As a quantitative trading researcher proficient in the Wyckoff Method, I will now write a comprehensive and in-depth quantitative analysis report based on the XRPUSDT data you provided.

XRPUSDT Wyckoff Quantitative Analysis Report

Symbol: XRPUSDT

Analysis Date Range: 2025-11-13 to 2026-01-12

Report Generation Time: 2026-01-13

1. Trend Analysis and Market Phase Identification

As of January 12, 2026, the subject XRPUSDT had an opening price of 2.07, a closing price of 2.06, a 5-day moving average (MA) of 2.11, a 10-day MA of 2.13, a 20-day MA of 2.00, with a daily change of -0.54%, weekly change of -12.12%, monthly change of +12.00%, quarterly change of +12.00%, and yearly change of +12.00%.

Based on the arrangement of price relative to moving averages (MA) and price action, we identify that XRPUSDT experienced a complete Wyckoff cycle phase during the analysis period.

- • Long-term Trend (Bearish Alignment): At the beginning of the analysis period (mid-November), the price (~2.32) was already below all key moving averages (MA_5D/10D/20D/30D/60D), with the MA_60D in a persistent downtrend (falling from 2.648 to 2.046), establishing the primary theme of a long-term downtrend.

- • Panic Selling and Automatic Rally: From November 17 to December 15, the price plummeted from 2.1637 to 1.8981, with bearish MA alignment intensifying. During this period, there were multiple instances of high-volume long bearish candlesticks (e.g., Nov 20, 21), and the RSI dipped to a low of 31.7, consistent with the characteristics of Panic Selling in Wyckoff theory. Subsequently, the market entered an Automatic Rally phase in mid-to-late December, with the price rebounding to the 1.95-2.05 range.

- • Secondary Test and Accumulation Range: From late December to early January, the price consolidated in a narrow range between 1.82-1.95 with significantly reduced volume (e.g., the VOLUME_AVG_7D_RATIO was only 0.48 on Dec 27). During this time, MA_5D and MA_10D gradually flattened and converged, typical behavior for conducting a "Secondary Test" and "Accumulation" of the previous panic lows. On January 2, a "gapping-up, high-volume medium bullish candlestick" (PCT_CHANGE: +6.76%, VOLUME_AVG_60D_RATIO: 1.03) marked a potential breakout attempt from the accumulation range.

- • Strong Markup and Signs of Distribution: From January 2 to January 5, the price surged rapidly from 2.0069 to 2.3478, a gain of 17%, forming a steep uptrend. Short-term MAs (MA_5D, MA_10D) quickly crossed above medium-term MAs (MA_20D, MA_30D), forming a bullish alignment. However, on January 5 and 6, volume reached record highs (VOLUME_AVG_60D_RATIO of 1.80 and 2.30, respectively), yet the price formed long upper shadows or closed lower — these are preliminary signs of distribution.

- • Current Phase (Secondary Test / Potential Distribution): As of January 12, the price has retreated from its peak to 2.0633. The bullish MA alignment structure remains, but the price has broken below MA_5D and MA_10D. The market is conducting a "Secondary Test" of the rapid markup in early January. If this test fails, it could confirm the start of a distribution phase.

Conclusion: The market completed a minor cycle of "decline-accumulation-markup" during the analysis period and is currently in the "critical testing phase following an uptrend". Close attention should be paid to supply pressure near the early January highs.

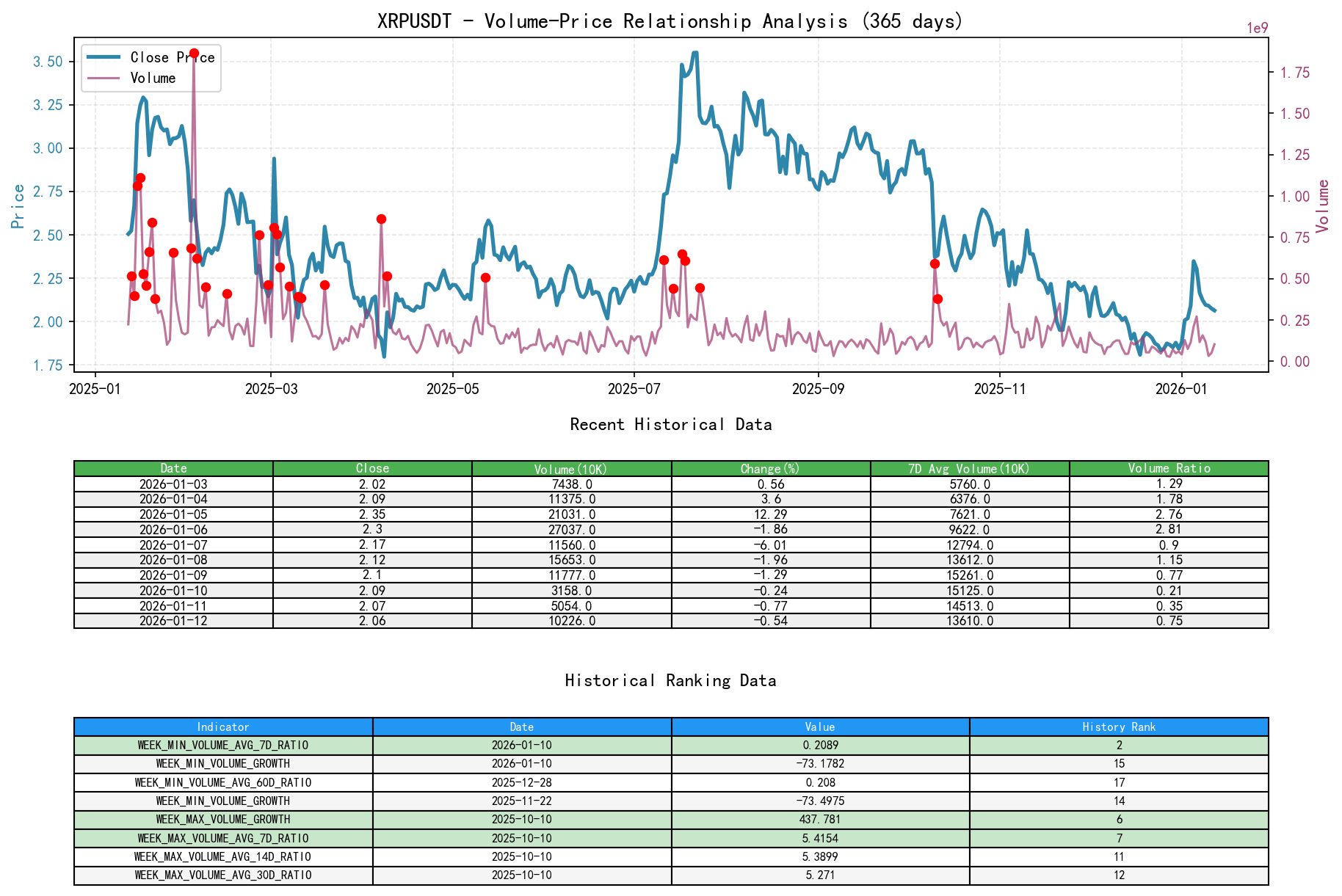

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, the subject XRPUSDT had an opening price of 2.07, a closing price of 2.06, a volume of 102,269,183.40, a daily change of -0.54%, a 7-day average volume of 136,106,020.44, and a 7-day volume ratio of 0.75.

Volume-Price analysis is key to identifying shifts in supply and demand. We have identified several key turning points with clear supply-demand signals.

- • Supply-Driven Decline (Mid-late November):

- • 2025-11-20/21: The price fell by -5.21% and -2.45% respectively, with volume surging to 1.92x and 2.22x the 60-day average. This is a classic "high-volume decline", indicating overwhelming supply (selling pressure), which was the core force driving the price breakdown.

- • Weak Bounce with Lack of Demand (Late December):

- • 2025-12-27 to 2025-12-30: The price staged a minor bounce, but volume remained consistently low, with VOLUME_AVG_60D_RATIO between 0.24 and 0.39. This is a "low-volume bounce", indicating a lack of genuine demand support for the rise, characteristic of a technical rebound.

- • Demand-Driven Markup Initiation (Early January):

- • 2026-01-02: The price rose by 6.76%, with volume spiking to 1.03x the 60-day average, ending the prolonged low-volume state and marking the first significant demand entry.

- • 2026-01-05: The price surged by 12.29%, with volume at 1.80x the 60-day average — a case of "rising price with rising volume", with demand fully dominating the market.

- • Supply Warning for Distribution (Early January):

- • 2026-01-06: The price fell by -1.86%, but volume hit a record high (2.30x the 60-day average). This is "high-volume stagnation/decline", a strong signal of renewed supply entering the market, suggesting the advance may be stalling.

- • 2026-01-12 (Latest Trading Day): The price closed down -0.54%, with volume (VOLUME_AVG_7D_RATIO: 0.75) significantly higher than the previous day (0.35). A failed rebound accompanied by increased volume indicates notable supply (selling pressure) at current price levels.

Conclusion: The supply-demand relationship underwent a complete cycle of "overwhelming supply dominance → demand vacuum → strong demand breakout → renewed supply emergence". The current (Jan 12) volume-price relationship shows significant supply encountered during the price pullback/rebound, warranting caution for a potential rebound failure.

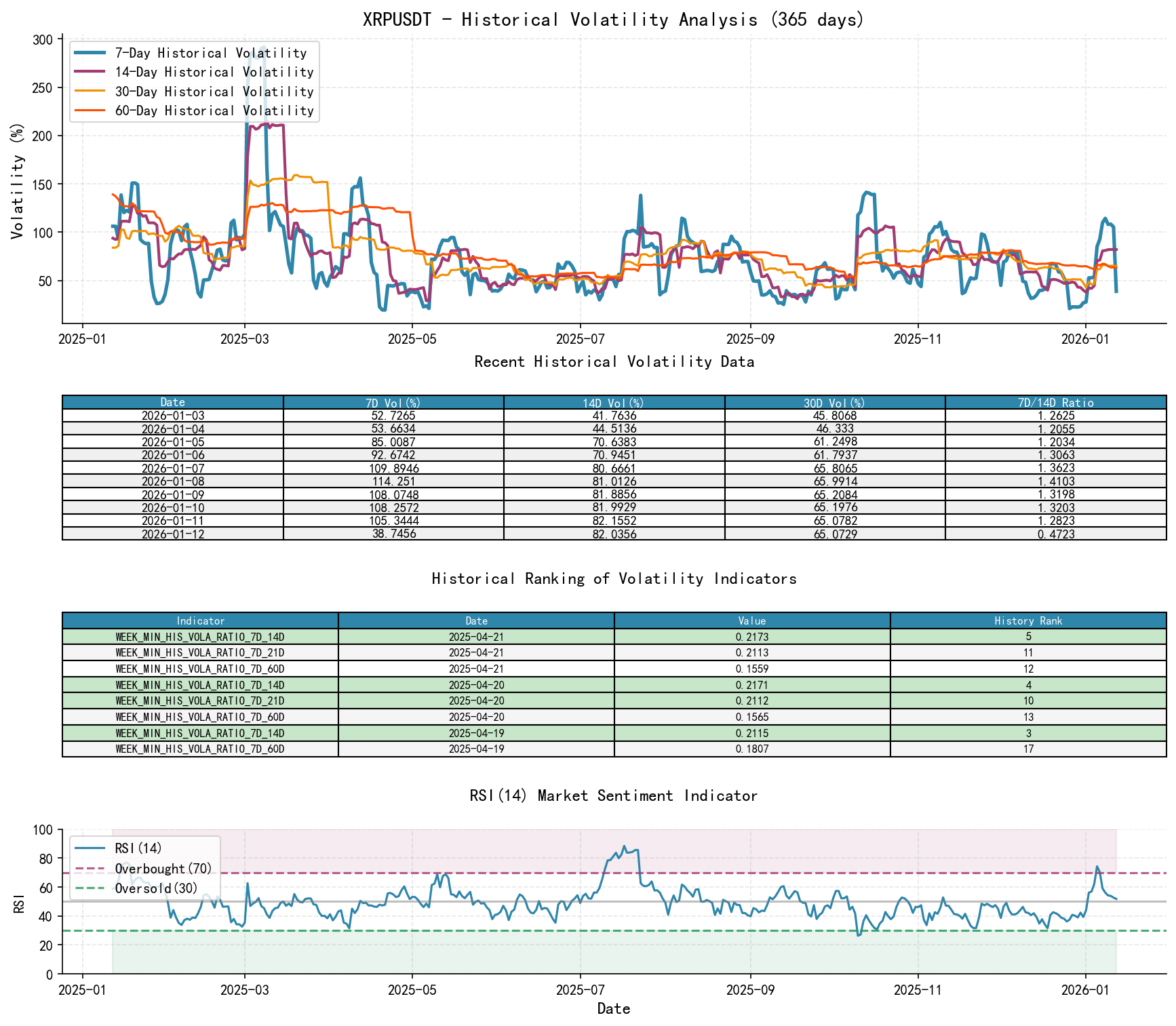

3. Volatility and Market Sentiment

As of January 12, 2026, the subject XRPUSDT had an opening price of 2.07, a 7-day intraday volatility of 0.58, a 7-day intraday volatility volume ratio of 0.95, a 7-day historical volatility of 0.39, a 7-day historical volatility volume ratio of 0.47, and an RSI of 51.83.

Volatility levels and their changes reveal the evolution of market sentiment from panic to euphoria and then to cooling.

- • Volatility Contraction and Sentiment Nadir: In late December, PARKINSON_VOL_7D and HIS_VOLA_7D continued to trend lower. Notably, on 2025-12-28, the Parkinson volatility dropped to 0.286, with historical ranking data indicating this was the "18th lowest level in nearly ten years", suggesting a quiet market with depressed sentiment, in a state of consolidation.

- • Volatility Spike and Euphoric Sentiment: The markup initiated on January 2 was accompanied by a sharp rise in volatility. HIS_VOLA_7D surged from 0.53 (Jan 2) to 1.10 (Jan 7). A rapid expansion in volatility over a short period typically indicates trend acceleration and a shift into euphoric sentiment, often a characteristic of a trend's terminal phase.

- • Sentiment Indicator Validation: RSI_14 touched the oversold zone at 31.7 at the bottom of the panic sell-off (Nov 21); reached the overbought zone at 74.3 at the peak of the rally (Jan 5); and has since retreated to a neutral 51.8. The RSI trajectory perfectly confirms the sentiment cycle from pessimism to optimism.

- • Current Sentiment State: The 7-day historical volatility has retreated rapidly from the high of 1.10 to 0.39, indicating that euphoric sentiment has significantly cooled, and the market has entered a period of calm observation.

Conclusion: Market sentiment went through a typical cycle of "depression → euphoria → cooling". The current decline in volatility from highs, combined with the price entering a test, suggests the market is transitioning from emotion-driven action to a stage of balanced supply-demand博弈.

4. Relative Strength and Momentum Performance

Returns across different periods reveal the strength changes in short-term and medium-term momentum.

- • Medium-term Momentum Turning from Weak to Strong: MTD_RETURN (month-to-date return) was still -14.5% on December 31 but had turned positive to +12.0% by January 12, indicating that following the strong January rally, medium-term downward momentum was completely reversed, establishing positive momentum.

- • Short-term Momentum Stalling and Retreating: The key WTD_RETURN (week-to-date return) reached a high of +26.85% in the week ending January 5, showing extremely strong short-term explosive force. However, in the subsequent two weeks (ending Jan 12), weekly returns were -12.12% and +11.99% respectively, indicating that short-term upward momentum encountered strong resistance with high volatility, disrupting the continuity of the advance.

- • Slight Improvement in Long-term Weak Structure: QTD_RETURN (quarter-to-date return) narrowed from -35.3% on December 31 to -28.0%, but the absolute value remains large, suggesting that while the long-term downtrend has eased due to the recent rally, it has not yet been reversed.

Conclusion: Medium-term (monthly) momentum has strongly turned positive, but short-term (weekly) momentum shows signs of exhaustion, casting doubt on the sustainability of the upward momentum. The market is at a short-term adjustment juncture within a medium-term rally structure.

5. Large Investor (Smart Money) Behavior Identification

Combining the above volume-price, volatility, and trend analysis, we infer the operational intent of large investors.

- • Accumulation Phase (Mid-late December): During the period of extreme market quiet (volatility hitting a phase low), shrinking volume, and narrow price consolidation, large investors were likely engaged in "stealth accumulation". The high-volume breakout on January 2 can be viewed as "scrambling for shares" or "marking up away from the cost zone" following the completion of accumulation.

- • Distribution Phase (January 5-6): At the peak of the rapid markup and market euphoria, there were record-breaking high volumes (2.3x the 60-day average) and price stagnation. This is highly likely large investors conducting "distribution", exchanging their holdings to retail investors chasing the rally at these elevated levels.

- • Current Behavior (Testing Demand): On January 12, the price rebounded from lows but closed lower with increased volume. This could be large investors "testing the strength of market demand" after the price retraced to a potential support level. A high-volume failed rebound suggests insufficient follow-through buying. If the price cannot quickly reclaim the 2.11 level in the future, Smart Money may conclude demand is exhausted and proceed with further distribution.

Conclusion: Smart Money appears to have completed a round of operations during the analysis period: "stealth accumulation at the bottom → markup and distribution at the top". The market is currently in the critical stage of "testing remaining demand to decide the intensity of the next distribution move".

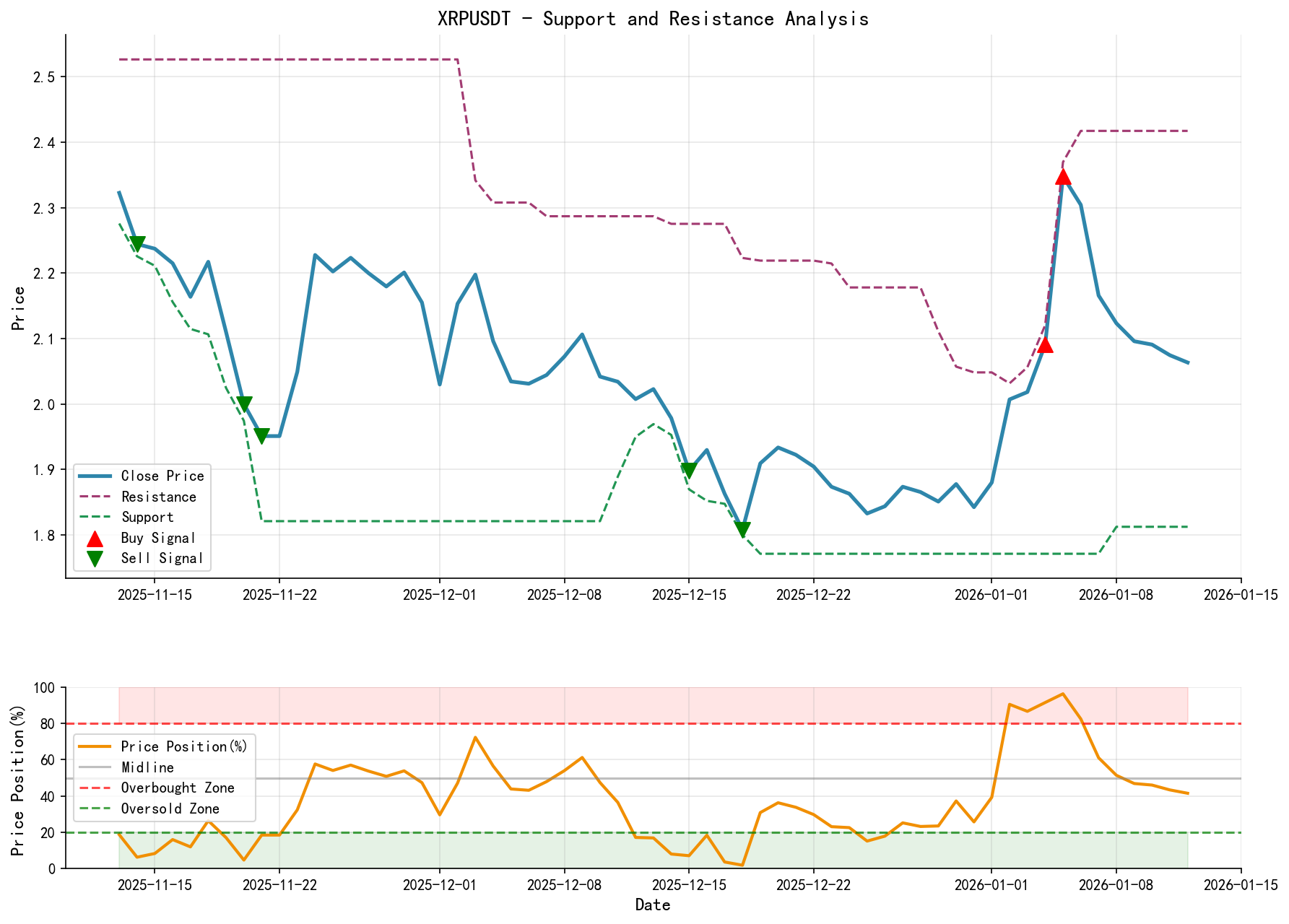

6. Support/Resistance Level Analysis and Trading Signals

Key Level Identification:

- • Major Resistance Levels:

- 1. R1: 2.3478 / 2.3695 — The highs and upper shadows formed on January 5-6, representing the upper boundary of the recent distribution zone and a strong resistance.

- 2. R2: 2.1100 / 2.1232 — The lower boundary of the consolidation platform formed on January 9-11, now broken and acting as nearby resistance.

- • Major Support Levels:

- 1. S1: 1.9509 - 1.9784 — The upper boundary of the dense trading range formed from December 22 to January 1, representing a recent supply-demand balance area.

- 2. S2: 1.8981 — The panic low on December 15, representing a stronger support level.

Integrated Trading Signals and Operational Recommendations:

- 1. Market Characterization: Currently in the "Secondary Test" phase within a medium-term rally structure, facing short-term supply pressure. Direction is unclear, risk is higher than opportunity.

- 2. Core Signal: Exercise caution and wait for demand confirmation signals.

- 3. Operational Recommendations:

- • Bullish Scenario (Low Probability, Requires Strong Signal Confirmation): If the price can break through and firmly hold above R2 (2.11) with significant volume (VOLUME_AVG_7D_RATIO > 1.2), the short-term downtrend test may be over. Consider entering a light long position with a target at R1 (2.35) and a stop loss set below 2.05.

- • Bearish Scenario (Higher Probability, Requires Confirmation): If the price rebound is continuously suppressed below R2 (2.11) with no increase in volume, or if the price breaks below S1 (1.95) with volume, it confirms the Secondary Test failure, and the market may revert to a downtrend. Consider establishing a short position upon breaking S1, targeting S2 (1.90), with a stop loss set above 2.03.

- • Current (Post-Close on Jan 12): Price is within a cluster of MAs, and volume-price shows emerging supply. Not recommended to open new positions. Existing holders should consider reducing exposure or setting tight stop-losses.

Future Validation Points:

- 1. Demand Validation: Can the price in the 1.95-2.06 region show low-volume stabilization or high-volume advance? This is key to determining if Smart Money is accumulating again.

- 2. Supply Validation: Does the price, upon rebounding to the 2.10-2.12 region, again form a "high-volume stagnation" candlestick? This would confirm ongoing distribution behavior.

- 3. Volatility Validation: If the price chooses a direction (especially downward), observe whether PARKINSON_VOL_7D spikes again, which would be a concomitant signal of a new trend initiation.

Disclaimer: All conclusions in this report are derived based on the provided historical data and the principles of Wyckoff Volume-Price analysis and do not constitute any investment advice. Financial markets carry significant risks; please make decisions prudently.

Thank you for your attention! Wyckoff Volume-Price market interpretation is published daily at 8:00 before market open. We kindly ask for your comments and shares, as your recognition is crucial. Let's work together to see the market signals.

Member discussion: