HSI (Hang Seng Index) Quantitative Analysis Report

Product Code: HSI

Analysis Date Range: November 21, 2025 to January 20, 2026

Report Generation Date: January 20, 2026

Report Summary: Based on Wyckoff's volume-price principles and historical data, the current HSI market is transitioning from a significant rebound to a distribution phase. Data indicates that, driven by record-high volume, the price reached the peak of this rebound (27,176.31 points) in mid-January 2026, followed by classic distribution signals such as high-volume stalling and rising volume on declining prices. Although the price remains above the key medium-term moving average (MA_60D), short-term momentum has weakened, and Smart Money shows signs of distribution at elevated levels. The comprehensive conclusion is short-term bearish, suggesting seeking shorting opportunities in resistance zones.

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying HSI opened at 26544.90, closed at 26487.51. The 5-day MA is 26836.15, the 10-day MA is 26633.97, the 20-day MA is 26236.47. Daily change: -0.29%, Weekly change: -1.34%, Monthly change: +3.34%, Quarterly change: +3.34%, Yearly change: +3.34%.

- • Moving Average Array Analysis: At the beginning of the analysis period (late November), the market exhibited a clear bearish alignment (Close Price < MA_5D < MA_10D < MA_20D). A strong rebound subsequently began, and by January 13, 2026, the price broke above all moving averages, forming a short-term bullish alignment. By the end of the analysis period (January 20), although the price remains above the MA_60D (26088.85), it has fallen below the MA_5D (26836.15) and MA_10D (26633.97), and the MA_5D has crossed below the MA_10D forming a "death cross," indicating that the short-term uptrend has definitively weakened, and the medium-term trend has entered a consolidation phase.

- • Inferred Market Phase: Corresponds to the Wyckoff "Rally-Distribution" transition phase.

- • Rally (December 2025 - Early January 2026): Price rebounded continuously from the low of 25178.63 points to 27206.84 points, accompanied by a moderate increase in volume.

- • Distribution (Starting Mid-January 2026): Price oscillated repeatedly above the 27000 level, frequently displaying classic distribution candlesticks such as "high-volume stalling" (e.g., January 13 with massive volume but only a 0.56% gain) and "rising volume on declining prices" (e.g., January 19 with a -1.05% drop and sustained high volume). This marks exhaustion of upward momentum and initiation of distribution by large participants at high levels.

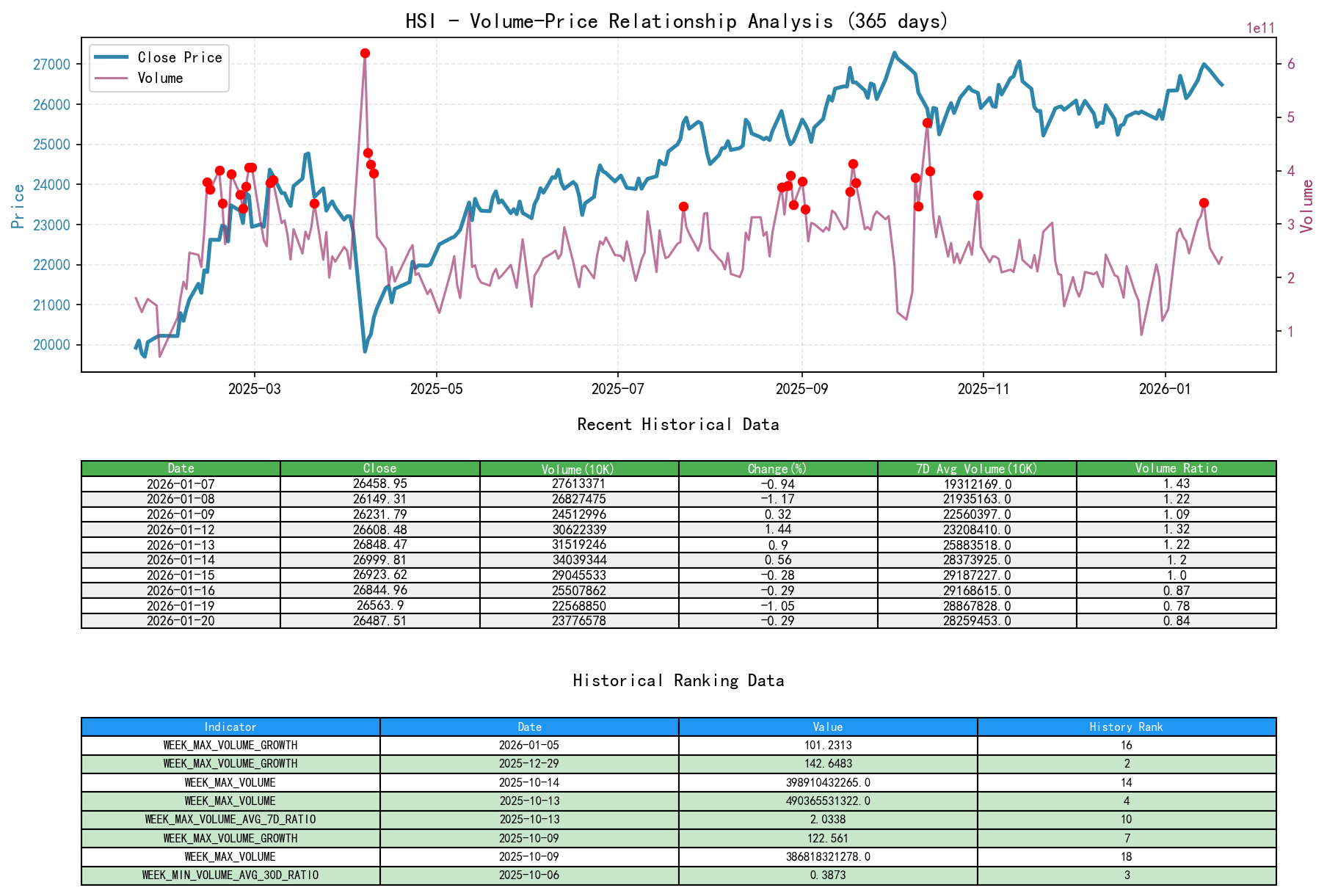

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying HSI opened at 26544.90, closed at 26487.51, volume 237765786869, daily change -0.29%, volume 237765786869, 7-day average volume 282594533300.86, 7-day volume ratio 0.84.

- • Analysis of Key Anomalous Volume-Price Days (Based on Wyckoff Events):

- 1. Panic Selling / Shakeout (2025-12-29): Price fell -0.71%, but volume surged 142.65% sequentially, with

VOLUME_AVG_7D_RATIOreaching 1.32. This is typical shakeout or panic selling behavior, clearing out weak holdings for the subsequent rebound. Historical ranking data shows this day's volume increase ranked 2nd in the past 10 years, an extremely rare event, confirming a panic-driven market low. - 2. Demand-Driven Rally (2026-01-06): Price surged 1.38%, with volume increasing 2.93% sequentially, and a

VOLUME_AVG_7D_RATIOof 1.68. This represents the last clear wave of "rising price with rising volume" demand-driven activity towards the end of the rebound. - 3. Supply-Driven Distribution Signals (2026-01-05 & 01-13):

- • January 05: Price closed almost flat (+0.03%), but volume exploded 101.23% sequentially (

VOLUME_AVG_7D_RATIO1.80), constituting a classic "Stopping Volume" signal. This day's volume increase ranked 16th in the past 10 years, a highly anomalous event. - • January 13: Price reached a new high but closed with an upper shadow, with gains narrowing to 0.56%, while volume remained high at 315.19 billion (

VOLUME_AVG_14D_RATIO1.47). This confirms the "Stopping Volume" signal from the previous day.

- • January 05: Price closed almost flat (+0.03%), but volume exploded 101.23% sequentially (

- 1. Panic Selling / Shakeout (2025-12-29): Price fell -0.71%, but volume surged 142.65% sequentially, with

- • Supply-Demand Structure Conclusion: The market's supply and demand forces have undergone a fundamental shift by the end of the analysis period. The structure transitioned from "Strong Demand > Supply" from late December to early January, to "Strong Supply ≥ Demand" from mid-January onwards. Recent (Jan 16-20) price corrections have been accompanied by volume receding from peaks but remaining above average (

VOLUME_AVG_30D_RATIOall >1.08), indicating ongoing supply release with insufficient demand to absorb it.

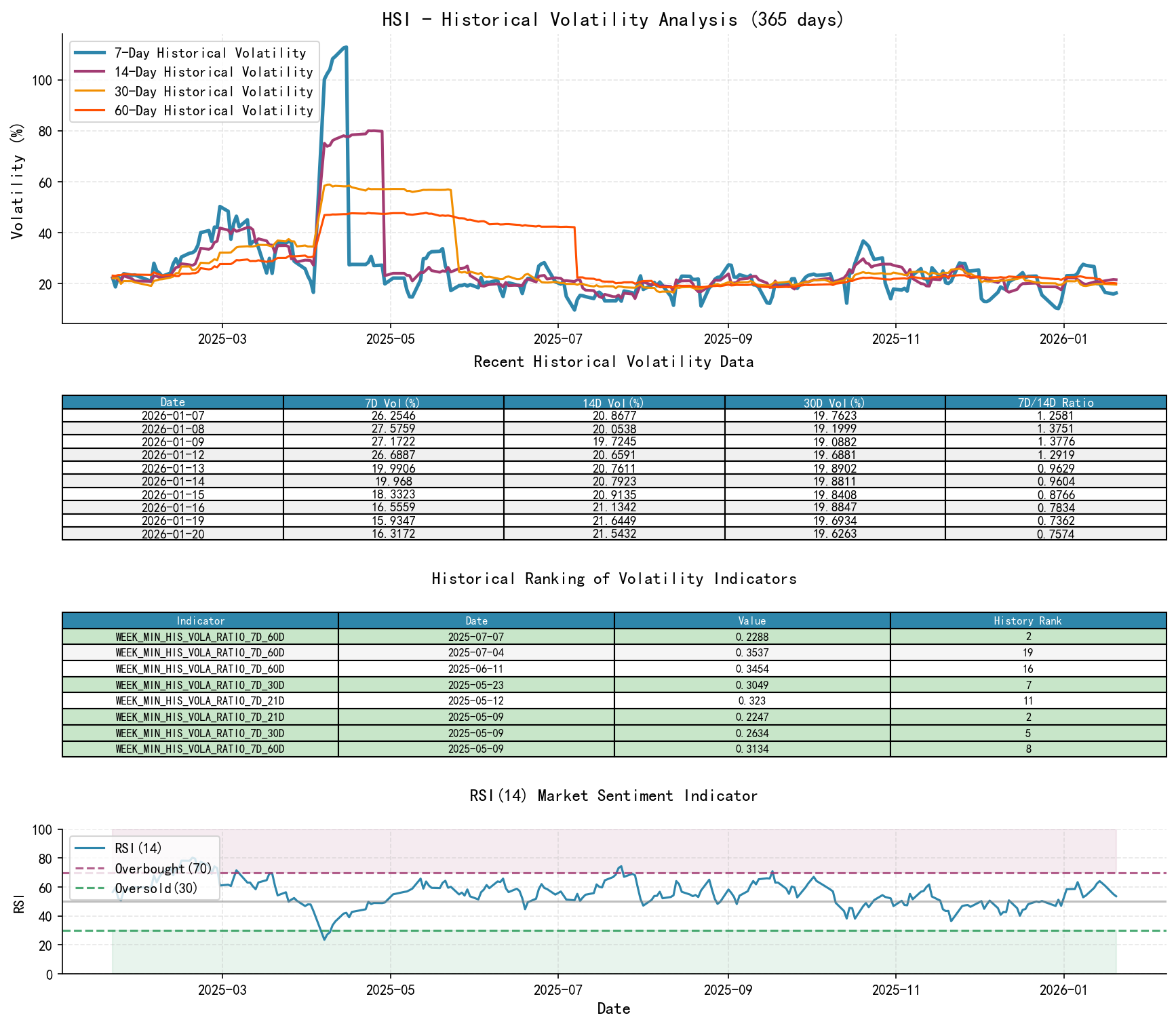

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying HSI opened at 26544.90, 7-day intraday volatility 0.15, 7-day intraday volatility ratio 1.03, 7-day historical volatility 0.16, 7-day historical volatility ratio 0.76, RSI 53.66.

- • Volatility Levels: Historical volatility (

HIS_VOLA_7D) peaked around 0.28 near the rebound high in early January, then fluctuated and declined to 0.16 by period-end. Parkinson intraday volatility (PARKINSON_VOL_7D) showed a similar pattern, declining from a peak of 0.157 to 0.149. The shift from expansion to contraction in volatility often accompanies the end of a trending move. - • Volatility Structure: Period-end

HIS_VOLA_RATIO_7D_14Dis 0.757, andPARKINSON_RATIO_7D_14Dis 1.027, indicating short-term volatility has become significantly lower than medium-term volatility. Market sentiment has shifted from exuberance to cooling, although intraday volatility remains relatively active, suggesting intense battle between bulls and bears. - • Overbought/Oversold Status: RSI_14 reached a high of 64.16 on January 14, entering overbought territory, then retreated to 53.66 by period-end, residing in a neutral-to-weak zone. The bearish divergence pattern between RSI and price (higher price on Jan 13/14 but lower RSI high) confirms the decay of upward momentum.

4. Relative Strength and Momentum Performance

- • Return Analysis: As of period-end, YTD (Year-to-Date) return is +3.34%, QTD (Quarter-to-Date) return is identical, indicating a good start to the year. However, short-term momentum has deteriorated markedly:

MTD_RETURN(Month-to-Date) has retreated sharply from its peak of +5.34% on January 14 to +3.34%;WTD_RETURN(Week-to-Date) has turned negative at -1.34%. - • Momentum Conclusion: Short-term and medium-term momentum has turned negative or significantly weakened. This corroborates the technical conclusion of price resistance at key levels and the emergence of distribution volume signals, indicating severe challenges to the sustainability of the uptrend.

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff events and anomalous volume-price behavior, Smart Money intent is inferred as follows:

- • Accumulation/Shakeout (Late December 2025): The record-breaking high-volume decline on December 29, followed by price stabilization and rebound, aligns with characteristics of "Panic Selling" or "Shakeout." Smart Money likely absorbed panic selling in this zone.

- • Distribution (Mid-January 2026): The "Stopping Volume" signals on January 5 and 13 are textbook signs of Smart Money Distribution. The enormous volume indicates significant share exchange at high levels, while the inability of price to advance effectively suggests seller (supply) force dominance. Subsequent price drops on increased volume further confirm ongoing distribution.

- • Current Behavior: During the market pullback, volume has not quickly shrunk to very low levels (still above the 30-day average), suggesting distribution may still be ongoing, or new supply is entering. Smart Money shows no intention to strongly defend the current level or launch a new offensive.

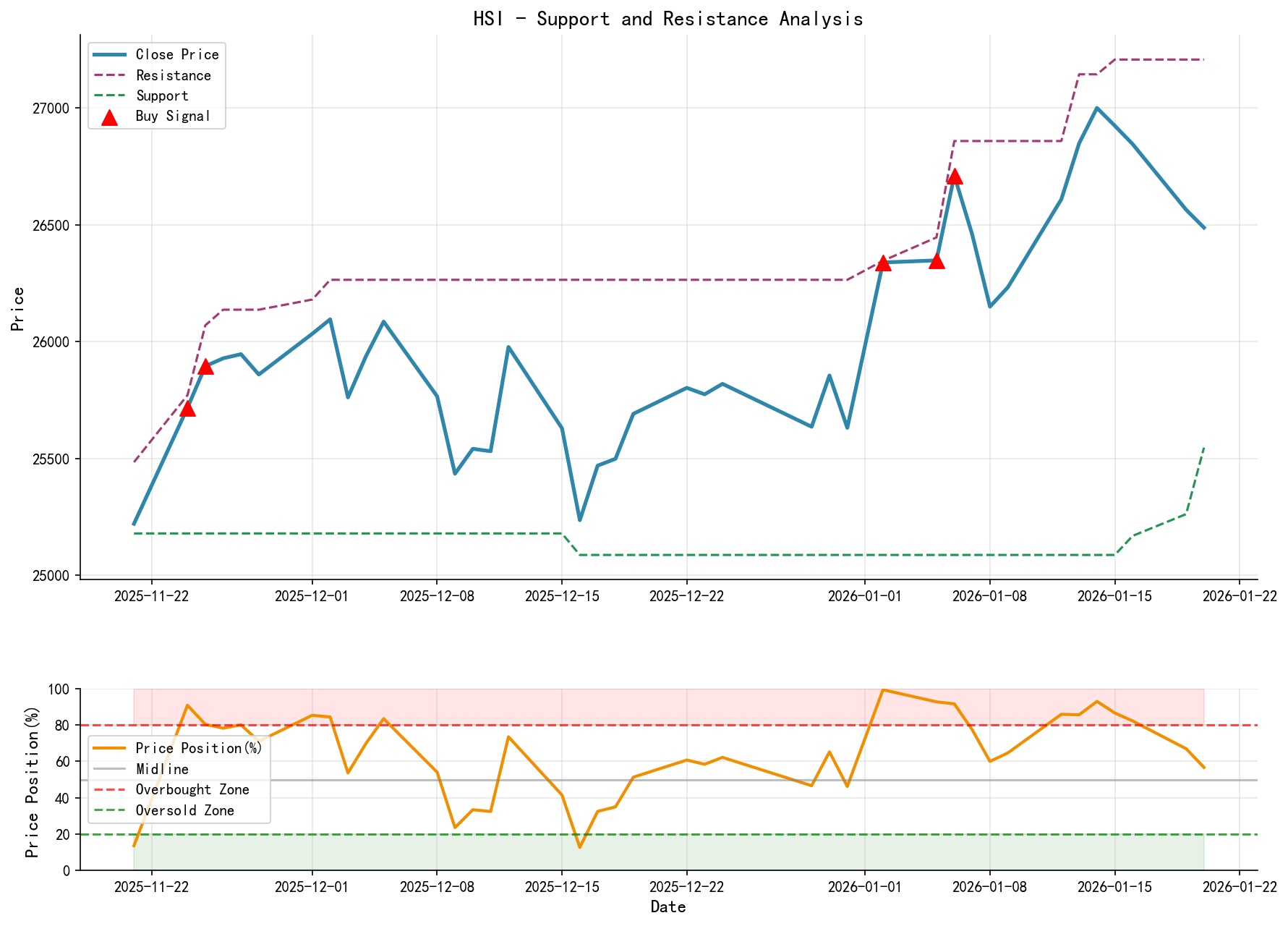

6. Support/Resistance Level Analysis and Trading Signals

- • Key Resistance Levels:

- 1. Upper Boundary of Distribution Range: 27176 - 27207 points (Jan 15-16 highs). This is the peak of this rebound and the primary supply zone.

- 2. Secondary Resistance / Rebound Test Level: 26800 - 27000 points (Jan 19-20 highs and vicinity of MA_5D/10D).

- • Key Support Levels:

- 1. Recent Oscillation Low / Demand Test Level: 26363 - 26400 points (Jan 20 low and vicinity of previous gap).

- 2. Medium-Term Lifeline: MA_60D ~ 26089 points. A break below this level would confirm a turn to a medium-term bearish trend.

- 3. Final Support: 25178 points (November 2025 low).

- • Comprehensive Wyckoff Trading Signal: Bearish

- • Event Combination: "Stopping Volume" at rally end + RSI bearish divergence + Death cross in moving averages + Price break below recent support trendline.

- • Operational Recommendations:

- 1. Shorting Opportunity: Consider establishing short positions when price rebounds into the 26800-27000 points resistance zone, showing signs of rally exhaustion and relatively subdued volume.

- 2. Stop-Loss Level: Set at 27210 points (above recent high).

- 3. Target Levels: First target 26000 points (MA_60D and psychological level), second target 25500 points.

- • Future Validation Points (Falsification/Confirmation Conditions):

- • Falsification (Bearish view incorrect): If price breaks above the 27210 points resistance with strong volume and sustains above it, the distribution structure is invalidated, and the market may initiate a new upward wave.

- • Confirmation (Bearish view correct): If price rebounds on low volume and declines again, effectively breaking below the 26363 points support, especially accompanied by renewed volume expansion, it would confirm the start of the post-distribution markdown phase, strengthening the bearish trend.

Disclaimer: This report is derived entirely from quantitative analysis of the provided historical data, adhering to Wyckoff's volume-price principles. All conclusions are probabilistic judgments and do not constitute any investment advice. Financial markets carry significant risks; please exercise caution in decision-making.

Thank you for your attention! Wyckoff Volume-Price Market Interpretation is published daily at 8:00 AM before market open. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: