Quantitative Analysis Report Based on the Wyckoff Method

Product Code: 399808

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Time: 2026-01-20

I. Trend Analysis & Market Phase Identification

As of 2026-01-20, for the underlying asset 399808: Open Price 3026.69, Close Price 2949.96, 5-day MA 2984.28, 10-day MA 2966.14, 20-day MA 2890.21, Daily Change -2.20%, Weekly Change -0.50%, Monthly Change 4.79%, Quarterly Change 4.79%, Annual Change 4.79%

1. Moving Average Alignment & Trend Structure:

- • Initial Phase (2025-11-21 to early Dec): Price was in a primary downtrend. Throughout this period, the closing price (

CLOSE) remained below the 5-day (MA_5D), 10-day (MA_10D), and 20-day (MA_20D) moving averages, withMA_5D<MA_10D<MA_20D, forming a bearish alignment. After a significant breakdown below all MAs on November 21st (-6.26%), the short-term moving average system acted as clear resistance. - • Basing & Reversal Phase (mid to late Dec 2025): Price began rebounding after hitting a cycle low of 2662.39 on December 16th. By late December, the price gradually moved above all short-term moving averages, closing at 2889.20 on December 26th, significantly above the

MA_20D(2756.81). TheMA_5DandMA_10Dbegan to turn upward. - • Uptrend Establishment Phase (Jan 2026): Entering January, a clear and strengthening bullish alignment formed:

MA_5D>MA_10D>MA_20D>MA_30D>MA_60D. The price continued advancing along the 5-day MA, reaching a cycle high of 3031.38 on January 19th, followed by a correction on January 20th.

2. Wyckoff Market Phase Inference:

- • Nov to early Dec 2025: Late Accumulation / Preliminary Support & Selling Climax. The heavy-volume decline on Nov 21st (volume 50.27B,

VOLUME_GROWTH+7.2%) is typical of a selling climax. Subsequent trading days saw significantly reduced volume (e.g., Dec 4th volume 22.29B) and narrow price fluctuations, indicating exhaustion of supply and potential accumulation by large investors at low levels. - • Mid to late Dec 2025: Demand Entry & Early Markup. Price rebounded from the Dec 16th low, accompanied by a moderate increase in volume (e.g., Dec 26th volume 46.32B,

VOLUME_GROWTH+58.5%). Price easily broke through prior resistance (e.g., breaking aboveMA_20Don Dec 23rd), representing a demand-driven upswing. - • Mid Jan 2026 to Present: Potential Early Distribution. Price accelerated to new highs (3031.38) but showed signs of high-volume churning. On Jan 14th, price fell slightly by -0.20%, but volume hit 73.74B, ranking 5th highest in the past decade (

HISTORY_RANK: 5), with turnover value also ranking 5th (HISTORY_RANK: 5). This is a strong sign of emerging supply. On Jan 20th, price fell on high volume (-2.20%, volume 59.78B), providing initial confirmation that supply is overwhelming demand.

II. Volume-Price Relationship & Supply-Demand Dynamics

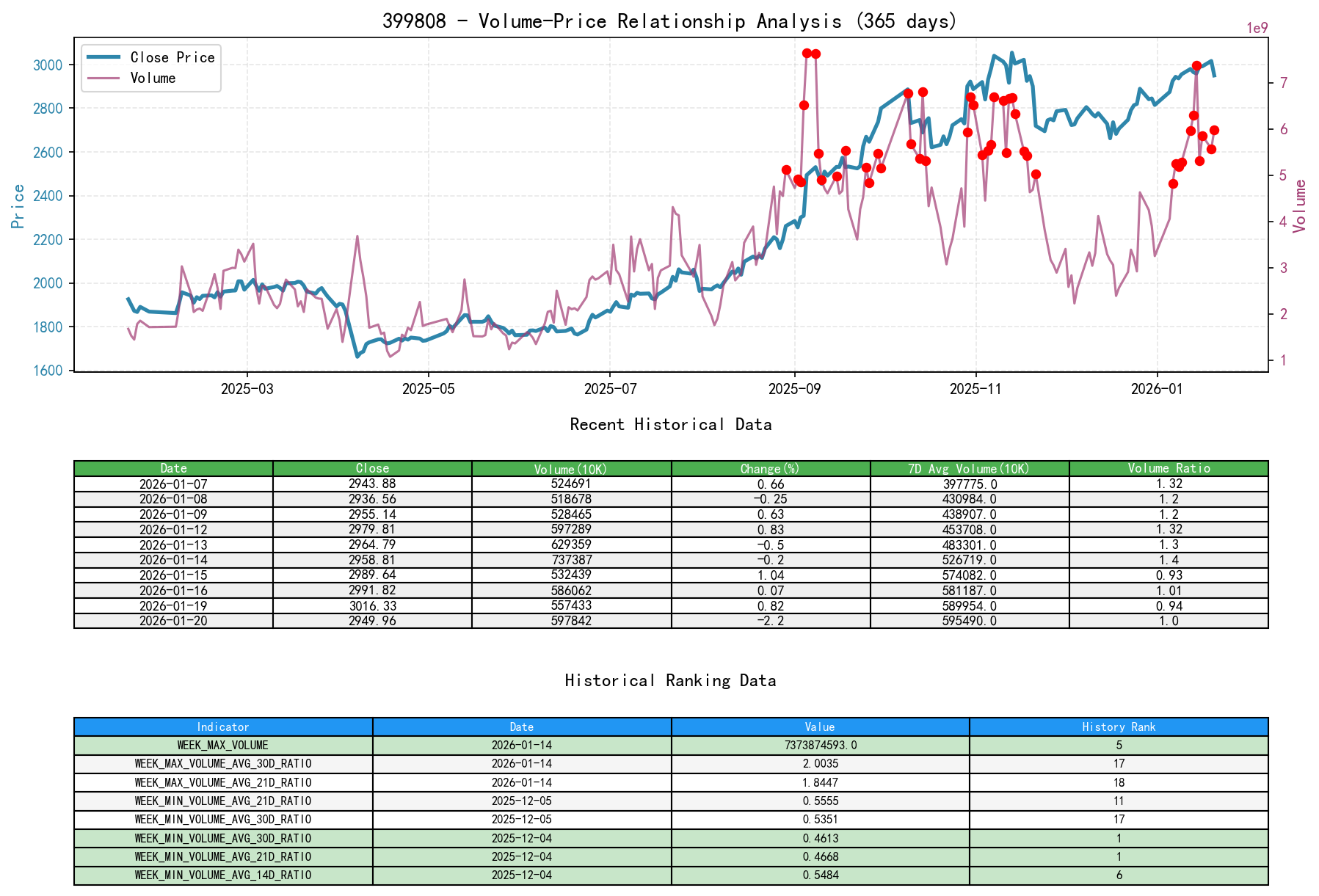

As of 2026-01-20, for the underlying asset 399808: Open Price 3026.69, Close Price 2949.96, Volume 5978424000, Daily Change -2.20%, Volume 5978424000, 7-Day Average Volume 5954909769.86, 7-Day Volume Ratio 1.00

Core Conclusion: The market has completed a full cycle of "Supply Exhaustion -> Demand Recovery -> Supply Re-emergence."

- • Supply-Driven Panic Selling (2025-11-21): Price plummeted (

PCT_CHANGE: -6.26%) with increased volume to 50.27B (VOLUME_AVG_30D_RATIO: 0.96). Price down on high volume indicates a large outflow of supply, consistent with a Wyckoff "Selling Climax" event. - • Low-Demand, Low-Volume Rebound (2025-11-25 to 12-05): Price rebounded from lows, but volume consistently remained below various moving average levels (e.g., Dec 4th:

VOLUME_AVG_14D_RATIO: 0.55, ranking 6th lowest in the past decade;VOLUME_AVG_21D_RATIO: 0.47, ranking 1st lowest). This suggests the initial rebound was driven by short-covering or limited buying, lacking substantial demand support. - • Demand Recovery with Rising Volume (2025-12-08 to 2026-01-13): Price rose accompanied by steadily increasing and persistently above-average volume. Key signals:

- • Dec 26th: A 2.47% surge with volume exploding by 58.5% (

VOLUME_AVG_7D_RATIO: 1.58), a sign of strong demand entry. - • Early Jan: Volume ratios (e.g.,

VOLUME_AVG_14D_RATIO) consistently exceeded 1.2, with both price and volume rising, indicating healthy supply-demand dynamics.

- • Dec 26th: A 2.47% surge with volume exploding by 58.5% (

- • Supply Re-emergence with High-Volume Churning & Decline (2026-01-14 to 01-20): Key turning signals.

- • Jan 14th (High-Volume Churning): Price fell slightly by -0.20%, but volume reached an extreme 73.74B (5th highest in the past decade), with turnover value also 5th highest. The daily volume/21-day average ratio (1.84) and /30-day average ratio (2.00) ranked 18th and 17th in the past decade, respectively. This is a classic "Effort vs Result" divergence—massive volume (effort) failed to push price higher (result), indicating strong supply met at high levels.

- • Jan 20th (High-Volume Decline): Price fell -2.20% with volume remaining high (59.78B,

VOLUME_AVG_14D_RATIO: 1.16), confirming supply now dominates the market.

III. Volatility & Market Sentiment

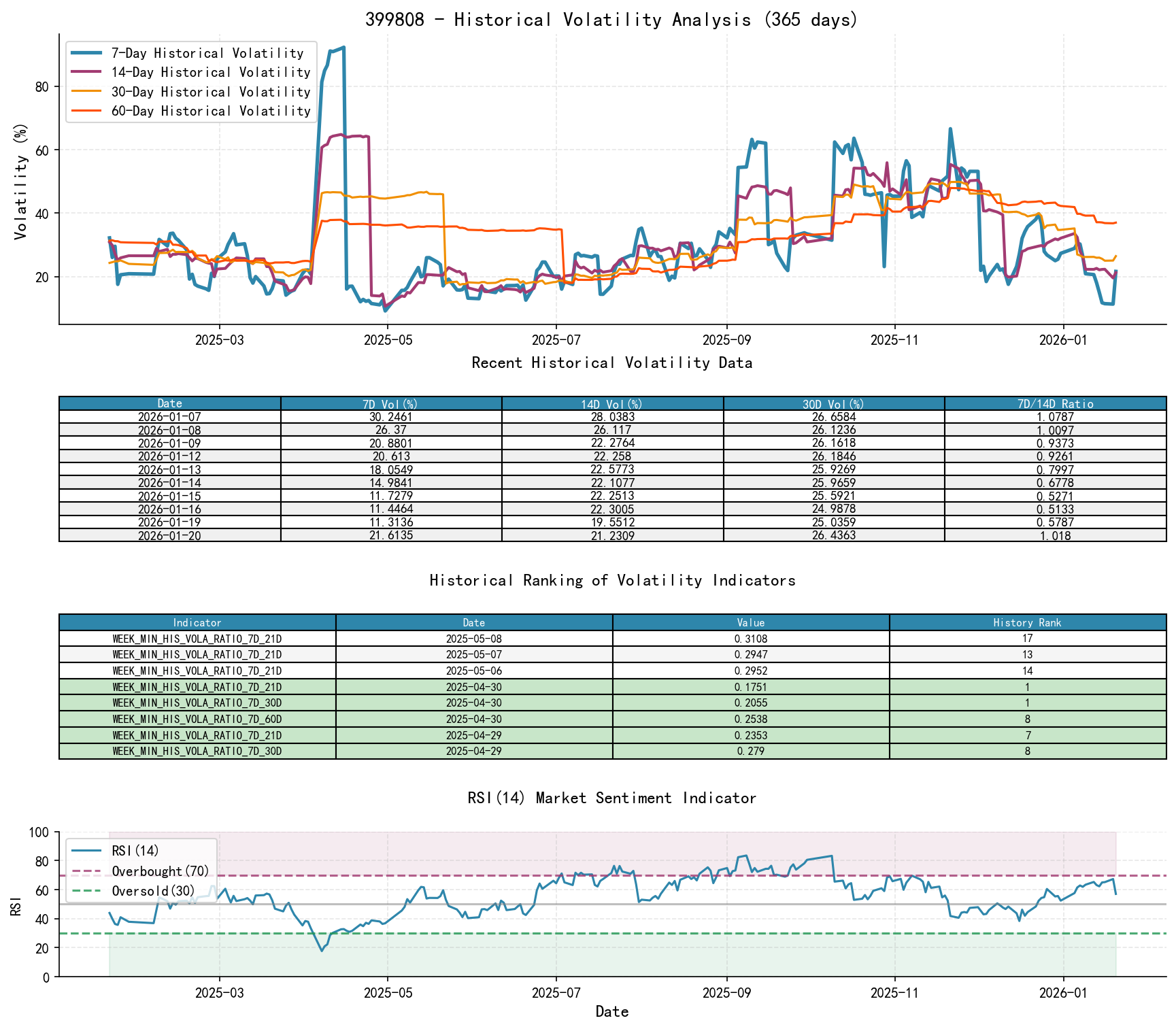

As of 2026-01-20, for the underlying asset 399808: Open Price 3026.69, 7-day Intraday Volatility 0.29, 7-day Intraday Volatility Volume Ratio 1.16, 7-day Historical Volatility 0.22, 7-day Historical Volatility Volume Ratio 1.02, RSI 57.07

- • Volatility Levels:

- • During the Nov 21st panic day, both short-term historical volatility (

HIS_VOLA_7D: 0.6659) and Parkinson volatility (PARKINSON_VOL_7D: 0.3918) were at elevated levels within the analysis period, reflecting panicked market sentiment. - • During the low-volume consolidation in early December, volatility (

HIS_VOLA_7D<0.25,PARKINSON_VOL_7D~0.22) contracted significantly, indicating sentiment had turned neutral with a temporary balance between buyers and sellers. - • During the January rally and correction, volatility increased but did not reach extreme levels, showing normal emotional fluctuations accompanying the trend.

- • During the Nov 21st panic day, both short-term historical volatility (

- • Volatility Structure:

- • On Jan 20th, short-term volatility began rising relative to medium-term volatility (

HIS_VOLA_RATIO_7D_14D: 1.02,PARKINSON_RATIO_7D_14D: 1.16). Combined with the high-volume price decline, this suggests sentiment may be shifting from optimism to tension.

- • On Jan 20th, short-term volatility began rising relative to medium-term volatility (

- • Market Sentiment (RSI):

- • At the November lows,

RSI_14dropped to 41.82, approaching oversold territory. - • As prices rose, RSI entered strong territory, reaching 67.34 on Jan 19th, close to overbought. It retreated to 57.07 on Jan 20th with the price correction, moving away from extreme levels. The sentiment indicator moved in sync with the price trend, without exhibiting a prolonged bearish divergence.

- • At the November lows,

IV. Relative Strength & Momentum Performance

- • Momentum Analysis: The underlying asset displayed a significant V-shaped reversal and strong upward momentum during the analysis period.

- • From the cycle low (2025-12-16) to the cycle high (2026-01-19), the price increased by 13.85%.

- • Short-term momentum was strong: as of Jan 19th,

WTD_RETURNwas 1.23% andMTD_RETURNreached 7.15%. - • Momentum Validation: The strong momentum aligns with the healthy volume-price relationships observed in Phase II (Demand Entry) and early Phase III (Markup). However, momentum began weakening in late January (negative

WTD_RETURNon Jan 20th), resonating with the supply pressure indicated by volume-price analysis.

V. Large Investor ("Smart Money") Behavior Identification

Based on Wyckoff principles and the volume-price analysis above, inferences regarding large investor intent are as follows:

- 1. Late Nov to early Dec 2025: Smart Money Accumulation. During the panic-driven, high-volume decline (Nov 21st) and the subsequent low-volume, gradual decline, large investors likely accumulated positions at low levels, exploiting market panic. The extreme contraction in volume (e.g., several volume ratios hitting decade-low levels on Dec 4th) indicated that floating supply was nearly exhausted, creating conditions for a subsequent rally.

- 2. Late Dec 2025 to early Jan 2026: Smart Money Rally & Attracting Followers. Through consecutive high-volume rallies (e.g., Dec 26th), smart money rapidly pushed prices higher, moving away from their cost basis while attracting trend-followers and retail buyers. This phase exhibited healthy, demand-driven action.

- 3. From mid-Jan 2026: Smart Money Begins Distribution. As prices hit new highs and market sentiment turned optimistic, signature smart money distribution behavior emerged:

- • The extreme-volume churning on Jan 14th: This likely represents large-scale distribution by smart money near the ~3030 high, utilizing robust retail buying interest. The massive volume consisted of significant buying (retail) and selling (smart money) simultaneously, yet price failed to advance.

- • The high-volume decline on Jan 20th: Distribution activity continued or accelerated, with supply becoming overt, causing prices to fall. By this point, smart money had successfully transferred a portion of holdings to the market.

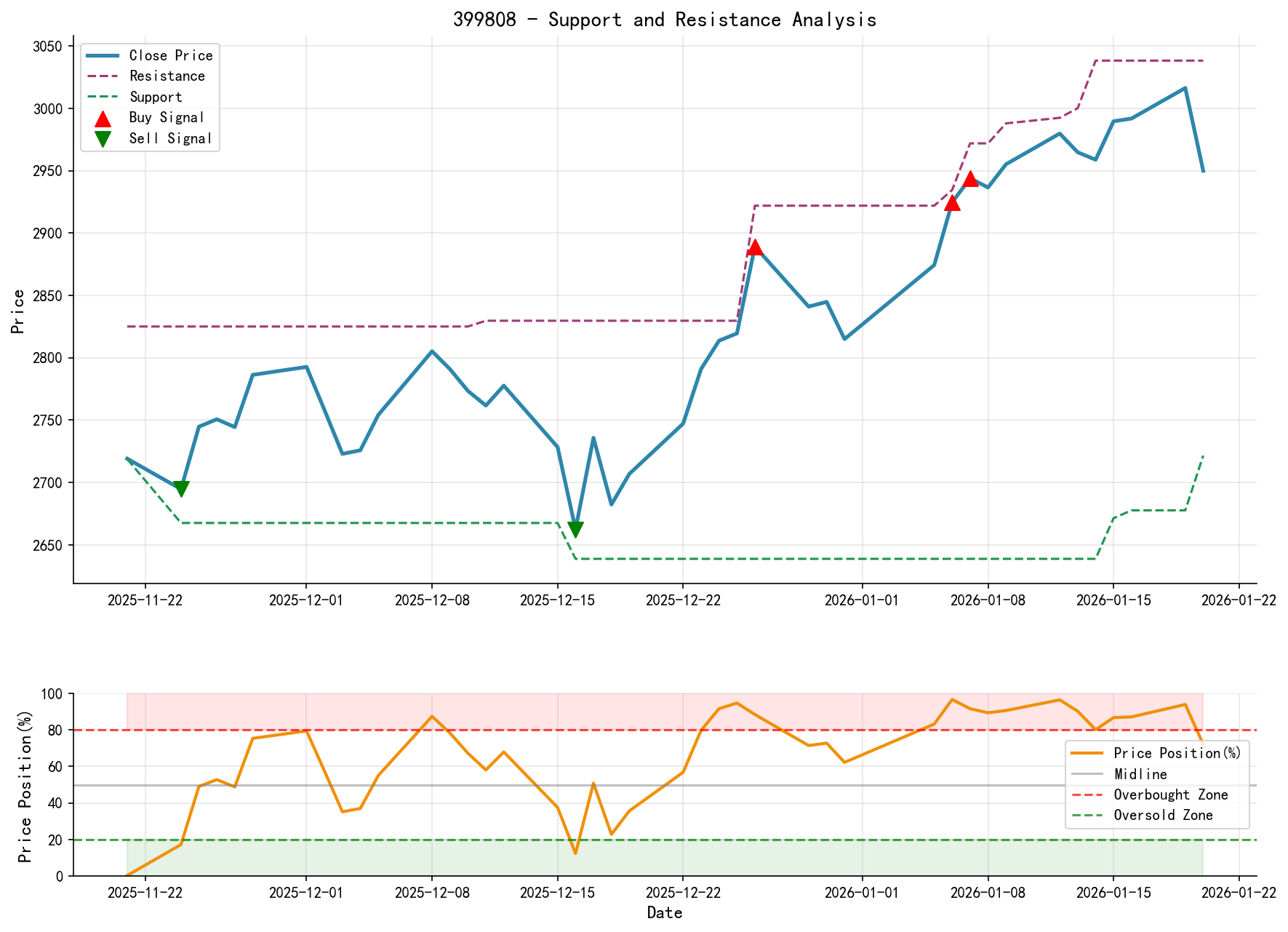

VI. Support/Resistance Level Analysis & Trading Signals

- • Key Support Levels:

- • Primary Support: ~2880-2900 zone. This area represents the top of the high-volume bullish candlestick on Dec 26th, the consolidation platform after the early-January breakout, and is near the current

MA_20D(~2890). A break below would seriously challenge the uptrend structure. - • Secondary Support: ~2800-2820 zone. The breakout origin from late December and the region of the

MA_30D. - • Ultimate Support: ~2700-2720 zone. The bottom range formed in Nov-Dec.

- • Primary Support: ~2880-2900 zone. This area represents the top of the high-volume bullish candlestick on Dec 26th, the consolidation platform after the early-January breakout, and is near the current

- • Key Resistance Levels:

- • Primary Resistance: ~3030-3040 zone. The recent highs, where extreme-volume churning occurred, forming a strong supply zone.

- • Integrated Wyckoff Events & Trading Signals:

- • Current Market Phase Judgment: The market has most likely entered the early Distribution phase. The primary evidence is the key bearish signal of "extreme-volume churning" on Jan 14th.

- • Operational Recommendation: Shift to a cautious stance, focusing on defense and identifying high-probability shorting opportunities.

- • Long Positions: Should begin reducing exposure or raising stop-loss levels. Any new long positions should be considered high-risk. Stops could be placed below 2880.

- • Short Positions: Could look for shorting opportunities on rebounds that stall near the 3000 level, with initial stops placed above 3040. A more robust short entry would require confirmation of a break below the key 2880-2900 support zone.

- • On the Sidelines: Recommend maintaining a wait-and-see approach, awaiting clearer directional signals from the market.

- • Future Validation Points:

- 1. Bearish Confirmation: A confirmed, closing break below the 2880-2900 support zone, accompanied by increased volume, would confirm completion of the Distribution phase and entry into a Markdown phase.

- 2. Bullish Negation (Current Judgment Error): If, after a brief correction, the price breaks above 3040 with strong, demand-driven volume and sustains above it, this would indicate the Jan 14th extreme volume may have been absorbed by even stronger subsequent demand, and the uptrend continues. Current data does not support this hypothesis.

Conclusion Reiteration: Based on the Wyckoff analysis of volume-price data for 399808 from 2025-11-21 to 2026-01-20, the market has completed a cycle rotation from Accumulation, through Markup, to initial Distribution. The core bearish signal stems from the "extreme-volume churning" event on 2026-01-14, which ranked 5th in the past decade, strongly suggesting large-scale investor distribution at historical highs. Investors are advised to shift from an aggressive long bias to a defensive posture and closely monitor the battle between buyers and sellers around the key 2880-2900 support zone.

Disclaimer: This report/interpretation is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risks; invest with caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Wyckoff Volume-Price Market Interpretations are released daily at 8:00 AM before the market open. Please feel free to comment and share; your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: