Understood. Following your instructions. As a quantitative trading researcher proficient in the Wyckoff Method, I will produce a comprehensive and in-depth quantitative analysis report based on the DOGEUSDT data you provided. All conclusions are derived from data and strictly adhere to Wyckoff price-volume principles.

DOGEUSDT Wyckoff Quantitative Analysis Report

Product Code: DOGEUSDT

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Time: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of 2026-01-20, the underlying asset DOGEUSDT has an open price of 0.13, a close price of 0.12, a 5-day moving average of 0.14, a 10-day moving average of 0.14, a 20-day moving average of 0.14, a daily change of -3.85%, a weekly change of -16.25%, a monthly change of 5.72%, a quarterly change of 5.72%, and a yearly change of 5.72%.

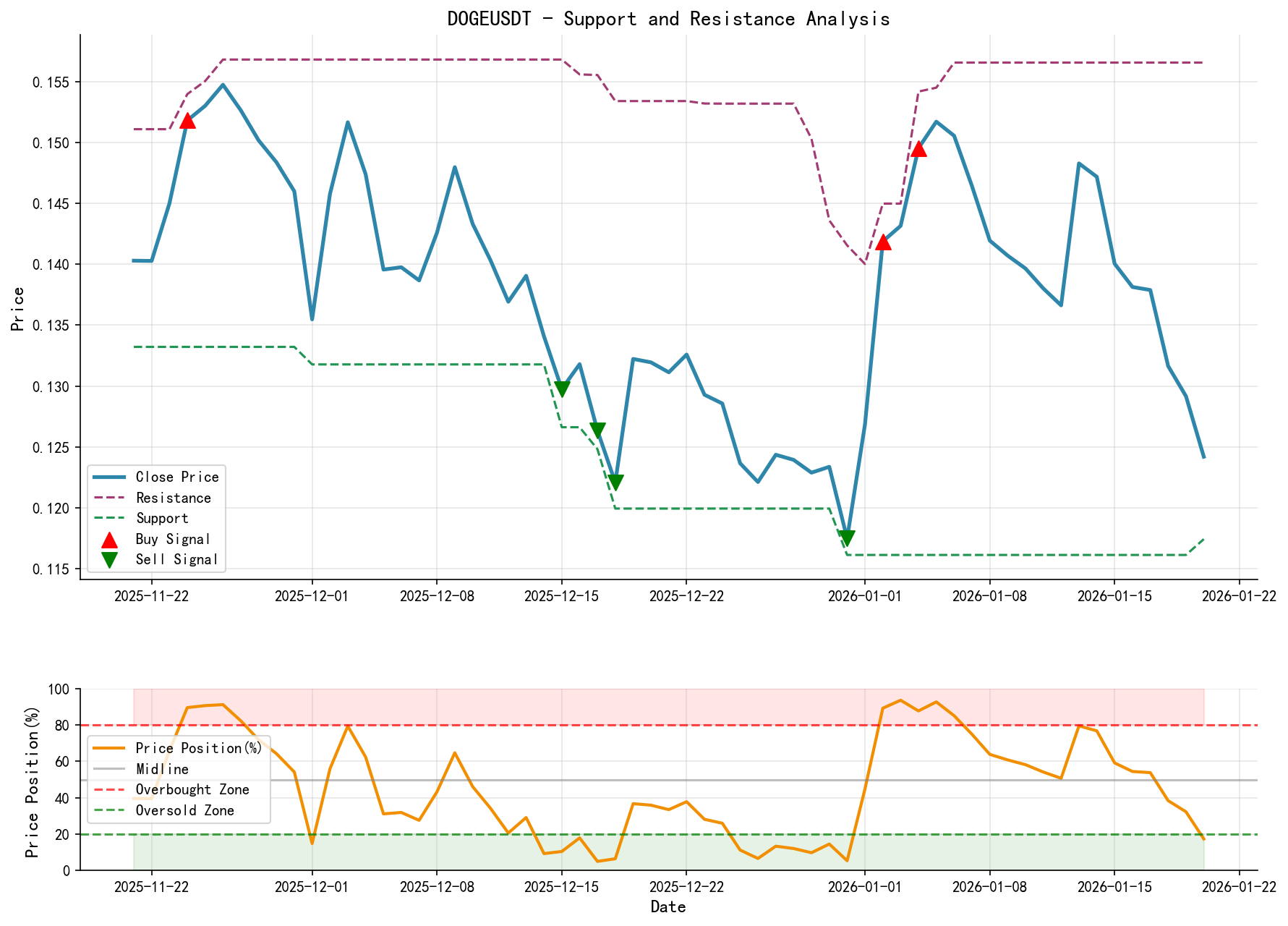

- • Moving Average Arrangement and Trend: Throughout the analysis period, the price exhibited a clear bearish trend. As of 2026-01-20, the price (0.12419) is below all moving averages (MA_5D: 0.13537, MA_20D: 0.13984, MA_60D: 0.13829), forming a bearish alignment. The longer-term moving average (MA_60D) continues to decline, confirming the medium-term downtrend.

- • Key Moving Average Crossovers: In the early phase of the period (late November to December 2025), the price consistently traded below the MA_20D and MA_60D. Multiple short-term rebounds (e.g., Dec 2) attempted to breach the MA_20D but failed each time, with the MA_5D acting as direct resistance. The strong rebound in early January 2026 temporarily pushed the MA_5D above the MA_20D, but it could not sustain. The MA_5D and MA_20D turned downward again, forming a "death cross" pattern, confirming the end of the rebound and the resumption of the downtrend.

- • Market Phase Inference: Based on Wyckoff theory, the market has undergone a phase transition from "Decline" to "Panic" to "Testing." The decline from November to December 2025 was accompanied by intermittent high volume (e.g., Nov 21, Dec 1), characteristic of an orderly decline. The high-volume crash on 2026-01-19 (price -1.88%, volume 1.347B, +181% growth) displays classic "Selling Climax (SC)" features. Subsequently, on 2026-01-20, the price continued to decline but with significantly reduced volume (-48.9%) and a narrower decline. This aligns with the initial characteristics of the Wyckoff "Automatic Rally (AR)" or "Secondary Test (ST)," indicating that after the large absorption of supply on the panic day, supply has temporarily exhausted. The current market is in the Testing phase of the panic low, aiming to confirm whether supply has dried up and if demand can enter.

2. Price-Volume Relationship and Supply-Demand Dynamics

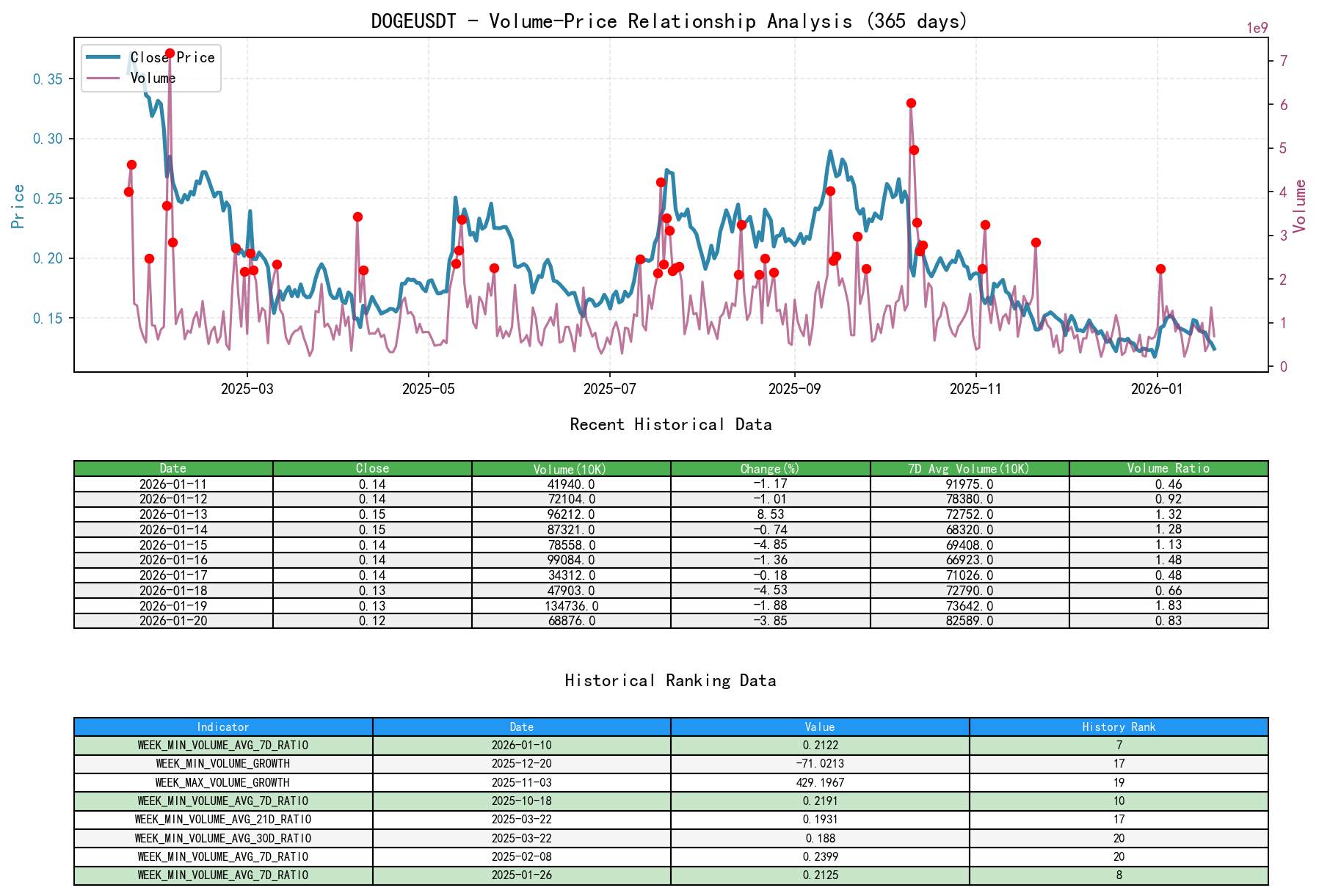

As of 2026-01-20, the underlying asset DOGEUSDT has an open price of 0.13, a close price of 0.12, a volume of 688,760,447.00, a daily change of -3.85%, a volume of 688,760,447.00, a 7-day average volume of 825,899,898.00, and a 7-day volume ratio of 0.83.

- • Panic Selling Day (Supply Climax): Data for 2026-01-19 clearly shows panic dominated by supply: a sharp price decline accompanied by a surge in volume to a nearly two-month high (1.347B), with

VOLUME_GROWTHreaching 181% andVOLUME_AVG_14D_RATIOhitting 1.77. This is a typical "sharp decline on heavy volume," representing the peak of market panic with a large amount of selling at any cost. - • Supply Exhaustion Signal: 2026-01-20 is a key observation day. The price made a new low but the decline narrowed to -3.85%, while volume sharply contracted by 48.9% compared to the previous day, and

VOLUME_AVG_7D_RATIOfell to 0.83. This pattern of "declining price with contracting volume" is a crucial supply exhaustion signal in Wyckoff theory. It indicates that following the panic selling of the previous day, the willingness to sell at lower prices has drastically diminished. Although the price closed lower, selling pressure has significantly eased. - • Historical Anomalous Volume: Historical ranking data shows that the

VOLUME_AVG_7D_RATIOon 2026-01-10 (0.2122) ranked as the 7th lowest in nearly a decade, indicating extremely thin trading and strong investor hesitation that day. The massive rebound volume on 2026-01-02 (VOLUME_AVG_14D_RATIO: 4.27) contrasts sharply with the panic volume on 2026-01-19, outlining a rapid shift in market sentiment from extreme optimism (rebound buying) to extreme pessimism (panic selling). - • Demand Attempt and Failure: From January 1st to 6th, 2026, a clear demand-led rebound occurred, characterized by "rising price on increasing volume." Notably, on January 2nd, the price rose 11.87% on a volume of 2.240B, the highest during the period. However, subsequent price gains lacked momentum and volume could not be sustained (after Jan 7th), ultimately evolving into the panic on Jan 19th. This suggests the rebound was an "oversold bounce" rather than a trend reversal, eventually overwhelmed by stronger supply.

3. Volatility and Market Sentiment

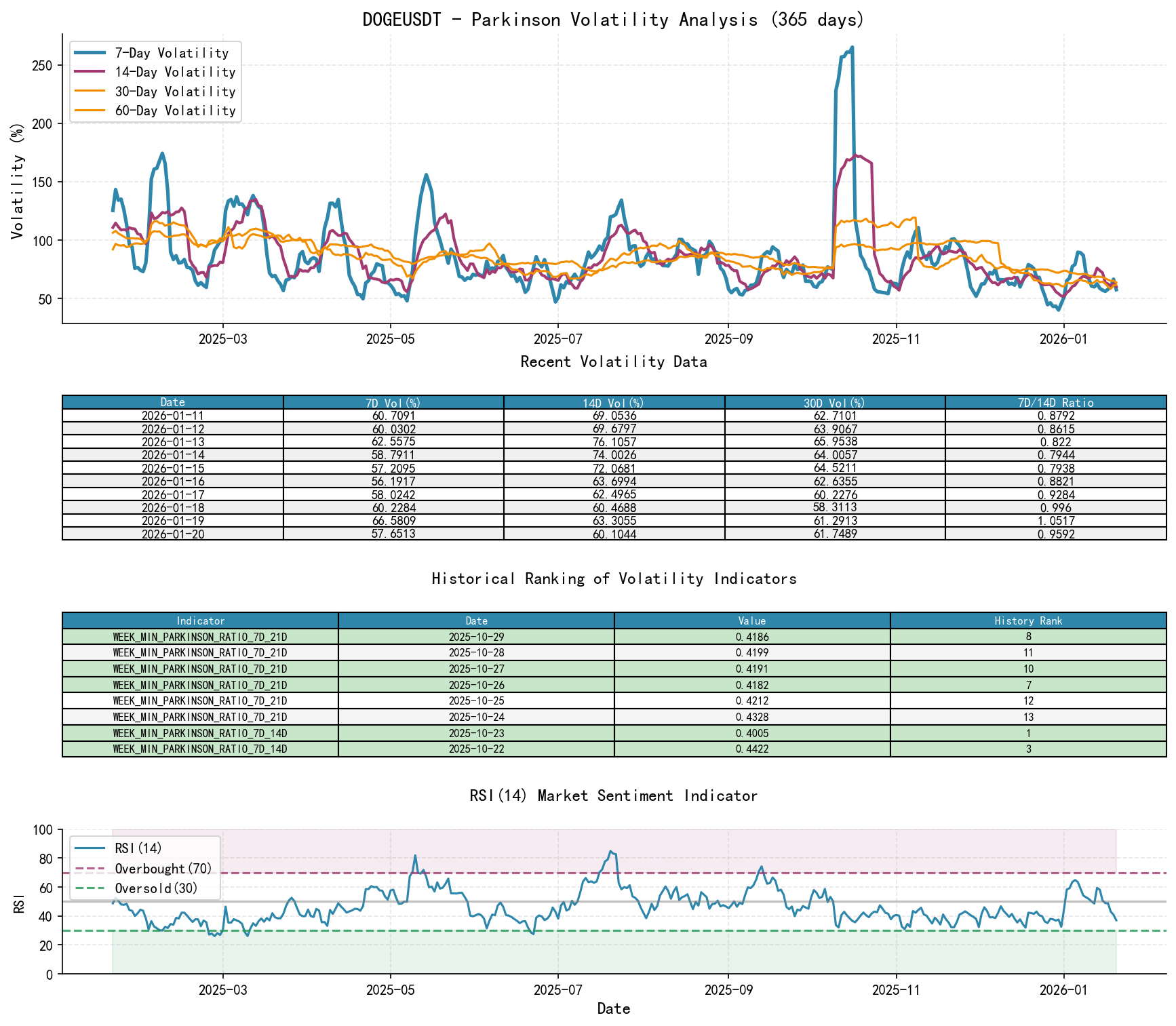

As of 2026-01-20, the underlying asset DOGEUSDT has an open price of 0.13, a 7-day intraday Parkinson volatility of 0.58, a 7-day intraday volatility ratio of 0.96, a 7-day historical volatility of 0.37, a 7-day historical volatility ratio of 0.62, and an RSI of 37.01.

- • Volatility Structure: Recent volatility shows a contraction trend. Short-term historical volatility (

HIS_VOLA_7D) decreased from a high of 1.04 on Jan 4th to 0.37 on Jan 20th. The 7-day Parkinson intraday volatility (PARKINSON_VOL_7D) also declined from a high of 0.90 on Jan 6th to 0.58. Volatility ratios (e.g.,HIS_VOLA_RATIO_7D_14D) are generally below 1, indicating short-term volatility has fallen below medium-term levels. The market has transitioned from "high-volatility panic decline" to "low-volatility gradual decline," with sentiment temporarily stabilizing but leaning bearish. - • Extreme Volatility Events: Historical ranking data points out that the

HIS_VOLA_RATIO_7D_14Don 2026-01-12 (0.2317) was the 8th lowest in nearly a decade. Around this date, short-term volatility rapidly contracted to levels far below medium-term volatility, a phenomenon often occurring after sharp volatility events (like the early-January rebound and subsequent decline). This is one of the signals of waning market momentum and an impending directional move. - • Oversold Condition Confirmation: The

RSI_14touched or fell below the oversold threshold of 35 multiple times during the period (e.g., 34.33 on Dec 17, 37.01 on Jan 20). Particularly during the crash on Jan 19-20, the RSI re-entered the oversold zone, resonating with signals like the price making new lows and anomalous volume, strengthening the judgment that the market is in the final stages of emotional selling.

4. Relative Strength and Momentum Performance

- • Comprehensive Momentum Weakening: Returns across all timeframes are negative or at extremely low levels. As of Jan 20,

WTD_RETURNis -16.25%, indicating very weak short-term momentum;MTD_RETURNis +5.72%, but this is largely due to the early January rebound, with recent sharp pullbacks eroding most of those gains; longer-termYTDandQTD_RETURNare also +5.72%, showing medium-term momentum is barely flat. - • Momentum Structure Analysis: Momentum data indicates the market is in a weak rebound pattern within a downtrend. The strong early-January rebound provided short-term positive momentum but failed to reverse the long-term downtrend defined by the longer cycle (

TTM_12is -64.97%). The renewed negative momentum aligns with other price-volume signals like the price breaking below short-term moving averages and contracting volume.

5. Large Investor ("Smart Money") Behavior Identification

- • Behavior Inference: The behavior trajectory of large investors (Composite Man - CM) is clear:

- 1. Distribution and Suppression (Nov-Dec 2025): Each rebound during the decline was accompanied by significant volume (e.g., Nov 24, Dec 3), yet prices failed to sustain upward movement, suggesting possible CM distribution or added short positioning during rallies.

- 2. Inducing Panic (2026-01-19): The "high-volume crash" on Jan 19 is a classic manifestation of CM behavior. This move aims to flush out the final stop-loss orders of longs and test the genuine demand at the market bottom. The massive volume indicates significant change of hands at lower levels, involving both panicked retail selling and potential CM passive or active accumulation below.

- 3. Observation and Testing (2026-01-20): After inducing panic, the CM immediately reduced selling pressure the next day (sharp volume drop) to observe the market's own reaction (the height and volume of the automatic rally). This "declining price with contracting volume" is a sign that the CM has ceased active supply and is preparing to test market demand. If subsequent prices can rise modestly in a low-volume environment, it will strengthen the CM's confidence in bottom formation.

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Strong Support: 0.12000 (Low of the panic day, 2026-01-19). This is the lowest point in nearly two months and a key psychological level; a break below opens new downside space.

- • Immediate Resistance: 0.14000 (Lower boundary of the mid-January 2026 consolidation platform, also near the MA_20D).

- • Secondary Resistance: 0.13000 (Near the 2026-01-20 close, also the area around the Jan 19 close of 0.12916).

- • Integrated Wyckoff Events and Trading Signals:

- • Current Event: The market has just shown a potential bottom structure of "Selling Climax (SC)" followed by "Supply Exhaustion/Automatic Rally (AR/ST initial phase)." Jan 19 was the SC, Jan 20 was the preliminary supply exhaustion signal.

- • Bullish Signal Trigger Conditions: The price needs to show small gains on contracting or steady volume, reclaiming the 0.1292 level (Jan 19 close), and ultimately break out above the 0.1300-0.1316 zone (Jan 19-20 highs) on volume. This would signal renewed demand entry and a successful secondary test.

- • Bearish Signal Trigger Conditions: If the price fails to hold above 0.1292 and experiences another high-volume decline below this level, especially a break below the 0.1200 panic low, it would confirm the continuation of the downtrend, indicating the CM has no intention of accumulating at this price.

- • Operational Recommendations:

- • Strategy Stance: Cautious observation, preparing to capture potential rebound opportunities. Currently at a critical turning zone, wait for clearer signals from the market itself.

- • Aggressive Strategy: If the price continues to consolidate or rise slightly with shrinking volume within the 0.1240-0.1280 range over the next 1-3 trading sessions, consider a light long position upon a volume-backed (

VOLUME_AVG_7D_RATIO> 1.2) breakout above 0.1300. Strict stop-loss below 0.1200. - • Conservative Strategy: Wait for clearer "Secondary Test" success signals. This would be characterized by a price pullback to around 0.1240 with extremely low volume (

VOLUME_AVG_7D_RATIO< 0.7), followed by a volume-backed bullish candle (volume increase >50% from previous day) reclaiming levels above 0.1290. This could serve as a safer long entry point. Stop-loss similarly set below 0.1200. - • Targets: Initial target towards 0.1400 (previous platform resistance), with a potential extension to 0.1500 upon a strong breakout.

- • Future Validation Points:

- 1. Demand Validation: Whether the price can hold above 0.1240 without significant volume in the coming days and attempt to attack the 0.1290-0.1300 zone.

- 2. Supply Validation: Observe if significant selling pressure (high-volume stagnation or long upper wicks) emerges when the price rebounds to the 0.1290-0.1310 zone.

- 3. Structure Validation: Whether the market can form a clear "Higher Low" (HL), thereby constructing a preliminary uptrend structure.

Conclusion Restatement: After experiencing a prolonged bearish trend, DOGEUSDT displayed characteristics of a Wyckoff "Selling Climax" on 2026-01-19, followed by a sharp volume contraction the next day, suggesting possible temporary supply exhaustion. Combined with contracting volatility, oversold RSI, and key historical ranking indicators (volume and volatility ratios at decade extremes), the market is positioned at a significant potential trend inflection point. Traders are advised to closely observe price-volume behavior within the 0.1240-0.1300 range, waiting for confirmation signals of a successful "Secondary Test" to capture potential swing rebound opportunities. Until the price clearly stabilizes above 0.1300 or decisively breaks below 0.1200 on volume, maintain high vigilance and avoid subjective directional bias.

Disclaimer: This report/interpretation is solely for market analysis and research based on public information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding accuracy or completeness. The market involves risks; investing requires caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Daily Wyckoff price-volume market analysis is published promptly at 8:00 AM before the market opens. Please feel free to comment and share; your recognition is greatly appreciated. Let's work together to see the market signals clearly.

Member discussion: