All right. As a quantitative trading researcher proficient in the Wyckoff Method, I will author a comprehensive and in-depth quantitative analysis report based on the provided BTCUSDT data and historical ranking metrics.

Quantitative Analysis Report: BTCUSDT (Bitcoin)

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

Researcher: Quantitative Trading Researcher (Wyckoff Method)

I. Trend Analysis and Market Phase Identification

As of January 20, 2026, the subject BTCUSDT opened at 92630.99, closed at 89717.38. The 5-day MA is 94521.53, the 10-day MA is 93778.80, the 20-day MA is 92357.06. The daily change is -3.15%, weekly change is -5.97%, monthly change is +2.36%, quarterly change is +2.36%, yearly change is +2.36%.

- 1. Moving Average Alignment and Trend Judgment:

- • Overall Trend: Throughout the analysis period, the BTC price (CLOSE) has consistently traded below all moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), forming a standard bearish alignment. The MA_60D (long-term trend line) declined continuously from

109,065USD to90,051USD, indicating a clear and robust long-term downtrend. - • MA Crossovers and Dynamics: The MA_5D and MA_20D remained in a prolonged "death cross" state, with the MA_5D mostly trading below the MA_20D, confirming the short-to-medium-term trend as bearish. Although the MA_5D briefly attempted to cross above the MA_10D during periods such as late December to early January, it failed to sustainably lead longer-term MAs to reverse, indicating weak rally momentum.

- • Conclusion: The market is in a primary downtrend. Any price increases should be defined as rallies or secondary reactions within the broader declining channel.

- • Overall Trend: Throughout the analysis period, the BTC price (CLOSE) has consistently traded below all moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), forming a standard bearish alignment. The MA_60D (long-term trend line) declined continuously from

- 2. Market Phase Identification (Wyckoff Framework):

- • 2025-11-21 to 2025-12-15 (Panic Selling and Potential Accumulation Zone): Price rapidly declined from

85,129USD to86,432USD (the low on December 15). During this period, characteristics of panic selling appeared on November 21 (daily volume of72,256BTC, 2.13 times the 7-day average, price fell -1.74%, RSI dipped to the oversold zone at 23.12). Subsequent declines saw progressively shrinking volume, and signs of a Secondary Test emerged around December 15 (price testing or approaching the prior low with significantly lower volume than the panic day). - • 2025-12-16 to 2026-01-14 (Technical Rally and Potential Distribution Zone): Price rallied from

86,432USD to96,951USD (the high on January 14). This rally was accompanied by moderate volume expansion, but stalling action appeared when price challenged the97,000USD zone (e.g., January 13-14, volume expanded but price gains narrowed). Price failed to decisively break the strong resistance of MA_30D, and RSI faced rejection near the 70 level. - • 2026-01-15 to 2026-01-20 (Rally Failure and Initiation of a New Decline): Price retreated from the high and experienced a high-volume decline on January 20 (volume

18,063BTC, a 26.35% increase from the previous day, price fell sharply by -3.15%), decisively breaking below the recent support platform formed during the rally (93,000-94,000USD area). This aligns with the Wyckoff characteristic of entering the Markdown phase after distribution. - • Comprehensive Conclusion: By the end of the analysis period, the market had transitioned from a "Technical Rally" (Automatic Rally) into a "new decline phase following confirmed distribution". The rally in mid-to-late December likely constituted a distribution range for large investors.

- • 2025-11-21 to 2025-12-15 (Panic Selling and Potential Accumulation Zone): Price rapidly declined from

II. Volume-Price Relationship and Supply-Demand Dynamics

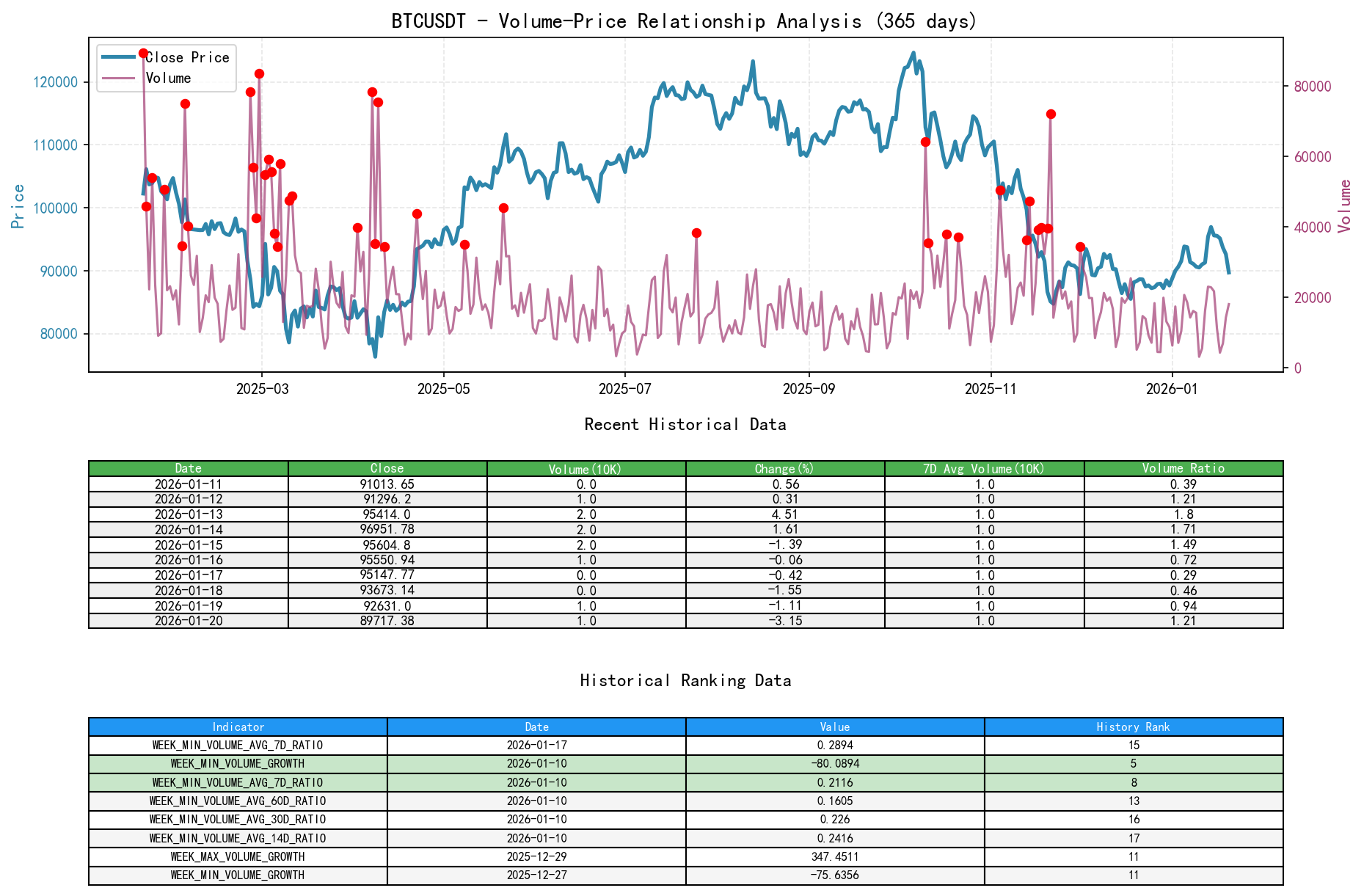

As of January 20, 2026, the subject BTCUSDT opened at 92630.99, closed at 89717.38, volume 18062.54, daily change -3.15%, volume 18062.54, 7-day average volume 14891.21, 7-day volume ratio 1.21.

- 1. Analysis of Key Volume-Price Days:

- • Demand-Dominated Day (Strong Rally):

2025-12-02, price surged +5.79%, volume28,210BTC, 1.54 times the 7-day average. This was a clear signal of expanding demand that initiated the December rally. - • Supply-Dominated Days (High-Volume Stalling/Decline):

- •

2026-01-14: Price rose only +1.61%, but volume was as high as22,852BTC (1.71 times the 7-day average), showing high-volume stalling at highs, indicating supply beginning to overwhelm demand. - •

2026-01-20: Price fell sharply -3.15%, volume18,063BTC (1.21 times the 7-day average), representing a high-volume decline, confirming supply's complete control of the market.

- •

- • Panic/Climax Day (Selling Climax):

2025-11-21: As mentioned earlier, a high-volume decline with extreme oversold RSI, typical of panic selling. Historical rankings show itsVOLUME_GROWTHwas +81.85%. While its weekly ranking wasn't extreme, itsVOLUME_AVG_7D_RATIO(2.13) andVOLUME_AVG_60D_RATIO(3.09) indicated abnormal volume expansion relative to both short and long-term averages. - • Lack of Demand Days (Low-Volume Rally): Multiple trading days from

2025-12-27to2026-01-03, where prices edged up but volume consistently stayed below various period averages (e.g.,2026-01-03,VOLUME_AVG_7D_RATIOwas only 0.64), indicating the rally lacked sustained incremental funding.

- • Demand-Dominated Day (Strong Rally):

- 2. Interpretation of Volume Anomaly Indicators:

- • Extreme Contraction Signal: The volume data for

2026-01-10holds significant meaning. ItsVOLUME_AVG_7D_RATIO(0.21),VOLUME_AVG_14D_RATIO(0.24),VOLUME_AVG_30D_RATIO(0.23),VOLUME_AVG_60D_RATIO(0.16) all ranked in extremely low percentiles in historical rankings (8th-17th). This reveals that during a period of minor price consolidation, market participation dropped to an ice-cold level, planting the seeds for the subsequent directional move (which ultimately chose downward). - • High-Volume Breakout Signal:

2025-12-29had aVOLUME_GROWTHof +347.45%, the 11th highest single-day increase in nearly a decade. This massive volume occurred at a critical level after the price rebounded from lows. Determining its nature (demand initiation post-accumulation or distribution at the rally's end) requires judging subsequent price action. The failure of price to continue rising and its subsequent consolidation at relatively high levels lean towards interpreting this as secondary distribution or shaking-out behavior. - • Comprehensive Conclusion: The supply-demand balance decisively shifted in mid-January. The earlier rally was driven by intermittent demand expansion (early December) but lacked sustained high volume. The high-volume stalling at highs in mid-January was a clear signal of supply entering the market. The high-volume breakdown decline on January 20 confirmed the overwhelming dominance of supply forces.

- • Extreme Contraction Signal: The volume data for

III. Volatility and Market Sentiment

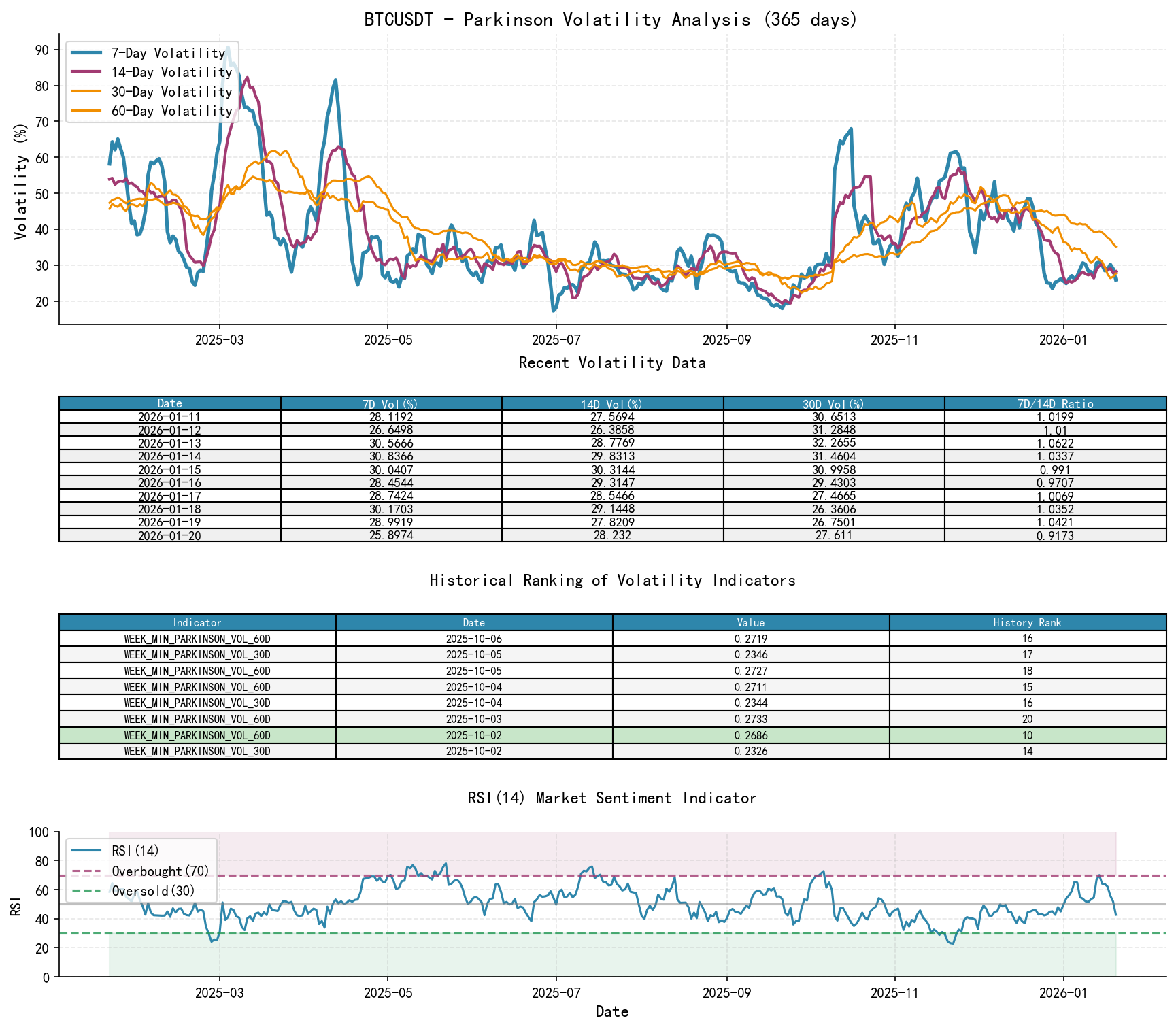

As of January 20, 2026, the subject BTCUSDT opened at 92630.99, 7-day intraday volatility 0.26, 7-day intraday volatility ratio 0.92, 7-day historical volatility 0.28, 7-day historical volatility ratio 0.81, RSI 42.71.

- 1. Volatility Levels and Changes:

- • Volatility Trend: Historical volatility (HIS_VOLA) and Parkinson volatility were elevated from late November to early December (HIS_VOLA_7D > 0.45), corresponding to the panic decline phase. Subsequently, volatility overall trended lower and converged, especially from late December to early January, dropping to extremely low levels (HIS_VOLA_7D lowest at 0.11, seen on

2025-12-26), indicating the market entered a low-volatility consolidation. - • Volatility Anomalies:

- •

2026-01-13: Short-term volatility expanded sharply (HIS_VOLA_7D jumped from 0.20 to 0.40) alongside a significant price rise, a typical volatility expansion accompanying breakout rallies. - •

2026-01-20: During the decline, the ratio of HIS_VOLA_7D (0.28) to HIS_VOLA_14D (0.35) (HIS_VOLA_RATIO_7D_14D) fell to 0.81, showing short-term volatility rising but not yet exceeding medium-term. If this ratio continues to rise in the future, it would suggest the decline might accelerate.

- •

- • Historical Extremes: The

WEEK_MIN_HIS_VOLA_14D(0.1615) on2026-01-02reached the 19th lowest level in nearly a decade, confirming the extreme complacency and volatility compression to its limits in early January. Such a state often precedes significant subsequent volatility.

- • Volatility Trend: Historical volatility (HIS_VOLA) and Parkinson volatility were elevated from late November to early December (HIS_VOLA_7D > 0.45), corresponding to the panic decline phase. Subsequently, volatility overall trended lower and converged, especially from late December to early January, dropping to extremely low levels (HIS_VOLA_7D lowest at 0.11, seen on

- 2. RSI Sentiment Indicator:

- • Throughout the period, the RSI_14 mostly operated within the neutral-to-weak range of 30-60. Clear oversold (<30)** conditions only appeared during the panic selling on November 21-22. Clear **overbought (>70) conditions only briefly appeared at the rally peak on January 13-14.

- • Conclusion: Market sentiment recovered from extreme panic in late November, went through a low-volatility period of hesitation (late December), briefly turned optimistic in mid-January, but was quickly pushed back by selling pressure. Currently (January 20, RSI=42.71), it has returned to neutral-to-weak. The pattern of lower highs and lower lows in RSI aligns with the prevailing downtrend.

IV. Relative Strength and Momentum Performance

- 1. Multi-Period Return Analysis:

- • Short-Term Momentum (WTD_RETURN): At the end of the analysis period (week of January 20), it stood at -5.97%, momentum turned sharply negative, consistent with the high-volume breakdown decline.

- • Medium-Term Momentum (MTD_RETURN, QTD_RETURN): The return since the start of January is +2.36%, but the return for this quarter (Q4 2025) is -25.36%. This shows that while there was a rebound in January, it cannot reverse the severe loss pattern for the entire quarter; medium-term momentum remains weak.

- • Long-Term Momentum (YTD): The 2026 YTD return is +2.36%, significantly better than the TTM_12 returns from the same period last year (-12.27% to -6.33%). However, this rebound follows a deep decline, and its sustainability is questionable.

- • Comprehensive Conclusion: Momentum structure shows divergence: Very short-term momentum has deteriorated, medium-term momentum is extremely weak, and YTD momentum is temporarily positive due to the rebound. This structure is typical at the end of a rally within a downtrend; once short-term momentum turns negative, it can easily trigger a deeper decline.

V. Large Investor ("Smart Money") Behavior Identification

Based on Wyckoff volume-price principles and analysis of extremes in historical ranking data:

- 1. During the Panic Selling in Late November: The massive decline was accompanied by extreme RSI oversold conditions. Smart money likely conducted selective accumulation in this zone. They likely were not buying at the absolute bottom but receiving panic selling from retail investors during the selling climax.

- 2. During the Rally from December to Early January: The rally overall featured moderate volume, but high-volume stalling appeared at key resistance levels (e.g.,

94,000,97,000USD). Smart money likely utilized the rally for distribution, transferring shares acquired in November to late-coming buyers chasing the rally at higher prices. - 3. Key Behavior in Mid-January:

- • Testing and Shaking Out: On January 10, there was a near-decade-level extreme volume contraction (multiple volume ratio metrics ranked among historically low percentiles). This signals a pause in smart money activity and a loss of market direction. The subsequent high-volume rally (January 13) might have been a shakeout or test, aiming to gauge supply pressure above.

- • Distribution Confirmation and Shorting: The high-volume stalling at highs on January 14 is a clear signal of smart money distributing or beginning to establish short positions. The low volatility in early January (19th lowest in nearly a decade) in historical rankings provided a typical environment for this "distribution/shorting after low volatility precedes directional move" pattern.

- 4. Breakdown Decline on January 20: The high-volume break below key support indicates smart money's distribution phase was likely complete, and the market entered the Markdown phase they now guide. Selling at this stage may stem from: a) Remaining distribution of leftover shares; b) Newly established short positions; c) Stop-loss triggering from trend-followers.

- 5. Core Inference: Large investors completed an operational cycle of "panic accumulation -> rally distribution -> confirmed shorting" within this period. In the current phase, their primary intent is to facilitate or allow prices to decline to re-accumulate at lower levels in the future or profit from their short positions.

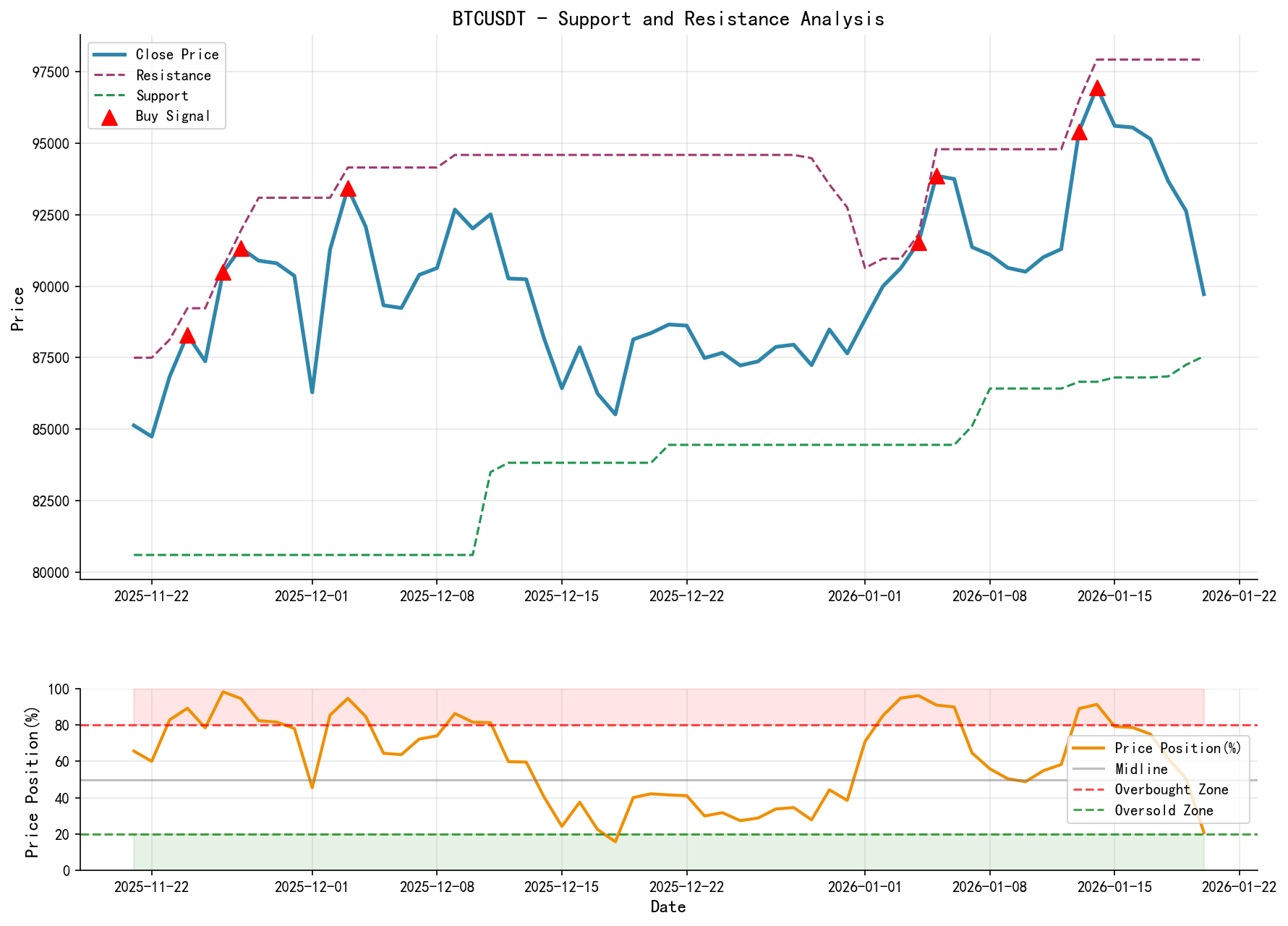

VI. Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Levels:

- • Primary Resistance:

- • R1:

93,000-94,000USD: The recent rally highs and the lower boundary of the consolidation range before the January 20 breakdown; now converted to strong resistance. - • R2:

97,000USD: The absolute high of the January 14 rally and a psychological level. - • R3: MA_30D (currently approximately

90,860USD): Dynamic medium-term resistance.

- • R1:

- • Primary Support:

- • S1:

86,000USD: The launch point for the early January rally, now broken with volume and converted to resistance. - • S2:

83,800USD: The panic low from December 1, 2025. - • S3:

80,000USD: A major psychological level and the general area of the November 21, 2025, swing low.

- • S1:

- • Primary Resistance:

- 2. Comprehensive Trading Signals and Operational Recommendations:

- • Core Judgment: Bearish. The market has completed distribution and entered a new declining phase. This judgment is supported by supply-demand dynamics, trend, momentum, and smart money behavior.

- • Operational Recommendations:

- • Aggressive Strategy (Right-Side Shorting): Consider establishing partial short positions near the current price (

89,717USD). - • Conservative Strategy (Shorting on Rallies): Wait for price to rebound to the R1 (

93,000) or R3 (90,860, near MA_30D) zones. If signs of weakness (stalling, low volume) appear, it would be a more optimal entry point for shorting. - • Stop-Loss Level: Stop-loss for all short positions should be placed above R2 (

97,000) to account for low-probability strong reversals. - • Target Level: Initial target towards the S2 (

83,800) and potentially S3 (80,000) zones.

- • Aggressive Strategy (Right-Side Shorting): Consider establishing partial short positions near the current price (

- • Long Strategy: Strongly discouraged to initiate long positions against the trend under the current structure. Any attempt to trade a bounce should be considered high-risk.

- • Future Validation Points (to Falsify/Confirm the Current Bearish View):

- 1. Falsification Signal (Bearish View Fails): Price with high volume (VOLUME_AVG_7D_RATIO > 1.2) strongly recovers and stabilizes above S1 (

86,000USD), and subsequently RSI can sustain above 50. This would suggest the January 20 breakdown was a "false break," and the market may enter a more complex consolidation. - 2. Confirmation Signal (Bearish View Valid): Price without significant high-volume rebounds continues trading below

86,000USD and approaches the83,800USD support. Particularly, if another high-volume decline (expanding supply) occurs during the descent, it would strengthen the persistence of the downtrend.

- 1. Falsification Signal (Bearish View Fails): Price with high volume (VOLUME_AVG_7D_RATIO > 1.2) strongly recovers and stabilizes above S1 (

Disclaimer: All conclusions in this report are derived based on the provided historical data and analytical models and do not constitute any investment advice. Financial markets involve risks, and past performance is not indicative of future results. Investors should make independent judgments and decisions cautiously based on their own circumstances.

Thank you for your attention! Wyckoff Volume-Price market analysis will be released daily at 8:00 AM before market open. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals.

Member discussion: