All right, following your instructions. Using the Wyckoff Method as a framework and based on the provided PEPEUSDT data, I will compose a comprehensive, in-depth, and data-driven quantitative analysis report.

PEPEUSDT Wyckoff Price-Volume Analysis Report

Product Code: PEPEUSDT

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

Analyst Role: Quantitative Trading Researcher (Wyckoff Method)

I. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset PEPEUSDT has an open price of 0.00, close price of 0.00, 5-day moving average of 0.00, 10-day moving average of 0.00, 20-day moving average of 0.00, daily change of -3.41%, weekly change of -22.37%, monthly change of 26.55%, quarterly change of 26.55%, and annual change of 26.55%.

- 1. Price and Moving Average Relationship:

- • Current State (2026-01-20): The price (

CLOSE: 0.00000510) is below all moving averages (MA_5D: 0.00000568, MA_10D: 0.00000587, MA_20D: 0.00000597, MA_30D: 0.00000533, MA_60D: 0.00000487), exhibiting a clear bearish alignment. - • Trend Evolution:

- • Throughout the observation period, moving averages of all timeframes (MA_5D to MA_60D) have shown a persistent downward trend, confirming the market is in a long-term downtrend.

- • Key Turning Point: In early January 2026 (January 1st to 4th), the price experienced an explosive rally. The MA_5D quickly crossed above the MA_10D and MA_20D, forming a short-term golden cross, and converged significantly with the MA_30D and MA_60D.

- • Failed Trend Reversal: After peaking on January 5th (

CLOSE: 0.00000700), the price rapidly declined. The MA_5D subsequently turned downward and successively crossed below the MA_10D, MA_20D, and MA_30D, forming a sequence of "death crosses." This indicates that the early January rally was a sharp bear market rally (or a bull trap within a distribution phase), not a trend reversal.

- • Current State (2026-01-20): The price (

- 2. Price Action and Market Phase Identification:

- • November - December 2025: The price drifted lower from 0.00000456 (November 25th) to 0.00000372 (December 18th), with occasional weak rebounds on declining volume. This aligns with the characteristics of a "Downtrend" and "Automatic Reaction" in Wyckoff theory.

- • December 19, 2025 - January 4, 2026: Following a "Selling Climax" (a high-volume drop of -4.86% on December 18th), the market entered a "Powerful Rally" (Spring/SOS). From January 1st to January 4th, four consecutive days of massive, high-volume surges (cumulative gain over 78%) rapidly lifted the price away from the bottom. These are typical features of the initial phase of a Wyckoff bullish structure (Spring + SOS). However, historical rankings show that during this period, volume metrics reached their highest level in nearly a decade (

WEEK_MAX_VOLUME_AVG_7D_RATIO: 8.91), and the RSI entered overbought territory (WEEK_MAX_RSI_14: 82.15, rank #16), laying the groundwork for subsequent concerns. - • January 5, 2026 - January 20, 2026: After reaching a high of 0.00000726, the price failed to sustain its gains and turned to decline on elevated volume, continuing its descent. The high price level exhibited characteristics of "high-volume stagnation/decline." Combined with the price falling back below all moving averages, it can be concluded that the market has rapidly transitioned from a brief rally/testing phase into a Distribution phase or the initial stage of a new downtrend. The massive early January rally likely served as a stage for large investors to distribute holdings by exploiting market FOMO sentiment.

Conclusion: The current market is in a post-Distribution decline phase. The long-term trend is bearish. The massive early January rebound has proven to be a major bear market rally (or a distribution event), and the market has now resumed its downtrend.

II. Price-Volume Relationship and Supply-Demand Dynamics

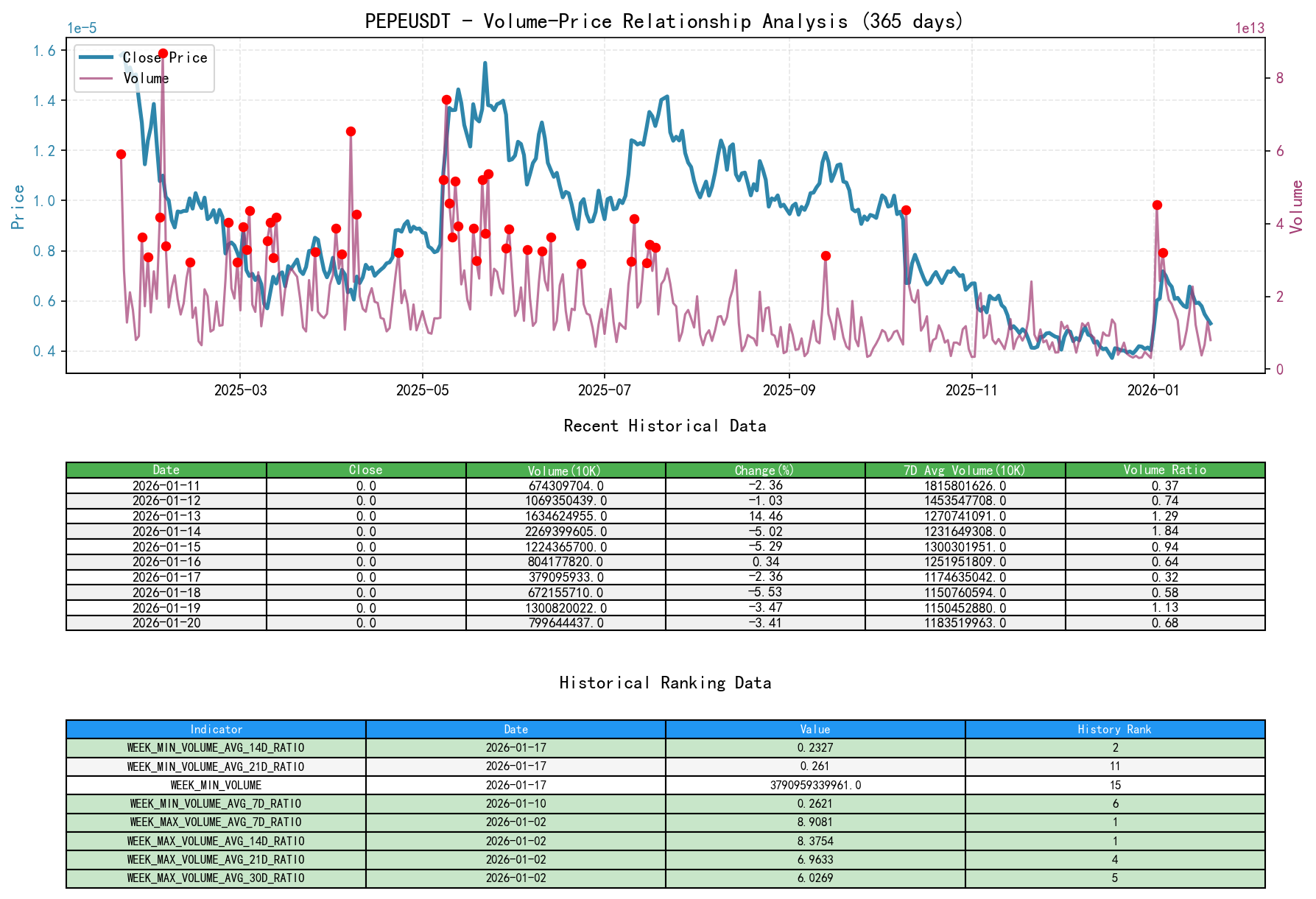

As of January 20, 2026, the underlying asset PEPEUSDT has an open price of 0.00, close price of 0.00, volume of 7996444379624.00, daily change of -3.41%, volume of 7996444379624.00, 7-day average volume of 11835199639457.43, and 7-day volume ratio of 0.68.

- 1. Key Price-Volume Day Analysis:

- • Supply-Dominated Days (High-Volume Decline/Stagnation):

- • 2026-01-05/06/07/08: As the price retreated from its highs, volume remained enormous (

VOLUME_AVG_7D_RATIObetween 1.30-2.20), constituting a classic "supply overpowering demand" signal. Particularly on January 8th, with a price drop of -7.32% and volume reaching 1.56 trillion (1.55 times the recent 60-day averageVOLUME_AVG_60D_RATIO), it clearly indicates heavy selling pressure at high levels. - • 2026-01-20 (Analysis Day): The price declined -3.41% on volume (0.80 trillion) that was 0.68 times the 7-day average (

VOLUME_AVG_7D_RATIO). While seemingly low volume, theVOLUME_GROWTHwas -38.53%, indicating that following the preceding day's (Jan 19th) high-volume decline (VOLUME_GROWTH+93.53%), selling pressure, while moderating, persists, with buying power weak. This is a low-volume, grinding decline under sustained supply dominance.

- • 2026-01-05/06/07/08: As the price retreated from its highs, volume remained enormous (

- • Demand-Dominated Days (High-Volume Advance):

- • 2026-01-01 to 01-04: Consecutive days of massive, high-volume advances represent the most significant recent demand surge. However, its nature must be judged in conjunction with subsequent price action. Based on the outcome, this more closely resembles a "Buying Climax" than healthy accumulation.

- • Insufficient Demand Days (Low-Volume Rebound):

- • 2025-12-26/27/30: The price experienced minor rebounds, but volume was below the 7-day, 14-day, 30-day, and 60-day averages (

VOLUME_AVG_*D_RATIOall less than 1), indicating a lack of follow-through demand. This represents a continuation pattern within the downtrend.

- • 2025-12-26/27/30: The price experienced minor rebounds, but volume was below the 7-day, 14-day, 30-day, and 60-day averages (

- • Supply-Dominated Days (High-Volume Decline/Stagnation):

- 2. Quantitative Analysis of Abnormal Volume:

- • Historical Extremes: Historical ranking data clearly reveals the extreme nature of early January volume. Both

WEEK_MAX_VOLUME_AVG_7D_RATIO(8.91) andWEEK_MAX_VOLUME_AVG_14D_RATIO(8.38) rank #1 over the past decade. Such astronomical volume appearing during a rapid price surge is highly suggestive of distribution activity by large investors. - • Current Supply-Demand State: As of January 20th, the short-term volume ratio (

VOLUME_AVG_7D_RATIO: 0.68) has returned to a normal-to-low level, while volume growth is negative. This indicates that following the high-level distribution and subsequent sustained decline, market activity has decreased. Supply remains dominant but its force has diminished, while demand is entirely absent, leading the market into a "dull" or "grinding decline" state.

- • Historical Extremes: Historical ranking data clearly reveals the extreme nature of early January volume. Both

Conclusion: The supply-demand relationship has clearly shifted from the early January "false demand climax (distribution)" to the current state of "supply dominance, demand exhaustion." Historically significant volume at the rally peak is a strong bearish signal.

III. Volatility and Market Sentiment

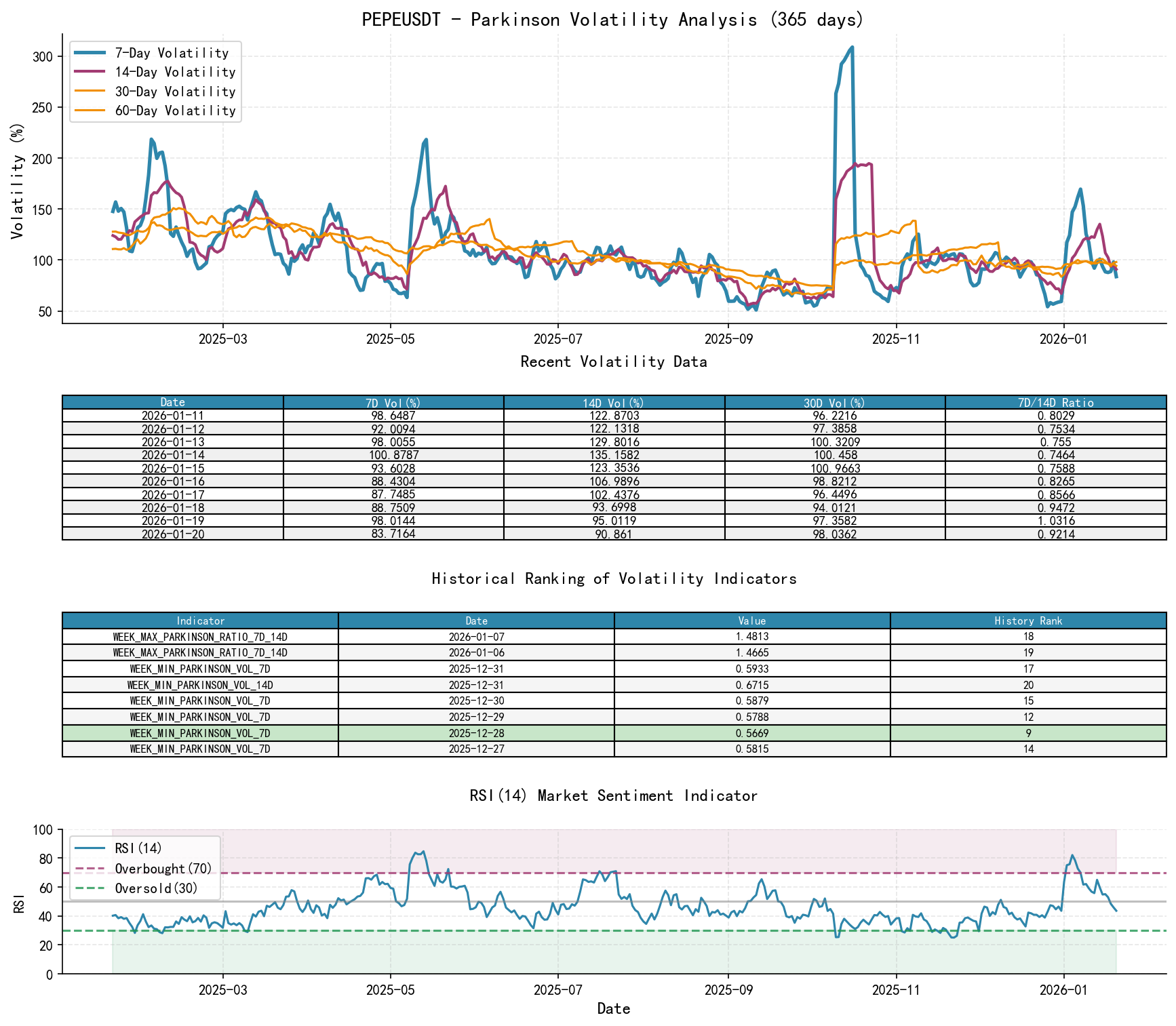

As of January 20, 2026, the underlying asset PEPEUSDT has an open price of 0.00, 7-day intraday volatility of 0.84, 7-day intraday volatility volume ratio of 0.92, 7-day historical volatility of 0.41, 7-day historical volatility volume ratio of 0.42, and RSI of 43.64.

- 1. Volatility Level and Changes:

- • Current State: Short-term volatility has contracted sharply.

HIS_VOLA_7Dis 0.4061, at an extremely low level (historical rank #4 low).PARKINSON_VOL_7Dis 0.8372, also at a low level. - • Volatility Structure Anomaly: Short-term volatility ratios relative to medium/long-term volatility are extremely low.

HIS_VOLA_RATIO_7D_14D(0.4243),7D_21D(0.2490), and7D_30D(0.2954) are all at historically extreme low percentiles (ranks #16, #1, #1 respectively). This indicates market sentiment has rapidly shifted from extreme euphoria (high volatility) in early January to extreme apathy and directional confusion (low volatility). - • Interpretation: Such "Volatility Crush" typically occurs after a major event (like the January surge and plunge), with market participants entering a wait-and-see mode. Combined with the price being in a decline, this often represents a consolidation/pause within a downtrend or a calm before a new down leg, not a bottoming signal.

- • Current State: Short-term volatility has contracted sharply.

- 2. Market Sentiment Indicator (RSI):

- • Current State:

RSI_14is 43.64, in a neutral-to-weak zone, neither overbought nor oversold. - • Sentiment Evolution: The RSI has rapidly retreated from extreme overbought levels (82.15 on Jan 4th) to its current level, indicating that frenzied sentiment has completely dissipated. However, the speed of the price decline has outpaced the RSI's decline, suggesting persistent downward pressure.

- • Current State:

Conclusion: Market sentiment has completed the transition from "extreme greed" to "apathy/mild fear". The extremely low short-term volatility ratios are a warning sign, indicating a lack of meaningful buyer-seller conflict during the decline, with bears in firm control, potentially setting the stage for a grinding decline or a new wave of panic.

IV. Relative Strength and Momentum Performance

- 1. Periodic Return Analysis:

- • Short-Term Momentum (WTD/MTD):

WTD_RETURNis -22.37%,MTD_RETURNis 26.55%. Short-term momentum has sharply turned negative, with a substantial weekly loss, indicating extremely heavy recent selling pressure. The positive monthly return is primarily attributed to the early January surge and is being rapidly eroded. - • Medium/Long-Term Performance (QTD/YTD/TTM):

QTD_RETURNis 26.55%,YTDis 26.55% (same as MTD),TTM_12is -67.72%. This shows that even after the January rally, PEPEUSDT remains in a deep bear market over a longer timeframe (one year), with extremely weak relative strength.

- • Short-Term Momentum (WTD/MTD):

Conclusion: The momentum profile exhibits a pattern of "extremely weak long-term, sharp short-term decline". Any positive medium-term (MTD/QTD) performance is fragile and unsustainable. The core market momentum has shifted back to negative, consistent with the conclusions from trend and price-volume analysis.

V. Large Investor (Smart Money) Behavior Identification

Synthesizing the analysis from the above four dimensions allows for a clear delineation of large investor behavior:

- 1. Distribution Phase (January 1 - Mid-January 2026): This is the core smart money behavior within this analysis cycle.

- • Action: Capitalizing on extreme pessimism and long-term low prices at the end of 2025, they initiated the move with a bullish candlestick on January 1, 2026, creating the illusion of a "New Year, new trend" and "bottom breakout." Subsequently, from January 2nd to 4th, leveraging record-breaking, historically high volume (rank #1 in nearly a decade), they rapidly drove prices higher, attracting retail and trend-followers to FOMO in.

- • Intent: To distribute their accumulated holdings at elevated prices to the buying frenzy of retail and momentum traders during the rapid price surge and extreme market euphoria (RSI overbought >82). The high-volume stagnation and decline after January 5th signal the culmination and confirmation of the distribution.

- 2. Observation and Pressure Phase (Late January 2026 - Present):

- • Action: After completing the main distribution, smart money buying has disappeared. The market has entered a low-volume, grinding decline state with sharply contracted volatility.

- • Intent: By ceasing purchases and allowing prices to naturally decline, they test the true strength of underlying demand while conserving energy for the next potential move (further downside pressure for accumulation or waiting for even lower levels). The current extremely low indicators like

HIS_VOLA_RATIO_7D_14Dreflect the temporary absence of smart money and a directionless market.

Conclusion: Large investors successfully executed a "bottom-rally-bull-trap distribution" during this cycle. Who was buying at the high volume? Retail and some institutions chasing the rally. Who was selling at the high volume? Smart money that had positioned earlier or was exiting positions. Who is on the sidelines during the current low volume? All major market participants, including smart money, who are waiting for prices to reach more attractive levels or for a new catalyst.

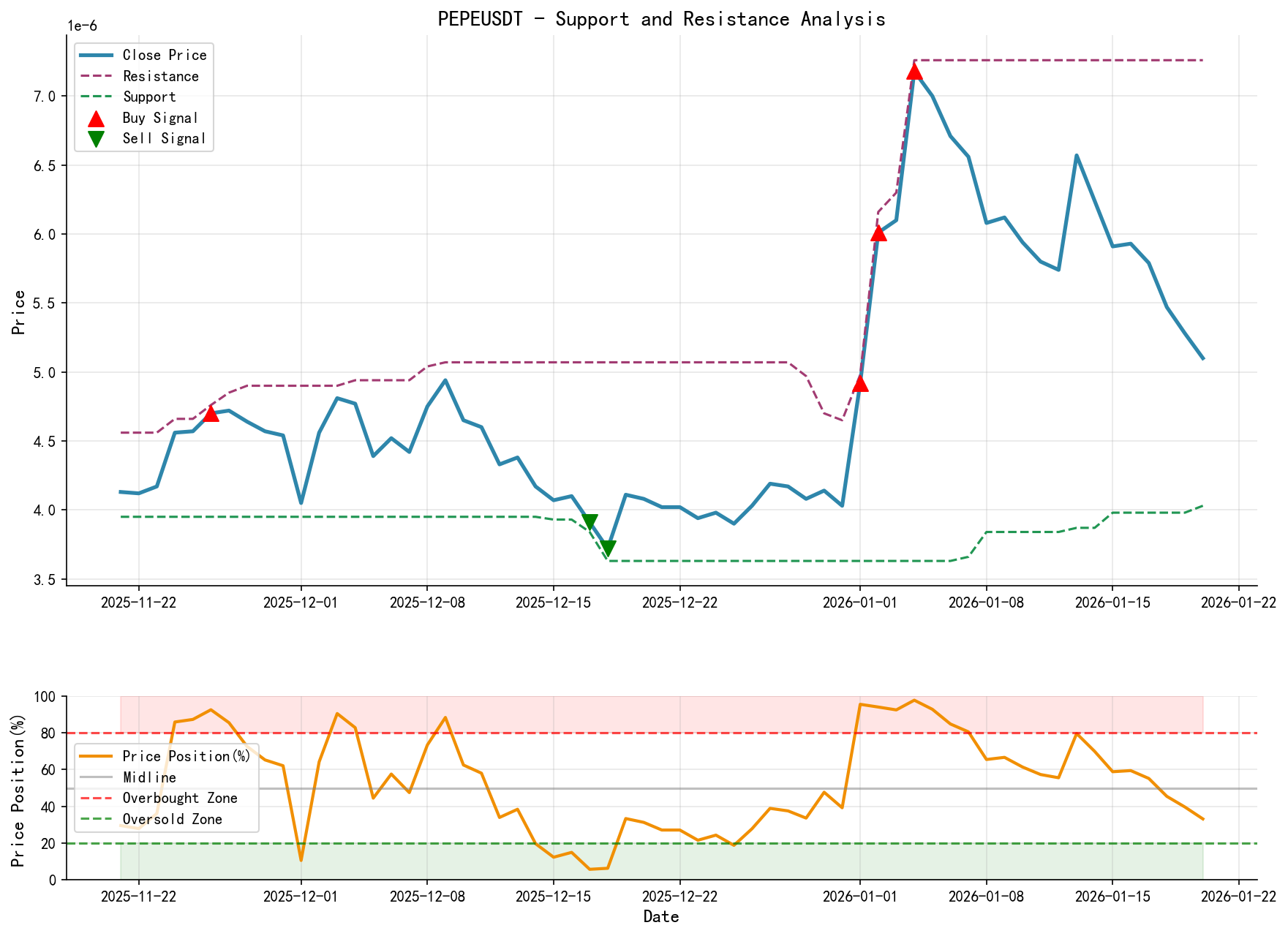

VI. Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Level Identification:

- • Strong Resistance Levels:

- • R1: 0.00000726 - The absolute high of this rally (2026-01-04

HIGH), also the upper boundary of the distribution range. - • R2: 0.00000492 - The breakout point from the strong move on January 1, 2026. Now breached, it should act as strong resistance.

- • R1: 0.00000726 - The absolute high of this rally (2026-01-04

- • Key Support Levels:

- • S1: 0.00000400 - 0.00000410 - A psychological level and the lower boundary of the price congestion zone from late December 2025 to the January 1, 2026 breakout. This is the most critical support level to monitor currently.

- • S2: 0.00000363 - The low (

LOW) formed during the Selling Climax on December 18, 2025.

- • Strong Resistance Levels:

- 2. Integrated Wyckoff Events and Trading Signals:

- • Primary Signal: Bearish. The market structure has completed the classic bear market or post-distribution decline sequence: "Selling Climax -> Powerful Rally (SOS) -> Secondary Test/Distribution -> Breakdown."

- • Operational Recommendations:

- • For Existing Long Holders: Any rebound approaching resistance R2 (~0.00000492) presents an opportunity to reduce or exit positions. A stop-loss could be set above a price level that decisively reclaims the MA_5D.

- • For Flat Positions / Those Seeking Short Opportunities: Maintain a watchful stance; initiating new short positions at current levels (~0.00000510) is not recommended due to the low short-term volatility offering poor risk-reward. Await one of two signals:

- 1. Failed Rally Signal: A price rebound to the vicinity of R2 (e.g., 0.00000480-0.00000500) accompanied by clear signs of low-volume stagnation or a high-volume bearish candlestick. This could serve as a high-probability short entry point.

- 2. Breakdown Signal: A high-volume break below the key support level S1 (0.00000400), confirming the continuation of the downtrend. Consider a momentum short trade, targeting S2 (0.00000363).

- • Future Validation Points (Conditions to Invalidate the Bearish Thesis):

- • Key Invalidation Signal: Price recaptures and holds above R2 (0.00000492) on high volume (

VOLUME_AVG_7D_RATIO> 1.5), accompanied by a concurrent rise in intraday volatility (PARKINSON_VOL_7D). This would suggest the January 20th decline might have been a "Shakeout" rather than a continuation, necessitating a reassessment of the market structure. - • Secondary Observation Point: Whether an RSI bullish divergence can form as the

RSI_14enters oversold territory (<30) during further price declines, coupled with the appearance of high-volume bullish reversal candlesticks. This could indicate short-term selling exhaustion.

- • Key Invalidation Signal: Price recaptures and holds above R2 (0.00000492) on high volume (

Final Conclusion and Action Summary:

PEPEUSDT is currently in a downtrend following a large-investor-led distribution at elevated prices. Data from all dimensions (trend, price-volume, volatility, momentum, smart money behavior) support this conclusion. Historical ranking data underscores the anomalous nature of the early January volume surge and the extremity of the current volatility structure, strengthening the reliability of this assessment. The core strategy is "sell into strength" or "sell on breakdown," not "buy the dip." Investors should patiently await either a price rebound to key resistance levels showing signs of renewed supply, or a clear high-volume break below key support, to seek high-conviction trading opportunities. Clear evidence of high-volume buying strength is required to invalidate the current bearish outlook.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. Markets involve risk; investing requires caution. Any investment actions taken based on this report are at the investor's own risk.

Thank you for your attention! Wyckoff Price-Volume Market Analysis is published daily before the market opens at 8:00 AM. Your feedback and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals.

Member discussion: