As a quantitative trading researcher proficient in the Wyckoff method, I will author a comprehensive, in-depth quantitative analysis report based on the data you provided for product code 399986.

Wyckoff Volume-Price Analysis Report

Product Code: 399986

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Time: 2026-01-20

Dimension 1: Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset 399986 had an opening price of 7185.71, a closing price of 7241.94, with moving averages: MA_5D at 7333.23, MA_10D at 7428.13, MA_20D at 7503.92. Performance figures: Daily change +0.76%, Weekly change -3.83%, Monthly change -4.75%, Quarterly change -4.75%, Yearly change -4.75%.

- 1. Moving Average Alignment and Trend Evolution:

- • Initial Phase (Late November): The price (CLOSE) was above all moving averages (MA_5D, MA_10D, MA_20D, MA_30D, MA_60D), showing a typical bullish alignment. The MA_60D (long-term MA) was the lowest, providing foundational support.

- • Weakening Phase (Early to Mid-December): The price first broke below the MA_5D and MA_10D. Subsequently, the MA_5D crossed below the MA_20D, forming a death cross (MA_5D remained below MA_20D consistently from December 5th onward), signaling a weakening short-term trend. After finding brief support near the MA_20D and MA_30D, the price fell below all short-term moving averages by mid-December.

- • Bearish Alignment Established (Late December to January): Entering January, the MA_5D, MA_10D, MA_20D, and MA_30D had fully formed a bearish alignment (MA_5D < MA_10D < MA_20D < MA_30D). The price continued to trade below all moving averages. The MA_60D was decisively broken on January 16th, confirming the establishment of a medium-term downtrend.

- 2. Market Phase Inference (Based on Wyckoff Principles):

- • Late November to Early December 2025: Distribution or Uptrend Finale. Prices oscillated at high levels near 7800 points, with multiple failed upward attempts (e.g., high open, low close on Nov 26th; a rebound on Dec 1st failing to surpass prior highs). Accompanied by relatively high volume (see volume-price analysis below), this fits the characteristics of the Distribution phase.

- • Mid-December 2025 to Mid-January 2026: Markdown and Panic. Prices broke below key support levels (e.g., MA_60D and the 7200-point integer level), showing consecutive large down candles (e.g., -1.58% on Dec 10th, -1.91% on Jan 14th, -1.45% on Jan 16th). Crucially, January 14th and 16th were accompanied by extremely high volume, indicative of typical panic selling, marking an acceleration of the downtrend.

- • January 20, 2026 (Latest Trading Day): Potential Stopping Action after Panic. Following the consecutive sharp declines, the price closed with an up candle (+0.76%). Volume remained active but was lower than the preceding panic levels. This may represent the emergence of initial support but requires subsequent confirmation as a valid "Stopping Action".

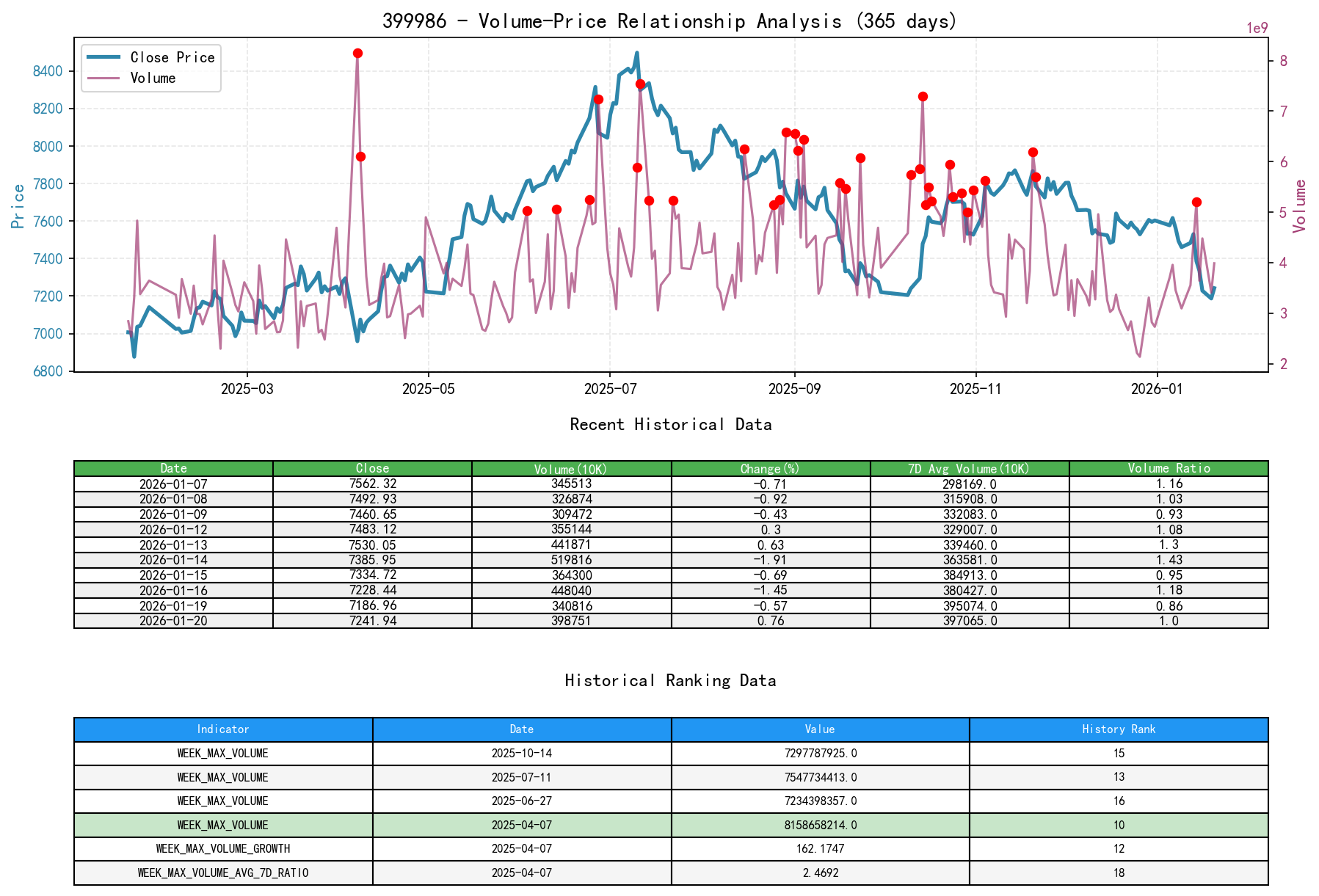

Dimension 2: Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset 399986 had an opening price of 7185.71, a closing price of 7241.94, volume of 3987517500, daily change +0.76%, 7-day average volume of 3970659684.57, and a 7-day volume ratio of 1.00.

- 1. Key Daily Volume-Price Signals:

- • 2025-11-21 & 11-24: High-Volume Decline (Supply Dominated). Prices fell -1.04% and -0.77% respectively, with volumes reaching 1.30x and 1.05x of the recent 7-day average. High-volume declines at high levels are a clear signal of Supply overwhelming Demand, foreshadowing a potential trend reversal.

- • 2025-11-25: High-Volume Advance (Demand Test). Price rose +1.32% with increased volume from the previous day, but the relative 7-day average ratio (0.89) showed that the chase wasn't extreme. This can be viewed as a test of demand against the decline, but it failed to sustain.

- • 2025-12-10 & 2026-01-14: High-Volume Plunge (Panic Selling). Both days saw declines of -1.58% and -1.91% with volume ratios (VOLUME_AVG_7D_RATIO) of 1.11 and 1.43 respectively, exhibiting classic panic selling features. Supply poured out during the decline.

- • 2026-01-16: Massive Volume with Long Lower Shadow (Potential Demand Entry). Price plunged to a new low of 7228 points, but the daily candlestick had a prominent lower shadow and extremely high volume (1.16x the 60-day average). This "high-volume hammer" is a sign in Wyckoff theory of potential professional investors (smart money) absorbing shares at panic levels.

- • 2026-01-20: Low-Volume Rebound (Demand Probe). A rebound occurred after the panic decline, but volume significantly receded compared to the previous two days (VOLUME_GROWTH was +17.0%, but VOLUME_AVG_7D_RATIO was 1.00). This shows initial caution from demand; further observation is needed to determine if this is a technical bounce or a substantive return of demand.

- 2. Volume Level Analysis:

- • Combined with historical ranking data, the average volume (AVERAGE_VOLUME_60D) in late November 2025 reached peak levels in nearly a decade (ranking 1st, 2nd, 5th, 6th, 13th). This confirms extreme market activity during that period, highly consistent with the "Distribution phase" assessment.

- • Entering the January panic period, volume expanded significantly again but did not surpass the November peak. This aligns with volume-price characteristics at the end of a decline: after panic selling (Jan 14, 16), volume contracts during the rebound.

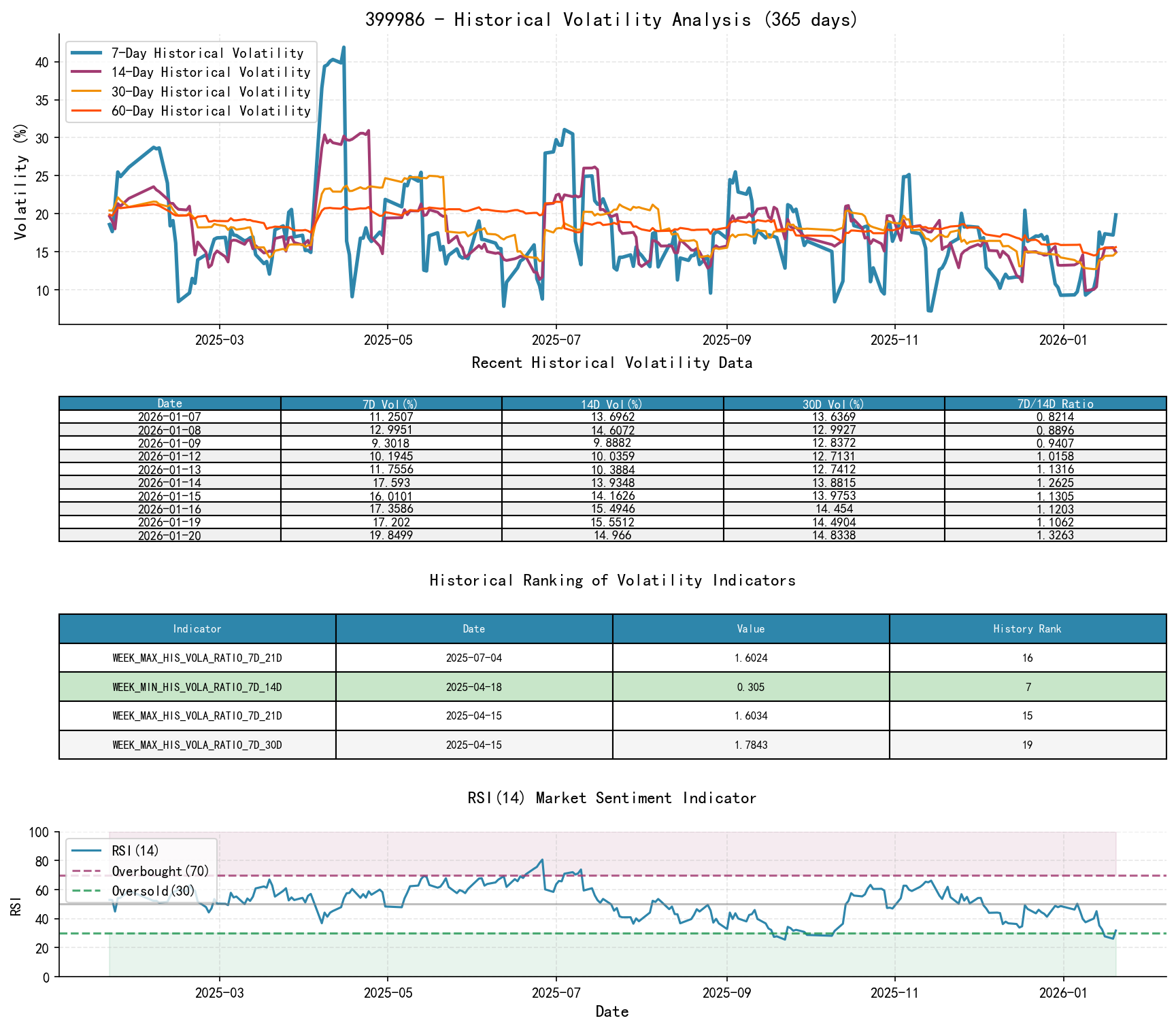

Dimension 3: Volatility and Market Sentiment

As of January 20, 2026, the underlying asset 399986 had an opening price of 7185.71, 7-day Parkinson volatility of 0.15, 7-day Parkinson volatility ratio of 1.12, 7-day historical volatility of 0.20, 7-day historical volatility ratio of 1.33, and RSI of 31.84.

- 1. Volatility Analysis:

- • Panic Outbreak: On key down days, short-term historical volatility (HIS_VOLA_7D) and Parkinson volatility (PARKINSON_VOL_7D) spiked significantly. For example, on Jan 14th, HIS_VOLA_7D surged to 0.1759, with its ratio to the 60-day volatility (HIS_VOLA_RATIO_7D_60D) reaching 1.15, indicating abnormal short-term volatility expansion and extreme market panic.

- • Volatility Expansion: The PARKINSON_RATIO_7D_60D indicator remained above 1 throughout mid-to-late January (1.06 on Jan 20th), indicating intraday price ranges had exceeded long-term averages, signaling an unstable market state.

- • RSI Oversold Confirmation: The RSI_14 indicator declined steadily from the neutral 50-55 zone in early December, reaching a deeply oversold area of 27.79 on Jan 16th before slightly rebounding (31.84 on Jan 20th). This validates extreme pessimism in market sentiment and a short-term need for a technical bounce from a momentum perspective.

Dimension 4: Relative Strength and Momentum Performance

- 1. Momentum Turned Negative Across the Board:

- • MTD_RETURN: Transitioned from a positive +3.43% in November 2025 to -4.75% in January 2026, indicating a sharp deterioration in medium-term momentum.

- • YTD (Year-to-Date): Performance for 2025 had once reached +9.35% (Nov 21st), pulling back to +6.79% by year-end. Entering 2026, it turned negative to -4.75% within just three weeks, showing strong negative momentum.

- • Conclusion: Short-term (WTD), medium-term (MTD), and year-to-date (YTD) momentum have all weakened, consistent with the technical pattern of price breaking below all moving averages, confirming the market is currently in a downtrend dominated by sellers.

Dimension 5: Large Investor (Smart Money) Behavior Identification

Based on the above volume-price, volatility, and trend analysis, the operational intent of large investors can be inferred:

- 1. November 2025: High-Level Distribution. Price near annual highs (~7906 points) coincided with the highest average volume levels in nearly a decade (confirmed by historical ranking data), yet price advances were weak. This suggests large investors conducted substantial distribution in the region above 7800 points, transferring shares to retail buyers chasing highs. The high-volume declines on November 21st and 24th are typical distribution signals.

- 2. December 2025: Confirming Weakness and Shakeout. After breaking below key moving averages, price rebounds were weak and volume gradually contracted, showing lack of demand. Occasional high-volume declines during this period can be viewed as a "Shakeout" to wash out remaining bullish conviction and eliminate weak holders.

- 3. Early to Mid-January 2026: Panic Selling and Preliminary Accumulation Signs.

- • January 14th: A classic public panic selling day. Massive down candle with spiking volatility. Smart money typically does not sell heavily at this moment (having already distributed at higher levels) but observes the market reaction.

- • January 16th: A Key Signal Day. Price made a new low but formed a massive-volume candle with a long lower shadow. This strongly suggests significant buying interest actively absorbing panic-selling pressure at the lowest panic levels (below 7228 points). This is a sign in Wyckoff theory that the "Panic" phase may be ending and an "Automatic Rally" may begin.

- • January 20th: Rebound accompanied by contracting volume. This indicates that after the initial panic buying, large capital is not rushing to aggressively push prices higher, possibly in an observation or gradual accumulation phase. The market is entering an observation period for a potential "Secondary Test".

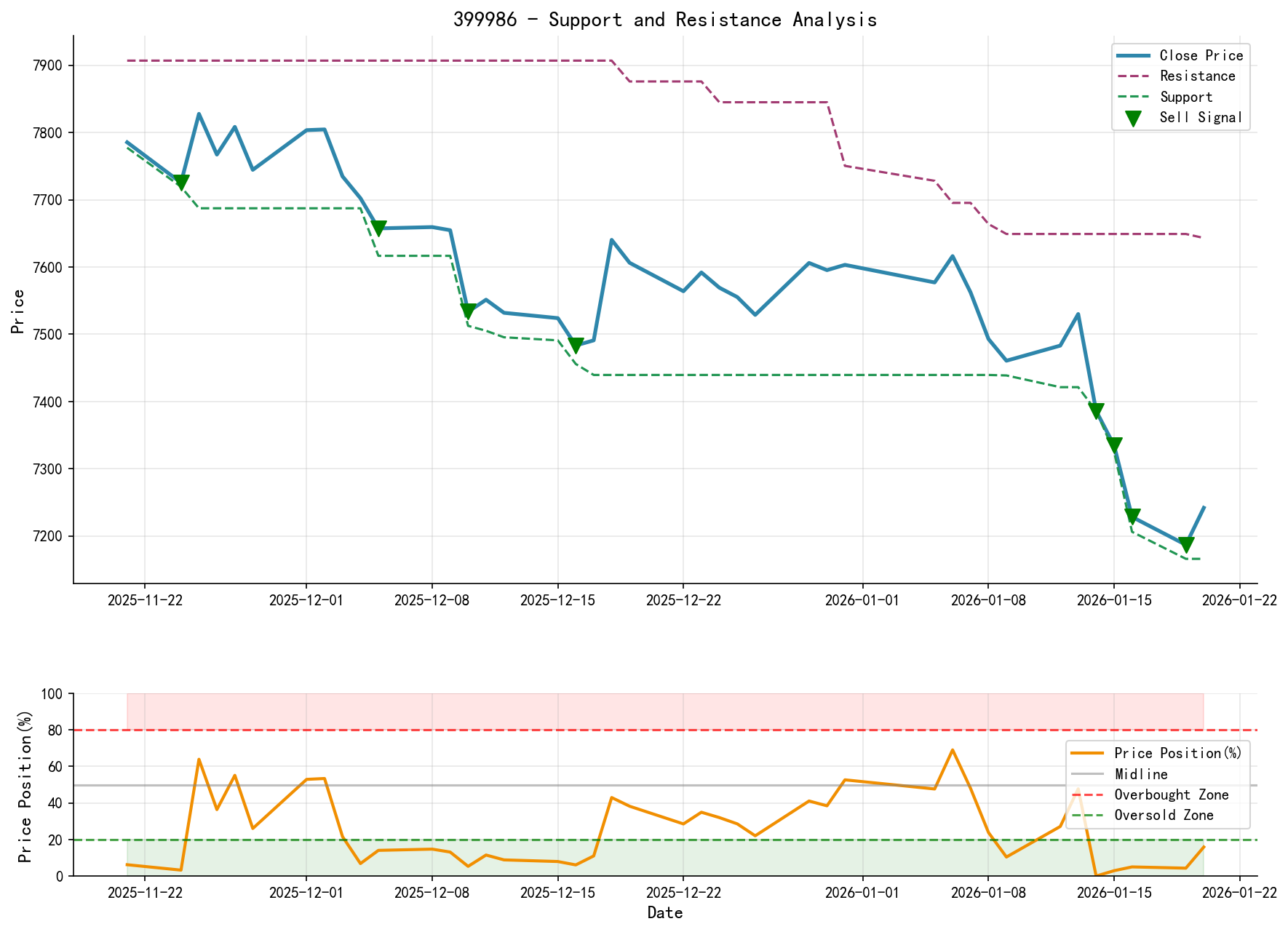

Dimension 6: Support/Resistance Level Analysis and Trading Signals

- 1. Key Price Levels:

- • Strong Support Zone: Around 7200 points. The panic low on Jan 16th (7228 points) and its lower shadow area constitute the most significant recent support and the zone where potential accumulation may have occurred. A decisive break below this level would open further downside.

- • Secondary Resistance Zone: 7400-7500 point area. The upper bound of the dense trading range from Jan 14th-16th, also a prior minor consolidation platform.

- • Primary Resistance Zone: 7600-7800 point area. The region of prior multiple rebound highs and the location of MA_30D and MA_60D. This is the key resistance band that needs to be overcome for a trend reversal.

- 2. Integrated Trading Signals and Operational Recommendations:

- • Primary Trend: In a medium-term downtrend, sellers are dominant.

- • Current Phase: Possibly in the early transition from "Panic Selling" towards "Accumulation". The massive-volume lower shadow on Jan 16th is a significant positive signal, but trend reversal confirmation requires more evidence.

- • Operational Recommendations:

- • Sellers (Short Positions): Investors who established short positions in the high distribution zone may consider taking partial profits near the 7200-point support area and moving stop-losses above the 7600-point level.

- • Buyers/Observers:

- • Adopt a wait-and-see approach, anticipating a secondary test. Chasing the current rebound is strictly prohibited. Wait for the price to retest the 7200-7250 support zone again.

- • Ideal Long Signal: During the secondary test of the 7200 support, a candlestick pattern appears showing significantly diminished volume (supply exhaustion) or renewed high-volume stabilization/rebound (demand confirmation) (e.g., long lower shadow, small body).

- • Potential Entry Point: If the secondary test is successful and the price rises back above the 7400-point level, consider initiating a light long position.

- • Initial Stop-Loss: Set below the Jan 16th low (7228 points).

- • Trend Reversal Confirmation Point: Price breaks out decisively with volume and stabilizes above the 7600-7800 resistance zone, accompanied by a repairing moving average system.

- 3. Future Validation Points:

- • Bullish Validation: Price forms a higher low (HL) above 7200 points, and a subsequent rebound can break through the 7400-7500 area with significant volume.

- • Bearish Validation: Price rebounds encounter resistance and fall back from the 7500-7600 area with contracting volume, or directly breaks below the 7200 support with high volume, indicating a continuation of the downtrend.

Conclusion Reiterated: The market (399986) has undergone a complete cycle from high-level distribution -> trend weakening -> accelerated decline -> panic selling. The latest data shows preliminary signs of smart money accumulation during the panic (Jan 16th massive-volume lower shadow), but the medium-term trend has not yet reversed. The strategy should prioritize cautious observation and awaiting the results of a secondary test at key support levels, preparing for potential early-stage trend reversal while strictly managing downside risks.

Disclaimer: This report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risks, and investments require caution. Any investment actions based on this report are undertaken at one's own risk.

Thank you for your attention! Daily Wyckoff Volume-Price Market Analysis is published promptly before the market opens at 8:00 AM. Please feel free to comment and share; your recognition is crucial. Let's work together to understand market signals.

Member discussion: