WTD_RETURN): As of the week ending January 20, the weekly return was -16.77%, showing a significant negative shift in momentum. This aligns with the price pullback from rally highs and the breach below short-term moving averages.

- • Momentum Shift: Looking at QTD_RETURN, Q4 2025 was extremely weak (-55.23%), while Q1 2026 to date (QTD_RETURN +30.35%) shows a strong quarterly momentum reversal. However, the recent weakening of weekly (WTD) momentum suggests the quarterly-level rebound may be facing a phase of adjustment.

- • Momentum and Trend Validation:

The rapid deterioration in short-term momentum corroborates with the price-volume structure of falling below short-term MAs and contracting volume, jointly pointing to the exhaustion of rebound momentum. The dominant long-term downward momentum continues to limit the height and sustainability of any rally.

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff events and volume-price analysis, inferences regarding large investor behavior are as follows:

- 1. Accumulation Behavior: During the panic declines in December 2025 (notably on Dec 1 and 18), accompanied by record-breaking volume, it is inferred that large investors were absorbing shares during the "Selling Climax" at low prices. This is typical accumulation behavior at the end of a downtrend.

- 2. Markup & Test Behavior: The massive volume surge on January 9-10, 2026, was likely driven by these accumulated large investors along with momentum followers, aiming to quickly move away from their cost basis and test supply pressure overhead.

- 3. Distribution Behavior: The "high-volume stagnation/decline" on January 11th is a key signal. At such elevated price and volume levels, who was selling? It is inferred that early accumulators and some trapped late buyers were taking profits and distributing. Smart money utilized market euphoria to transfer shares to less informed buyers.

- 4. Current Intent: Following rapid distribution, the market entered a phase of low-volume drift lower. Large investors are likely currently in a wait-and-see mode, awaiting a pullback to more attractive levels (e.g., near the prior panic selling zone) or a new signal of supply-demand imbalance before their next operation.

Core Inference: The January rebound was a textbook, smart money-led short-term operation of "Accumulation - Markup - Distribution." Currently, the distribution phase is largely complete, and market initiative has returned to the supply side.

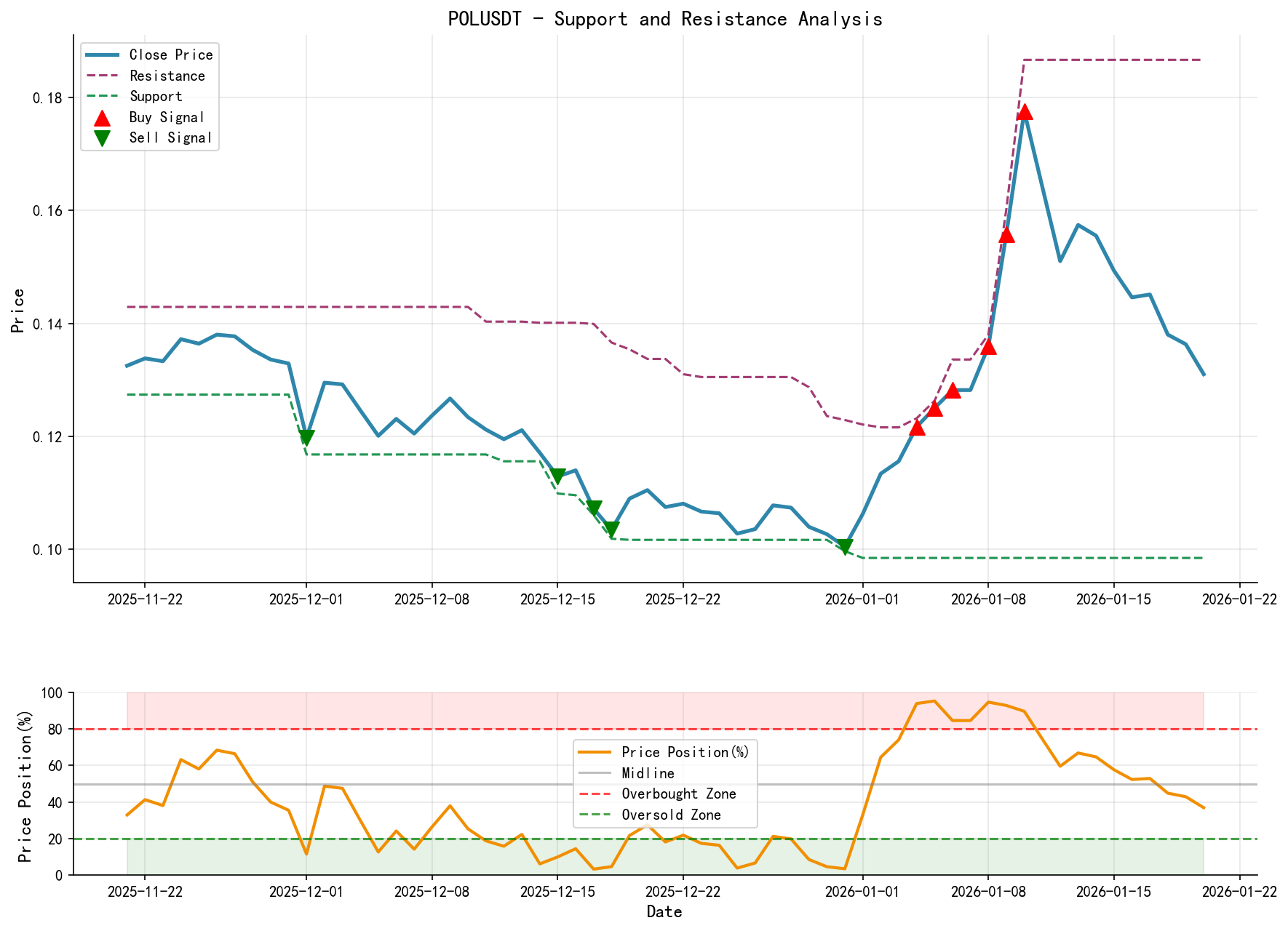

6. Support/Resistance Level Analysis and Trading Signals

- • Critical Price Levels:

- • Strong Resistance Zone (Supply Zone): 0.1600 - 0.1866. This is the high-volume congestion area and peak of the January rally, also coinciding with the long-term pressure from the MA_30D and MA_60D. Any rally into this zone will face significant selling pressure.

- • Minor Resistance / Recent Breakdown Level: 0.1380 - 0.1500. This is the area where the price consolidated and broke down in late January, now acting as resistance.

- • Immediate Support (Demand Test Zone): 0.1250 - 0.1290. This is the platform area preceding the January rally initiation and is near the current price.

- • Strong Support Zone (Potential Accumulation Zone): 0.1005 - 0.1020. This is the low area established during the late 2025 panic selling. Historical ranking data indicates that closing and low prices in this zone are at absolute lows for the past 10 years. This is the critical demand zone determining whether the long-term trend can reverse.

- • Integrated Wyckoff Trading Signals:

- • Primary Signal: Bearish / Wait-and-See. The market is in the phase of resuming its downtrend post-distribution. The main conflict is weakening demand versus re-emerging supply.

- • Operational Recommendations:

- 1. Bearish Strategy (Aggressive): If the price rallies into the 0.1380-0.1500 resistance zone and shows signs of stalling or forms bearish high-volume candlestick patterns, it could be considered a shorting opportunity. Set a stop-loss above 0.1600. Target the 0.1020 strong support zone.

- 2. Bullish Strategy (Patient Wait): Long positions are not advisable currently. A worthwhile long opportunity lies in whether the price can retest the 0.1020 strong support zone. If clear Wyckoff demand entry signals (such as a Spring or Jump across the Creek) manifest at that level with "low-volume stabilization" or "high-volume bullish reversal," it could be considered a high-quality long-term positioning opportunity. Maintain a wait-and-see stance until then.

- 3. Breakout Strategy (Trend Reversal Confirmation): If the price breaks out and sustains above the 0.1600-0.1866 strong resistance zone on high volume in the future, it would indicate supply has been fully absorbed and a potential trend reversal, necessitating a re-evaluation of the market phase.

- • Future Validation Points:

- 1. Confirm Bearish View: Price continues its low-volume drift lower and decisively breaks below the 0.1250 immediate support, seeking support near 0.1020.

- 2. Invalidate Bearish View: Price finds support in the 0.1250-0.1290 zone and experiences a high-volume advance (VOLUME_AVG_7D_RATIO > 1.5) to reclaim the MA_5D and MA_10D, indicating renewed demand and an interruption of the decline.

- 3. Key Trend Reversal Signal: A strong demand signal as described above appears near 0.1020, or a high-volume breakout above the 0.1600 resistance band occurs.

Disclaimer: This report is based on quantitative analysis of historical data and does not constitute any investment advice. Markets involve risks; investment requires caution. All conclusions are derived from the provided data and may be subject to model bias and data lag risks.

Thank you for your attention! Wyckoff volume-price market interpretations are published daily at 8:00 AM before the market opens. Please feel free to comment and share; your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: