As an expert quantitative trading researcher proficient in the Wyckoff Method, I will provide you with a comprehensive quantitative analysis report on ICLN based on the data you have provided.

Quantitative Analysis Report: ICLN

Product Code: ICLN (iShares Global Clean Energy ETF)

Analysis Date Range: November 21, 2025 - January 20, 2026

Report Generation Date: January 21, 2026

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset ICLN had an opening price of 17.43, a closing price of 17.53, a 5-day moving average (MA) of 17.54, a 10-day MA of 17.34, a 20-day MA of 16.95. Performance: Daily change -0.96%, Weekly change -0.11%, Monthly change +6.70%, Quarterly change +6.70%, Yearly change +6.70%.

Data Observations:

- • Moving Average Arrangement: As of January 20, 2026, the price (17.53) is trading above all major moving averages. It shows a short-term bullish alignment:

MA_5D (17.536) > MA_10D (17.343) > MA_20D (16.947). However, theMA_20D (16.947)andMA_30D (16.847)are still slightly below theMA_60D (16.900), indicating the mid-term moving averages are still in a repair process. - • Price Action:

- • Correction Phase (Late November - Mid December): The price fell from the November 28th high (16.99) to the December 17th low (16.00), a decline of approximately 5.8%. During this period, the price consecutively fell below the MA_5D, MA_10D, and MA_20D.

- • Rebound and Breakout Phase (Late December - Early January): Starting December 22nd, the price began to rebound and on January 2, 2026, broke through the previous high (16.99) with high volume (+4.08%, volume 6.49 million), forming a higher high and higher low structure. From January 2nd to January 16th, the price oscillated upward within the 17.10-17.70 range.

- • Current Status (January 20th): The price retraced slightly from the January 16th high (17.70) to 17.53 but remains above all moving averages.

Wyckoff Framework Interpretation:

Integrating price and volume behavior, the market has experienced a clear "correction - accumulation - markup" cycle:

- 1. Decline/Correction after Distribution (Late Nov - Mid Dec): The price retreated from 17.18 (near MA_30D), which can be seen as a natural correction or minor distribution following the prior advance.

- 2. Potential Accumulation Zone (Mid Dec - Late Dec): Within the 16.00-16.60 range, the price tested lower levels multiple times (e.g., Dec 17) but did not make new lows (compared to the Nov 21 low of 15.625). Concurrently, volume was elevated on down days (Dec 17) and significantly elevated on rally days (Dec 22, Jan 2), consistent with characteristics of a "Shakeout" and "Signs of Demand." The extremely low volatility in late December (see Part 3) is a typical sign of the late accumulation phase.

- 3. Markup Phase (January to present): The high-volume breakout on January 2nd is a clear bullish "Jump Across the Creek" signal, indicating demand has taken complete control of the market and an uptrend is established. The current phase is a normal pullback or "Secondary Test" within the ongoing uptrend.

Phase Determination: The market is currently in a "Re-accumulation" or minor pullback phase within an established uptrend (Markup).

2. Volume-Price Relationship and Supply-Demand Dynamics

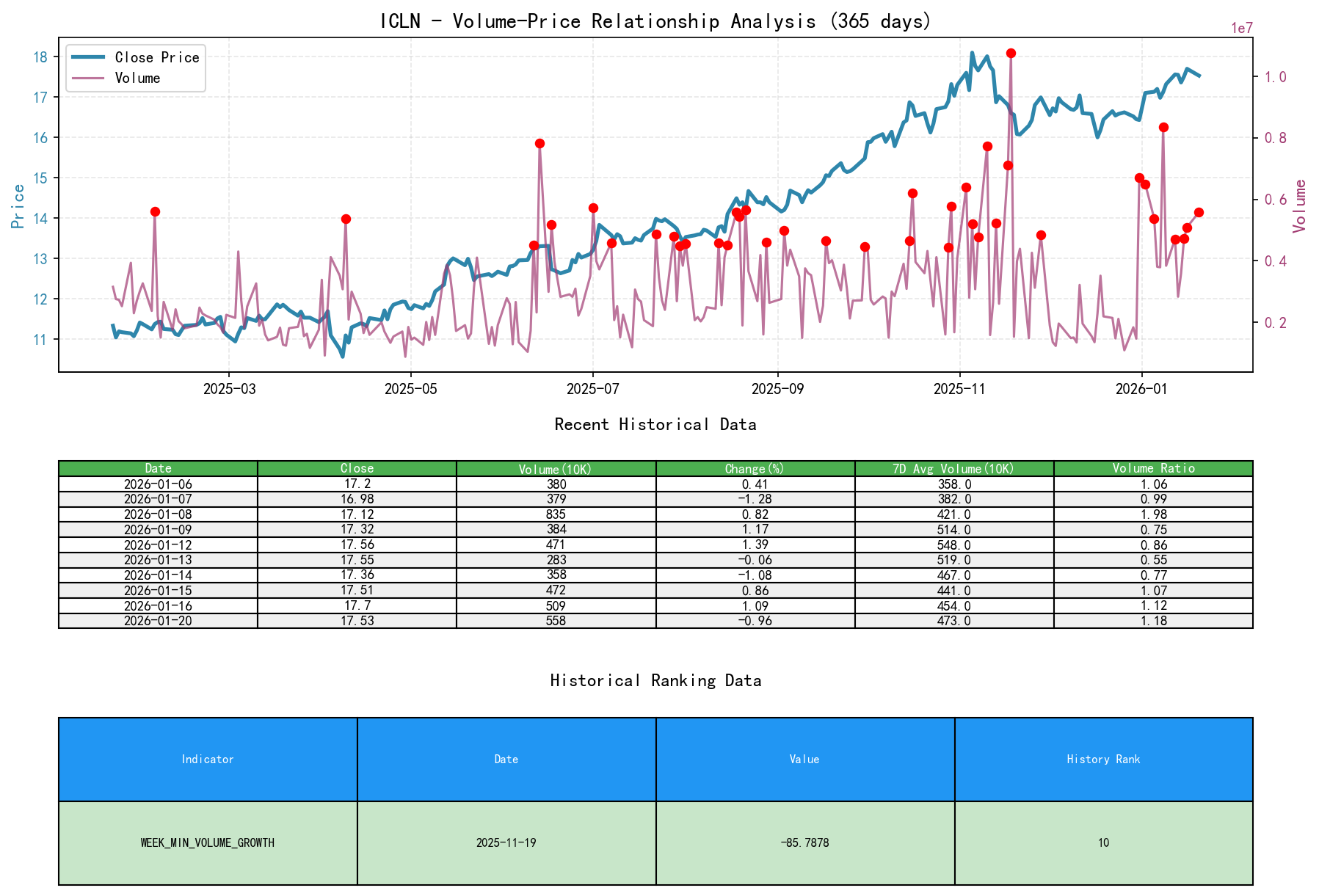

As of January 20, 2026, the underlying asset ICLN had an opening price of 17.43, a closing price of 17.53, volume of 5,583,363, daily change of -0.96%, volume 5,583,363, 7-day average volume 4,734,543.29, and a 7-day volume ratio of 1.18.

Key Day Analysis:

- • Demand-Dominated Days (Bullish):

- • 2026-01-02:

PCT_CHANGE+4.08%,VOLUME6.497M,VOLUME_AVG_7D_RATIO2.70. High-volume breakout, a strong demand signal. - • 2025-12-22:

PCT_CHANGE+1.28%,VOLUME2.144M,VOLUME_AVG_7D_RATIO0.93,VOLUME_AVG_14D_RATIO1.12. Rising volume (above 14-day average) halting the decline and rebounding, confirming effective support near 16.00. - • 2025-11-26:

PCT_CHANGE+2.25%,VOLUME3.124M,VOLUME_AVG_7D_RATIO0.65, butVOLUME_AVG_30D_RATIO0.74. Price rise with volume increase, indicating demand recovery.

- • 2026-01-02:

- • Supply-Dominated Days (Bearish/Cautionary):

- • 2025-12-01:

PCT_CHANGE-2.59%,VOLUME1.903M,VOLUME_AVG_7D_RATIO0.56. Decline on low volume, indicating supply did not exert full pressure initially in the decline, but demand was absent. - • 2025-12-12:

PCT_CHANGE-2.58%,VOLUME1.958M,VOLUME_AVG_7D_RATIO1.09. Decline on elevated volume, a clear signal of emerging supply, causing the short-term rally to terminate. - • 2026-01-07:

PCT_CHANGE-1.28%,VOLUME3.791M,VOLUME_AVG_7D_RATIO0.99. Reversal from highs on elevated volume, showing supply resistance emerged near 17.20.

- • 2025-12-01:

- • Neutral/Transfer Days:

- • 2025-12-31:

PCT_CHANGE-0.12%,VOLUME6.697M,VOLUME_AVG_7D_RATIO3.80. High-volume narrow-range consolidation. This is typical of large institutional position adjustments (year-end rebalancing). While not a clear directional signal, it accumulated energy for the subsequent breakout. - • 2026-01-20 (Latest Trading Day):

PCT_CHANGE-0.96%,VOLUME5.583M,VOLUME_AVG_7D_RATIO1.18. Pullback on elevated volume, but price found support near the MA_5D (17.536). Need to observe whether supply persists (price breaks below MA_5D) or demand absorbs here (decline halts on low volume).

- • 2025-12-31:

Supply-Demand Dynamics Summary:

The market successfully completed the process of supply exhaustion and demand absorption near 16.00 in December. The breakout in early January confirmed absolute dominance by demand. Currently, in the 17.50-17.70 area, some supply pressure has appeared, manifested as a price pullback. However, the volume during the pullback indicates demand absorption still exists, with no panic-selling high-volume down days yet. Overall, the supply-demand structure is bullish, but faces short-term resistance digestion.

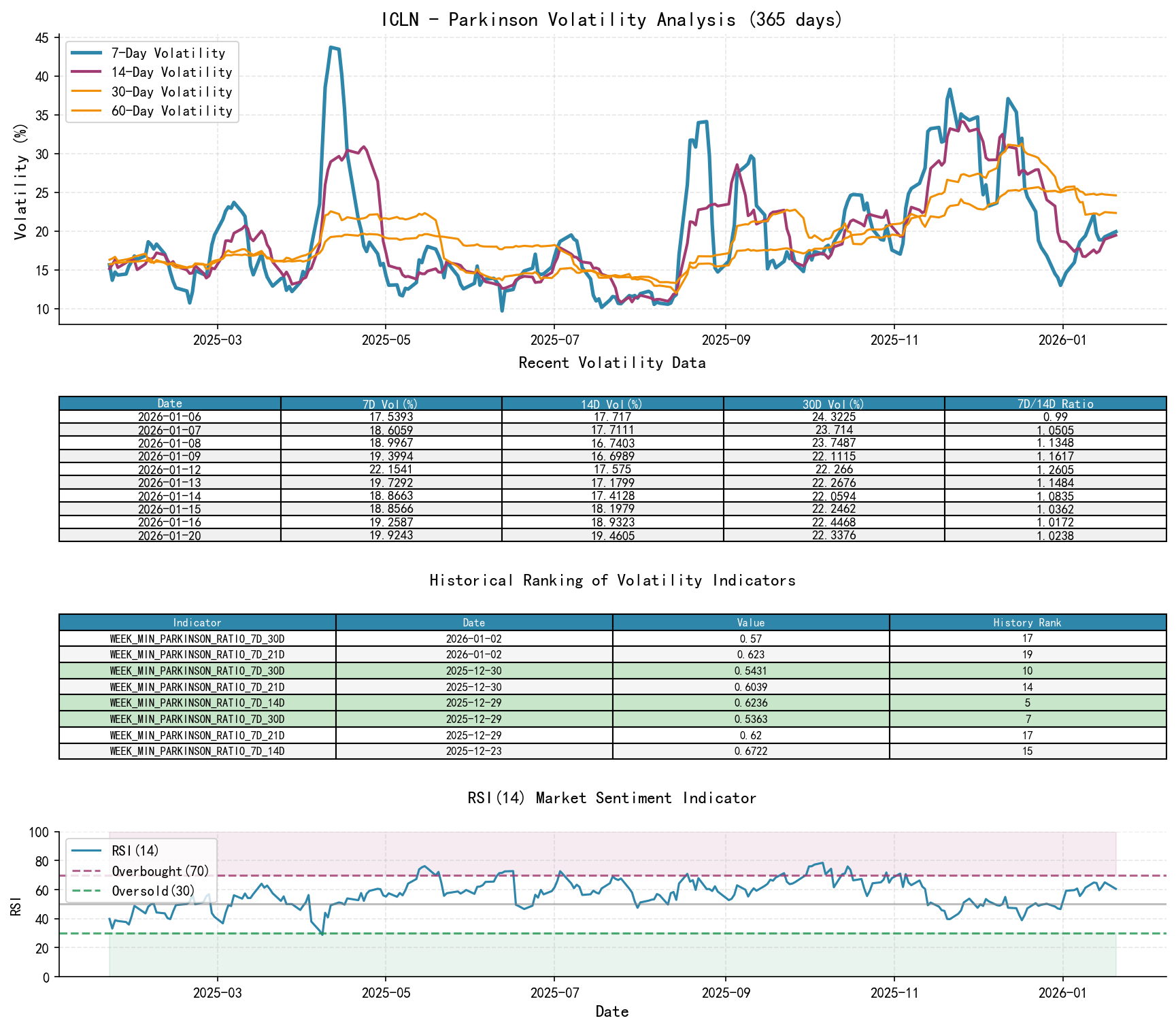

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset ICLN had an opening price of 17.43, 7-day intraday volatility of 0.20, 7-day intraday volatility ratio of 1.02, 7-day historical volatility of 0.20, 7-day historical volatility ratio of 0.77, and RSI of 60.53.

Volatility Levels:

- • Historical Volatility (HIS_VOLA): Short-term (

HIS_VOLA_7D: 0.198) is significantly lower than mid-to-long-term (HIS_VOLA_30D: 0.250,HIS_VOLA_60D: 0.324), indicating recent market movement has been relatively calm with converging volatility. - • Intraday Volatility (PARKINSON_VOL): Similarly shows the structure

PARKINSON_VOL_7D (0.199) < PARKINSON_VOL_30D (0.223) < PARKINSON_VOL_60D (0.246), confirming short-term volatility compression. - • Volatility Ratios and Historical Rankings (Key Signals):

- •

PARKINSON_RATIO_7D_14Ddropped to an extremely low level of 0.623-0.672 in late December. According to historical ranking data, this ratio reached the 5th lowest level in nearly a decade on 2025-12-29. This indicates extreme compression of short-term volatility relative to mid-term volatility, typically occurring during a calm period before a trend initiation or major news release. - •

PARKINSON_RATIO_7D_30Dand_7D_60Dalso reached near-decade-low rankings (7th lowest, 10th lowest) in late December. This systemic, cross-cycle volatility compression is a strong market preparation signal. - • Entering January, these ratios have rebounded from their extreme lows, indicating the market has transitioned from "calm" to "active" state.

- •

Sentiment Indicator (RSI):

- •

RSI_14is currently 60.53, in the neutral-to-strong zone, neither in overbought territory (>70) nor close to oversold (<30). - • At the December 17th low (16.00), the RSI touched a low of 38.92, close to but not reaching oversold levels, consistent with a "Shakeout" rather than "panic selling" characteristic.

- • At the January 16th high (17.70), the RSI peaked at 65.07, showing sentiment was not excessively euphoric during the advance.

Sentiment Summary: The extreme volatility compression in late December was a key signal of brewing market sentiment, foreshadowing a directional move. The subsequent high-volume advance validated a breakout in sentiment to the positive side. The current RSI indicates healthy market sentiment, leaving room for trend continuation.

4. Relative Strength and Momentum Performance

Multi-Cycle Momentum Analysis:

- • Short-term Momentum:

WTD_RETURN-0.11%, indicating a slight pullback this week (as of Jan 20), short-term momentum is pausing. - • Strong Mid-term Momentum:

MTD_RETURN+6.70%,QTD_RETURN+6.70%. Since January, mid-term momentum has been very strong, confirming trend validity. - • Excellent Long-term Momentum:

YTD+41.21%,TTM_12+53.23%. Long-term momentum is extremely strong, indicating ICLN is within a long-term ascending channel.

Momentum and Trend Validation: The strong MTD and QTD returns mutually validate the conclusions of price breaking to new highs and the bullish moving average alignment, confirming the validity of the mid-term uptrend. The short-term (WTD) pullback is a normal consolidation within an uptrend.

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff principle-driven volume-price analysis, inferred large investor operations are as follows:

- 1. Accumulation in Mid-to-Late December: Within the 16.00-16.60 range, the price tested lows multiple times, but volume was elevated on key down days (Dec 17) and the initial rebound day (Dec 22). Smart money systematically accumulated positions at lows, utilizing market pessimism and year-end thin trading. The extremely low volatility ratios in late December signaled they had completed their positioning and were awaiting timing.

- 2. Markup and Testing in Early January: The high-volume, strong bullish candle on January 2nd is clear evidence of concentrated smart money buying to force a breakout, aiming to escape the cost zone and attract trend followers. The subsequent oscillation within 17.10-17.70 served as a test of breakout validity and a process to observe follow-through buying and overhead supply.

- 3. Transfer and Support Testing in Current Phase: The elevated-volume pullback on January 20th likely contains two parts of fund behavior: a) Some early-entering smart money conducting profit-taking near resistance; b) Other institutional funds, bullish on the subsequent trend, actively absorbing supply during the pullback (as volume remains elevated). If the price can stabilize with low volume at the MA_5D or MA_10D, it indicates smart money successfully executed a "shakeout," clearing out weak hands and laying the foundation for the next advance.

Intent Summary: Smart money completed major accumulation in late December and initiated a breakout markup in early January. Currently, the market is in a consolidation and transfer phase following the markup. Their intent is to solidify the breakout results, test market support strength, and prepare for potential further advances.

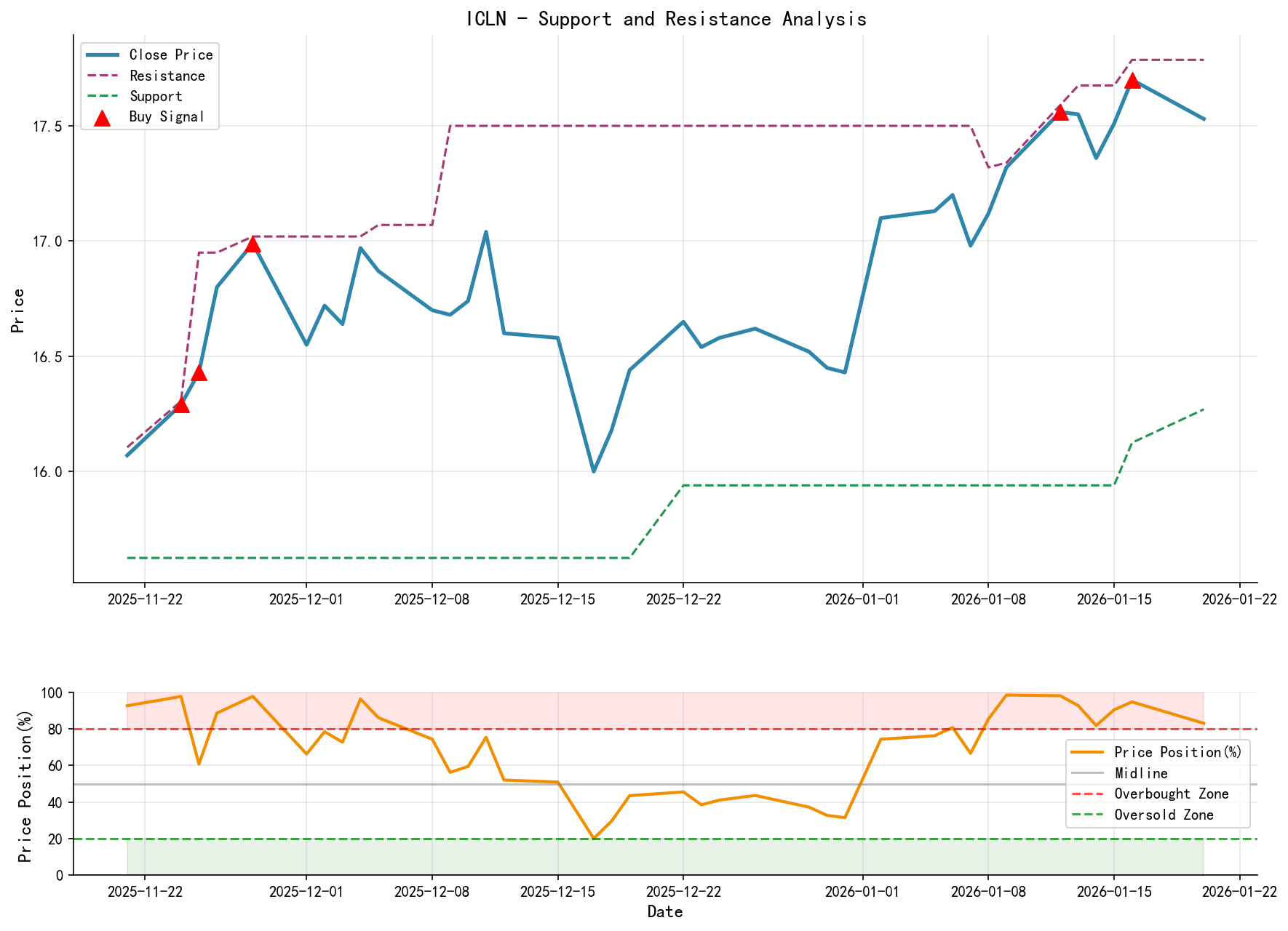

6. Support/Resistance Level Analysis and Trading Signals

Key Price Levels:

- • Immediate Support: 16.43 - 16.53. This area is the upper boundary of the early January breakout platform, the current

MA_10D (17.343)level, and a prior volume concentration zone. - • Strong Support: 16.00. The December decline low, also the lower boundary of the accumulation zone, holding significant psychological and technical importance.

- • Immediate Resistance: 17.70 - 17.79. The small range formed by the January 16th high (17.70) and January 12th high (17.786).

- • Next Resistance Level: Upon breaking 17.80, the target extends to the 18.50 - 19.00 area (based on measuring objectives from prior long-term price action).

Integrated Trading Signals and Operational Recommendations:

- • Overall Assessment: Bullish, currently at a pullback-buying opportunity node within an uptrend.

- • Core Logic: Bullish trend alignment + Strong mid-term momentum + Complete structure of smart money accumulation followed by breakout + Healthy sentiment indicators.

- • Specific Operational Recommendations:

- 1. Entry Timing: It is recommended to look for opportunities to establish long positions in batches near the 16.43 - 16.53 support area, when signs of price stabilization appear (e.g., lower shadows, small real body candles) accompanied by diminishing volume.

- 2. Stop-Loss Setting: The initial stop-loss should be placed just below the strong support level at 16.00 (e.g., 15.90). If the price breaks below 16.00, the accumulation-breakout logic may be invalidated.

- 3. Target Prices: The first target is the breakout above the prior high at 17.79, with the second target looking towards 18.50.

- 4. Add-on Signal: If the price breaks through 17.79 with high volume, it can be considered a trend resumption signal for considering adding to positions.

- • Future Validation Points (Events to Monitor):

- • Bullish Validation: After the price stabilizes with low volume in the support zone, a subsequent high-volume bullish candle appears (volume greater than the 7-day average).

- • Bearish Warning: The price breaks below 16.43 with high volume, especially closing below the

MA_10D. - • Trend Acceleration Signal: The price breaks through 17.79 with high volume, and the RSI remains in the strong 60-70 zone.

Risk Warning: Although the overall structure is bullish, vigilance is required against potential chain reactions triggered by overall market risks (e.g., broad market correction). All operations should strictly implement stop-loss discipline.

Disclaimer: This report is generated based on the provided historical data and analytical models. All conclusions are presented objectively for market research purposes and do not constitute any investment advice. Financial markets carry risks; invest with caution.

Thank you for your attention! Daily Wyckoff volume-price market interpretation is released promptly at 8:00 AM before the market opens. Please feel free to leave comments and share; your recognition is crucial. Let's work together to clearly see market signals.

Member discussion: