Good. In accordance with your instructions, below is an in-depth quantitative analysis report based on the Wyckoff Market Principles, prepared using the data you provided.

Wyckoff Quantitative Analysis Report - 513060

Product Code: 513060

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-20

1. Trend Analysis & Market Phase Identification

As of January 20, 2026, the target 513060 had an opening price of 0.65, a closing price of 0.64, a 5-day moving average of 0.67, a 10-day moving average of 0.65, a 20-day moving average of 0.63, a daily change of -0.77%, a weekly change of -3.16%, a monthly change of +10.46%, a quarterly change of +10.46%, and an annual change of +10.46%.

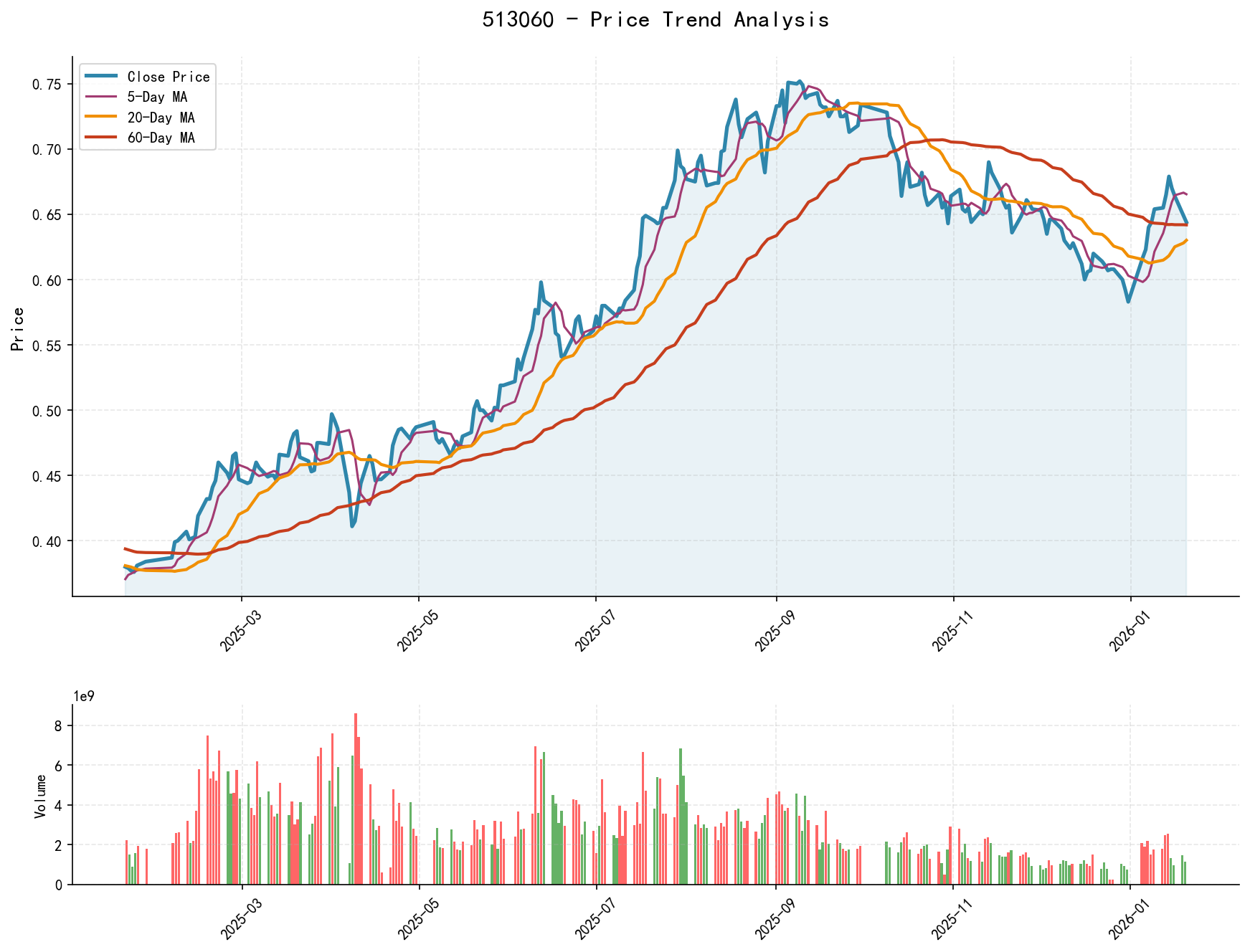

- 1. Trend Structure:

- • Long-term Trend (MA_60D): Throughout the observation period, the MA_60D declined continuously from 0.697 (11/21) to 0.642 (01/20), clearly indicating a long-term downtrend.

- • Mid-term Trend (MA_20D/30D): The MA_20D and MA_30D also showed a downward trajectory, consistently positioned below the MA_60D. The mid-term trend aligns with the long-term trend, forming a bearish pattern.

- • Short-term Trend (MA_5D/10D): After hitting a cyclical low on December 31, 2025 (close 0.583), the price initiated a strong rebound on January 5, 2026 (gain of 5.83%). This drove the MA_5D to cross above the MA_10D on January 8, forming a "Golden Cross." By the end of the reporting period (01/20), the order was MA_5D (0.665) > MA_10D (0.654) > MA_20D (0.630), showing a short-term bullish alignment.

- • Conclusion: The market is at a critical inflection point. The long-term and mid-term trends remain downward, but the short-term trend has clearly turned upward. The strong rally starting January 5th is attempting to challenge the mid-term downtrend line.

- 2. Inferred Market Phase:

- • 2025-11-21 to 2025-12-31: The market was in the phase of "Panic Selling" or the "Late Stage of Distribution." Prices declined persistently against a backdrop of contracting volume. Although there were minor rebounds (e.g., 11/24-11/26), the volume failed to expand effectively (VOLUME_AVG_7D_RATIO generally below 1), unable to halt the downtrend. By late December, volume dropped to extremely low levels (MIN_VOLUME/14D_RATIO ranked 7th and 10th over the past decade), and prices made new lows. This aligns with the Wyckoff characteristics preceding a "Selling Climax," including "Automatic Rally" and before the "Secondary Test."

- • 2026-01-05 to Present: The market has entered the phase of "Automatic Rally" and "Potential Accumulation Testing." The massive up-day on January 5th (volume surge of 181%, VOLUME_AVG_7D_RATIO reaching 2.84, ranking 4th over the past decade) was a clear signal of demand entering the market. The subsequent advance was accompanied by sustained high volume (e.g., 01/13, 01/14), indicating active buying interest. The recent pullback (01/19, 01/20) can be viewed as a "Test" of the prior breakout, aiming to assess the quality of new demand and the strength of remaining supply.

2. Volume-Price Relationship & Supply-Demand Dynamics

As of January 20, 2026, the target 513060 had an opening price of 0.65, a closing price of 0.64, a trading volume of 1,159,705,700, a daily change of -0.77%, a volume of 1,159,705,700, a 7-day average volume of 1,763,162,814.00, and a 7-day volume ratio of 0.66.

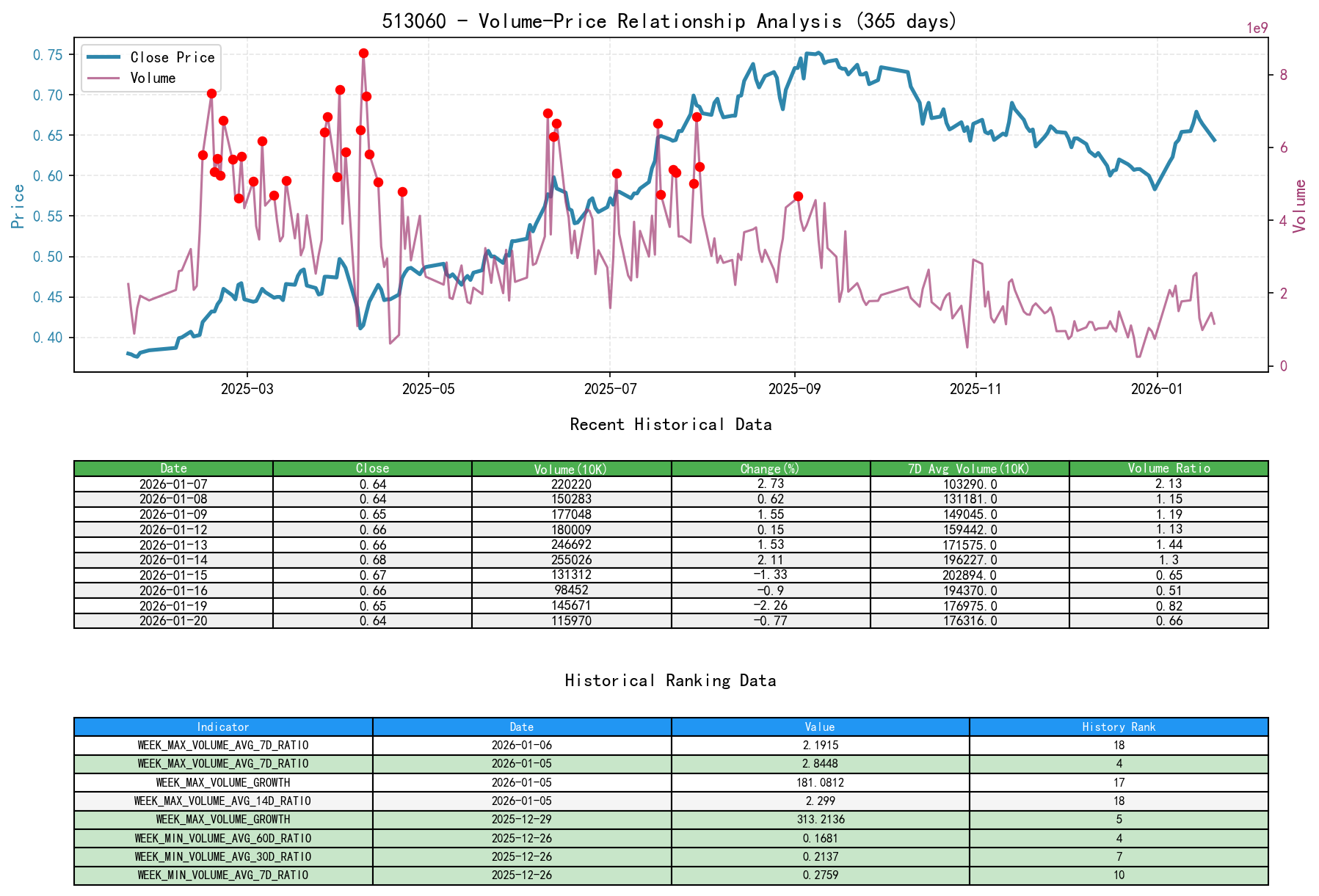

- 1. Supply-Demand Characteristics at the End of the Decline:

- • Supply Exhaustion: In late December 2025, during the process of price making new lows, trading volume contracted to extreme lows. For example, on December 25th and 26th, the VOLUME_AVG_7D_RATIO was 0.237 and 0.276 respectively (ranking 9th and 10th over the past decade), and the AMOUNT reached the 3rd and 4th lowest levels in the past decade. This aligns with the Wyckoff concept of "Exhaustion" – selling pressure (supply) had been depleted, allowing new lows to be made without increasing volume, a leading signal that the decline may be nearing its end.

- 2. Supply-Demand Characteristics at the Start of the Rebound:

- • Strong Demand Entry: On January 5, 2026, the price closed up 5.83%, with volume exploding by 181% compared to the previous day (WEEK_MAX_VOLUME_GROWTH ranking 17th over the past decade). The relative volume ratio to the 7-day average reached 2.84 (ranking 4th over the past decade). This is a textbook case of "volume-price expansion on an up day" (Demand In Control), indicating that large buyers began actively and collectively absorbing supply.

- • Demand Continuity and Supply Testing: The sessions on January 13th (up 1.53%, volume ratio to 14-day average 2.01) and January 14th (up 2.11%, volume ratio to 14-day average 1.89) showed that demand continued to actively push prices higher, and supply was unable to effectively halt it. The declines on January 15th (-1.33%) and January 19th (-2.26%) exhibited the characteristic of "light-volume decline", with volume ratios to the 7-day average of 0.65 and 0.82 respectively. This indicates that the selling pressure was not panic-driven or large-scale renewed supply, but more likely profit-taking or technical correction, representing a healthy "pullback on light volume."

- 3. Supply-Demand Balance Assessment:

- • Current State: From extreme supply exhaustion (late December) to a powerful demand surge (early January), followed by a light-volume pullback, a fundamental reversal in the market's supply-demand relationship has occurred. The current pullback is a test of the high-volume demand zone established earlier. As long as the pullback process maintains relatively light volume (supply does not expand), the rebound structure remains healthy.

3. Volatility & Market Sentiment

As of January 20, 2026, the target 513060 had an opening price of 0.65, a 7-day intraday volatility of 0.28, a 7-day intraday volatility ratio of 0.97, a 7-day historical volatility of 0.30, a 7-day historical volatility ratio of 0.74, and an RSI of 51.92.

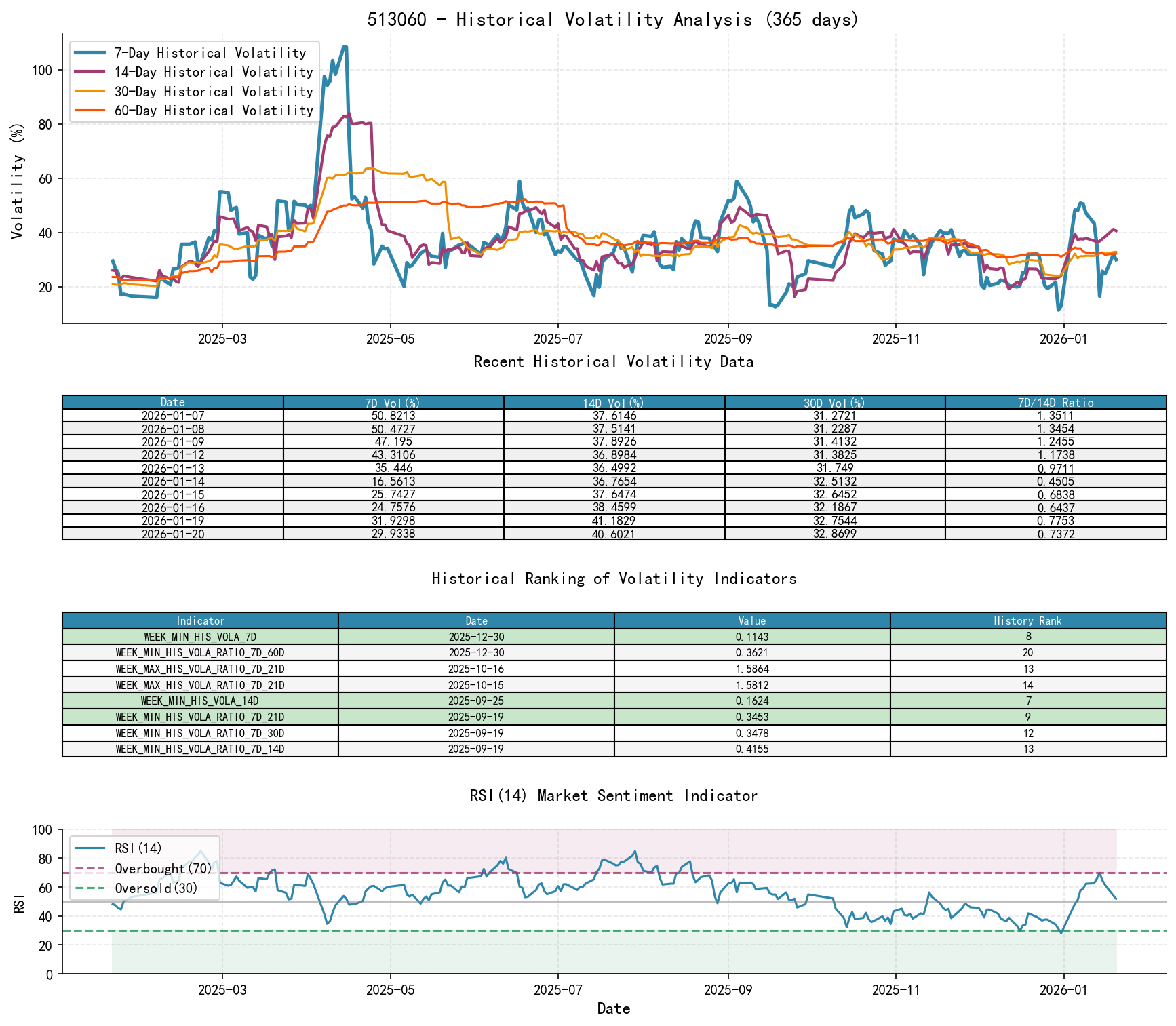

- 1. Analysis of Volatility Extremes:

- • Sentiment Freeze: In late December 2025, the short-term Parkinson Volatility (PARKINSON_VOL_7D) dropped to historically low levels (0.143-0.166, ranking 5th, 8th, 12th over the past decade). Historical Volatility (HIS_VOLA_7D) was also extremely low (0.114, ranking 8th over the past decade). Extreme compression in volatility often signals depressed market sentiment and brewing change.

- • Sentiment Activation and Surge: The rebound in early January 2026 was accompanied by a rapid expansion in short-term volatility. On January 12th, PARKINSON_RATIO_7D_14D reached 1.371 (ranking 9th over the past decade), indicating that short-term volatility significantly exceeded its mid-term average, quickly igniting market sentiment. This impulsive surge in volatility is typical of the initial stages of a trend change.

- • Current Sentiment: As of January 20th, the ratio of short-term volatility (PARKINSON_VOL_7D: 0.279) to mid-term volatility (PARKINSON_VOL_14D: 0.288) has retreated to 0.97, indicating sentiment has cooled from extreme excitement and entered a relatively stable state.

- 2. RSI Overbought/Oversold Verification:

- • Bullish Divergence at Bottom: On December 30th/31st, 2025, prices made new lows (0.592, 0.583), but the 14-day RSI (31.13, 28.13) did not make corresponding new lows (higher than the low on November 21st). This is a potential bullish divergence signal, hinting at weakening downward momentum.

- • Overbought Pullback: As the rebound peaked on January 14th, the RSI reached 69.77, entering overbought territory. Subsequently, prices pulled back, and the RSI retreated to 51.92 by January 20th, residing in a neutral-to-strong zone, providing room for potential further advances.

4. Relative Strength & Momentum Performance

- • Momentum Reversal: In the fourth quarter of 2025 (QTD), the target accumulated a loss of -20.57%, exhibiting severe negative momentum. Entering January 2026, a sharp momentum reversal occurred. As of January 20th, the Month-to-Date (MTD) return reached +10.46%, significantly outperforming the prior downtrend period.

- • Strong Short-term Momentum: The Weekly return (WTD) peaked in the second week of January (week of 01/12) at 6.74%. Although there has been a pullback in the recent two weeks, the overall short-term momentum has turned from negative to positive, with considerable strength.

- • Conclusion: Momentum indicators confirm the "short-term trend is upward" judgment mentioned in the trend analysis. The transition from extreme weakness to a strong rebound is direct evidence of a change in the market's internal forces.

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff theory and the above data analysis, the behavioral path of large investors (Smart Money) can be inferred:

- 1. "Quiet Accumulation" in Late December: At a time when market volume was extremely low, volatility hit historical lows, and retail sentiment was frozen, Smart Money likely used the illiquid environment for quiet accumulation. During this phase, although prices made new lows, volume did not expand, indicating no large-scale resistance selling. This allowed Smart Money to establish positions at lower costs.

- 2. "Aggressive Attack and Absorption" in Early January: On January 5th, Smart Money announced its entry publicly with a massive high-volume up-day. This magnitude of volume growth (ranking 17th over the past decade) and relative volume (ranking 4th) is not typical retail behavior but a clear sign of concentrated institutional fund building. The subsequent days of continued volume expansion on advances represent the process of buying power consistently overwhelming supply and further absorbing shares.

- 3. "Shakeout and Testing" Since Mid-January: After the price rally met resistance near the mid-term moving averages (MA_20D/30D), a pullback ensued. The decline during this period exhibited "light volume" characteristics, indicating that Smart Money was not distributing shares on a large scale at these levels. Their purpose was more likely a "Shakeout" – flushing out short-term profit-takers and weak holders who bought near the bottom, while simultaneously testing the true supply situation at resistance levels, preparing for potential further action.

6. Support/Resistance Level Analysis & Comprehensive Trading Signals

- 1. Key Levels:

- • Primary Support:

- • S1: 0.600 - 0.583: The price consolidation zone and low formed in late December 2025. This is the starting point of the current rebound and the bottom area of the "Panic Selling." It is the most critical line of defense for the bulls.

- • S2: 0.644 - 0.639: The current price zone, near the midpoint of the large up-day on January 5th and the recent volume consolidation area, providing immediate support.

- • Primary Resistance:

- • R1: 0.665 - 0.670: The recent rebound high (01/16 close) and the convergence area of the MA_20D/30D, serving as the short-term bull-bear demarcation line.

- • R2: 0.684: The highest point of this rebound (01/14). A break above this level would open up new upside space.

- • Primary Support:

- 2. Wyckoff Comprehensive Trading Signals & Suggestions:

- • Current Market State Judgment: The market has completed the "Panic Selling", undergone an "Automatic Rally", and is currently likely in the phase of "Secondary Test" or "Shakeout." Although the long-term downtrend remains intact, the short-term structure has turned bullish, and signs of Smart Money entry are clear.

- • Core Trading Signal: Bullish, looking for signals of the pullback ending for entry.

- • Specific Operational Suggestions:

- • Bullish Strategy:

- • Ideal Entry Point: When the price pulls back near the S2 (0.644-0.639) or S1 (0.600-0.583) zone and shows signs of "Supply Exhaustion" (e.g., small candlestick body, long lower shadow, volume contracting again), it can be considered an opportunity for accumulation.

- • Confirmation Signal: If the price subsequently rises on expanding volume, breaking above R1 (0.670), it would confirm the end of the pullback and the resumption of the uptrend.

- • Stop-Loss Setting: Strictly place stops below the key support S1 (0.583) to guard against the market structure being invalidated.

- • Bearish/Wait-and-See Strategy:

- • If the price rallies near R1 or R2 and shows signs of volume expansion with price stagnation or long upper shadows (sign of expanding supply), consider short-term shorting or closing long positions.

- • If the price breaks below and sustains trading under S1 (0.583), it would declare the failure of this rebound, and the market would revert to a downtrend. Shift to a wait-and-see or bearish stance.

- • Bullish Strategy:

- 3. Future Verification Points:

- • Bullish Confirmation: The price effectively breaks above R1 (0.670) with an expanding-volume up-day (volume ratio >1.2) within the next 1-2 weeks, preferably closing above the MA_30D.

- • Bearish Warning: If the price, near current levels or after a minor bounce, experiences consecutive down days on expanding volume, with the volume ratio consistently >1.2, and quickly breaks below S2 (0.639), it would indicate that supply has regained control of the market, requiring a reassessment of the bullish thesis.

Disclaimer: This report is based on quantitative analysis of historical data. The conclusions are derived from Wyckoff volume-price principles and do not constitute specific investment advice. Markets involve risks; invest cautiously. Any trading decision should be made by integrating more real-time information and personal risk tolerance.

Thank you for your attention! Daily Wyckoff Volume-Price market insights are published at 8:00 AM sharp, before market open. Please feel free to leave comments and share. Your support is crucial. Let's work together to see the market signals.

Member discussion: