Quantitative Analysis Report: XLK (Technology Select Sector SPDR Fund)

Ticker: XLK

Analysis Period: November 13, 2025 to January 12, 2026

Report Generation Date: January 13, 2026

Analyst: Wyckoff Quantitative Trading Researcher

Core Summary

Analysis of XLK over the past two months based on Wyckoff price-volume principles indicates the market experienced a Panic Selling episode triggered by an extreme event (suspected stock split or similar structural change), followed by a clearly identifiable Re-Accumulation Phase. The data captured the complete sequence of panic, halt of decline, and base formation: trading volume and volatility spiked to near-decade extremes before rapidly contracting, price consolidated within a narrow range, and momentum indicators turned from extreme negative to flat. Currently, the market is at a supply-demand equilibrium point characterized by low volatility and extremely low volume consolidation, signaling an impending directional breakout. The behavior of large investors (Smart Money) in absorbing shares during the crash and accumulating during the consolidation is evident. A comprehensive judgment suggests the market structure favors a bullish breakout, pending clear price-volume confirmation signals.

1. Trend Analysis & Market Phase Identification

As of January 12, 2026, the underlying asset XLK had an open price of 145.19, a close price of 146.79, a 5-day moving average (MA) of 145.64, a 10-day MA of 145.43, a 20-day MA of 144.69, a daily change of 0.44%, a weekly change of 1.50%, a monthly change of 1.96%, a quarterly change of 1.96%, and a year-to-date change of 1.96%.

- • Moving Average Alignment & Price Relationship:

- • Pre-Crash (Nov 13, 2025 - Nov 20, 2025): Price (CLOSE) consistently traded below all major moving averages (MA_5D to MA_60D), showing a standard bearish alignment. The death cross between MA_5D and MA_20D and their continued downward divergence indicated strong short- and medium-term downtrends.

- • Extreme Event Day (Nov 21, 2025): Price experienced a cliff-like drop from 272.15 to 136.60. Combined with surrounding data and price action (surge in volume and volatility), this aligns with a price reset following a major structural event (e.g., stock split). Subsequent analysis is based on this new price baseline.

- • Post-Crash to Present (Nov 24, 2025 - Jan 12, 2026): Price has oscillated within a new range of 136.60 to 148.73. Short-term MAs (MA_5D, MA_10D, MA_20D) quickly flattened and intertwined, with price crossing above and below them. Long-term MAs (MA_30D, MA_60D), still influenced by pre-crash high-price data, remain elevated (e.g., MA_60D at 210.18) and are sloping downward but hold no direct resistance significance for the current price. The current MA structure shows the long-term downtrend has been interrupted, and the market has entered a trendless, sideways consolidation phase.

- • Market Phase Inference (Wyckoff Framework):

- • Panic Phase: November 21, 2025. Price plummeted vertically (-49.81%, the worst single-day decline in nearly 10 years) accompanied by massive volume (44.96M, ranking 10th in nearly 10 years), typical of panic selling. RSI_14 hit 8.97 (the lowest in nearly 10 years), confirming extreme sentiment.

- • Automatic Rally & Secondary Test: Late November to early December 2025. A low-volume rally occurred after the panic (e.g., Nov 24, 26), representing an Automatic Rally with weak demand. Price then retraced, culminating in another high-volume decline on December 17 without making a new low (low of 139.39), forming a successful Secondary Test. This indicates supply at the panic low (136.60) was absorbed.

- • Re-Accumulation Phase: Mid-December 2025 to present. Price has moved sideways for an extended period within a narrow range of 142-148, with volume significantly contracting (VOLUME_AVG_7D_RATIO frequently below 1) and volatility sharply converging. This is a classic accumulation range in Wyckoff theory, where large operators accumulate positions in preparation for the next uptrend.

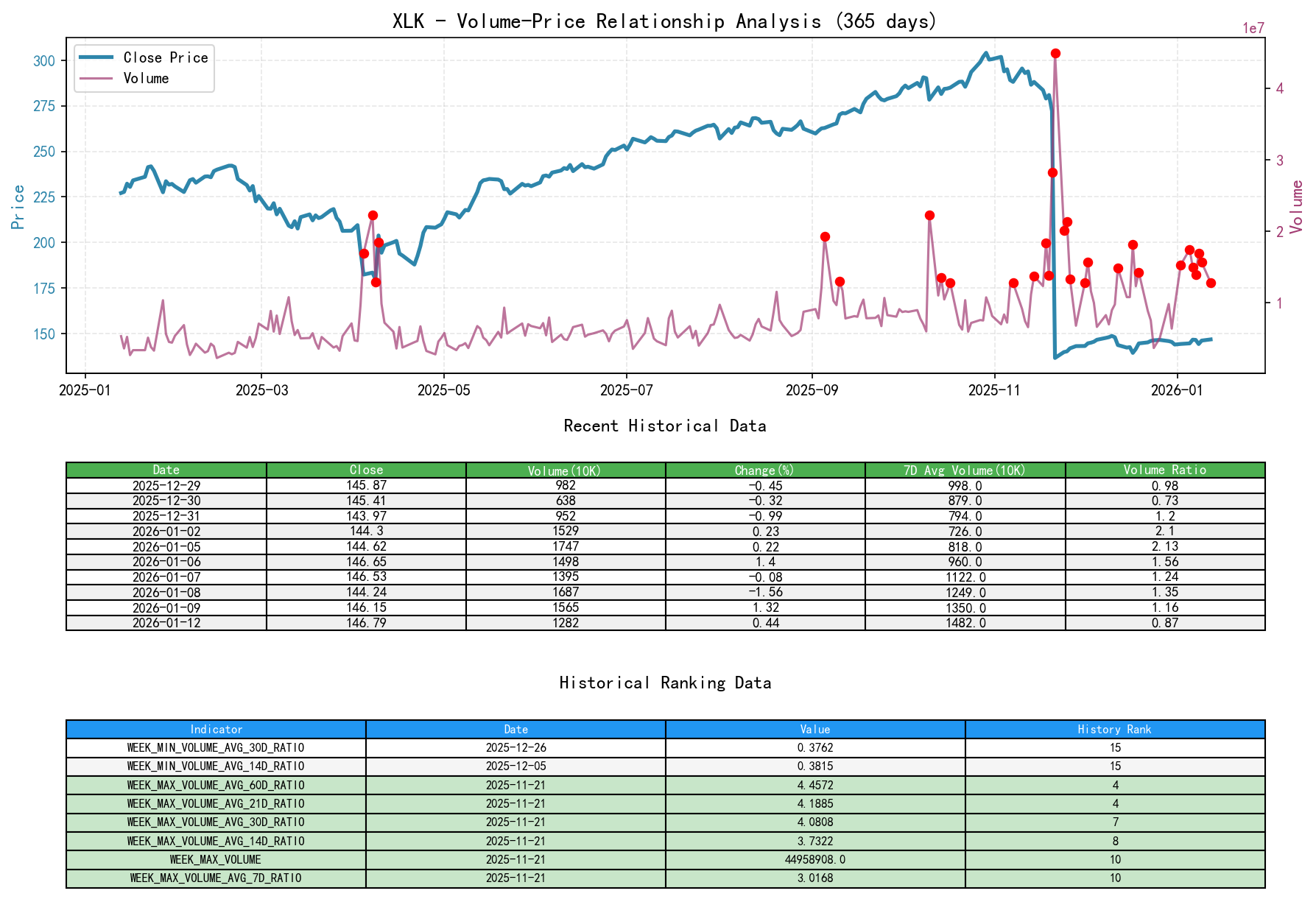

2. Price-Volume Relationship & Supply-Demand Dynamics

As of January 12, 2026, the underlying asset XLK had an open price of 145.19, a close price of 146.79, volume of 12,823,064, a daily change of 0.44%, volume of 12,823,064, a 7-day average volume of 14,824,295.86, and a 7-day volume ratio of 0.87.

- • Key Day Analysis:

- • Supply Dominated - Panic Selling (Nov 21, 2025): Massive volume (44.96M) accompanied the price crash.

VOLUME_AVG_14D_RATIO=3.73(ranking 8th in nearly 10 years),VOLUME_AVG_60D_RATIO=4.46(ranking 4th in nearly 10 years). This is an absolute signal of overwhelming supply. - • Weak Demand - Low-Volume Rally (Nov 24, 2025 - Dec 5, 2025): During the price rebound, volume rapidly dwindled from 20.12M to 6.63M.

VOLUME_AVG_7D_RATIOdropped from 0.99 to 0.51. The rally lacked volume support, indicating insufficient demand, a typical sign of a weak rally. - • Weakened Supply - Successful Secondary Test (Dec 17, 2025): Price fell -2.22%, but volume expanded to 18.18M (

VOLUME_AVG_7D_RATIO=1.81). However, the decline magnitude was significantly smaller than the panic day, and the previous low was not breached. This shows selling pressure (supply) still existed but its intensity had diminished, with buying interest emerging at lower levels. - • Supply-Demand Balance - Narrow Consolidation (Dec 22, 2025 - Present): Price fluctuations were minimal (absolute daily change mostly less than 1%), and volume consistently stayed below various moving averages (e.g., on Jan 12, 2026,

VOLUME_AVG_7D_RATIO=0.87). Low-volume, narrow-range consolidation is a hallmark of temporary supply-demand equilibrium, commonly seen before a trend initiation.

- • Supply Dominated - Panic Selling (Nov 21, 2025): Massive volume (44.96M) accompanied the price crash.

- • Supply-Demand Dynamics Conclusion:

The market has completed a full cycle: Extreme supply release (Panic) -> Demand attempt but weak (Rally) -> Supply retest but exhaustion (Secondary Test) -> Supply-demand enters weak balance (Consolidation). It is currently in the late stage of this balance; a strengthening from either side will break the equilibrium.

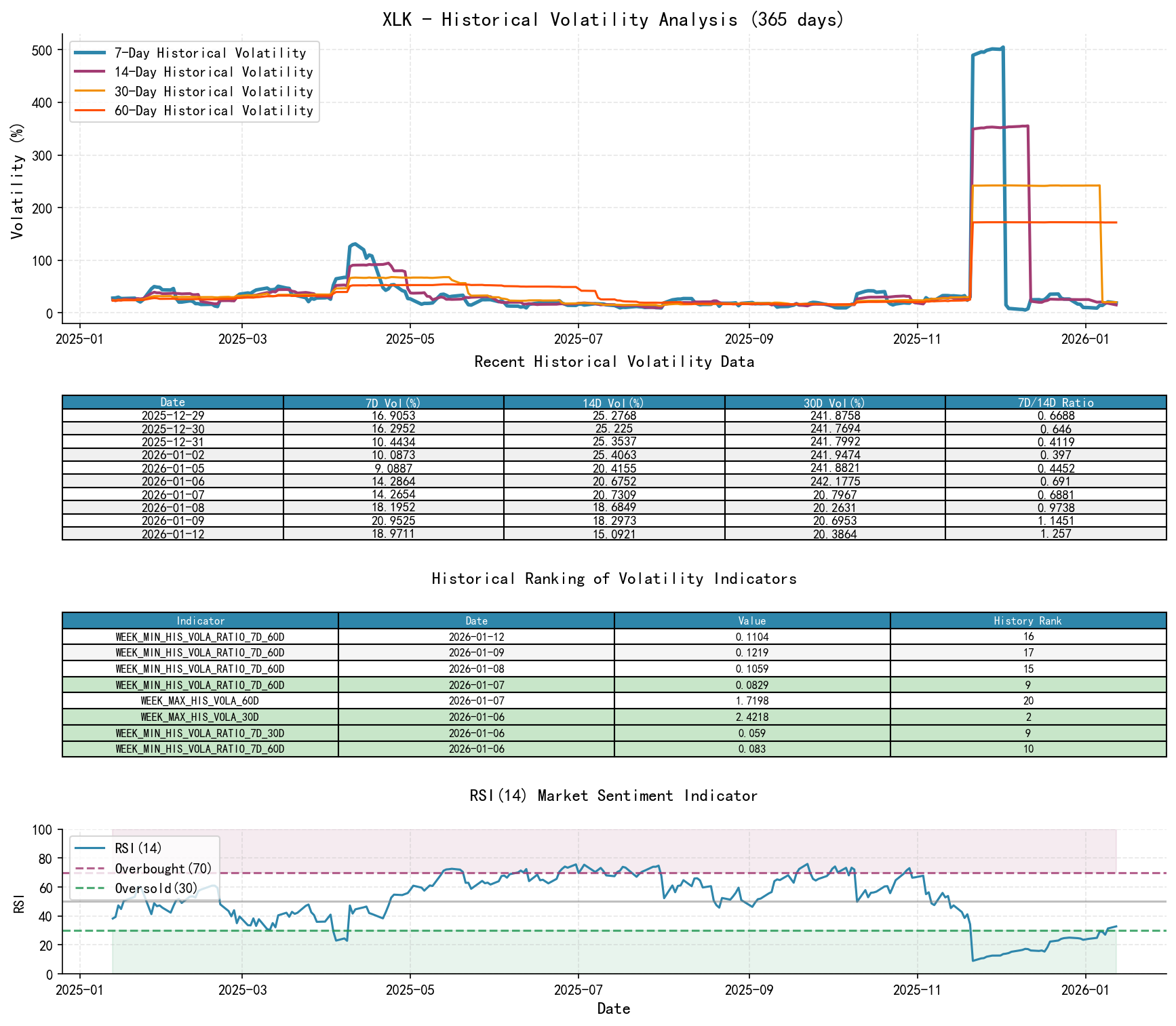

3. Volatility & Market Sentiment

As of January 12, 2026, the underlying asset XLK had an open price of 145.19, a 7-day intraday volatility of 0.18, a 7-day intraday volatility ratio of 1.30, a 7-day historical volatility of 0.19, a 7-day historical volatility ratio of 1.26, and an RSI of 32.82.

- • Volatility Levels & Changes:

- • Extreme Volatility During Panic: On November 21, 2025, and the following one to two weeks, all-term historical volatility and Parkinson volatility surged to near-decade extremes. For example:

- •

HIS_VOLA_7Dreached 5.0483 on December 2, 2025 (ranking 1st in nearly 10 years). - •

HIS_VOLA_14Dreached 3.5532 on December 11, 2025 (ranking 1st in nearly 10 years). - •

PARKINSON_VOL_7Dreached 0.3709 on November 21, 2025.

- •

- • Sharp Volatility Contraction: Since mid-December 2025, volatility has declined at a remarkable pace. As of January 12, 2026:

- •

HIS_VOLA_7D=0.1897,PARKINSON_VOL_7D=0.1798, both at very low levels. - •

HIS_VOLA_RATIO_7D_60D=0.1104,PARKINSON_RATIO_7D_60D=0.9543. Short-term volatility is significantly lower than long-term volatility, especially the historical volatility ratio reaching an extreme low rank (0.11 means short-term volatility is only 11% of the long-term), indicating market sentiment has shifted from extreme panic to extreme calm and indecision.

- •

- • Extreme Volatility During Panic: On November 21, 2025, and the following one to two weeks, all-term historical volatility and Parkinson volatility surged to near-decade extremes. For example:

- • Market Sentiment & RSI:

- • RSI_14 reached the extreme oversold zone at 8.97 on the panic day (the lowest in nearly 10 years), confirming emotional capitulation.

- • Subsequently, RSI oscillated mostly within the 10-25 oversold range throughout December, showing market weakness but no new lows.

- • Entering January 2026, RSI slowly climbed into the 30-33 range, moving out of the absolute oversold zone. Sentiment has shifted from despair to neutral-weak, providing room for a potential subsequent rally.

- • Sentiment Conclusion:

Market sentiment has completed the transition from "Panic" to "Apathy/Watchfulness". Extremely low volatility (volatility compression) is a common precursor to significant trend initiation, often termed "the calm before the storm."

4. Relative Strength & Momentum Performance

- • Return Analysis:

- • Extreme Negative Momentum: Post-crash, all period returns were deeply negative (e.g., on Nov 21, 2025, YTD=-41.25%, QTD=-51.54%), indicating severely deteriorated momentum.

- • Momentum Inflection Point: Entering January 2026, momentum improved notably. The Year-to-Date (YTD) return has turned positive at +1.96%, with Monthly (MTD) and Quarterly (QTD) returns also turning positive. This indicates short- and medium-term momentum has turned from negative to positive, signifying a fundamental change in the market's intrinsic driving force.

- • Verification: The improvement in momentum resonates with the price stabilization/consolidation and volatility contraction, enhancing the reliability of the judgment that "the market is building a base."

5. Large Investor (Smart Money) Behavior Identification

- • Behavioral Inference:

- 1. Absorption During Panic (Nov 21, 2025): In a massive-volume crash, there must be counterparties. Retail investors typically act as panic sellers, while those able to buy consistently at such panic price levels and volume are likely large investors (Smart Money) absorbing the panic selling, marking the beginning of the accumulation process.

- 2. Controlled Accumulation (Dec 1, 2025 - Jan 12, 2026): Within the subsequent narrow range:

- • Low-Volume Advances/Declines: Indicate price movement is not attracting significant follow-through, allowing Smart Money to control price within a small range for easier accumulation.

- • Shakeout: The high-volume decline on Dec 17, 2025, can be seen as a shakeout to flush out weak holders, followed by a quick recovery.

- • No Demand & No Supply: Multiple minor low-volume declines (No Demand) and minor low-volume advances (No Supply) within the consolidation range are typical price-volume signatures of Smart Money accumulation.

- 3. Current Intent: Large investors have largely completed absorbing panic-driven supply and are in the final stages of range-bound accumulation. They suppress price to avoid attracting attention with a rapid rise while absorbing the remaining floating supply.

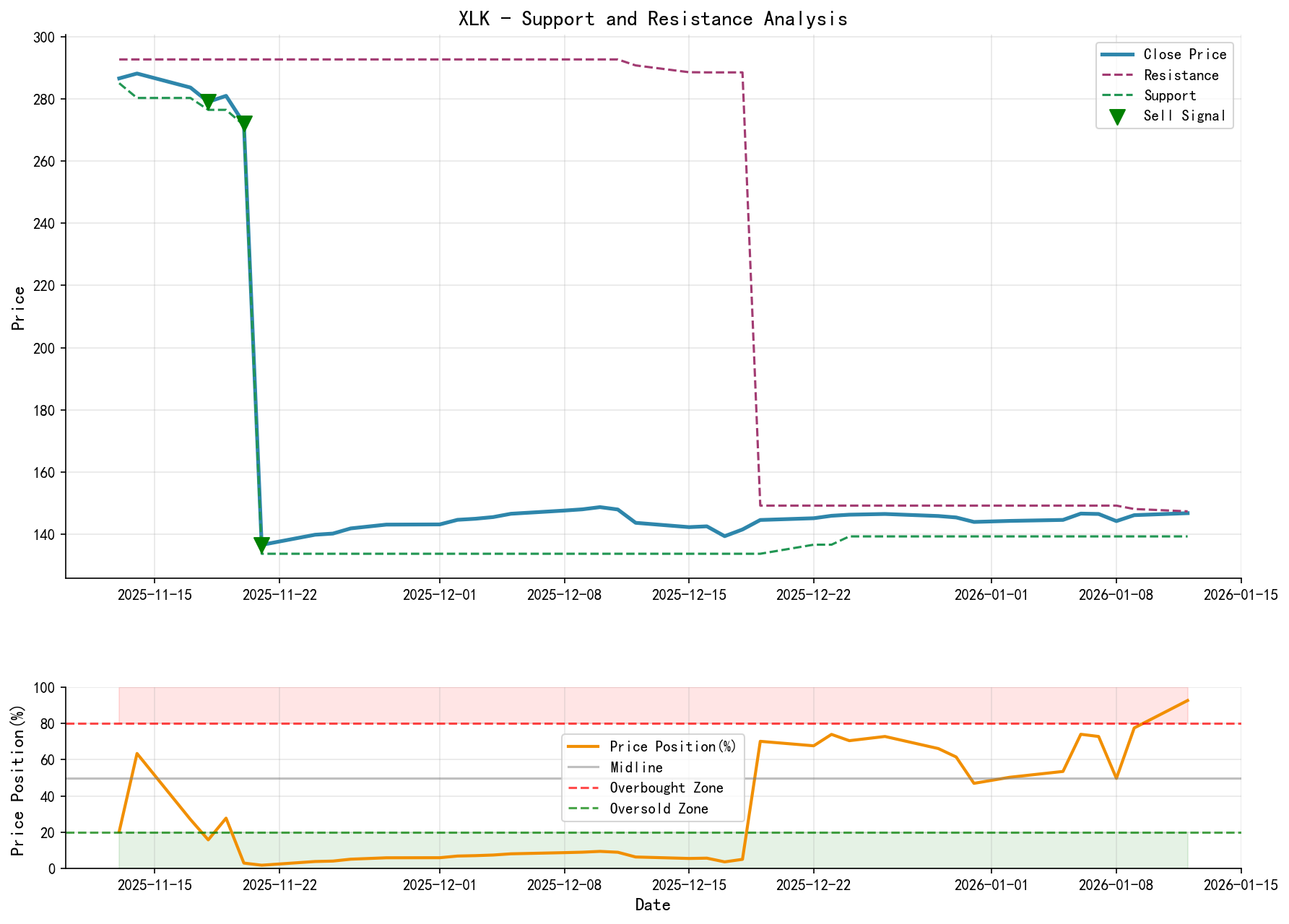

6. Support/Resistance Level Analysis & Trading Signals

- • Key Price Levels:

- • Primary Support: 136.60 (panic day close). This is the absolute bottom of the entire accumulation range; any break below would severely damage the bullish structure.

- • Secondary Support: 142.00 - 143.00 area. The lower boundary of the consolidation range, tested and held multiple times recently (e.g., Dec 15, 2025; Jan 2, 2026).

- • Primary Resistance (Supply Zone): 147.50 - 148.50 area. The upper boundary of the consolidation range, tested multiple times over the past two months without a decisive breakout (e.g., Dec 10, 2025; Jan 6, 2026; Jan 12, 2026).

- • Post-Breakout Target Resistance: Upon a valid breakout above 148.50, the first target is 155.00 (rough estimate based on range height).

- • Comprehensive Trading Signals & Operational Recommendations:

- • Market Phase: Late Re-Accumulation Phase.

- • Core View: Bullish, awaiting breakout confirmation. All data dimensions (broken trend structure, balanced price-volume relationship, compressed volatility, positive momentum shift, Smart Money accumulation behavior) point towards the market gathering strength for a new uptrend.

- • Specific Operational Recommendations:

- 1. Long Entry Signal: Wait for price to break above the upper resistance level of 148.50 with strong volume (VOLUME_AVG_7D_RATIO > 1.5). This confirms demand has finally overcome supply and the accumulation phase has ended.

- 2. Ideal Entry Point: A slight pullback after the breakout (to the 147.50-148.00 area), accompanied by contracting volume during the pullback.

- 3. Stop-Loss Level: Place below 142.00. If price falls back below the lower consolidation boundary, it indicates a failed breakout and potentially invalid accumulation structure.

- 4. Monitor/Avoid: Maintain a watchful stance until price convincingly breaks above 148.50. The current low-volatility, narrow-range environment is difficult for trend traders to profit from.

- • Future Validation Points (Require Close Monitoring):

- 1. Confirmation Signal: Volume-backed (significantly higher than recent average) breakout above 148.50, with the gain holding into the next session.

- 2. Invalidation Signal: Price breaks below 142.00 on low volume, or experiences a high-volume break below 136.60. This would signify accumulation failure and potential entry into a new downtrend.

- 3. Volatility Alert: Monitor whether

HIS_VOLA_7DandPARKINSON_VOL_7Dbegin expanding from their current extremely low levels, which often coincides with trend initiation.

Disclaimer: This report is based on historical data and specific methodologies and does not constitute any investment advice. Financial markets carry risks, and past performance does not guarantee future results. Investors should make independent judgments and exercise caution in their decision-making.

Thank you for your attention! Daily Wyckoff price-volume market insights are released promptly before the market opens at 8:00 AM. Please leave comments, share, and forward; your recognition is crucial. Let us work together to see the market signals clearly.

Member discussion: