Very well, following your instructions, below is the comprehensive, in-depth quantitative analysis report based on the provided 399006 (Growth Enterprise Market Index) data. The report strictly adheres to the Wyckoff Method, deriving conclusions from six dimensions, all based on the provided data.

Growth Enterprise Market Index (399006) Wyckoff Price-Volume Analysis Report

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-20

Analysis Framework: Wyckoff Method | Quantitative Signals | Large Trader Intent Identification

I. Trend Analysis & Market Phase Identification

As of January 20, 2026, the underlying asset 399006 has an open price of 3340.46, a close price of 3277.98, with moving averages: MA_5D 3347.51, MA_10D 3340.50, MA_20D 3280.01. Daily Change: -1.79%, Weekly Change: -1.32%, Monthly Change: 2.34%, Quarterly Change: 2.34%, Yearly Change: 2.34%.

1. Moving Average Alignment & Price Action:

- • Earlier Period (Late November to Early December 2025): The market was in a recovery phase following a downtrend. Prices rebounded from ~2920 (Nov 21), successively rising above MA_5D and MA_10D, but remained consistently pressured below MA_20D, MA_30D, and MA_60D, showing a bearish alignment pattern.

- • Mid Period (Mid-December to Early January 2026): The market entered a strong uptrend (Markup). On December 8, prices broke through all moving average resistance with a 2.60% gain accompanied by a surge in volume (

VOLUME_AVG_14D_RATIO=1.03). Subsequently, MA_5D > MA_10D > MA_20D > MA_30D > MA_60D formed a standard bullish alignment, with prices operating above the moving averages and highs continuously rising (3190 -> 3388), confirming the uptrend. - • Recent Period (Mid-January 2026 to present): The market shows signs of trend weakening and reversal risk. Starting January 13, prices began to fall below MA_5D. By January 20, the closing price (3277.98) had fallen below both MA_5D (3347.51) and MA_10D (3340.50), though it remains above MA_20D (3280.01) and longer-term moving averages. MA_5D shows signs of turning downward, MA_10D is flattening, indicating the bullish alignment structure is beginning to loosen.

2. Market Phase Inference:

Based on price action and price-volume relationships (see below), data strongly suggests the market may be transitioning from the Markup phase to the Distribution phase.

- • Evidence A (End of Markup Characteristics): From January 5 to January 12, prices accelerated upward, with volume hitting extreme highs (ranking 4th-7th historically over the past decade), but price gains appeared feeble relative to the volume (e.g., only +0.82% on Jan 14). This aligns with the Wyckoff principle of "effort (volume) without result (price advance)," a signal for the early stages of distribution.

- • Evidence B (Reversal Signs): On January 13 and January 20, the market experienced high-volume declines (volume ranked 5th and remained high, with prices falling -1.96% and -1.79% respectively). This is a clear signal that supply is beginning to dominate the market. The breach of key short-term moving averages further confirms exhaustion of upward momentum.

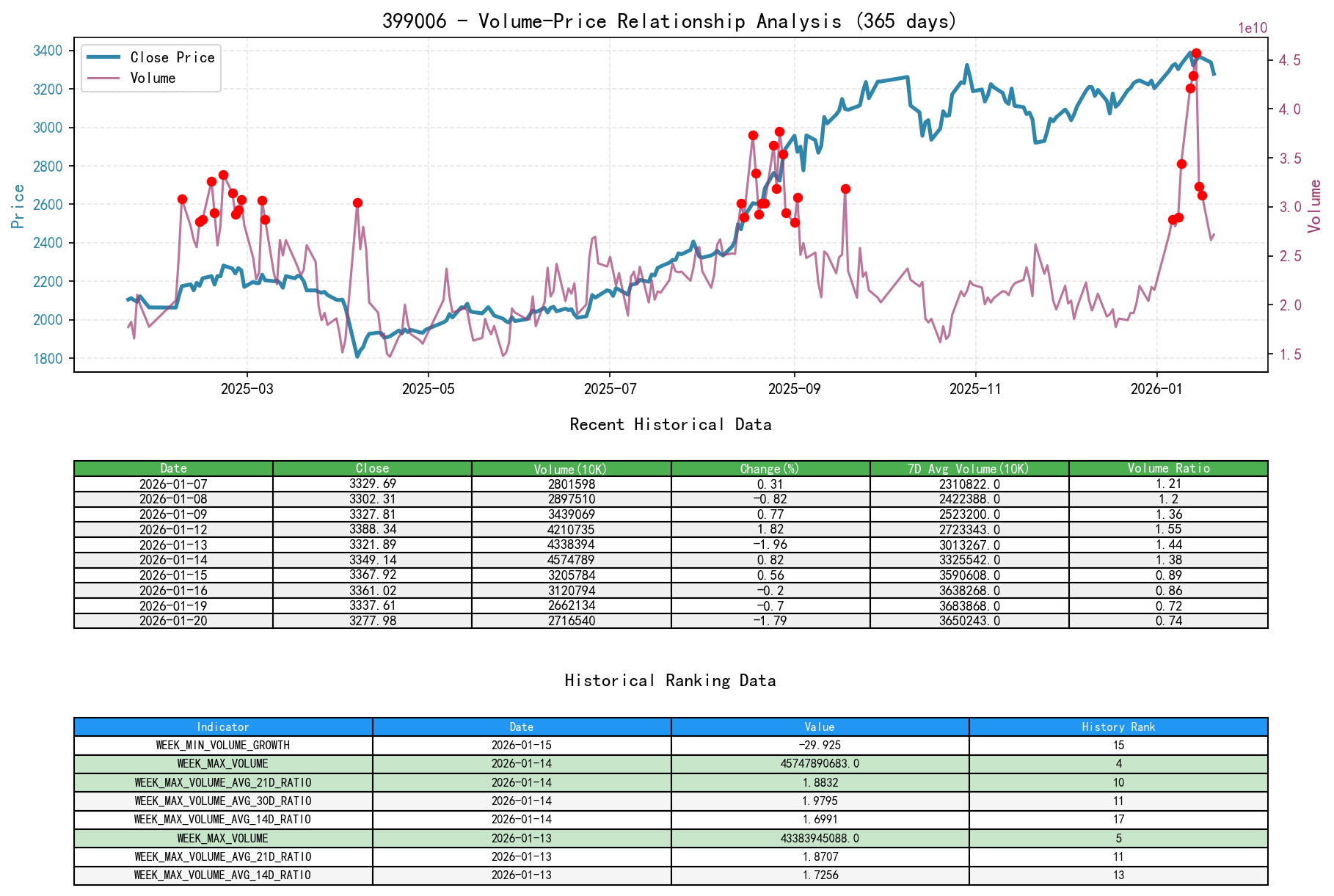

II. Price-Volume Relationship & Supply-Demand Dynamics

As of January 20, 2026, the underlying asset 399006 has an open price of 3340.46, a close price of 3277.98, volume of 27165406400, daily change of -1.79%, 7-day average volume of 36502432032.00, and a 7-day volume ratio of 0.74.

Core Finding: Recent extreme, historically significant high-volume activity, but the supply-demand relationship has qualitatively shifted.

1. Demand-Dominated Period (Accumulation/Early Markup):

- • December 8: Volume expanded by 3% compared to the 14-day average (

VOLUME_AVG_14D_RATIO=1.03), accompanied by a 2.60% price surge. This is a classic high-volume breakout signal, indicating strong demand entering the market. - • December 17: Following a prior correction, volume moderately increased (

VOLUME_AVG_7D_RATIO=0.97), and prices rebounded strongly by 3.39%, constituting a demand recovery signal post-Shakeout.

2. Supply-Dominated Period (Distribution/Early Markdown):

- • January 12-14: A critically significant distribution signal window. Volume reached near-decade highs for three consecutive days (ranking 4th, 5th, 7th), with corresponding

VOLUME_AVG_14D_RATIOvalues as high as 1.79, 1.73, 1.70 (historical ranks 10, 13, 17). However, price action showed:- • Jan 12: Up 1.82% (effort and result still somewhat matched, but showing signs of exhaustion).

- • Jan 13: High-volume plunge of -1.96% (

VOLUME_AVG_14D_RATIO=1.73). This is a clear signal of supply overwhelming demand. - • Jan 14: High-volume stagnation, with a mere 0.82% gain (

VOLUME_AVG_14D_RATIO=1.70), indicating extreme difficulty for prices to advance despite massive volume. - • Conclusion: The price-volume combination over these three days is typical of "climactic distribution." The enormous volume suggests exceptionally active share exchange among large investors, while price stagnation/decline indicates the power of distributors (supply) outweighing that of buyers (demand).

- • January 20: Volume remained elevated (

VOLUME_AVG_60D_RATIO=1.17), and prices fell -1.79% on high volume, continuing the supply-dominated pattern. Meanwhile,VOLUME_GROWTHwas only 2.04%, slowing from the massive growth of previous days, possibly indicating an absence of panic selling and instead orderly distribution.

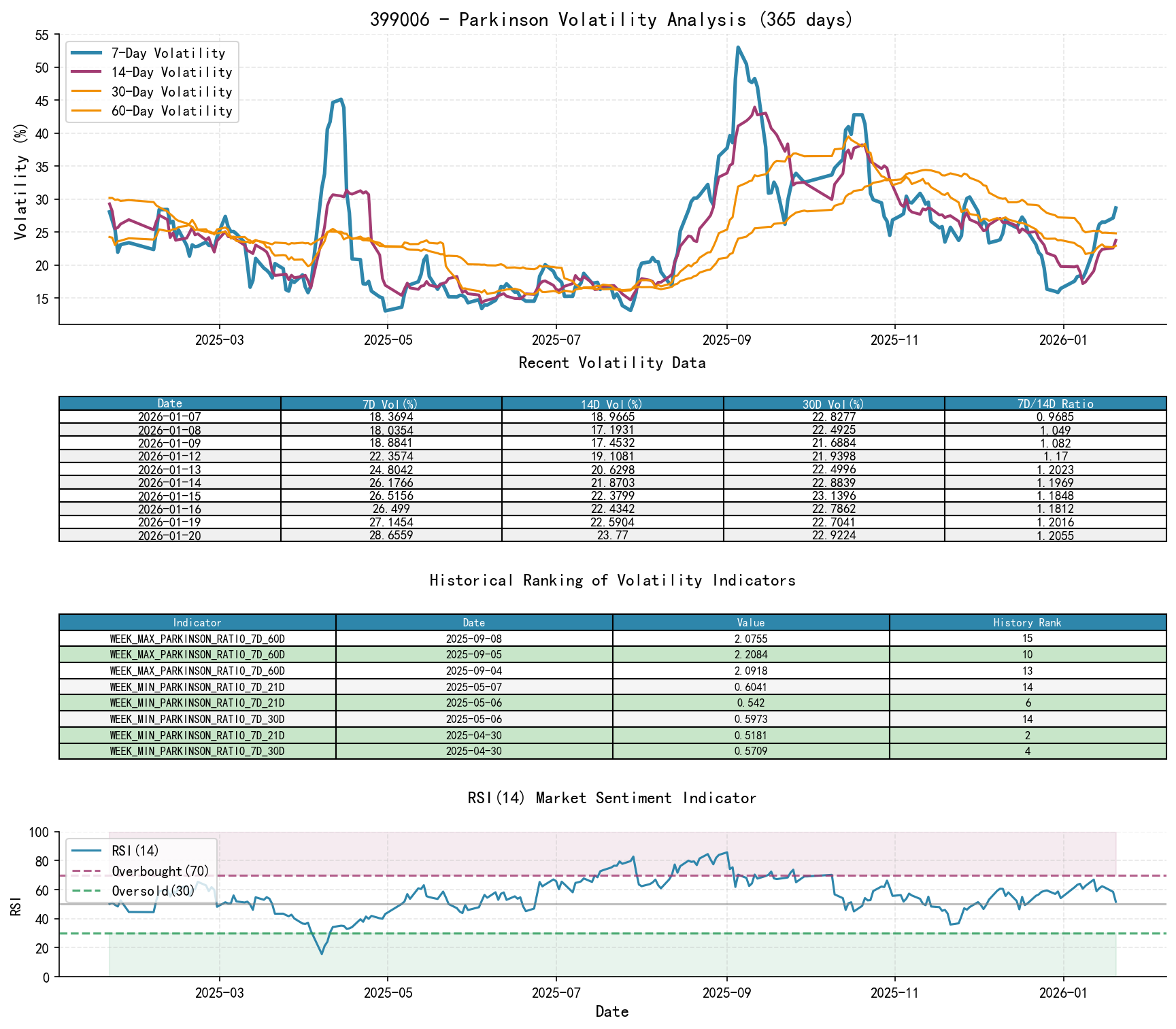

III. Volatility & Market Sentiment

As of January 20, 2026, the underlying asset 399006 has an open price of 3340.46, 7-day intraday volatility (Parkinson) of 0.29, 7-day intraday volatility ratio of 1.21, 7-day historical volatility of 0.27, 7-day historical volatility ratio of 1.03, and an RSI of 51.59.

1. Volatility Levels & Changes:

- • Historical Volatility (HIS_VOLA):

HIS_VOLA_7Drose from around 0.25 in early January to 0.27 by Jan 20;HIS_VOLA_14Drose from 0.30 to 0.26. Short-term volatility is not significantly higher relative to the long-term (HIS_VOLA_60D=0.30), suggesting overall market sentiment has not yet entered extreme panic, but tension is rising. - • Intraday Volatility (PARKINSON_VOL):

PARKINSON_VOL_7Drose consistently from 0.22 on Jan 12 to 0.29 on Jan 20, withPARKINSON_RATIO_7D_60Dreaching 1.15. This indicates a significant recent intensification of intraday price swings. This aligns with the observation of high volatility and sharp price oscillations at elevated levels, a leading indicator of potential trend change. - • RSI Sentiment Indicator: RSI_14 reached a high of 66.96 in the overbought zone on Jan 12, then retreated to 51.59 by Jan 20 amid price declines, having moved out of the overbought zone but not yet entering oversold territory. This corroborates the shift in market sentiment from optimistic euphoria to neutral-weak.

2. Sentiment Phase Assessment:

Market sentiment has transitioned from optimistic euphoria (accompanied by extreme volume) in early January to the current state of caution and divergence. Expanding volatility concurrent with price decline reflects strengthening bearish force, but it has not yet triggered widespread panic selling (volume not making new highs, RSI not oversold).

IV. Relative Strength & Momentum Performance

- • Short-term Momentum (WTD/MTD): As of Jan 20, the weekly return (

WTD_RETURN) is -1.32%, and the month-to-date return (MTD_RETURN) is 2.34%. Short-term momentum has turned from positive to negative, and the MTD return has significantly retraced from its peak of 5.78% on Jan 12. - • Mid-term Momentum (QTD/YTD): The quarter-to-date (

QTD_RETURN) and year-to-date (YTD) returns are both 2.34%, still positive. However, considering the index rose over 5% in January, the current return rate implies mid-term upward momentum has significantly decelerated. - • Momentum Conclusion: Momentum indicators across all timeframes point to exhaustion. The negative short-term momentum is direct evidence of a potential trend reversal, while the flattening mid-term momentum suggests the sustainability of the uptrend is challenged.

V. Large Trader ("Smart Money") Behavior Identification

Based on the above price-volume, volatility, and momentum analysis, the operational intent of large traders can be clearly inferred:

- 1. Distribution in Progress: The historically extreme high volume accompanied by price stagnation/decline on Jan 12-14 is textbook distribution behavior. Smart money leveraged the market's high sentiment and ample liquidity to conduct large-scale distribution in the ~3400 zone. The historical ranking data (volume rank 4th-7th) greatly enhances the reliability of this assessment, indicating this phenomenon is extreme even within the past decade.

- 2. Supply Dominates, Demand Dries Up: The high-volume declines on Jan 13 and 20 indicate that during the distribution process, supply completely overwhelmed demand. Buyers (possibly retail or late-institutional investors) were unable to sustain prices. The extreme negative

VOLUME_GROWTHof -29.92% on Jan 15 (historical rank 15) also hints at a rapid retreat of follow-on buying interest after the climax of distribution. - 3. Current Phase: The market is likely in Phase B of the Distribution phase (reaction or trading range). Smart money has completed most of its distribution. After prices broke below short-term support, they are now testing the support strength of mid-term moving averages (e.g., MA_20D). Their intent is to observe whether sufficient demand re-enters at key levels to decide on subsequent actions (e.g., secondary distribution or directly entering the markdown phase).

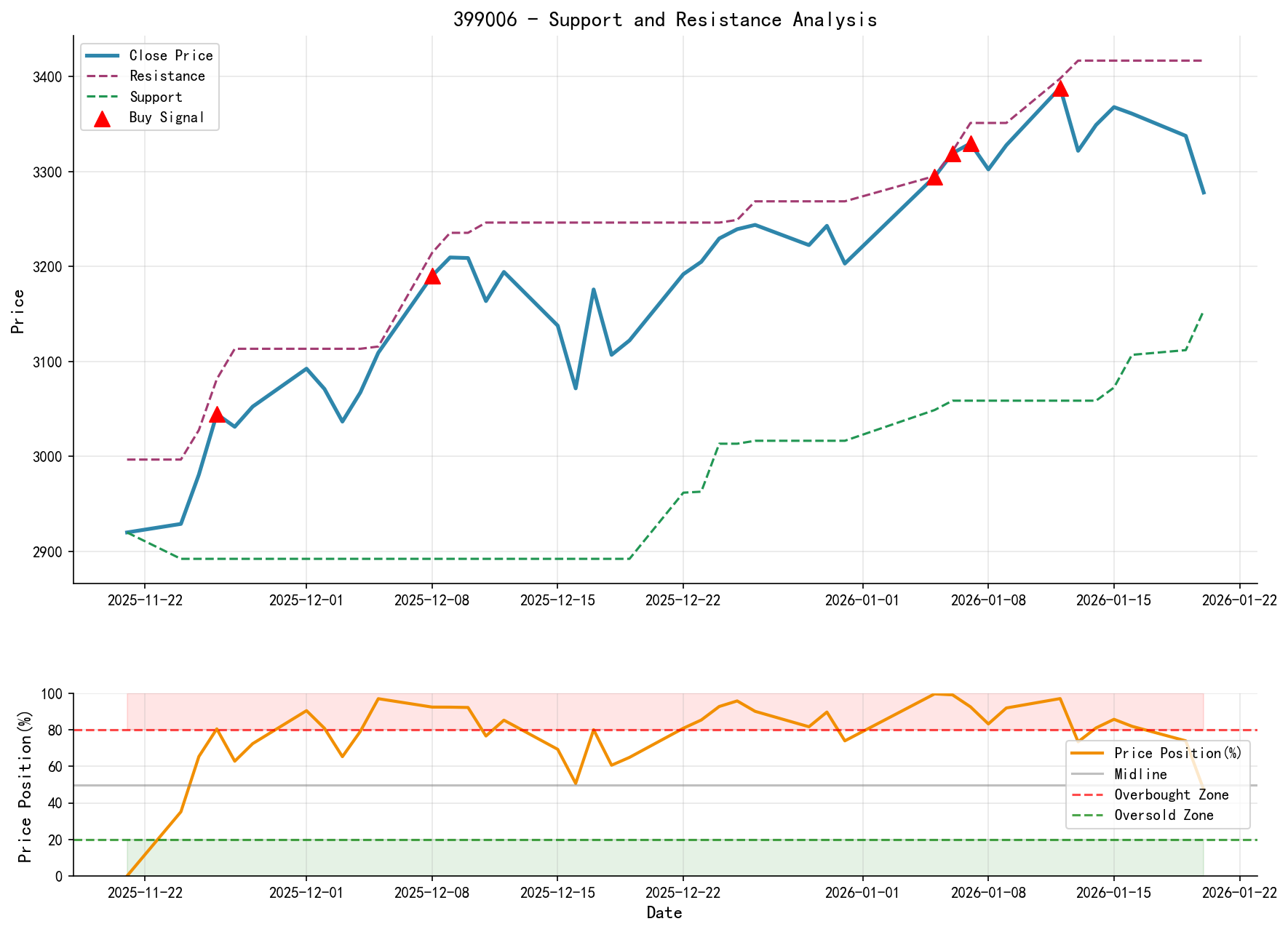

VI. Support/Resistance Level Analysis & Trading Signals

Key Levels:

- • Strong Resistance: 3400 points. This is the double-top area formed on Jan 12-13, accompanied by historically extreme volume, and is confirmed as the primary distribution/supply zone.

- • Intermediate Resistance/Trendline: 3300 points. This is the upper bound of the recent trading range and coincides with MA_10D. Failure to decisively reclaim this level on a rebound would maintain the weak structure.

- • Near-term Support: ~3250 points (near the Jan 20 low) and ~3200 points (Jan 13 low). A break below 3250 would test the 3200 integer level.

- • Critical Support: MA_20D (~3280 points) and MA_60D (~3180 points). These moving averages represent the lifeline of the intermediate-term trend. A decisive break below MA_20D would confirm a short-term bearish shift; a break below MA_60D would signal a potential intermediate-term trend reversal.

Comprehensive Wyckoff Trading Signals & Operational Recommendations:

- • Primary Trend Signal: Bearish. The core logic is the occurrence of historically extreme high-volume distribution at highs, followed by price breaking below key short-term moving averages, coupled with weakening momentum indicators.

- • Operational Recommendations:

- • For Holders (Long Positions): Should reduce positions or exit on a price rebound near the 3300 resistance zone. Use a close below 3250 as the final stop-loss signal.

- • For Observers/Traders:

- • Aggressive Short Opportunity: Consider a light short position if price rebounds into the 3290-3310 zone and shows signs of exhaustion (e.g., small candlestick body, long upper wick). Place a stop-loss above 3350.

- • Key Observation Points: Monitor price action around 3280 (MA_20D) and 3200 points. If low-volume stabilization/rebound occurs, it may present a short-term bounce opportunity, but upside is limited (targeting 3300). If a high-volume break below 3200 occurs, it would open up further downside, providing a clearer signal to follow the downtrend.

- • Future Validation Points:

- 1. Conditions to Invalidate Bearish View: Price needs to break out and sustain above 3400 with strong, high volume, accompanied by healthy volume (moderate expansion). This would negate the distribution structure, suggesting the market has absorbed supply and resumed the uptrend.

- 2. Conditions to Confirm Bearish View: Price fails again near 3300 on a rebound and turns down, or breaks below 3200 support with high volume. This would likely confirm the market's entry into the Wyckoff Markdown phase.

Report Summary: The Growth Enterprise Market Index, after a strong rally, exhibited near-decade rare, high-volume activity with clear distribution characteristics in the ~3400 zone. Subsequently, prices broke below short-term moving averages on high volume, and momentum weakened. Data analysis suggests smart money may have completed large-scale distribution, with supply beginning to dominate the market. The current strategy should prioritize risk defense. Any rebound should be viewed as an opportunity to reduce exposure or structure tactical short positions, unless price can decisively reclaim and hold above key resistance levels.

Disclaimer: This report/analysis is solely for market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding accuracy or completeness. Markets involve risks; invest with caution. Any investment actions based on this report are taken at your own risk.

Thank you for your attention! Wyckoff Price-Volume Market Analysis is published daily at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: