As a quantitative trading researcher proficient in the Wyckoff method, I will compile a comprehensive and in-depth quantitative analysis report based on the BOTZ data you provided. All conclusions are strictly derived from the data and adhere to Wyckoff's principles of volume and price.

BOTZ Quantitative Analysis Report

Product Code: BOTZ

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset BOTZ had an opening price of 37.59, a closing price of 37.17, a 5-day moving average (MA) of 38.20, a 10-day MA of 38.06, a 20-day MA of 37.24, a daily change of -3.08%, a weekly change of -1.80%, a monthly change of +2.59%, a quarterly change of +2.59%, and a yearly change of +2.59%.

- • Moving Average Alignment and Price Relationship:

- • As of the end of the analysis period (2026-01-20), the closing price of 37.17 has fallen below all short-term moving averages (MA_5D: 38.20, MA_10D: 38.06, MA_20D: 37.24), remaining only above the MA_30D (36.98) and MA_60D (36.47). This indicates that the short-term trend has weakened.

- • During the observation period, the price successfully broke above all moving averages twice, in mid-December and early January, forming a short-term bullish alignment, particularly when reaching the swing high of 38.16 on January 7. However, the subsequent pullback quickly disrupted this structure.

- • Key Signal: The MA_5D has decisively crossed below the MA_20D, forming a "death cross," confirming the initiation of short-term downward momentum. From a longer-term perspective, after the price retreated from the January high, the medium- and short-term moving averages (5/10/20-day) have converged and begun to diverge downward. This is a classic technical signal indicating that the uptrend may be ending and transitioning to a downtrend.

- • Market Phase Inference (Wyckoff Perspective):

- • Uptrend Phase (2025-11-21 to 2026-01-12): The price oscillated upward from a low of 32.73 to a high of 38.44. This period was accompanied by healthy volume-price alignment (detailed in Part 2), characteristic of a typical uptrend.

- • Distribution Phase (2026-01-12 to 2026-01-20): After reaching the high of 38.44, the price exhibited the following Wyckoff distribution characteristics: a) Stalling or down days on high volume appeared near the peak (January 13: down 1.53%, volume 953k, higher than the 7/14-day average). b) The final appearance of a SOW (Sign of Weakness) — On January 20, a sharp drop of 3.08% on high volume (volume surged to 1.261 million, 1.5 times the 60-day average), with the closing price breaking below key short-term support, confirming the completion of distribution and entry into a downtrend.

- • Currently, the market has clearly transitioned from the "Distribution" phase into the initial stage of the Downtrend.

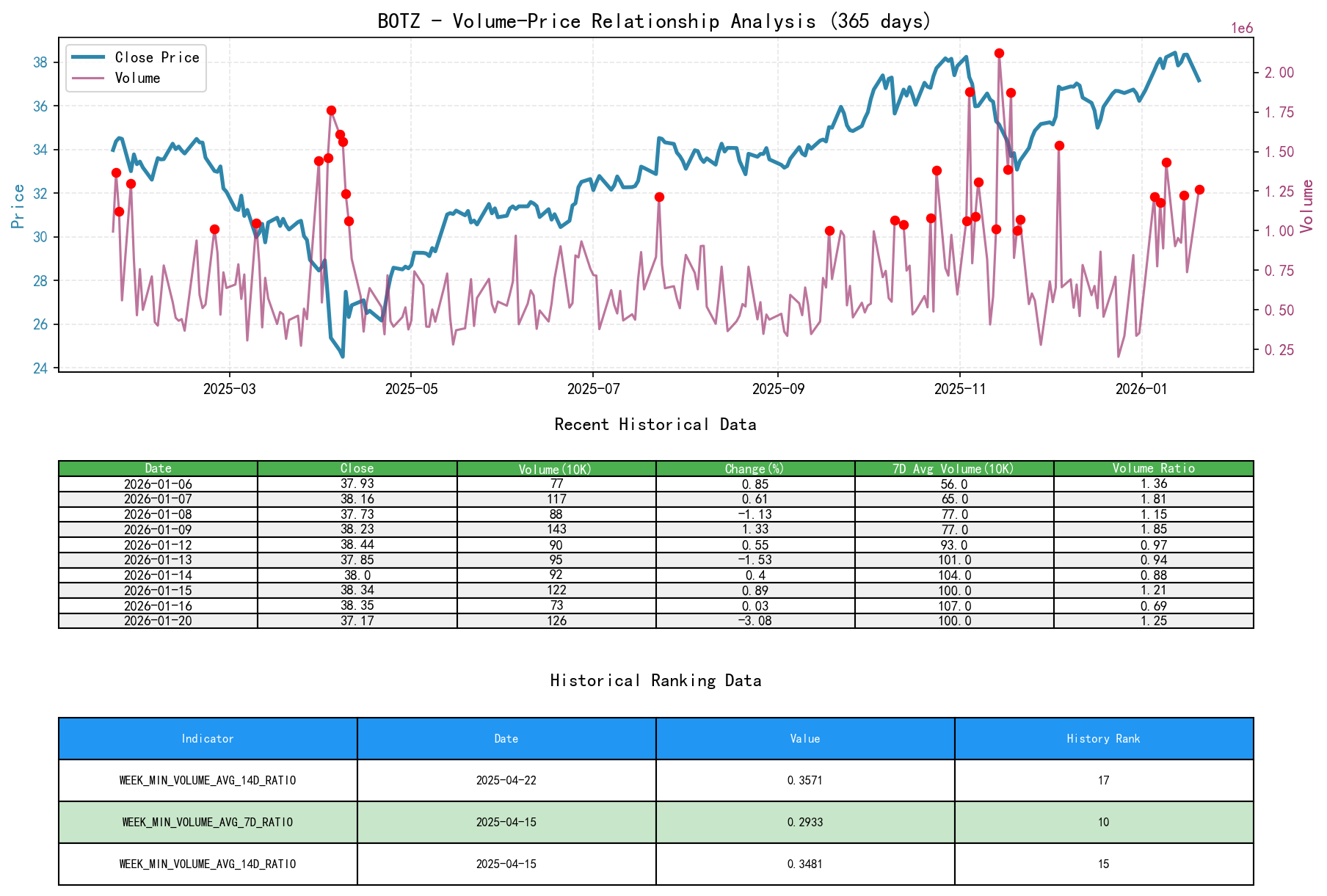

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset BOTZ had an opening price of 37.59, a closing price of 37.17, volume of 1,261,351, a daily change of -3.08%, a 7-day average volume of 1,008,671.43, and a 7-day volume ratio of 1.25.

- • Demand-Driven Phase:

- • 2025-12-04: Price increased by 3.86% on volume of 1.538 million, which was 1.93 times the 60-day average (797k) (

VOLUME_AVG_60D_RATIO= 1.93). This is a classic "high-volume advance," indicating strong demand (smart money buying) dominating the market, a hallmark signal of a breakout following accumulation. - • 2026-01-07: After a minor pullback, the price advanced again by 0.61% on volume of 1.179 million, which was 1.83 times the 30-day average (

VOLUME_AVG_30D_RATIO= 1.83), indicating demand re-entering at a critical level to attempt continuation of the uptrend.

- • 2025-12-04: Price increased by 3.86% on volume of 1.538 million, which was 1.93 times the 60-day average (797k) (

- • Supply-Driven / Distribution Signals:

- • 2026-01-09: Although the price rose by 1.33%, the volume was exceptionally high at 1.434 million, 2.17 times the 30-day average. Anomalously high volume at a relatively high price (near previous highs) warrants caution for potential "effort without result" or smart money distributing on strength.

- • 2026-01-20 (Key Reversal Day): The price plummeted 3.08% on volume of 1.261 million (

VOLUME_AVG_60D_RATIO= 1.50). This is a classic panic selling or SOW signal. The massive volume signifies a large influx of supply (selling pressure), while the significant closing decline shows demand unable to absorb it, with supply completely overwhelming demand, establishing the start of a downtrend. TheVOLUME_GROWTHof 71.03% further validates the abnormal surge in trading activity.

- • Lack of Demand Signals:

- • During corrections within the entire uptrend wave, volume typically contracted (e.g., 2025-12-24, 2025-12-30), indicating healthy adjustments. However, after the decline on January 13, the volume on rally days (Jan 14, 15) was relatively modest and failed to exceed the volume of the down day, hinting at insufficient follow-through demand and setting the stage for the subsequent decline.

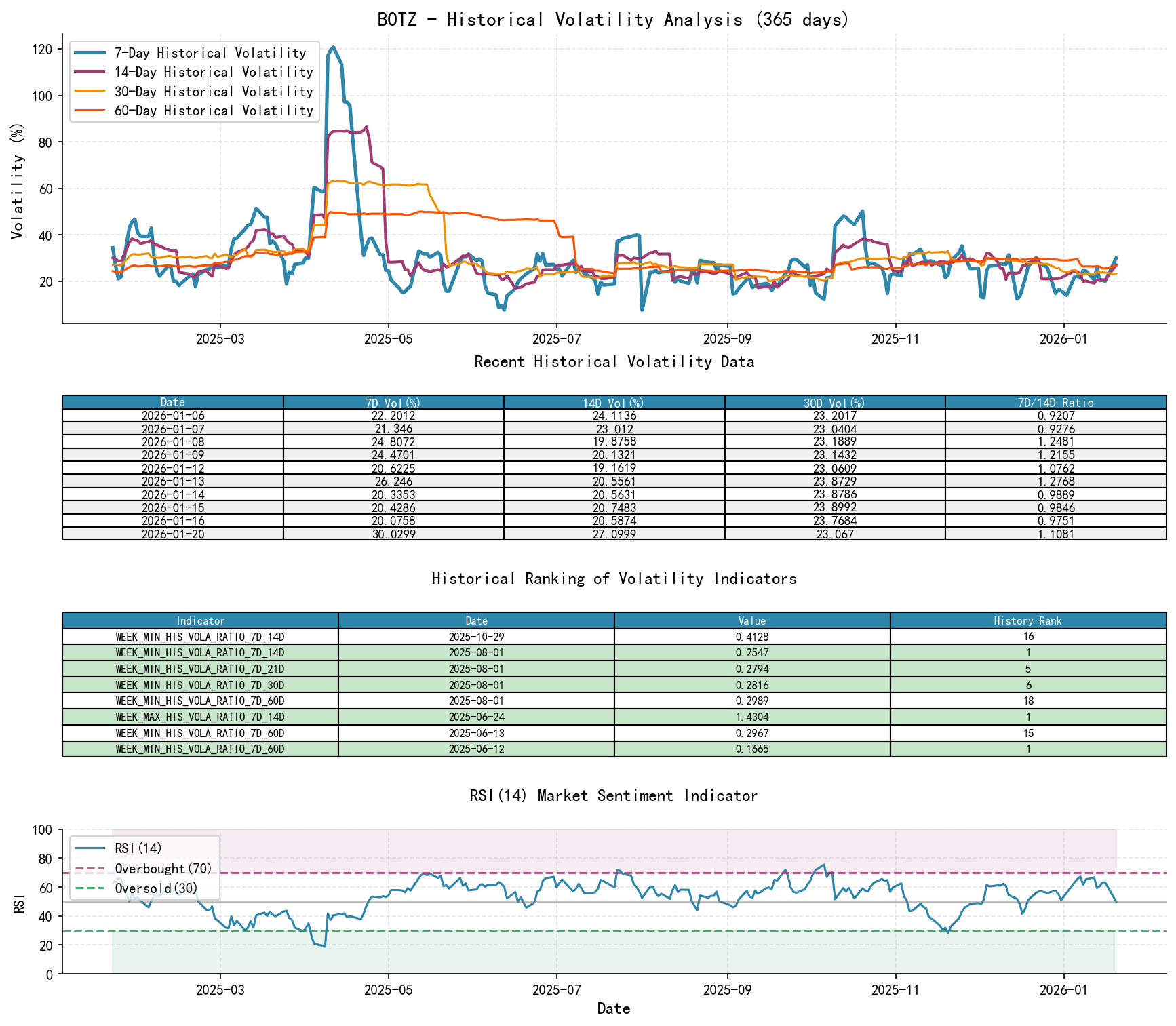

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset BOTZ had an opening price of 37.59, a 7-day intraday volatility of 0.14, a 7-day intraday volatility ratio of 1.02, a 7-day historical volatility of 0.30, a 7-day historical volatility ratio of 1.11, and an RSI of 49.86.

- • Volatility Levels:

- • Short-term volatility has increased significantly recently. Taking Parkinson volatility as an example, the 7-day volatility (

PARKINSON_VOL_7D= 0.138) has risen relative to the 60-day volatility (PARKINSON_RATIO_7D_60D= 1.019). - • Key Signal: On January 20,

HIS_VOLA_RATIO_7D_60D= 1.124,PARKINSON_RATIO_7D_60D= 0.845. Although the Parkinson ratio did not exceed 1, the historical volatility ratio indicates that short-term volatility is significantly 12.4% higher than the long-term average. Combined with the expanded daily range (High-Low) and high-volume plunge, this clearly points to the release of market panic sentiment.

- • Short-term volatility has increased significantly recently. Taking Parkinson volatility as an example, the 7-day volatility (

- • Sentiment Indicators:

- •

RSI_14quickly declined from the overbought zone on January 7 (67.3) to 49.86 on January 20, entering a neutral-to-bearish zone. This rapid decline coincided with the high-volume price drop, confirming a sharp reversal in momentum and a shift in market sentiment from optimism to caution or even pessimism.

- •

4. Relative Strength and Momentum Performance

- • Momentum Analysis:

- • Short-term Momentum Turns Negative:

WTD_RETURNis -1.80%, andMTD_RETURNhas sharply retraced from the high of +5.82% on January 15 to +2.59%. This indicates that short-term and monthly momentum has significantly deteriorated and turned negative. - • Medium-term Momentum Persists but is Tested:

YTDreturn remains positive (+2.59%) but is retreating from recent highs. The longer-termTTM_36return is as high as 62.53%, showing the long-term trend remains strong, but the current correction is testing the sustainability of this long-term momentum. - • Conclusion: Short-term momentum has clearly weakened, mutually validating the conclusions of the price breaking below short-term moving averages and the high-volume decline.

- • Short-term Momentum Turns Negative:

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff principles and the above volume-price analysis, the operational intent of large investors is clearly discernible:

- 1. Accumulation and Position Building: The oscillating uptrend from late November to early December 2025, especially the high-volume breakout on December 4, indicates smart money actively building positions, leading the initiation of this rally.

- 2. Distribution: The behavior from January 9 to January 20, 2026, is a classic distribution process. The high-volume advance on January 9 at relatively high levels was likely smart money distributing (selling holdings to retail investors chasing the rally). The subsequent low-volume rebound (Jan 14-15) and the final high-volume plunge (Jan 20) constitute a complete "distribution structure" — finalized with the SOW signal confirming distribution completion and successful smart money exit.

- 3. Current Intent: With the appearance of the SOW, smart money has shifted to a wait-and-see approach or begun establishing short positions. Market dominance has transferred from the demand side (buyers) to the supply side (sellers). Unless clear "re-accumulation" signals appear at lower levels (e.g., high-volume selling exhaustion, massive absorption after panic selling), their short-term intent is bearish or waiting for lower prices.

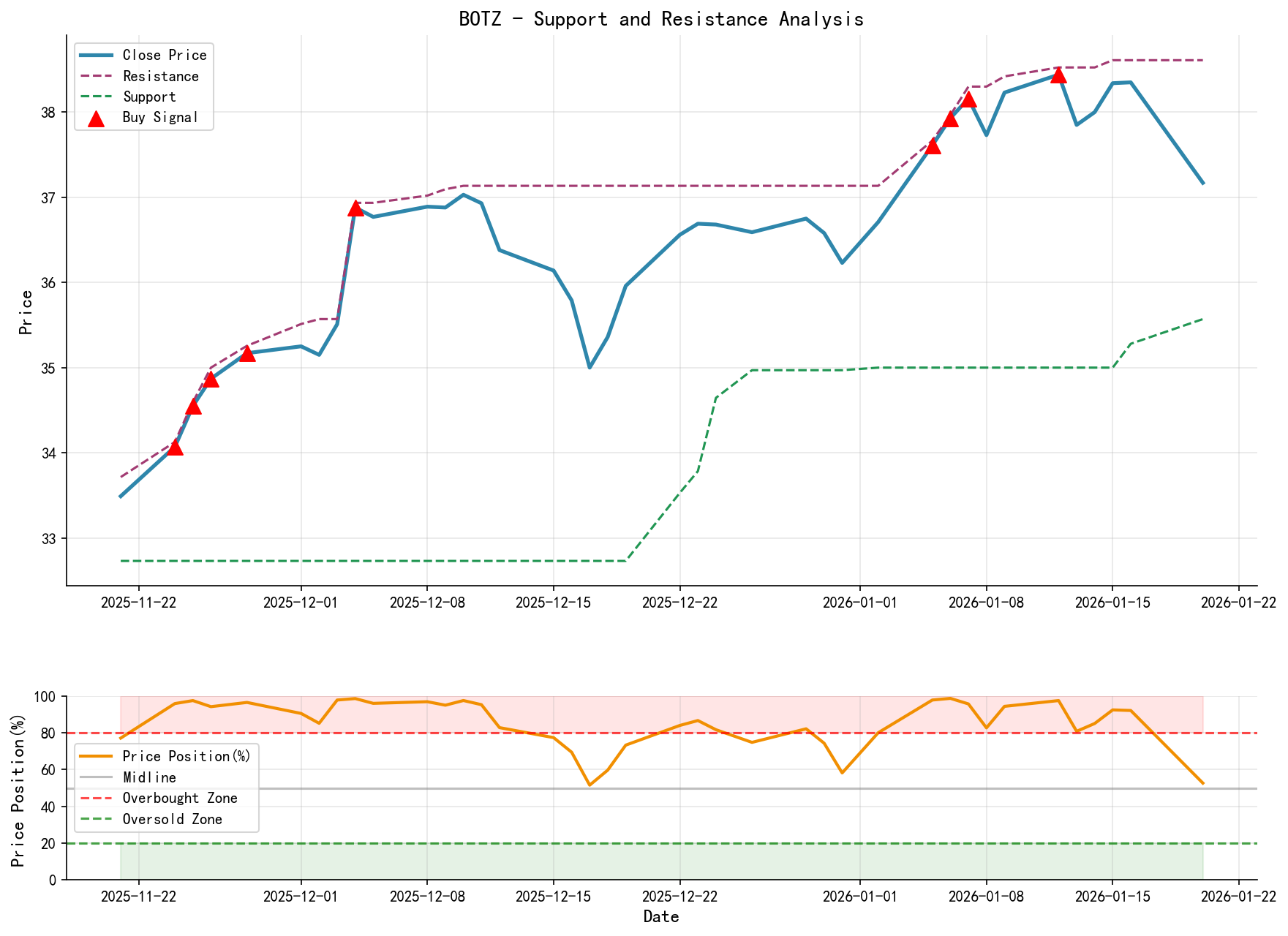

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Resistance Zone: 37.87 - 38.53. This is the starting area of the recent decline and the upper part of the large bearish candle on January 20, expected to constitute strong resistance.

- • Near-term Support: 35.00. This is the low platform formed during the mid-December 2025 correction and a significant pivot point in the preceding uptrend.

- • Major Support: 32.73. The starting low of this uptrend (2025-11-21). If the downtrend continues, this level will be a crucial battleground.

- • Historical Ranking Data Integration:

- • According to the provided

HISTORY_RANKdata, during the period of January 12-15, 2026, BOTZ's weekly opening, closing, and low prices all reached the 19th-20th highest levels in nearly 10 years. This quantifiably confirms that the price was indeed in a historically high relative area at that time, significantly increasing the probability of a technical correction or trend reversal from that zone, providing important historical data support for identifying the "distribution phase."

- • According to the provided

- • Comprehensive Trading Signals and Operational Recommendations:

- • Overall Judgment: Bearish. The market has completed distribution and entered the initial stage of a downtrend. Key evidence: High-volume stalling after highs followed by a high-volume plunge (SOW), moving average death cross, negative short-term momentum, and surging volatility indicating panic.

- • Operational Recommendations:

- • Bearish Strategy: Consider establishing short positions at the current price (~37.20) or on a rebound near the 37.50-37.80 resistance zone.

- • Stop-loss Level: Place above the key resistance zone, e.g., 37.90 (near the January 20 high).

- • Target Levels: First target at the 35.00 support zone; if broken, the second target could be towards the area below 34.00.

- • Future Validation Points:

- 1. Bearish View Validation: If subsequent price rebounds fail to decisively hold above 37.50 on low volume, or if the price directly breaks below 36.50 (recent minor platform) on high volume, the downtrend will be reinforced.

- 2. Bearish View Invalidation: If the price shows significant low-volume selling exhaustion or a high-volume bullish engulfing candle near the current level or the 35.00 support level, be alert for a potential pause in the decline. The market might enter a sideways consolidation or re-accumulation phase. Short positions should be closed, and the situation re-evaluated.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. The market involves risks; invest with caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Wyckoff volume-price market analysis is published daily at 8:00 AM before the market opens. Please feel free to comment and share. Your recognition is crucial. Let's work together to identify market signals.

Member discussion: