Very well, as per your instructions. As a quantitative trading researcher proficient in the Wyckoff method, I will compose a comprehensive, in-depth, and data-driven quantitative analysis report based on the provided 000989.SH data (2025-11-21 to 2026-01-20) and historical ranking data.

Wyckoff Quantitative Analysis Report: 000989.SH

Product Code: 000989.SH

Analysis Date Range: 2025-11-21 to 2026-01-20

Report Generation Date: 2026-01-20

Core Summary:

Integrating price-volume, volatility, market structure, and historical extreme data, we judge that 000989.SH is currently at the tail end of a large-scale distribution phase. In December 2025, the market experienced significant institutional accumulation (manifested as panic selling and absorption) at low levels (the 5400-point zone), which triggered a strong rebound. However, entering January 2026, after the price rebounded to a key resistance zone (the 5750-point zone), consecutive occurrences of high-volume stagnation and high-volume plunges were observed, accompanied by a sharp spike in volatility. This strongly suggests that large investors are leveraging market optimism for distribution at high levels. The current price has retreated below the short-term rising trendline, with a bearish medium-term structure. A bearish strategy is recommended, seeking shorting opportunities upon a rebound near resistance levels.

1. Trend Analysis & Market Phase Identification

As of 2026-01-20, the underlying 000989.SH has the following metrics: Opening Price 5743.83, Closing Price 5737.45, 5-Day MA 5671.38, 10-Day MA 5686.92, 20-Day MA 5607.18, Daily Change +0.02%, Weekly Change +1.24%, Monthly Change +2.58%, Quarterly Change +2.58%, Year-to-Date Change +2.58%.

- • Moving Average Alignment Analysis: Throughout the observation period, the long-term moving averages (MA_60D, MA_30D, MA_20D) have consistently remained above the medium and short-term moving averages, forming a standard bearish alignment, confirming the long-term downtrend. However, since late December, the price (CLOSE) has successfully broken above the MA_5D and MA_10D, briefly approaching the MA_20D. The MA_5D has also crossed above the MA_10D, indicating that the short-term trend has shifted from a unilateral decline to a fluctuating rebound.

- • Price Action & Market Phase:

- • 2025-11-21 to 12-10: End of Decline & Initial Stabilization. Price rebounded from the low of 5275 points, with volume moderately expanding (VOLUME_AVG_7D_RATIO > 1). The RSI recovered from the oversold zone (29.91). This aligns with Wyckoff characteristics of "stopping action" or "preliminary support."

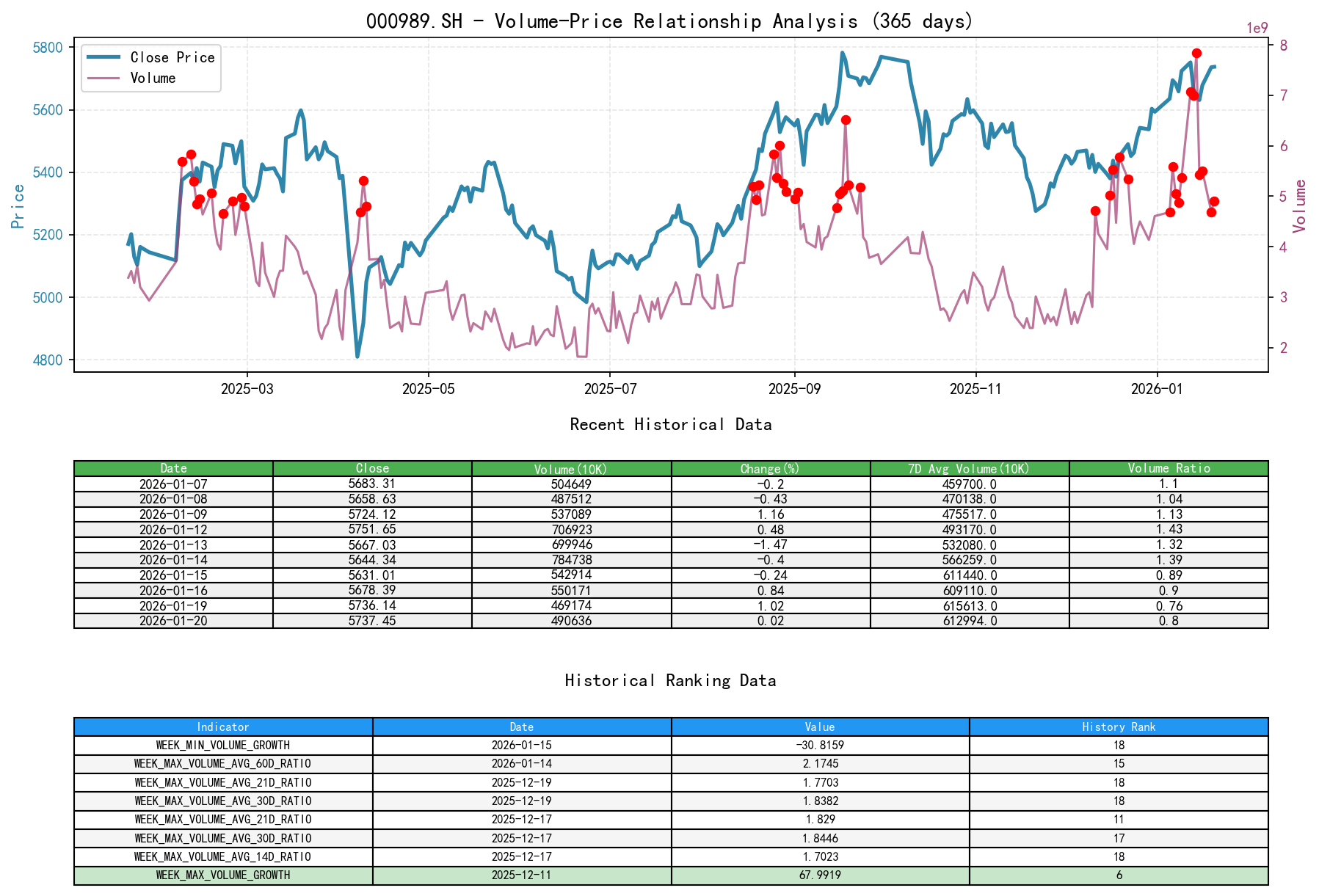

- • 2025-12-11 to 12-19: Panic Selling & Large-Scale Accumulation. This is the key phase. On December 11th, a massive-volume plunge occurred (volume 4.71 billion, a sequential increase of +67.99%, ranking as the 6th highest single-day volume increase in nearly a decade). However, the closing price only fell slightly by -1.00% and was located in the lower half of the day's range, forming a contradictory combination of "heavy volume decline with relative price resilience." Subsequent trading days (12-17, 12-19) continued to show high volume accompanied by price increases (VOLUME_AVG_14D_RATIO reached 1.70 and 1.60 respectively, both ranking within the top 20 historically). This aligns with Wyckoff's "Selling Climax" and subsequent "Automatic Rally" and "Secondary Test" characteristics, indicating large-scale capital absorbing shares during the panic, which is typical accumulation behavior.

- • 2026-01-05 to 01-20: Accelerated Rebound & Signs of Distribution. The price continued its rebound, reaching a new phase high of 5756.25 on January 12th. However, observations reveal: ① On the day of the new high, volume was extremely high (7.07 billion) but the gain was limited (+0.48%). The very next day (January 13th) saw a high-volume plunge (-1.47%) with volume reaching 7.00 billion, marking the 5th highest turnover value record in nearly a decade. This pattern of "high-volume stagnation at highs followed by a high-volume plunge" is a classic distribution signal. Although the price saw minor rebounds afterward, volume energy significantly contracted (VOLUME_AVG_7D_RATIO dropped to 0.76-0.90), indicating insufficient buying demand at higher levels.

Phase Judgment: The market has transitioned from the accumulation phase in mid-to-late December to the distribution phase in early-to-mid January, and is currently in the post-distribution decline or retest phase.

2. Volume-Price Relationship & Supply-Demand Dynamics

As of 2026-01-20, the underlying 000989.SH has the following metrics: Opening Price 5743.83, Closing Price 5737.45, Volume 4906365500, Daily Change +0.02%, Volume 4906365500, 7-Day Average Volume 6129940457.14, 7-Day Volume Ratio 0.80.

- • Key Daily Volume-Price Signals:

- • Demand-Dominated Days: 2025-12-17 (Price +1.06%, Volume +10.14%, VR 1.44), 2025-12-19 (Price +1.20%, Volume +29.21%, VR 1.32), 2026-01-06 (Price +1.05%, Volume +19.37%, VR 1.28). These high-volume up-days are evidence of strong demand during the accumulation and rally phases.

- • Supply-Dominated Days (Key Warnings):

- • 2025-12-11: Ultimate Supply Signal. Price decline (-1.00%) accompanied by extreme volume expansion (VR 1.70, volume growth rank historically 6th). Massive selling emerged, but the closing price did not make a new low, hinting at strong demand absorption below.

- • 2026-01-13 & 01-14: Distribution Confirmation Signal. Following the new high, two consecutive days of high-volume declines (VR 1.32 and 1.39 respectively). Notably, the turnover value on January 14th reached 144.5 billion, setting the 3rd highest record in nearly a decade. This indicates that at the rebound highs, supply (selling pressure) completely overwhelmed demand.

- • Insufficient Demand Days: 2026-01-19, 01-20, the price showed minor fluctuations, but volume significantly contracted to 76%-80% of the 7-day average, indicating weak market follow-through buying appetite and exhaustion of upward momentum.

- • Supply-Demand Dynamics Conclusion: The panic selling in December was absorbed by massive demand, leading to a depletion of supply and triggering a rebound. However, upon reaching highs in January, supply regained dominance and flooded the market, while demand failed to keep pace effectively. The supply-demand balance has been broken, shifting to oversupply.

3. Volatility & Market Sentiment

As of 2026-01-20, the underlying 000989.SH has the following metrics: Opening Price 5743.83, 7-Day Intraday Volatility 0.16, 7-Day Intraday Volatility Ratio 1.13, 7-Day Historical Volatility 0.16, 7-Day Historical Volatility Ratio 1.08, RSI 64.44.

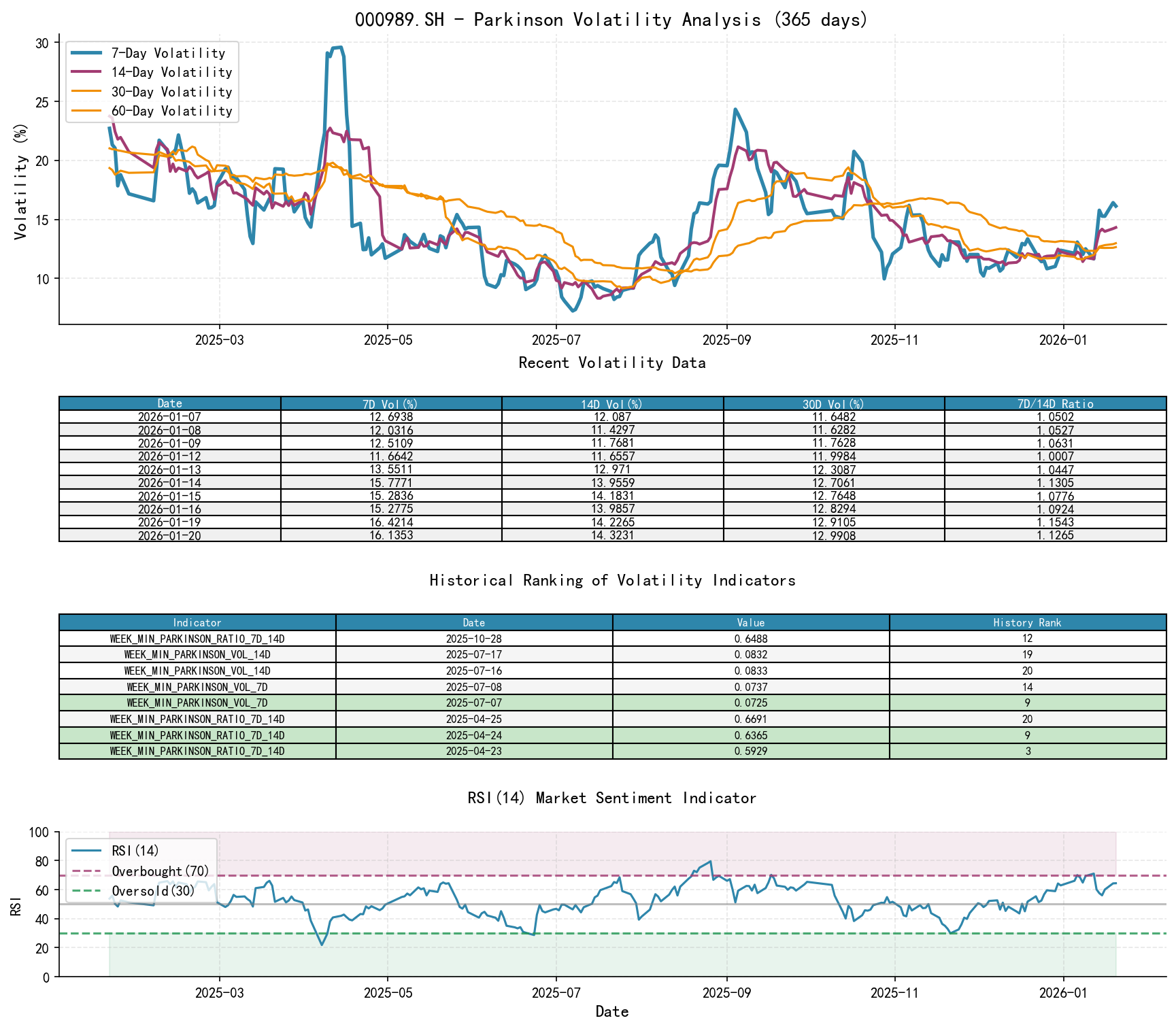

- • Volatility Levels: Both short-term historical volatility (HIS_VOLA_7D) and Parkinson volatility exhibited two significant peaks in mid-December (accumulation period) and mid-January (distribution period), corresponding to intense fluctuations in market panic and optimism, respectively. HIS_VOLA_RATIO_7D_14D reached as high as 1.21 on January 13th, indicating a sharp amplification of short-term volatility exceeding recent averages, a typical characteristic of unstable sentiment at trend extremes.

- • Market Sentiment (RSI): The RSI rebounded after touching the oversold zone (29.91) in early December, reaching a high of 71.07 on January 12th (near overbought), then quickly retreated to the current 64.44. The RSI's retreat from overbought levels coincided with high-volume price declines at highs, confirming a shift in sentiment from optimism to caution.

Sentiment Conclusion: Market sentiment has completed a full cycle of "panic (December) -> optimism (early January) -> hesitation/turn (mid-January)." Current volatility remains at a relatively high level, indicating significant market divergence, but the peak in sentiment has passed.

4. Relative Strength & Momentum Performance

- • Periodic Returns:

- • Short-term Momentum (WTD, MTD): Was significantly positive in early January (e.g., +1.63% WTD on Jan 6th) but has recently weakened or turned negative, indicating exhaustion of short-term upward momentum.

- • Medium-term Momentum (QTD, YTD): Despite the recent rebound, QTD returns (since December) have been negative for most of the period. Although YTD (2026) shows a positive return (+2.58%), it is significantly weaker than the rebound's peak in late December, revealing a still fragile medium-term momentum structure.

- • Momentum Validation: The short-term strong rebound failed to reverse the medium-to-long-term weakness, which aligns with the Wyckoff theory that "the trend will resume its downtrend after distribution." The momentum performance corroborates the conclusions from the volume-price analysis.

5. Large Investor ("Smart Money") Behavior Identification

Based on the above analysis, we infer the operational intent of large investors as follows:

- • December 2025 (Accumulation Phase): At the 5400-point zone, they conducted large-scale, proactive absorption by leveraging market panic (the massive-volume decline on Dec 11th). Historical ranking data shows that volume ratios (relative to 14, 21, 30-day averages) during this period were all within the top 20 historically. This is not retail behavior but organized large-scale fund positioning activity.

- • January 2026 (Distribution Phase): After successfully pushing the price up to the 5750-point resistance zone, they began reverse operations. From January 12th to 14th, amid high market sentiment and retail chasing, they distributed at high levels. This is evidenced by: ① New highs with minimal gains (supply resistance); ② Immediately suppressing the price with even greater volume the next day (active selling); ③ Turnover values reaching historical extremes (ranks 3rd and 5th). This is typical "distributing shares to the public" behavior.

- • Current Intent: Major distribution activity may be nearing completion. Subsequent actions may involve creating rebounds (like the low-volume minor gains on Jan 19-20) to attract the final wave of longs, or directly conducting downtrend "shakeouts" to clean up remaining floating supply.

6. Support/Resistance Level Analysis & Trading Signals

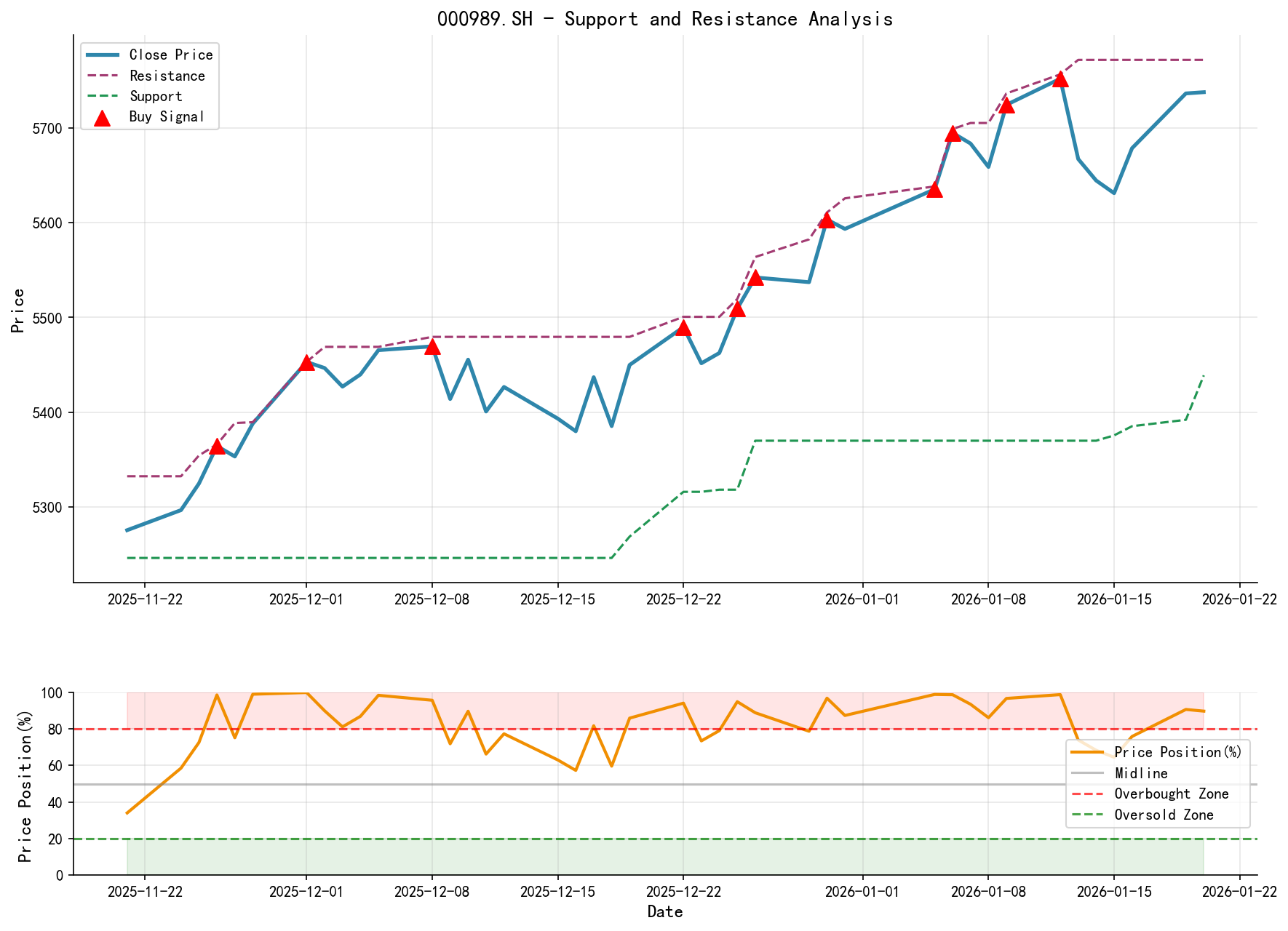

- • Key Resistance Levels:

- • R1: 5750-5770 Zone. The recent multiple-test highs (2026-01-12, 01-13), also the core area where distribution occurred. Strong resistance.

- • R2: 5700 Zone. Short-term psychological barrier and recent oscillation midpoint.

- • Key Support Levels:

- • S1: 5600-5620 Zone. The recently touched support level, also the starting area of the January rally. A break below would confirm the post-distribution downtrend.

- • S2: 5400-5430 Zone. The upper boundary of the December 2025 accumulation range. A crucial medium-term bull-bear demarcation line.

- • Comprehensive Trading Signals & Operational Recommendations:

- • Primary Signal: Bearish.

- • Operational Recommendations:

- 1. Aggressive Shorting: Wait for the price to rebound to the 5700-5720 resistance zone and show signs of exhaustion (e.g., small body candlesticks, long upper shadows) or short-term weakening signals. Consider establishing short positions then. Initial stop-loss set above 5770.

- 2. Conservative Shorting / Add-on Point: A clear break below the 5600 support level (e.g., daily close below 5600) can be regarded as confirmation of the downtrend, providing an opportunity to add to short positions. Stop-loss can be moved down to just above 5650.

- 3. Long-side Caution: Unless the price effectively breaks through and sustains above 5770, all long-side actions should be considered counter-trend trades with extremely high risk. Participation is not recommended.

- • Future Validation Points:

- • Bearish View Confirmed: Price breaks below 5600 on high volume, and rebounds fail to reclaim this level.

- • Bearish View Invalidated: Price breaks through 5770 on high volume and sustains above it, with pullbacks not making new lows. This may suggest the distribution was absorbed by stronger demand, necessitating a reassessment of the market phase.

End of Report

Disclaimer: The content of this report/analysis is solely market analysis and research based on publicly available information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding its accuracy or completeness. The market involves risks; investment requires caution. Any investment actions based on this report are taken at one's own risk.

Thank you for your attention! Wyckoff Volume-Price Market Analysis is released daily at 8:00 AM before the market opens. Comments and shares are sincerely appreciated; your recognition is crucial. Let us work together to perceive market signals.

Member discussion: