All right, I will draft a comprehensive quantitative analysis report for the provided ETHUSDT data and historical ranking metrics, using Wyckoff's Principles of Price and Volume as the core framework.

ETHUSDT Quantitative Analysis Report (Wyckoff Method)

Product Code: ETHUSDT

Analysis Date Range: 2025-11-21 to 2026-01-20

Core Objective: To identify current market supply-demand dynamics, the intentions of large investors, and key trading signals based on price and volume data.

1. Trend Analysis & Market Phase Identification

As of January 20, 2026, the underlying asset ETHUSDT recorded an opening price of 3189.56, a closing price of 3006.03, a 5-day moving average of 3279.82, a 10-day moving average of 3238.58, a 20-day moving average of 3182.22, a daily change of -5.75%, a weekly change of -9.62%, a monthly change of +1.16%, a quarterly change of +1.16%, and a yearly change of +1.16%.

- • Moving Average Arrangement & Trend:

- • Dominant Trend: Since the beginning of the analysis period on November 21, the price has consistently traded below all major moving averages (MA_5D/10D/20D/30D/60D), displaying a clear and robust bearish alignment. The MA_60D (approx. 3851) has declined to around 3060, and the MA_30D has also fallen from 3540 to 3107, indicating a strong and persistent medium-to-long-term downtrend.

- • Rally & Failure: From early December to mid-January, the price staged a rally from 2799 to 3384. During this period, the price briefly crossed above the MA_5D/10D but consistently failed to hold above the MA_30D and never challenged the MA_60D. This aligns with the characteristics of a "Bear Market Rally" in Wyckoff theory, where the rally fails upon encountering long-term supply (represented by the declining moving averages).

- • Latest Development: As of January 20, the price (3006) has once again fallen below all short-term moving averages, and the MA_5D (3280) has turned downward, confirming the end of the rally and the resumption of bearish trend dominance.

- • Wyckoff Market Phase Assessment:

- • Beginning of Analysis Period (Late November): The market was in a Markdown phase, with the high-volume plunge on November 21 possibly indicating proximity to a Panic Selling phase.

- • Mid-Period (December - Early/Mid-January): The market entered a Re-Accumulation or Bear Market Rally phase. After multiple support tests below 3000, the price rebounded. However, the rally showed poor price-volume relationships (see below), and the peak (3384) failed to attract sustained incremental demand.

- • Current (January 20): After encountering strong supply below the key resistance zone (3300-3400), the price experienced a high-volume long bearish candlestick decline. This suggests the market may be transitioning from a "Bear Market Rally/Distribution" phase back to the beginning of a new Markdown phase.

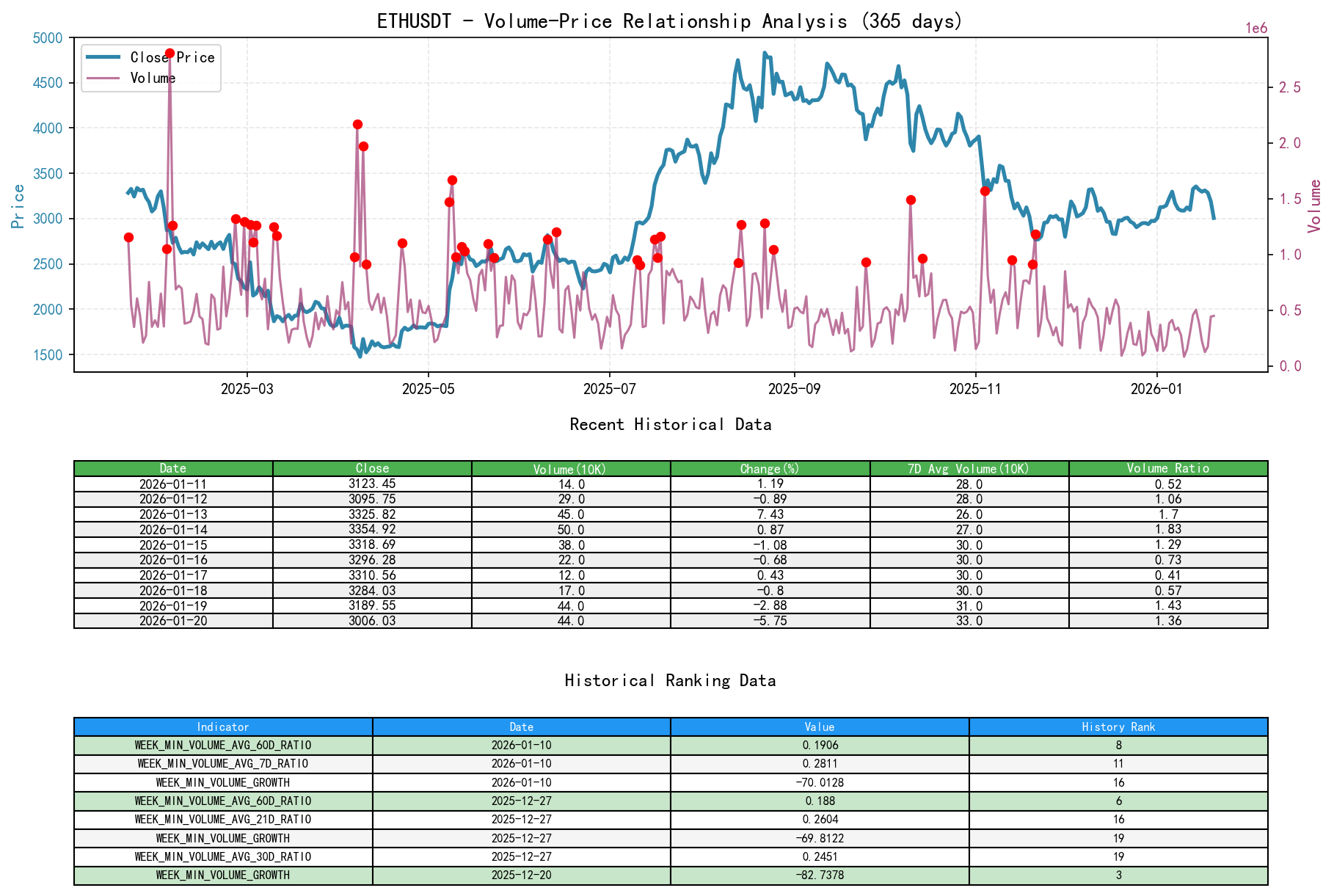

2. Price-Volume Relationship & Supply-Demand Dynamics

As of January 20, 2026, the underlying asset ETHUSDT recorded an opening price of 3189.56, a closing price of 3006.03, a trading volume of 448962.29, a daily change of -5.75%, a trading volume of 448962.29, a 7-day average volume of 330765.41, and a 7-day volume ratio of 1.36.

- • Key Day Analysis:

- 1. Panic Selling & Preliminary Support (2025-11-21): Price fell 6.43% on a massive 364.64% volume surge (

VOLUME_GROWTH), ranking 11th highest in single-day growth over the past decade (HISTORY_RANK: 11). This is typical panic selling (a Selling Climax), but the enormous volume also hints at potential absorption at lower levels. - 2. Supply Emergence During Rally (2025-11-24): Price rose 5.40% on volume equal to 0.99 times the 7-day average. Despite the rise, volume did not significantly exceed that of prior down days, indicating weak demand strength.

- 3. Extremely Low-Volume Rally (2025-12-20): Price rose slightly by 0.81%, but volume plummeted 82.74% (

HISTORY_RANK: 3), with the volume/7-day average ratio at only 0.22 (HISTORY_RANK: 4). This shows extremely low market participation, suggesting the rally was driven by short covering or minimal buying pressure, lacking institutional demand, a classic sign of a weak rally. - 4. High-Volume Plunge & Demand Collapse (2026-01-20): Price dropped sharply by 5.75% on volume 1.45% higher than the previous day and 1.36 times the 7-day average. This is a clear Supply Dominant Day, indicating a sharp increase in selling pressure and a lack of buying absorption at a critical level, declaring the rally's end.

- 1. Panic Selling & Preliminary Support (2025-11-21): Price fell 6.43% on a massive 364.64% volume surge (

- • Supply-Demand Dynamics Conclusion:

- • Supply (Selling Pressure): Weakened below 3000 (post-panic selling) but became very strong above 3300 (December and January highs), with each approach to this zone met by high-volume selling.

- • Demand (Buying Power): Consistently weak. The only notable rallies (e.g., Nov 24, Jan 2, Jan 13) were accompanied by volumes whose historical rankings were far lower than those of the panic selling day. Demand failed to expand consistently and overcome supply at key resistance levels.

- • Volume Behavior: The

VOLUME_AVG_7D/14D/21D_RATIOrepeatedly hit historical lows (ranking 4th-7th) in mid-to-late December, confirming market apathy and demand deficiency during the rally.

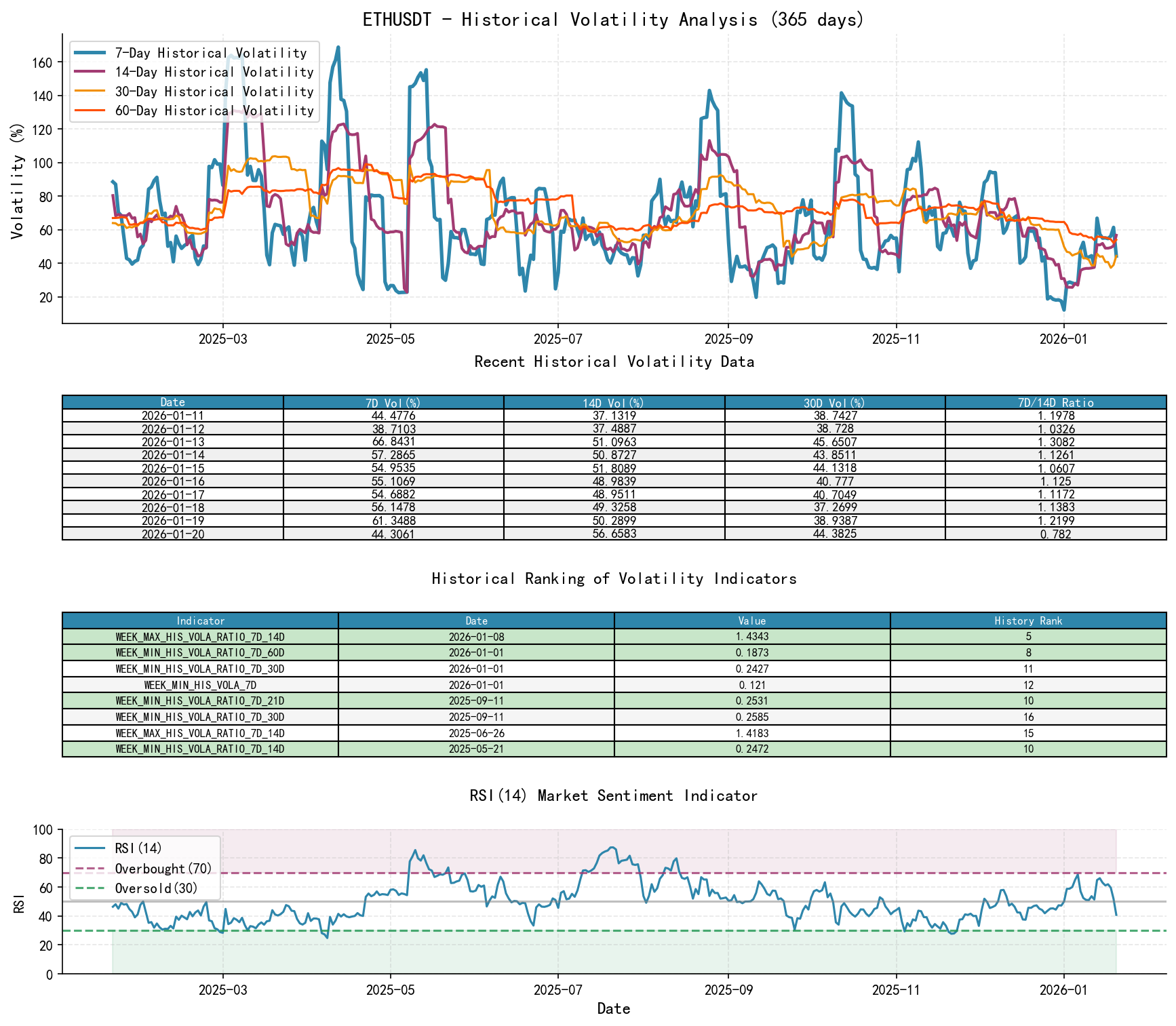

3. Volatility & Market Sentiment

As of January 20, 2026, the underlying asset ETHUSDT recorded an opening price of 3189.56, a 7-day intraday volatility of 0.40, a 7-day intraday volatility ratio of 0.94, a 7-day historical volatility of 0.44, a 7-day historical volatility ratio of 0.78, and an RSI of 40.78.

- • Volatility Analysis:

- • Expansion Following Extreme Compression: During the narrow-range consolidation from late December to early January,

HIS_VOLA_7Ddropped to 0.121 on Jan 1 (12th lowest in a decade), withHIS_VOLA_RATIO_7D_30Dand7D_60Das low as 0.243 and 0.187 (ranking 8th and 11th respectively). This represents extreme volatility compression, typically preceding a significant volatility expansion. - • Volatility Expansion: The breakout in early January and the subsequent decline in mid-to-late January were accompanied by a sharp rise in short-term volatility. On Jan 8,

HIS_VOLA_RATIO_7D_14Dreached 1.434 (5th highest in a decade), indicating a rapid surge in short-term volatility sentiment far exceeding the medium-term level. - • Latest Status:

HIS_VOLA_7D(0.443) remains above the December lows, butPARKINSON_VOL_7D(0.396) is relatively stable, suggesting the current decline is primarily driven by overnight gaps or opening moves, rather than sustained intraday panic.

- • Expansion Following Extreme Compression: During the narrow-range consolidation from late December to early January,

- • Sentiment Indicator (RSI):

- • Oversold & Rebound: The RSI_14 touched the oversold zone at 27.7 in late November and rose to near-overbought levels (68.7) by mid-January alongside the price rebound.

- • Trend Confirmation: The current RSI_14 has rapidly retreated from its high to 40.78, not yet entering the deeply oversold territory. This suggests further downside momentum may be possible, with market sentiment shifting from rebound optimism to pessimism, but not yet reaching extreme panic.

4. Relative Strength & Momentum Performance

- • Periodic Return Analysis:

- • Short-Term Momentum (WTD/MTD): Deteriorated sharply. The week-to-date return (WTD_RETURN) is -9.62%, and the month-to-date return (MTD_RETURN) has rapidly shrunk from +11.68% on Jan 15 to +1.16%. Short-term momentum has clearly turned negative.

- • Medium-to-Long-Term Momentum (QTD/YTD/TTM): All remain negative. QTD_RETURN is +1.16% (influenced by the January rally, still weak), and the trailing 12-month return (TTM_12) is -8.46%. The asset remains in a medium-to-long-term weak structure.

- • Momentum Conclusion: The short-term rally momentum has been completely exhausted and reversed, while medium-to-long-term downward momentum remains dominant. The price has failed to alter its long-term negative return profile.

5. Large Investor (Smart Money) Behavior Identification

Based on the price-volume, volatility, and trend analysis above, the inferred actions of large investors are as follows:

- 1. Re-Accumulation Attempt (December - Early January): Following the November panic selling, large funds may have engaged in test buying or accumulation within the 2800-3000 range, manifested as repeated tests and rebounds at lower price levels.

- 2. Distribution Utilizing the Rally (Early-Mid January): When prices rallied to the key technical resistance zone of 3300-3400 (previous highs, declining MAs), smart money likely distributed. Evidence includes: a) price stagnation in the resistance zone; b) consecutive high-volume down days on Jan 19 and 20, particularly the high-volume long bearish candlestick on the 20th, which is a classic sign of supply overwhelming demand, likely indicative of institutional selling.

- 3. Current Intent: After successfully distributing or reducing long positions at higher levels, large investors may now be shifting to a wait-and-see approach or preparing to cover at lower levels. They have not shown strong absorption intent at current levels (the decline wasn't accompanied by exceptionally massive volume, but volume has clearly increased), instead allowing prices to decline to test lower support.

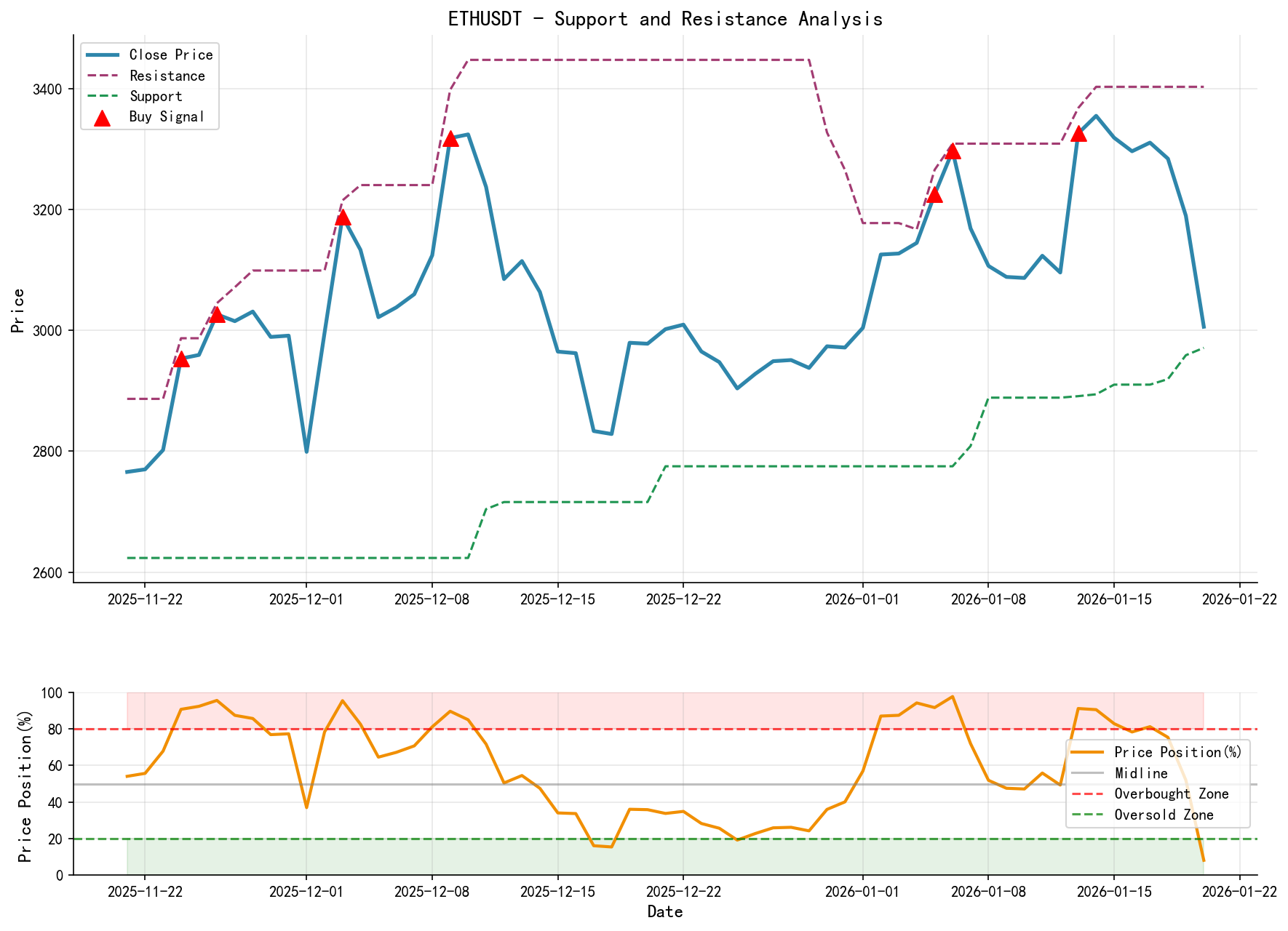

6. Support/Resistance Level Analysis & Trading Signals

- • Key Price Levels:

- • Important Resistance Zone: 3180-3200. This is the lower boundary of the consolidation range before the breakdown on Jan 19-20, and the area where the current MA_20D and MA_30D converge. Any rally to this zone that is not accompanied by sustained high volume will face significant supply pressure.

- • Primary Resistance Zone: 3300-3400. The peak area of the January rally, a clear supply zone, and the starting point of this current decline.

- • Immediate Support: 2980-3000. The low of January 20 and the platform area tested multiple times in December. A break below this would confirm further downside potential.

- • Next Support: 2780-2800. The significant low area from November-December.

- • Integrated Wyckoff Trading Signals & Operational Suggestions:

- • Core Assessment: Bearish. The market is in the rally-ending phase of a primary downtrend, with supply-demand dynamics indicating supply has regained control.

- • Operational Suggestions:

- 1. Bearish Strategy (Primary): Consider establishing short positions near the 3180-3200 resistance zone, especially if signs of rally exhaustion appear (e.g., upper shadows, shrinking volume). Initial stop-loss can be set above 3300 (beyond the primary resistance zone).

- 2. Bullish Wait-and-See / Patience: Do not blindly attempt to buy the dip at current levels (~3000). Genuine long opportunities require waiting for a "Secondary Test" signal: when price re-tests the 2980-3000 support, look for a halt-of-decline pattern with significantly shrunken volume (e.g., small candlesticks, long lower shadows), indicating supply exhaustion.

- • Key Validation Points:

- 1. Bearish Validation: Price breaking below 2980 on high volume would confirm the continuation of the downtrend, with targets towards the 2780-2800 area.

- 2. Bearish Invalidation (Requiring Caution): If price finds strong support in the 2980-3000 zone and breaks above 3200 on high volume, holding above on a pullback, then a reassessment is required to evaluate if the market is constructing a more complex bottom structure. Current data does not support this hypothesis.

Report Conclusion Reiteration: Based on Wyckoff's Price-Volume Principles, ETHUSDT, after experiencing a weak bear market rally, encountered strong supply at a key resistance zone, resulting in a high-volume decline signaling the resumption of the bearish trend. The current strategy should focus primarily on selling into rallies, paying close attention to shorting opportunities near the 3180-3200 resistance zone and the outcome at the 2980 support level. Only upon clear evidence of supply exhaustion (e.g., a low-volume test at critical support) should the possibility of a trend reversal be considered. All conclusions are derived from the provided data, with historical ranking data reinforcing the extremity and significance of key price-volume phenomena.

Disclaimer: The content of this report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding the accuracy or completeness of the content. The market carries risks, and investment requires caution. Any investment actions taken based on this report are at the investor's own risk.

Thank you for your attention! Wyckoff Price-Volume market analysis is published daily at 8:00 AM before the market opens. Please feel free to leave comments and share. Your recognition is greatly appreciated. Let us work together to see the market signals clearly.

Member discussion: