As requested. Following your instructions. As a quantitative trading researcher proficient in the Wyckoff Method, I will compose a comprehensive and in-depth quantitative analysis report based on the XLB data you provided (analysis period: 2025-11-13 to 2026-01-12) and its historical ranking metrics.

Wyckoff Quantitative Analysis Report: XLB

Product Code: XLB

Analysis Period: 2025-11-13 to 2026-01-12

Report Generation Date: 2026-01-13

1. Trend Analysis and Market Phase Identification

As of 2026-01-12, the underlying asset XLB had an opening price of 48.37, a closing price of 48.52, a 5-day moving average of 47.30, a 10-day moving average of 46.56, a 20-day moving average of 45.95, a daily price change of 0.54%, a weekly change of 4.16%, a monthly change of 6.99%, a quarterly change of 6.99%, and an annual change of 6.99%.

- • Moving Average Alignment and Trend: The data shows that prior to the extreme event on 2025-11-21 (where the stock price plummeted from 84.46 to 43.175), the various moving averages (MA_5D to MA_60D) were already in a bearish alignment (Price < MA_5 < MA_10 < MA_20 < MA_30 < MA_60), indicating the market was in a clear long-term downtrend. After the extreme event, the short-term moving averages quickly crossed below the long-term ones. All moving averages (from MA_5D at 45.17 to MA_60D at 64.01) are currently below the current price (48.52), forming a highly dispersed bearish alignment. Although the price has recently rebounded from its lows, it remains below all major moving averages, indicating the overall market structure is still bearish.

- • Moving Average Crossover Signals: Following the crash event (2025-11-21), the MA_5D quickly crossed below all longer-term moving averages, forming a strong death cross signal. By the end of the analysis period (2026-01-12), the MA_5D (47.30) has crossed above the MA_10D (46.56) but remains below the MA_20D (45.95), indicating only an extremely short-term weak rally that has not yet reversed any medium-term downtrend.

- • Market Phase Identification (Wyckoff Framework):

- • Prior to 2025-11-21: The price declined gently from 87.57 to 84.46, with volume expanding (VOLUME_AVG_30D_RATIO reached 1.47) but limited price decline (-1.49%), exhibiting characteristics of the late "Distribution" phase, where supply began to dominate but did not trigger panic.

- • 2025-11-21: The single-day crash of -48.88%, accompanied by a surge in volume to nearly 21 million shares (ranking 16th highest single-day volume in the past decade), constitutes a classic "Panic/Selling Climax (SC)" event. Historical rankings confirm this was the largest single-day decline in the past decade (ranked #1).

- • 2025-11-24 to 2025-12-19: The price fluctuated widely within the 43-45.5 range. Volume receded from extreme highs but remained elevated. During this period, there were multiple instances of probing lower followed by rebounds. The RSI stayed in the extreme low zone below 10 before gradually recovering. This aligns with the characteristics of an "Automatic Rally (AR)" and "Secondary Test (ST)", forming a typical structure of the Accumulation Phase. The market was digesting panic selling pressure, and smart money was likely absorbing shares in this range.

- • From 2025-12-22 to Present (2026-01-12): The price consolidation range shifted higher (44.5-48.5), with lows gradually rising (43.48 -> 44.09 -> 45.35). Volume showed moderate expansion during rallies (e.g., 2026-01-06). This phase can be viewed as the early stage of "Markup" following accumulation. However, given the overall pressure from moving averages, it is currently more accurately defined as "Testing and Attempting a Breakout from the Upper Boundary of the Accumulation Range".

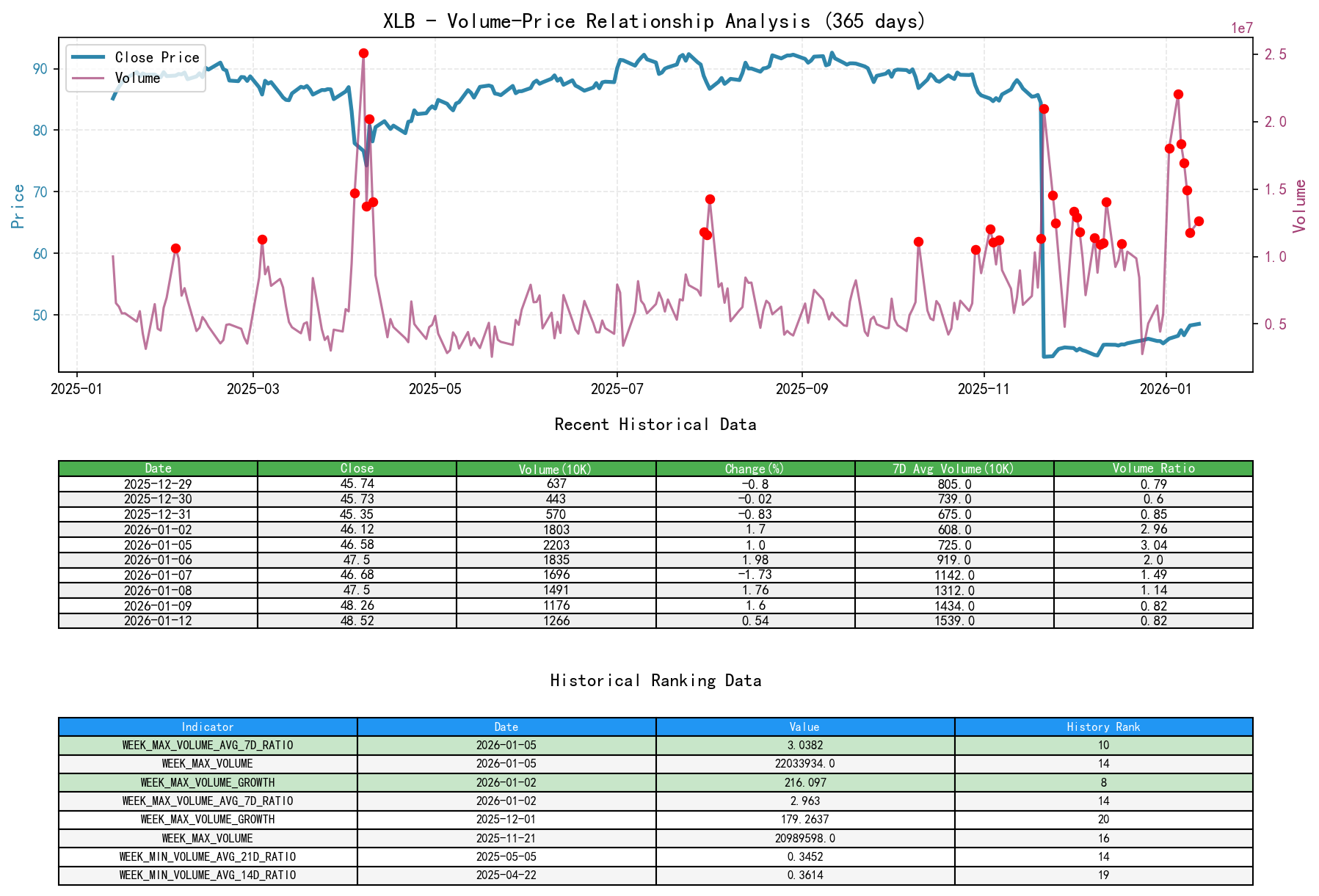

2. Volume-Price Relationship and Supply-Demand Dynamics

As of 2026-01-12, the underlying asset XLB had an opening price of 48.37, a closing price of 48.52, a daily volume of 12,667,199, a daily price change of 0.54%, a daily volume of 12,667,199, a 7-day average volume of 15,396,165.86, and a 7-day volume ratio of 0.82.

- • Panic Day (2025-11-21): Heavy-volume crash (Volume 20.99M, PCT_CHANGE -48.88%). Wyckoff principles view this as a fierce confrontation point between "exhaustion of supply" and "entry of demand." The historically extreme decline and massive volume (supported by HISTORY_RANK) indicate panic selling was fully absorbed, serving as a potential trend reversal signal.

- • Accumulation Range (2025-11-24 to 2025-12-19): Exhibited a typical positive volume-price structure of "rising on high volume and falling back on low volume." For example:

- • 2025-12-10: Price rose 1.96%, volume was 1.09B shares (VOLUME_AVG_7D_RATIO=1.01), indicating demand emergence.

- • 2025-12-11: Continued rising 1.99%, volume was 1.10B shares (VOLUME_AVG_7D_RATIO=1.06), indicating sustained demand.

- • Subsequent pullback days (e.g., 2025-12-15, -0.07%) showed significantly lower volume (VOLUME_AVG_7D_RATIO=0.88), indicating weakening supply.

- • Recent Rally (From 2026-01-02 onwards): Signs of a high-volume breakout emerged at the start of the new year.

- • 2026-01-02: Rose 1.70%, volume surged 216% (VOLUME_GROWTH historical rank #8), reaching 18.03M (VOLUME_AVG_7D_RATIO=2.96), showing strong demand entering the market.

- • 2026-01-06: Rose 1.98%, volume 18.35M (VOLUME_AVG_7D_RATIO=2.01), confirming demand.

- • Potential Warning Signal: On 2026-01-12 (analysis day), the price rose 0.54% but exhibited high-volume stalling at a relative high (volume 12.67M, VOLUME_AVG_7D_RATIO=1.14). This is the first sign of "Sign of Weakness (SOW)" appearing after the rally, requiring close monitoring.

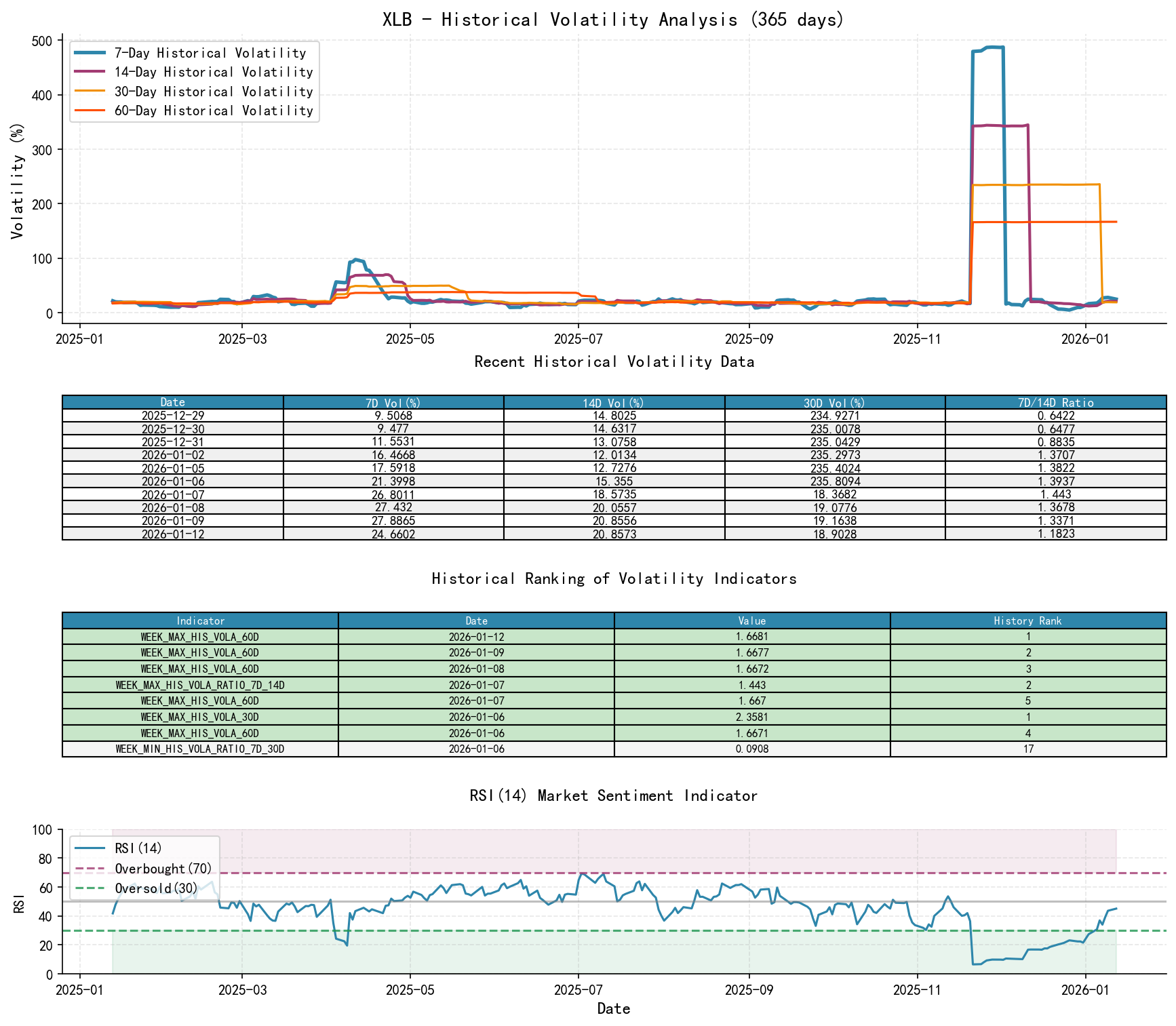

3. Volatility and Market Sentiment

As of 2026-01-12, the underlying asset XLB had an opening price of 48.37, a 7-day intraday volatility of 0.21, a 7-day intraday volatility ratio of 1.47, a 7-day historical volatility of 0.25, a 7-day historical volatility ratio of 1.18, and an RSI of 45.11.

- • Extreme Volatility Peak: During the panic day (2025-11-21) and the following week, HIS_VOLA_7D surged to around 4.80, reaching the highest levels in nearly a decade (historical rank top 6). Simultaneously, HIS_VOLA_RATIO_7D_60D reached 2.89, meaning short-term volatility was nearly three times the long-term volatility (historical rank top 6), confirming market sentiment reached a panic extreme.

- • Volatility Convergence: Entering December 2025, volatilities across time horizons (HIS_VOLA and PARKINSON_VOL) began to decline systematically and stepwise. For example, HIS_VOLA_7D dropped from 4.8 to below 0.25, and PARKINSON_VOL_7D from 0.19 to 0.21. This indicates market sentiment is normalizing from panic, with volatility reverting to the mean, creating conditions for a new trend to develop.

- • RSI Sentiment Indicator: The RSI_14 dropped to a low of 6.53 (the #1 lowest in nearly a decade) post-panic, confirming severe oversold conditions. It then fluctuated and recovered within the accumulation range, currently at 45.11, having moved out of the oversold zone into a neutral-weak area. Sentiment repair is underway but has not yet reached overbought levels.

4. Relative Strength and Momentum Performance

- • Short-Term Momentum Turns Positive: Recent data shows a significant improvement in short-term momentum. MTD_RETURN (6.99%), QTD_RETURN (6.99%), YTD (6.99%) are all positive, and WTD_RETURN (4.16%) is also positive, indicating very strong short-term and year-to-date momentum.

- • Medium-to-Long-Term Momentum Remains Extremely Weak: Despite the short-term rally, the TTM_12 return is still -41.75% and TTM_24 is -41.86%, indicating the medium-to-long-term trend remains deeply entrenched in a bear market. The current strong rally is occurring on the basis of a massive decline (-48.88%). Its relative strength needs to break through key resistance levels (e.g., MA_60D) to confirm a trend reversal.

- • Conclusion: Momentum analysis shows that XLB is in the midst of a significant but unconfirmed-trend-reversal bear market rally within a severe long-term downtrend. Short-term momentum is strong but acts counter to the direction of long-term momentum.

5. Identification of Large Investor (Smart Money) Behavior

- • Absorption During Panic Day (2025-11-21): Facing a nearly 50% crash, the massive volume (20.99M) is unlikely attributable to retail investors. This strongly suggests large institutional investors conducted organized, large-scale absorption during the panic, completing the transfer of shares from weak holders to strong holders. This is typical "smart money" accumulation behavior.

- • Consolidation in the Accumulation Range (2025-11-24 to 2025-12-19): The pattern of rising on high volume and falling back on low volume within the range indicates funds were consistently and patiently absorbing floating supply while suppressing rapid price increases to lower costs. This is standard operating procedure for institutional accumulation.

- • New Year High-Volume Breakout (2026-01-02 and after): The consecutive high-volume rallies in early January can be viewed as a "Jump across the Creek" attempt driven by smart money following the completion of accumulation, aimed at testing and attracting trend-following traders.

- • Current Potential Behavior (2026-01-12): The high-volume stalling at a high level (0.54% gain against 1.14x the 7-day average volume) is a warning signal. This may indicate: 1) Some early-entering smart money conducting minor distribution (testing market supply) near resistance; or 2) Encountering natural overhead supply from previously trapped holders. Subsequent price action is needed for verification.

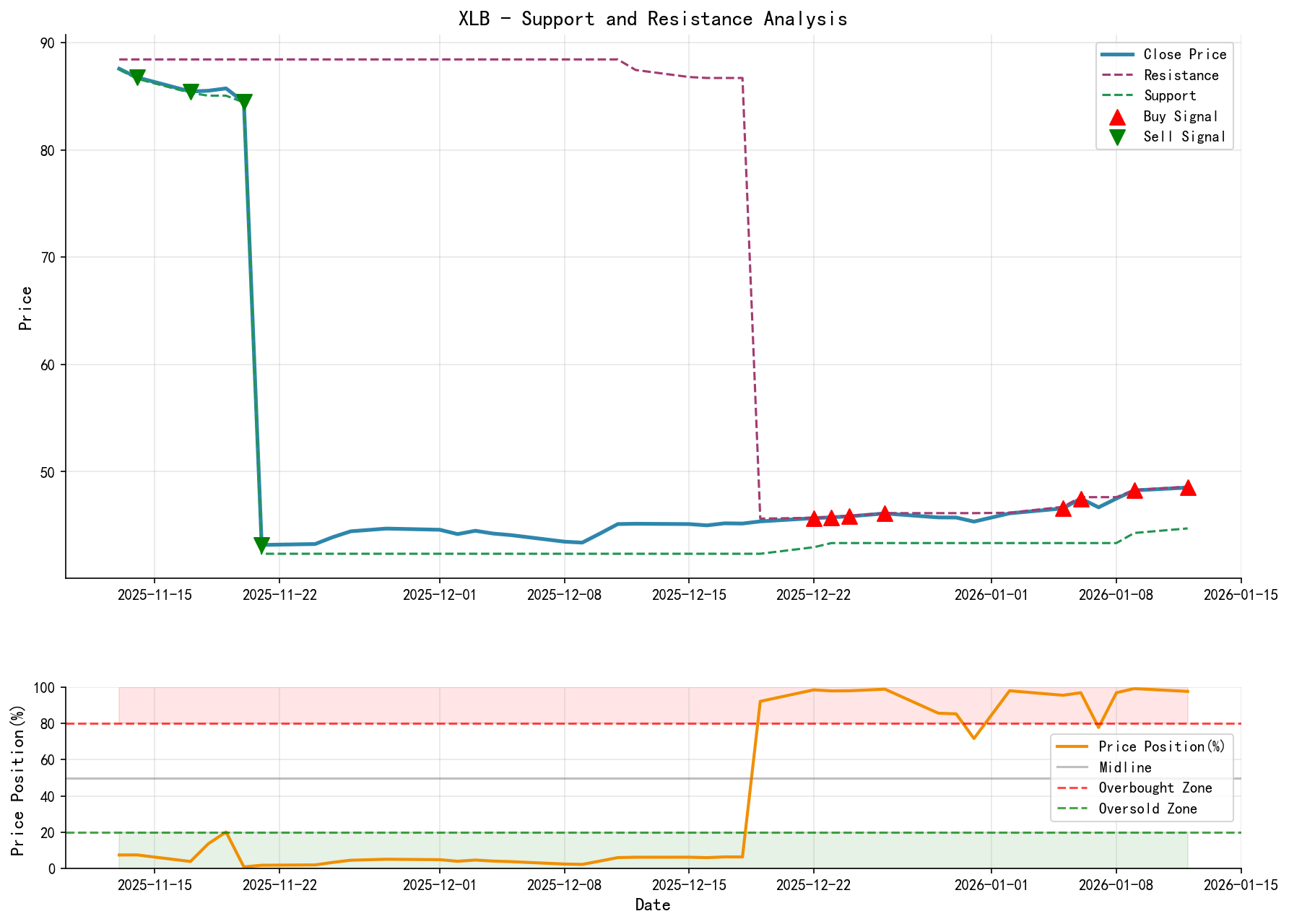

6. Support/Resistance Level Analysis and Trading Signals

- • Key Support Levels:

- • Primary Support Zone: 44.00 - 44.50. This is the central axis of the recent consolidation range and an area where multiple pullback lows cluster, also the upper boundary of the December 2025 accumulation range. A break below this zone would破坏破坏 the rally structure.

- • Strong Support Level: 43.00 - 43.50. The important low range following the panic. A break below would signify accumulation failure, leading the market to seek new lows.

- • Key Resistance Levels:

- • Recent Resistance Zone: 46.50 - 47.50. This is the current rally high and the small plateau formed on 2026-01-08 and 01-09. Major Resistance Levels: MA_60D (currently 64.01, declining) and MA_30D (45.36). The price needs to effectively stabilize above the MA_30D before challenging longer-term moving average pressure.

- • Psychological Resistance Level: 50.00.

- • Comprehensive Trading Signals and Action Recommendations:

- • Overall Assessment: The market has completed a classic Panic/Selling Climax (SC) and Accumulation process and is currently in the early Markup phase of a bear market rally. However, the medium-term trend has not reversed, and recent supply-side signs have emerged.

- • Action Recommendations:

- • For Long/Band Traders: The current price (~48.5) carries high chasing risk. Maintain a wait-and-see approach or hold cautiously. The ideal long addition/entry point should be when the price pulls back to the support zone of 44.00-44.50 and shows signs of low-volume stabilization. Initial stop-loss can be set below 43.00.

- • For Short Sellers/Hedgers: Consider establishing a tentative short position at the current price (~48.5) or upon a rebound to the resistance zone of 47.50-48.50 accompanied by high-volume stalling or bearish candlestick patterns, betting on the rally's end and a return to consolidation or downtrend. Stop-loss should be set above the recent high of 48.61.

- • For Existing Position Holders: It is advisable to take partial profits at resistance levels (47.50-48.50) to lock in gains. Move the stop-loss for the remaining position to breakeven or below the 44.00 support.

- • Future Validation Points:

- 1. Bullish Validation: Price needs to break through and hold above 48.60 (recent high) on high volume (VOLUME_AVG_7D_RATIO > 1.2), followed by a pullback on low volume that holds above 46.50. This would confirm the continuation of the uptrend, targeting 50.00 and higher.

- 2. Bearish Validation: If the price stalls around 48.50 and then breaks below 46.00 on high volume (VOLUME_AVG_7D_RATIO > 1.1), it suggests the rally may be over, and the market will retest the 44.00-44.50 support zone.

- 3. Key Observation Day: The volume-price action on the next trading day is crucial to determine whether the high-volume small positive candlestick on 2026-01-12 is a continuation signal or a short-term top signal.

Disclaimer: This report is based on quantitative analysis of historical data. All conclusions are derived from models and data inferences and do not constitute any investment advice. Financial markets involve risks, and past performance is not indicative of future results. Investors should make independent decisions based on their own risk tolerance.

Thank you for your attention! Daily Wyckoff Volume-Price Market Insights are released promptly before the market opens at 8:00. Your comments and shares are greatly appreciated. Your recognition is crucial. Let's work together to see the market signals clearly.

Member discussion: