Alright. As a quantitative trading researcher proficient in the Wyckoff Method, I will write a comprehensive and in-depth quantitative analysis report for you based on the provided BNBUSDT data and historical ranking indicators.

BNBUSDT Wyckoff Price-Volume Analysis Report

Product Code: BNBUSDT

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-21

Core Conclusion: BNBUSDT has concluded a multi-month downtrend. After experiencing a panic sell-off (mid-December), it has entered an Accumulation phase dominated by large investors. Following a technical rebound, the current price has encountered supply near the key resistance level of 950, leading to a short-term correction and consolidation. It is advisable to look for buying-on-dip opportunities when the price retraces to the key support zone (830-850), combined with price-volume signals, and to confirm and add positions upon a decisive breakout above the 950 resistance.

1. Trend Analysis and Market Phase Identification

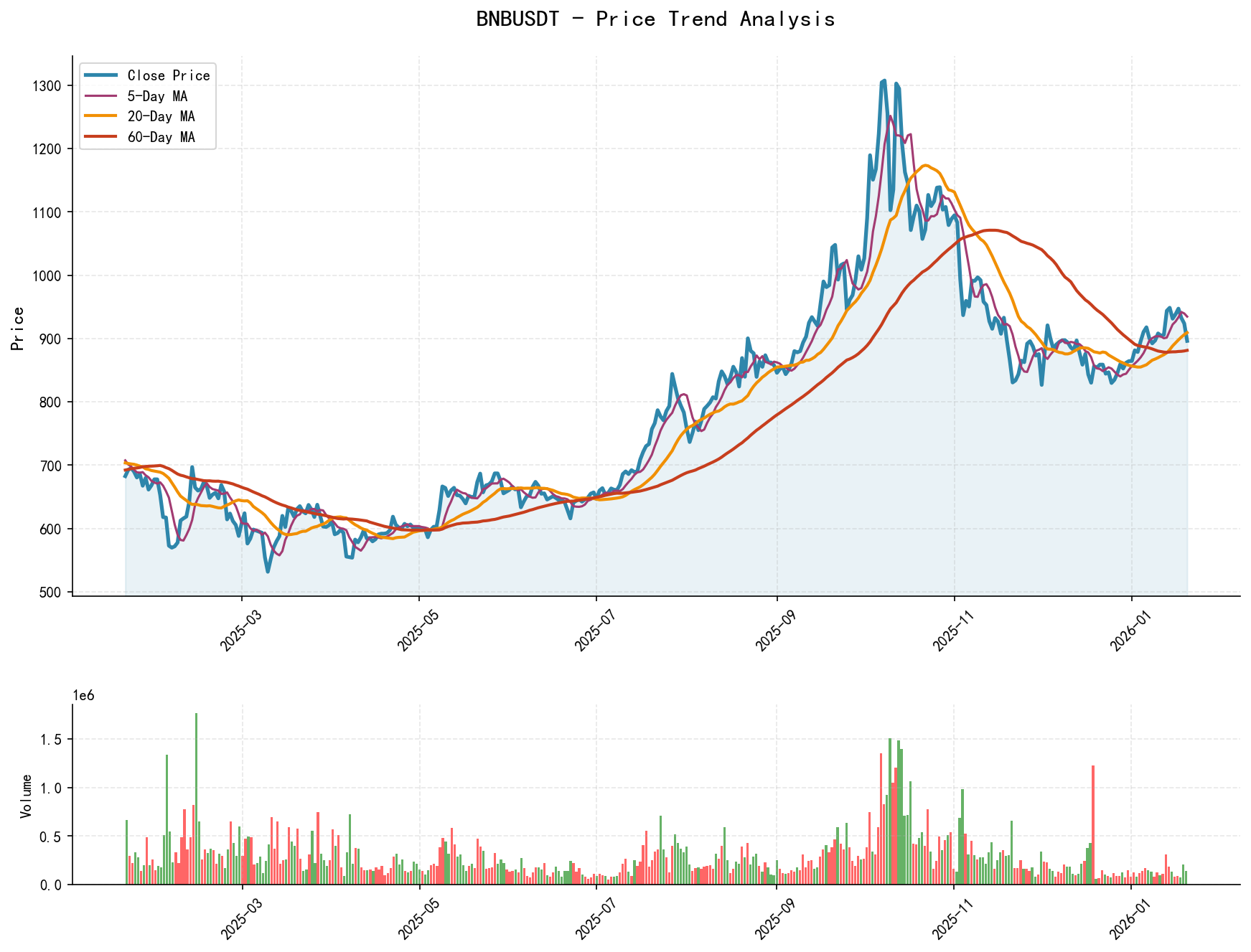

As of 2026-01-20, for BNBUSDT: Opening Price 923.60, Closing Price 896.13, MA_5D 934.52, MA_10D 928.28, MA_20D 909.21, Daily Change -2.97%, Weekly Change -5.04%, Monthly Change 3.68%, Quarterly Change 3.68%, Yearly Change 3.68%

- • Moving Average Alignment and Trend: During the analysis period, the price remained below all major moving averages (MA_5D to MA_60D) for an extended time, showing a clear bearish alignment. The MA_60D (1061 to 881) continued to slope downward, confirming a long-term downtrend. However, since the end of December, the MA_5D has started to cross above the MA_10D and MA_20D, and the price has also rebounded near the MA_20D (906), indicating that the short-term downtrend has ended, and the market has entered a phase of technical rebound or consolidation for a base. Currently, the price (896) is being suppressed by the MA_20D (909), suggesting that the intermediate-term trend has not yet turned bullish.

- • Key Turning Points and Market Phases:

- • Panic and Test (2025-12-15 to 2025-12-19): The price plunged to 843 on December 17th. The next day (Dec 18th), it tested lower again but closed with a long lower shadow (low 818, close 830) on massive volume (430k). Combined with the RSI falling below 30 into oversold territory, this aligns with the characteristic of "Selling Climax (SC)" in Wyckoff theory – emotional selling absorbed by large buyers.

- • Signs of Accumulation (2025-12-19 to 2026-01-13): On December 19th, following the bottom test, the price closed with an extremely large bullish candle (volume 1.227 million, the highest in the analysis period), confirming the presence of absorbing forces. The subsequent rebound (to 943) was accompanied by orderly volume expansion (e.g., high-volume surge on Jan 13th), with prices gradually rising and pullbacks occurring on low volume, indicating diminishing supply and demand taking control. This phase is preliminarily identified as "Accumulation".

- • Rebound and Encountering Supply (2026-01-14 to Present): After a high-volume surge to 953 on January 13th, the price consolidated at high levels for several consecutive sessions and then fell on increased volume (-2.97%) to close at 896 on Jan 20th. This indicates that strong supply was encountered near the key resistance level of 950, and the market may be entering the initial stage of "Distribution" or a "Re-test" phase.

2. Price-Volume Relationship and Supply-Demand Dynamics

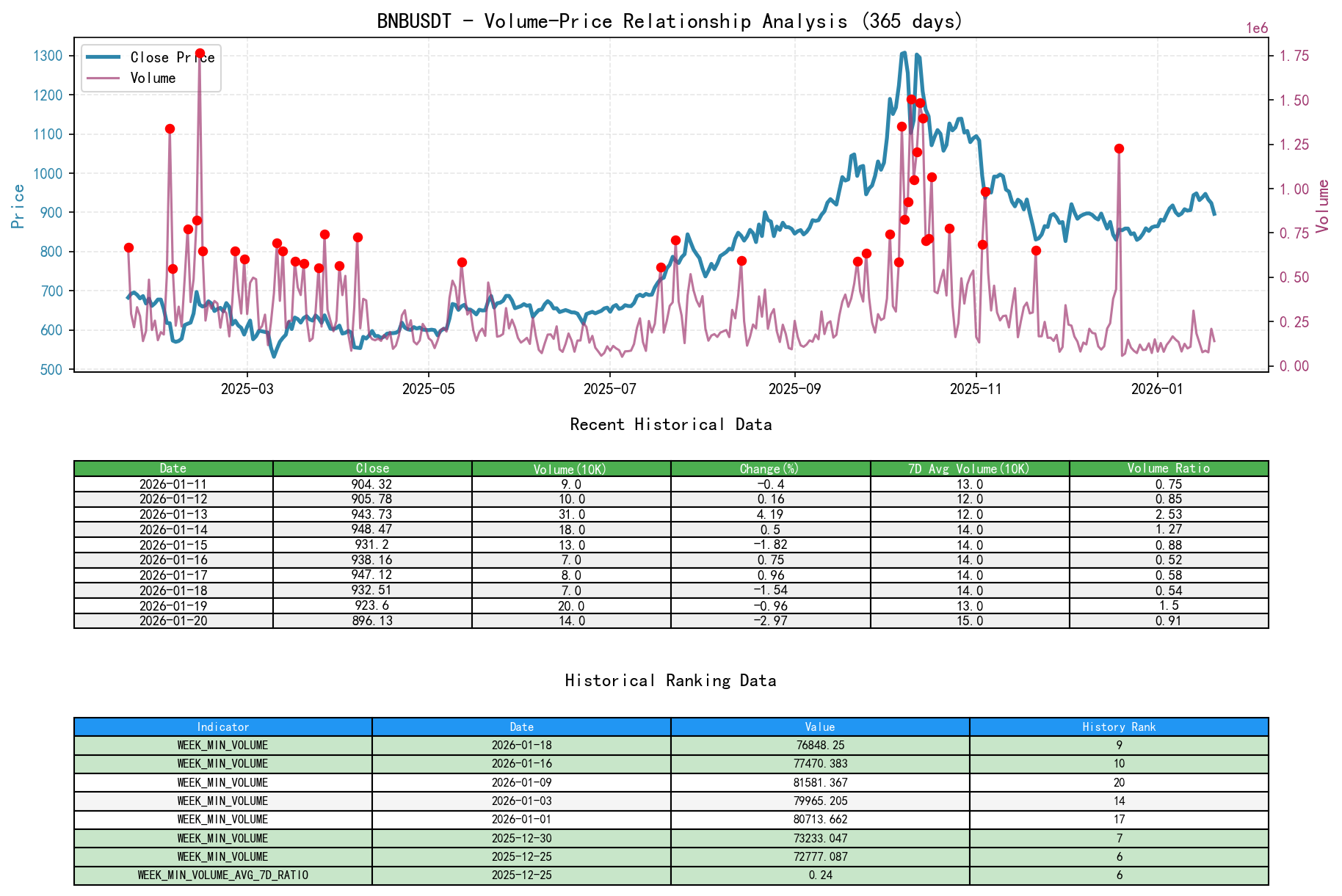

As of 2026-01-20, for BNBUSDT: Opening Price 923.60, Closing Price 896.13, Volume 140171.50, Daily Change -2.97%, Volume 140171.50, 7-Day Avg Volume 153753.10, 7-Day Volume Ratio 0.91

- • Key Day Analysis:

- • Supply Dominated Day (2025-11-21): Price fell -4.16% on extremely high volume of 654k (VOLUME_AVG_7D_RATIO=2.14), a classic "high-volume decline", indicating overwhelmingly dominant supply.

- • Lack of Demand Days (2025-12-05 to 2025-12-12): Price fluctuated slightly within a range, but volume continued to contract (VOLUME consistently below 150k for multiple days, with several volume ratio indicators hitting historically low ranks), characteristic of "low-volume consolidation", showing a lack of market direction and weak trading interest.

- • Panic Absorption Day (2025-12-19): Extreme volume (1.227 million) accompanied a price increase of +3.14% (bullish candle with long lower shadow). HISTORY_RANK data shows that the day's volume ratios relative to the 14, 21, and 30-day moving averages (6.54, 6.51, 5.89) all ranked as the 2nd/3rd highest in nearly a decade. This is a classic Wyckoff event: "Massive Absorption after a Selling Climax (AR after SC)", a strong signal of smart money entry.

- • Demand Recovery Day (2026-01-13): Price surged +4.19% on volume of 312k (VOLUME_AVG_7D_RATIO=2.53), with VOLUME_AVG_21D_RATIO=2.82 reaching a recent high, representing "high-volume breakout advance", confirming robust demand.

- • Supply Re-emergence Day (2026-01-20): Price declined -2.97% on volume of 140k (VOLUME_AVG_7D_RATIO=0.91), which is a significant increase compared to the low volume of the preceding days (e.g., 77k on Jan 18th). This is "high-volume stalling/decline", indicating supply re-entering at resistance.

- • Supply-Demand Transition: From "Supply Exhaustion (historically low volume)" in mid-December to "Massive Demand Absorption post-Panic", then to "Orderly Demand Push" in early January, and finally evolving into "Demand Halted, Supply Emerging" in late January. Current supply and demand have reached short-term equilibrium in the 900-950 range.

3. Volatility and Market Sentiment

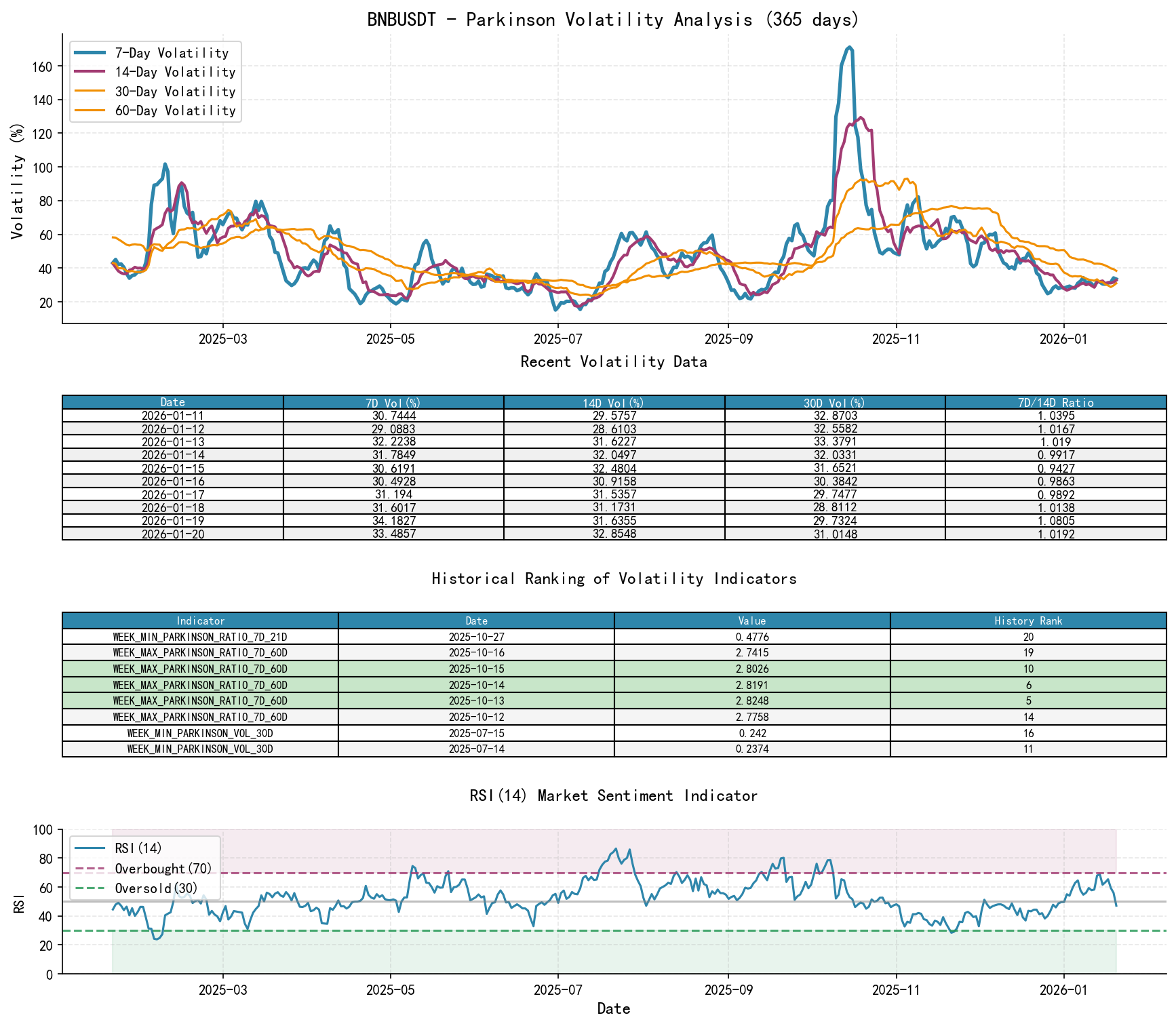

As of 2026-01-20, for BNBUSDT: Opening Price 923.60, 7-Day Intraday Volatility 0.33, 7-Day Intraday Vol Ratio 1.02, 7-Day Historical Volatility 0.29, 7-Day Historical Vol Ratio 0.86, RSI 47.15

- • Volatility Level: The 7-day historical volatility (HIS_VOLA_7D) touched an extreme low of 0.1108 on Dec 12th (historically ranking 13th lowest in nearly a decade), then surged to 0.5019 on Dec 19th, marking the market's transition from "dormant" to "active". Current volatility remains around 0.29, a neutral level, indicating stabilizing market sentiment.

- • Volatility Structure: At the key turning point on Dec 19th, HIS_VOLA_RATIO_7D_14D reached 1.429 (historically ranking 4th highest in nearly a decade), showing that short-term volatility spiked far above intermediate-term, a classic "panic and turning point" signal. This ratio has since retreated to 0.858, with short-term volatility returning to normal.

- • Market Sentiment (RSI): RSI_14 remained below 30 from late November to mid-December, in an extremely oversold state. It subsequently recovered with the price rebound, reaching 68 (Jan 14th), nearing overbought. Currently, RSI has retraced to 47.15, back in a neutral-to-weak zone, consistent with the price correction.

4. Relative Strength and Momentum Performance

- • Periodic Returns:

- • Short-term (WTD_RETURN): This week's (as of Jan 20th) return is -5.04%, momentum turned negative, aligning with the high-volume decline on the daily chart.

- • Intermediate-term (MTD_RETURN): This month's (January) return to date is +3.68%, still positive overall, but momentum has significantly weakened compared to the mid-January high (+9.74%).

- • Long-term (QTD_RETURN/YTD): This quarter's (Q1) return to date is +3.68%. Compared to the steep decline in the previous period (Nov-Dec), clear signs of a bottom reversal in intermediate-term momentum have emerged.

- • Momentum Validation: The strong rebound from Dec 19th to Jan 13th was comprehensively validated by volume, volatility, and RSI data, constituting an effective momentum repair.

5. Large Investor (Smart Money) Behavior Identification

- • Accumulation Operations (2025-12-17 to 19): At the panic lows (818-843 zone), the market saw rarely high volume in nearly a decade (volume ratios historically ranking 2nd/3rd highest). This is not retail behavior but proactive, large-scale accumulation by large investors capitalizing on market panic. The concurrent spike in TB_BASE_VOLUME (true transaction volume) data confirms the "authenticity" of the trades.

- • Shakeout and Markup (2025-12-30 to 2026-01-13): Volume in early January shrank to extremely low levels (daily volume and average volume hitting historically low ranks for multiple days), indicating reduced floating supply and improved control by dominant players. The subsequent high-volume advance (Jan 13th) was a clear move by smart money to mark up the price and move away from the cost base.

- • Test and Distribution Preparation (2026-01-14 to 20): After touching the 950 resistance, the price showed signs of high-volume stalling and decline (Jan 20th). This could be smart money testing overhead supply pressure, or possibly conducting initial distribution (partial profit-taking on low-cost positions) at this key psychological level, or both. It is necessary to observe whether subsequent rebounds occur on lower volume (secondary test) to confirm if the supply has been absorbed.

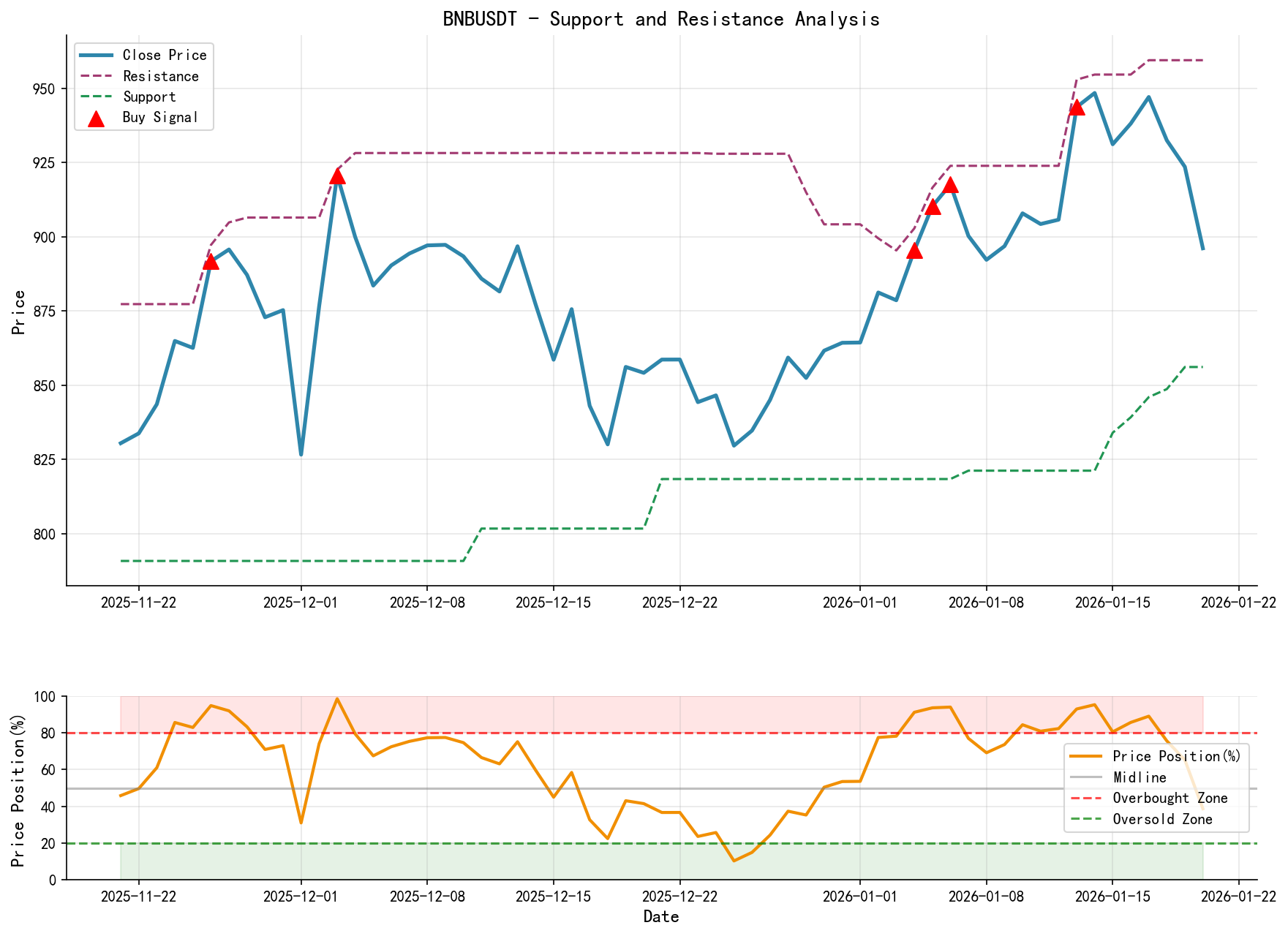

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- 1. Primary Support Zone 830-850: Corresponds to the December panic sell-off low zone and the early January pullback low. This zone is the cost base for large investor accumulation and serves as the lifeline for judging whether the accumulation structure is breached. A break below would necessitate re-evaluating the market structure.

- 2. Secondary Support 875-890: Corresponds to the lower boundary of the recent consolidation range and near the MA_5D. If this level can be held on low volume, the short-term correction may conclude.

- • Key Resistance Levels:

- 1. Primary Resistance ~950: The January high (953) and a prior congestion zone during the downtrend. A decisive breakout above this level would open new upside targets towards 1000.

- 2. Secondary Resistance 925-935: The recent consolidation high zone, where supply initially appeared.

- • Comprehensive Trading Signals and Operational Suggestions:

- • Signal Nature: Neutral / Awaiting Pullback Buying Signal. The market has moved away from the panic bottom but faces short-term correction pressure. The current level (Jan 20th close) is not suitable for chasing.

- • Operational Recommendations:

- 1. Buy-on-Dip Opportunity (Bullish): If the price retraces to the 875-890 support zone on low volume and shows reversal candlestick patterns (e.g., long lower shadow, small body), consider light entry, with a stop-loss set below 850. This offers a better risk-reward ratio.

- 2. Breakout Follow-through (Bullish): If the price can decisively break through and sustain above 950 on high volume (VOLUME_AVG_7D_RATIO > 1.5) in the future, execute a right-side confirmation trade (add position), with a stop-loss set below the breakout point.

- 3. Risk Avoidance (Bearish): If the price breaks below the 850 support on high volume, it suggests the accumulation structure may have failed. Exit positions and move to the sidelines, with the next support observed around 800.

- • Future Validation Points:

- 1. Bullish Validation: The price shows a combination of low-volume stabilization + renewed high-volume demand entry at key support zones (830-850 or 875-890).

- 2. Bearish Validation: The price consistently shows "advancing on low volume, declining on high volume" price-volume divergence patterns below 950, or directly breaks below 850 on high volume.

- 3. Trend Confirmation: The MA_20D transitions from declining to flat and begins to turn upward, while the price sustains above the MA_20D.

Disclaimer: This report is based on historical data and quantitative model analysis. All conclusions are derived from market research and do not constitute any investment advice. Financial markets carry significant risks; please make decisions prudently.

Thank you for your attention! Daily Wyckoff Price-Volume Market Interpretation is published promptly at 8:00 AM before the market opens. We sincerely appreciate your comments and shares; your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: