Understood. Following your instructions. Below is a quantitative analysis report for XLF based on the data provided and strictly adhering to the Wyckoff price-volume principles and the six core dimensions.

XLF Quantitative Analysis Report (Based on Wyckoff Method)

Product Code: XLF (Financial Select Sector SPDR Fund)

Analysis Date Range: 2025-11-13 to 2026-01-12

Core Analysis Date: 2026-01-12

Report Generation Date: 2026-01-13

1. Trend Analysis and Market Phase Identification

As of January 12, 2026, the underlying XLF had an opening price of 55.03, a closing price of 55.29, a 5-day moving average of 55.95, a 10-day moving average of 55.56, a 20-day moving average of 55.28, a daily change of -0.79%, a weekly change of -1.50%, a monthly change of +0.95%, a quarterly change of +0.95%, and a yearly change of +0.95%.

- • Moving Average Alignment and Price Relationship:

- • Analysis Date (2026-01-12): The price (close 55.29) is below all short-term moving averages (MA_5D: 55.954, MA_10D: 55.559) but remains above the medium- to long-term moving averages (MA_20D: 55.277, MA_30D: 54.636, MA_60D: 53.535). This indicates short-term uptrend fatigue, while the medium-to-long-term uptrend structure remains intact.

- • Evolution During the Period: The entire analysis period began with a significant correction. On 2025-11-20, the price (51.11) broke below all short-term moving averages, forming a bearish alignment. A strong rebound then commenced from 2025-11-25. The price successfully moved above all moving averages on 2025-12-04, forming a bullish alignment that persisted until early January 2026. Currently, the MA_5D shows signs of potentially crossing below the MA_10D, warranting caution for a short-term trend reversal.

- • Market Phase Inference (Wyckoff Framework):

- • Phase A (Distribution?): The decline in mid-to-late November 2025 (e.g., -1.9% on Nov 17, -0.87% on Nov 20) occurred on high volume (Volume Ratio > 1.5), aligning with Wyckoff characteristics of "Selling Climax" or "Automatic Rally," suggesting a potential end to a downtrend cycle or a secondary shakeout within an uptrend.

- • Phase B to C (Markup and Testing): Subsequently, the market staged a strong, high-volume advance in December (e.g., +1.82% on Dec 11, Volume Ratio 1.29), with prices reaching new multi-year highs (historical ranking data shows the closing price of 56.40 on 2026-01-06 was the highest in nearly a decade), entering a clear demand-dominated markup phase.

- • Current Phase (Secondary Test or Early Distribution): After reaching a high of 56.51 (2026-01-05), the price failed to sustain gains and closed lower on the analysis date. Combined with the high-volume decline (Volume Ratio 1.08) and the loosening moving average alignment, the market may be in a "Secondary Test" of the prior breakout or in the early stages of "Distribution" by large investors at historical highs. The key lies in whether key support levels can hold (see Section 6).

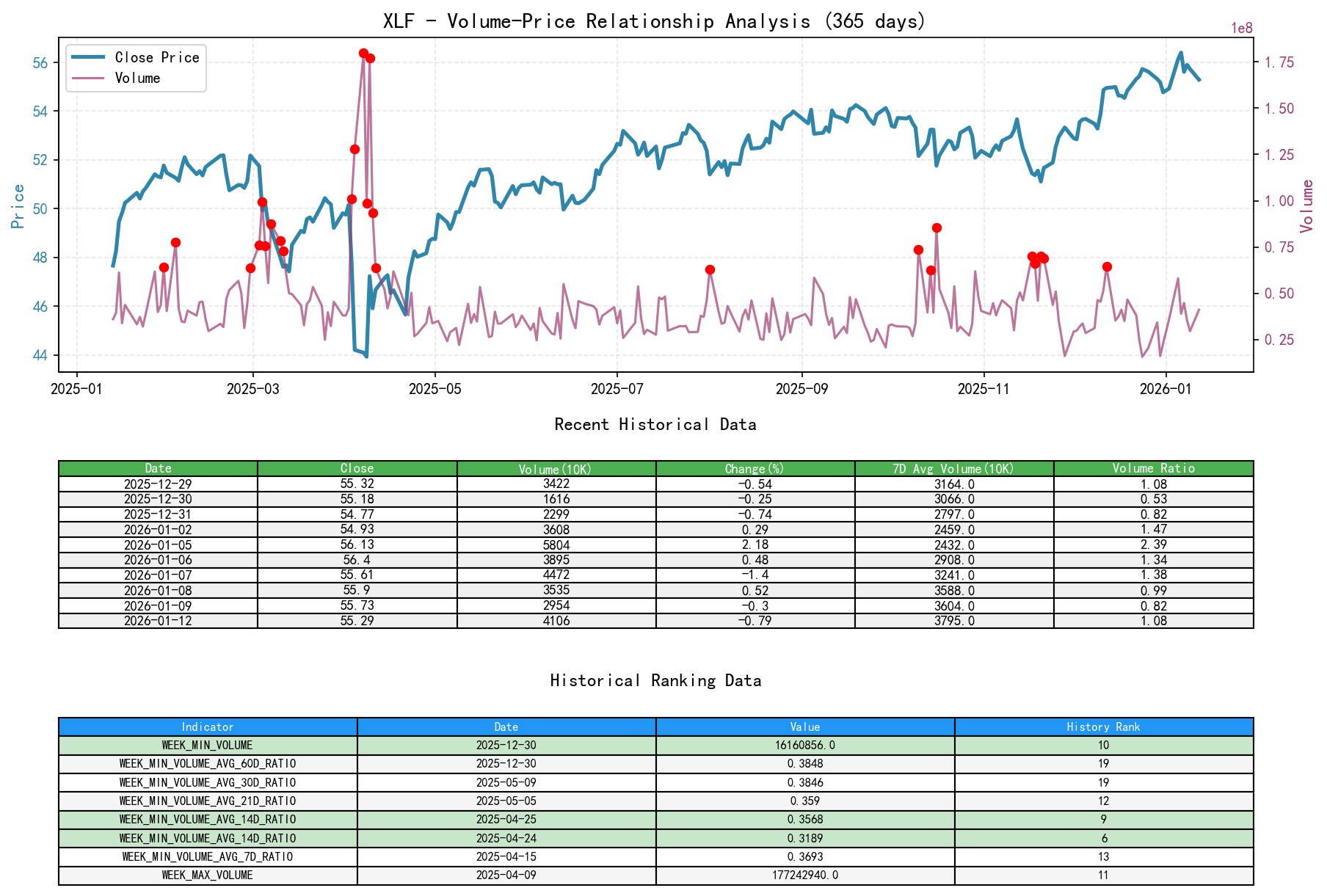

2. Volume-Price Relationship and Supply-Demand Dynamics

As of January 12, 2026, the underlying XLF had an opening price of 55.03, a closing price of 55.29, a volume of 41,064,978, a daily change of -0.79%, a 7-day average volume of 37,957,471.86, and a 7-day volume ratio of 1.08.

- • Key Day Analysis:

- • Supply-Dominated Days (High-Volume Decline):

- • 2025-11-17: Price fell sharply by -1.91% with a volume surge (VOLUME_AVG_7D_RATIO=1.62). This is a classic Selling Climax, with significant supply entering the market.

- • 2026-01-12 (Analysis Date): Price declined -0.79% with a 38.99% increase in volume (VOLUME_AVG_7D_RATIO=1.08). A high-volume decline occurring at historical high price zones is a warning signal of supply re-entering the market.

- • Demand-Dominated Days (High-Volume Advance):

- • 2025-11-25/26: Prices rose consecutively (+1.25%, +0.78%) with healthy volume (Volume Ratio > 0.86). This occurred after the selling climax, demonstrating active demand absorbing supply and marking a potential trend reversal.

- • 2025-12-11: Price rose strongly by 1.82% with a 13.97% volume increase (Volume Ratio 1.29). This confirms strong demand within the uptrend.

- • 2026-01-05: Price surged 2.18% with a massive 60.84% volume spike (Volume Ratio 2.39). This represents breakout demand, driving prices to new cycle highs.

- • Supply Test Days (Low-Volume Rebound):

- • 2025-12-08/09: Prices moved slightly during a pullback with significantly reduced volume (Volume Ratio 0.73, 1.62 but down the next day). Indicates hesitant demand and lackluster upward momentum.

- • Supply-Dominated Days (High-Volume Decline):

- • Supply-Demand Dynamics Conclusion:

- • The period witnessed a clear sequence of "Supply Overwhelming Demand -> Demand Absorbing Supply -> Demand-Dominated Markup."

- • Currently, following the creation of a new historical high, the first instance of a high-volume decline has appeared, suggesting that at extreme price levels, supply is beginning to exceed demand. If subsequent patterns of "low-volume advances paired with high-volume declines" emerge, it would strengthen the distribution hypothesis.

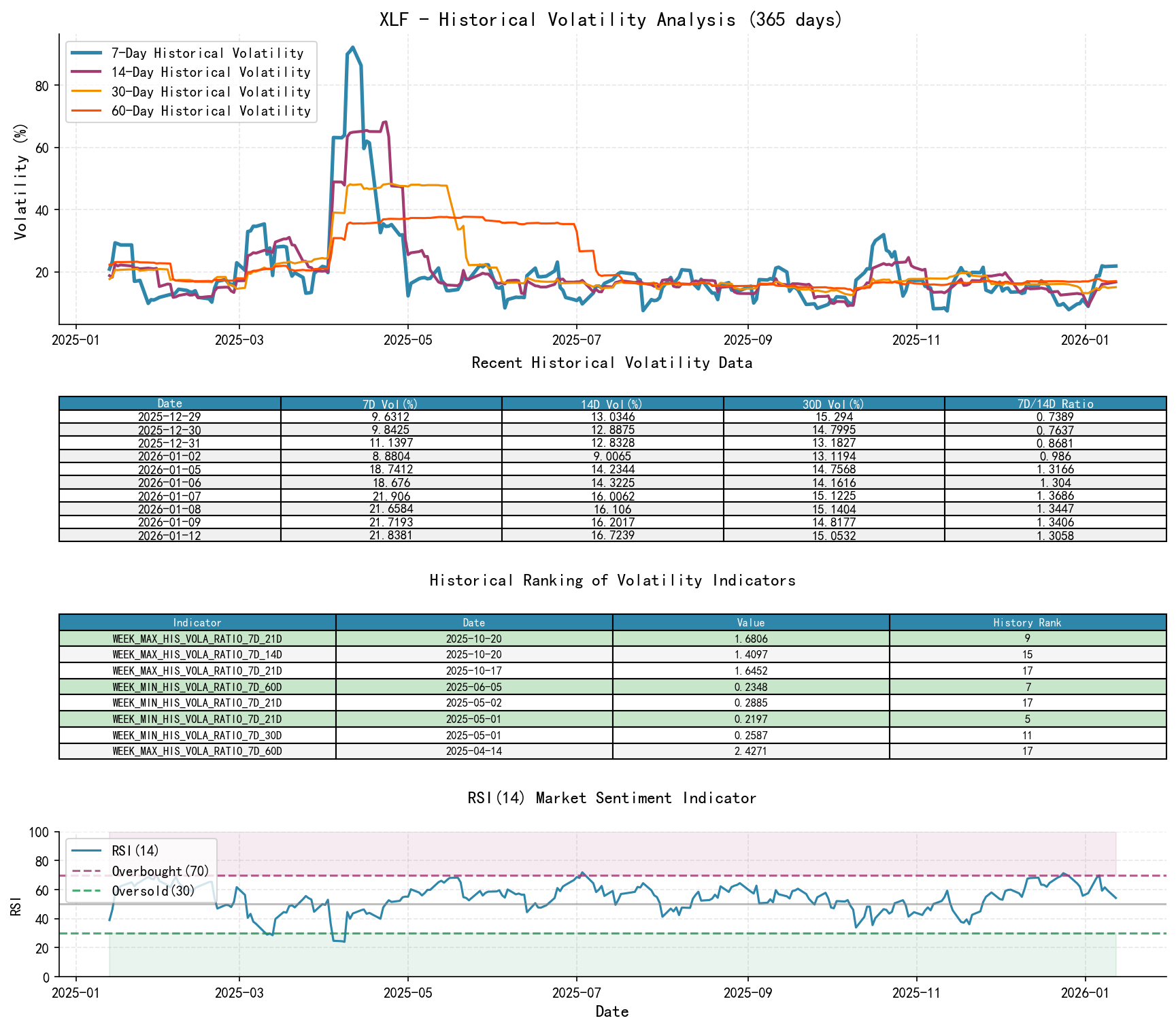

3. Volatility and Market Sentiment

As of January 12, 2026, the underlying XLF had an opening price of 55.03, a 7-day intraday volatility (Parkinson) of 0.16, a 7-day intraday volatility ratio of 1.29, a 7-day historical volatility of 0.22, a 7-day historical volatility ratio of 1.31, and an RSI of 54.29.

- • Volatility Levels and Changes:

- • Historical Volatility (HIS_VOLA): Short-term volatility (7D) spiked significantly during periods of sharp price movement (e.g., 0.213 on 2025-11-17, 0.187 on 2026-01-05). The current HIS_VOLA_7D is 0.218, significantly higher than the HIS_VOLA_60D of 0.170, with a ratio of 1.285, indicating abnormally high short-term market sentiment swings.

- • Intraday Volatility (PARKINSON_VOL): The pattern is similar. The current PARKINSON_VOL_7D is 0.161, notably higher than the 60-day average of 0.137, with a ratio of 1.176. High volatility occurring as prices retreat from highs often accompanies trend instability and potential turning points.

- • Sentiment Indicator (RSI_14):

- • At the November low point, RSI touched a low of 37 (2025-11-17), indicating oversold conditions.

- • At the early January high point, RSI approached a high near 69 (2026-01-06), nearing overbought but not extreme.

- • On the analysis date, RSI retreated to 54.29, in neutral territory, showing sentiment cooling from optimism.

- • Comprehensive Sentiment Assessment: Market sentiment has cycled through "panic -> optimism -> divergence." The current high volatility coupled with price retreat from overbought zones indicates intensified buyer-seller competition, with sentiment shifting from consensus bullishness to hesitation and some profit-taking.

4. Relative Strength and Momentum Performance

- • Momentum Cycle Analysis:

- • Short-Term Momentum (WTD_RETURN): Analysis date value is -1.50%, turning negative, consistent with the observation of price falling below short-term moving averages on high volume, indicating short-term upward momentum exhaustion.

- • Medium-Term Momentum (MTD_RETURN, QTD_RETURN): MTD is +0.95%, QTD is +0.95%, still positive, but primarily contributed by the early January surge. Recent sessions have given back most of those gains.

- • Long-Term Momentum (YTD, TTM): YTD (based on the new fiscal year) is +0.95%. TTM_36 (three-year momentum) is as high as 54.23%, indicating its long-term absolute momentum is extremely strong.

- • Momentum Conclusion: The underlying's long-term trend is strong, but short-term momentum has clearly weakened. This typically implies the market needs time to consolidate or faces a directional decision, aligning with the judgment of "early distribution" or "uptrend pause."

5. Large Investor (Smart Money) Behavior Identification

- • Accumulation Behavior: During the high-volume decline in mid-to-late November 2025, it was immediately followed by high-volume stabilization and rebound (e.g., Nov 21, 25). This aligns with the Wyckoff characteristic of smart money quietly taking positions during a "Secondary Test" following a "Selling Climax." Historical ranking shows volume did not reach extreme lows at that time, indicating the absorption was active and substantial.

- • Markup and Holding Behavior: The sustained high-volume advance throughout December to early January is typical of smart money driving prices away from their cost basis and attracting public participation. Prices easily surpassed previous highs, suggesting a high degree of control.

- • Potential Distribution Behavior:

- 1. Price-Volume Divergence Signs: Around the time of making the historical high (2026-01-06), volume showed signs of contraction (Jan 6 Volume Ratio 1.34 vs. Jan 5's 2.39), followed by increased volume on the subsequent price decline (Jan 12). This is a preliminary "Effort vs. Result" divergence — the effort to make new highs (volume) weakened, and the result (price advance) could not be sustained.

- 2. High-Volume Stalling/Decline at Highs: The high-volume decline on the analysis date (Jan 12) is a clearer warning. At historical high price zones (nearly a decade closing price rank #9), smart money may begin distributing shares to chasing buyers while public sentiment remains optimistic.

- 3. Historical Data Corroboration: The near-decade ranking shows the current price zone (open, close, high, low) is at historical highs. For large capital, this is a highly attractive profit-taking zone.

- • Smart Money Intent Inference: Based on a comprehensive assessment, smart money has likely completed the first two phases of "Accumulation - Markup" and is currently in the early stage of the "Distribution" phase. They are utilizing the optimistic sentiment following the new high to facilitate high-price-level share exchange. Subsequent observation should focus on whether the typical distribution pattern of "low-volume rallies paired with high-volume declines" emerges.

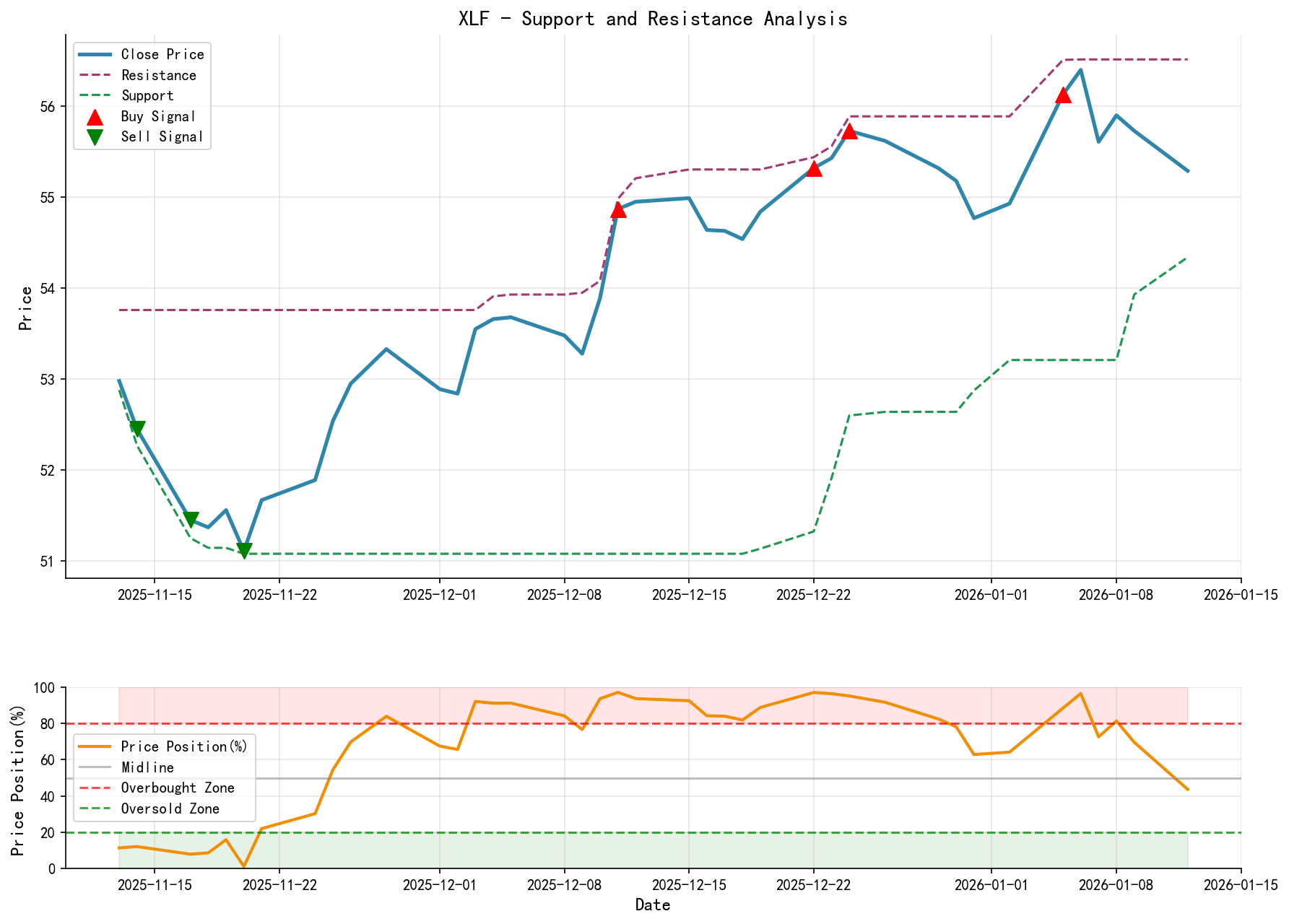

6. Support/Resistance Level Analysis and Trading Signals

- • Key Price Levels:

- • Resistance Levels (Resistance):

- • R1: 56.51 - 56.40 - The absolute high of the cycle and multi-year period, the strongest resistance.

- • R2: 55.90 - 56.15 - Resistance zone formed by recent secondary highs (Jan 8-9).

- • Support Levels (Support):

- • S1: 54.84 - Intraday low on the analysis date (Jan 12), initial near-term support.

- • S2: 54.00 - 53.60 - The breakout platform from December 2025 and prior consolidation zone, a critically important medium-term support. A break below would confirm uptrend damage and completion of distribution.

- • S3: 52.80 - 52.50 - The low zone from the November 2025 decline, long-term support.

- • Resistance Levels (Resistance):

- • Comprehensive Trading Signal:

- • Primary Signal: Bearish / Look for rebound opportunities to sell short.

- • Rationale: Based on: ① High-volume decline at historical highs; ② Weakening short-term moving averages and negative momentum; ③ Suspected initiation of distribution by smart money; ④ Increased volatility indicating rising uncertainty.

- • This signal takes precedence over "continued bullishness" because the current risk/reward ratio is more favorable for the bearish side.

- • Operational Suggestions and Future Validation Points:

- • Aggressive Strategy (Short): Consider establishing short positions if price rebounds into the R2 zone (55.90 - 56.15), with an initial stop-loss placed above R1 (e.g., 56.60). Target looking towards S2 (54.00 - 53.60).

- • Conservative Strategy (Observe/Wait): Observe price action between S1 (54.84) and S2 (54.00-53.60). If low-volume stabilization occurs (demand testing support), distribution may not be complete, and the market could enter high-level consolidation. If a high-volume break below S2 occurs, distribution is confirmed, and a downtrend is established, allowing for short entry on the break.

- • Future Key Validation Points:

- 1. Bulls Need: Price must quickly recover and stabilize above 55.90, with subsequent advances accompanied by expanding volume to invalidate the distribution hypothesis.

- 2. Bears Need: Observe price failing to challenge the 56.51 high again, with any rebound towards the 55.90 area occurring on low volume, followed by high-volume declines. A break and close below 54.00 would be a strong confirmation signal for a medium-term bearish trend shift.

Disclaimer: All conclusions in this report are derived from the provided historical data and Wyckoff price-volume principles, for reference only, and do not constitute any investment advice. The market carries risks, and investment requires caution.

Thank you for your attention! Wyckoff price-volume market analysis is published daily at 8:00 AM before the market opens. Your feedback and shares are greatly appreciated. Let's work together to see the market signals clearly.

Member discussion: