Excellent, please standby. As a quantitative trading researcher proficient in the Wyckoff Method, I will prepare a comprehensive, in-depth quantitative analysis report for you based on the data sheet and historical ranking metrics you provided for product code 513980. All conclusions are strictly derived from data and conform to the principles of Wyckoff's price-volume analysis.

Quantitative Analysis Report: Product Code 513980

Analysis Period: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-20

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, for the underlying asset 513980, the opening price was 0.74, closing price 0.74, 5-day moving average (MA) 0.76, 10-day MA 0.75, 20-day MA 0.74, daily change -0.94%, weekly change -2.76%, monthly change 4.23%, quarterly change 4.23%, yearly change 4.23%.

Based on Moving Average (MA) analysis, product 513980 has been in a clear long-term downtrend over the past approximately two months, but recent structure shows signs of transition.

- • Bullish/Bearish Alignment: Throughout the observation period, the price (CLOSE) consistently traded below the MA_5D, MA_10D, MA_20D, MA_30D, and MA_60D, forming a classic "bearish alignment". This indicates that medium-to-long-term supply has been dominant.

- • MA Crossovers and Price Action:

- 1. Sustained Decline Phase (2025-11-21 to 2025-12-31): The MA_5D remained below the MA_20D, with prices continually making new lows, such as the dip to 0.709 on December 16. This phase aligns with the characteristics of "Markdown" or the late stage of "Panic Selling" in Wyckoff theory.

- 2. Potential Phase Transition (2026-01-05 to 2026-01-20): Following a high-volume bullish candlestick on January 5, 2026, the price initiated a rebound. A key signal emerged: the MA_5D (0.762) crossed above and held above the MA_20D (0.737) after January 12, even though the MA_10D remained below the MA_20D. This marks an exhaustion of short-term downward momentum, signaling the market's entry into a transitional testing period between "Accumulation" and "Distribution". The recent price oscillation within the 0.74-0.78 range is typical behavior for potential bottom formation.

Conclusion: The market has transitioned from a unidirectional downtrend to a consolidation/bottom-building phase. The current moving average system indicates the long-term trend remains bearish-biased, but the strong performance of the short-term MA (MA_5D) suggests the downtrend may have been interrupted, and the market is attempting to establish a trading range.

2. Volume-Price Relationship and Supply-Demand Dynamics

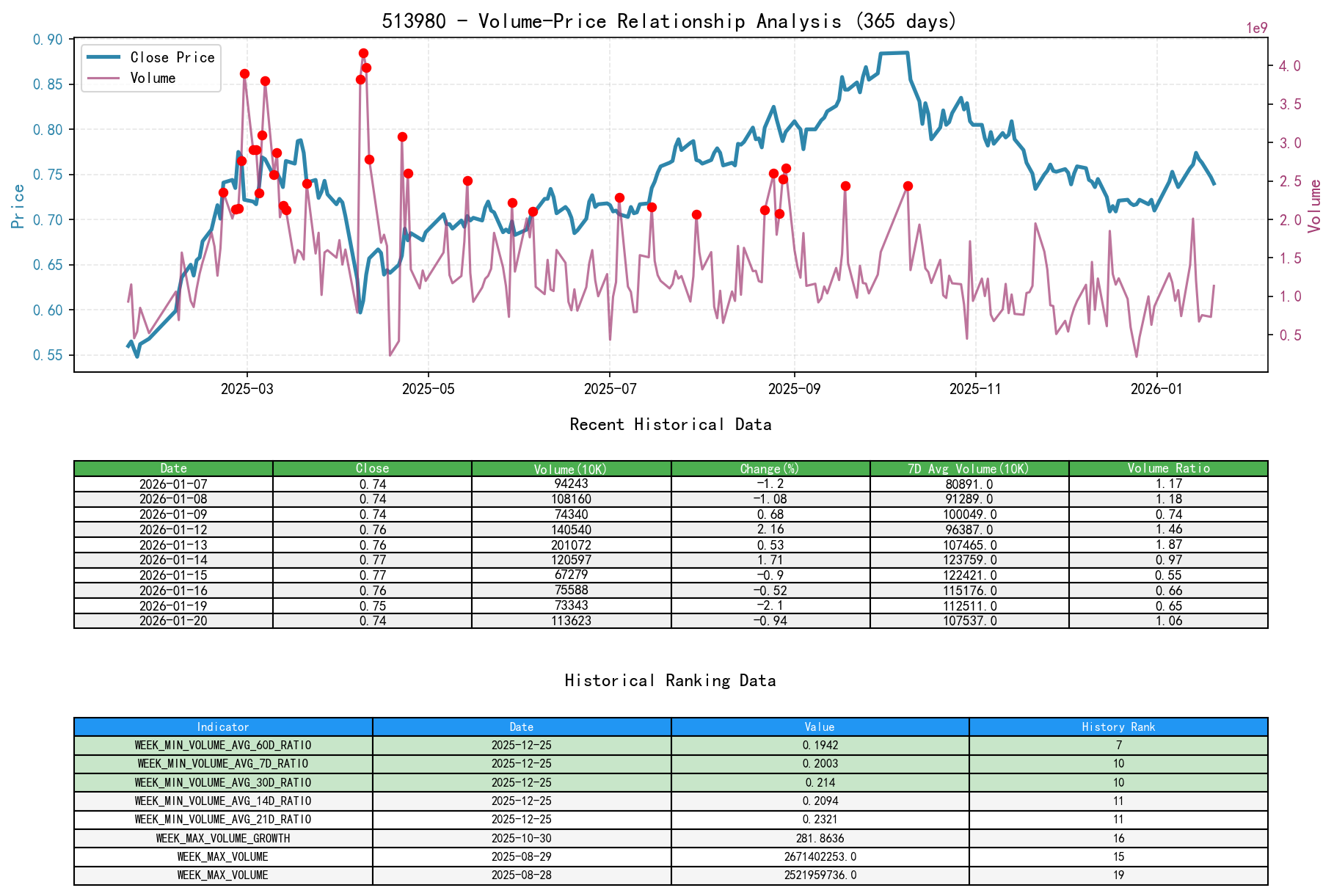

As of January 20, 2026, for the underlying asset 513980, the opening price was 0.74, closing price 0.74, volume 1,136,236,900, daily change -0.94%, volume 1,136,236,900, 7-day average volume 1,075,374,436.86, 7-day volume ratio 1.06.

Volume-price relationships reveal a dramatic and critical shift in recent market supply and demand forces.

- • Panic Selling and Heavy Absorption (2025-12-16): On that day, the price plummeted -2.21%, closing at a new low of 0.709, but volume surged to 1.85 billion, more than 1.6 times the average volume over the past 60 days (1.15 billion) (

VOLUME_AVG_60D_RATIO= 1.605). This is a classic "Climax" signal, where the public sells in fear, but the massive volume indicates large-scale investors actively absorbing at lower levels. This often marks the beginning of an accumulation process. - • Rebound Confirmation and Demand Entry (2026-01-05 & 01-12): On January 5, the price rose sharply by 4.51%, with volume (1.30 billion) being 2.17 times the 7-day average (

VOLUME_AVG_7D_RATIO= 2.174). This represents "demand-led advance", validating the effectiveness of the previous low. On January 12, the price rose again by 2.16% on high volume (1.41 billion volume, 1.69 times the 14-day average), further confirming buying power. - • Advance Exhaustion and Supply Resurgence (2026-01-19 & 01-20): The price encountered resistance upon rebounding to the 0.76-0.78 range. On January 19, the price fell -2.10%; although volume (733 million) was not significantly elevated, it broke below a short-term key level. On January 20, the price fell -0.94% with notably increased volume to 1.14 billion (1.06 times the 7-day average). This represents "supply-led decline" or a "Secondary Test (ST)" of the previous rebound, indicating that selling pressure remains strong at current price levels, requiring further market digestion.

Conclusion: Demand clearly entered the market at the panic low on December 16 and during the early January rebound, establishing initial support. However, supply reacted swiftly in the 0.76-0.78 range, causing a price pullback. The current market is in a balanced zone of supply-demand contention.

3. Volatility and Market Sentiment

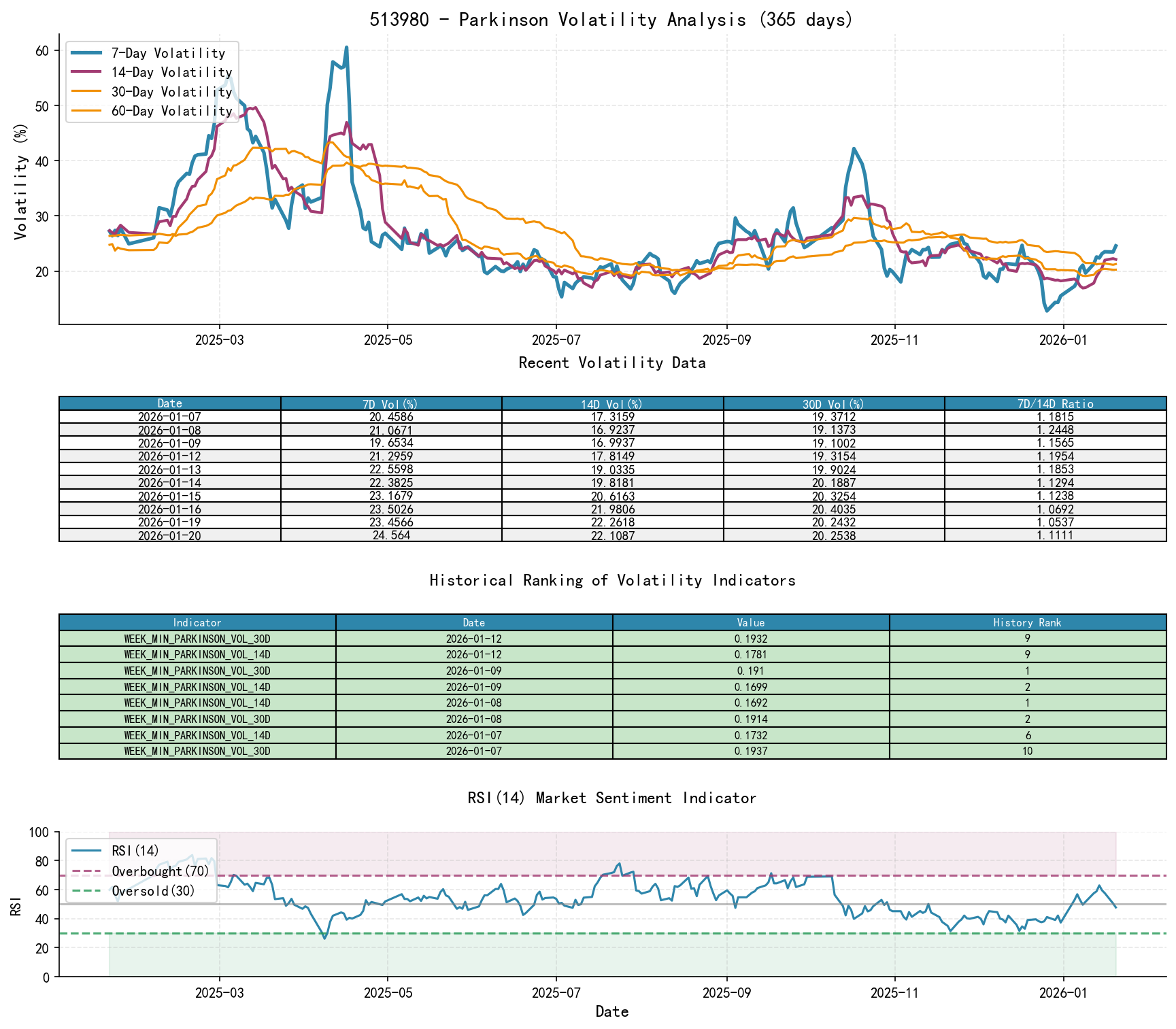

As of January 20, 2026, for the underlying asset 513980, the opening price was 0.74, 7-day intraday Parkinson Volatility 0.25, 7-day Parkinson Volatility Ratio 1.11, 7-day historical volatility 0.29, 7-day historical volatility ratio 0.86, RSI 47.75.

Volatility and RSI data clearly depict a market sentiment cycle transitioning from extreme compression to panic and then retreat.

- • Extreme Volatility Contraction (Historical Lows): Historical ranking data shows multiple volatility indicators hitting extreme lows from late December 2025 to early January 2026. For example:

- •

WEEK_MIN_PARKINSON_VOL_14Dreached 0.1692 on January 8, the 1st lowest in nearly 10 years. - •

WEEK_MIN_PARKINSON_VOL_30Dreached 0.1910 on January 9, the 1st lowest in nearly 10 years. - •

WEEK_MIN_PARKINSON_RATIO_7D_60Dreached 0.5451 on December 26, the 6th lowest in nearly 10 years.

This reflects "momentum exhaustion" in the late stages of a decline, where volatility plummets to an ice-low, often a precursor to a trend change.

- •

- • Sharp Volatility Expansion and Sentiment Release: Entering January, volatility surged sharply along with the price rebound. On January 8,

HIS_VOLA_RATIO_7D_14Dreached 1.367; on January 12,HIS_VOLA_RATIO_7D_30Dreached 1.487, indicating short-term volatility far exceeding medium-to-long-term averages, quickly igniting market sentiment. - • RSI Oversold Condition and Rebound Confirmation: The RSI_14 dropped to 31.63 on December 16, approaching the oversold region, coinciding with the panic selling day. Subsequently, the RSI rebounded, peaking at 62.97 on January 14, indicating buying pressure. The current RSI has retreated to 47.75, in a neutral-to-weak zone, consistent with the price pullback pattern.

Conclusion: The market has undergone a classic sentiment cycle of "volatility compression -> extreme event (panic selling) -> volatility explosion -> volatility retreat." The historically low volatility confirms the suppressed state of the market in the earlier period, and the subsequent rebound is the inevitable result of pent-up sentiment release.

4. Relative Strength and Momentum Performance

Momentum data indicates the product showed absolute weakness during the observation period but exhibited a significant rebound momentum in the short term.

- • Weak Medium-to-Long-Term Momentum: QTD_RETURN and YTD_RETURN were mostly significantly negative until turning positive after the January rebound (QTD: 4.23%, YTD: 4.23%). This indicates relative weakness for this asset within a larger timeframe.

- • Strengthening Short-Term Momentum: A crucial signal emerged in January. MTD_RETURN rebounded sharply from -5.71% at the end of December to +4.23% by January 20. WTD_RETURN, although negative (-2.76%), combined with positive returns in previous weeks (e.g., +3.49% the week of January 5), shows that short-term downward momentum was reversed in January, with the market now in a recovery phase post-decline.

Conclusion: The product's medium-to-long-term momentum remains under pressure, but a significant and strong reversal signal has appeared in the short-term (January) momentum, cross-verifying the "demand entry" and "bottom formation" identified in the volume-price analysis.

5. Smart Money Behavior Identification

Integrating the above dimensions allows for an inference of the behavior path of large investors (smart money):

- 1. Stealth Accumulation (Late December 2025): During the period of historically low volatility and extremely low volume (e.g., December 25's

VOLUME_AVG_60D_RATIOwas the 7th lowest in nearly 10 years), smart money likely began small-scale, dispersed position-building when market attention was minimal. - 2. Massive Absorption Amid Panic (2025-12-16): When panic selling (high-volume plunge) occurred, smart money decisively stepped in, absorbing massive volume, completing the most critical step in the accumulation process. This was not retail behavior but organized capital inflow.

- 3. Markup and Testing (January 2026): Smart money rapidly moved the price away from the accumulation zone through consecutive high-volume advances (January 5, 12), testing overhead supply pressure. The exceptionally high volume on January 13 (2.01 billion, 2.39 times the 14-day average) could represent "scarcity buying" or "churning" during the markup phase.

- 4. Current Behavior – Shakeout or Distribution Test: After encountering resistance near 0.78 and pulling back, the high-volume decline on January 20 presents two possibilities per Wyckoff theory. It could be a "Shakeout", creating panic to flush out weak longs in the early stages of an advance; or it could indicate encountering stronger supply, with smart money conducting a "distribution test" at this level to gauge market follow-through.

Core Judgment: Based on the massive absorption on the panic selling day and the subsequent organized high-volume markup, smart money conducted clear accumulation activity in the 0.70-0.75 range. The current price range consolidation is part of its process to test overhead supply and underlying demand strength.

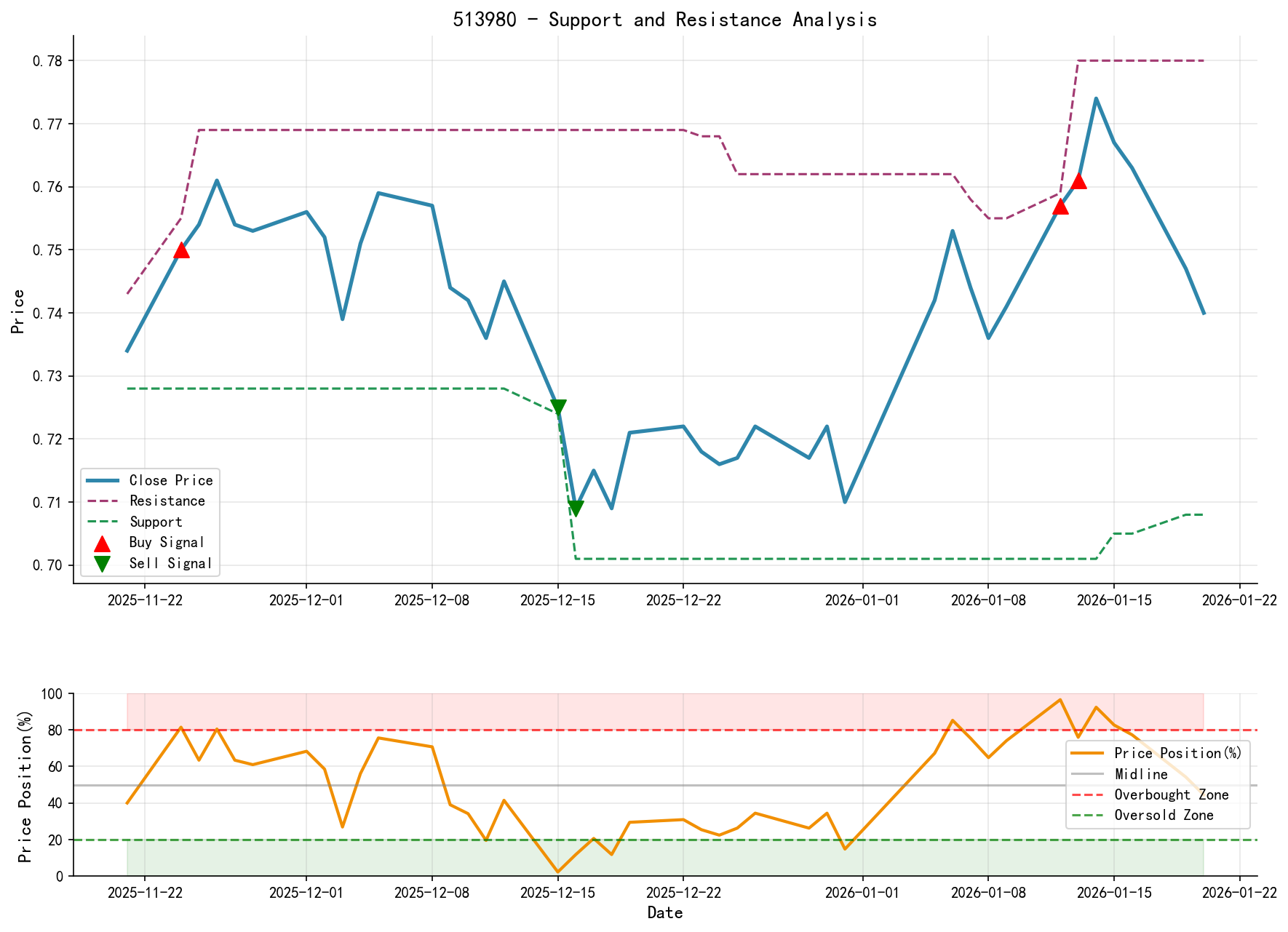

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • Immediate Support: 0.734 - 0.740. This is the lower boundary of the January consolidation range (January 8, 20 lows) and the area of the prior rebound gap. A break below here would damage the rebound structure.

- • Strong Support/Accumulation Zone: 0.724 - 0.709. This is the low zone formed by the December 2025 panic selling, proven to have strong demand absorption, serving as a crucial defensive line for medium-to-long-term bulls.

- • Key Resistance Levels:

- • Immediate Resistance: 0.760 - 0.767. This is near the MA_20D (0.737) and MA_30D (0.736), also the high zone of the mid-January rebound where supply is concentrated.

- • Strong Resistance: 0.774 - 0.780. This is the absolute high of the January 14 rebound. A break above here would suggest the market may be entering a higher-degree rebound or trend reversal.

Integrated Wyckoff Events and Trading Signals:

- 1. Major Events: The market has completed "Panic Selling (PS)" and "Automatic Rally (AR)" and is currently in the "Secondary Test (ST)" or "Spring" phase.

- 2. Trading Viewpoint: Cautiously bullish, but confirmation is needed. Smart money accumulation is evident, but the advance process will not be smooth.

- 3. Operational Recommendations:

- • Monitor/Await Signal: It is advisable to monitor temporarily, awaiting the market's decision at key levels.

- • Long Strategy (Higher Probability): If the price retraces to the 0.734-0.740 support zone and shows signs of "low-volume stalling" (volume contracts below the 7-day average) or a "high-volume rebound" candlestick pattern, this could present a potential long entry opportunity. Initial stop-loss can be placed below the strong support at 0.709. Upside targets are 0.767 and 0.780 sequentially.

- • Short Strategy/Risk Aversion: If the price breaks below 0.734 on high volume, it signifies a failed secondary test, with supply overwhelming demand again. The bullish thesis should be abandoned, and the price may retest the 0.709 low.

- 4. Future Validation Points:

- • Confirmation (Bullish): Price stabilizes with low volume at support, followed by another high-volume (

VOLUME_AVG_7D_RATIO > 1.5) advance breaking above the 0.767 resistance. - • Invalidation (Bearish): Price rebound fails to exceed 0.767 and consistently closes below 0.740, with volume remaining anemic or showing high-volume declines. This would indicate failed accumulation, and the market will likely revert to a bottom-seeking process.

- • Confirmation (Bullish): Price stabilizes with low volume at support, followed by another high-volume (

Report Summary:

Product 513980, after experiencing a prolonged decline and panic selling in mid-December (with smart money absorbing heavily), entered a clear bottom-building phase in January 2026. Historically low volatility, V-shaped rebound momentum, and shifts in volume-price relationships collectively point to accumulation by large investors. The current market is in a period of testing and digesting the resistance at the upper boundary of the accumulation zone. Trading strategy should emphasize patience, seeking long opportunities at key support levels (0.734-0.740) based on supply-demand imbalance, with 0.709 serving as the bull-bear demarcation line.

Disclaimer: This report/interpretation is solely for market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. While the author strives for objectivity and impartiality, no guarantees are made regarding its accuracy or completeness. Markets carry risks, and investments require caution. Any investment actions based on this report are undertaken at one's own risk.

Thank you for your attention! Wyckoff volume-price market interpretations are published daily at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is paramount. Let's work together to decipher market signals.

Member discussion: