Please find below the in-depth quantitative analysis report based on the NDX data you provided.

NASDAQ-100 Index (NDX) Wyckoff Quantitative Analysis Report

Product Code: NDX

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

I. Trend Analysis & Market Phase Identification

As of January 20, 2026, the underlying NDX has an opening price of 25155.03, a closing price of 24987.57, a 5-day moving average (MA) of 25614.38, a 10-day MA of 25604.02, a 20-day MA of 25510.00, with a daily change of -2.12%, a weekly change of -2.93%, a monthly change of -1.04%, a quarterly change of -1.04%, and an annual change of -1.04%.

Based on the relationship between price and moving averages and price action analysis, the NDX market underwent a transition from distribution at a阶段性高点 (staged high point) to a clear downtrend during the analysis period.

- 1. Evolution of Trend Structure:

- • Late November to Early December 2025: After a period of decline (rebounding from around 24600), the price successfully broke above the 5-day and 10-day MAs and became entangled with the 20-day, 30-day, and 60-day MAs, showing a pattern of consolidation and recovery.

- • Since January 2026: The price structure deteriorated. Taking the data from January 20 as an example, the closing price

24987.566is clearly below all key moving averages (MA_5D: 25614.38,MA_10D: 25604.02,MA_60D: 25372.48), forming a typical bearish alignment. The price fell from the high of25873.178on January 13 to the low of24954.180on January 20, a decline of over 3.5%, confirming the downtrend.

- 2. Market Phase Inference (Based on Wyckoff Theory):

- • Key Event: December 19, 2025: The price closed up 1.31% (

25346.178) that day, but the volume of2,864,226,839was the second highest in nearly a decade (ranked #2 historically). Combined with historical ranking data, the volume increase of 115.34% that day was the highest in nearly ten years. This divergence of "high volume with limited price advance" is a classic characteristic of the "Distribution" phase in Wyckoff theory, suggesting that large investors may have been using price strength for selling. - • Current Phase (Late January 2026): The price has moved away from the December high range and entered the Markdown phase. The high-volume decline on January 20 indicates that supply continues to be present. The RSI has entered the weak zone (38.62) but is not at extreme oversold levels, suggesting that downward momentum may not yet be fully exhausted.

- • Key Event: December 19, 2025: The price closed up 1.31% (

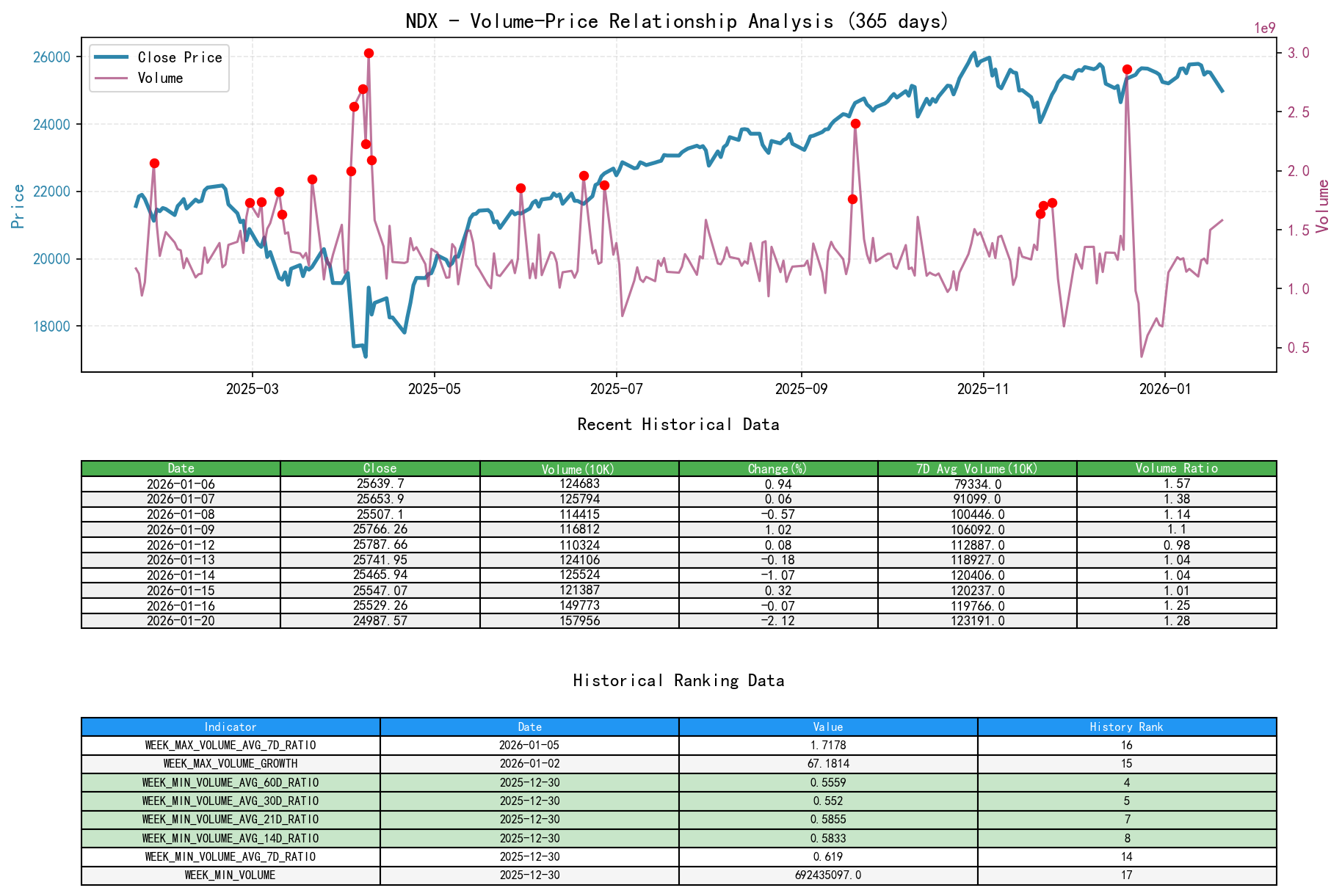

II. Volume-Price Relationship & Supply-Demand Dynamics

As of January 20, 2026, the underlying NDX has an opening price of 25155.03, a closing price of 24987.57, a volume of 1579561761, a daily change of -2.12%, a volume of 1579561761, a 7-day average volume of 1231919232.00, and a 7-day volume ratio of 1.28.

Volume analysis reveals a decisive shift in the balance of supply and demand at critical junctures.

- 1. Key Signals of Supply Dominance:

- • 2025-12-19 (Distribution Day): Extremely high volume (historically ranked #2) but the price only advanced 1.31%, presenting a scenario of "high volume with limited price advance". The

VOLUME_AVG_7D_RATIOwas as high as 2.21, meaning the day's volume was over 2.2 times the 7-day average. This clearly indicates that substantial buying (demand) was completely absorbed and overwhelmed by even greater selling (supply). - • 2026-01-20 (Accelerated Decline Day): The price fell sharply by 2.12% on a volume of

1,579,561,761, with aVOLUME_AVG_7D_RATIOof 1.28. This is "high-volume decline", indicating heavy selling pressure during the drop, with supply completely dominating the market and demand unable to absorb it.

- • 2025-12-19 (Distribution Day): Extremely high volume (historically ranked #2) but the price only advanced 1.31%, presenting a scenario of "high volume with limited price advance". The

- 2. Evidence of Insufficient Demand:

- • During price rebounds on days like January 8 and January 14, the

VOLUME_AVG_7D_RATIOwas below 1 (0.94 and 1.04, respectively), showing "low-volume rallies". This confirms weak demand during the downtrend; rallies lack sustainability and are vulnerable to renewed selling pressure.

- • During price rebounds on days like January 8 and January 14, the

- 3. Conclusion: The supply-demand balance has tilted towards supply. The massive distribution on December 19 was the turning point, after which the market entered a supply-driven downtrend. Any recent rallies appear fragile due to low volume.

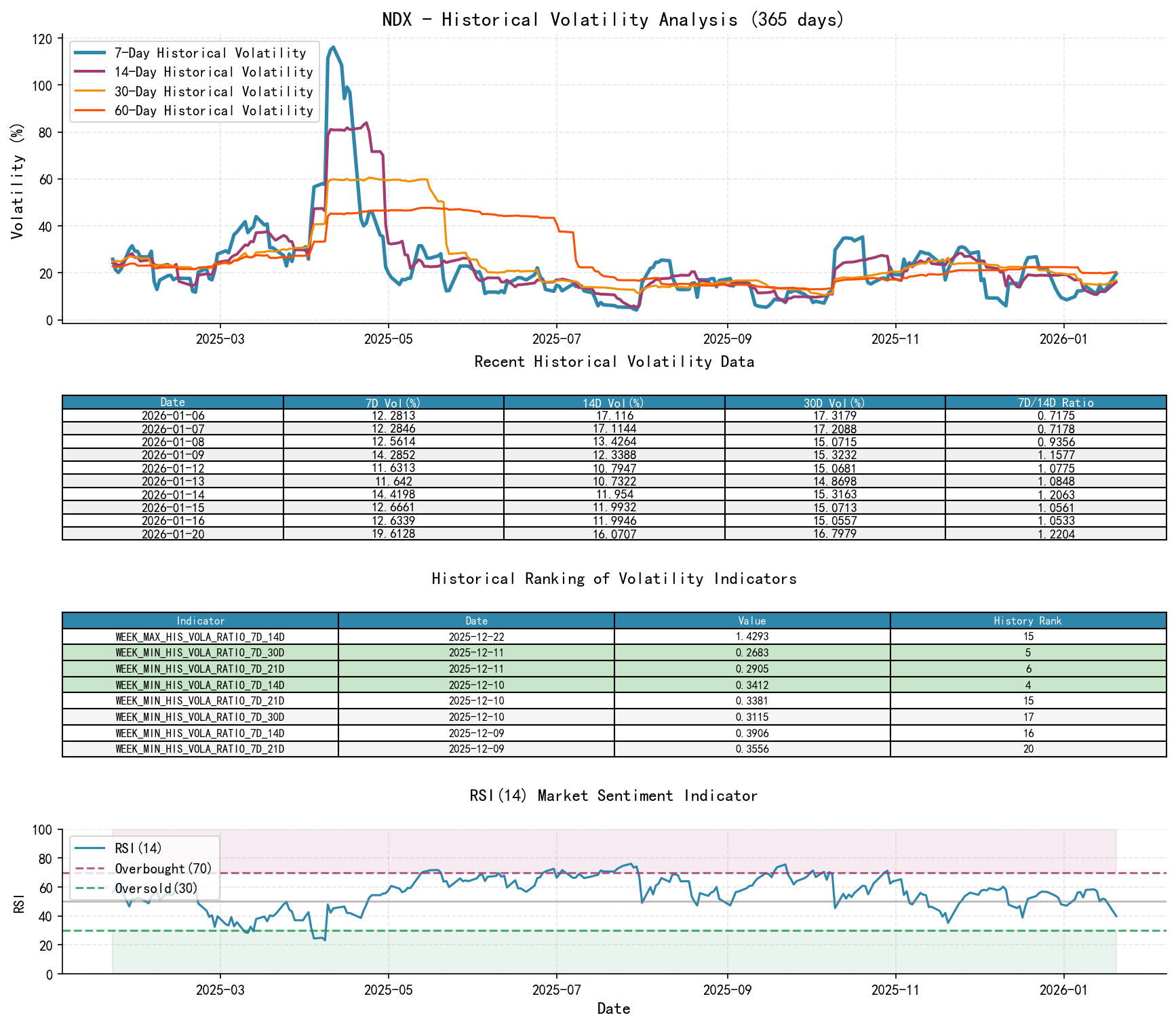

III. Volatility & Market Sentiment

As of January 20, 2026, the underlying NDX has an opening price of 25155.03, a 7-day intraday volatility of 0.13, a 7-day intraday volatility ratio of 1.09, a 7-day historical volatility of 0.20, a 7-day historical volatility ratio of 1.22, and an RSI of 39.92.

Volatility indicators and the RSI together point to a shift in market sentiment from stable to tense and pessimistic.

- 1. Volatility Expansion:

- • Historical Volatility (HIS_VOLA): On January 20,

HIS_VOLA_7D(0.196) was significantly higher thanHIS_VOLA_14D(0.161), with their ratioHIS_VOLA_RATIO_7D_14Dat 1.22, indicating that short-term volatility is rising rapidly and market panic is intensifying. - • Parkinson Volatility: The

PARKINSON_RATIO_7D_14Dof 1.09 similarly shows that the intraday price range is widening. This pattern of short-term volatility exceeding medium-term volatility typically occurs during trend acceleration or panic selling phases.

- • Historical Volatility (HIS_VOLA): On January 20,

- 2. Sentiment Indicators:

- • RSI: Having retreated consistently from near-overbought levels (56-60) in early December, it fell to

39.92by January 20, entering the weak zone. This confirms the fading of market momentum, though it has not yet reached extreme oversold territory (<30), suggesting there may be room for further decline.

- • RSI: Having retreated consistently from near-overbought levels (56-60) in early December, it fell to

- 3. Conclusion: Market sentiment is shifting from relative stability in December towards panic. The synchronized expansion of volatility, coupled with falling prices and high volume, reinforces the validity of the current downtrend.

IV. Relative Strength & Momentum Performance

Returns across all periods have turned negative, indicating deterioration in both short-term and medium-term momentum.

- 1. Momentum Exhaustion:

- • Short-term: The

WTD_RETURN(weekly return) is -2.93%, and theMTD_RETURN(monthly return) is -1.04%, indicating strong short-term downward momentum. - • Medium/Long-term: Although

YTDremains positive (benefiting from December gains), the sustained recent decline has pulled theTTM_12(trailing 12-month return) down from over 23% in December to 16.54%. Momentum has shifted from strong to weak.

- • Short-term: The

- 2. Comprehensive Assessment: Momentum analysis aligns with the conclusions from trend and volume-price analysis, confirming that the market is in a downtrend cycle dominated by bearish momentum.

V. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff events and abnormal volume-price action, the operational path of large investors can be inferred.

- 1. Distribution Behavior: December 19, 2025, is the key day for identifying smart money behavior. The record-breaking volume combined with a modest price gain is a classic sign of institutional investors conducting large-scale distribution at a relatively high level. The historical ranking data (#1 for volume growth in ten years) reinforces the extremity and significance of this action, which is typically not driven by retail behavior.

- 2. Subsequent Behavior: After distribution was completed, the market lost the support of large buying. During the January decline, no clear, sustained signs of demand intervention were observed (low-volume rallies). The high-volume decline on January 20 likely involved two groups: late-to-the-game long positions stopping out, and continuing institutional selling.

- 3. Inferred Current Intent: After completing the阶段性 (staged) distribution, smart money is likely currently in a state of observation or trend-following shorting. The market needs to show clear signs of "supply exhaustion" (such as a strong rebound following a panic-driven, high-volume crash) to attract them back for early accumulation.

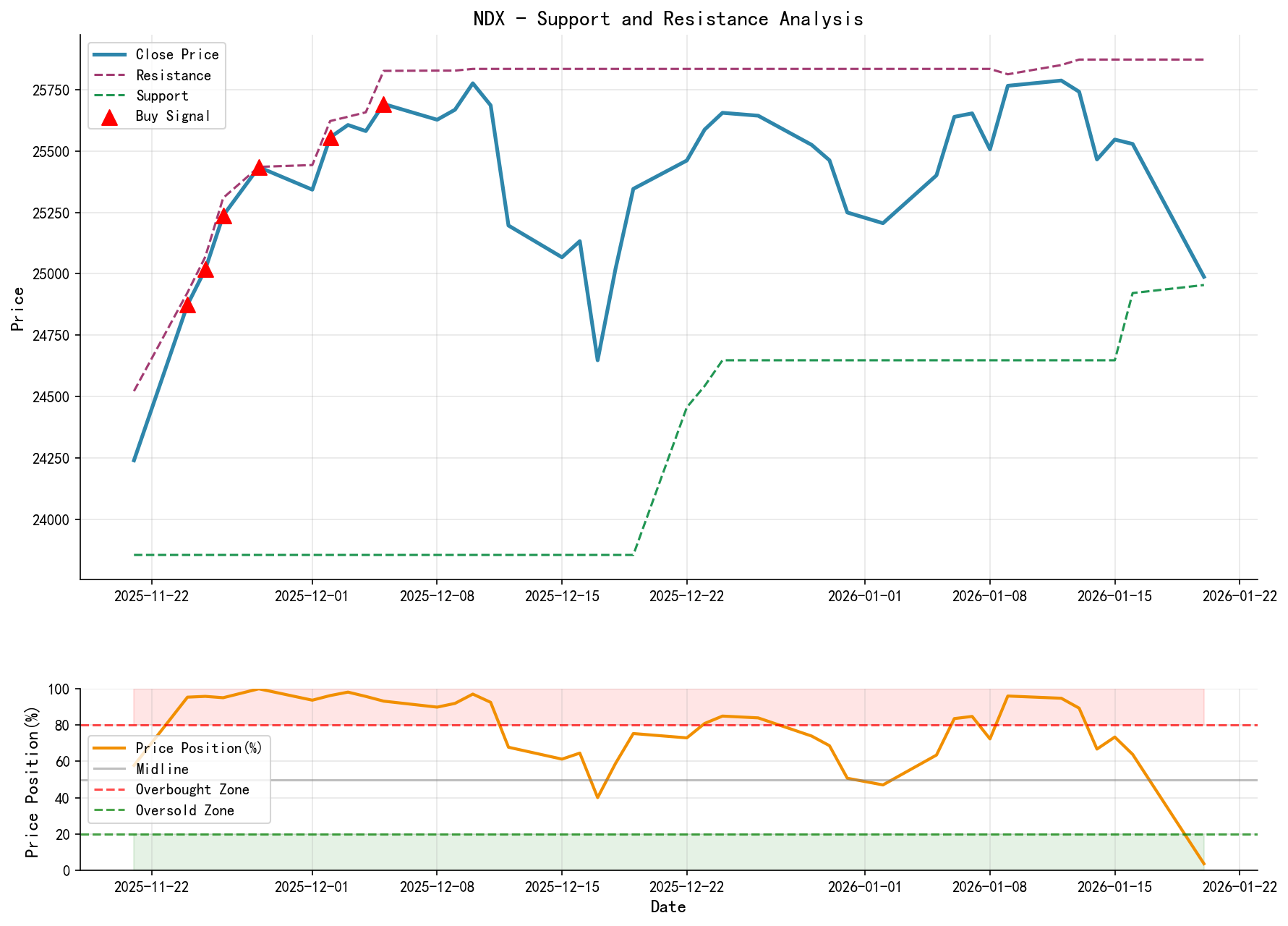

VI. Support/Resistance Level Analysis & Trading Signals

Key Price Levels:

- • Resistance Levels:

- 1. 25500 - 25800: The price has repeatedly faced rejection and turned lower in this range recently (e.g., January 13, January 15). This area coincides with the descending short-term MAs (MA_5D, MA_10D), forming a strong resistance zone.

- 2. 25000 (Psychological Level & Recent Low): The close on January 20 was slightly below this level. If a rebound occurs, this will act as the first resistance.

- • Support Levels:

- 1. 24950: The intraday low on January 20, representing the most recent support.

- 2. 24500 - 24700: The low of the consolidation range from late November 2025, and a potential void area below the 60-day MA (approx. 25372).

Comprehensive Wyckoff Trading Signals & Operational Recommendations:

- 1. Primary Signal: Bearish. The market is in a clear downtrend, dominated by supply, with no effective signs of demand recovery.

- 2. Operational Recommendations:

- • Existing Long Positions: Consider reducing positions or placing stop-loss orders on rebounds towards resistance levels (e.g., around 25500). The closing price on January 20 can serve as a reference exit point.

- • Bearish Strategy: Consider entering on a price rebound to the

25400-25600area (near the descending MA_5D) if signs of weakness appear (e.g., small-bodied candlesticks, long upper wicks), as this may offer a relatively favorable risk-reward ratio. The initial stop-loss should be placed above the recent rebound high (e.g., above 25800). - • New Long Positions: Maintain a wait-and-see approach. Current conditions do not provide a safe setup for going long. It is necessary to wait for Wyckoff accumulation signals like a "Spring" or "Secondary Test" – i.e., patterns of low-volume decline or high-volume stopping of decline at support levels (e.g., 24500-24700) – before considering early accumulation.

- 3. Future Validation Points:

- • Potential Signals for Trend Reversal: Monitor price action at key support zones (e.g., 24500-24700). If extremely high volume (panic selling) is followed by a rapid price recovery and a strong close, it could signal Preliminary Support or a Selling Climax.

- • Signals for Trend Continuation: If price rebounds continue on low volume and encounter renewed high-volume selling at any resistance level (e.g., 25500), it would confirm the continuation of the downtrend.

- • Conditions to Invalidate the Current Bearish Conclusion: If the price breaks out and holds firmly above 25800 on high volume (VOLUME_AVG_7D_RATIO > 1.2), it would indicate renewed demand entering the market, necessitating a re-evaluation of the market structure.

Core Conclusion: Following a textbook institutional distribution event on December 19, 2025, NDX has transitioned into a supply-driven downtrend. Current conditions include expanding volatility, negative momentum, and pessimistic market sentiment. Trading strategies should primarily focus on following the bearish trend or maintaining a观望 (wait-and-see) stance, patiently waiting for Wyckoff accumulation signals – signs of supply exhaustion and emerging demand – to appear at lower price levels.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantees regarding its accuracy or completeness. Markets involve risks; invest with caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Wyckoff Volume-Price Market Insights are published daily at 8:00 AM before market open. Your comments and shares are greatly appreciated. Your recognition is paramount. Let's work together to see the market signals clearly.

Member discussion: