Understood, as per your instructions. I will adopt the persona of a quantitative trading researcher proficient in the Wyckoff Method. Based on the provided data and historical ranking metrics for the 399934 index, I will compose a comprehensive and in-depth quantitative analysis report.

Quantitative Analysis Report: Supply and Demand Analysis Based on the Wyckoff Method

Product Code: 399934 (CSI Shanghai-Shenzhen-Hong Kong Cloud Computing Theme Index)

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Time: 2026-01-20

1. Trend Analysis and Market Phase Identification

As of January 20, 2026, the underlying asset 399934 has an opening price of 6088.88, a closing price of 6129.27, a 5-day moving average of 6193.81, a 10-day moving average of 6284.22, a 20-day moving average of 6285.68, a daily change of +0.67%, a weekly change of -3.25%, a monthly change of -2.23%, a quarterly change of -2.23%, and a yearly change of -2.23%.

Data Derivation and Observations:

- • Moving Average Alignment and Trend: As of 2026-01-20, the price (6129.27) has fallen below all short-term to medium-term moving averages (MA_5D: 6193.81, MA_10D: 6284.22, MA_20D: 6285.68). The price structure exhibits a clear downtrend. The moving averages are in a bearish alignment: MA_5D < MA_20D < MA_10D < MA_30D (6254.24), indicating the mid-term uptrend structure has been broken, and the short-term is in a clear downtrend.

- • Key Turning Point: The market formed a significant rally from late December 2025 to early January 2026 (low: 6105.09, high: 6501.13). However, after peaking on 2026-01-06, the price sharply reversed and fell, rapidly breaking through key moving average support levels.

- • Wyckoff Phase Judgment: Combining price action and volume-price relationships (see below), the current market is transitioning from a "Distribution" phase towards a "Markdown" or even "Panic" phase. The high-volume surge followed by a reversal in early January 2026 (01-06, 01-07) is a classic "Distribution" characteristic. The subsequent consecutive high-volume declines (01-14, 01-16) mark strong supply entering the market, initiating the Markdown phase and potentially triggering panic selling.

Core Conclusion: Both short-term and mid-term trends have turned bearish. The market has exited its uptrend and is currently in a rapid, supply-driven decline. Caution is advised for potential further panic selling.

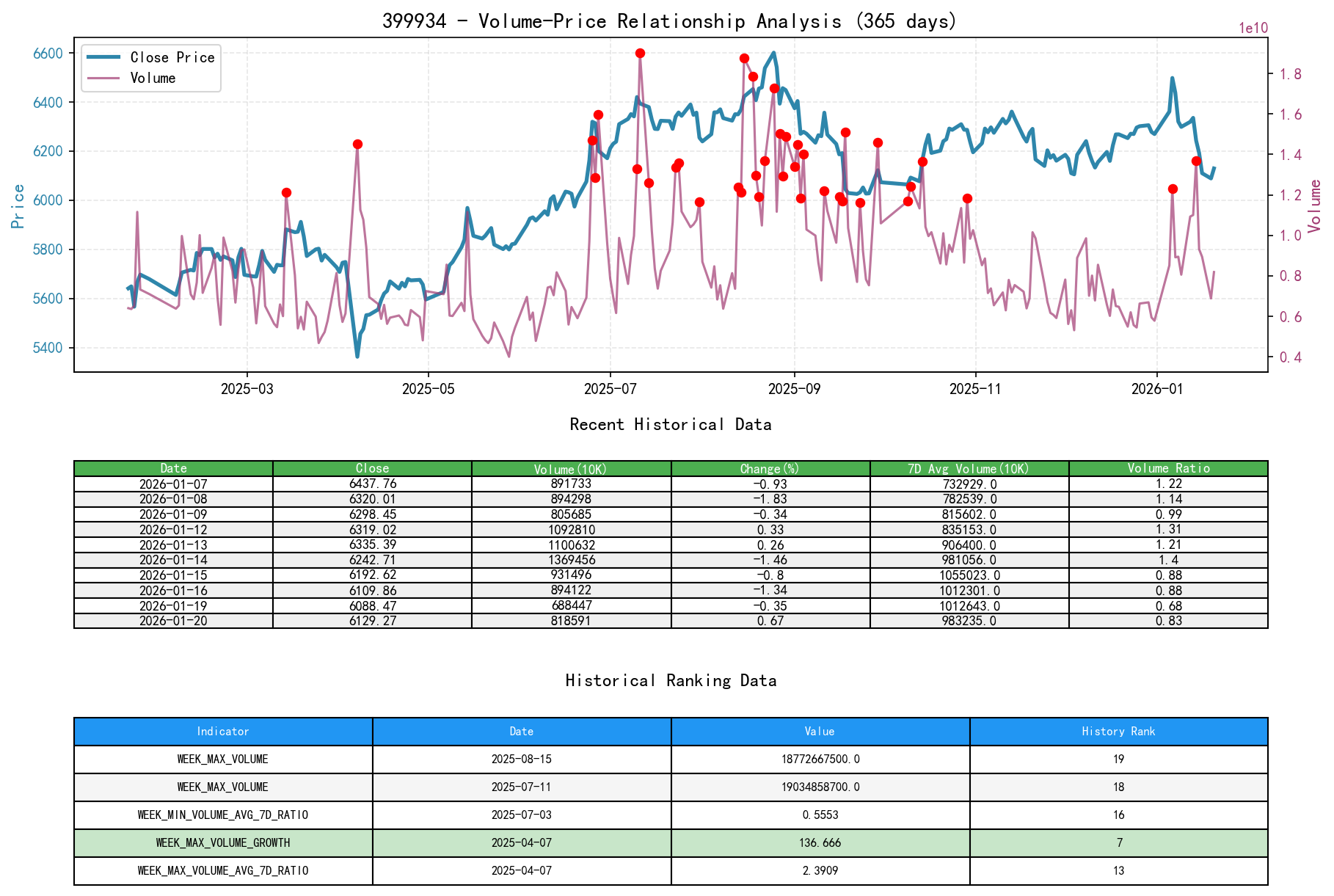

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 20, 2026, the underlying asset 399934 has an opening price of 6088.88, a closing price of 6129.27, a trading volume of 8185916900, a daily change of +0.67%, a trading volume of 8185916900, a 7-day average volume of 9832357471.43, and a 7-day volume ratio of 0.83.

Data Derivation and Observations:

- • Distribution Signals (Demand Exhaustion, Supply Emergence):

- • 2026-01-06: Price reached a new phase high (6501.13), rising 2.15%, but accompanied by extreme volume (

VOLUME12.305B,VOLUME_AVG_7D_RATIO1.933). This pattern is a "Buying Climax" or "Sign of Strength on Weakness", often a signal of large investors distributing shares during high sentiment. - • 2026-01-07 & 2026-01-08: Price failed to sustain gains and turned downward (-0.93%, -1.83%), with volume still very high (

VOLUME_AVG_7D_RATIO1.217 and 1.143, respectively). This is the classic "High Volume Stalling/Decline", confirming supply has completely overwhelmed demand, the distribution process is complete, and the markdown has begun.

- • 2026-01-06: Price reached a new phase high (6501.13), rising 2.15%, but accompanied by extreme volume (

- • Panic Selling Signals (Panic-Driven Supply Surge):

- • 2026-01-14 and 2026-01-16: Price fell significantly by -1.46% and -1.34%, respectively, with unusually high volume (

VOLUME_AVG_7D_RATIO1.396 and 0.883). Notably on 01-14, volume hit a recent high (13.695B). These are classic "Panic Selling" days, indicating the decline is triggering stop-losses and panic selling.

- • 2026-01-14 and 2026-01-16: Price fell significantly by -1.46% and -1.34%, respectively, with unusually high volume (

- • Demand Test Signal (Preliminary Stop in Decline, but Force is Weak):

- • 2026-01-20: After consecutive declines, a rebound (+0.67%) occurred, but volume was relatively subdued (

VOLUME_AVG_7D_RATIO0.833). This is a "Low Volume Rally", indicating the decline has paused temporarily, but active buying demand remains insufficient, casting doubt on the sustainability of the bounce.

- • 2026-01-20: After consecutive declines, a rebound (+0.67%) occurred, but volume was relatively subdued (

Core Conclusion: The volume-price relationship clearly depicts a complete "Distribution-Markdown-Panic" sequence. Major supply dominated both the early January highs and the mid-January decline. The current low-volume bounce at lower levels indicates weak demand. Without high-volume advances, the downtrend is unlikely to reverse.

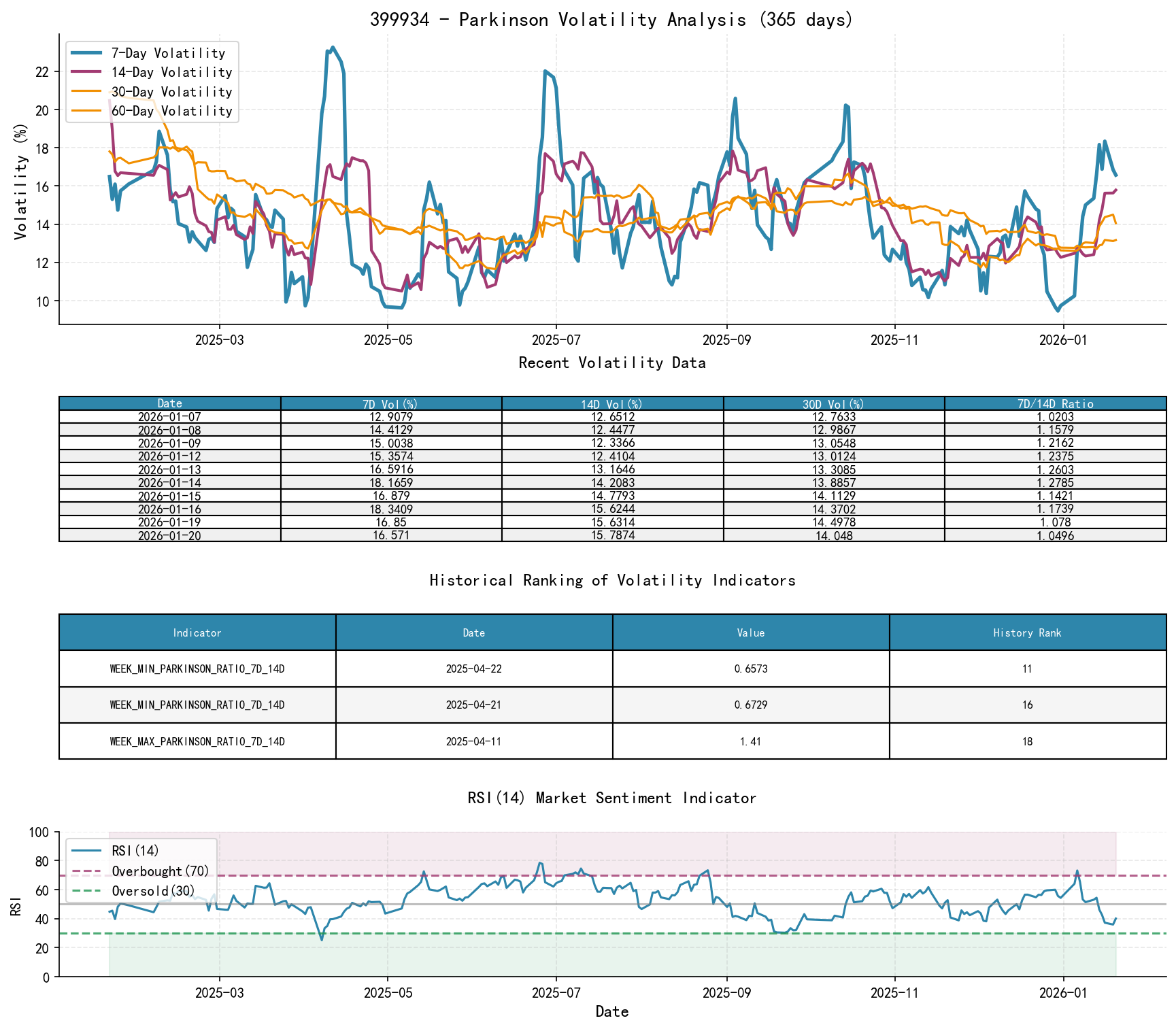

3. Volatility and Market Sentiment

As of January 20, 2026, the underlying asset 399934 has an opening price of 6088.88, a 7-day intraday Parkinson volatility of 0.17, a 7-day intraday volatility volume ratio of 1.05, a 7-day historical volatility of 0.16, a 7-day historical volatility volume ratio of 0.76, and an RSI of 40.11.

Data Derivation and Observations:

- • Volatility Spike (Quantitative Evidence of Panic Sentiment):

- • Historical volatility (

HIS_VOLA_7D) surged to extremely high levels above 0.26 during the period 2026-01-08 to 01-13. Historical ranking data confirms the extremity of this phenomenon: The values ofWEEK_MAX_HIS_VOLA_RATIO_7D_14D(7-day/14-day volatility ratio) on dates like 01-09, 01-13, 01-12, 01-08 (1.45, 1.44, 1.44, 1.43) all ranked within the top 1% of the past decade (ranked 1st, 5th, 6th, 11th). This indicates short-term volatility was abnormally higher than medium-term volatility, a classic feature of panicked market sentiment and accelerating declines. - • Parkinson intraday volatility (

PARKINSON_VOL_7D) also rose concurrently to above 0.18 in mid-January, confirming intense intraday price swings.

- • Historical volatility (

- • Volatility Shift from Extreme Calm to Extreme Activity:

- • Historical ranking data also shows that on 2025-12-29/30,

WEEK_MIN_HIS_VOLA_7D(0.0414, 0.0563) ranked 3rd and 11th among the lowest values of the past decade, respectively. This reveals the market was in a state of extreme calm and low volatility at the end of December. The subsequent sharp volatility expansion in early January perfectly demonstrates a market rhythm shift from "the calm before the storm" to "trend eruption."

- • Historical ranking data also shows that on 2025-12-29/30,

- • Overbought/Oversold Verification:

- • RSI_14 reached an overbought high of 73.23 on 2026-01-06, synchronized with the price peak, providing a divergence warning. RSI then fell rapidly, hitting a low of 37.22 on 01-16, showing the market entered a short-term oversold region, offering a technical explanation for the current weak bounce.

Core Conclusion: Volatility data rapidly shifted from historically low values to historically high values, quantitatively confirming that market sentiment has switched from "extreme optimism/calm" to "panic/chaos." Current RSI is in oversold territory, but repairing panic sentiment requires time and volume confirmation.

4. Relative Strength and Momentum Performance

Data Derivation and Observations:

- • Momentum Turns Negative Across All Horizons: As of 2026-01-20, all momentum indicators across timeframes are negative:

WTD_RETURN(-3.25%),MTD_RETURN(-2.23%),QTD_RETURN(-2.23%),YTD(-2.23%). This indicates the underlying asset is in a significant weak downtrend across short-term, medium-term, and year-to-date periods. - • Momentum Structure Breakdown: Observing the evolution of

QTD_RETURNandYTD, both were positive (around +3.6%) during the period from late December 2025 to January 5, 2026. However, following the mid-January decline, they have turned negative. This marks the complete erosion of all previously accumulated positive momentum and a fundamental reversal in the market's kinetic structure.

Core Conclusion: Momentum indicators align highly with the conclusions from price trend and volume-price analysis, confirming the market is currently in a comprehensively weak downtrend with no signs of strength in any timeframe.

5. Large Investor ("Smart Money") Behavior Identification

Comprehensive Inference Based on the Above Four Dimensions:

- 1. High-Level Distribution (Early January 2026): Smart money utilized the market's frenzy on January 6th to conduct large-scale distribution through massive volume. The subsequent high-volume decline on January 7th was the confirmation signal that they stopped supporting prices, allowing the market to fall freely.

- 2. Observation and Selective Absorption During the Decline (Mid-January 2026): During the high-volume plunges on January 14th and 16th, significant selling pressure undoubtedly emerged, likely including passive stop-losses and panic retail selling. Smart money may have engaged in selective, tentative absorption during this process but did not form a strong consensus to buy (as no high-volume bounce occurred). Their purpose might be to accumulate a small amount of cheap筹码 for a potential future bounce or to test the depth of market selling pressure.

- 3. Current Phase: Watchfulness (January 20, 2026): The low-volume bounce on January 20th indicates smart money did not enter aggressively to go long at this level. They are more likely in a watchful mode, waiting for supply to be completely exhausted (manifested as extremely low-volume declines or a sharp drop in volume following panic selling) or for clearer reversal signals.

Core Conclusion: Large investors have completed high-level distribution and were one of the initiators and primary drivers of this decline. Currently, they are in an observation and tentative operation phase, not showing strong bullish intent. Market dominance remains in the hands of the bears (the supply side).

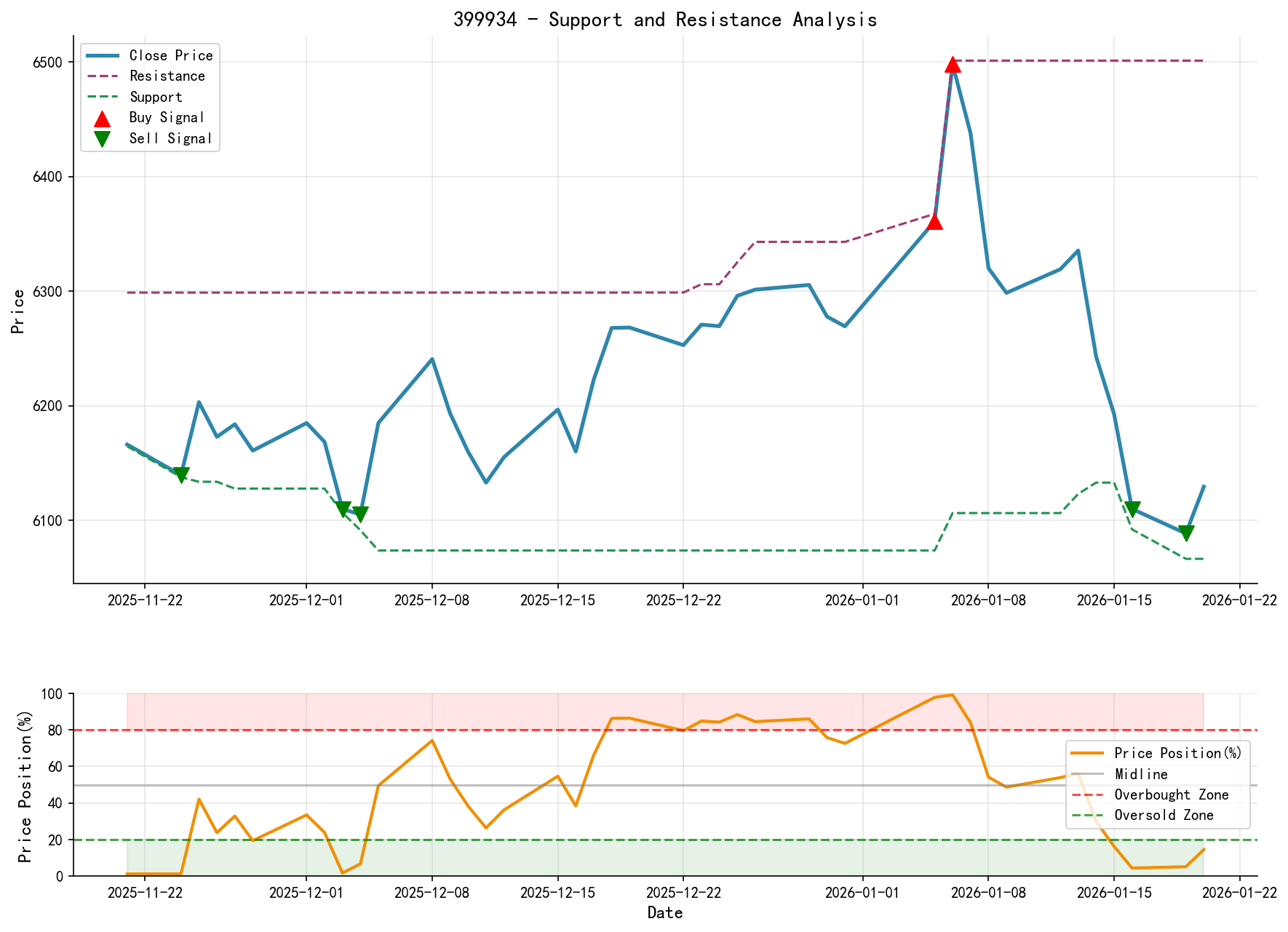

6. Support/Resistance Level Analysis and Trading Signals

Key Price Level Identification:

- • Upper Resistance:

- • Strong Resistance 1: Previous high area 6500-6367 (2026-01-06 high).

- • Strong Resistance 2 / Converted Resistance: Previous moving average congestion zone and gap lower boundary 6280-6320 (near MA_20D, MA_10D, and the January 8th gap).

- • Lower Support:

- • Recent Support: 6091-6066 (2026-01-16 low & 2026-01-19 low).

- • Key Psychological Support: The 6000 round number level.

- • Longer-Term Support: 5900-5800 (Late November 2025 trading congestion zone).

Integrated Wyckoff Trading Signals and Operational Recommendations:

- • Current Primary Trend Signal: Bearish (Trend, volume-price, momentum all point downward).

- • Current Wyckoff Phase: Markdown phase, potentially with a "Secondary Test" or "Selling Climax".

- • Operational Recommendations (for Swing/Trend Traders):

- • Bears (Short Positions): Can continue holding, moving stop-loss/take-profit levels up to the 6220-6250 area (recent bounce high and near MA_30D). If the price rebounds to this area and shows stalling with low volume, it is an observation point for adding or initiating short positions.

- • Bulls / Those Seeking a Rebound: Maintain a wait-and-see approach; avoid blindly bottom-fishing. Wait for clearer signs of a downtrend halt.

- • Key Validation Points and Future Observations:

- 1. Bearish Scenario Confirmation Point: If the price rebounds to around 6250 and exhibits low-volume stalling or high-volume decline, the downtrend will continue, with the next target around 6000.

- 2. Potential Downtrend Halt / Reversal Observation Points (must be satisfied simultaneously):

- • Price Action: A "Selling Climax" day (extremely high volume, significant price decline but closing off lows) or extremely low-volume (

VOLUME_AVG_7D_RATIO< 0.6) narrow-range consolidation within the 6050-6100 support zone. - • Volume Signal: A "high-volume advance" on a daily or hourly basis within the aforementioned price zone, with volume at least 1.3 times the 7-day average (

VOLUME_AVG_7D_RATIO> 1.3), indicating demand is beginning to actively and forcefully absorb supply. - • Volatility Signal:

HIS_VOLA_7Dretreats significantly from highs, indicating market sentiment is calming.

- • Price Action: A "Selling Climax" day (extremely high volume, significant price decline but closing off lows) or extremely low-volume (

Final Summary: The 399934 index is currently in a supply-driven decline initiated by high-level distribution from large investors. The historical extreme rankings of volatility data confirm the intensity of this decline. All technical dimensions (trend, volume-price, momentum, sentiment) point to a bear market. Trading should primarily involve following the downtrend (shorting) or staying on the sidelines. Any bottom-fishing attempts should only be cautiously considered after multiple signals from the "Potential Downtrend Halt / Reversal Observation Points" are validated by data. The next phase of market contention will unfold between the 6090-6066 support zone and the 6280-6320 resistance zone.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. The market carries risks; invest with caution. Any investment actions based on this report are undertaken at your own risk.

Thank you for your attention! Daily Wyckoff volume-price market interpretations are released punctually at 8:00 AM before the market opens. Please feel free to leave comments and share; your recognition is crucial. Let's work together to see the market signals.

Member discussion: