Quantitative Analysis Report Based on the Wyckoff Method: Product 399935

Product Code: 399935

Analysis Period: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-20

Methodology: Wyckoff Price-Volume Analysis, Market Structure Analysis, Alpha Signal Identification

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset 399935 has an open price of 7087.72, a close price of 6987.24, a 5-day moving average (MA) of 7014.35, a 10-day MA of 6939.37, a 20-day MA of 6665.88, a daily change of -1.51%, a weekly change of 2.15%, a monthly change of 8.87%, a quarterly change of 8.87%, and a yearly change of 8.87%.

Data Observations and Deductions:

- • Price vs. Moving Average Relationship: At the end of the analysis period (2026-01-20), the price (6987.24) has fallen below the short-term MA_5D (7014.35), but remains above the MA_20D (6665.88), MA_30D (6524.39), and MA_60D (6446.15). The long-term moving averages (MA_20/30/60D) are arranged in a bullish pattern, providing support.

- • Moving Average Dynamics: Within the data window, after falling below all major moving averages in late November 2025, the price initiated a strong rebound from early December to mid-January 2026, successfully breaking above all moving averages. However, a critical recent signal has emerged: MA_5D (7014.35) shows signs of flattening and descending towards MA_20D (6665.88), indicating exhaustion of short-term upward momentum. The MA_CROSS direction signal has shifted from "Upward" to "Converging/Pending".

- • Price Action and Phase Identification:

- 1. Decline Phase (2025-11-21 to 2025-12-01): The price fell continuously from around 6000 points to a low of 5793 points (November 24th), with active volume. The RSI once fell below 35, consistent with characteristics of panic selling or the late stage of a decline.

- 2. Accumulation and Rebound Phase (2025-12-01 to 2026-01-16): The price rebounded with significant volume in early December, breaking the downtrend. Since early January, the price accelerated its rise, continuously setting new historical highs (Historical ranking data shows that closing price, open price, highs, and lows recently reached extremely high values, ranking within the top 1-20 positions over the past decade), accompanied by a sharp surge in volume (see price-volume analysis below), consistent with a Markup Phase.

- 3. Potential Phase Transition Signal (2026-01-12 to present): After reaching a historical high of 7214.62 (January 16th), the price failed to close at new highs for several consecutive days and exhibited signs of high-volume stagnation and decline (e.g., January 13th, January 20th). Combined with historically extreme prices and abnormal volume, the market may be entering the early stages of Distribution, where large investors exchange holdings at historical highs.

Conclusion: The long-term trend remains bullish (price above long-term MAs), but clear signs of short-term weakness and potential reversal have emerged. The market may be transitioning from a strong "Markup Phase" to the early stages of a "Distribution Phase". Close attention should be paid to whether the price finds support at key moving averages (MA_20D).

2. Price-Volume Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset 399935 has an open price of 7087.72, a close price of 6987.24, a trading volume of 7218485200, a daily change of -1.51%, a trading volume of 7218485200, a 7-day average volume of 9405005671.43, and a 7-day volume ratio of 0.77.

Data Observations and Deductions:

- • Healthy Demand Period (2025-12-01 to 2026-01-12): The early stages of this rally (December) were accompanied by a moderate increase in volume (VOLUME_AVG_7D_RATIO mostly between 1.1 and 1.3), indicating steady demand entering the market. Entering January, volume showed explosive growth, with daily volumes exceeding the 7-day/14-day/21-day averages by 50%-100% or more on multiple days (e.g., January 6th, January 14th). Historical ranking data confirms that during this period, "7-day average trading volume" (~9.4 billion) and "volume/14-day average volume ratio" (1.97) reached historically high levels, ranking 12th and 15th respectively over the past decade, indicating extremely robust demand even at historically high price levels.

- • Supply Overwhelming Demand Signals (Critical Day Analysis):

- • 2026-01-13: The price fell sharply by -2.95% (intraday range exceeding 3.7%), with volume reaching 9.47 billion, and a volume/7-day average volume ratio of 1.19. This is a classic "High-Volume Decline" (Supply Overwhelming Demand), indicating significant selling pressure emerging at historical highs.

- • 2026-01-14: Despite closing up 1.62%, the session saw extreme volatility and recorded the third-highest single-day volume (11.89 billion) and fifth-highest turnover value over the past decade. Such massive volume resulted in only a moderate gain, constituting a classic "High-Volume Stagnation" signal, suggesting supply is actively countering demand.

- • 2026-01-20 (Latest Trading Day): The price fell -1.51%. The volume (7.22 billion), while substantial, has receded from the extreme levels of previous days (VOLUME_GROWTH at -7.38%). This represents a "Decline accompanied by volume retreating from extreme highs", potentially indicating a pause in panic selling, but not a vigorous demand-driven rebound.

Conclusion: This rally was driven by continuously expanding demand, peaking in mid-January (price and volume hitting historical extremes simultaneously). However, the subsequent combination of "High-Volume Stagnation" and "High-Volume Decline" constitutes a clear Supply in Control signal in Wyckoff theory, suggesting upward momentum may be exhausted and market control is shifting from buyers to sellers.

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset 399935 has an open price of 7087.72, a 7-day intraday volatility of 0.29, a 7-day intraday volatility ratio of 1.10, a 7-day historical volatility of 0.38, a 7-day historical volatility ratio of 1.16, and an RSI of 62.41.

Data Observations and Deductions:

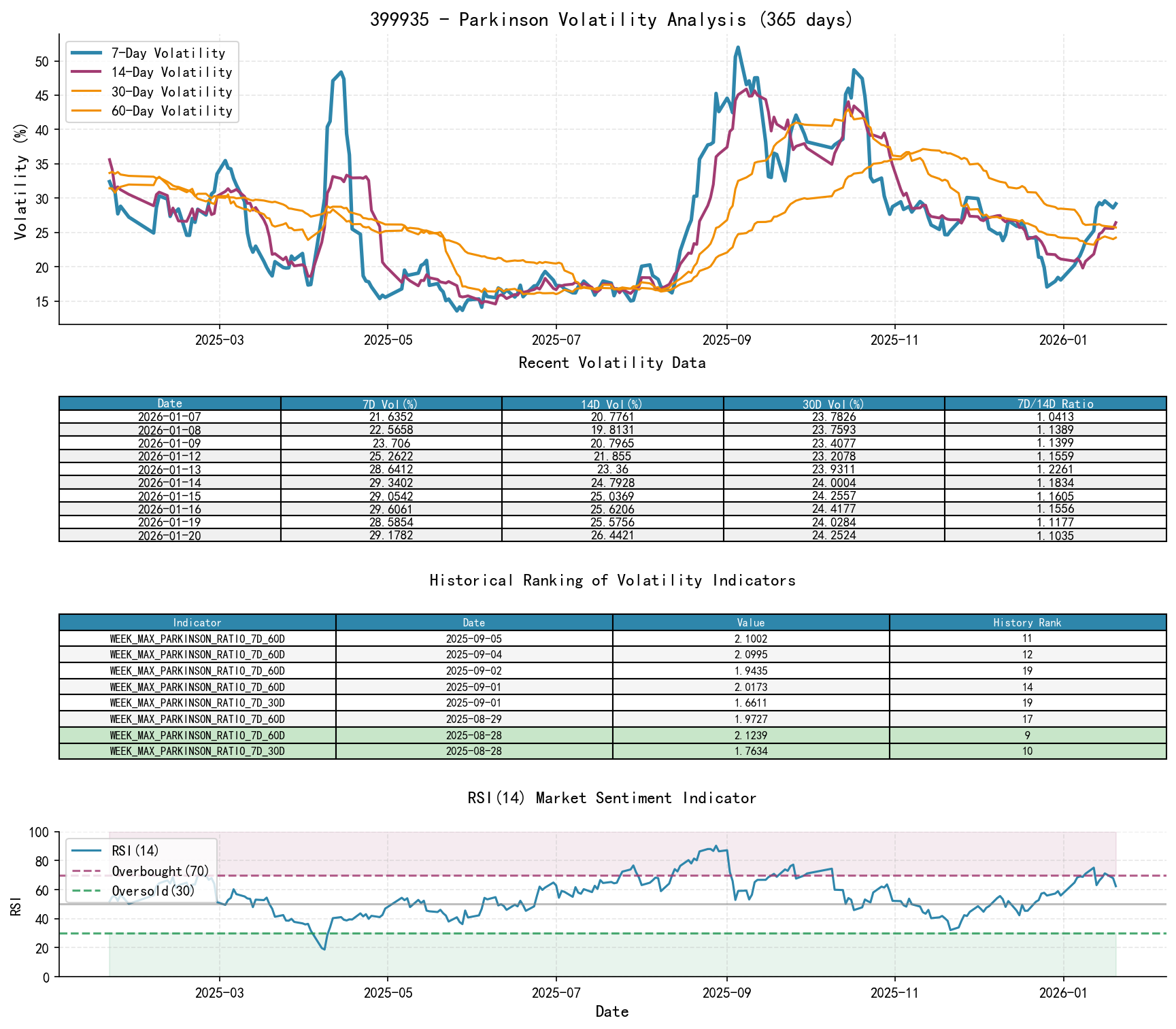

- • Volatility Level: The short-term historical volatility (HIS_VOLA_7D: 0.3846) is significantly higher than the 14-day (0.3312), 30-day (0.3124), and 60-day (0.3220) volatilities. HIS_VOLA_RATIO_7D_60D reaches 1.19, indicating a sharp increase in short-term market volatility, far exceeding long-term normal levels.

- • Intraday Volatility: The Parkinson intraday volatility (PARKINSON_VOL_7D: 0.2918) is also above its 14-day, 30-day, and 60-day averages (PARKINSON_RATIO_7D_60D=1.13), confirming heightened intraday price fluctuations recently.

- • Sentiment Indicators: The RSI_14 has quickly retreated from overbought territory (71.24 on January 16th) to the current 62.41, moving out of extreme overbought conditions but remaining in a strong zone. This rapid retreat from overbought levels typically coincides with fading upward momentum.

Conclusion: Abnormal amplification of short-term volatility, combined with wide swings and declines at high price levels, reflects increased market tension and divergence. This often occurs at potential trend inflection points where bullish and bearish forces contend fiercely. The RSI's decline confirms a shift in short-term sentiment from exuberance to caution.

4. Relative Strength and Momentum Performance

Data Observations and Deductions:

- • Periodic Returns: Short-term momentum shows clear divergence. MTD_RETURN (+8.87%) and QTD_RETURN (+8.87%) remain very strong, indicating persistent medium-term upward momentum. However, WTD_RETURN (+2.15%) is significantly weaker than previous weeks, and the latest daily return (-1.51%) is negative, indicating that short-term upward momentum has significantly weakened or even reversed.

- • Momentum Confirmation: The strong MTD return aligns with the price-volume surge observed in the first half of January's markup phase. The attenuation of short-term momentum corroborates the recent supply signals of "high-volume stagnation/decline," providing mutual validation.

Conclusion: Medium-term momentum remains strong, but clear signals of short-term momentum exhaustion have emerged. This divergence between short-term and medium-term momentum serves as a warning for a potential trend adjustment or reversal.

5. Large Investor (Smart Money) Behavior Identification

Inferences Based on the Above Analysis:

- • Distribution Behavior Identification: During the process of setting new historical highs (around the 7200-point zone), historically massive trading volumes occurred. Smart money likely utilized extreme market optimism and high liquidity to conduct proactive distribution in this zone. The "high-volume stagnation/decline" on January 13th-14th is a classic market manifestation of distribution behavior: large sell orders being absorbed by exuberant retail or momentum buying.

- • Behavioral Intent: The intent of smart money's operation is not to immediately crash the market, but to orderly transfer holdings to the public while maintaining market enthusiasm. The recent price decline with volatility but without a crash-like collapse aligns with the characteristics of a distribution phase.

- • Correlation with Historical Rankings: Historical ranking data shows multiple price and volume indicators reaching extreme levels over the past decade. Smart money excels at exiting during "historic prosperity," and the current data pattern strongly fits this behavioral model.

Conclusion: Data strongly suggests that large investors (smart money) are conducting distribution operations at historical high levels. Behind the massive volume lies institutional-level selling being absorbed by robust market demand. Their operational intent is to take profits and reduce risk exposure, not to continue driving prices higher.

6. Support/Resistance Level Analysis and Trading Signals

Key Price Levels:

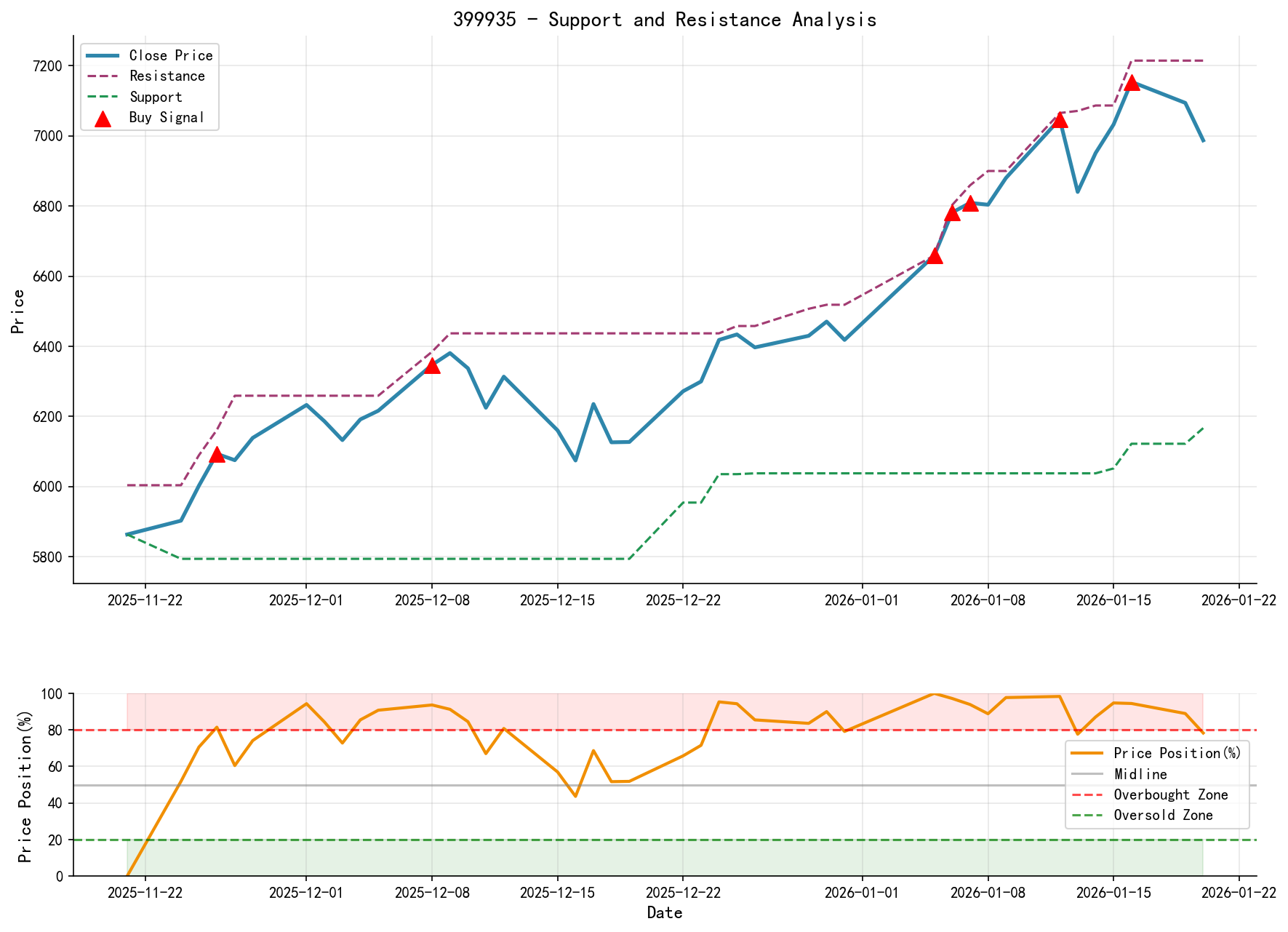

- • Near-term Resistance Zone: 7100 - 7200 points. This is the historical high zone reached in this rally and the area where clear supply-overwhelming-demand occurred, constituting strong resistance.

- • Initial Support Zone: 6800 - 6850 points. The lower boundary of the recent consolidation range and the area defended on January 19th-20th. A break below would confirm a deepening short-term correction.

- • Core Support Zone: 6650 - 6700 points (near MA_20D). This is the area of the medium-term uptrend line (20-day MA) and the previous breakout platform, a critical line of defense for bulls. A high-volume break below could signal the end of the markup phase.

- • Ultimate Support Zone: 6400 - 6500 points (MA_30D/MA_60D convergence zone). The lifeline of the long-term trend.

Comprehensive Wyckoff Events and Trading Signals:

- • Current Event: The market has exhibited a variant of "High-Volume Stagnation in an Overbought State" (UTAD, Upthrust After Distribution), along with Bar-by-Bar evidence of "Supply Overwhelming Demand".

- • Trading Signal: Bearish / Shift to Defense.

- • At the current price level (~6987 points), initiating new long positions is not recommended. Existing long positions should consider partial profit-taking or setting tight stop-losses.

- • Potential shorting opportunities should await secondary confirmation signals upon a rebound near 7100 points showing weakness (e.g., long upper shadows, lack of volume), or serve as a trend-following signal when the price breaks below the 6800-point support on high volume.

- • Operational Recommendations:

- 1. Observation / Wait: The primary strategy is to observe and wait for the market's behavior at key support levels (e.g., 6800, 6700).

- 2. Confirmation Point (Bearish Thesis): The price closes below 6800 points, accompanied by increased volume or weak rebounds on low volume. This would strengthen the case for the market entering a Distribution-Decline phase.

- 3. Invalidation Point (Bearish Thesis): The price finds strong support and rebounds on high volume in the 6800-6700 point zone, re-establishes above 7000 points, and sets new highs. This would indicate the current pullback is merely a secondary correction within an ongoing uptrend.

- 4. Risk Control: Any trading decision should be based on price action near key levels (e.g., reaction after testing support/resistance), with strict stop-loss placement.

Final Summary: A comprehensive analysis of product 399935 based on Wyckoff principles, incorporating price-volume, volatility, momentum, and historical ranking data, indicates that after a rally to new historical highs driven by massive demand, clear signs of a top reversal, dominated by large investor distribution behavior, have emerged. Short-term market risk has increased sharply. Operations should shift to a defensive stance, awaiting the market's directional choice at key support levels. The upcoming test of the 6800-6700 point zone in the next few trading sessions is crucial.

Disclaimer: This report/interpretation is solely for market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. The market involves risks; investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Price-Volume Market Analysis is published daily at 8:00 AM before market open. We sincerely appreciate your comments and shares, as your recognition is paramount. Let's work together to discern market signals.

Member discussion: