Okay, following your instructions, I will act as a quantitative trading researcher proficient in the Wyckoff Method. Based on the XLY data (2025-11-13 to 2026-01-12) and its historical ranking metrics you provided, I will write a comprehensive and in-depth quantitative analysis report. All conclusions will be strictly derived from the data and will adhere to Wyckoff's principles of volume and price analysis.

XLY (Consumer Discretionary Select Sector SPDR Fund) Quantitative Analysis Report

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

Core Objective: To extract supply and demand Alpha signals and identify the intentions of large investors based on the Wyckoff Method.

1. Trend Analysis and Market Phase Identification

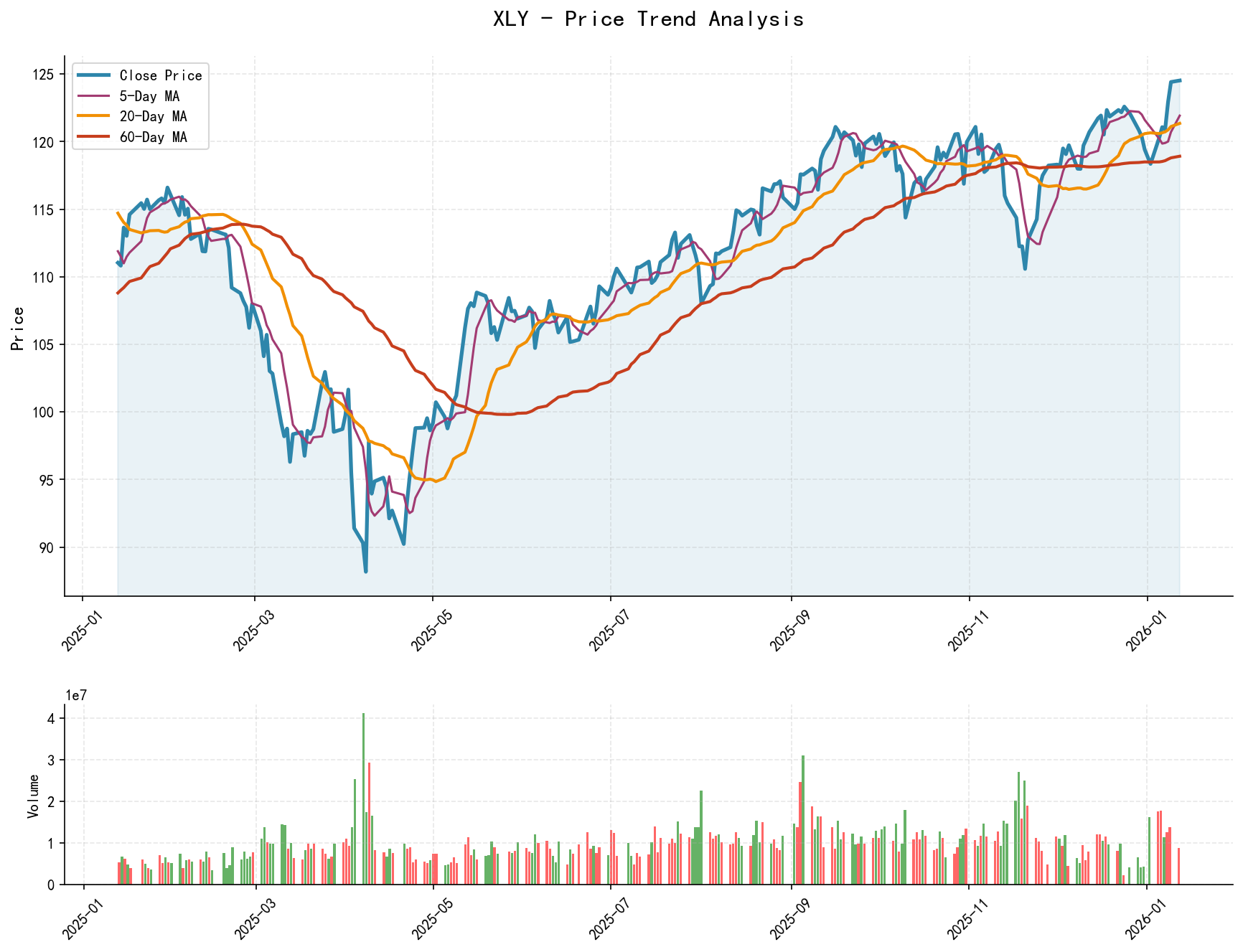

As of 2026-01-12, the underlying asset XLY had an opening price of 123.87, a closing price of 124.52, a 5-day moving average of 121.92, a 10-day moving average of 121.06, a 20-day moving average of 121.35, a daily change of +0.09%, a weekly change of +3.51%, a monthly change of +4.28%, a quarterly change of +4.28%, and an annual change of +4.28%.

- • Moving Average Alignment and Price Action:

- • Bullish Alignment Established: Since late November 2025, XLY successfully bottomed and rebounded. By the end of the analysis period (2026-01-12), its price (124.52) had clearly broken above all key moving averages (MA_5D: 121.92, MA_10D: 121.06, MA_20D: 121.35, MA_30D: 120.44, MA_60D: 118.92), presenting a standard bullish alignment pattern. Short-term moving averages (MA_5D, MA_10D) are above the long-term ones and provide dynamic support for the price.

- • Key Moving Average Crossovers: Around 2025-11-25, MA_5D crossed above MA_20D, forming a "Golden Cross," confirming the start of a short-term uptrend. Subsequently, MA_10D also crossed above MA_20D, further strengthening the medium-term bullish structure.

- • Market Phase Inference (Wyckoff Perspective): Combining the price action (continuous rebound from the mid-November low of 110.58 to a new all-time high of 124.52) and volume-price relationship (detailed below), the market clearly experienced a complete Wyckoff cycle segment: Panic Selling (around 2025-11-20) -> Automatic Rally/Secondary Test -> Accumulation (late November to early December 2025) -> Markup (mid-December 2025 to present). The current market is in the Wyckoff Markup Phase, with prices continuously reaching new highs driven by demand.

2. Volume-Price Relationship and Supply-Demand Dynamics

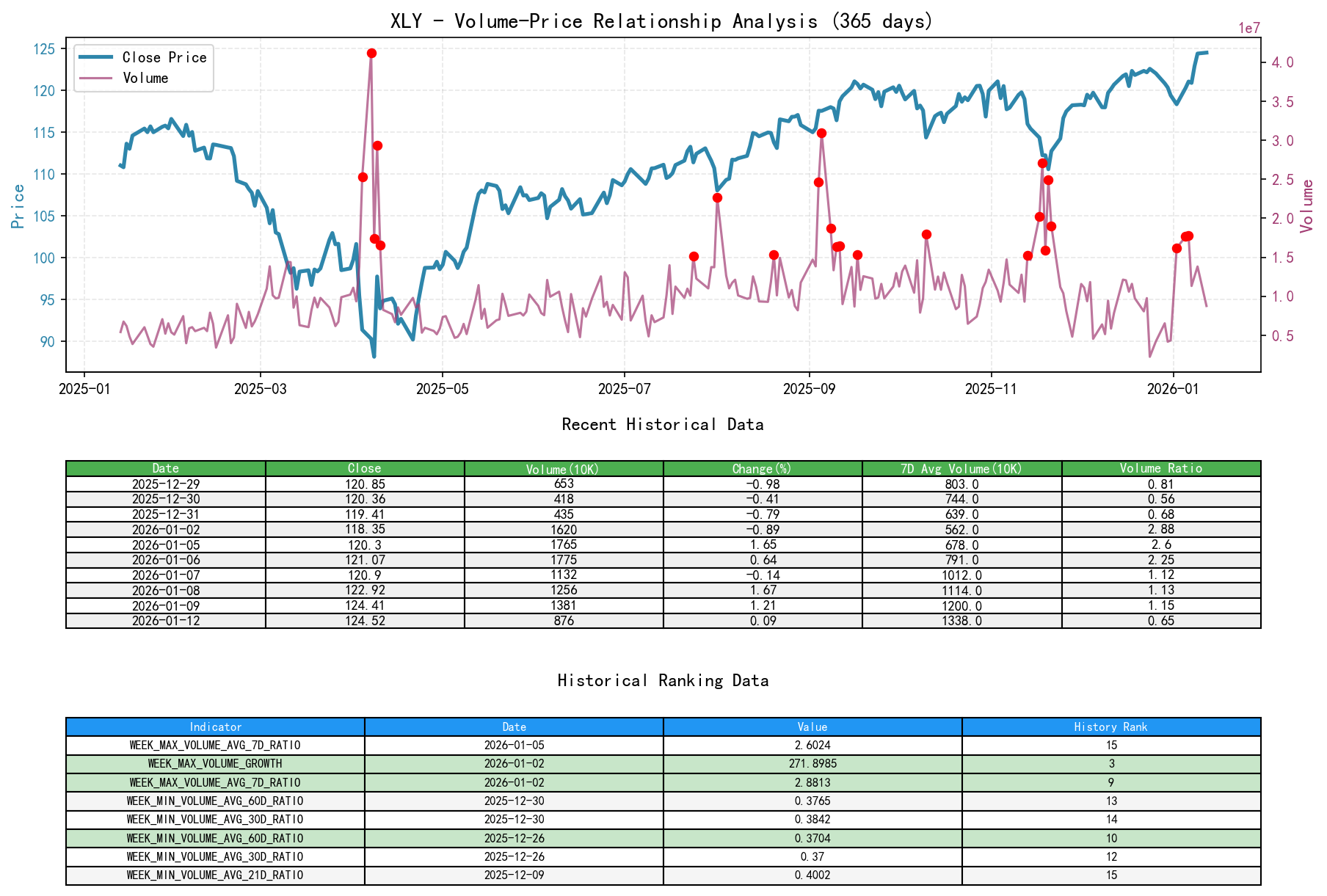

As of 2026-01-12, the underlying asset XLY had an opening price of 123.87, a closing price of 124.52, a volume of 8,763,060, a daily change of +0.09%, a 7-day average volume of 13,383,083.43, and a 7-day volume ratio of 0.65.

- • Core Volume-Price Signal Analysis:

- 1. Supply-Driven Decline (Selling Climax): On 2025-11-18 and 2025-11-20, prices fell by -1.85% and -1.49%, respectively, but volume expanded significantly (VOLUME_AVG_30D_RATIO was 2.32 and 2.02, respectively). Notably, on November 18th, volume reached 27.05 million, more than 2.3 times the 30-day average, and the amount (AMOUNT) ranked 12th in the past decade on a weekly basis, indicating large-scale supply (selling) emerged, possibly accompanied by panic, aligning with the Wyckoff characteristics of "Panic Selling" or "Terminal Shakeout."

- 2. Initial Signs of Demand Intervention: On 2025-11-21, the price rebounded +1.96% after consecutive declines. Although volume (19.01 million) decreased from the previous day, it remained significantly above the recent average (VOLUME_AVG_30D_RATIO: 1.48). This shows that active buying (demand) began absorbing at the low levels, effectively absorbing the supply.

- 3. Confirmation of Demand Strength: On 2025-11-25, the price surged +2.14%, breaking through the previous consolidation range, but volume (10.39 million) actually contracted (VOLUME_AVG_30D_RATIO: 0.81). Subsequently, on 2025-12-01, the price rose slightly, and volume (11.58 million) significantly recovered compared to the previous few trading days (VOLUME_GROWTH: +139.89%), indicating the rise was confirmed by incremental funds.

- 4. Breakout and Supply Test: On 2026-01-02, the first trading day of the new year, the price fell -0.89%, but volume surged by 272% (16.20 million), and the volume/7-day average ratio (2.88) reached the 9th highest extreme level in the past decade on a weekly basis. This typically means a large amount of supply emerged at the new price level or event-driven selling pressure. However, the next day (2026-01-05), the price immediately rebounded +1.65% on heavy volume (17.65 million), completely recovering the loss and reaching a new high. This constitutes a Wyckoff "Spring at Support" or a "successful test of supply shock," indicating that the massive selling was fully absorbed by stronger demand, a highly bullish signal.

- 5. Healthy Volume-Price Action During Uptrend: During the subsequent rise (2026-01-08 to 01-12), prices continued to make new highs, with volume remaining active but not exhibiting extreme expansion (VOLUME_AVG_60D_RATIO between 0.79 and 1.25). This shows demand steadily pushing prices higher without encountering large-scale supply resistance, indicating a healthy trend.

- • Supply-Demand Conclusion: The market experienced a supply-driven panic decline in mid-to-late November. Subsequently, demand forces strongly intervened at key levels (110-112 area) and absorbed all selling pressure. Entering 2026, a massive supply shock was quickly digested, confirming the absolute dominance of demand. The current market's supply-demand dynamics are strongly bullish.

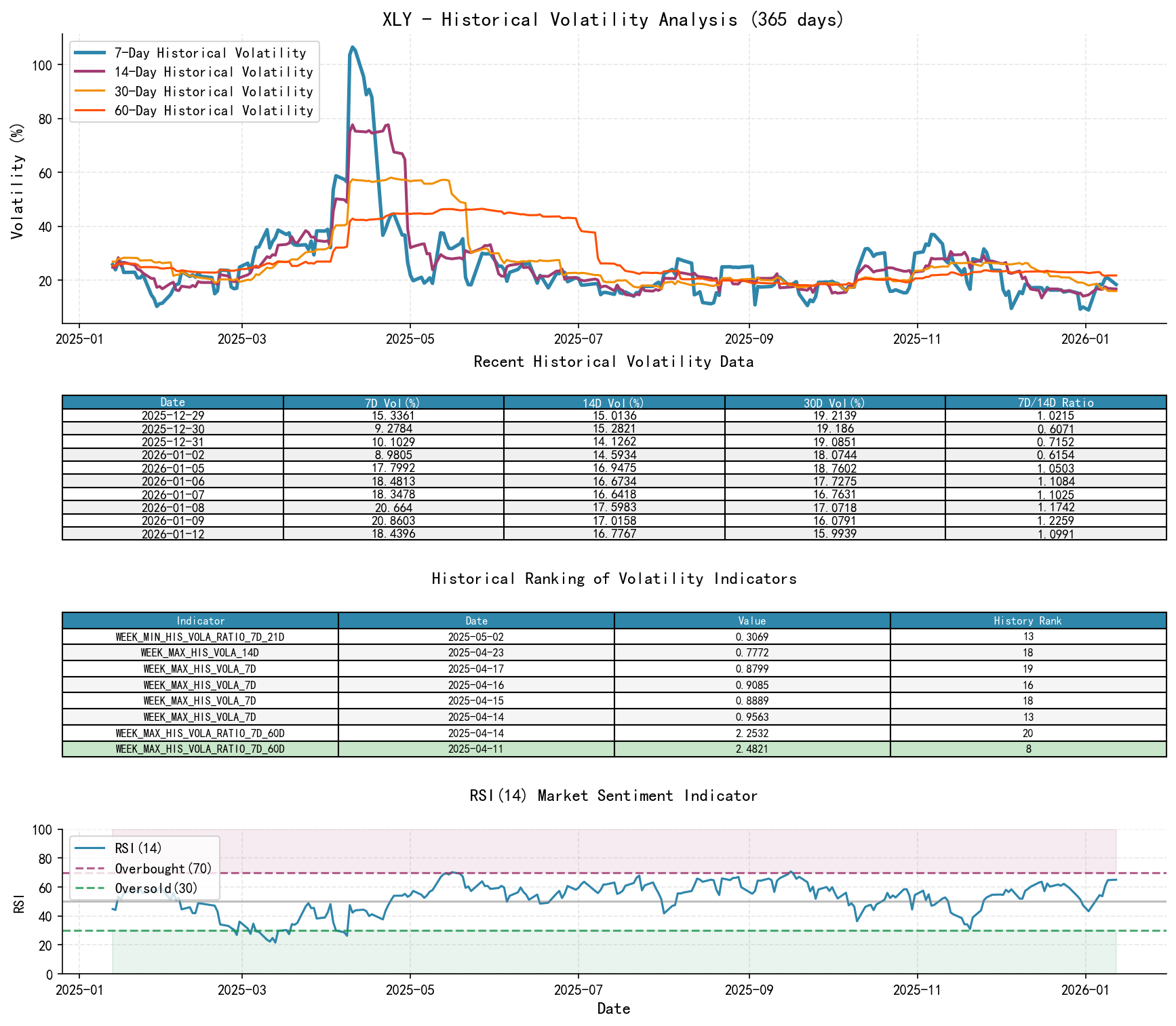

3. Volatility and Market Sentiment

As of 2026-01-12, the underlying asset XLY had an opening price of 123.87, a 7-day intraday volatility of 0.20, a 7-day intraday volatility volume ratio of 1.46, a 7-day historical volatility of 0.18, a 7-day historical volatility volume ratio of 1.10, and an RSI of 65.10.

- • Volatility Analysis:

- • Volatility Expansion: During the price rise, short-term volatility has consistently exceeded long-term volatility. The Parkinson Volatility Ratio (PARKINSON_RATIO_7D_14D) reached 1.47 on 2026-01-09, with its weekly maximum ranking as high as 10th in the past decade; the next day (01-12), this ratio was 1.46, ranking 13th. This indicates recent intraday price movements have been exceptionally volatile and trend-enhancing, a typical characteristic of trend acceleration.

- • Sentiment Status: RSI_14 climbed from an oversold low of 31.02 on November 20th to 65.10 on 2026-01-12. The current RSI is in the strong zone but not overbought (>70), indicating sufficient upward momentum and optimistic but not overheated market sentiment. The expansion in volatility and the strong rise in RSI corroborate each other, pointing to active trend-driven buying, not panic.

4. Relative Strength and Momentum Performance

- • Momentum Analysis:

- • Comprehensive Strength: XLY's momentum performance is very strong across all timeframes: short-term (WTD_RETURN: +3.51%), medium-term (MTD_RETURN: +4.28%), and long-term (YTD: +4.28%). This indicates its rise is not a short-term bounce but is supported by funds across multiple time dimensions, possessing sustained relative strength.

- • Momentum Validation: The strong momentum performance is fully consistent with the conclusions of the bullish trend, healthy volume-price relationship, and expanding volatility (characteristic of trending markets), mutually validating the effectiveness and strength of the current uptrend.

5. Large Investor (Smart Money) Behavior Identification

Based on Wyckoff principles and the above data, inferences regarding large investor behavior are as follows:

- • Accumulation: At the end of the price decline in mid-to-late November 2025, the counterparties absorbing the massive selling (e.g., on November 18th) were likely smart money. They accumulated shares from retail panic selling, completing accumulation in the bottom area.

- • Shakeout and Test: The heavy-volume decline on January 2, 2026, may have consisted of two parts: some selling influenced by events or sentiment, and another part possibly being a "shakeout" by large investors to flush out weak long positions. The strong reversal and recovery on January 5th then showed the smart money's intention to quickly test and confirm that supply at that level had been cleared before continuing to push prices higher.

- • Markup (Pushing Higher): During the process of breaking through previous highs (around 122-123 area) and reaching new all-time highs (124.52), volume remained active but not uncontrolled, indicating large investors are pushing prices higher in a controlled and steady manner, not engaging in final distribution. The recent extremely high Parkinson Volatility Ratios also reflect active institutional fund operations within the trend.

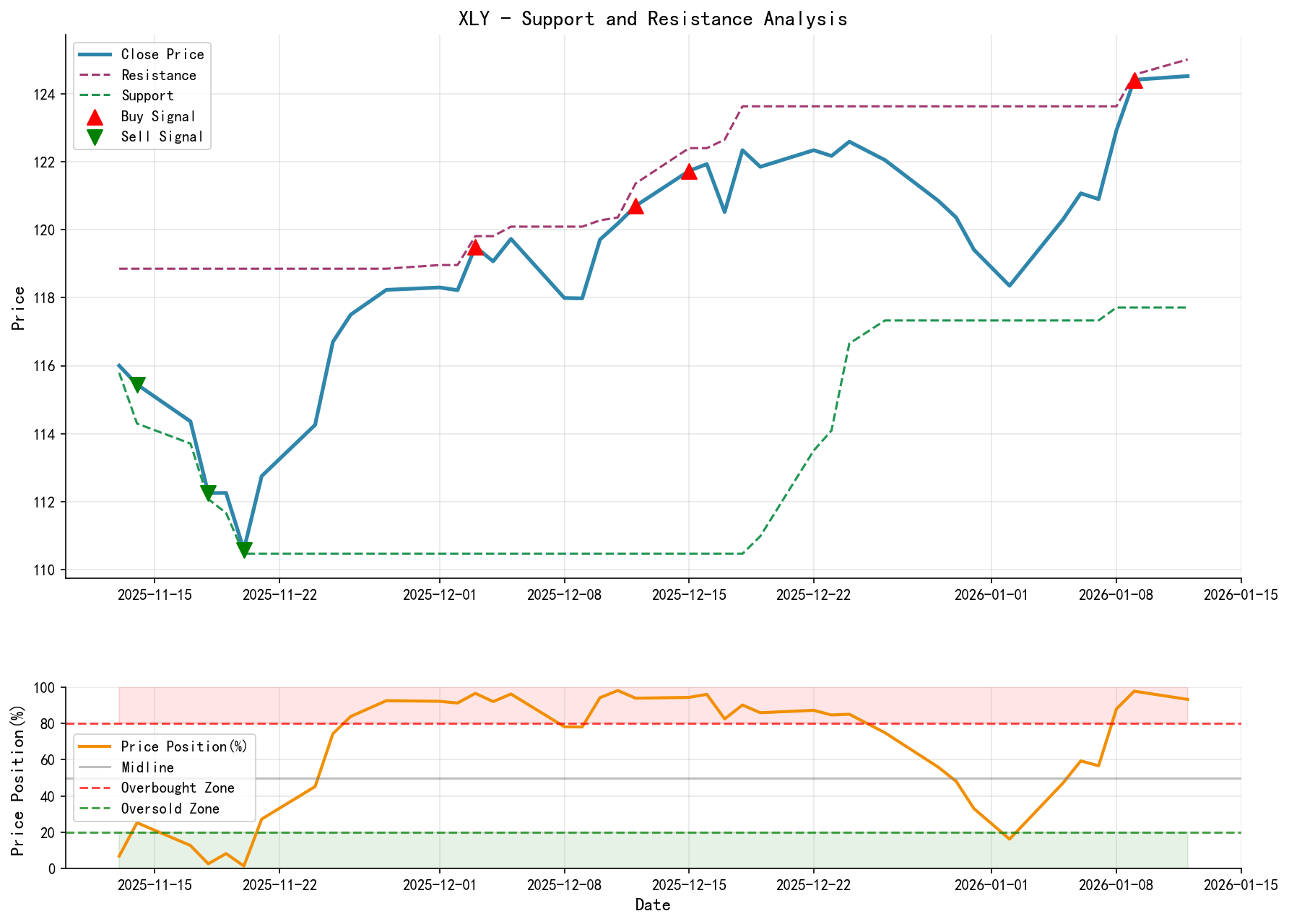

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Primary Support Zone: 122.34 - 122.92 Area. This is the recently broken volume concentration zone and previous high area, also where the current MA_5D (121.92) and MA_10D (121.06) are located. According to Wyckoff theory, a successfully broken point becomes the new support.

- • Secondary Support Zone: 120.30 - 120.90 Area. Corresponds to the upper boundary of the early January 2026 consolidation platform and the vicinity of MA_20D (121.35).

- • Current Resistance/Target Level: The price has reached a new all-time high, so there is no historical price resistance above. The next psychological resistance is at the 125.00 round number.

- • Historical Extremity Alert: The current closing price (124.52) and intraday high (125.01) both set the highest records in the past decade (ranking 1st historically). Simultaneously, volume ratios and volatility ratios are also at historically high levels (ranking in the top 15), indicating the market is in a dual state of extremity in both volume-price and volatility. Although the trend is upward, vigilance against sharp volatility is required.

- • Integrated Wyckoff Events and Trading Signals:

- • Market Phase: Wyckoff Markup Phase.

- • Supply-Demand Condition: Demand fully dominates, supply effectively absorbed.

- • Large Investor Intent: Pushing prices higher, no signs of distribution.

- • Trading Signal: Bullish.

- • Operational Suggestions:

- 1. Direction: Follow the primary trend, seek long opportunities.

- 2. Entry: Consider establishing long positions in batches when the price retraces to the primary support zone (122.34-122.92) and shows signs of low-volume stabilization or demand recovery (e.g., lower shadows, bullish engulfing candles).

- 3. Stop Loss: Stop loss for long positions should be set below the secondary support zone (120.30) to manage the low-probability risk of a potential trend reversal.

- 4. Target: Initial target can be set at 125.00 and above, primarily adopting a trend-following strategy, closely monitoring volume-price changes.

- • Future Validation Points (Potential Risk Points for Bullish Logic):

- 1. Heavy Volume but Stagnant Price or Long Upper Shadows: If at high levels (e.g., above 125), volume expands significantly (VOLUME_AVG_60D_RATIO > 1.5) but the price cannot close high (forming a doji or bearish candle), this could be an early signal of Initial Supply (PSY) or Distribution.

- 2. Breaching Key Support Without Rebound: If the price breaks below the 122.34 support, rebounds weakly, and is accompanied by expanding volume, the uptrend structure may be compromised, requiring reassessment of whether the market has entered a distribution phase.

- 3. RSI Showing Bearish Divergence: If the price continues to make new highs, but the peaks of RSI_14 gradually decline, forming a bearish divergence, this is a warning signal of waning momentum.

Report Core Conclusion: After experiencing a supply shock in November 2025 and subsequent demand-driven accumulation, XLY broke out to new all-time highs with strong momentum in early 2026, entering a clear Wyckoff Markup Phase. Data indicates the current market is demand-driven, with large investors in a markup mode. A trend-following long strategy is recommended, maintaining a bullish view above key support levels while setting clear stop losses to manage potential volatility risks at these extreme historical data levels.

Disclaimer: The content of this report/interpretation is solely market analysis and research based on public information and does not constitute any investment advice or operational guidance. The author strives for objectivity and fairness but makes no guarantees regarding its accuracy or completeness. The market carries risks, and investment requires caution. Any investment actions taken based on this report are at the investor's own risk.

Thank you for your attention! Daily Wyckoff volume-price market interpretations are published punctually at 8:00 AM before the market opens. Your comments and shares are sincerely appreciated, as your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: