Quantitative Analysis Report: XLE (Energy Select Sector SPDR Fund)

Product Code: XLE

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Time: 2026-01-13

Key Event Summary:

The data indicates that on 2025-11-21, XLE experienced an extreme price event (a daily drop of -49.68%), falling from approximately44. Considering the volume, price action, and subsequent data patterns, this is highly likely to be a "1-for-2" stock split (halving of the share price, doubling of the share count), rather than a fundamental crash. The following analysis will primarily focus on the post-split volume-price behavior (from 2025-11-21 onward) within the new price range ($44-47) to assess the current genuine supply-demand dynamics and the intent of large investors.

1. Trend Analysis & Market Phase Identification

As of January 12, 2026, XLE had an opening price of 46.75, a closing price of 46.34, a 5-day MA of 46.18, a 10-day MA of 45.50, a 20-day MA of 45.08, with a daily change of -0.71%, a weekly change of -1.17%, a monthly change of 3.65%, a quarterly change of 3.65%, and an annual change of 3.65%.

- • Moving Average Structure & Price Relationship:

- • Pre-Split (2025-11-13 to 2025-11-20): The price traded around $90, with all short-term moving averages (MA_5D, MA_10D, MA_20D) aligned in a bullish configuration, indicating an uptrend.

- • Post-Split (2025-11-21 onward): The price has been consolidating within a narrow range of45-46) near the current price, indicating the short-term trend has entered a directionless consolidation phase. Because the MA calculations include pre-split high-price data, the MA_30D and MA_60D remain significantly higher than the current price (>$60), creating a misleading technical "bearish alignment" signal. This signal is invalidated by the split event and should be ignored.

- • Wyckoff Market Phase Inference:

- • Panic/Selling Climax (SC/LPSY): The massive drop on 2025-11-21 (regardless of cause) can be viewed within the Wyckoff framework as a "selling climax" event, marking a transition to a new, lower trading range.

- • Automatic Rally (AR) & Secondary Test (ST): Post-split, the price did not continue to fall but found support near44 area without breaking below it, accompanied by significantly lower volume compared to the panic day, fitting the characteristics of a "secondary test."

- • Current Phase Assessment: The price oscillates repeatedly within the new range ($44-47), with volume expanding at the range's upper boundary (e.g., 2026-01-05) and contracting at the lower boundary or during pullbacks (e.g., 2025-12-24, 2026-01-12). Combined with the moving average convergence, the market is currently in a "phase of accumulation" or "re-accumulation." Large investors may be repositioning within this range.

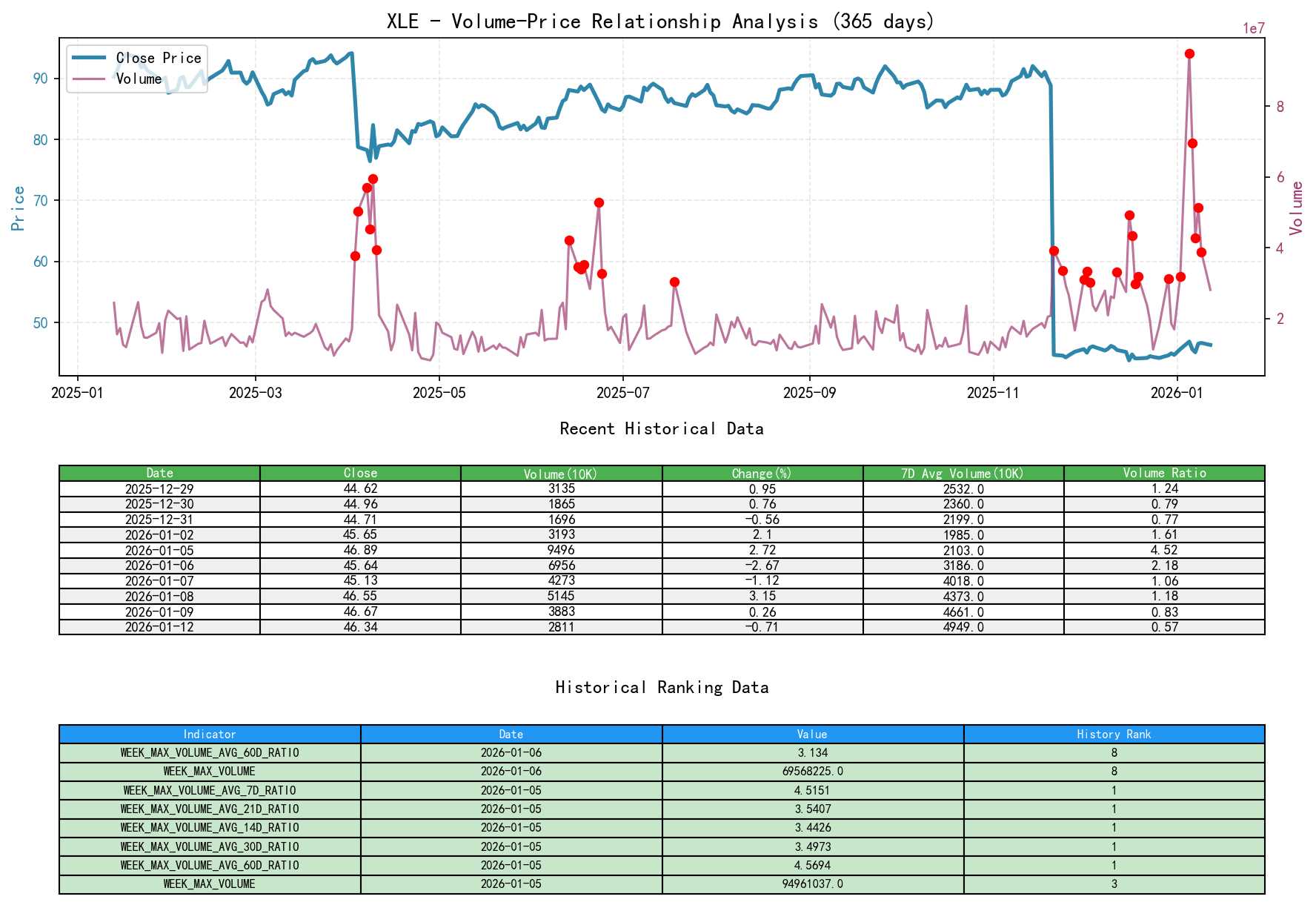

2. Volume-Price Relationship & Supply-Demand Dynamics

As of January 12, 2026, XLE had an opening price of 46.75, a closing price of 46.34, a volume of 28,111,494, a daily change of -0.71%, a 7-day average volume of 49,494,405.71, and a 7-day volume ratio of 0.57.

- • Key Day Analysis (Based on Wyckoff Principles):

- 1. Panic/Event Day (2025-11-21): Volume of 39.31 million shares (historical rank #3), price "plummeted." This is a special high volume caused by the split, not genuine selling pressure. The true analysis starting point should be the next day.

- 2. Demand-Dominated Advance (2026-01-05): Volume of 94.96 million shares (ranking #3 highest in the past decade), price surged 2.72%, closing near the day's high.

VOLUME_AVG_7D_RATIOwas as high as 4.52 (historical rank #1), indicating extremely strong demand—a clear sign of strength (SOS) / demand control day. - 3. Pullback with Exhausted Supply (2026-01-12): Price declined modestly by -0.71%, volume at 28.11 million shares, shrinking by 27.6% compared to the previous day (38.84 million) (

VOLUME_GROWTH-27.62%). A pullback on declining volume indicates supply did not emerge with the price drop, a healthy correction signal. - 4. Supply-Present Rally (2025-12-16): Price fell -3.05%, yet volume expanded to 49.31 million shares (

VOLUME_AVG_7D_RATIO1.88). This is a down day on increased volume, indicating significant supply was encountered during the decline, halting the rally.

- • Supply-Demand Landscape Conclusion:

- • Range Lower Boundary (~$44): Multiple tests have been accompanied by contracting volume or moderate expansion followed by quick rebounds, showing effective support; supply does not dominate absolutely here.

- • Range Upper Boundary (~$47): The breakout attempt (2026-01-05) was accompanied by massive demand, but the next day (2026-01-06) saw a sell-off on increased volume (69.57 million,

VOLUME_AVG_60D_RATIO3.13), showing strong supply exists at the upper boundary, forming resistance. - • Overall Dynamics: The market is in a consolidation phase with balanced supply and demand, but demand's resilience at the key support level ($44) and its explosive force during the breakout attempt (Jan 5th) give it a slight edge.

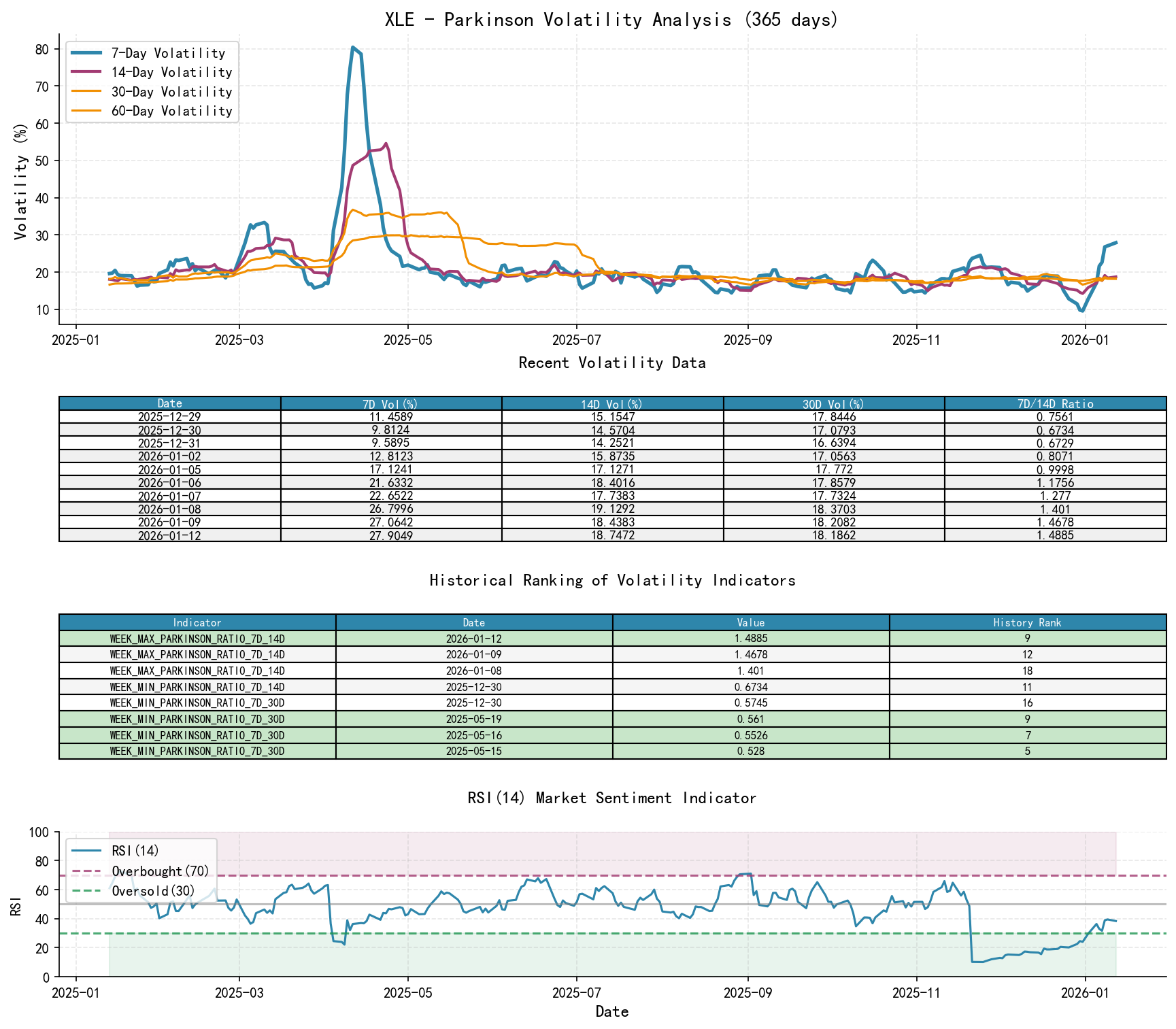

3. Volatility & Market Sentiment

As of January 12, 2026, XLE had an opening price of 46.75, a 7-day Parkinson volatility of 0.28, a 7-day Parkinson volatility ratio of 1.49, a 7-day historical volatility of 0.42, a 7-day historical volatility ratio of 1.41, and an RSI of 38.39.

- • Volatility Levels & Extremes:

- • During the Split Event: Volatility spiked to extreme levels.

HIS_VOLA_7Dreached 4.97 on 2025-12-01 (historical #1), andHIS_VOLA_RATIO_7D_60Dreached 2.91 around the same time (historical #1), indicating short-term volatility far exceeded its long-term average, placing the market in a state of extreme panic and disorder. - • Current State (2026-01-12): Volatility has significantly subsided.

HIS_VOLA_7Dis 0.42, andPARKINSON_VOL_7Dis 0.28, both having retreated from their peaks.HIS_VOLA_RATIO_7D_14Dis 1.41 (historical rank #12), still above 1, indicating short-term volatility remains relatively active compared to the recent past (14 days) but is no longer in the extreme panic zone.

- • During the Split Event: Volatility spiked to extreme levels.

- • Market Sentiment (RSI):

- • Extreme Oversold: Post-split,

RSI_14touched a low of 10.13 on 2025-11-25 (the #1 lowest in the past decade), confirming extreme pessimism and oversold conditions. - • Sentiment Recovery: The RSI then gradually climbed and currently stands (2026-01-12) at 38.39, out of the oversold zone but still in neutral-to-weak territory, indicating market sentiment has recovered from panic but has not yet entered optimistic or overbought territory, leaving room for potential further advance.

- • Extreme Oversold: Post-split,

4. Relative Strength & Momentum Performance

- • Long-term return data is distorted due to the split (YTD, TTM, etc., are invalidated by the sudden price base change). The focus should be on short-term momentum post-split.

- • Recent Momentum: Since the low on 2026-01-02, the price has shown a choppy upward trend.

WTD_RETURNandMTD_RETURNhave turned positive simultaneously for the first time post-split (as of Jan 12, both at 3.65%), indicating short-term momentum has shifted from negative to positive. - • Momentum-Volume Confirmation: This short-term rally was confirmed by the massive volume advance on 2026-01-05. The alignment of momentum with demand release enhances the validity of the rebound.

5. Large Investor ("Smart Money") Behavior Identification

Based on the above volume-price, volatility, and phase analysis, the inferred large investor behavior is as follows:

- 1. "Passive Behavior" on Event Day: The massive volume on 2025-11-21 was passive turnover due to the split, not reflecting active trading intent.

- 2. Accumulation Behavior: Post-split, the price found support multiple times near $44, and pullbacks were often accompanied by declining volume. Smart money is likely conducting planned, discreet accumulation near the lower range boundary, manifested as "testing support on low volume" and "rebounding with increased volume from lows."

- 3. Distribution Testing & Resistance Confirmation: When the price challenged the upper boundary near $47 (2026-01-05), there was record volume but the price failed to hold. The next day saw a sell-off on high volume. This suggests smart money or prior trapped supply engaged in distribution or tested selling pressure at the resistance level, preventing a rapid breakout.

- 4. Current Intent: Smart money is conducting "re-accumulation" within the new $44-47 range. They are absorbing supply at lower levels while simultaneously applying selling pressure at the upper boundary to suppress the price and accumulate shares at a lower cost. The massive volume surge on Jan 5th could be a test of overhead supply or early entry by aggressive capital.

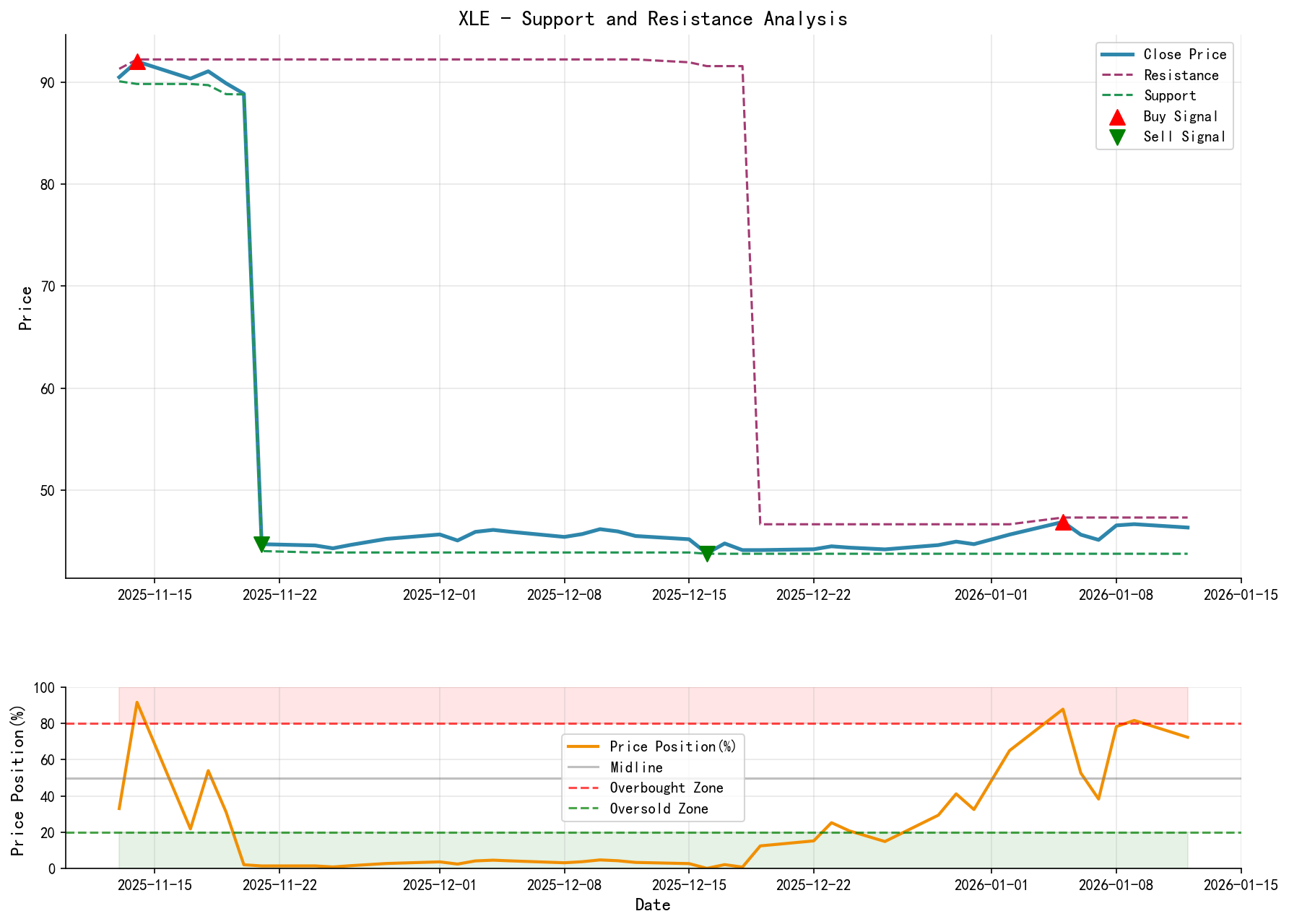

6. Support/Resistance Level Analysis & Trading Signals

- • Key Support Levels:

- • Primary Support:44.20. The low point area tested multiple times post-split and the starting point of the Automatic Rally after the panic event (SC/LPSY). A breakdown below this area would negate the accumulation hypothesis and turn the trend bearish.

- • Secondary Support:45.30. The mid-axis of the recent consolidation range and near the 20-day MA, acting as a short-term bull-bear dividing line.

- • Key Resistance Levels:

- • Primary Resistance:47.30. The high area of the massive-volume candle on 2026-01-05 and the upper boundary of the range. A decisive breakout above this area is a key signal for the completion of accumulation and the initiation of an uptrend.

- • Secondary Resistance:46.40. A cluster area of recent rally highs.

- • Integrated Wyckoff Trading Signals & Operational Suggestions:

- • **Overall View: ** Bullish, but in a consolidation phase late in accumulation. The market structure shows demand dominance, with smart money accumulating positions.

- • Operational Suggestions:

- • Aggressive Strategy (Buying the Dip): Consider establishing long positions when the price pulls back to the45.50 support zone and shows signs of stabilization on low volume (e.g., a long lower shadow, small-bodied candle with contracting volume). Initial stop-loss should be placed below $44.00.

- • Conservative Strategy (Breakout Follow-through): Wait for the price to close above $47.30 on strong volume (significantly above recent average volume), confirming accumulation completion and trend initiation, for a right-side follow-through entry. A successful retest of $47 could serve as an add-on point.

- • Risk Avoidance: If the price breaks below $44.00 on increased volume, exit positions immediately and adopt a wait-and-see approach, as the accumulation structure may be invalidated.

- • Future Validation Points:

- 1. Demand Validation: Any future test of the45 support must occur on contracting volume, followed by an immediate rebound.

- 2. Supply Exhaustion Validation: Any pullback during price advances should exhibit the characteristic of decreasing volume.

- 3. Breakout Confirmation: An upward breakout above $47.30 must be accompanied by expanding volume, reaching at least 70% of the Jan 5th volume level (~66 million shares), to demonstrate demand's ability to overcome all supply.

Disclaimer: This report is a quantitative analysis based on historical data and Wyckoff principles and does not constitute any investment advice. Markets involve risks, and investing requires caution. Traders should consider their own risk tolerance and implement strict stop-losses.

Thank you for your attention! Wyckoff volume-price market analysis is published daily at 8:00 AM before the market opens. Your comments and shares are greatly appreciated. Your recognition is vital. Let's work together to decipher market signals.

Member discussion: