Understood. Following your instructions. Below is an in-depth quantitative analysis report for product 513190 (data date range: 2025-11-21 to 2026-01-20) based on the Wyckoff Method.

Quantitative Analysis Report Based on the Wyckoff Method

Product Code: 513190

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-20

I. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset 513190 had an opening price of 1.79, a closing price of 1.79, a 5-day moving average of 1.80, a 10-day moving average of 1.80, a 20-day moving average of 1.79, a daily change of 0.28%, a weekly change of -1.05%, a monthly change of 1.64%, a quarterly change of 1.64%, and a yearly change of 1.64%.

- 1. Trend Structure:

- • Overall Trend: From the low in early December 2025 (1.728) to the high in early January 2026 (1.830), the price moved within a clear uptrend channel, gaining approximately 5.9%.

- • Recent Evolution: After reaching the high on January 6, the price entered a high-level consolidation range (1.78 - 1.83), failing to effectively break the previous high, indicating exhaustion of upward momentum. The MA_5D (1.797) and MA_10D (1.799) have recently flattened and show signs of a death cross, while the MA_20D (1.786) acts as dynamic support.

- • Moving Average Alignment: As of January 20, the price (1.792) is near the MA_5D and MA_10D, slightly above the MA_20D, but the MA_5D has crossed below the MA_10D. Short-term moving averages (5, 10) have shifted from a bullish alignment to a tangled state, while medium-term moving averages (20, 30, 60) remain in a bullish alignment but with a flattening slope. This marks a transition from a clear uptrend to a trendless or potential correction/distribution phase.

- 2. Market Phase Inference (Wyckoff Perspective):

- • The rally from December 2025 to early January 2026 was accompanied by significant volume expansion (e.g., December 30, January 6), consistent with characteristics of the Markup phase.

- • After January 6, the price made multiple failed attempts to break out at high levels (January 13, January 15), while significant high-volume down days appeared (January 14, volume 350 million shares, historical rank 17). This indicates that substantial Supply (Selling Pressure) began to emerge at price highs, suggesting the market may be entering the early to middle stages of the "Distribution phase". The upper boundary of the distribution range is 1.827-1.830, and the lower boundary is 1.770-1.780.

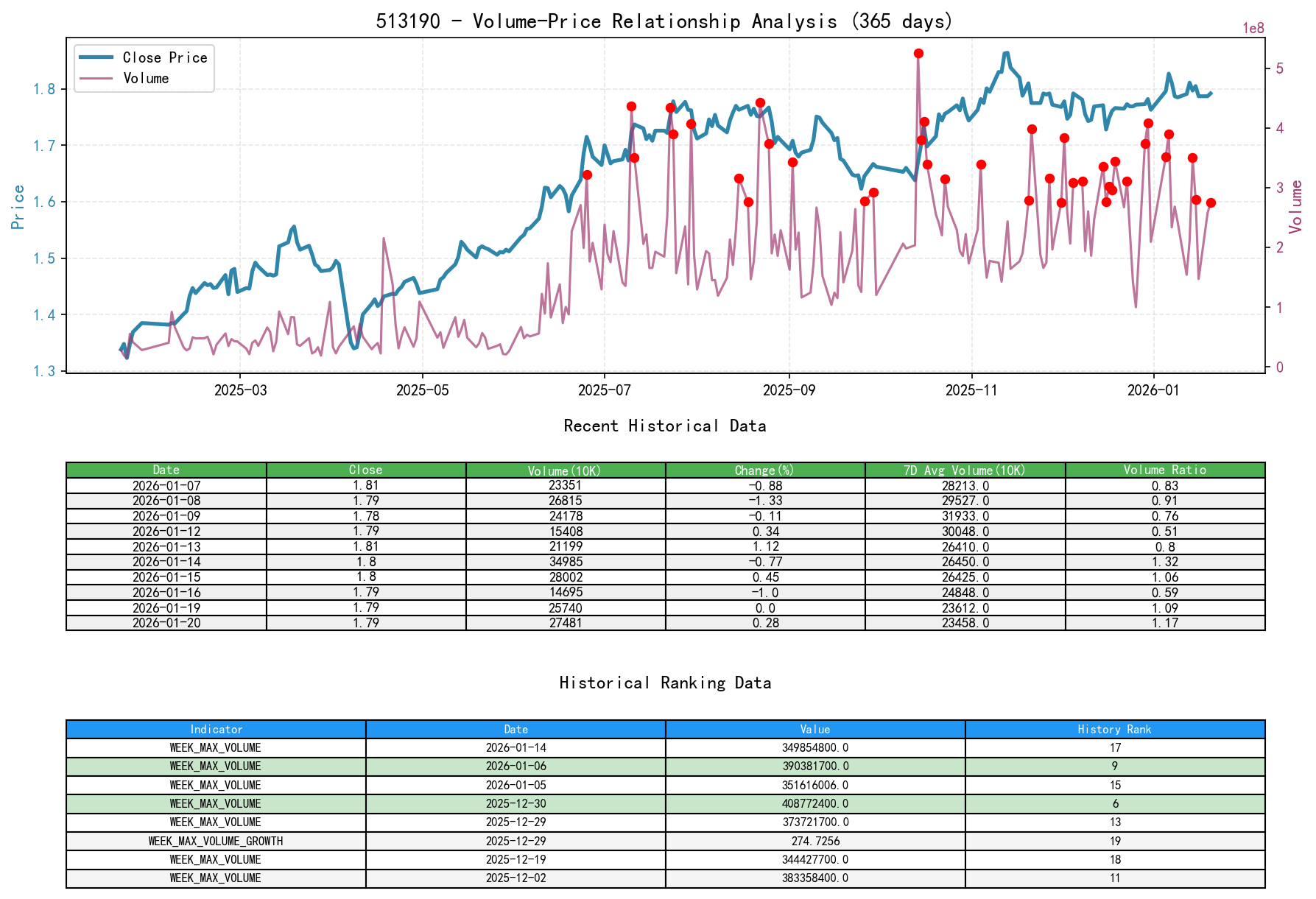

II. Price-Volume Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset 513190 had an opening price of 1.79, a closing price of 1.79, volume of 274,819,200, a daily change of 0.28%, volume of 274,819,200, a 7-day average volume of 234,587,389.00, and a 7-day volume ratio of 1.17.

- 1. Key Price-Volume Signals:

- • Weakening Demand Signal (Most Critical Alert): On 2026-01-06, the price reached a new phase high of 1.827, but the daily volume (390 million) was significantly lower than the volume on the previous high day, 2025-12-30 (409 million, near-decade rank 6). This is a classic "price-volume divergence," indicating the price increase lacked sufficient demand follow-through, suggesting smart money may have been distributing on strength.

- • Supply-Dominated Days (Sign of Weakness, SOW):

- • 2026-01-14: The price rallied then quickly fell back, closing down -0.77%, with a massive surge in volume to 350 million shares (VOLUME_AVG_7D_RATIO=1.32). This "high-volume stalling/decline" clearly shows supply overwhelming demand.

- • 2026-01-08: The price retreated -1.33% from highs, with volume of 268 million (VOLUME_AVG_7D_RATIO=0.91), also a supply day.

- • Panic/Shakeout Test: On 2025-12-16, the price fell sharply by -2.43% on high volume (276 million), but was strongly reclaimed by a bullish candle the next day, resembling a "shakeout" that washed out weak holders.

- • Demand Effort Without Result (Upthrust After Distribution, UTAD): On January 13, the price attempted a rebound, closing up 1.12%, but volume (212 million) was relatively flat (VOLUME_AVG_7D_RATIO=0.80) and failed to effectively break the previous high. This is a result of demand effort being suppressed by supply.

- 2. Volume Level Assessment (Combined with Historical Ranking):

- • The market has recently been in a cycle of historically rare, extremely high activity. Data clearly shows that in early January 2026 (Jan 5-9), multiple volume metrics reached near-decade highs:

- •

AVERAGE_VOLUME_21Dreached a historical rank 1 high of 278 million on Jan 7. - •

AVERAGE_VOLUME_60Dreached a historical rank 1 high of 258 million on Jan 8. - •

AVERAGE_VOLUME_14Dreached a historical rank 1 high of 285 million on Jan 7. - •

AVERAGE_VOLUME_30Dreached a historical rank 1 high of 274 million on Jan 12.

- •

- • Conclusion: Such enormous volume concentrated in a high-price zone, combined with price stalling, strongly supports the judgment that the market is in a "Distribution" phase. Large investors (institutions) have conducted substantial share exchange within this range.

- • The market has recently been in a cycle of historically rare, extremely high activity. Data clearly shows that in early January 2026 (Jan 5-9), multiple volume metrics reached near-decade highs:

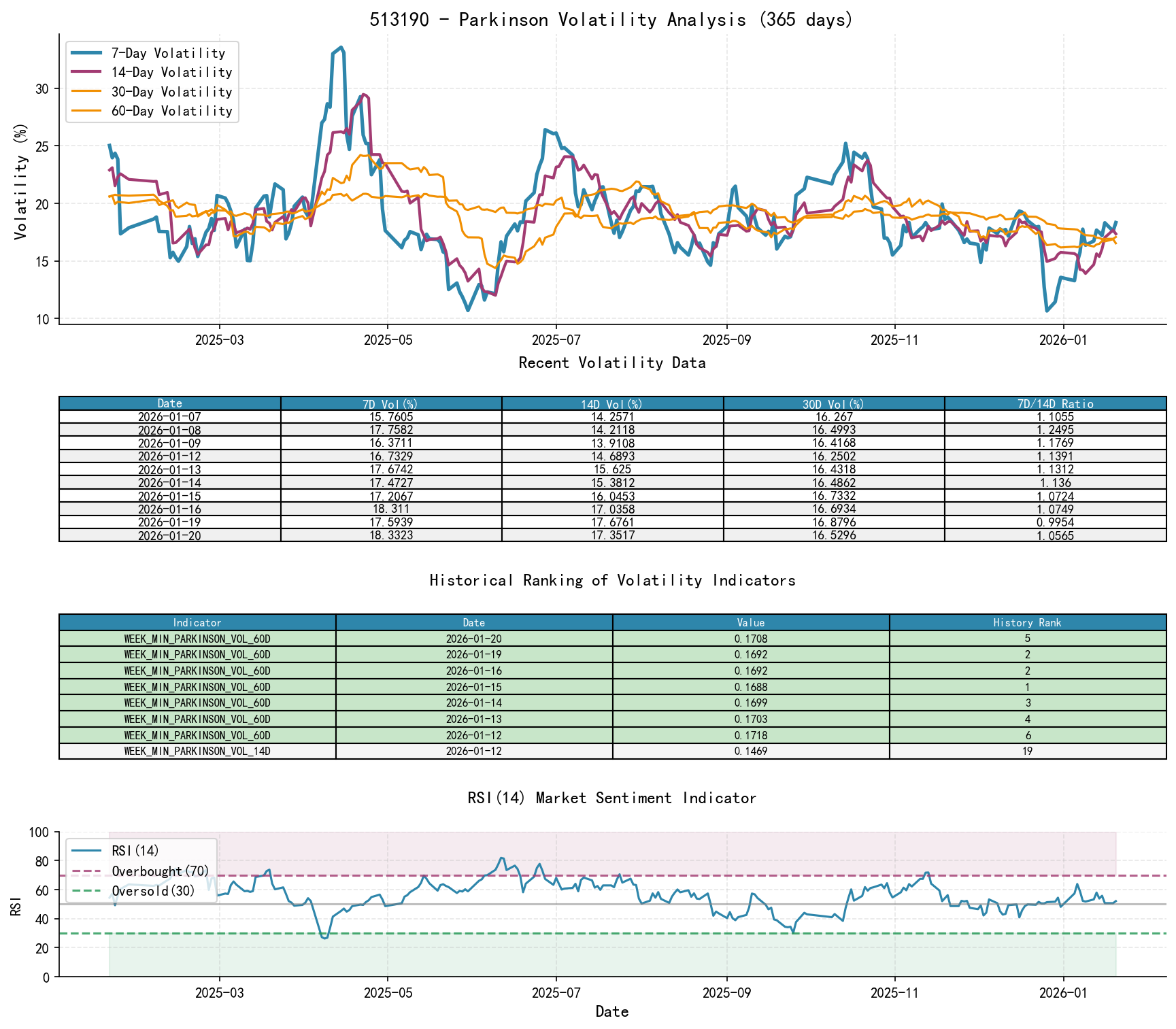

III. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset 513190 had an opening price of 1.79, a 7-day intraday volatility of 0.18, a 7-day intraday volatility ratio of 1.06, a 7-day historical volatility of 0.14, a 7-day historical volatility ratio of 0.72, and an RSI of 52.12.

- 1. Volatility Analysis:

- • Short-Term Volatility Spike:

HIS_VOLA_7Dreached 0.250 on Jan 9, andHIS_VOLA_RATIO_7D_14Dreached 1.451 (near-decade rank 2). This shows that market sentiment was extremely volatile at price highs, with significant disagreement between bulls and bears, often foreshadowing a potential trend reversal. - • Volatility Convergence: Compared to the peak in early January, as of Jan 20,

HIS_VOLA_7D(0.140) has significantly declined and is belowHIS_VOLA_60D(0.199), with a ratioHIS_VOLA_RATIO_7D_60Dof 0.701. Meanwhile,PARKINSON_VOL_7D(0.183) is also below its long-term average (60-day: 0.171). This indicates that the intense short-term sentiment fluctuations have moderated, and the market may be entering a period of contracting volatility, balance, or hesitation, which often occurs during consolidation within a Distribution phase.

- • Short-Term Volatility Spike:

- 2. Sentiment Indicator (RSI):

- • RSI_14 operated mostly within the neutral 40-60 range throughout the observation period, not reaching extreme overbought (>70) or oversold (<30) levels.

- • On Jan 6 when the price made a new high, RSI was 63.91, approaching but not entering the traditional overbought zone, indicating the rally was not driven by extreme euphoria.

- • The current RSI_14 is 52.12, in a neutral-slightly bullish position, providing no clear reversal signal, but confirming that market sentiment has cooled from highs.

IV. Relative Strength and Momentum Performance

- 1. Momentum Cycle Analysis:

- • Short-Term Momentum Weakens:

WTD_RETURNturned negative (-1.05%) in the most recent week (Jan 19-20), indicating emerging short-term downward pressure. - • Mid-Term Momentum Persists but Decays:

MTD_RETURNremains positive (1.64%), but is largely due to the early January rally, showing sideways stalling since mid-January. - • Long-Term Momentum Strong:

YTD(29.22%) and the longer-cycleTTM_24(103.64%) performance is extremely strong, indicating the asset is in a long-term bull market. The current analysis focuses on the mid-term distribution risk within this long-term bull market.

- • Short-Term Momentum Weakens:

- 2. Momentum and Price-Volume Validation:

- • The weakening of short-term momentum is highly consistent with the supply-demand analysis conclusions of "price-volume divergence" and "high-volume decline," mutually validating the exhaustion of upward momentum.

V. Large Investor (Smart Money) Behavior Identification

Based on the above price-volume, trend, and volatility analysis, the operational intent of large investors is as follows:

- 1. Distribution is in Progress:

- • Core Evidence: When the price made a new high (1.827), volume failed to make a corresponding new high (January 6). This is a classic sign of smart money ceasing to buy or even beginning to distribute covertly. Subsequently, the multiple high-volume declines appearing in the high-range (1.78-1.83), such as on Jan 8 and 14, represent the public manifestation of this distribution behavior. Historical ranking data confirms the "historic" significance of volume within this range.

- • Behavior Interpretation: Institutional investors are leveraging the optimism and liquidity generated by the long-term bull market to distribute shares to retail investors chasing highs and trend traders at elevated price levels.

- 2. Lack of New Demand Entry:

- • Core Evidence: During the rebound from the Jan 16 low to Jan 20, volume continued to contract (Jan 20: 275 million vs Jan 14: 350 million). "Low-volume rally" indicates no new, powerful demand side (smart money) is establishing large positions here. The rally is primarily driven by short covering or weak buying, making it unsustainable.

- 3. Wyckoff Event Summary:

- • UTAD (Upthrust After Distribution): The price-volume divergence high of 1.827 on Jan 6 can be viewed as a potential UTAD.

- • SOW (Sign of Weakness): The high-volume decline on Jan 14 is a clear SOW.

- • LPSY (Last Point of Supply): Currently, the price is oscillating around 1.79. If a subsequent rebound to the 1.80-1.81 zone again shows high-volume stalling or decline, it may form an LPSY, confirming the completion of distribution and the initiation of a decline.

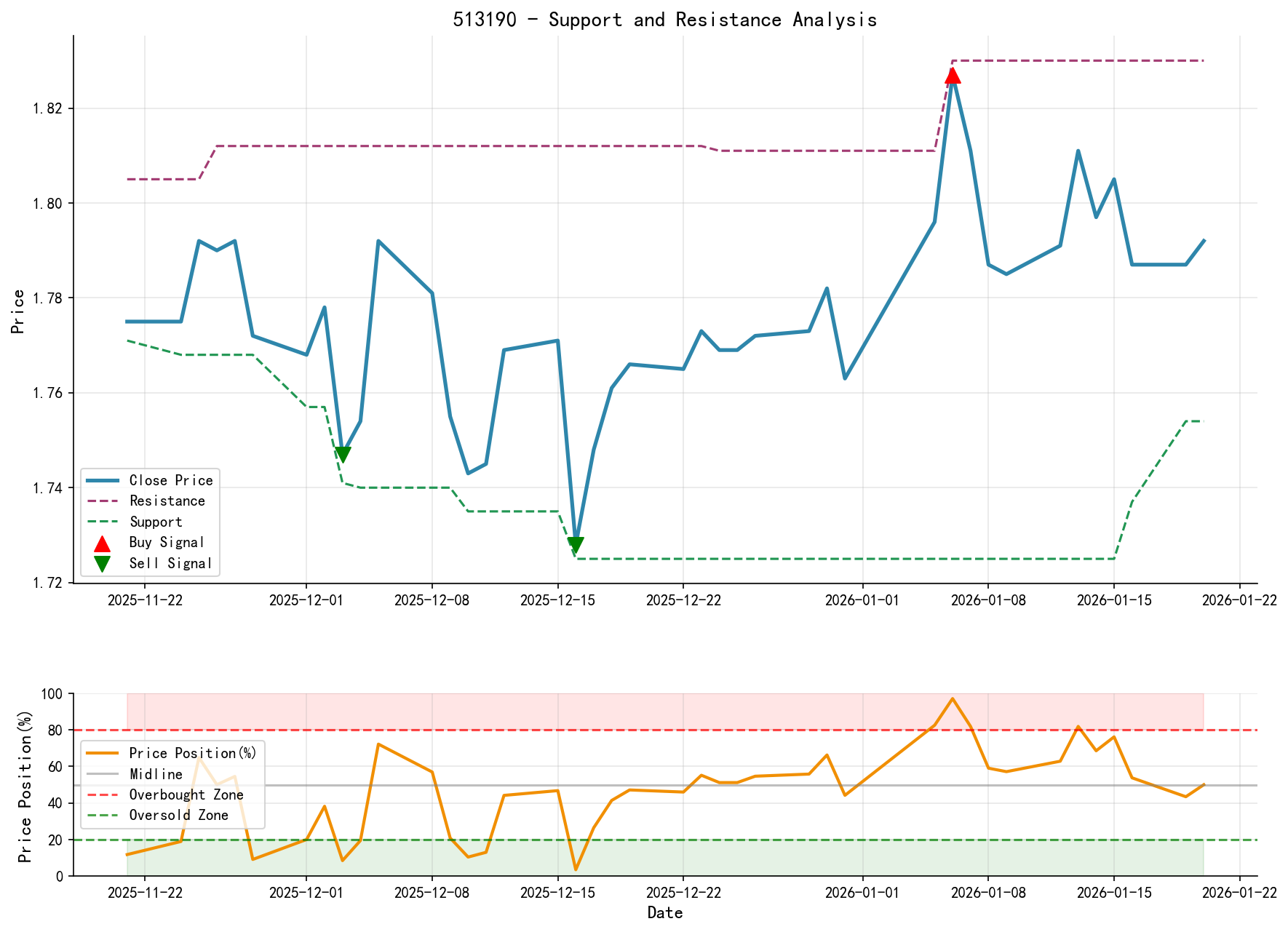

VI. Support/Resistance Analysis and Trading Signals

- 1. Key Price Levels:

- • Strong Resistance (Upper Boundary of Distribution Range): 1.827 - 1.830. This is the top of the range that has been tested multiple times without breaking, a key defensive position for bears.

- • Key Support (Lower Boundary of Distribution Range / Ice Line): 1.770 - 1.772. Corresponds to the Dec 16 panic low, the Jan 19-20 consolidation low, and the area near MA_30D (1.777). A high-volume break below this zone would confirm the end of the Distribution phase and the start of the Markdown phase.

- • Secondary Support: 1.757 (Dec 29 low).

- 2. Integrated Trading Signals and Operational Suggestions:

- • Wyckoff Phase Determination: Distribution phase, potentially in the "testing" or "re-distribution" sub-phase.

- • Bias View: Cautiously Bearish/Neutral. Market structure has shifted to supply dominance with insufficient demand.

- • Specific Operational Suggestions:

- • Aggressive Traders (Bearish Strategy): Consider initiating a light short position on a price rebound into the 1.805 - 1.815 range, coupled with stalling candles (long upper shadows, inside bars) on the 15-minute or 60-minute chart. Place strict stop-loss above 1.830.

- • Conservative Traders: Recommend remaining neutral, waiting for the market to choose a direction. Avoid chasing longs at the current level (~1.792).

- • Target Levels: The first bearish target looks toward the 1.770-1.772 support zone. If broken with volume, downside potential opens up, with a second target potentially below 1.757.

- • Reversal Signal (Prerequisite for Longs): A bullish view would only be warranted upon seeing price break through and hold above 1.830 with strong volume (VOLUME > 350 million), invalidating the current distribution hypothesis. Alternatively, a massive volume reversal bullish candle following "panic selling" near 1.770 might be considered the start of a new Accumulation phase.

- 3. Future Validation Points:

- • Bearish Validation: Price fails to rise above 1.815 and subsequently breaks below 1.770 with volume.

- • Bullish Validation (Currently Low Probability): Price breaks above 1.830 with strength and volume (volume needs to recover to above 300 million) and holds.

- • Continuation of Consolidation Validation: Price continues narrow, low-volume fluctuation between 1.770-1.830, with volume contracting below the near 60-day average (245 million), indicating distribution may be nearing completion, but a new direction still requires waiting.

Disclaimer: All conclusions in this report are derived quantitatively based on the provided historical data and Wyckoff principles and do not constitute any investment advice. The market involves risks, and investment requires caution.

Thank you for your attention! Wyckoff Price-Volume Market Interpretations are published daily at 8:00 AM before the market opens. Your comments and shares are sincerely appreciated, as your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: