KWEB Quantitative Analysis Report (Based on Wyckoff Methodology)

Product Code: KWEB

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Time: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset KWEB had an opening price of 35.12, a closing price of 34.97, a 5-day moving average of 36.70, a 10-day moving average of 36.36, a 20-day moving average of 35.67, a daily change of -2.07%, a weekly change of -5.28%, a monthly change of 2.70%, a quarterly change of 2.70%, and a yearly change of 2.70%.

Based on the dynamic relationship between price and moving averages, combined with price action, the current market phase is identified.

- • Trend Structure and Alignment:

- • Overall Trend: Throughout the observation period, the price has consistently traded below all key moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), forming a clear bearish alignment. This indicates that the long-term, medium-term, and short-term trends are all pointing downward.

- • Phased Fluctuations: From late December 2025 to mid-January 2026, a rebound occurred. During this period, MA_5D briefly crossed above MA_10D and MA_20D, generating a short-lived bullish signal (e.g., January 12-13). However, this rebound failed to effectively challenge the strong resistance zone formed by MA_30D and MA_60D. The price quickly retreated after touching 37.73, falling below all short-term moving averages again, confirming the resumption of the bearish trend.

- • Inferred Market Phase (Wyckoff Perspective):

- • Phase 1 - Preliminary Support and Automatic Rally (PS/AR): In late December 2025, the price found support in the 34.00-34.60 range and rallied with exceptionally high volume (34.55 million, 3.11 times the 7-day average) on January 2, 2026. This aligns with the characteristics of an "Automatic Rally" following "Panic Selling."

- • Phase 2 - Secondary Test and Accumulation (ST/Accumulation): The rebound high in early January (37.66) can be seen as a Secondary Test of the prior decline. However, the subsequent price action (high-volume decline after January 13) did not show an effective "accumulation" structure, instead indicating a weak rally.

- • Current Phase - Markdown Following Distribution: On January 12, the price reached a near-two-month high (37.73) accompanied by extreme volume (43.46 million), but failed to sustain the advance and reversed downward. This fits the Wyckoff Distribution characteristic: at relatively high levels, large investors distribute holdings to the chasing public. The price has now broken below the lower boundary of the distribution range (approximately 36.50), entering the initial stage of the Markdown phase following distribution.

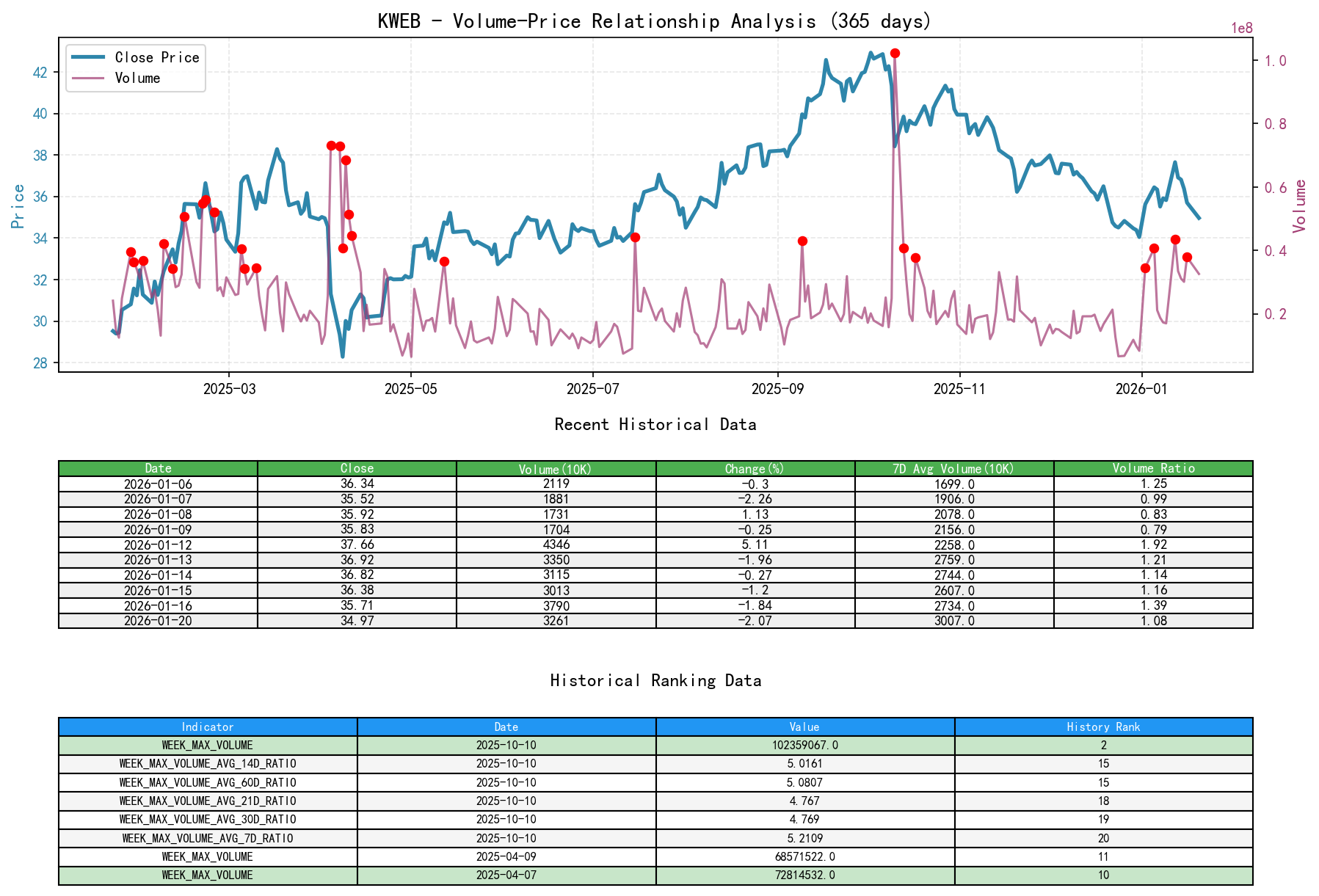

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset KWEB had an opening price of 35.12, a closing price of 34.97, a trading volume of 32,618,622, a daily change of -2.07%, a volume of 32,618,622, a 7-day average volume of 30,076,823.86, and a 7-day volume ratio of 1.08.

Volume-price analysis is key to judging shifts in supply and demand forces. Key day identification is as follows:

- • Demand-Dominated Days (Potential Bullish Signals):

- • 2026-01-02: Price surged 4.64%, with volume spiking to 34.55 million, which is 3.11 times the 7-day average volume (

VOLUME_AVG_7D_RATIO). This is a classic high-volume breakout, indicating strong buyer demand, possibly a correction from prior oversold conditions or new capital inflow. - • 2026-01-12: Price rose 5.11%, with volume reaching 43.46 million, the highest during the observation period, and 1.92 times the 7-day average. This shows strong buying interest, but its nature needs to be judged in conjunction with subsequent price action.

- • 2026-01-02: Price surged 4.64%, with volume spiking to 34.55 million, which is 3.11 times the 7-day average volume (

- • Supply-Dominated Days (Potential Bearish Signals):

- • 2026-01-20 (Latest Trading Day): Price declined 2.07%, with volume at 32.61 million, 1.28 times the 14-day average and 1.51 times the 21-day average. A high-volume decline clearly indicates supply (selling pressure) is dominant and may have breached key support.

- • 2025-12-22: Price plummeted 4.77%, with volume at 21.36 million, 1.23 times the 7-day average. This is a sign of Panic Selling, often occurring at the end of a downtrend but can also trigger a rebound.

- • 2025-12-24, 2025-12-26, 2025-12-31: These days exhibited low-volume grinding declines (the

VOLUME_AVG_7D_RATIOwas below 0.7 for all), indicating weak demand during the decline, but also a reduction in active selling pressure, characteristic of a disorganized decline phase.

- • Supply-Demand Shift Signals:

- • Shift from Supply to Demand: Following an extreme low-volume decline (volume only 0.68 times the 7-day average) to the low of 34.015 on 2025-12-31, a massive bullish reversal candle appeared on 2026-01-02, forming a clear supply-to-demand shift signal.

- • Shift from Demand to Supply: The massive volume with stalled advance on 2026-01-12 (price failed to continue rising after extreme volume), followed by consecutive high-volume decline days (January 16, January 20), constituted a shift signal indicating demand exhaustion and supply regaining control.

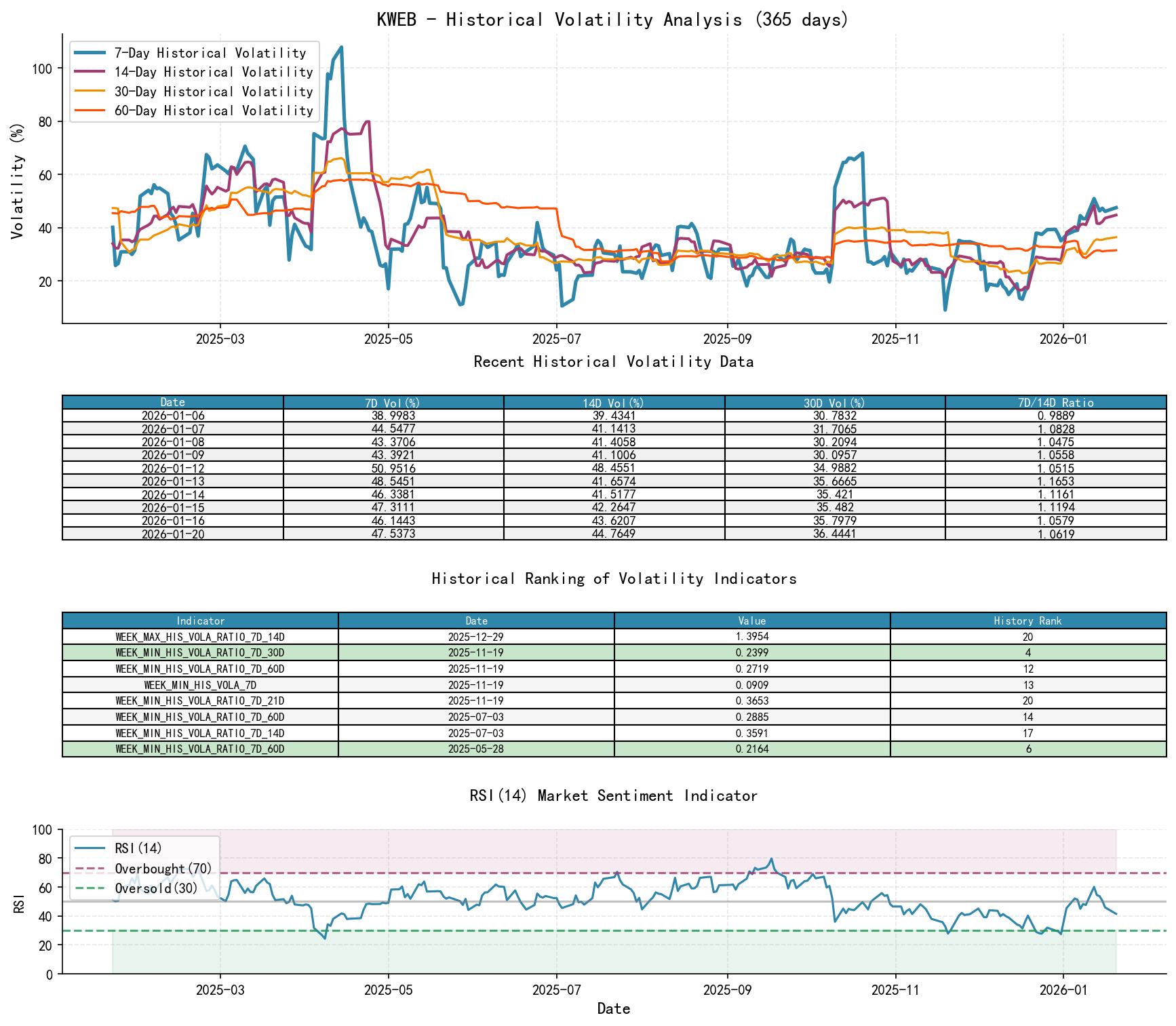

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset KWEB had an opening price of 35.12, a 7-day intraday Parkinson volatility of 0.19, a 7-day intraday volatility ratio of 1.05, a 7-day historical volatility of 0.48, a 7-day historical volatility ratio of 1.06, and an RSI of 41.49.

Volatility levels and changes reveal market nervousness and potential turning points.

- • Volatility Level and Compression:

- • In mid-to-late December 2025, the short-term Parkinson intraday volatility (

PARKINSON_VOL_7D) dropped to historically extreme lows below 0.10 (ranking 19th and 20th historically). Concurrently, ratio indicators likePARKINSON_RATIO_7D_14Dalso fell to near-decade lows (e.g., 0.5865, ranking 7th). This signaled extreme volatility compression, often preceding a significant volatility expansion (regardless of direction). - • Historical volatility (

HIS_VOLA_7D) surged above 0.39 from late December to early January, withHIS_VOLA_RATIO_7D_14Dreaching 1.395 on December 29 (ranking 20th historically), confirming volatility had shifted from a compressed state to an expansion state, activating market sentiment.

- • In mid-to-late December 2025, the short-term Parkinson intraday volatility (

- • Sentiment Indicator Validation:

- • RSI_14: Reached a significantly oversold level of 27.47 on 2025-12-31, setting the stage for the subsequent technical rebound. At the rebound high on 2026-01-12, RSI rose to 60.15, nearing overbought but not extreme, indicating the rebound sentiment was not overheated. The current (January 20) RSI is 41.49, in a neutral-to-weak zone, with room to decline further.

4. Relative Strength and Momentum Performance

Returns over different periods reveal the underlying asset's momentum structure and its changes.

- • Momentum Structure:

- • Short-Term Momentum Weakening: The latest week-to-date return (

WTD_RETURN) is -5.28%, indicating strong short-term downward momentum. - • Medium-Term Momentum Decay: The month-to-date return (

MTD_RETURN) is +2.70%, and the quarter-to-date return (QTD_RETURN) is also +2.70%, significantly lower than the highs around January 12 (MTD >10%), indicating the decline since mid-January has substantially eroded the quarter's gains. - • Long-Term Momentum Weakness: Although the year-to-date (

YTD) return remains positive (+2.70%), momentum has significantly deteriorated compared to the mid-January highs (>10%). - • Conclusion: The momentum structure exhibits characteristics of "short-term turning negative, medium-term flattening and decaying," consistent with the judgment that the price has broken below short-term moving averages and entered a declining phase.

- • Short-Term Momentum Weakening: The latest week-to-date return (

5. Large Investor (Smart Money) Behavior Identification

Synthesizing volume-price and volatility data to infer the operational intent of institutional capital.

- 1. Accumulation Behavior: The end of the decline in late December 2025 (panic selling on Dec 22, low-volume grinding decline on Dec 31), followed by the massive rally on January 2, 2026, forms a potential "Panic Selling - Automatic Rally" structure. Smart money may have conducted tentative accumulation in the 34.00-34.60 range.

- 2. Distribution Behavior: This is the core judgment of the current phase. On January 12, 2026, the price rebounded to a recent high of 37.73, accompanied by record-breaking volume (43.46 million). However, the price failed to hold, declining on high volume the next day. This "high-volume stalling at highs" is a classic marker of Distribution in Wyckoff theory. Large investors likely utilized the strong rebound and public optimism to conduct large-scale distribution at this level.

- 3. Current Behavior: The high-volume declines on January 16 and 20 indicate that following the completion of distribution, supply fully controls the market, allowing the downtrend to continue. Smart money is likely currently in a wait-and-see or short-selling mode, with no apparent buying behavior.

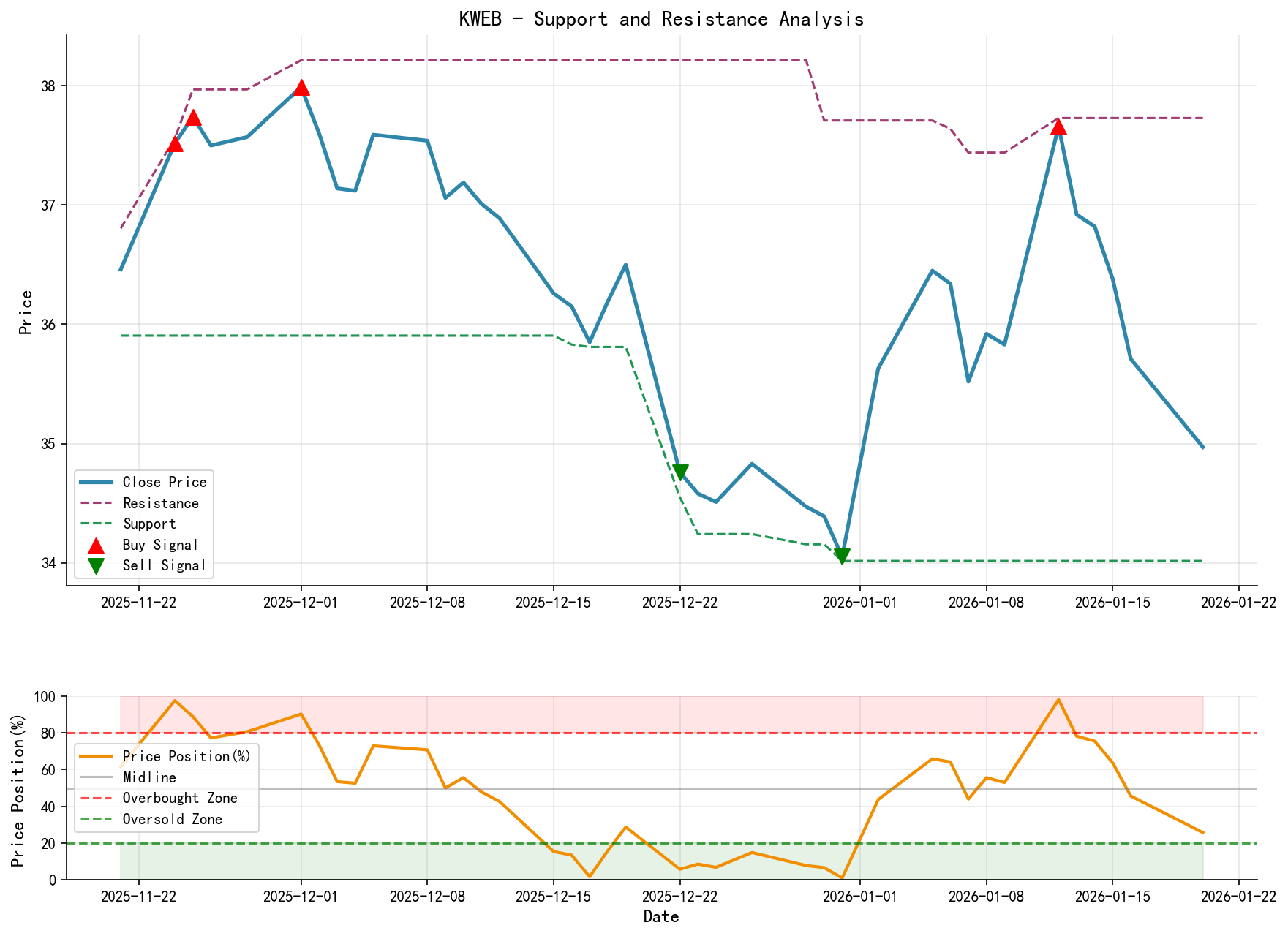

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • S1: 34.015 - The low on December 31, 2025, also a significant bottom following the prior panic selling. A breach opens up downside space.

- • S2: 33.50 / 32.00 - Psychological round numbers and potential support on longer-term charts.

- • Key Resistance Levels:

- • R1: 36.80-37.00 - The lower boundary of the recent consolidation platform before the decline, near the January 20 opening price.

- • R2: 37.50-37.73 - The core area of the January distribution range and the previous high, constituting strong resistance.

- • R3: 39.00 and above - The long-term descending trendline resistance formed by MA_30D and MA_60D.

Comprehensive Conclusion and Operational Recommendations

- • Market Phase Determination: KWEB is in the "initial stage of Markdown following Distribution completion." Main features: bearish alignment restored, clear distribution volume-price structure at highs, current high-volume decline.

- • Bull-Bear Force Contrast: Supply (sellers) is significantly stronger than demand (buyers). Any rebound without substantial volume support should be viewed as an opportunity to reduce positions or initiate short positions.

- • Large Investor Intent: Has completed phased distribution and is currently leading or acquiescing to the downtrend.

Operational Recommendations:

- 1. Primary Strategy (Trend-Following): Bearish/Bias/Neutral. Long positions should not be considered for medium-to-long term until the price reclaims and stabilizes above 37.50 (distribution range).

- 2. Specific Actions:

- • Short Opportunities: If the price rallies near the 36.80-37.00 (R1) resistance zone and shows signs of stalling (e.g., small-bodied candles, long upper shadows) or reverses on increased volume, it could be considered a technical short entry point. Initial stop-loss can be set above 37.75 (above R2).

- • Long Risk: Any attempt to "buy the dip" should be exercised with extreme caution. Only if the price retests the 34.015 (S1) support and shows a clear "high-volume stabilization" signal (e.g., a hammer candlestick with a long lower shadow accompanied by a sharp volume spike) should one consider a light position to trade a technical bounce, with a stop-loss set below 33.90.

- 3. Key Validation Points:

- • Bearish Validation: A confirmed close below 34.015 (S1) accompanied by increased volume would confirm an acceleration of the downtrend.

- • Bullish Reversal Signal (Currently Low Probability): The price needs to break above and sustain closes above 37.73 (R2) to negate the current distribution-markdown structure. Strategy adjustment should await such signals.

Risk Warning: Market volatility has shifted from extreme compression to expansion, and short-term fluctuations may intensify. All trades should be executed with strict position control and stop-losses.

Disclaimer: This report/analysis is solely market analysis and research based on public information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantees regarding its accuracy or completeness. Markets involve risks, investment requires caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Wyckoff Volume-Price market interpretation is published daily at 8:00 AM before market open. Your comments and shares are highly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: