Alright, as a quantitative trading researcher proficient in the Wyckoff Method, I will prepare an in-depth quantitative analysis report on META based on the data you provided. The report will strictly follow the six dimensions you requested, with all conclusions derived from data and aligned with Wyckoff's principles of volume and price action.

META (Meta Platforms Inc.) Quantitative Analysis Report

Product Code: META

Analysis Period: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of 2026-01-20, the target META had an opening price of 607.88, a closing price of 604.12, a 5-day moving average of 625.93, a 10-day moving average of 639.69, and a 20-day moving average of 650.62. The daily change was -2.60%, weekly change -4.27%, monthly change -8.48%, quarterly change -8.48%, and annual change -8.48%.

Based on the moving average alignment and price behavior, META is currently in the concluding or panic stage of a clear long-term downtrend, but no definitive reversal signals have yet appeared.

- • Bullish/Bearish Alignment: Throughout the analysis period, a typical and intensifying bearish alignment is evident. On the start date (2025-11-21), the price (594.25) had already fallen below all major moving averages (MA_5D ~ MA_60D). By the end of the analysis period (2026-01-20), the moving averages had descended from their highs and exhibited a downward divergence pattern: MA_5D (625.93) < MA_10D (639.69) < MA_20D (650.62) < MA_30D (652.41) < MA_60D (650.13). The price (604.12) consistently trades below all major moving averages, confirming a market strongly dominated by bearish sentiment.

- • Market Phase Inference: Following a rebound from above $600 in late November 2025, the price experienced a significant "Secondary Test" high point (673.42) in mid-December 2025 (Dec 4th & 5th), but on declining volume, failing to decisively break above the prior high. The price has since declined steadily, with an accelerated drop and increased intraday volatility observed in mid-to-late January 2026. According to Wyckoff theory, this aligns with the characteristics of transitioning from Distribution to Markdown, potentially entering a Panic phase. The price has retraced all gains from the early December rally and set a new low (600.0), indicating that supply (selling pressure) has re-established absolute dominance after the rally.

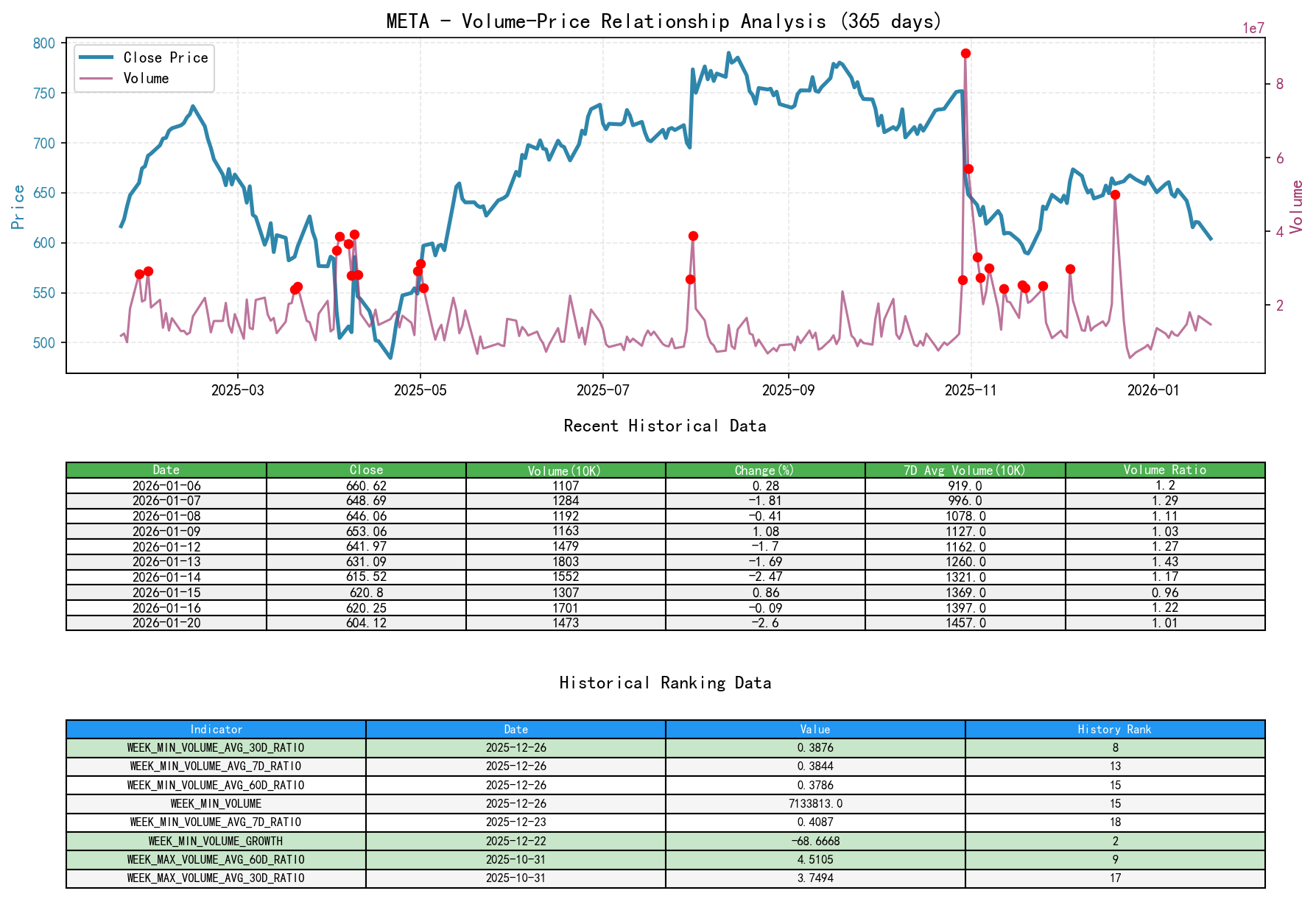

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-20, the target META had an opening price of 607.88, closing price 604.12, volume 14735782, daily change -2.60%, volume 14735782, 7-day average volume 14571527.57, and 7-day volume ratio 1.01.

The data indicates that Supply (selling) is the primary market driver, but recent signs of potential panic selling have emerged, which is often an area of interest for large investors.

- • Key Day Analysis:

- • Distribution Day: 2025-12-19, the stock fell -0.85%, but volume surged to 49.977 million shares (far exceeding recent averages), with turnover reaching $33.02 billion. This is a classic case of "high-volume stagnation/decline", indicating massive supply emerging at relatively high levels that buyers could not absorb. Historical ranking data confirms that the day's turnover ranked 6th highest in the past 10 years, highlighting the extreme nature and significance of this selling event. This is a clear signal of distribution by large capital.

- • Panic/Selling Climax Days: 2026-01-14 and 2026-01-20. Both days saw declines exceeding -2.4%, with volumes significantly higher than the 30-day and 60-day averages (VOLUME_AVG_30D_RATIO > 1.05). Particularly on January 20th, the price fell -2.60% on high volume (14.736 million), significantly above the 30-day and 60-day average volumes. This high-volume plunge at the end of a downtrend may indicate the emergence of panic selling.

- • Supply Absorption Day: 2025-12-04, the stock surged 3.43% on expanded volume of 29.875 million shares, 1.33 times the 30-day average volume at the time. This shows substantial demand (buying) entering the market during the initial rebound from a decline. However, the subsequent price increase failed to sustain, indicating that supply (overhead resistance or new selling pressure) in that zone remains heavy, rendering the rebound ineffective.

- • Lack of Demand Days: In late December 2025 (Dec 23, 24, 26), volume shrank to extremely low levels (averaging around 7 million), with minimal price fluctuations. Historical rankings show that the volume on December 26th (7.134 million) was the 15th lowest in the past 10 years, with a volume growth rate of -68.67%, the 2nd lowest in 10 years. This indicates extremely low market participant interest, with demand (buyers) unwilling to enter at these price levels.

- • Supply-Demand Shift Signals: No effective "Spring" (Terminal Shakeout) or "Sign of Strength" has been observed yet. Following the high-volume decline on January 20, 2026, it is crucial to monitor whether "low-volume stabilization" or "high-volume rebound" appears subsequently. This would be a preliminary sign of demand re-entering and supply exhaustion.

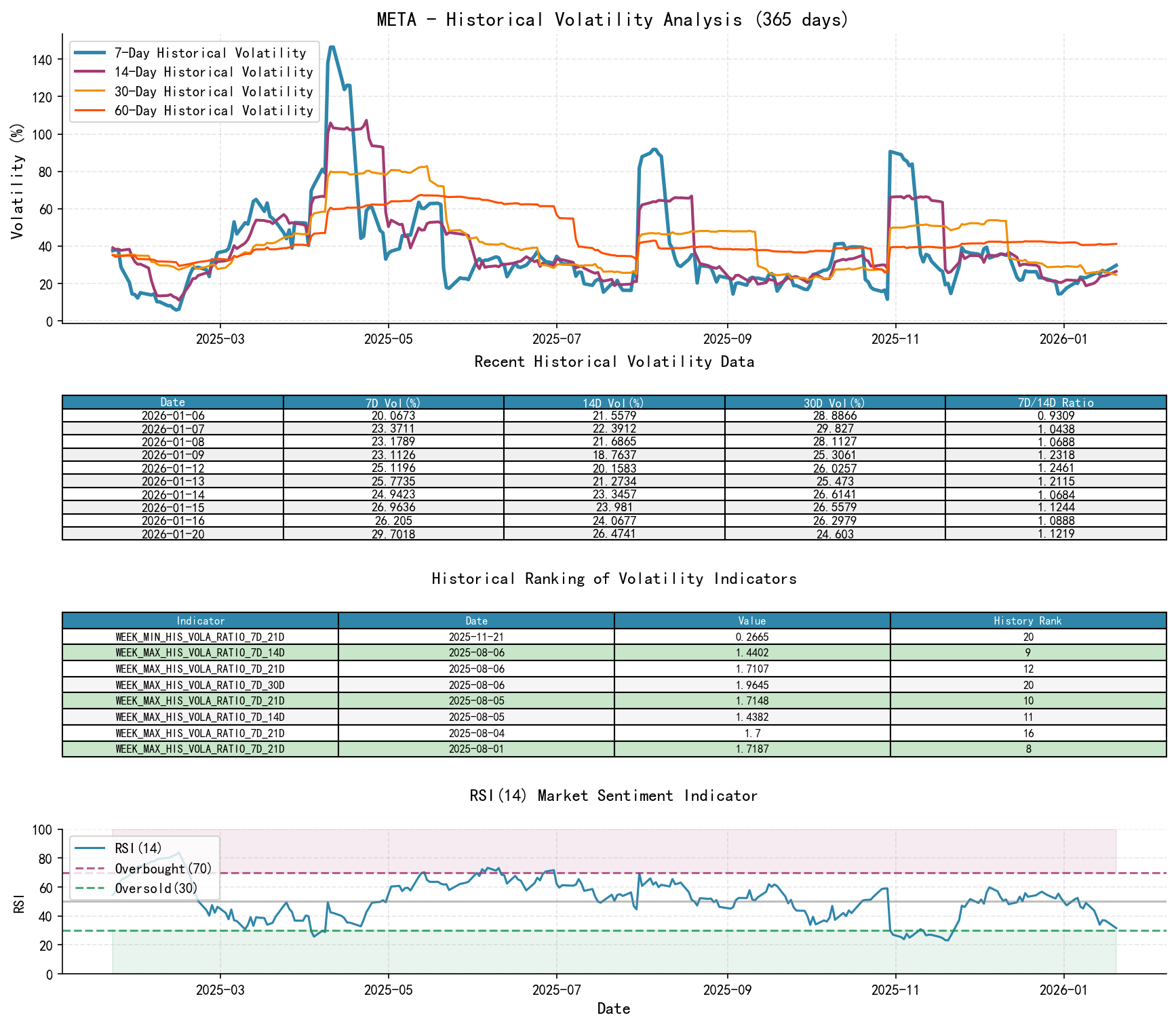

3. Volatility and Market Sentiment

As of 2026-01-20, the target META had an opening price of 607.88, a 7-day intraday volatility (Parkinson) of 0.23, a 7-day intraday volatility ratio of 0.97, a 7-day historical volatility of 0.30, a 7-day historical volatility ratio of 1.12, and an RSI of 31.65.

Market sentiment is extremely pessimistic. Volatility characteristics indicate accelerating downward momentum, but it has not yet reached a peak of extreme sentiment.

- • Volatility Levels: The short-term historical volatility (HIS_VOLA_7D) recently (2026-01-20) rose to 0.297, significantly higher than the 0.144 in early December 2025. Concurrently, the Parkinson intraday volatility (PARKINSON_VOL_7D) also recovered from a low of 0.192 (2025-12-05) to 0.227. The significant rise in short-term volatility reflects the acceleration of the downtrend and heightened market nervousness.

- • Volatility Ratios: On January 20th, HIS_VOLA_RATIO_7D_60D (0.721) and PARKINSON_RATIO_7D_60D (0.834), while above recent lows, remained below 1.0, indicating that the increase in short-term volatility has not yet surpassed the long-term volatility center, suggesting panic may not have reached an extreme. However, HIS_VOLA_RATIO_7D_14D (1.122) and PARKINSON_RATIO_7D_14D (0.966) show short-term volatility beginning to exceed medium-term, signifying the release of downward momentum.

- • RSI Oversold Condition: The RSI_14 reading on 2026-01-20 was 31.65, entering the technical oversold zone, but not at a historical extreme (the low was 26.37 on 2025-11-21). This creates conditions for a technical rebound, but oversold RSI readings can persist during a downtrend and are not an immediate reversal signal; they must be judged in conjunction with volume-price behavior.

4. Relative Strength and Momentum Performance

META exhibits strong negative momentum across all timeframes, with short-term, medium-term, and long-term trends highly aligned, indicating comprehensive weakness.

- • Return Analysis:

- • Short-term (WTD): The return for the most recent week (as of Jan 20) was -4.27%, showing strong short-term downward momentum.

- • Medium-term (MTD/QTD): The month-to-date return is -8.48%, and the quarter-to-date return is also -8.48%, indicating that the downtrend is not only short-term but has also established significant negative medium-term momentum.

- • Long-term (YTD/TTM): The year-to-date return is -8.48%, and the trailing twelve-month return is only -1.41%, showing long-term momentum has turned negative.

- • Momentum Confirmation: The strong negative momentum provides a highly consistent mutual confirmation with the bearish-aligned moving averages and the supply-dominated volume-price relationship, reinforcing the assessment that the market is currently in a downtrend.

5. Large Investor ("Smart Money") Behavior Identification

Based on extreme volume-price data and Wyckoff events, the behavioral patterns of large investors can be inferred:

- 1. Distribution Phase (Mid-to-late December 2025): When the stock price rebounded to the $660-670 zone from lows, large investors used the rally for concentrated distribution. The record-breaking turnover on December 19th (6th highest in 10 years) coupled with a price decline is typical behavior of "smart money" transferring holdings to the public. They did not believe in the sustainability of the rally, opting to lock in profits or cut losses at higher levels.

- 2. Markdown and Potential Shakeout (Late December 2025 to Present): After distribution was completed, the price lost support and entered a free-fall phase. Extremely low volume during this period indicates smart money was not actively participating. The recent high-volume decline (mid-to-late January 2026) could imply two possibilities:

- • a) Panic Selling (Public Selling): Ordinary investors, panicking as losses widened, engaged in irrational selling.

- • b) Smart Money's Terminal Shakeout (Support Test): Smart money leverages market panic to create a sharp decline, shaking out the last, weak holders.

- • Key Observation Point: If scenario (a), it will be followed by disorderly decline. If scenario (b), an "oversold rebound" will follow the panic selling, with smart money quietly accumulating at low levels. Currently, we need to observe whether "high-volume advance" or "long lower shadow stabilization" occurs subsequently to confirm scenario (b).

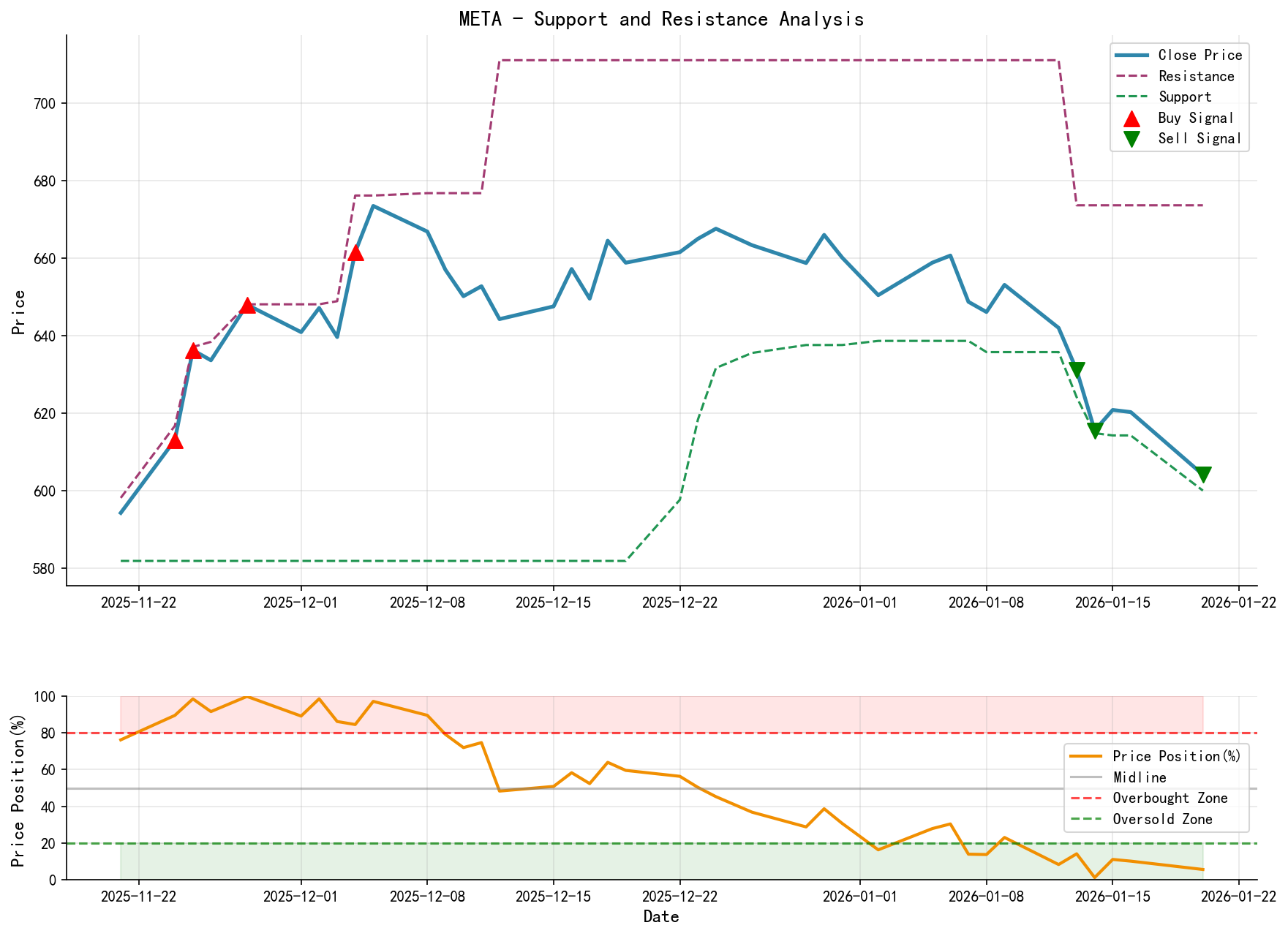

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • Absolute Support (Panic Low): $600.00 (the low on 2026-01-20). This is a significant psychological and technical level. A decisive break below could open the door to further downside.

- • Secondary Support:585.00 (the low area from November 2025).

- • Key Resistance Levels:

- • Primary Resistance:625.00 (near the recent minor consolidation platform and the 5-day MA).

- • Strong Resistance Zone:650.00 (the convergence area of the 20-day and 30-day MAs, also the consolidation platform from early January).

- • Trend Resistance:675.00 (the December rally high and the location of the downtrend line).

- • Comprehensive Wyckoff Trading Signals and Recommendations:

- • Current Signal: Bearish/Watch. The market is in a clear downtrend with no reliable bottom reversal pattern present.

- • Operational Recommendations:

- 1. Bears/Observers: Maintain short positions or continue watching. A stop-loss reference can be set above $640 (if a rebound breaks above this level, the downtrend may be compromised).

- 2. Potential Bulls/Bottom Fishers: Strictly avoid blind bottom-fishing at current prices. Wait for clear bottom-formation signals.

- • Future Validation Points and Potential Long Conditions:

- 1. Signal A (Initial Stabilization): The price stabilizes near or slightly below $600, accompanied by "low-volume, narrow-range consolidation" or a candlestick with a long lower shadow and increased volume.

- 2. Signal B (Demand Entry Confirmation): Following the stabilization signal, a "high-volume advance" candlestick appears (gain > 3%, volume > 1.5x 60-day average), forcefully breaking through the $620-625 resistance zone. This would be the first strong evidence of demand beginning to overwhelm supply and smart money starting accumulation.

- 3. Signal C (Trend Reversal Confirmation): The price subsequently demonstrates sustained high volume and effectively breaks through and holds above the $640-650 strong resistance zone. At that point, it could be considered that the downtrend may be ending, and a new markup phase or accumulation range is beginning.

- • Recommendation: Only after "Signal A + Signal B" appear successively should one consider establishing a tentative long position, with a stop-loss set below the low of "Signal A". Any operation before "Signal C" appears should be treated as a rally within the downtrend, not a trend reversal.

Summary: META is in a deep downtrend triggered by large investor distribution behavior. Market sentiment is pessimistic, with heavy short-term selling pressure. Although the stock price has entered oversold territory and approached key support, the trend remains downward until clear, demand-driven Wyckoff reversal events (such as high-volume stabilization, a successful Spring test) appear. Investors should prioritize risk control and patiently wait for the market to issue its own reversal signals.

Disclaimer: This report/interpretation is solely for market analysis and research based on public information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantee of its accuracy or completeness. The market involves risks, and investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is released daily before the market opens at 8:00 AM. Your comments and shares are highly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: