Okay. As a quantitative trading researcher proficient in the Wyckoff Method, I will write a comprehensive and in-depth quantitative analysis report for you based on the data and historical ranking metrics you provided.

Quantitative Analysis Report: 513120 (Based on the Wyckoff Method)

Product Code: 513120

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-20

Summary

Based on the analysis of price, volume, and derivative data from November 21, 2025, to January 20, 2026, 513120 experienced a complete cycle of "decline-bottoming-reversal." Wyckoff analysis clearly reveals the behavioral evolution of large investors from the final stage of 【Panic Selling】 to 【Accumulation】 and into the current phase of 【Demand-Dominated Uptrend】 . The data indicates the market is currently in the early stages of a new upward trend, with core support and resistance levels clearly defined. The trading strategy should lean towards being aggressive.

1. Trend Analysis & Market Phase Identification

As of 2026-01-20, the underlying asset 513120 opened at 1.32, closed at 1.31, with a 5-day moving average (MA) at 1.37, 10-day MA at 1.35, 20-day MA at 1.29. Daily change: -0.91%, weekly change: -4.58%, monthly change: +9.97%, quarterly change: +9.97%, yearly change: +9.97%.

- • Trend Judgment: During the analysis period, the price action shows a clear "V-shaped" reversal. Before December 31 (closing price 1.194), the price was consistently suppressed below all moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), displaying a bearish alignment and confirming a definitive downtrend. Starting from January 5, 2026, the price broke through all short-term moving averages (MA_5D, MA_10D) with a 【High-Volume Long Green Candle】 and subsequently led the MA_5D to cross above the MA_10D and then the MA_20D, forming an early signal of 【Bullish Alignment】 (current: MA_5D > MA_10D > MA_20D). However, the MA_30D and MA_60D remain above, indicating the medium-to-long-term trend is still in the process of recovery.

- • Key Moving Average Crossover: On January 9, 2026, the MA_5D (1.279) crossed above the MA_20D (1.262), issuing a clear short-term bullish signal. This crossover occurred after a significant price rebound and was confirmed by high volume (that day's

VOLUME_AVG_7D_RATIO=1.34), enhancing the signal's validity. - • Market Phase Inference (Based on Wyckoff Theory):

- • Late November to Late December 2025: Distribution and Panic Selling. The price declined from around 1.33 to 1.194. Although there were rebounds during this period (e.g., Nov 26), volume failed to expand consistently (

VOLUME_AVG_*_RATIOgenerally below 1), representing "rallies on lack of demand," consistent with the Wyckoff characteristics of transitioning from "distribution" into a "markdown" phase. The consecutive declines on Dec 29-31 accompanied by volume shrinking to historically extreme lows (see historical rankings) are classic signals of 【Final Exhaustion of Supply】 or the late stage of 【Panic Selling】. - • From January 5, 2026, to Present: Accumulation Completion and Uptrend Initiation. On January 5, the price surged +5.95% from a low level on exceptionally high volume (

VOLUME_GROWTH=+236.78%, Top 5 Rank over the past decade;VOLUME_AVG_7D_RATIO=3.06, Top 1 Rank over the past decade). This formed a "Spring" or "High-Volume Absorption After Panic Selling" phenomenon, signaling that large investors began active accumulation. Subsequently, the price underwent strong consolidation at a relatively high level (1.32-1.41), with volume remaining active (VOLUME_AVG_14D_RATIOoften >1.5). This represents the early stage of an 【Uptrend】 where demand consistently overwhelms supply.

- • Late November to Late December 2025: Distribution and Panic Selling. The price declined from around 1.33 to 1.194. Although there were rebounds during this period (e.g., Nov 26), volume failed to expand consistently (

2. Price-Volume Relationship & Supply-Demand Dynamics

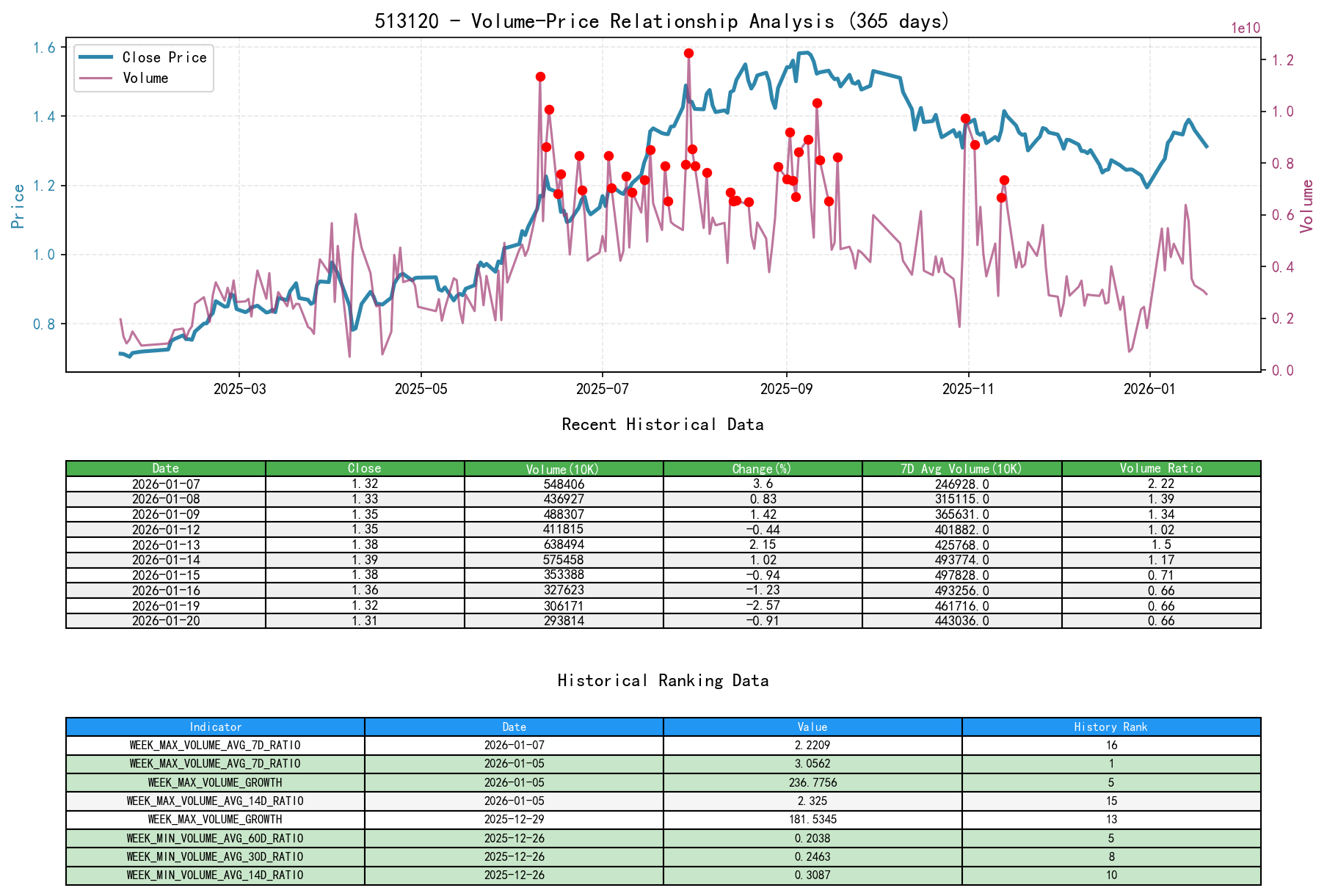

As of 2026-01-20, the underlying asset 513120 opened at 1.32, closed at 1.31, volume 2938148700, daily change -0.91%, volume 2938148700, 7-day average volume 4430369845.14, 7-day volume ratio 0.66.

- • Key Day Identification & Supply-Demand Force Shift:

- 1. Supply-Dominated Decline (2025-12-15/16): Significant price drops (-3.23%, -1.83%) with expanded volume (

VOLUME_AVG_7D_RATIO0.93, 1.05 respectively), indicating heavy selling pressure, supply-dominated. - 2. Exhausted-Demand Gradual Decline (2025-12-29 to 31): Consecutive price declines, but with extremely low volume (

VOLUME_AVG_7D_RATIOdropped from 1.09 to 0.86, historically low-ranked). This indicates active selling (supply) was nearly exhausted—a critical bottom signal. - 3. Demand Outbreak Starting Point (2026-01-05): The Decisive High-Volume Up Day.

PCT_CHANGE=+5.95% (Weekly maximum, Top 8 Rank over the past decade),VOLUME_GROWTH=+236.78% (Top 5 Rank over the past decade),VOLUME_AVG_7D_RATIO=3.06 (Top 1 Rank over the past decade). This is a textbook signal of demand entering with overwhelming force, marking a fundamental reversal in the supply-demand balance. - 4. Demand-Sustained Strong Consolidation (2026-01-08 to 14): Price oscillated within the 1.33-1.41 range, but daily volume consistently stayed above the 14-day and 21-day averages (

VOLUME_AVG_14D_RATIOoften >1.5,VOLUME_AVG_21D_RATIOoften >1.7). During this period, price declines (e.g., Jan 12, -0.44%) saw relatively lower volume, while price advances (e.g., Jan 13, +2.15%) saw higher volume. This is a healthy price-volume structure for 【Uptrend Continuation】 , indicating demand continues to actively absorb supply.

- 1. Supply-Dominated Decline (2025-12-15/16): Significant price drops (-3.23%, -1.83%) with expanded volume (

- • Volume Anomaly Conclusion: Data clearly shows the market experienced 【Liquidity Exhaustion】 in late December (multiple

VOLUME_AVG_*_RATIOmetrics hit near-decade lows), followed by a 【Demand Surge】 in early January (multipleVOLUME_AVG_*_RATIOmetrics hit near-decade highs). This transition from extreme low volume to sharp high volume is the most powerful data evidence for a trend reversal.

3. Volatility & Market Sentiment

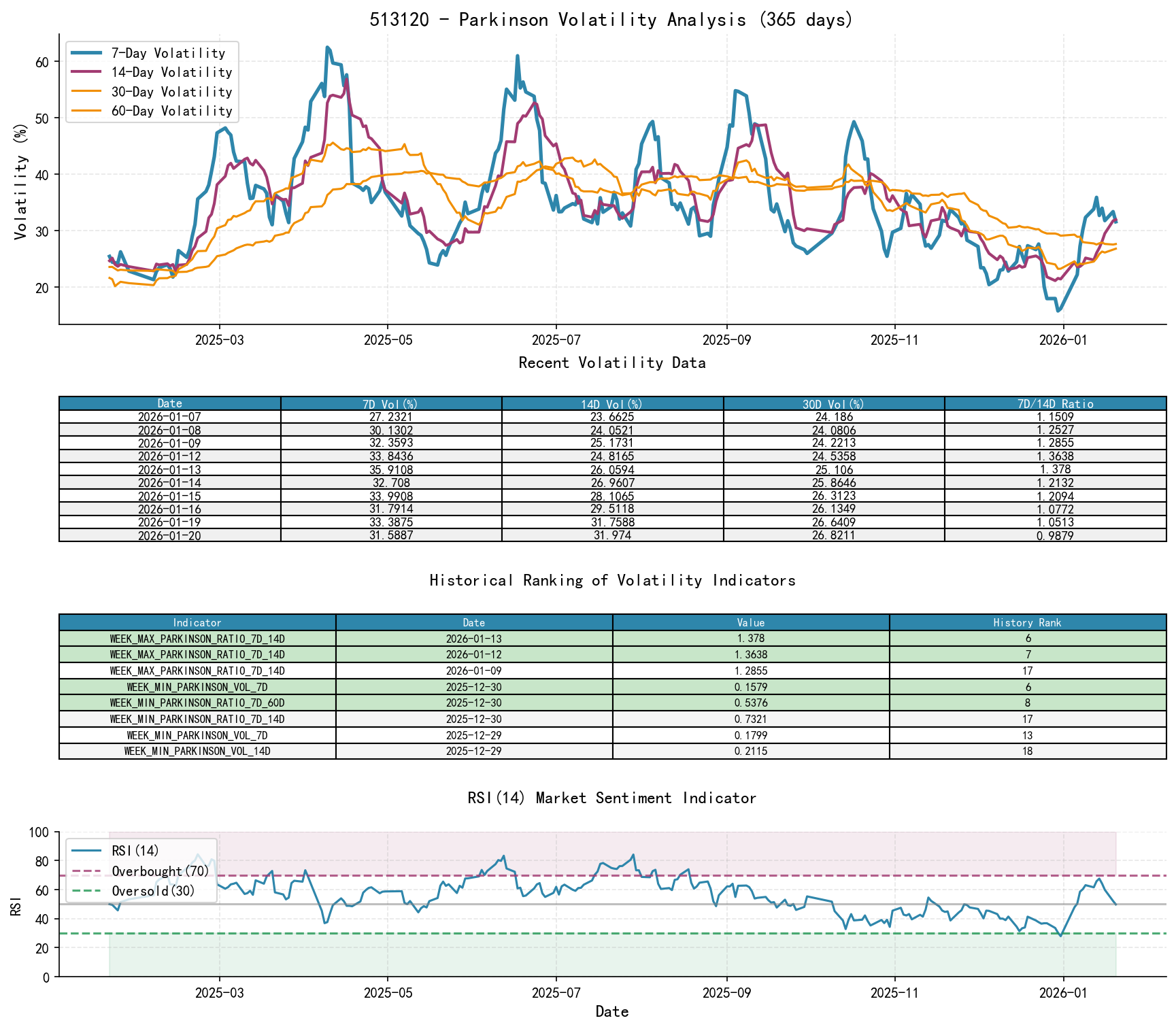

As of 2026-01-20, the underlying asset 513120 opened at 1.32, 7-day intraday Parkinson Volatility 0.32, 7-day Parkinson Vol Ratio 0.99, 7-day Historical Volatility 0.30, 7-day Historical Vol Ratio 0.69, RSI 49.81.

- • Volatility Level & Changes: The Parkinson intraday volatility (

PARKINSON_VOL_7D) fell below 0.18 on Dec 26, 29, and 30 (Ranked 6th, 13th, 6th lowest historically), indicating market volatility was extremely compressed, and sentiment reached a freezing point. Entering January, short-term volatility spiked rapidly.HIS_VOLA_RATIO_7D_14Dreached 1.35 and 1.34 on Jan 7 and 8 respectively (Ranked 9th, 11th highest historically), andPARKINSON_RATIO_7D_14Dreached 1.36 and 1.38 on Jan 12 and 13 respectively (Ranked 7th, 6th highest historically). This shows short-term volatility far exceeded medium-term levels, rapidly igniting market sentiment, typically corresponding to the initiation or acceleration phase of a trend. - • Market Sentiment Indicators: The RSI_14 dropped to 30.37 and 27.93 on Dec 30 and 31 respectively (Weekly minimum, Ranked 20th lowest historically), confirming the market entered a severely oversold region. Subsequently, the RSI quickly exited the oversold zone and rebounded above 65 in mid-January, showing sentiment shifted from extreme pessimism to optimistic, even overheated. The current RSI (49.81 as of Jan 20) has pulled back to a neutral zone, leaving room for potential further advances.

- • Comprehensive Sentiment Judgment: The simultaneous occurrence of extreme lows in volatility and RSI validates the 【Dual Crush of Sentiment and Volatility】 in late December, a classic market bottom characteristic. The subsequent sharp expansion in volatility and rapid rebound in RSI confirm 【Sentiment Reversal and Trend Initiation】.

4. Relative Strength & Momentum Performance

- • Momentum Trend: As of the end of the analysis period (2026-01-20), the product exhibits strong short-term momentum:

WTD_RETURNis -4.58% (normal pullback), butMTD_RETURNis +9.97%,YTDis +9.97%. Compared to the deep decline at the beginning of the analysis period (2025-11-21) whereQTD_RETURNwas -15.02%, momentum has fundamentally reversed. - • Momentum Confirmation: The strong positive return in January (

MTD_RETURN) fully aligns with the 【Demand-Outbreak Price-Volume Structure】 and the 【Initial Formation of Bullish MA Alignment】 . These three factors reinforce each other, confirming the authenticity and effectiveness of the upward momentum.

5. Large Investor ("Smart Money") Behavior Identification

Based on the comprehensive analysis of the above dimensions, the operational path of large investors can be clearly outlined:

- 1. Stealthy Accumulation/Absorbing Panic Selling (Late December 2025): When the market experienced 【Final Exhaustion of Supply】 (low-volume gradual decline) due to panic, smart money likely began left-side, moderate accumulation. The volume-backed rebound on Dec 19 (volume 18.5% above the 21-day average) was an initial test.

- 2. Overt, Large-Scale Entry (January 5, 2026): The long green candle on 【Exceptionally High Volume Rare in a Decade】 is a signature move where smart money publicly declares its stance. They absorbed all remaining panic selling at this level and proactively established long positions, completing the final step of the 【Accumulation Phase】.

- 3. Pushing Up and Shaking Out (From January 6, 2026, Onward): After quickly pulling the price away from the accumulation zone, it entered high-level consolidation. During this period, smart demand remained active (high volume), while using intraday price fluctuations (high volatility) to shake out weak hands, solidifying the foundation for the next leg up. The current behavior belongs to 【Demand Control Within an Uptrend】.

Core Inference: Exceptionally high volume (e.g., Jan 5) is the result of 【Large Demand-Side】 【Actively and Concentratedly Absorbing Supply】 at a critical level. Low volume (e.g., late Dec) is the manifestation of 【Retail Traders】 holding back due to panic or 【Exhaustion of Supply-Side Power】 . The dominant force in the current market has completely shifted from the supply side (sellers) to the demand side (large buyers).

6. Support/Resistance Level Analysis & Trading Signals

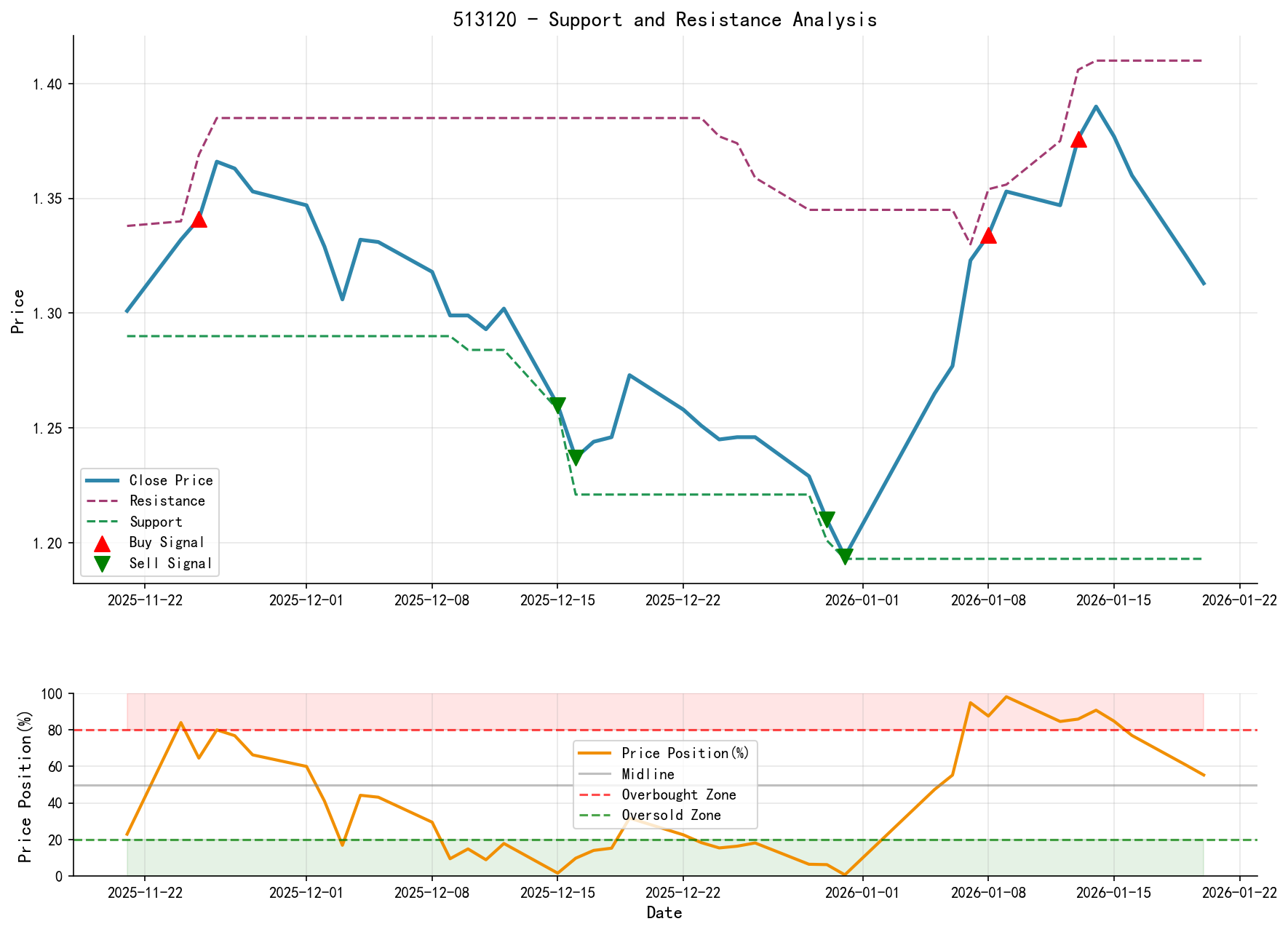

- • Key Support Levels:

- • S1 (Strong Support): 1.20 - 1.22 Zone. This is the low point formed by panic selling on Dec 29-31, 2025, and the starting point of the demand surge. Any pullback to this zone should encounter strong demand.

- • S2 (Dynamic Support): 1.31 - 1.33 Zone. This is the volume concentration zone formed between Jan 8-12, and where the short-term MA (MA_10D) currently resides.

- • Key Resistance Levels:

- • R1 (Near-Term Resistance): 1.35 - 1.41 Zone. This is the high point area reached during the Jan 13-15 rebound, where price advance stalled. A valid breakout above this zone will open up further upside.

- • R2 (Long-Term Resistance): 1.44 - 1.45 Zone. This is the current location of the 60-day MA (MA_60D), a key reference for the long-term trend.

- • Comprehensive Wyckoff Trading Signals:

- • Primary Signal: Bullish. The market has displayed the classic Wyckoff bullish reversal structure: "Panic Selling (LPS) -> Spring or High-Volume Rebound (Spring/BO) -> Successful Subsequent Test -> Uptrend (Jump)."

- • Market Phase: In the early stage of a new 【Demand-Dominated Uptrend】.

- • Operational Suggestions & Future Validation Points:

- • Aggressive Strategy (For Existing Positions): Hold positions, raise stop-loss to below the S1 zone (e.g., 1.195). Initial target is the upper bound of the R1 zone (1.41), with a subsequent target at the R2 zone upon breakout.

- • Prudent Strategy (For Observers): Wait for a price pullback to the S2 support zone (1.31-1.33) and observe for entry signals such as 【Low-Volume Stabilization】 or 【Resumption of High-Volume Advance】 . Consider establishing long positions in tranches within this zone, with an initial stop-loss below S1.

- • Key Validation Points:

- 1. Demand Sustainability Validation: During future price pullbacks, volume should exhibit orderly contraction (

VOLUME_AVG_7D_RATIO<1), indicating supply has not returned en masse. - 2. Breakout Effectiveness Validation: If price attacks the R1 resistance zone, a breakout needs high volume (

VOLUME_AVG_7D_RATIO>1.2) to confirm validity. - 3. Failure Signal: If price breaks below the S1 support (1.20) on high volume, it signifies the previous reversal structure has failed, requiring a reassessment of market logic.

- 1. Demand Sustainability Validation: During future price pullbacks, volume should exhibit orderly contraction (

Conclusion Reiterated: The quantitative analysis of 513120 shows that a trend reversal driven by large investors, based on extreme sentiment and price-volume anomalies, has already occurred. The current market is demand-dominated and in the early stages of an uptrend. It is recommended to adopt a relatively aggressive trading strategy, seeking risk-controlled entry opportunities near key support levels, while closely monitoring the aforementioned price-volume validation points.

Disclaimer: This report/analysis content is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness in the content but makes no guarantees regarding its accuracy or completeness. The market involves risks; investment requires caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Wyckoff Price-Volume Market Insights are released daily at 8:00 before market open. Please feel free to leave comments and share. Your recognition is crucial. Let us work together to see the market signals clearly.

Member discussion: