Alright, based on the data and historical ranking information you provided, here is an in-depth quantitative analysis report for product code 399989.

Wyckoff Volume-Price Analysis Report - Product Code: 399989

Analysis Period: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-20

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset 399989 had an opening price of 7420.26, a closing price of 7302.23, a 5-day moving average (MA) of 7614.13, a 10-day MA of 7481.32, a 20-day MA of 7185.14. Its daily change was -1.46%, weekly change was -5.32%, monthly change was 8.02%, quarterly change was 8.02%, and yearly change was 8.02%.

- • Moving Average Alignment and Price Relationship:

- • Initial Phase (Late November to End of December): The price (CLOSE) consistently traded below all major moving averages (MA_5D/10D/20D/30D/60D), exhibiting a clear bearish alignment. The market was in a definite downtrend.

- • Mid-Phase (Early to Mid-January): Starting from 2026-01-05, the price broke through all moving averages with a huge bullish candlestick on massive volume. MA_5D, MA_10D, and MA_20D successively crossed above MA_30D and MA_60D, forming a bullish alignment, signaling a shift from a downtrend to an uptrend in the medium term.

- • Recent Phase (Late January): Starting from 2026-01-16, the price retreated from its highs, successively breaking below MA_5D and MA_10D. As of 2026-01-20, the price is located between MA_10D and MA_20D, with MA_5D turning downwards. The bullish alignment is beginning to loosen, and the trend is entering a consolidation or correction phase.

- • Wyckoff Market Phase Inference:

- • Late November to December: Characteristics align with the late stage of the "Decline/Panic" phase. The price consolidated at low levels with shrinking volume (

VOLUME_AVG_7D_RATIOoften below 1), and RSI_14 repeatedly touched the oversold zone below 30 (e.g., a low of 30.29 on December 3rd), showing signs of selling exhaustion. - • Early January (Jan 5th - Jan 9th): A clear signal for the start of the "Markup" phase after accumulation appeared. The price broke through all resistance accompanied by historically massive volume (e.g., volume growth of 89.3% on Jan 5th). This is a classic sign of large-scale demand (smart money) entering to accumulate and initiating an offensive.

- • Mid-January (Jan 12th - Jan 15th): The price rose to a high (7776 points), but showed initial signs of "Distribution". Price action was volatile, reaching a new high (7964 points), but the closing price (7680 points) ended significantly lower, accompanied by persistently extreme volume (record-breaking volume for consecutive days). This signals the emergence of supply at high levels.

- • Late January (Jan 16th - Jan 20th): Confirmation of the Distribution phase and entry into the early "Markdown" phase. The price broke below short-term moving averages with increasing volume on declines (-2.48%, -1.06%, -1.46%), confirming that supply has taken dominance at high levels, disrupting the uptrend.

- • Late November to December: Characteristics align with the late stage of the "Decline/Panic" phase. The price consolidated at low levels with shrinking volume (

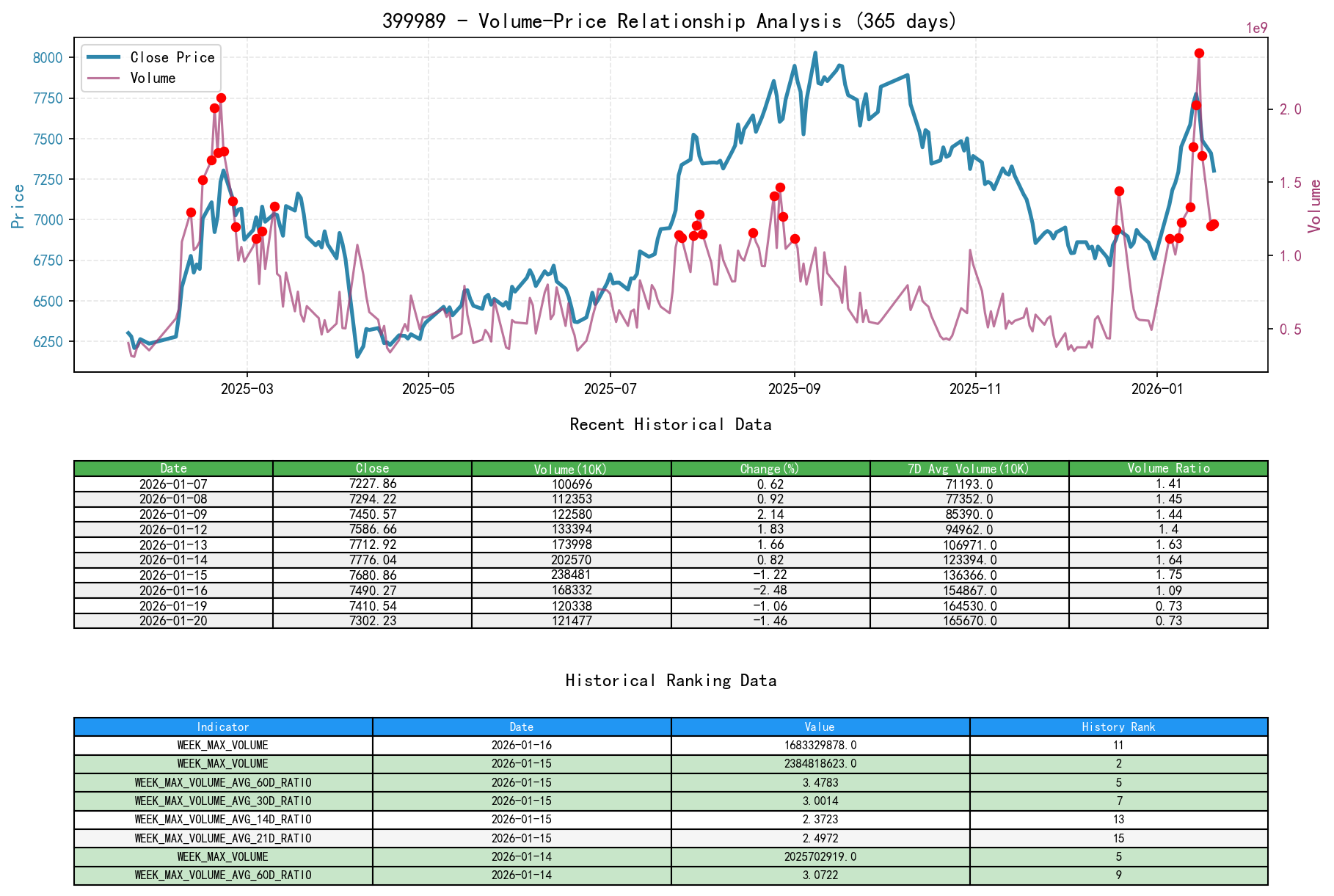

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset 399989 had an opening price of 7420.26, a closing price of 7302.23, volume of 1,214,771,700, a daily change of -1.46%, volume of 1,214,771,700, a 7-day average volume of 1,656,708,581.71, and a 7-day volume ratio of 0.73.

- • Key Volume-Price Signal Analysis:

- 1. High-Volume Breakout (Demand Dominant, 2026-01-05):

PCT_CHANGE +4.91%,VOLUME_GROWTH +89.32%,VOLUME_AVG_7D_RATIO 1.87. This is a textbook demand entry signal, breaking the long-term downtrend structure. - 2. Extreme Volume with Stagnation/Divergence (Supply Emerges, 2026-01-14): Intraday new high (7964 points) but only a slight gain at close (

PCT_CHANGE +0.82%), forming a long upper shadow. The day's volume reached 20.2 billion (5th in the last decade ranking),VOLUME_AVG_14D_RATIO 2.21(17th in the last decade ranking). This is a typical supply overwhelming demand high-divergence signal, potentially forming a "Buying Climax" or "UTAD" pattern. - 3. High-Volume Decline (Supply Dominant, 2026-01-16):

PCT_CHANGE -2.48%, volume reached 16.8 billion (11th in the last decade ranking),VOLUME_AVG_7D_RATIO 1.09. Confirms that supply has evolved from divergence to active selling. - 4. Low-Volume Rebound (Insufficient Demand, 2026-01-12): The day gained (

+1.83%), but volume significantly shrank compared to the extreme volume of previous days,VOLUME_AVG_7D_RATIO 1.40. Indicates insufficient follow-up demand during the rally, making the upward move fragile.

- 1. High-Volume Breakout (Demand Dominant, 2026-01-05):

- • Conclusion: The market experienced a dramatic shift from "massive demand-driven" to "extreme supply-suppressed" in the first half of January. The high-volume stagnation at highs and subsequent high-volume decline formed a clear supply-demand transition point.

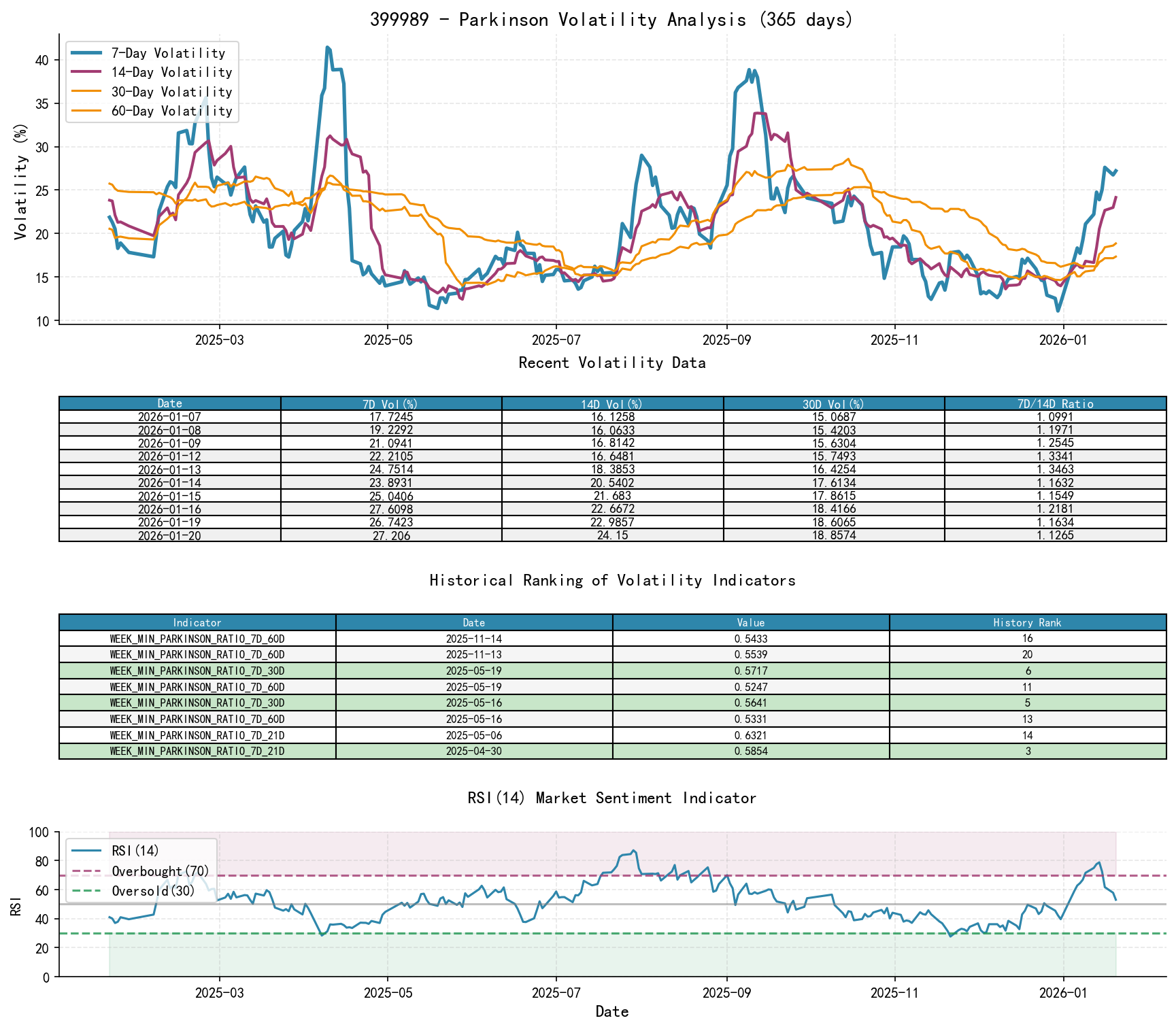

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset 399989 had an opening price of 7420.26, a 7-day intraday Parkinson volatility of 0.27, a 7-day intraday volatility ratio of 1.13, a 7-day historical volatility of 0.32, a 7-day historical volatility ratio of 0.90, and an RSI of 53.04.

- • Volatility Changes:

- • Early January: Historical volatility (

HIS_VOLA_7D) and Parkinson intraday volatility (PARKINSON_VOL_7D) surged sharply alongside the price rise. On January 5th,HIS_VOLA_7Djumped from around 0.15 to 0.38, with short-term volatility far exceeding long-term (HIS_VOLA_RATIO_7D_60Dreached 1.64). This marks a shift in market sentiment from dormancy to frenzy and trend acceleration. - • Late January: Despite the price decline, short-term volatility has begun to converge relative to longer-term periods (

HIS_VOLA_RATIO_7D_14Ddecreased from 1.33 to 0.90,PARKINSON_RATIO_7D_14Dfrom 1.20 to 1.13). This suggests the market may be transitioning out of a trend-based panic/frenzy into a consolidation or new equilibrium-seeking phase.

- • Early January: Historical volatility (

- • Sentiment Indicator (RSI):

- • RSI_14 reached 78.85 on January 14th (14th in the last decade ranking), entering a severe overbought zone. This is quantitative evidence of extreme optimism, typically signaling reversal risk.

- • As of January 20th, RSI_14 has retreated to 53.04, leaving the overbought zone, indicating sentiment has significantly cooled.

4. Relative Strength and Momentum Performance

- • Short-Term Momentum:

WTD_RETURNrapidly shifted from strong positive returns in early January (e.g., as high as 10.21% on Jan 9th) to negative ( -5.32% on Jan 20th), indicating that short-term upward momentum has been completely exhausted and reversed. - • Medium-Term Momentum:

MTD_RETURNremains positive at +8.02%, but has been halved from its high on January 14th (+15.03%), showing that medium-term upward momentum is being rapidly consumed. - • Long-Term Performance: Although

YTD(Year-to-Date) is positive,TTM_36(Trailing 36-month return) is -36.56%, indicating the long-term structure remains within a bearish framework. This recent rise is more likely a major rebound within a long-term downtrend. - • Conclusion: Short-term momentum has deteriorated, medium-term momentum is decaying, and the long-term structure remains weak. The current decline needs to be observed to determine if it is a healthy correction following the previous surge or the beginning of a return to the long-term downtrend.

5. Large Investor (Smart Money) Behavior Identification

- • Accumulation Phase (Late December to Early January): Against the backdrop of oversold RSI and low volume, the massive-volume breakout on January 5th was a clear signal of smart money initiating an offensive after bottom accumulation. They absorbed the selling from panic and hesitation.

- • Distribution Phase (Mid-January): As prices were driven to highs amid euphoric market sentiment (overbought RSI), record-breaking extreme volume appeared (2nd, 5th, and 8th in the last decade ranking). Combined with the stagnant price action (long upper shadows), it can be inferred that smart money conducted large-scale distribution at highs, exchanging holdings to the chasing public investors. The volume of 23.8 billion on January 15th (2nd in the last decade ranking) was the peak of this distribution activity.

- • Current Intent: The high-volume declines since January 16th indicate that smart money has completed its primary distribution, and the market has entered a supply-dominated declining phase. The current scenario of falling prices on increasing volume could be Panic Selling in the late stage of distribution, or it could be smart money inducing a decline to test the reaction of demand below.

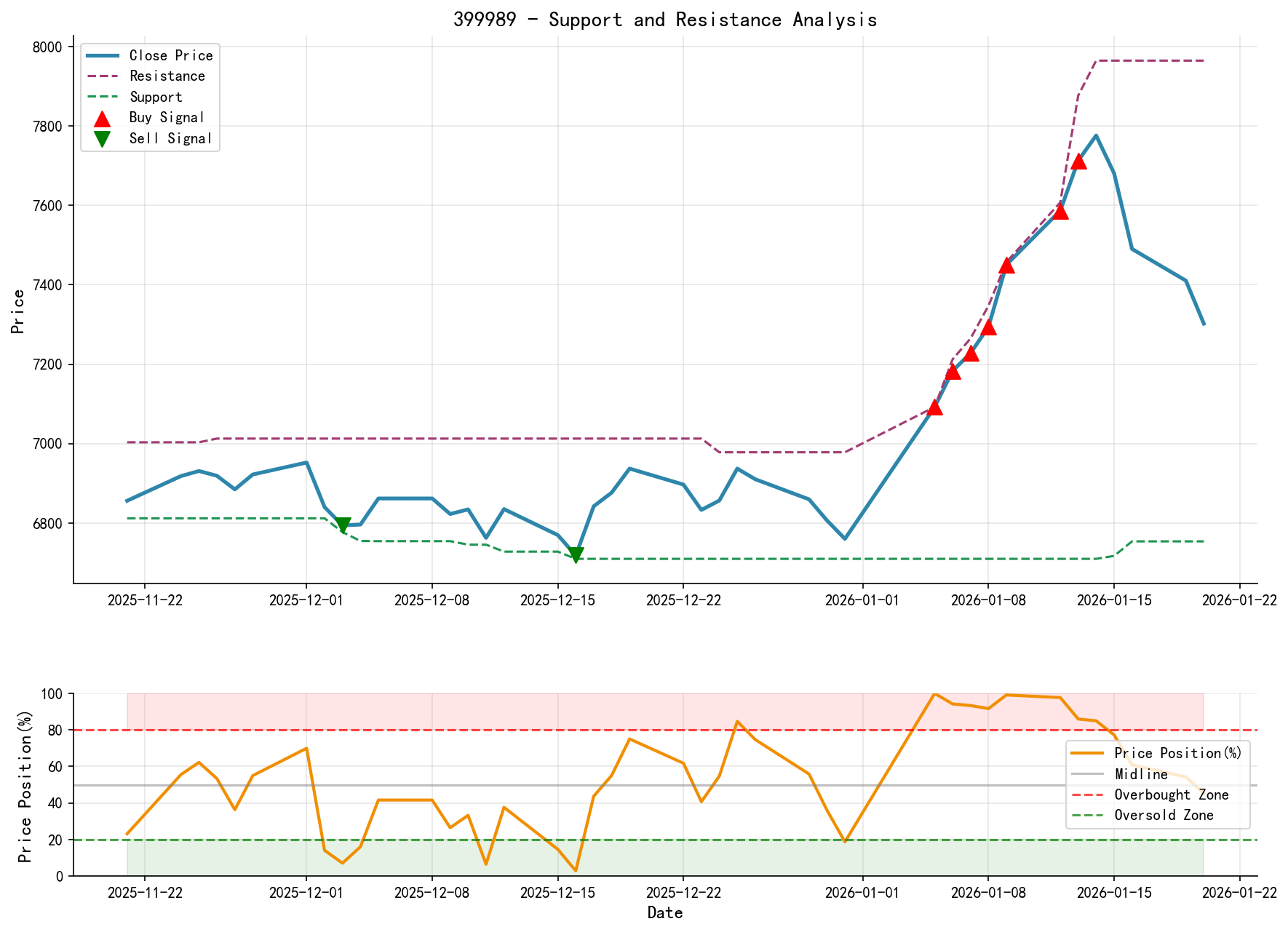

6. Support/Resistance Level Analysis and Trading Signals

- • Key Levels:

- • Resistance (R1): The 7776-7964 points zone. This is the absolute high zone of this rebound and also the area of extreme volume distribution, constituting strong resistance.

- • Resistance (R2): 7500 points. The recent rebound high after the decline and a breached short-term platform, acting as the first rebound resistance.

- • Support (S1): Around 7300 points. This is the first consolidation platform after the gap-up rise in early January (Jan 8-9) and the current price location, facing a test.

- • Support (S2): 7100-7200 points. The convergence zone of the launch gap from this rally and important moving averages (MA_30D/60D). This is the critical lifeline for determining whether the uptrend has ended.

- • Support (S3): Around 6800 points. The previous dense trading area and low-point region of the downtrend.

- • Comprehensive Wyckoff Events and Trading Signals:

- • Primary Signal: Bearish/Monitor. The market has shown a clear high-level "high-volume stagnation -> high-volume decline" distribution sequence. Large investor behavior has shifted from buying to distribution.

- • Operational Recommendations:

- 1. Long positions should exit or set strict stop-losses. Any rebound move near 7500 points, if accompanied by shrinking volume or renewed stagnation, presents an opportunity to reduce or exit positions.

- 2. Short positions can look for entry opportunities after a weak rebound, but position sizing must be controlled. An initial stop-loss can be placed above 7550 points (lower bound of the distribution zone).

- 3. Potential long opportunities require waiting: The price needs to retreat to the 7100-7200 support zone and show clear signs of low-volume stabilization or high-volume rebound, indicating renewed demand entry, before considering a counter-trend bounce.

- • Future Validation Points:

- 1. Bearish Validation: Price breaks below 7300 points on high volume and further slides towards 7100 points, confirming successful distribution and the continuation of the downtrend.

- 2. Bullish Invalidation (Scenario): Price finds strong support near 7300 or 7100 points and sees a demand-led high-volume bullish candlestick (volume ratio >1.5) reclaiming 7500 points. This could mean the current decline is merely a strong correction and the uptrend remains intact. However, given the extreme volume distribution that has already occurred, this scenario has a lower probability.

Core Report Conclusion Reiteration:

Based on Wyckoff volume-price principles, data analysis indicates that 399989 completed a full cycle transition from "smart money accumulation-driven rally" to "smart money extreme volume distribution" in mid-January. The market has now entered the declining phase following distribution. Last-decade ranking data (multiple indicators for volume, turnover, and volume ratios entering the historical top 20) confirms the extremeness and significance of this cycle transition. Strategy-wise, a defensive and trend-following bearish stance should be adopted, closely monitoring the defense or breach of the 7100-7200 critical support zone to determine the market's next direction.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and impartiality but makes no guarantees regarding its accuracy or completeness. Markets involve risks, and investments require caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Daily Wyckoff Volume-Price Market Interpretations are released promptly at 8:00 AM before the market opens. Your comments and shares are sincerely appreciated, as your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: